Market Highlights

- Prices are recovering following the recent weeks of consolidation.

- The SEC forfeited several ongoing investigations into cryptocurrencies this week.

- The Republican Party has approved a draft plan that “explicitly embraces crypto” ahead of its National Convention this week.

- Spot Ethereum ETF filings are nearing completion with the SEC.

Bitcoin

Bitcoin stabilised this week following recent consolidation. Price moved from lows around US$54,400 to start the week, eventually breaking US$60,870 to the upside when the market had a bullish response to the assassination attempt on Former President Donald Trump at a campaign rally in Pennsylvania. Trump is perceived as pro-crypto, and he’s stated that, if elected, he’d foster an innovative environment for crypto in the US. Price rallied over 6% following the incident in Pennsylvania.

Recent news and the developments driving sell-offs in recent weeks appear to have subsided this week. The German Government sold its final bitcoin on Friday when it was sent to an exchange. Despite the pullback in recent weeks, it appears that bitcoin’s price has held up throughout the German Government’s sell-off and news of Mt Gox’s bitcoin bankruptcy payouts. With bitcoin mining difficulty significantly dropping and many short-term traders selling their bitcoin at a loss, price could be nearing a local bottom.

Bitcoin is top of mind for those interested in the upcoming Bitcoin Conference in Nashville from July 25 to July 27, 2024. It was announced this week that Former President Donald Trump will speak at the event, as well as Presidential candidate Robert F. Kennedy Jr.

In macroeconomic news this week, the U.S. core consumer price index (CPI) month-on-month came in at 0.1%, slightly lower than the forecasted 0.2%. Similarly, CPI came in at -0.1%, the first time the index has had a negative reading since January 2023. Between the data that suggests inflation is cooling and lower unemployment claims than forecast this week (222,000 versus a forecast 236,000), a September rate cut is looking more likely. Given bitcoin’s correlation with crypto-specific news in recent weeks, investors will be watching closely to see how price responds to further macroeconomic data that may support the case for a September rate cut by the U.S. Federal Reserve.

Bitcoin is currently trading at US$64,655, an increase of over 14% on the week.

Ethereum

Ethereum had a stronger week, rising over 18% from lows around US$2,825 on Monday to begin the new week with a rally to break above the key level at US$3,220.

Also this week, Rostin Benham, chair of the U.S. Commodities and Futures Trading Commission (CFTC), said that Ethereum had been “reaffirmed” as a commodity in a Federal Court ruling earlier in July. Though the ruling isn’t binding, it may influence future cases investigating whether a cryptocurrency should be classified as a security or commodity.

Asset Managers worked on updates to their Ethereum ETF filings with the U.S. Securities and Exchange Commission (SEC) this week. VanEck amended the name of its product to “The VanEck Ethereum Trust,” Grayscale amended some of its filings, and Franklin Templeton amended their filing, too. Fees have not yet been administered for the asset managers’ filings, meaning another round of submissions is likely needed this week before spot Ethereum ETFs get the green light.

Ethereum is currently trading at US$3,490, an increase of over 15% on the week.

