Market Highlights

- A dormant BTC whale moved 80,000 BTC, worth US$8.6 billion.

- BitMine’s shares rallied 1,900% on its Ethereum treasury announcement.

- House Republicans say July 14 to 18 will be “crypto week” to progress major crypto bills.

- A group of tech billionaires is launching Erebor, a digital bank targeting crypto and AI projects.

- Ripple and Circle applied for national banking charters.

- Caleb & Brown has been acquired by Swyftx in the largest ANZ crypto merger to date.

Markets Overview

The S&P 500 and Nasdaq closed at record highs on July 3, following the release of U.S. non-farm payrolls for June, which came in at 147,000, over 35,000 above the forecast. Markets disregarded fears of potential tariff-induced inflation, as well as the high likelihood that the FOMC will leave interest rates unchanged at its July 30 meeting.

After markets closed on July 3, the U.S. House of Representatives passed the “big beautiful bill”. The bill, which extends President Trump’s 2017 tax cuts and increases government spending, will add US$3.4 trillion to the government’s US$36.2 trillion deficit.

U.S. stock futures are down to start the new week as President Trump’s 90-day pause on reciprocal tariffs was extended to August 1 amid ongoing negotiations.

Weekly performance: S&P 500 +1.7%, Dow Jones +2.3%, Nasdaq +1.6%.

Looking ahead:

- Reserve Bank of Australia cash rate decision on July 8.

- FOMC meeting minutes on July 9.

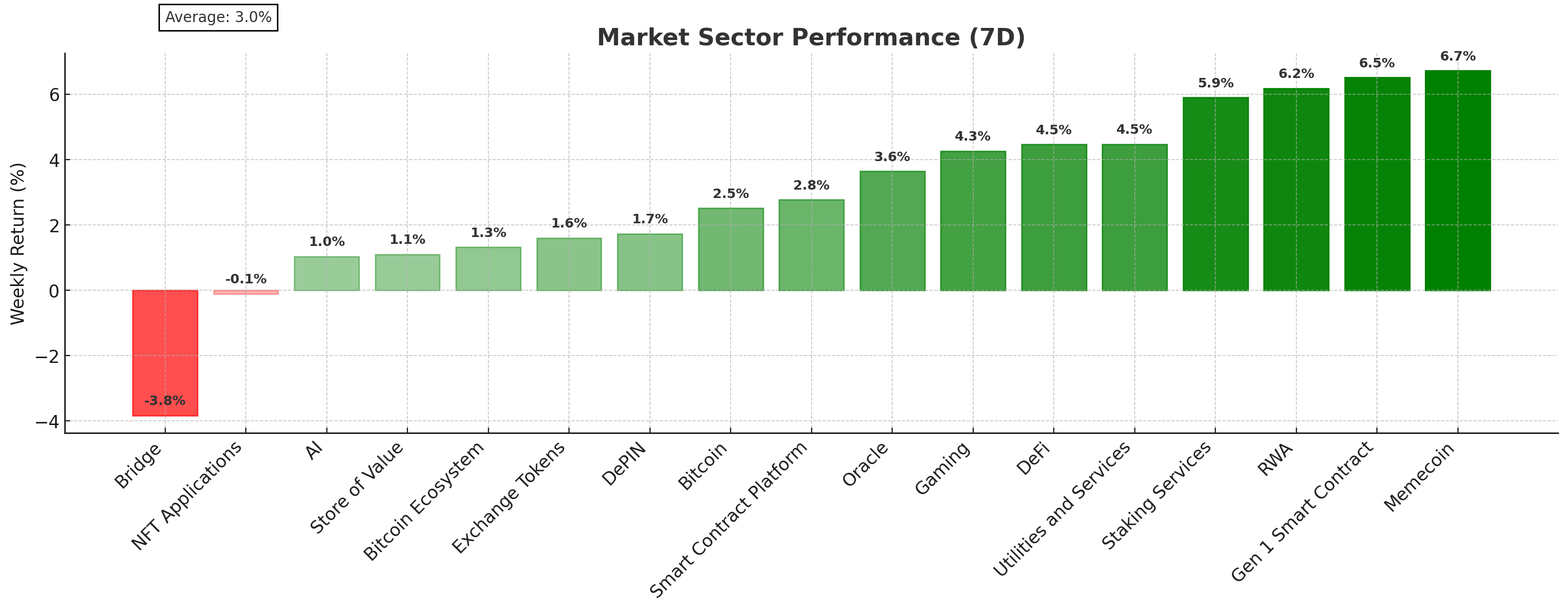

Crypto Market Sector Performance

A handful of sectors saw minor gains this week, while others saw minor losses, reflecting the week’s broadly flat sentiment across crypto.

