Market Highlights

- Strong price growth occurred across bitcoin, Ethereum and meme coins this week.

- Meme coins about cats, dogs and US politics experienced a flurry of trading volume.

- Spot Ethereum ETFs have been approved by the US Securities and Exchange Commission.

- South Korea has enacted legislation to protect crypto investors.

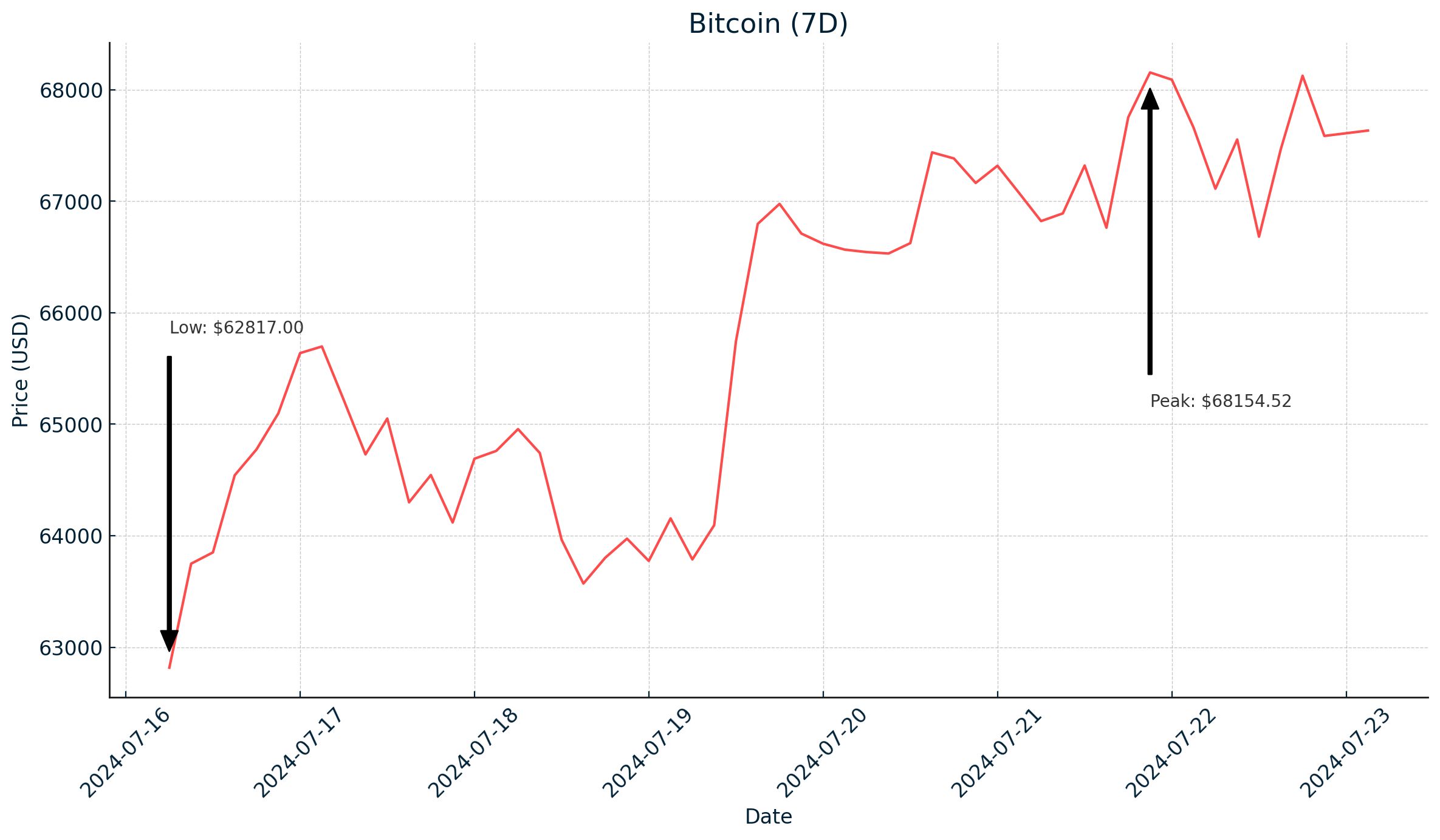

Bitcoin

Bitcoin has recovered from its recent period of consolidation. Developments in the US presidential race and the reduction of sell-side pressure are driving price back towards the all-time high of US$73,000, seen in March 2024. Starting the week around the key level at US$60,870, bitcoin’s price has been in the green most days since, showing the strong momentum behind the recent gains.

