Market Highlights

- XRP surged over 80% after Federal district judge Analisa Torres ruled in favour of Ripple in its long-lasting case against the SEC.

- Ethereum (ETH) hit a high of $2,029 on Friday - its highest price since May.

- Crypto’s total market cap surged 6% on Friday to hit US$1.3 trillion.

- The U.S. Bureau of Labor Statistics released its latest CPI report, slightly beating expectations.

- The United States Department of Justice apprehended Alex Mashinsky, the former CEO of Celsius Network

- BlackRock's request to introduce a Bitcoin exchange-traded fund has been officially included in the Securities and Exchange Commission's docket for review.

Price Movements

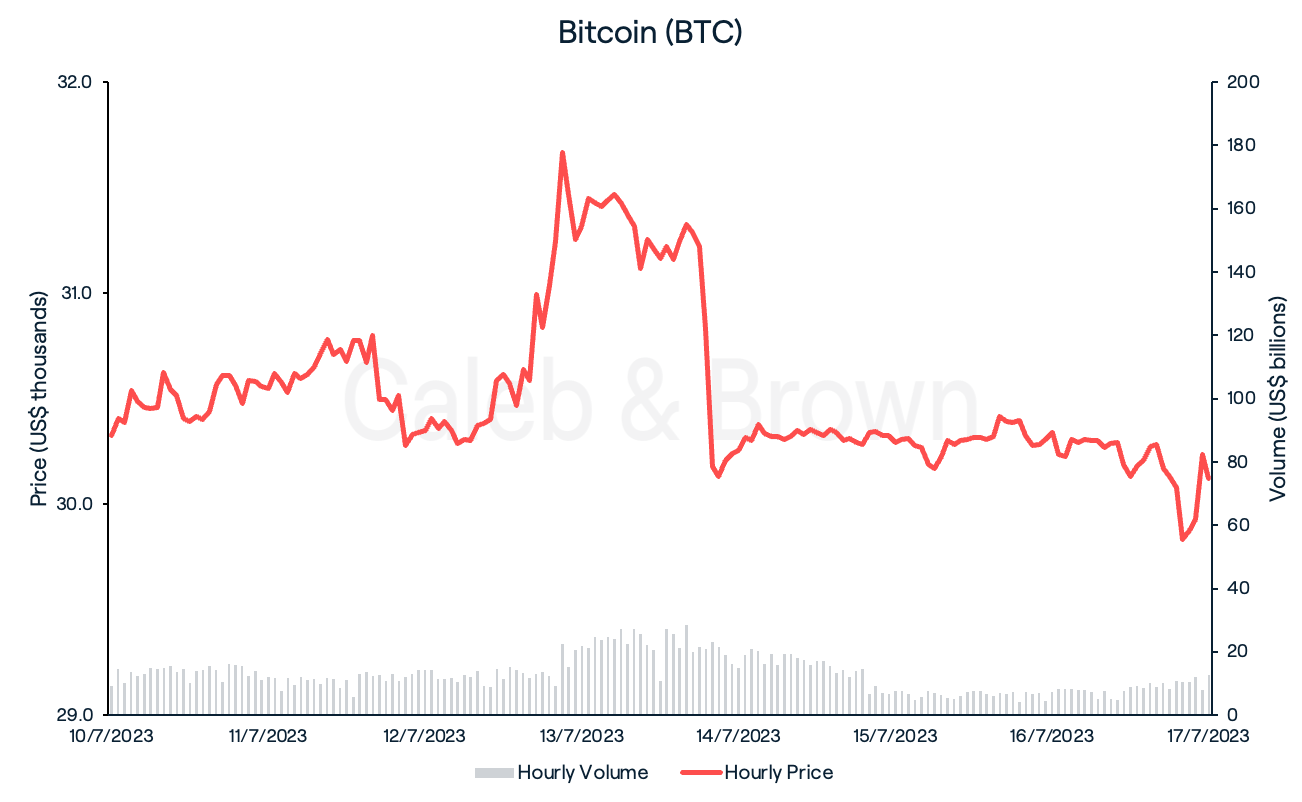

Bitcoin

It was a rollercoaster week for market leader Bitcoin (BTC), while altcoins stole the spotlight. BTC remained flat after the U.S. Bureau of Labor Statics released its latest CPI (consumer price index) report on Wednesday indicating a cooling inflation figure, slightly beating expectations.