Biggest gainer

- Memecoins: Bonk (+66%) gained as a nine-month-long downtrend was broken to the upside. Trading volume has rapidly increased from US$122 million at the start of July to US$1.4 billion as of July 6.

Biggest loser

- Bridge: Wormhole (-10.5%) declined potentially due to broader market consolidation, which may have reduced short-term demand for bridging services.

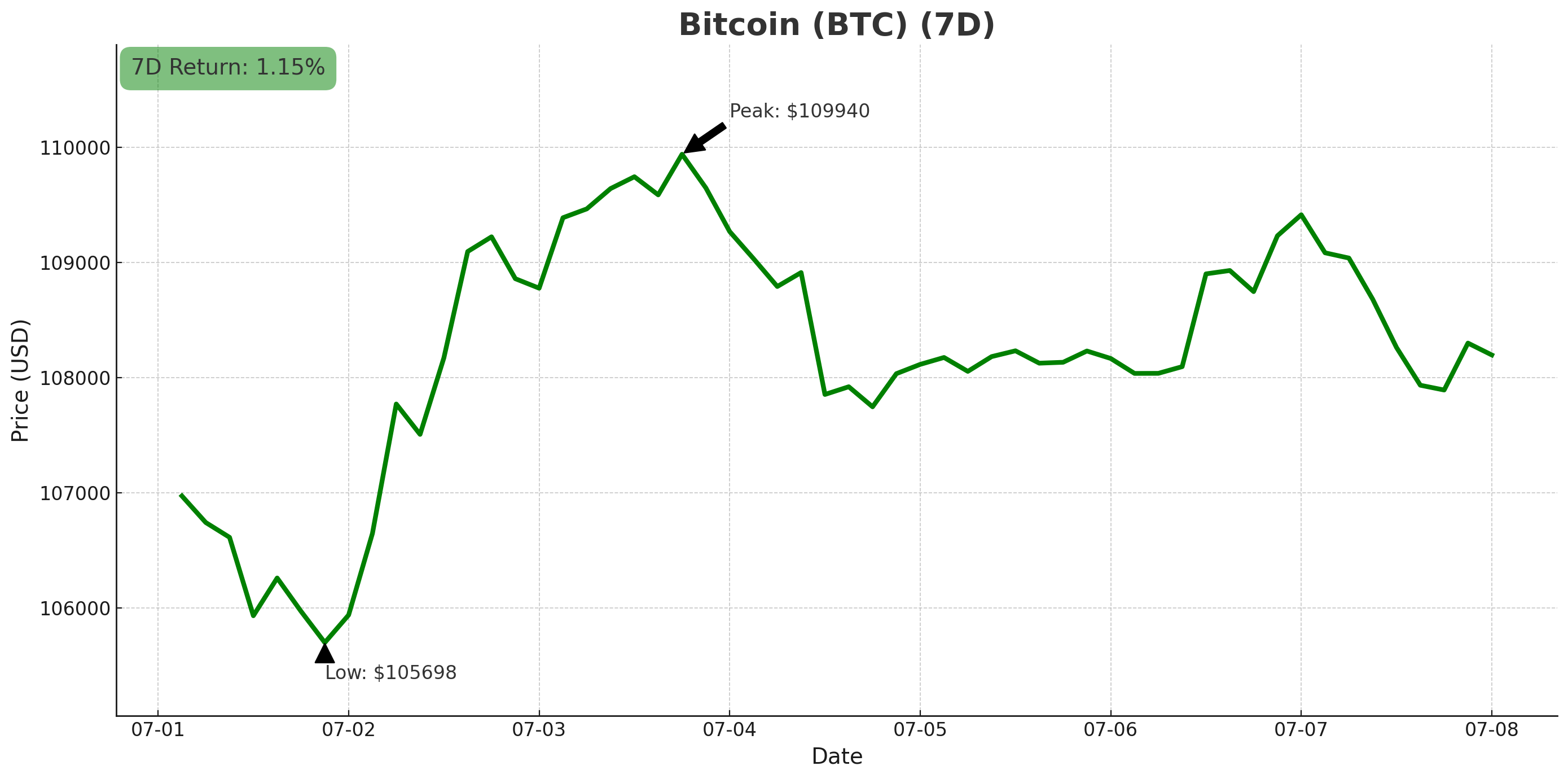

Bitcoin (BTC)

- Opened the week at US$108,386 (+0.8% on the week).

- BTC largely traded sideways as investors digested the likelihood of no U.S. rate cut until September and movements by dormant BTC whales.