Former President Donald Trump, who accepted the Republican nomination this week, confirmed that he will still speak at the Bitcoin conference in Nashville, Tennesse, despite the assassination attempt against him. Also this week, US Shark Tank investor and billionaire entrepreneur Mark Cuban asserted that recent support for Donald Trump from Silicon Valley tech executives is a “bitcoin play”. In a post on X, Cuban said that it isn’t just Former President Trump’s perceived support of crypto but the potential for lower tax rates and tariffs driving the price of bitcoin amid persistent global uncertainty.

Macroeconomic data presented some surprises in the US this week. Core retail sales came in at 0.4% for June, 0.3% higher than the forecast 0.1%. Unemployment claims also came in higher than forecast, with 243,000 claims, slightly above the forecast 229,000. The higher-than-expected data releases haven’t changed the US Federal Reserve's stance on interest rates, though. In a speech at the Federal Reserve Bank of Kansas City, US Federal Reserve Governor Christopher Waller said the central bank is “getting closer” to a rate cut. He maintained the central bank’s stance that the economy is headed for a “soft landing”, assuming there aren’t any major changes with inflation and employment data. Governor Waller said he’d be looking for further data in the coming months to see if the expectation of a “soft landing” holds.

Bitcoin is currently trading at US$67,522, an increase of almost 5% on the week.

