Market Highlights

- Bitcoin and Ethereum pulled back more than 3% this week

- DeFi lost 4.8% over the last seven days, while Web3 and Currencies managed positive returns

- A recent CoinShares poll showed that 43% of institutional investors believed BTC had the highest growth potential

- Lookonchain reported an ICO participating address which moved Ethereum (ETH) after eight years of dormancy

- McDonald’s Hong Kong unveiled McNuggets Land, an official Ethereum-based metaverse game

- The SEC accepted its second spot BTC ETF application for review, Valkyrie Bitcoin Fund

Price Movements

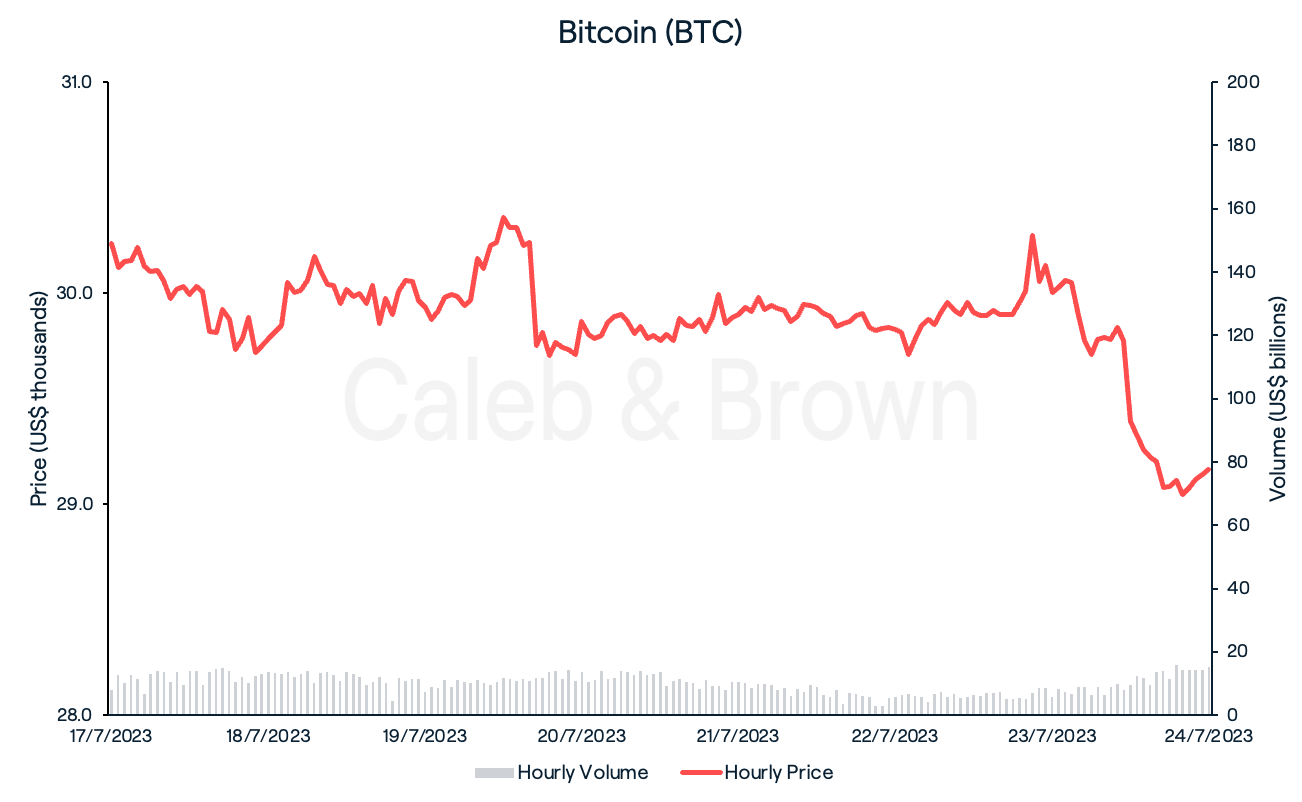

Bitcoin

After a blistering altcoin rally last week the crypto space cooled-off slightly as Bitcoin (BTC) teetered around the US$30,000 mark where it eventually failed to hold the line, closing the week at US$29,164, down 3.5%.

Meanwhile, a recent CoinShares poll revealed that of a total of 51 institutional investors, who collectively manage US$900 billion in assets, 43% believed BTC had the highest growth potential.