The report revealed CPI rose 0.2% in June and 3.0% annually, compared with Dow Jones estimates for increases of 0.3% and 3.1%, respectively.

On Friday however, BTC made an intra-week high of US$31,804 before giving up its gains over the weekend, closing the week at US$30,123, down a slight 0.6%.

Meanwhile, a recent report from Glassnode has suggested the US$30,000 mark to be a ‘firm foundation’ of price support, indicating a possibly long period of accumulation.

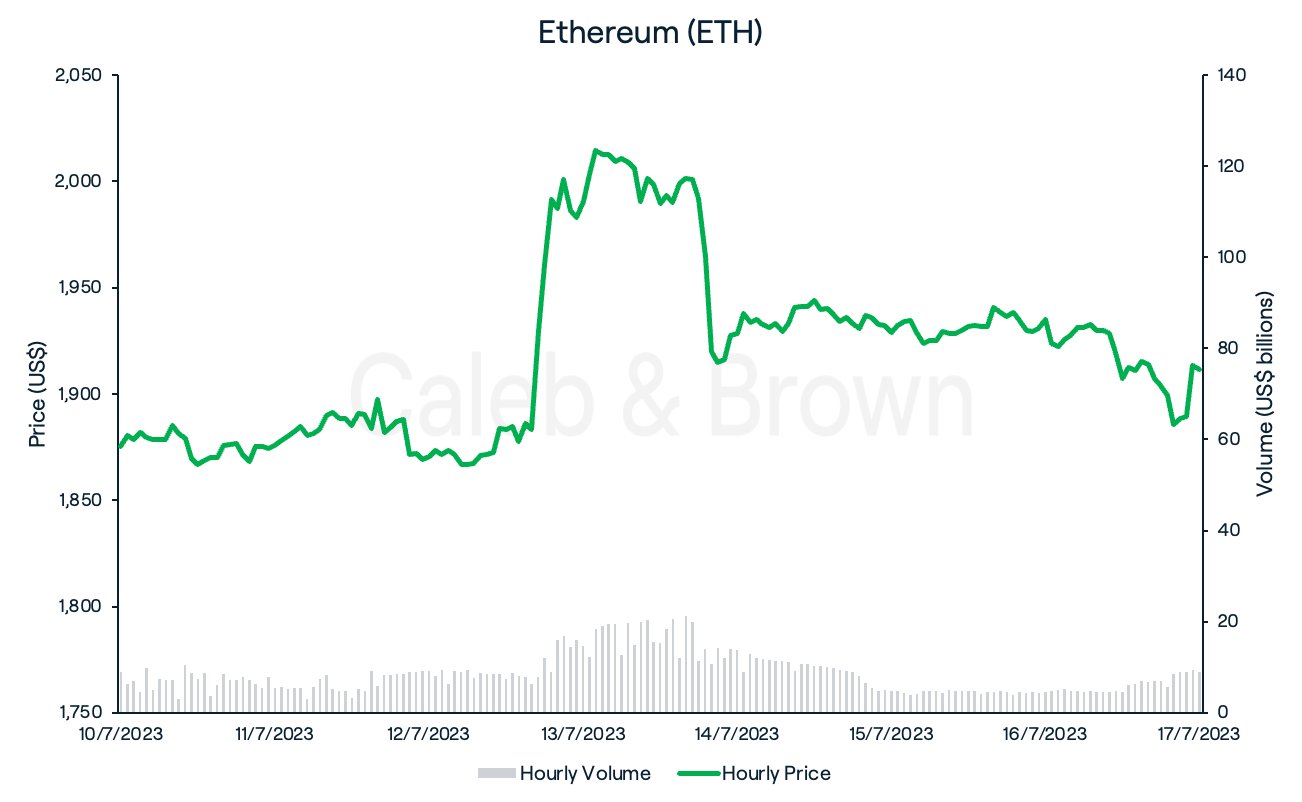

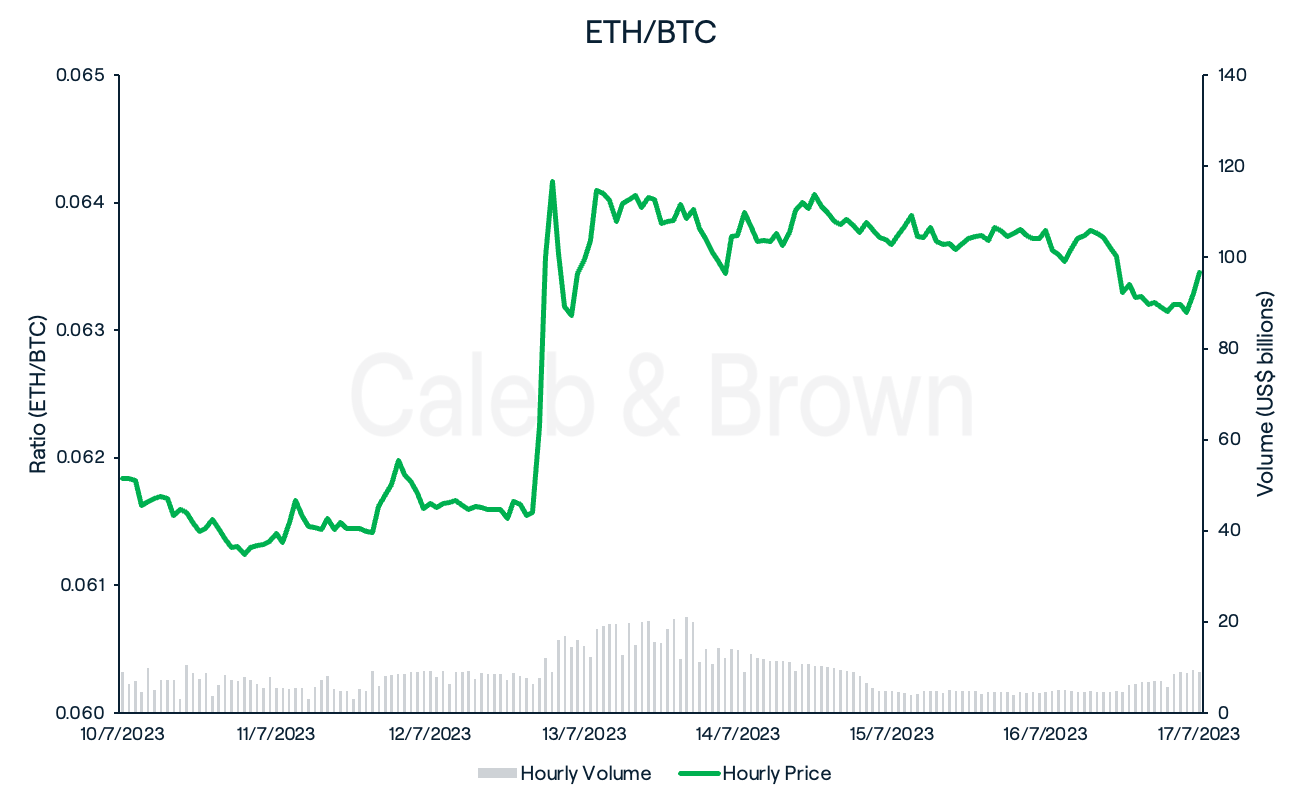

Ethereum

Ethereum (ETH) fared considerably better than BTC this week, hitting a high of US$2,029 on Friday, the first time since May. Overall, ETH held on to a weekly increase of 1.9%, closing the week at US$1,911.

This brought the ETH/BTC ratio up to ~0.0634, up 2.6%.