Altcoins

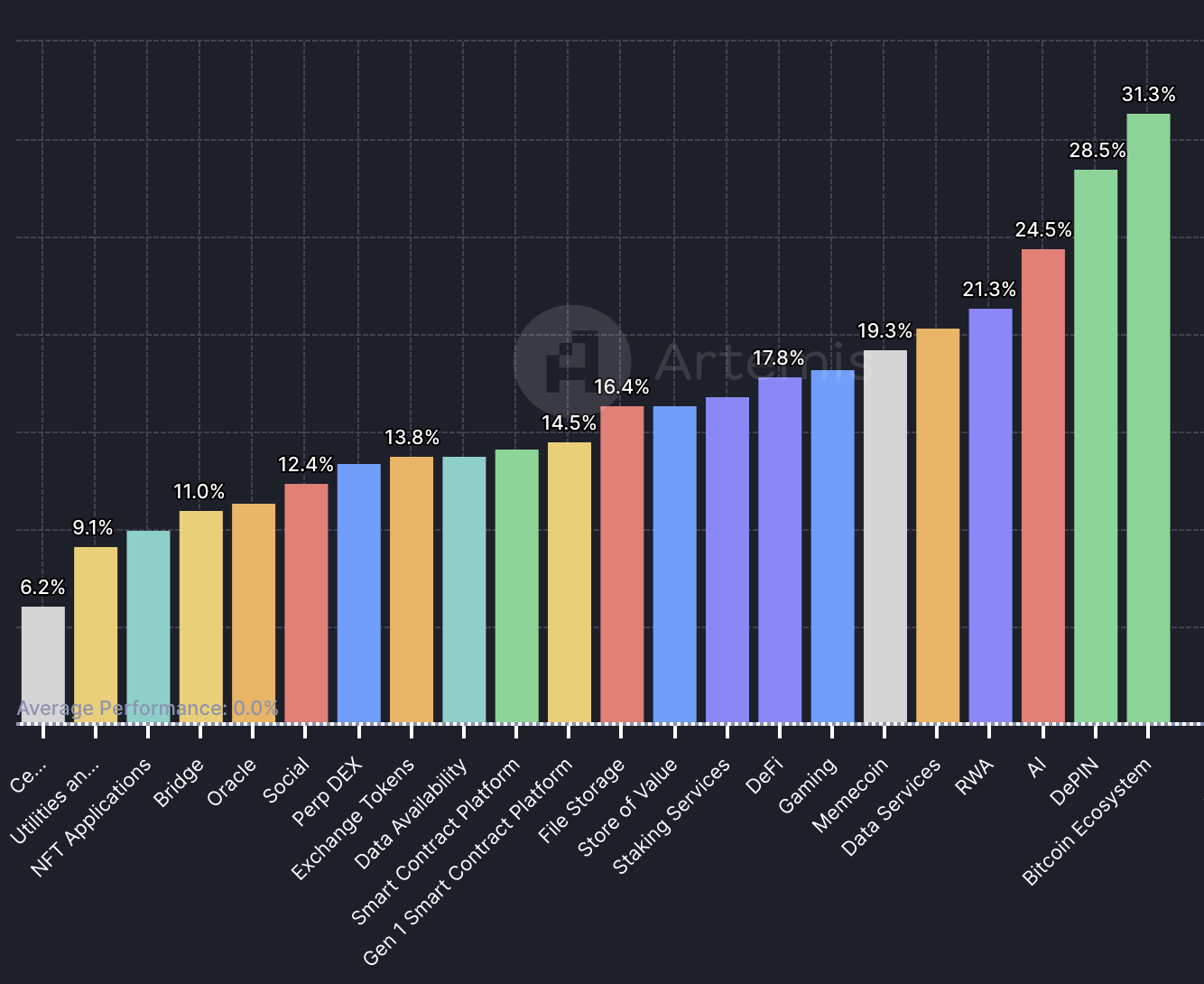

Market sector performance bounced back this week, presumably due to more positive sentiment across the market. Leading the way was the Bitcoin Ecosystem, which grew by 31.3%. Following this was decentralised physical infrastructure (DePIN), artificial intelligence (AI) and real-world assets (RWA), which grew by 28.5%, 24.5% and 21.3%, respectively. Centralised exchanges had the smallest growth, with 6.2%. This week’s growth in core market sectors, such as the Bitcoin network, DePIN and RWA, suggests that the upward momentum in price following the recent weeks of consolidation is driving growth in market sectors with immediate real-world application.

Culture Shock

- Mines of Dalarnia (DAR) gained 63.1%, taking its market cap to US$104 million. Price for the platform-mining blockchain game grew by over 40% on Sunday. Recently finding support at 0.103, announcements about giveaways and Degenverse joining DAR, plus ongoing interest in crypto games where users can earn cryptocurrency are presumably driving the gains.

- Opulous (OPUL) grew by 41.5%, taking its market cap to US$46.9 million. The tool, which helps artists predict their future royalties on music streaming platforms, recently hosted an “Ask Me Anything” (AMA) with updates about what’s coming next for OPUL. The recent gains may also indicate growing investor interest in tokenising real-world assets like music.