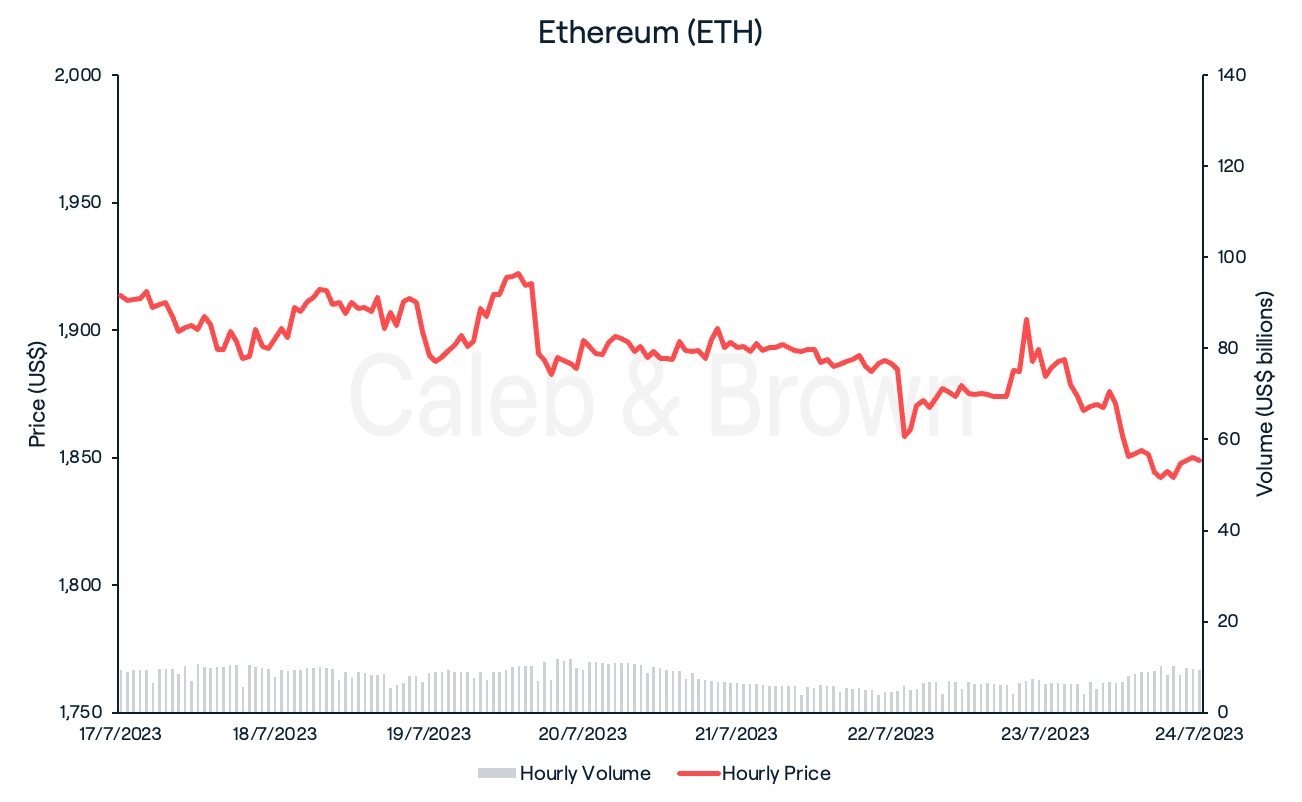

Ethereum

Ethereum (ETH) struggled to hold US$1,900, slipping well below on Sunday night to hit a weekly low of US$1,833 before recovering slightly to close the week at US$1,848, down 3.3%.

On Wednesday, blockchain analytics firm Lookonchain reported an ICO (Initial Coin Offering) participating address which moved funds after eight years of dormancy. The user deposited 61,216 ETH (worth approx. US$116 million) onto Kraken after receiving them at a purchase price of US$0.31/ETH.

