Market Highlights

- Declines were seen across the market amid strong bitcoin selling pressure.

- The commencement of Mt Gox’s bankruptcy bitcoin distributions, whale activity and the German Government’s ongoing sale of seized bitcoin are contributing to the price declines.

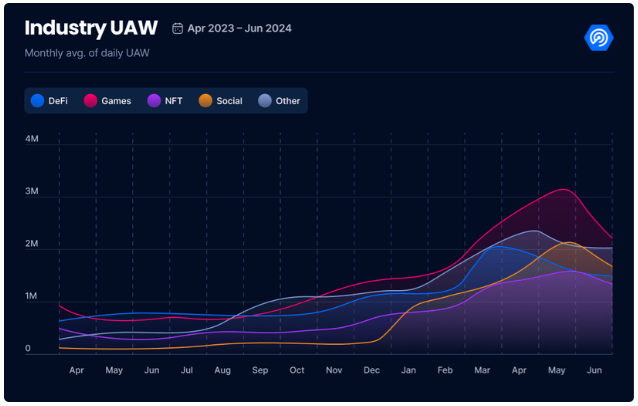

- Web3 users reached a record high in the second quarter of 2024.

- The US House of Representatives is voting this week to overturn President Joe Biden�’s veto of SAB 121.

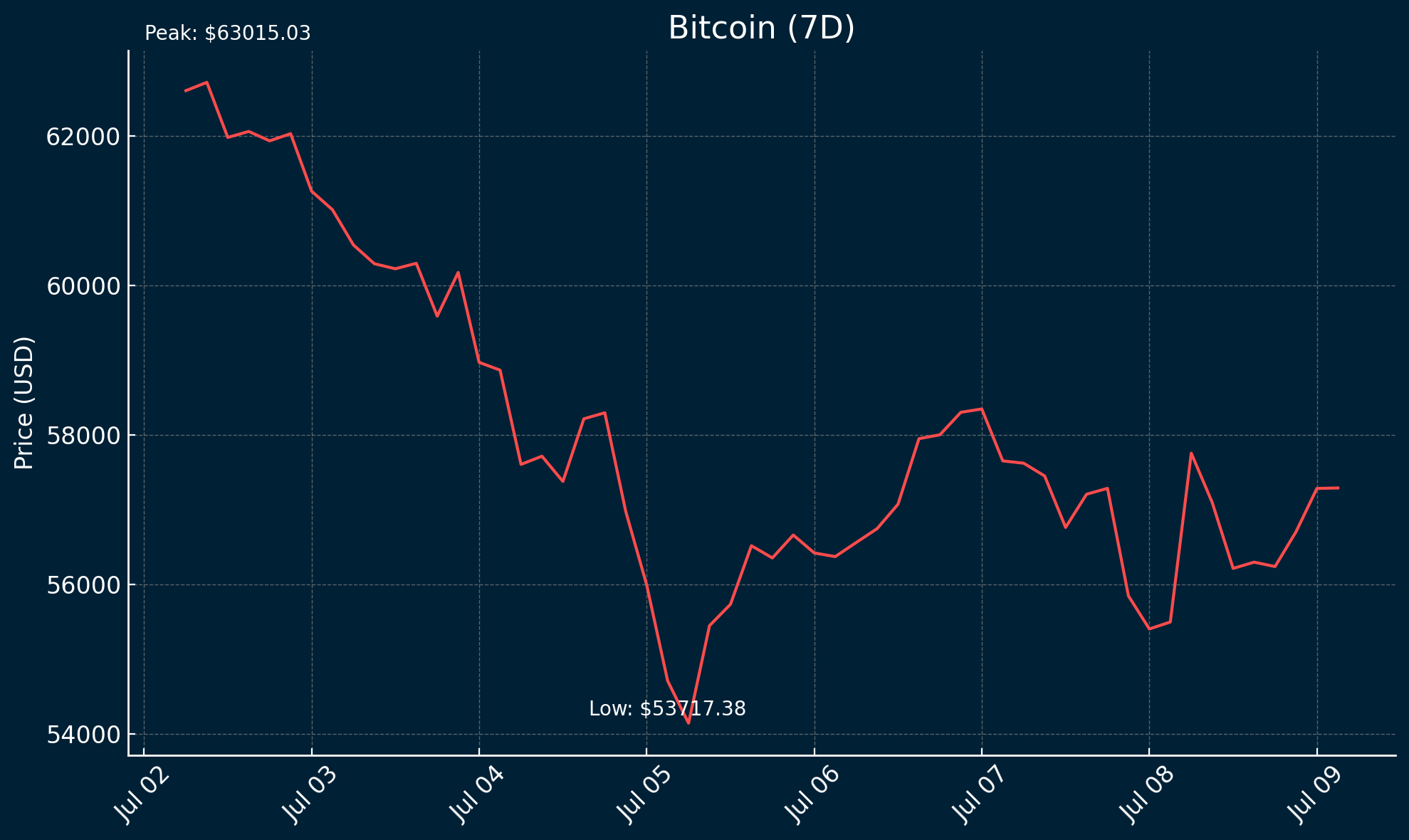

Bitcoin (BTC)

It was a shaky week for bitcoin as news of Mt. Gox’s bankruptcy bitcoin distributions commencing caused price to decline rapidly. From Monday’s high to Friday’s low, price fell over 16% to US$53,898. It marks the lowest price seen since February — a 27% drop from bitcoin’s all-time high of US$73,700 in March. It’s also the largest pullback since November 2022, when bitcoin sank to US$15,500.

Price fell upon the announcement from Mt. Gox, but the on-chain data tells a different story. According to Arkham Intelligence, 138,985 bitcoin (US$7.5 billion) are still held in Mt. Gox wallets, meaning only 2,701 bitcoin have left the exchange to make repayments. It shows that the story around Mt. Gox and the bearish pressure it creates have driven price this week, not the transactions themselves.

Binance deposits by whales suggest another driver of sell-side activity in bitcoin. Two wallets have deposited 9,500 bitcoin to Binance since 27 June. If sold, this would equate to whales liquidating around US$550 million. One of the whale’s wallets still holds over 4,300 bitcoin. This would equate to around US$250 million at current prices.

US non-farm payrolls came in slightly higher than the forecast of 190,000 at 206,000, with the unemployment rate remaining at 4.1 per cent. The stock market responded positively as the major indexes, including The Dow, S&P 500 and Nasdaq composite, rose 0.7%, 0.3% and 0.2%, respectively. This macroeconomic news wasn’t enough to buoy the price of bitcoin, though. The price declines saw over US$54 million worth of bitcoin positions liquidated. Over US$40 million of the liquidated positions were long bitcoin.

Bitcoin is currently trading at US$56,684, a decrease of almost 10% on the week.