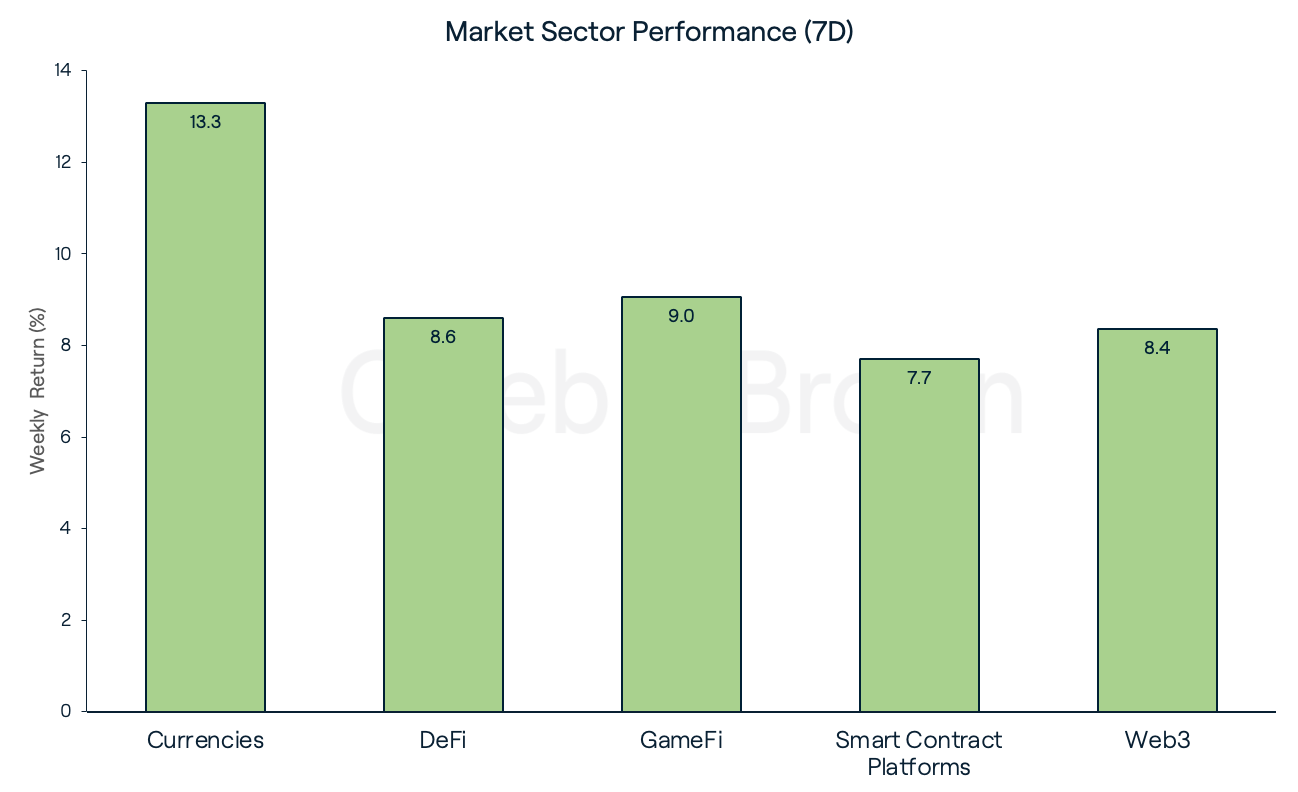

Altcoins

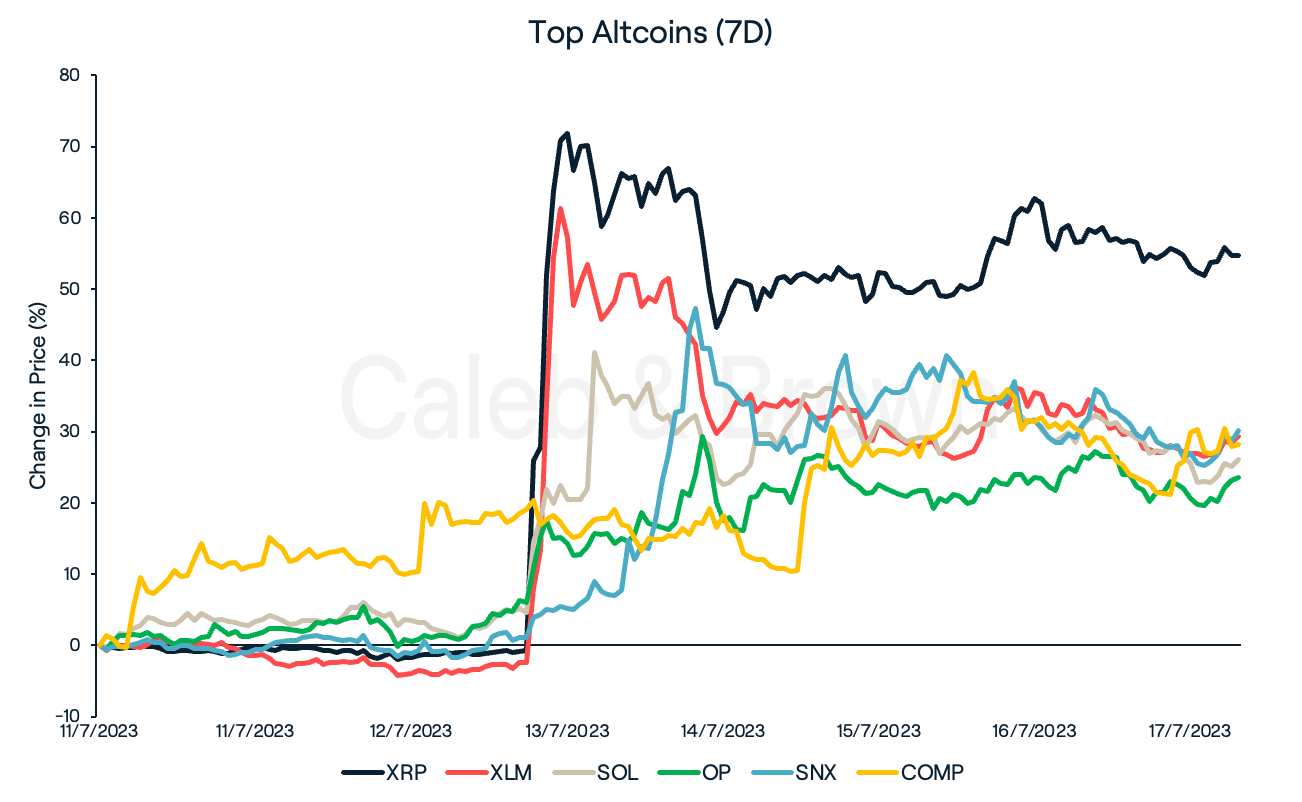

Market sectors have risen across the board with Currencies taking top spot, adding on 13.3% week-on-week. This was followed closely by GameFi and DeFi which rallied 9.0% and 8.6%, respectively.

XRP (XRP) was at the centre of attention this week, securing top spot after surging an astounding 54.7% over the last seven days, reaching a high of US$0.93 at its peak.

This was brought on after Federal district judge Analisa Torres ruled in favour of Ripple on Thursday, putting an end to Ripple’s long-lasting case against the SEC (Securities and Exchange Commission), however the SEC may still appeal the decision.

Torres ruled that XRP was "not necessarily a security on its face” and that programmatic sales of XRP to the public did not break securities laws. However, approximately US$728 million worth of institutional sales of XRP did qualify as securities offerings.

This saw layer-1 protocols Stellar (XLM) and Solana (SOL), as well as layer-2 Optimism (OP) also explode double-digits, each adding on 29.2%, 26.0%, and 23.5%, respectively.

Similarly, DeFi protocols Synthetix Network (SNX) and Compound (COMP) gained 30.2% and 28.1%, respectively.

In Other News

