Market highlights

- A Satoshi-era wallet sold approximately US $9.3 billion worth of BTC.

- President Trump’s crypto task force will release its 180-day report on July 30.

- BlackRock’s iShares Ethereum Trust (ETHA) reached US$10 billion in AuM in 251 days.

- The U.S. Senate has started considering its version of a crypto market structure bill.

- Wyoming’s state-based stablecoin, WYST, is expected to launch in August.

Markets Overview

In another strong week for TradFi assets, the S&P 500 and the Nasdaq closed at record highs. The continued rally was presumably due to strong Q2 corporate earnings, global M2 money supply reaching a record US$55.5 trillion, and markets anticipating a trade deal between the U.S. and the European Union, which was reached over the weekend. The trade agreement includes a 15% tariff to be levied on European goods, which is 15% lower than the 30% tariff that President Trump originally proposed.

The flash manufacturing and services PMI for June came in at or above forecast across Europe and the U.K, with the exception of the U.K.’s services PMI, which came in below forecast at 51.2. In the U.S., the manufacturing PMI came in under forecast at 49.5, while the services PMI came in 2.2 points above the forecast at 55.2. PMI data globally has been steady in recent months, suggesting that production and service delivery remain stable.

Traders and investors will be monitoring several key announcements this week, including the U.S. Federal Reserve’s rate decision on July 30, as well as additional Q2 earnings and other notable releases, which are listed below.

Weekly performance: S&P 500 +1.5%, Dow Jones +1.3%, Nasdaq +1%.

Looking ahead:

- Q2 corporate earnings (including Meta Platforms, Microsoft, Amazon and Apple)

- U.S. advance GDP q/q - July 30

- Bank of Canada rate decision - July 30

- Federal Reserve FOMC meeting – July 30

- Bank of Japan rate decision - July 30 (tentative)