- RFOX (RFOX) gained 39.4%, which takes its market cap to US$8.5 million. The immersive metaverse platform completed a migration this week. The migration allows users who hold RFOX and VFOX on the Ethereum and Binance Smart chains to migrate to JUC on the Avalanche Contract Chain (C-Chain).

Got Volume?

- Aerodrome Finance (AERO) grew by 49.5%, which takes its market cap to US$428.7 million. Its price gains have followed the general upward momentum across the crypto market this week. Plus, an announcement that the central liquidity and trading marketplace is outpacing Uniswap for volume is likely encouraging bullish sentiment.

Layer 2 leaps

- Stacks (STX) gained 43.3%. This takes its market cap to US$2.8 billion. This week’s gains are presumably due to the SEC dropping its investigation into the layer 2 Bitcoin blockchain. The network’s “Code for Stacks” initiative is likely driving price, too. The initiative has attracted more developers in the last week, where they share code improvements to earn STX.

Real-World Apps

- VeChain (VET) grew by 35%, taking its market cap to US$2.5 billion. The blockchain, which enables users to tokenise anything from supply chains to sustainability from their decentralised real-world and enterprise apps, benefited from this week’s bullish momentum. Recent announcements about partnerships that enable tap and pay functionality, plus the use of their near-field communication (NFC) technology in UFC gloves, could also be encouraging investor interest.