- The team behind Polygon is planning to introduce an enhanced token to coincide with their redesigned system's structure. Known as POL, the token is being referred to as a "3rd generation token" following the footsteps of Bitcoin and Ethereum. In its functionality, the upgraded Polygon token will grant POL holders the opportunity to act as validators within the network, and eventually deprecate the current MATIC token.

- Crypto exchange Coinbase announced it will be temporarily stopping new customers from staking crypto assets in four states amid legal proceedings from local regulators. Additionally, existing clients from these 4 states will not be able to stake additional crypto assets.

Crypto staked prior to the orders remain unaffected.

- On Thursday, the United States Department of Justice (DoJ) apprehended Alex Mashinsky, the former CEO of the defunct crypto lending company Celsius Network (CEL), and pressed seven criminal charges against him.

Regulatory

BlackRock's request to introduce a Bitcoin exchange-traded fund (ETF) has been officially included in the Securities and Exchange Commission's docket as part of the process for review. This development represents a significant step forward for the highly anticipated Bitcoin-related proposal currently under scrutiny by the SEC.

Recommended reading: It's been the centre of attention this week, but what exactly is XRP, what are its use cases, and why is it so popular?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6Hb7FLwmLnc4hQomT5f8np%2F0e190615dbbee3cb652881670ab12d81%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-07-19T11%3A48%3A15.481Z)