Market Highlights

- Spot Ethereum ETFs and the Bitcoin conference generated many headlines but little price movement.

- US Senator Cynthia Lummis says the US Government should hold bitcoin as a strategic reserve asset.

- A new scam buried in malicious Zoom meeting links is targeting crypto investors.

- Compound Finance’s (COMP) community claim a governance attack is linked to a US$24 million proposal that passed despite community objection.

Bitcoin

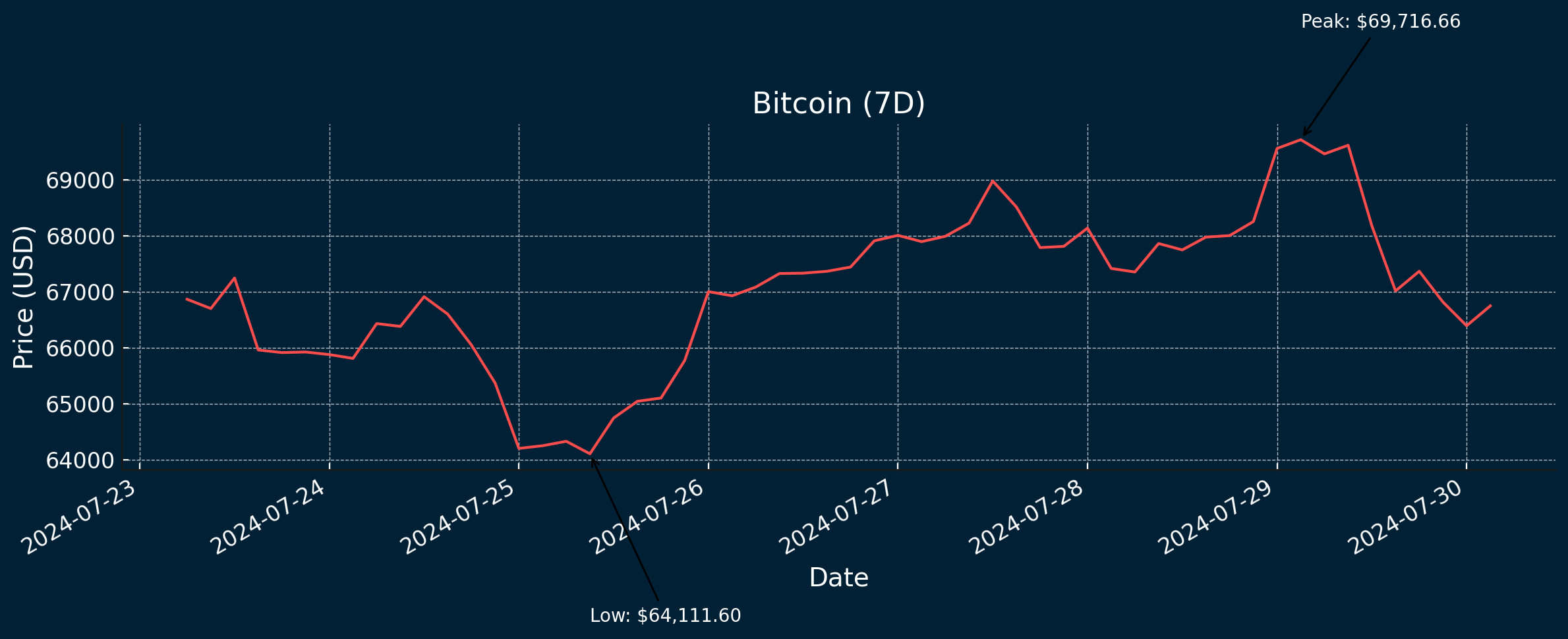

Starting the week around the key level at US$65,500, bitcoin’s price grew modestly throughout a week rich with headlines.

On Saturday, Republican Presidential nominee Donald Trump appeared for his much-anticipated speech at the Bitcoin2024 conference in Nashville. He took the opportunity to list promises to bitcoin and crypto investors, continuing his stance on making the United States an attractive place for the industry to innovate and grow. He told conference attendees, “I'm laying out my plan to ensure that the United States will be the crypto capital of the planet.” The crowd were happy to hear it, but this wasn’t the statement that got the biggest response. Further into his speech, Trump said that if elected, he would fire the Chair of the Securities and Exchange Commission (SEC), Gary Gensler, leading to an eruption of cheers.