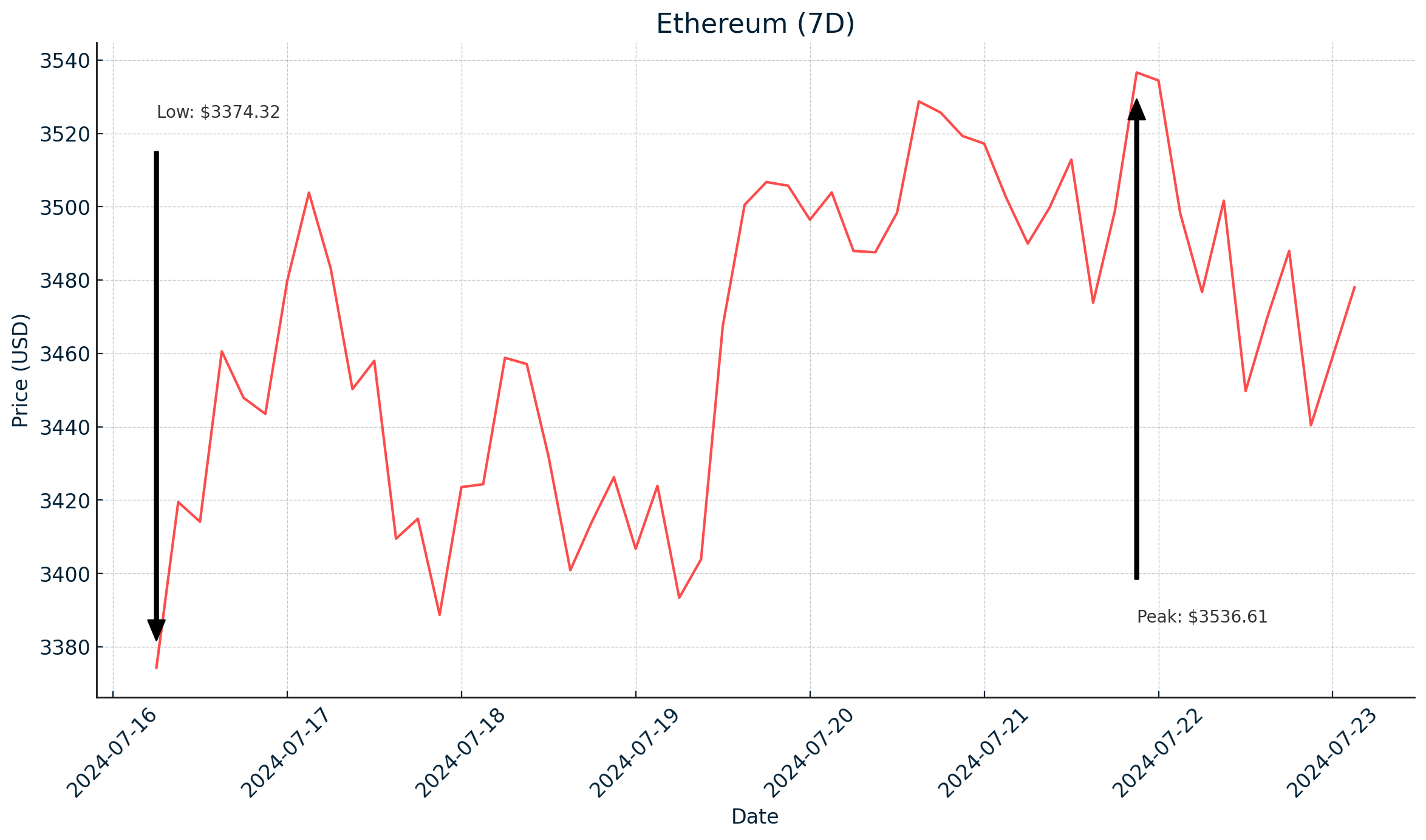

Ethereum

Ethereum started the week strong, around the key level of US$3,220, before accelerating above US$3,355. However, a retrace to start the new week saw last week’s gains lost. Price presumably consolidated while markets awaited the launch of Ethereum exchange-traded funds (ETFs).

The US Securities and Exchange Commission (SEC) approved nine spot Ethereum ETFs on Monday evening local time. The products will officially launch at 9:30am Eastern Daylight Time on Tuesday, 23 July, in the US. The Grayscale Ethereum Trust, Ethereum Mini Trust and Bitwise Ethereum ETF will trade on the New York Stock Exchange, while BlackRock’s iShares Ethereum Trust will trade on the Nasdaq. The other Ethereum ETF products will be listed on the Chicago Board Options Exchange.

While the launch of ETF products faired well for bitcoin, with price and inflows spiking after the January 2024 approval, analysts expect the launch of Ethereum ETFs to be “underwhelming”. Analysts also say that Grayscale’s ETF products could place selling pressure on Ethereum as it did on bitcoin. Grayscale will list two Ethereum ETF products: the main ETF and a mini ETF. The main ETF will convert from a closed-end product, meaning it will now be easier for investors to liquidate their funds once the product launches. Significant outflows from Grayscale's main Ethereum ETF are expected in the opening weeks, which may cause a retrace in the price of ETH.

Also this week, US SEC Commissioner Hester Pierce said that the possibility of staking in Ethereum ETFs could be reconsidered. The SEC requested that staking be removed from the applications early in the process.

Ethereum is currently trading at US$3,444, a decrease of 0.85% on the week.