- U.S. core PCE price index - July 31

- U.S. non-farm employment change - August 1

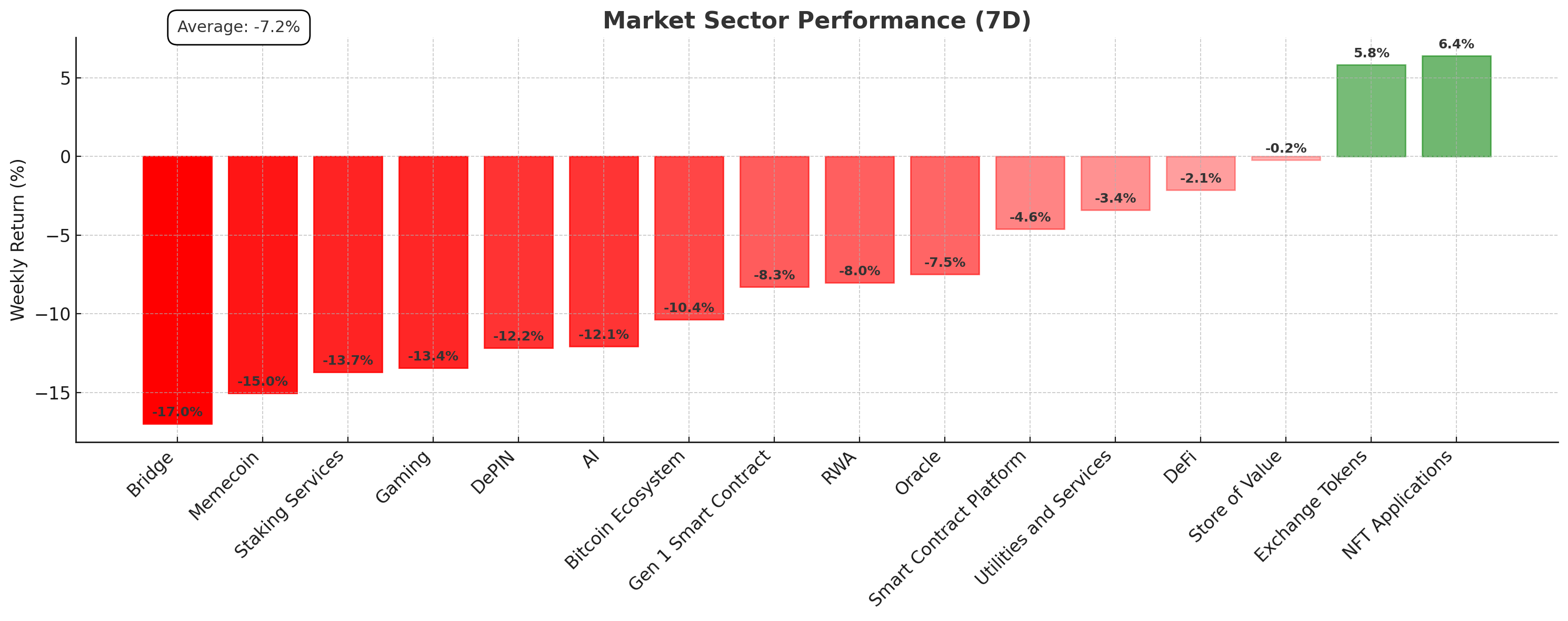

Crypto Market Sector Performance

Many sectors saw declines this week, with the exception of NFT applications and exchange tokens, which saw minor gains. Bridging services had the largest declines, potentially due to subdued performance across crypto markets and reduced demand for DeFi services.

Biggest gainer

- NFT applications: Pudgy Penguins (+8.5%) continued its recent gains following Canary Capital’s exchange-traded fund (ETF) application with the U.S. Securities and Exchange Commission (SEC).

Biggest loser

- Bridging: LayerZero (-20.3%) saw the biggest losses due to a 27.5 million token unlock, which increased selling pressure.