Following Trump’s speech, Senator Cynthia Lummis presented a more defined cryptocurrency policy for the United States. Senator Lummis proposed to establish a strategic bitcoin reserve, explaining that holding the asset could halve the country’s debt by 2045.

MicroStrategy’s Michael Saylor also spoke at the Bitcoin conference. He says the US Government should own the majority of the bitcoin supply. In the same speech, Saylor said he expects bitcoin’s market cap to reach US$280 trillion by 2045. At a market cap of US$100 trillion, one bitcoin would be worth US$5 million. MicroStrategy currently holds 226,00 bitcoin, worth approximately US$15.3 billion at the time of writing.

In macroeconomic news, this week’s releases may require the US Federal Reserve to spend more time analysing whether it will deliver a rate cut and when, but the markets have responded otherwise. The US Flash Manufacturing Purchasing Managers Index (PMI) came in at 49.5, slightly lower than the forecast of 51.7 (a reading above 50 indicates industry expansion, while a reading below suggests contraction). The Flash Services PMI came in at 56, slightly above the forecast of 54.7. The advance gross domestic product (GDP) reading for the quarter ending 30 June 2024 came in at 2.8%, almost a full percentage point higher than the forecast 2%. The month-on-month personal consumption index for July came in at the forecast 0.2%.

This week’s macroeconomic data releases didn’t have a significant impact on crypto prices. Markets are presumably awaiting the US Federal Reserve’s rate decision on Wednesday 31, July. The central bank is expected to keep rates on hold at 5.5%.

Bitcoin is currently trading at US$66,679, a decrease of almost 0.66% on the week.