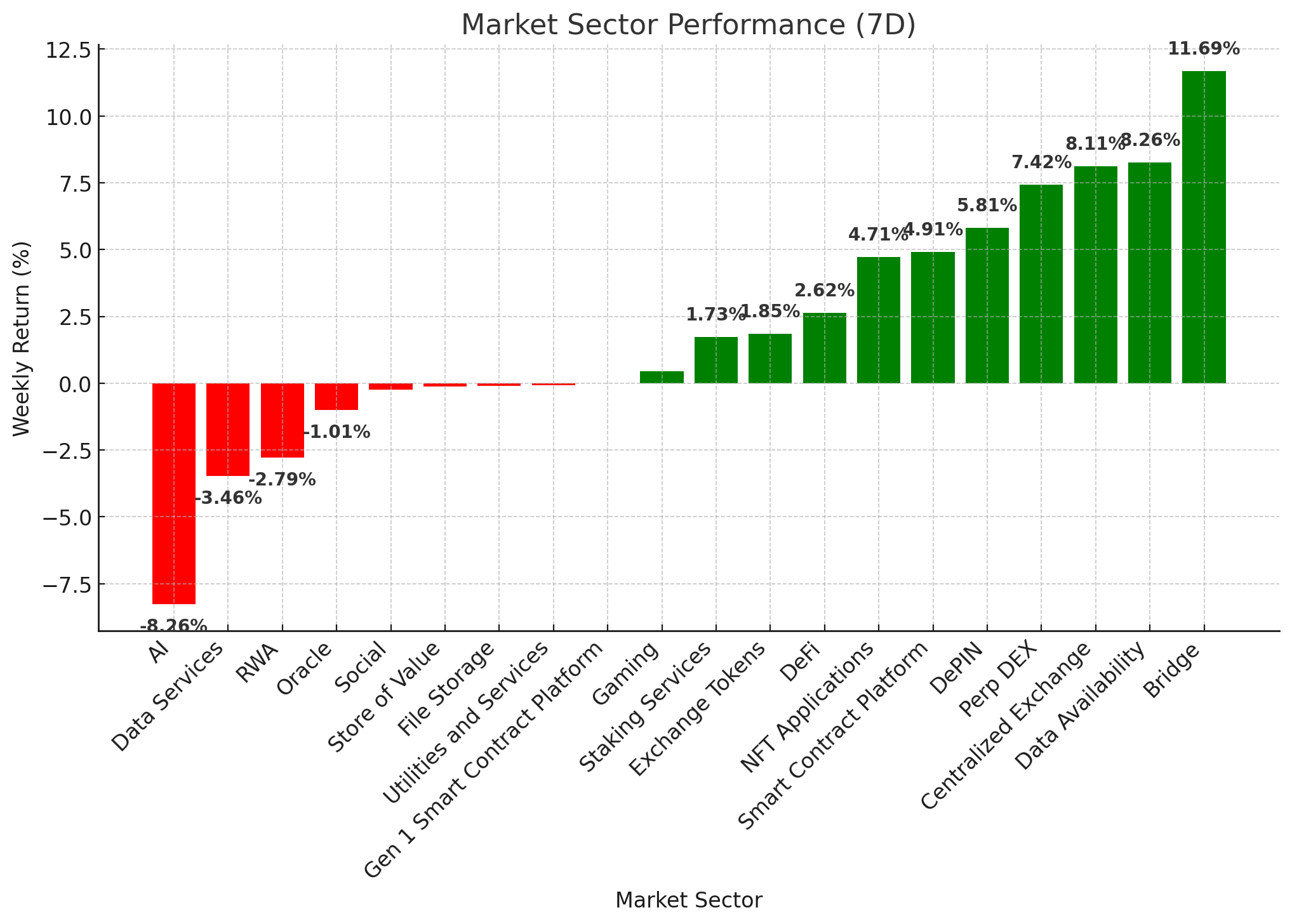

Altcoins

Market sector performance was strong for the second week in a row. The bridge sector expanded by 11.7%. Next were data availability, centralised exchanges and decentralised physical infrastructure (DePIN), which grew by 8.3%, 8.1% and 5.8%, respectively.

As prices have recovered across the market in the last two weeks, the sectors that experienced the largest growth have been the Bitcoin ecosystem (40.5%), data availability (38.4%) and DePIN (30.4%). This suggests that not only is bitcoin’s price driving sector growth, but the auxiliary sectors that strengthen decentralised networks, such as supporting nodes with storing data and providing consensus, are growing the crypto ecosystem, too.

Market Sector Performance (7D)