- US$790 million inflows to bitcoin asset investment products this week, with daily flows surpassing US$600 million for the first time in several weeks (-64.1%).

A dormant bitcoin whale moved 80,000 BTC, worth over US$8.6 billion, on July 4 from eight wallets inactive since 2011. The coins, acquired when BTC traded below US$1, were split into new addresses without further activity. Speculation surrounds the whale's identity, with some suggesting that it’s early investor Roger Ver.

Hut 8, the Bitcoin mining company with ties to the Trump family, raised US$220 million. The funds will be used to buy bitcoin and Bitcoin mining infrastructure. The company submitted filings last week to the Dubai International Finance Centre, revealing it had expanded its operations to Dubai.

Arizona Governor Katie Hobbs vetoed House Bill 2324, which would have enabled the state to establish a state-managed BTC reserve capitalised with BTC and other digital assets seized in criminal forfeiture. Hobbs said the bill disincentivises local law enforcement from working effectively with the state. House Bill 2324 is the third crypto bill that Hobbs has vetoed.

Strategy is expecting to report a Q2 gain of over US$14 billion on its BTC holdings. The company currently holds 597,325 BTC, with an average purchase price of US$70,982 per bitcoin.

In bitcoin buying news:

- Metaplanet is leading a consortium to acquire DV8, a publicly-listed firm in Thailand, to expand its BTC strategy to Southeast Asia’s public markets. The company bought 2,204 BTC this week, bringing its holdings to 15,555 BTC.

- Hong Kong-based DDC raised US$528 million, which will be used to buy 5,000 BTC over the next three years.

- Figma’s IPO filings revealed that the company holds US$55 million of Bitwise’s BTC ETF shares.

- Semler Scientific bought 187 BTC, bringing its total holdings to 4,636 BTC.