Ethereum

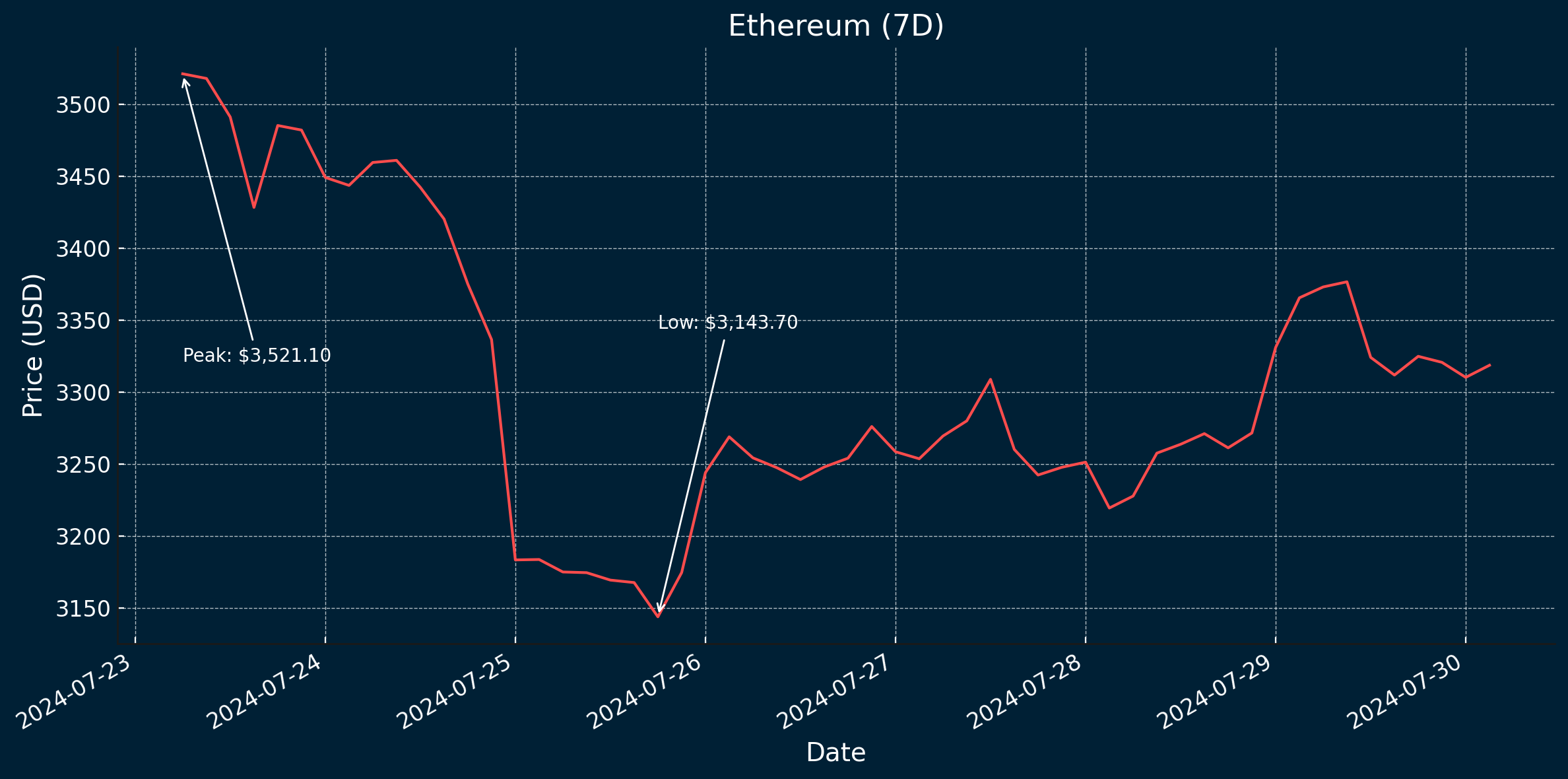

It was a big week for Ethereum, with the spot Ethereum exchange-traded funds (ETFs) finally launching on Tuesday in the US. However, the long-awaited launch of the ETFs did little to move price to the upside. Ethereum started the week around US$3,545 before breaking key levels at US$3,355 and US$3,220 to the downside then regaining some of the losses later in the week.

Sell-side pressure on Ethereum may be due to the outflows from Grayscale’s Ethereum Trust. Upon the launch of spot Ethereum ETFs, the fund converted from operating like a closed-end fund to an ETF, which saw US$484.9 billion of outflows on launch day. With hundreds of millions flowing into other funds, it was enough to post net inflows of US$107 million across all Ethereum ETFs on the first day of trading.

BlackRock’s iShares Ethereum Trust ETF saw inflows of US$266.5 million on the first day, followed by the Bitwise Ethereum ETF with $204 million net inflows. Coming in with the third largest inflows on day one was the Fidelity Ethereum Fund ETF, which saw inflows of US$71.3 million.

Ethereum is currently trading at US$3,312, a decrease of 1% on the week.