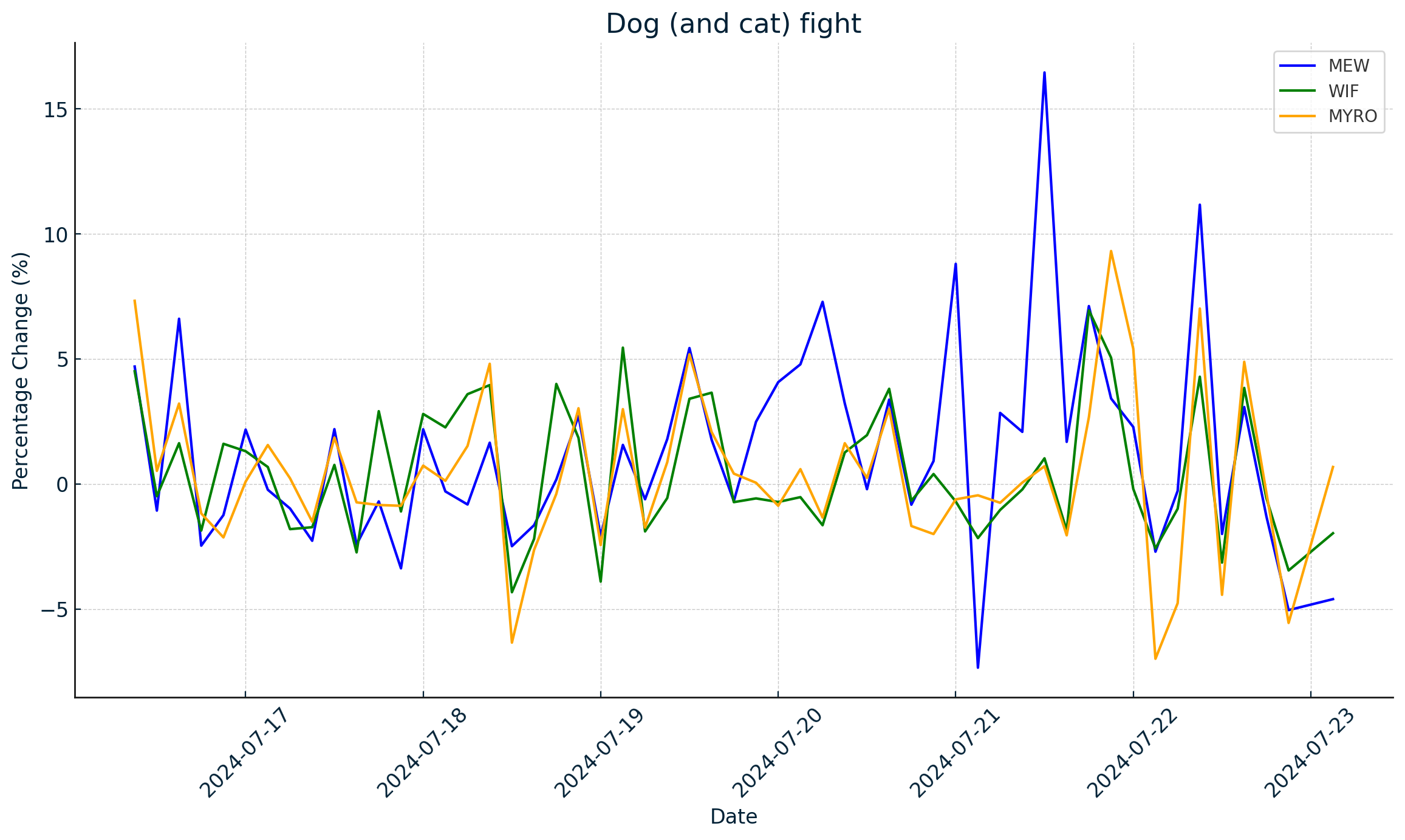

Dog (and cat) fight

- cat in a dogs world (MEW) contributed to this week’s meme coin growth, gaining 120.6%. This takes its market cap to US$667.1 million. The price of MEW started the week strong, like many other meme coins, before gaining further to end the week. The gains are presumably due to the MEW staking product launched by Salavi and the listing of MEW on crypto exchange PointPay.

- dogwifhat (WIF) gained 57.3%, which takes its market cap to US$2.8 billion. The gains came after Forbes named WIF as the best-performing cryptocurrency of 2024, gaining over 1,300% in the year to date. WIF’s feature in crypto.news’ chart of the week summary, noting that WIF’s price had risen above the key level at US$2.46, and a convincing close above US$2.40 would signal further momentum, presumably fuelled further price growth for WIF to end the week around US$2.80.

- Myro (MYRO) gained 55.2%, taking its market cap to US$165.8 million. The price of the Solana-based meme coin started the week with over 27% growth on Monday, 15 July alone. The growth is likely driven by this week’s uptick in volume across cat- and dog-based meme coins on the Solana network.