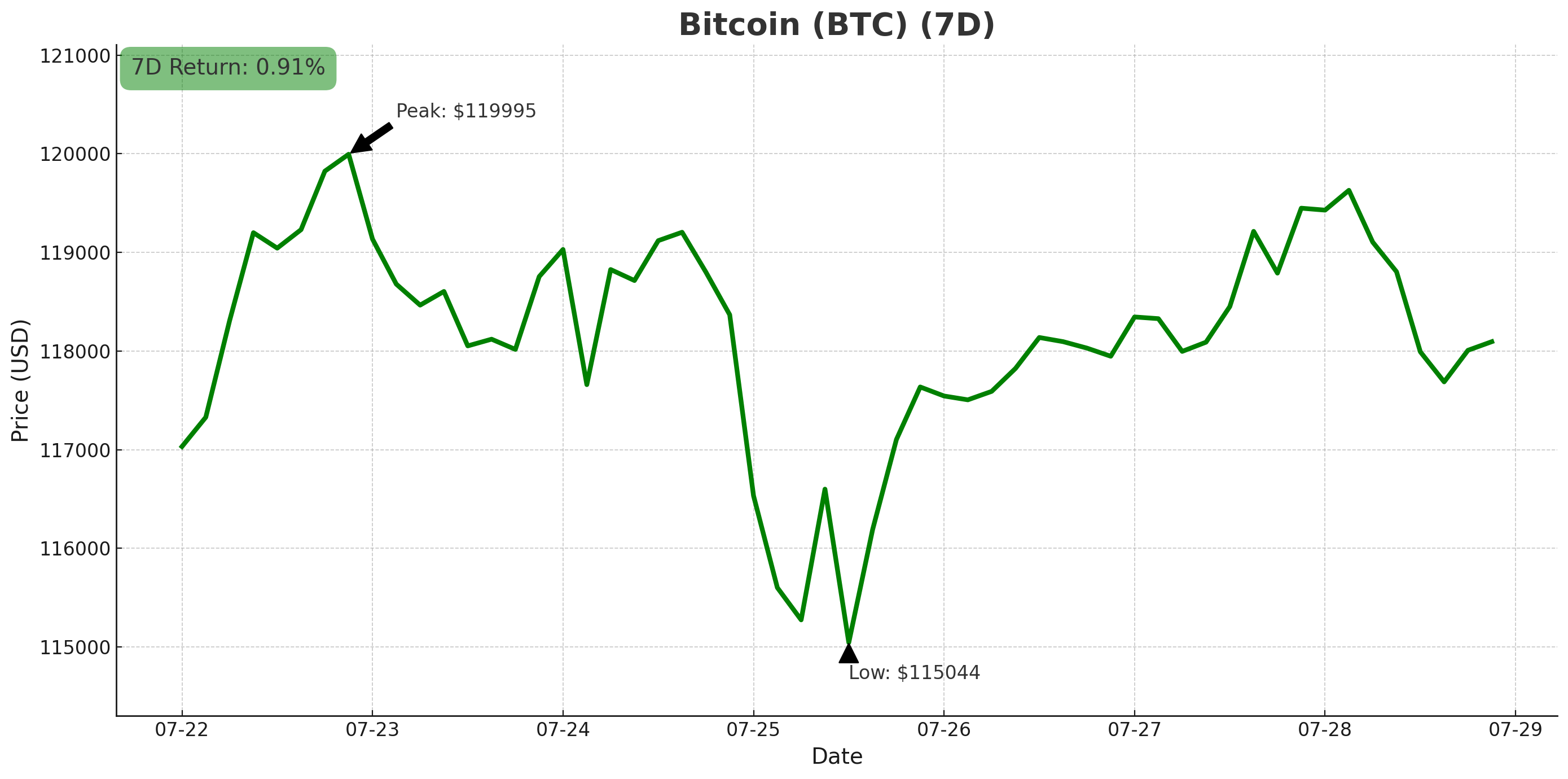

Bitcoin (BTC)

- Opened the week at US$117,315, traded flat and then sold off on Friday, July 25, as large holders moved US$3.7 billion worth of BTC to exchanges, creating selling pressure, though it has since largely recovered. (0.8% 7D)

- Bitcoin investment products saw US$175 million of outflows this week.

A Satoshi-era wallet awakened after 14 years and sold approximately 80,000 BTC this week, valued at around US $9.3 billion. The transaction was processed via Galaxy Digital, marking one of the largest single-entity exits in crypto history. Industry analysts suggest that the move may reflect strategic redistribution or institutional succession, rather than panic selling. It comes as exchange-traded fund (ETF) issuers have grown to a point where they may absorb the supply from BTC whales selling and any subsequent retail selling activity.

SpaceX, one of Elon Musk’s companies, consolidated US$153 million of its BTC holdings into a single on-chain wallet this week. It’s the company’s first blockchain activity in three years. The company currently holds 8,825 BTC, worth almost US$989 million. The movement came several days after the Trump Administration announced a review of the company’s government contracts, igniting speculation that SpaceX may sell some of its BTC holdings to shore up funds.

Jack Dorsey’s Block (XYZ) joined the S&P 500 on July 23. It comes as the company begins onboarding customers for Block’s “new native bitcoin acceptance experience,” which will allow merchants to accept BTC payments using the Lightning network.

In bitcoin buying news:

- Strategy’s new stock offering, Stretch (STRC), will sell shares at US$100 each, with an initial dividend rate of 9%. Following the initial announcement, the preferred stock offering was increased to US$2 billion from US$500 million. And another class action was filed against the firm, alleging that Strategy shareholders weren’t given the opportunity to vote on an amendment to its Strike offering. The company currently holds 607,770 BTC, worth over US$71 billion.

- MARA Holdings announced that it will raise US$850 million through the sale of private convertible notes to purchase more bitcoin, fund working capital, and pay down debt. The company’s stock price fell 10% on the news. MARA currently holds 50,000 BTC, worth US$5.9 billion.