Altcoins

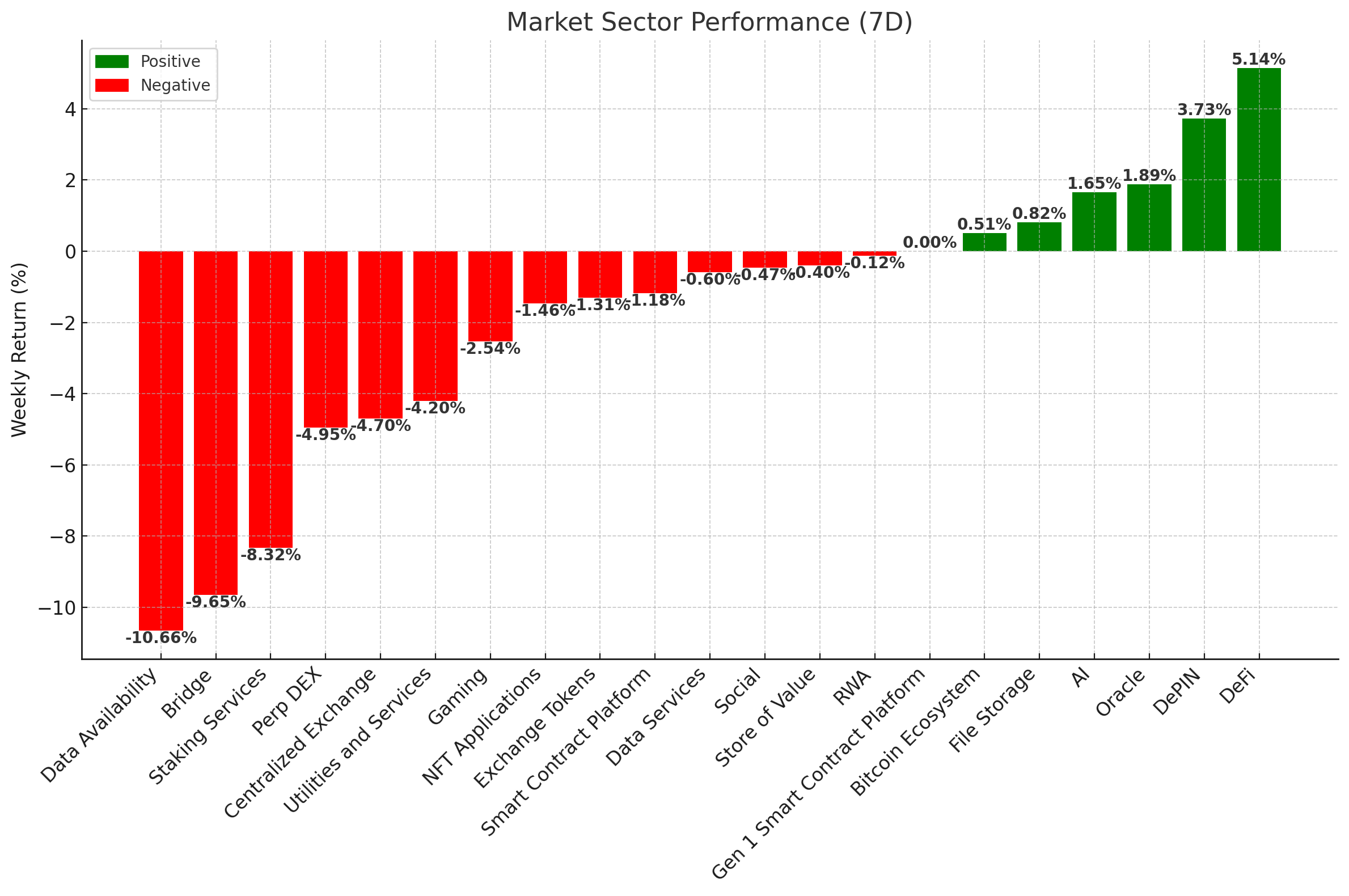

Growth across market sectors was more subdued than in recent weeks. Decentralised finance (DeFi) led the growth, expanding 5.1%. Next was Decentralised physical infrastructure (DePIN), which grew by 3.7%. The other market sectors contracted this week, with data availability experiencing the steepest losses, declining by 10.7%. The lack of growth across most crypto sectors this week likely reflects the unremarkable price action across the market, especially altcoins.

Market Sector Performance (7D)

Shop ‘til you drop

- StormX (STMX) grew by 82.7%, taking its market cap to US$107 million. Price for the crypto cashback and earnings platform took off to the upside on Tuesday. The gains may be due to technical price action that indicated strong buying signals, plus ongoing interest in projects that reward users for completing different tasks, including shopping.

The (multi)chain

- QuarkChain (QKC) gained 45.4%, bringing its market cap to US$80.9 million. The permissionless blockchain infrastructure, which uses blockchain sharding technology, retraced to US$0.0076 before shooting to the upside by over 80% in one day. Price has since pulled back slightly, but the strong price action indicates ongoing interest in scalable multi-chain projects.

DeFi gains

- Orca (ORCA) grew by 36%. This takes its market cap to US$162.6 million. After strong gains the week prior, Orca has continued its upward momentum. The gains may be due to the positive updates shared in Orca’s treasury report for the quarter ending 30 June 2024. Orca saw trading volume of US$78.8 billion and US$125 million in liquidity pool fees in the second quarter, plus US$13.5 million in protocol revenue in the first half of the year.