Multichain developments

- Neon (NEON) grew by 61.6%, taking its market cap to US$37.6 million. Following Neon’s token unlock on 17 July, price consolidated sideways before growing by over 107% in the following days and then slightly retracing. The price growth is likely due to the announcement that the Coin98 wallet integrated the Neon Ethereum virtual machine (EVM), making it the first parallelised EVM on Solana. This means users can seamlessly transfer SPL tokens between Solana and the Neon EVM with their Coin98 wallet.

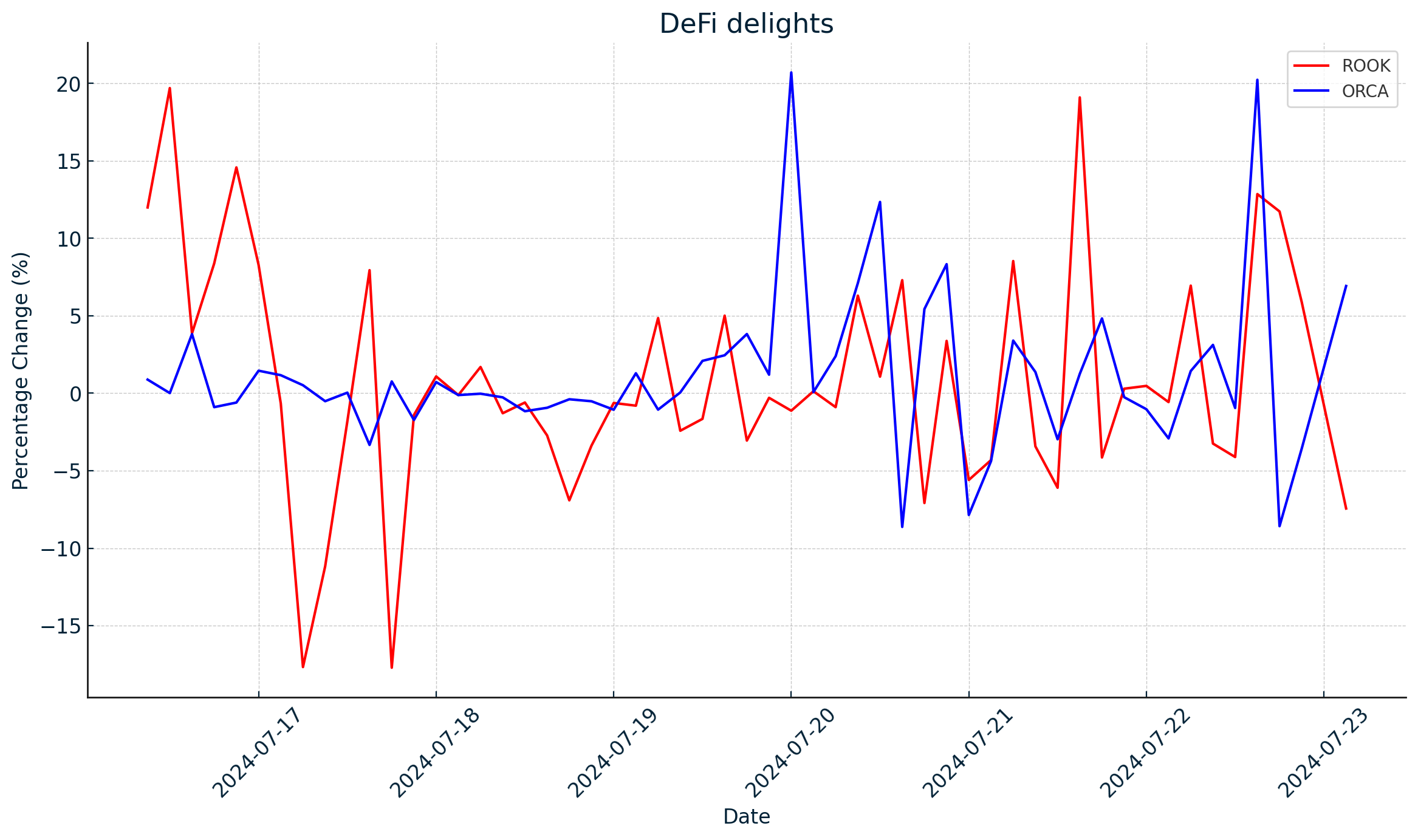

DeFi delights

- Rook (ROOK) grew by 63.8%, taking its market cap to US$978,500. The price of KeeperDAO’s native utility and governance token presumably moved to the upside after finding support at the key level of US$0.66. Price has been consolidating at this level in recent weeks. The gains are also potentially driven by the imminent approval of spot Ethereum ETFs, given that the KeeperDAO network is designed to strengthen the Ethereum ecosystem.