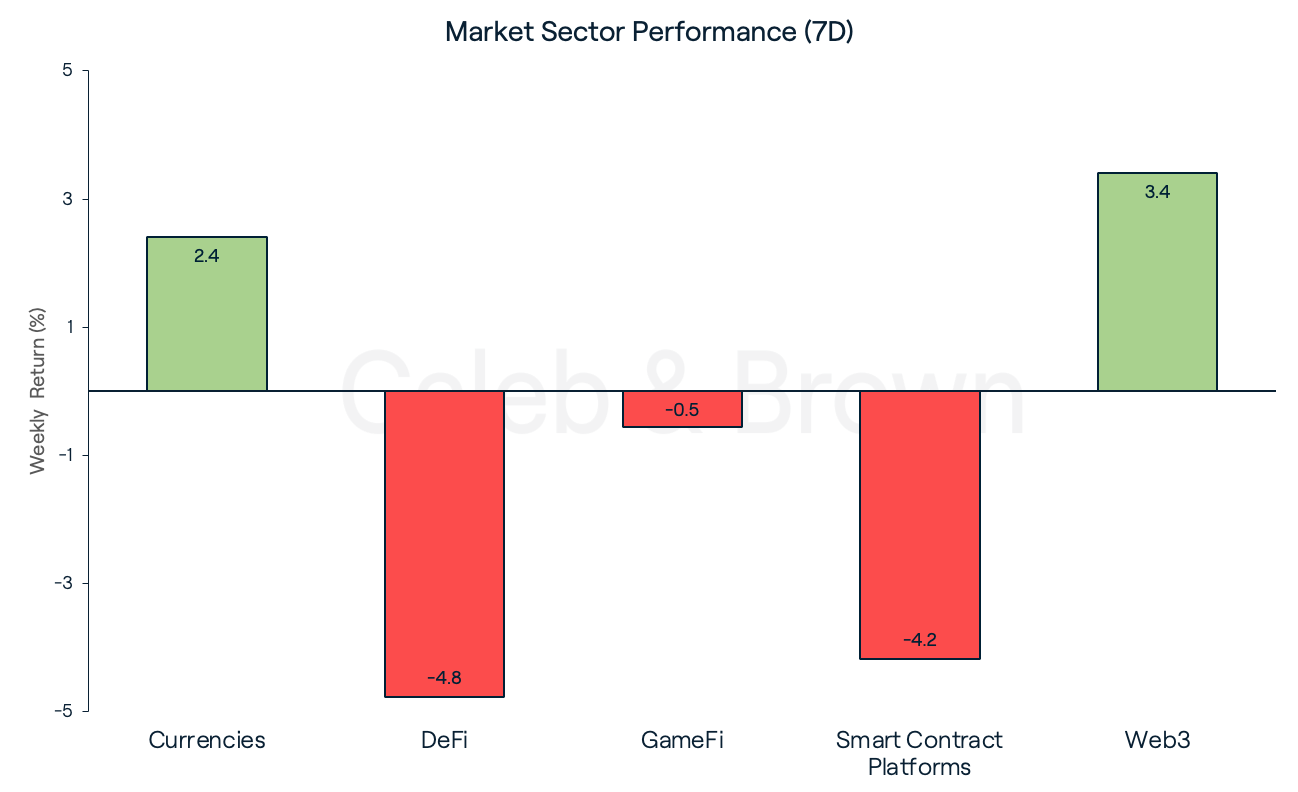

Altcoins

Shaky BTC price action caused varied sector performance this week with DeFi taking the largest hit, losing 4.8% over the last seven days. However, Web3 and Currencies managed positive returns, adding on 3.4% and 2.4%, respectively.