- Convex Finance (CVX) grew by 19.5%, taking its market cap to US$242.6 million. The staking platform, which allows users to deposit liquidity and earn yield on the Curve, Prisma, Frax and f(x) protocols, had some exciting announcements this week. First, a proposal to decrease interest rates to 8% and raise the minimum collateral ratio to 150% passed. Also this week, it was announced that the convergence CVX is the most efficient $CVX wrapping, awarding stakers with an annual percentage rate (APR) of over 120%.

Computer says yes

- Storj (STORJ) gained 21.1%, taking its market cap to US$73 million. Price for the cloud storage project, which aims to provide faster storage for 90% less than Amazon Web Services, found support at the key level of US$0.35 before moving to the upside around US$0.52. Upward momentum in Storj’s price could be due to strong technical price action and the ability of the project’s infrastructure to operate uninterrupted throughout the Crowdstrike outage, as users and investors learn the downsides of systems having a single point of failure.

- IRISnet (IRIS) gained 19.6%, taking its market cap to $73 million. The blockchain infrastructure, which is a communication relayer for other blockchains and applications, experienced strong growth this week. IRIS found support at the key level of US$0.012. Price moving upwards from this key level, plus recent announcements, such as its partnership with Horus, a company that makes Web 3.0 smart glasses, demonstrates growing interest in real-world applications for DePIN and physical devices.