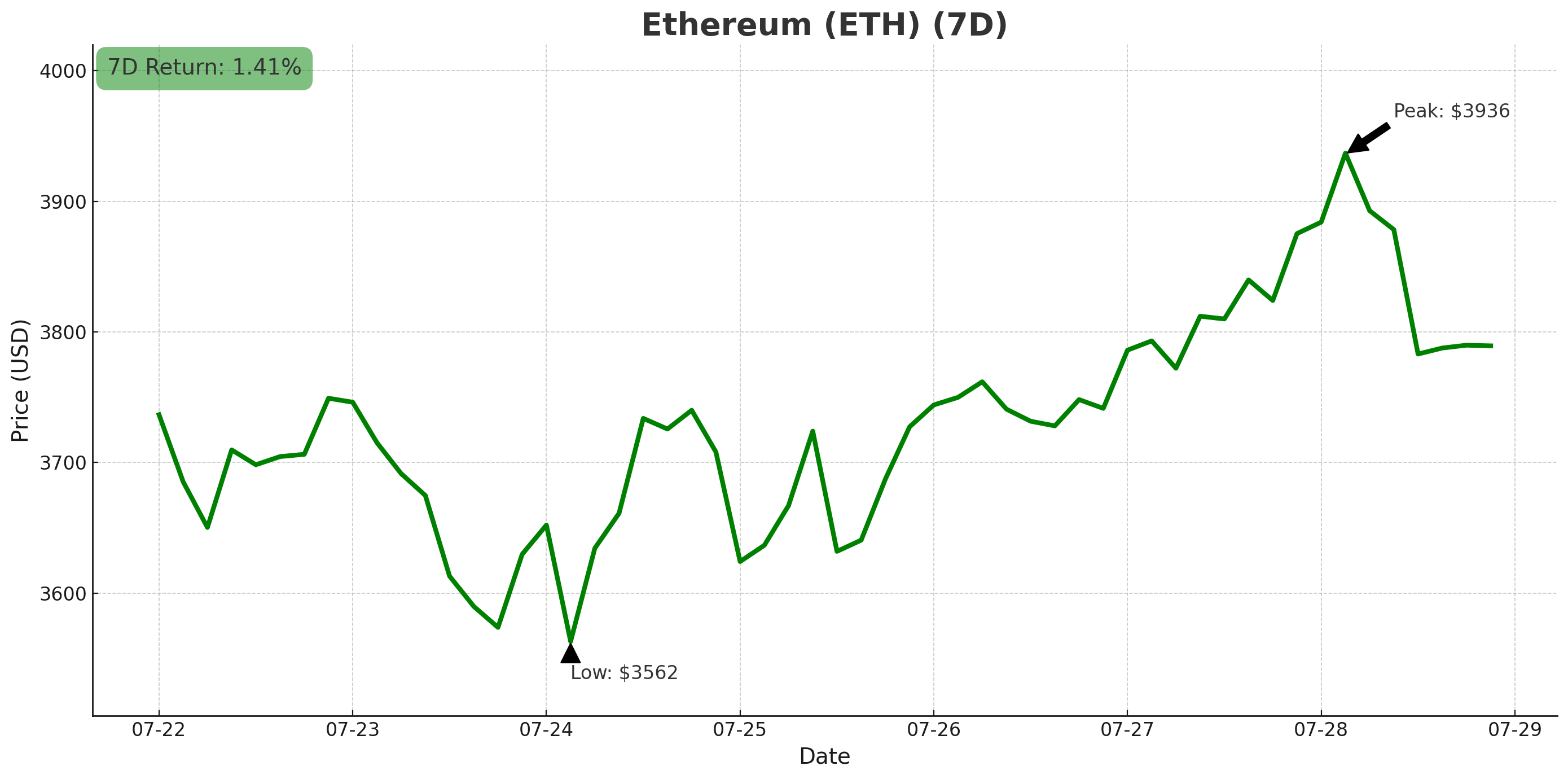

Ethereum (ETH)

- Opened the week at US$3,758, declined to around US$3,530 and then rallied to break US$3,880 for the first time since December 2024. (+1.3% 7D).

- Ethereum-focused funds saw nearly US$1.6 billion in inflows this week, significantly outperforming bitcoin fund flows and potentially signalling that altcoin season may be approaching.

BlackRock’s iShares Ethereum Trust (ETHA) became the third-fastest ETF to reach US$10 billion in assets under management, reaching the milestone in 251 days. It comes as Ethereum ETFs continued a 16-day inflow streak this week, outpacing BTC inflows.

BitMine Immersion Technologies, led by Tom Lee, has amassed 566,776 ETH, worth approximately US $2.1 billion, making it the world’s largest corporate Ethereum treasury. As part of a $250 million capital raise that closed on July 8, the NYSE-listed firm pivoted from Bitcoin mining to ETH accumulation and plans to stake up to 5% of the token’s total supply. BitMine’s average purchase price is US$3,643 per ETH.

SharpLink Gaming (SBET) bought 80,000 ETH this week, bringing its holdings to 360,807 ETH, worth over US$1.3 billion. SBE shares gained over 10% on the news.

Altcoins

Performance across the crypto market was more subdued this week, with the altcoin index declining to 39, down from 56 the previous week.