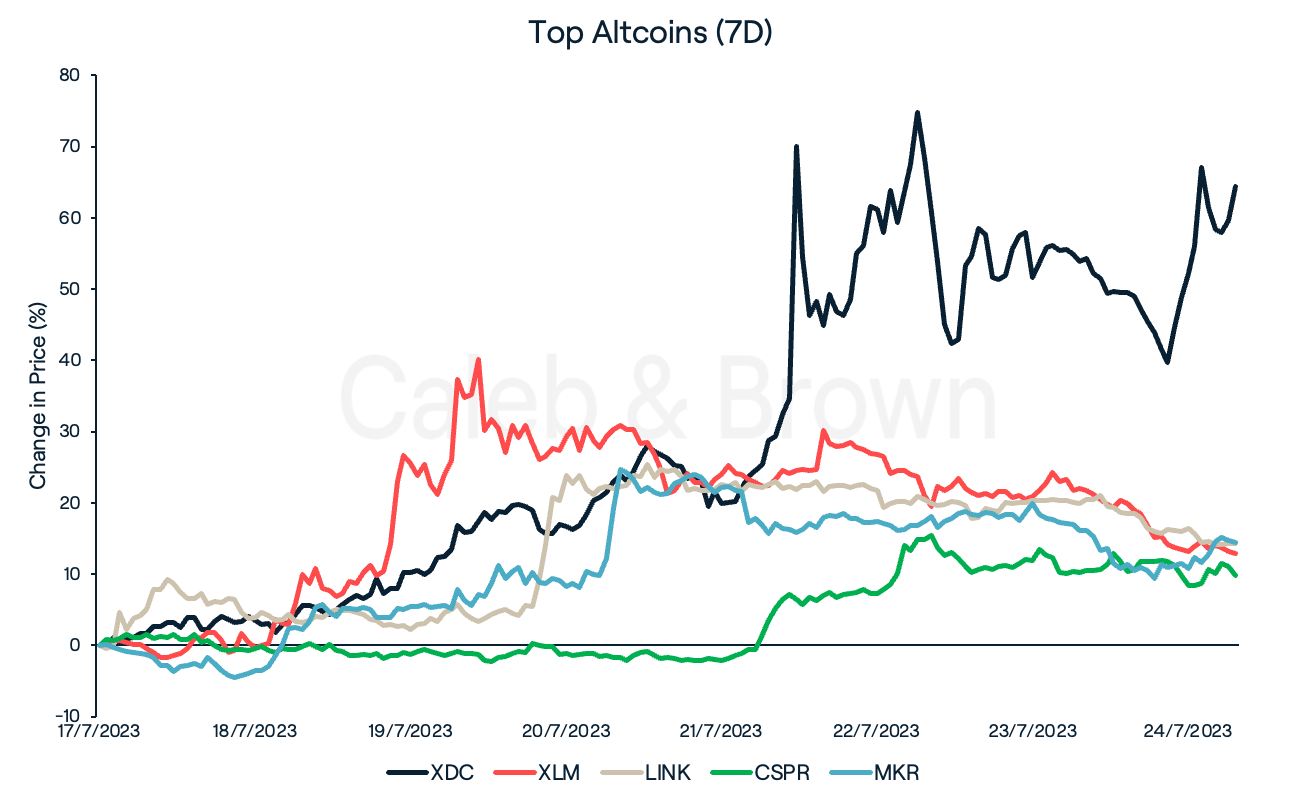

While the hype from XRP’s court case win had settled down this week, a few tokens maintained high interest and secured double-digit gains.

XDC Network (XDC) and Stellar (XLM) continued to piggyback from XRP’s win last week and have jumped 64.4% and 12.9%, respectively. Decentralised oracle protocol, Chainlink (LINK) and layer-1 protocol Casper Network (CSPR) also performed well, adding on 14.3% and 9.8% week-on-week. Chainlink recently launched its Cross-Chain Interoperability Protocol (CCIP) on its Mainnet, aiming to achieve secure interoperability, and create a private-public dynamic that will give traditional finance access to digital assets, and the crypto space to trillions of dollars.

Finally, Maker (MKR), the decentralised lending protocol rallied 14.4% after it activated a token buyback scheme on Wednesday, periodically removing MKR supply from the market.

In Other News

McDonald’s has entered the metaverse after McDonald’s Hong Kong unveiled McNuggets Land, an official Ethereum-based metaverse game, currently live in The Sandbox.

On Tuesday, the U.S. Securities and Exchange Commission (SEC) accepted its second spot BTC ETF application for review, Valkyrie Bitcoin Fund (BRRR).

Regulatory

- On Thursday, U.S. legislators presented a new bill with the goal of resolving the regulatory uncertainty surrounding the digital assets industry. The proposed legislation aims to define new definitions, create exemptions for digital assets, and lay out a clear process for digital asset intermediaries, such as cryptocurrency exchanges, to register with both the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

- The SEC signalled it would appeal the latest XRP ruling on Friday, disagreeing with the decision made. However, crypto lawyer John Deaton exclaimed “an appeal is not even close to a setback” on twitter, also stating “Don’t let anyone underestimate how significant this win is.”

Recommended reading: Not every crypto asset is the same. Each has unique and diverse use cases. In this guide, we'll explore the Top 10 most popular types of crypto.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6hS2pdraSDDD7f4QOcuuJb%2F27ee0891e871699945f67f165dcc970b%2FWeekly_Rollup_Tiles__6_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-07-25T01%3A54%3A03.378Z)