In Other News

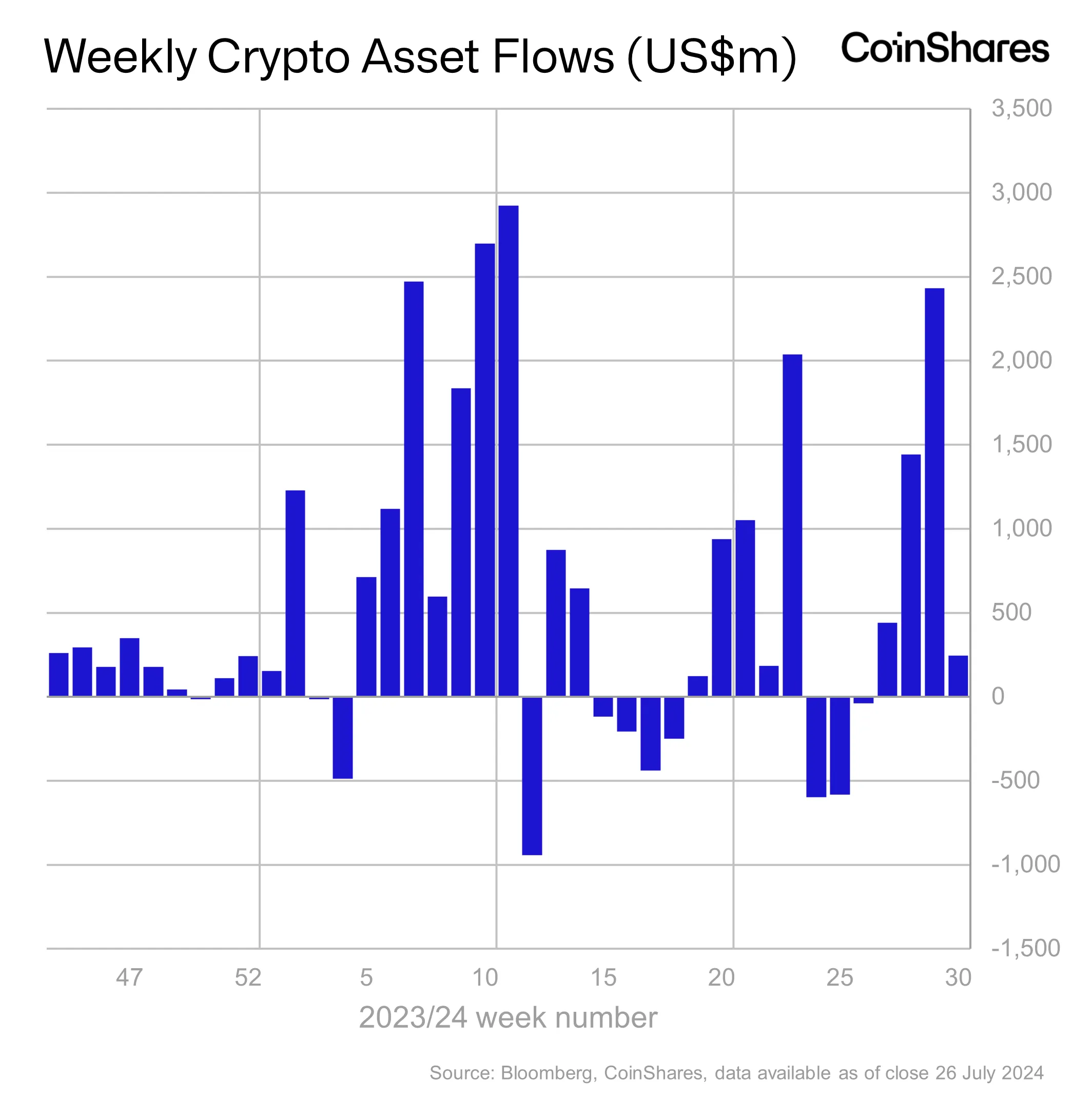

Digital asset investment products saw US$245 million of inflows this week. It’s a much smaller number than in previous weeks, as events such as investors selling their holdings from Grayscale’s Ethereum Trust brought the overall number down. But it doesn’t mean there wasn’t a flurry of activity across investment products. Trading volumes reached US$14.8 billion for the week — the highest volumes since May, presumably due to the launch of spot Ethereum ETFs.

The launch of spot Ethereum ETFs saw US$2.2 billion flow into these products. The inflows were offset by outflows of US$285 million.

Bitcoin investment products had inflows of US$519 million. This brings July’s inflows to date for bitcoin products to US$3.6 billion.

The total assets under management (AUM) across digital asset investment products currently stands at US$99.1 billion, with inflows for the year-to-date at a record US$20.5 billion.

- Bitcoin pioneer Jeff Garzik and Maxwell Sanchez, co-founder of VeriBlock, launched Hemi Labs and its new project, Hemi Network, on day one of the Bitcoin conference in Nashville. Hemi Network is a layer-2 blockchain network that aims to provide interoperability and scalability between the Bitcoin and Ethereum networks. The network uses a “Proof-of-Proof” (PoP) consensus. It’s designed to enhance security on the Bitcoin blockchain while enabling interoperability with the Ethereum network. PoP consensus requires a new type of miner, a PoP miner, who will publish consensus information from the Hemi Network and publish it to the Bitcoin network in exchange for a reward paid by the protocol.

- A new scam is sweeping the crypto community. Hackers have created a phishing-based malware distribution scheme. The scam typically starts with the malicious actor asking someone to discuss an opportunity, such as licensing their intellectual property or asking them to join their project. By insisting they meet only over Zoom, a malicious link is added to the meeting invite. When the link is clicked, it directs to a page that looks almost identical to a Zoom page, asking the user to download the software again. If the user clicks “install”, the malware installs and then redirects the user to a legitimate Zoom meeting while the malware goes to work in the background, stealing the victim’s crypto assets.

- A recent proposal passed by Compound Finance (COMP), a lending protocol, is driving claims of a governance attack. Running on a “proof-of-stake” consensus model, community members allege that a small group of whales were able to acquire a large enough amount of tokens to sway the vote in their favour. Proposal 289 suggested allocation of 5% of Compound’s treasury worth about US$24 million be placed in a yield-bearing protocol for one year. The protocol was designed by the “Golden Boys” and passed with 682,191 yes votes, defeating 633,636 no votes. Further investigation has found links between several accounts that acquired COMP tokens and proposals to divert COMP’s capital towards a product called goldCOMP, which was created by the “Golden Boys”.

Regulatory

Johnny Ng, a member of the Hong Kong Legislative Council, has said he will start conversations with stakeholders to explore adding bitcoin to Hong Kong’s financial reserves. In a post on X, he said it’s “worth considering”. Explaining further, Ng said that the public sees bitcoin as “digital gold”, so it could be possible to hold it as part of the region’s reserves, provided it is compliant. Hong Kong’s crypto licensing regime started in June 2023. The regime allows licensed exchanges to offer retail cryptocurrency trading services.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.