In Other News

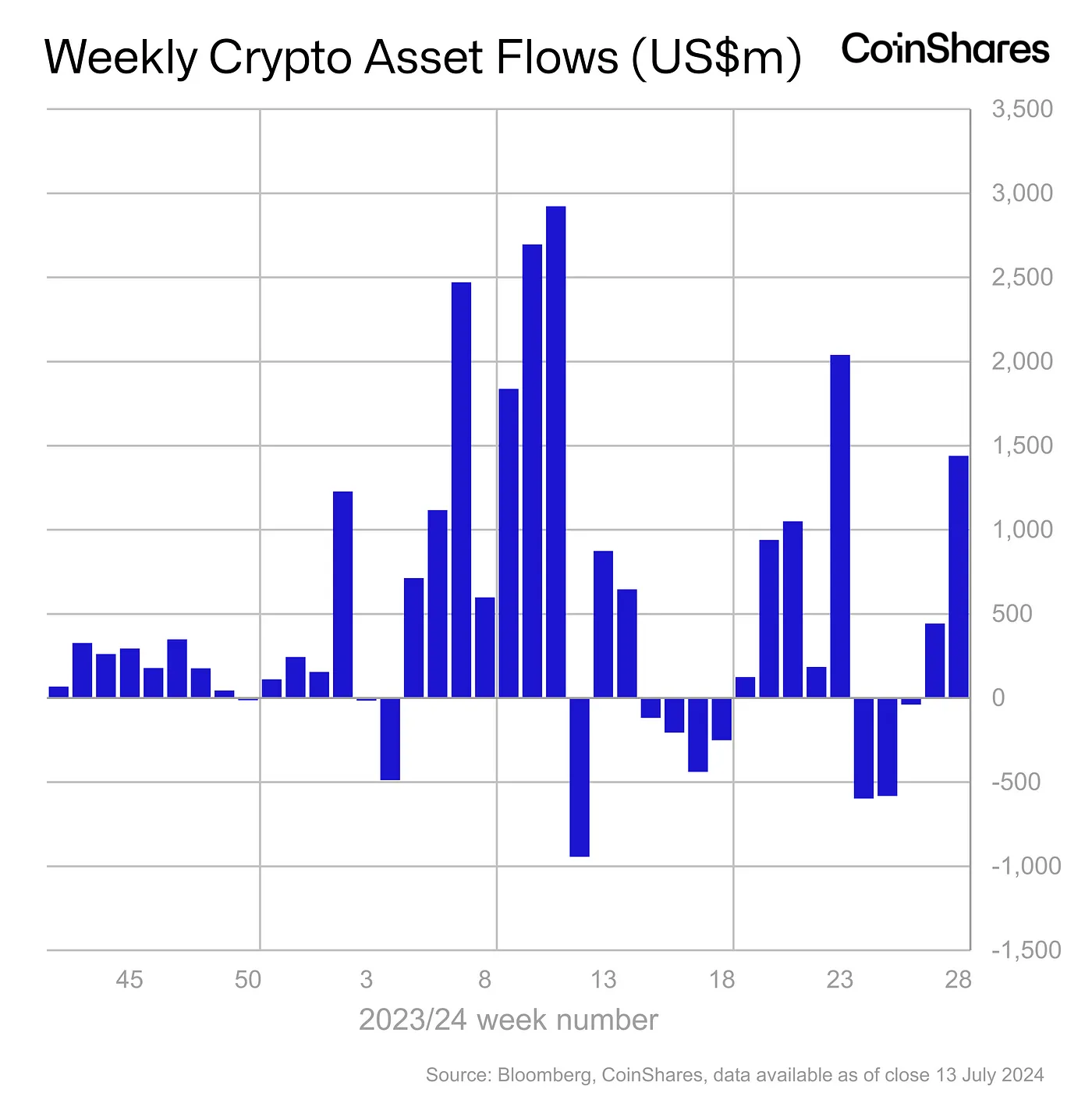

This week marked the fifth largest week of inflows on record, with US$1.44 billion flowing into digital asset investment products. Taking inflows for the year-to-date to a record US$17.8 billion, this surpasses the largest year of inflows in 2021, where US$10.6 billion inflows occurred. Bitcoin saw inflows of US$1.4 billion, and short-bitcoin had the largest week of outflows since April, with US$8.6 million leaving these products.

Ethereum investment products had inflows of US$72 million, presumably driven by the approval of spot-based Ethereum ETF products, which is expected in the coming weeks.

Amongst altcoins, Solana, Avalanche and Chainlink saw inflows of US$4.4 million, US$2 million, and US$1.3 million, respectively.

- The Republican party approved a draft plan that explicitly embraces crypto ahead of their national convention this week. The platform includes promises to end the “crypto crackdown”, banning the progression of technologies aimed at creating a central bank digital currency (CBDC), and protecting the rights of people to mine cryptocurrency, self-custody crypto assets, and transact freely. It’s the first time a major U.S. political party has had a formal platform on crypto, indicating awareness that the regulatory approach to crypto assets and complementary technologies is top of mind for many voters, investors, and the crypto industry.

- An online marketplace, Huione Guarantee, has been accused of operating a marketplace to facilitate crypto scams. According to blockchain analytics firm Elliptic, Huione Guarantee has processed at least US$11 billion worth of transactions for crypto scams in Southeast Asia. Operating via thousands of instant messaging channels run by different merchants, the platform mostly uses the US Tether stablecoin (USDT) for payments. The company has links to the Hun family, who has been accused of other illegal activities, including money laundering and scams. A spokesperson for Tether criticised Elliptic for publishing their findings publicly before contacting them as it limits their ability to freeze illicit activities on its network.

- Crypto portfolio manager CoinStats says the Lazarus Group, a North Korea consortium, is likely behind a June 22 hack where people lost US$2.2 million across 1,590 wallets. The hackers gained access to Coinstats’ infrastructure and third-party service providers via a likely social engineering attack on one of its employees, causing them to download malicious software on their work device. The software and impacted infrastructure have since been removed, and the company continues its investigation.

Regulatory

- The US House of Representatives failed to override President Joe Biden’s veto to overturn SAB 121. While some members flipped their votes from Yes to No, and vice versa, only 228 members voted in favour of overturning President Biden’s veto, falling short of the 290 votes required for a supermajority.

- The U.S. SEC forfeited several of its investigations into cryptocurrencies this week. Hiro Systems%20with%20no%20action.), a company that makes tools for developers to build apps on layer 2 blockchain, Stacks, who was also investigated, had a three-year investigation dropped. In a letter to Hiro, the SEC’s enforcement division said it didn’t intend to recommend an enforcement action.

- The investigation into Binance USD was also dropped along with the probe into Paxos, a crypto infrastructure provider. In 2023, the U.S. SEC issued a notice to Paxos over its involvement in the Binance USD stablecoin, stating that it was a security. With the SEC��’s crypto-related activities primarily centering around whether particular cryptocurrencies should be classified as a security, these forfeited investigations raise questions over the future regulatory landscape when it comes to classifying crypto assets.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.