- Orca (ORCA) grew by 52.5%, taking its market cap to US$119.4 million. The crypto marketplace on Solana had strong momentum to start the week before growing by over 65% on Saturday, 20 July, and then retracing. The gains are presumably due to the announcement that $CLOUD liquidity pools went live on Orca and the launch of $NAUTS rewards for liquidity pool providers.

In Other News

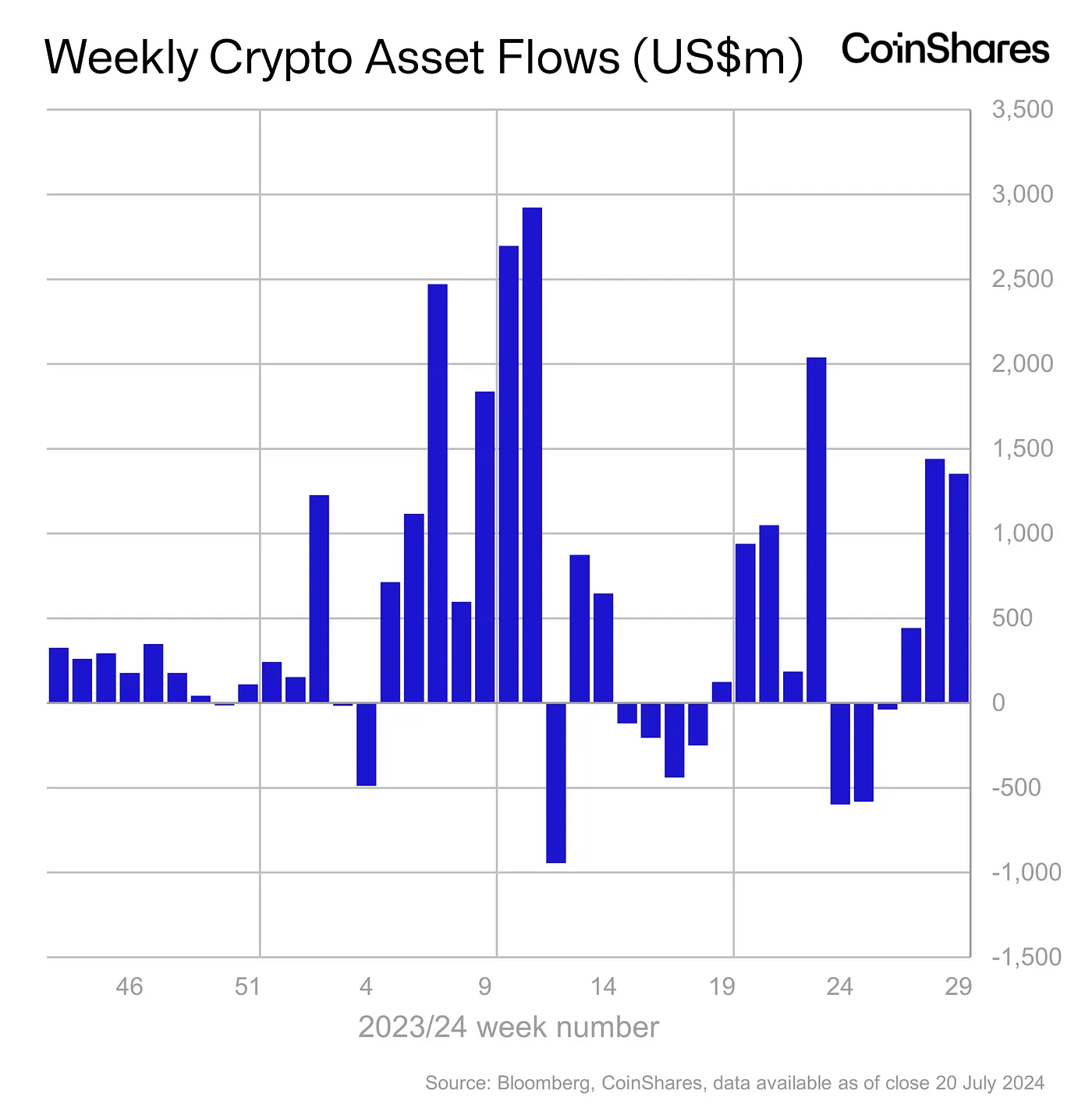

Another week of positive sentiment saw inflows of US$1.35 billion into digital asset investment products, bringing the total for the last three weeks of inflows to US$3.2 billion. Bitcoin investment products saw inflows of US$1.27 billion, while outflows in short-bitcoin exchange-traded products continued, with US$1.9 million leaving these products.

Ethereum investment products saw inflows of US$45 million, making it the altcoin with the largest inflows for the year to date.

The US and Switzerland saw the biggest inflows this week, with US$1.3 billion and US$66 million, respectively. Brazil and Hong Kong had small outflows of US$5.2 million and US$1.9 million, respectively.

- President Joe Biden announced that he would no longer be running in this year’s US presidential race. Upon the announcement, Solana-based meme coins Donald Tremp (TREMP) and TrumpCoin (DJT) rose 10.5% and 6.5%, respectively. Maga Hat (MAGA), an Ethereum-based meme coin, rose by over 7% on the news. The Solana-based meme coin, Joe Boden (BODEN), fell by almost 60% to an all-time low. And as President Biden’s next post on X announced Kamala Harris as the Democratic party nominee, the price of the Solana-based meme coin, Kamala Horris (KAMA), grew by over 100%. The steep gains and losses in meme coins based on US politics will likely continue as people use platforms like Polymarket to hedge their bets on who will be the next president.

- DeFi protocol, Rho Markets, experienced an exploit that saw US$7.6 million compromised from accounts on Friday. Built on the layer-2 scaling network, Scroll, the actor delivered an on-chain message to Rho Markets, telling it to address software issues that left the network open to funds being taken from accounts. “We understand that the funds belong to users and are willing to fully return,” said the poster. “But first, we would like you to admit that it was not an exploit or a hack but a misconfiguration on your end.” Rho Markets temporarily suspended activity on its project, which holds US$40 million in crypto assets, to address the issue. Funds are now being reassigned to the correct borrow pools.