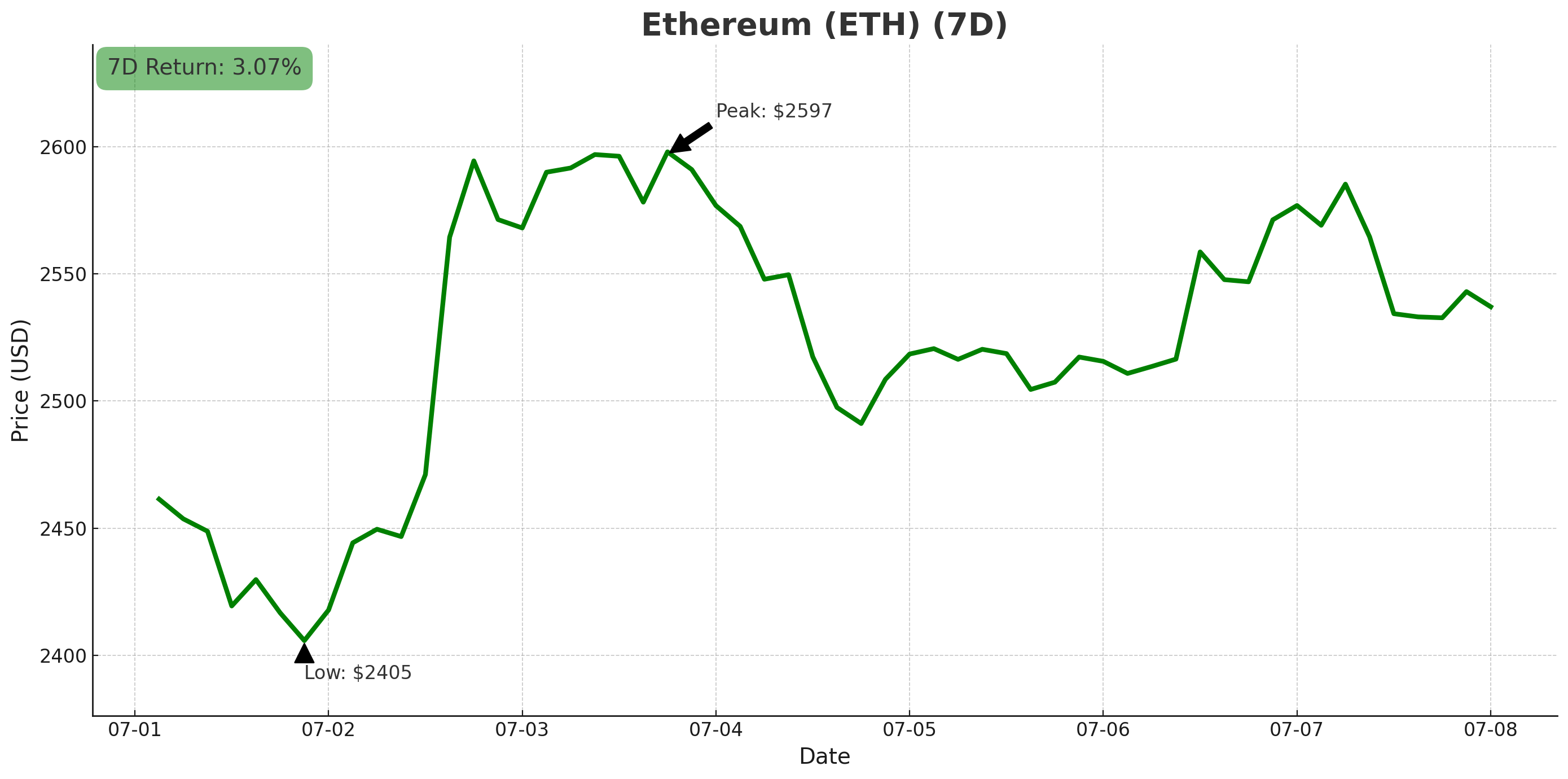

Ethereum (ETH)

- Opened the week at US$2,500, sold off and then rallied as it neared US$2,600, which hasn’t been broken to the upside in several weeks (+1.7% on the week).

- US$226 million inflows into Ethereum ETFs this week (-47.3%).

BitMine Immersion Technologies’ shares were halted twice on July 3, following its announcement of an Ethereum treasury strategy. The company’s shares rallied almost 1,900% throughout the week to US$135 before declining to US$118 in after-hours trading.

Two firms announced tokenised trading using the Ethereum network this week. Ondo Finance acquired Oasis Pro, allowing the Ethereum DeFi project to trade tokenised stocks. Similarly, Coinbase rallied to an all-time high after announcing tokenised U.S. stock trading for EU customers using the Ethereum layer-2 scaling network, Arbitrum.

Altcoins

The altcoin season index rose to 26 from 20 this week, indicating a slightly stronger performance by altcoins compared to bitcoin in the previous week.

Strong conviction

- Viction (VIC) gained 103%. The layer-1 blockchain gained over 120% on July 7, potentially due to the team's quick resolution of a network status issue.

Perfect storm

- StormX (STMX) declined by 87.5%. The cryptocurrency rebate platform continued its losses following its filing for Chapter 7 bankruptcy last week.

Past performance is not a reliable indicator of future results.