Synthetically stable

- Ethena (ENA) gained almost 23%, including an intraday gain of 37% on July 28, following institutional buying of the synthetic stablecoin protocol. Amongst the buyers was BitMEX co-founder Arthur Hayes, who bought almost 2.2 million ENA, worth about US$1 million.

Yielding growth

- Convex Finance (CVX) gained 24.5%. The DeFi protocol, which optimises yield farming strategies, presumably saw an increase in trading volume as f(x) Protocol is using its technology to introduce short trading functionality in DeFi.

In the vault

- BNB (BNB) gained 9.1% as CEA Industries (VAPE.US) announced plans to establish the world’s largest publicly traded BNB vault company. The company’s shares gained 620% on the news.

Suited up

- UMA (UMA) declined by 31%. The platform, which creates crypto derivatives native to Ethereum, presumably saw further losses as the Polymarket community recently protested an oracle vote by UMA whales. This vote saw them cast twice to resolve a prediction market wager that Zelenskyy would wear a suit before July, voting “No” despite evidence to the contrary.

AI declines

- Virtuals Protocol (VIRTUAL) declined by 25%. The network, which enables autonomous AI agents to operate with decentralised networks, presumably declined on the announcement that veVIRTUAL holders could claim their full allocation of tokens in the next airdrop.