- Japanese investment firm Metaplanet Inc. bought an additional 20.4 bitcoin this week, valued at US$1.27 million. This takes the firm’s bitcoin holdings to almost 246 bitcoin, which is worth 2.5 billion yen (US$15.5 million). Upon its latest bitcoin purchase, the Tokyo-listed invested firm’s stock price rallied by 21%. The company announced in May that it would adopt bitcoin as a treasury reserve asset due to ongoing economic pressure in Japan, such as high government debt, negative real interest rates, and the weakness of the Japanese Yen. According to Bitcointreasuries.net, Metaplanet made previous bitcoin purchases on April 23, May 10, June 11, July 1, July 8 and July 16.

Regulatory

South Korea has enacted legislation to protect crypto investors. The Virtual Asset User Protection Act was brought into force by the South Korean Financial Services Commission. It’s the first piece of legislation in the jurisdiction aimed at protecting crypto investors. The legislation defines digital assets as electronic tokens that can be traded or transferred electronically and excludes non-fungible tokens and central bank digital currencies. Crypto exchanges will also be required to deposit users’ funds into financial institutions to provide protection against bankruptcy. Interest will also need to be paid on deposits.

In case you missed it...

Don't miss out on:

- Market Insights & Outlook: Dive deep into the trends shaping the crypto world.

- Performance Updates: Get the latest on our fund's performance this quarter and beyond.

- Special Guest Appearance: Leigh Travers from Animoca Brands will share pioneering insights into web3 gaming and blockchain innovations.

🌐 Secure your spot now to stay ahead in your investment journey with guidance from the top minds in the industry!

🔗 Last Chance to Register: https://bit.ly/FlagshipFund_July

The Webinar is meant for:

- Australian "Wholesale Investors" only as defined in the Corporations Act 2001 (Cth); and

- U.S. Accredited Investors as defined in Regulation D of the U.S. Securities Act of 1933.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.