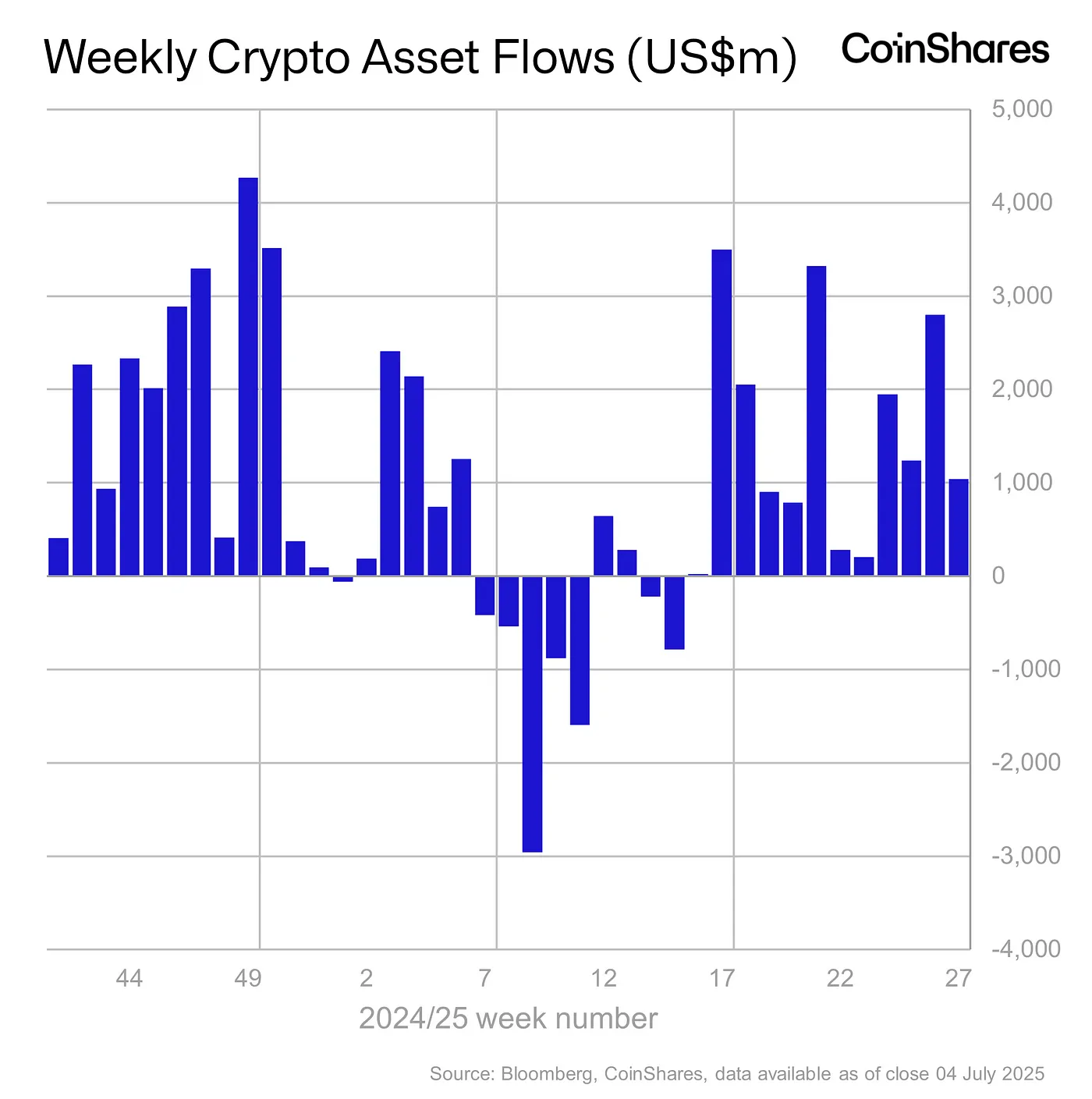

Crypto ETF News

Digital asset investment products saw US$1 billion of inflows this week, bringing total assets under management to a record US$188 billion.

The Rex-Osprey Solana + Staking ETF launched on July 2, with US$12 million in inflows on the first day of trading.

The U.S. Securities and Exchange Commission (SEC) paused an order to approve Grayscale’s Digital Large Cap Fund (GDLC) on July 4. The fund is modelled on the CoinDesk 5 Index, which tracks the performance of the five largest market-cap cryptocurrencies. It's unclear when GDLC may be approved for trading.

Other crypto news

- Caleb & Brown has been acquired by Swyftx in a deal valued at over AUD$100 million. As the world’s leading personal crypto brokerage service, Caleb & Brown brings over $2 billion in client assets, a global client base across 100+ countries, and a reputation for unmatched personalised support. The acquisition positions Caleb & Brown at the centre of Swyftx’s international growth strategy, combining high-touch service with powerful infrastructure to expand premium crypto access in Australia and the U.S.

- Following the passage of the “big beautiful bill” on July 3, House Republicans are making the week of July 14 to 18 “crypto week”. Policymakers aim to advance three major crypto bills: the CLARITY Act, the Anti-CBDC Surveillance State Act and the GENIUS Act.

- Senator Cynthia Lummis (R-WY) introduced the Lummis Crypto Tax Bill, which proposes a US$300 de minimis exemption for most digital asset transactions and aims to simplify tax reporting and encourage everyday crypto use. Additionally, it defers taxation on mining and staking rewards until assets are sold and streamlines charitable crypto donations.

- Tech billionaires Palmer Luckey, Peter Thiel, and Joe Lonsdale are launching Erebor, a digital bank targeting startups in crypto, AI, defence, and manufacturing. Erebor seeks to fill the void left by Silicon Valley Bank's collapse in 2023, offering services like stablecoin transactions and crypto-collateralised lending. The bank has applied for a U.S. national charter.

- Ripple applied for a U.S. national bank charter with the Office of the Comptroller of the Currency. The license would enable Ripple to manage reserves for its RLUSD stablecoin and access the Federal Reserve's payment systems. It follows Circle applying for a national trust licence earlier in the week.

- JD.com and Ant Group are lobbying the People's Bank of China to approve yuan-pegged stablecoins in Hong Kong, aiming to counter the dominance of U.S. dollar-backed tokens, such as Tether. The companies have reportedly applied for stablecoin licenses in Hong Kong and Singapore.

- DeFi Development Corp. (DFDV), a publicly traded Solana treasury firm, increased its convertible notes offering to US$112 million, with an option for an additional US$25 million. Most of the proceeds will be used to fund a prepaid forward stock purchase. The remaining capital will be used for general purposes, including the acquisition of additional Solana tokens. DFDV shares fell 3% on the announcement.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.