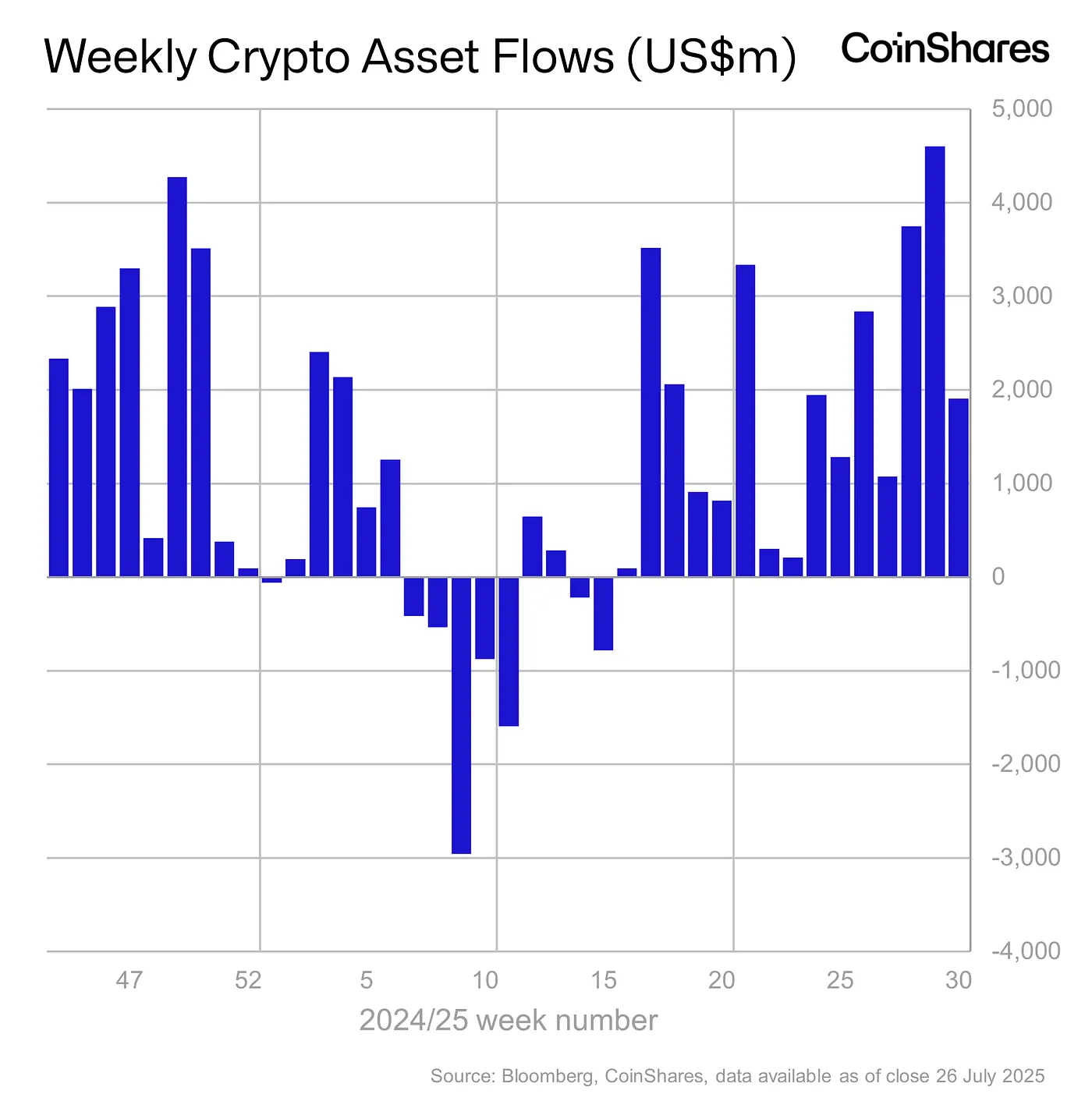

Crypto ETF News

Digital asset investment products saw inflows of US$1.9 billion this week. This brings month-to-date inflows to a record US$11.2 billion, surpassing the previous record of US$7.6 billion set in December 2024, marking the 15th consecutive week of inflows.

In altcoins, Solana, XRP and SUI saw inflows of US$311 million (a new record), US$189 million, and US$8 million, respectively. Other altcoins saw minor inflows, including Litecoin, which saw US$1.2 million and Bitcoin Cash, which gained US$0.66 million in inflows.

The U.S. Securities and Exchange Commission (SEC) paused Bitwise’s approval for the Bitwise 10 Crypto Index on July 22. And on July 29, it delayed its decision on the Trump-linked Truth Social Bitcoin ETF, the Grayscale Solana Trust, and the Canary Capital Litecoin ETF until September. The agency has intervened in several ETF approvals this month. Each time, the SEC’s Office of the Secretary has invoked Rule 431, which allows the agency to unilaterally review any staff decision made under delegated authority.

Other crypto news

- The U.S. Senate has started considering its version of a crypto market structure bill. It follows the passage of the CLARITY Act in the House on July 17. House Majority Whip Tim Emmer (R-MN) says the White House wants a market structure bill passed by September 30.

- President Trump’s crypto task force will release its 180-day report on its review of digital asset policy on July 30. The report is expected to outline how stablecoin oversight, token classification, and enforcement will proceed following the signing of the GENIUS Act into law and the passage of the CLARITY Act in the House. The report may also propose how the nation can build a strategic crypto reserve using seized assets, which could hold more than US$21 billion in assets.

- Wyoming’s stablecoin, WYST, is expected to launch in August. WYST is the first state-backed stablecoin in the U.S. and will be redeemable 1:1 for U.S. dollars, backed by cash and short-term Treasuries. The token won’t initially offer a yield, but legislators haven’t ruled out making that possible in the future. Critics of WYST argue that the token is a state-backed CBDC, whereas others contend that its 1:1 U.S. dollar backing distinguishes it from other CBDCs, which can be minted from nothing.

- Ethena Labs is making its stablecoin, USDtb, available in the U.S., following the passage of the GENIUS Act. The company is partnering with Anchorage Digital to make the USDtb available in the U.S. in the near future. The USDtb is predominantly backed by BlackRock’s tokenised money market fund, BUIDL. Similarly, Western Union is investigating opportunities to use stablecoins for cross-border payments, fiat conversion options in harder-to-reach markets and as a store-of-value product.

- BNY Mellon and Goldman Sachs are collaborating to create a tokenised version of Goldman Sachs’ money market fund (MMF). The product, developed with Goldman Sachs’ technology, will enable fund managers to subscribe to MMF shares using BNY Mellon’s Liquidity Direct and digital assets platform.

- Hong Kong’s licensed crypto exchange, OSL Group, has raised US$300 million in equity financing, marking the largest publicly disclosed digital-asset fundraise in Asia. The capital will be used to expand globally and accelerate the development of regulated stablecoin and payment infrastructure. Approximately 30% of the proceeds will support stablecoin initiatives. Hong Kong’s stablecoin licensing regime is set to launch on August 1.

- MEI Pharma is establishing a Litecoin treasury using the funding from a US$100 million private placement, which closed on July 23. The company is also adding Charlie Lee, founder of the Litecoin Foundation, to its board of directors.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.