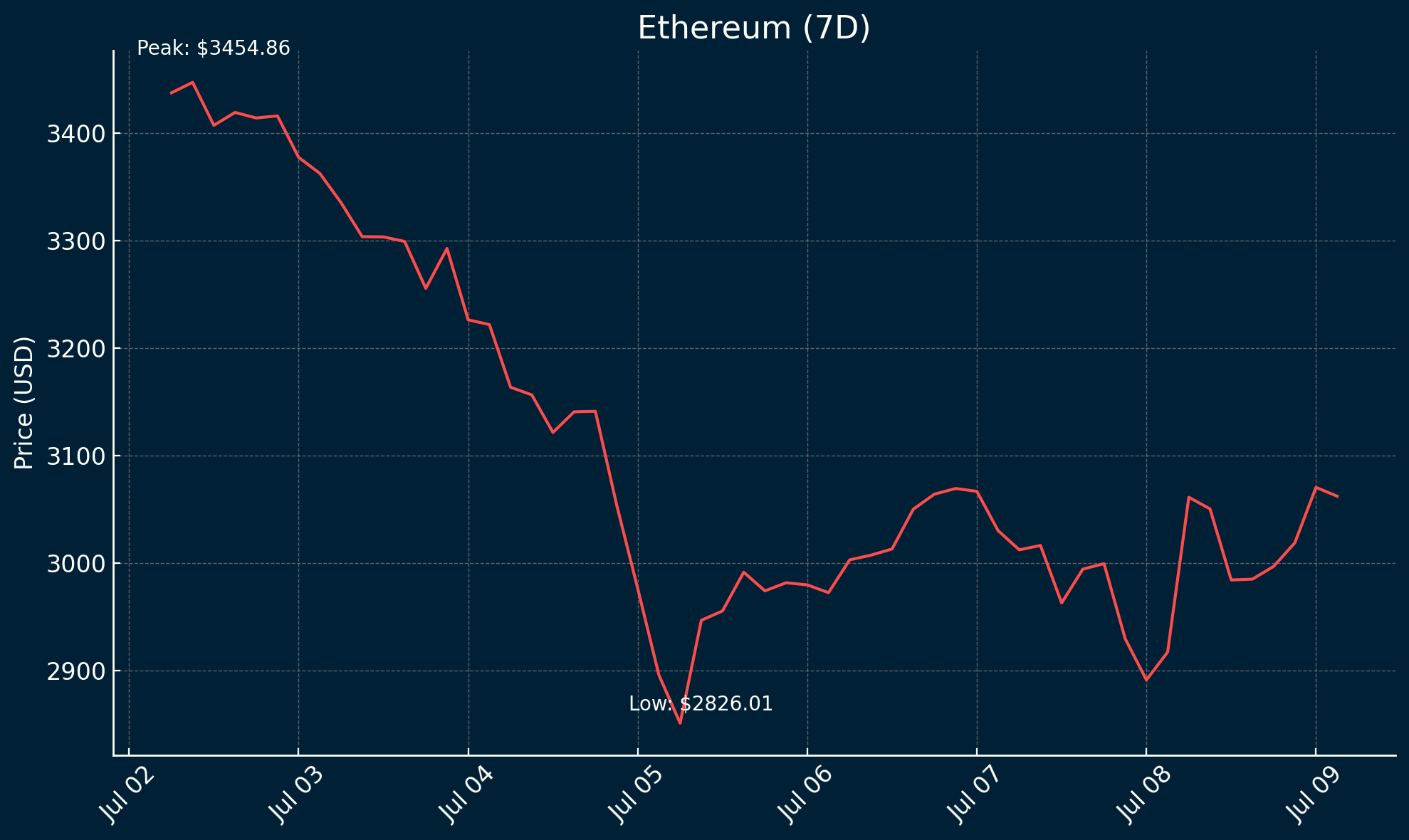

Ethereum (ETH)

Ethereum finished the week declining almost 20% between the week’s high and low.

Even news such as the first US-listed spot exchange-traded fund for Ethereum likely going live in July didn’t cause price to reverse. Research firm K33 estimates that Ethereum ETFs will buy 0.75% to 1% of all ETH in circulation. Ethereum and the wider market’s bearish week indicate that the Mt. Gox bankruptcy distributions, bitcoin whale activity and sales of seized bitcoin by the German government are currently driving markets to the downside.

Ethereum is currently trading at US3,026, a decrease of almost 12% on the week.

Altcoins

Market sector performance echoed the bearish sentiment across most cryptocurrencies this week. Data availability had a small gain of 1.3%. Following this was decentralised perpetual futures exchanges (Perp DEXs), which fell 7.9%. Oracles and smart contract platforms each contracted by 8.8%. Staking services faired the worst this week, falling 22.7%. This is presumably due to the correlation between market performance and the strength of staking platforms, given that market shocks are seeing investors liquidate their positions.

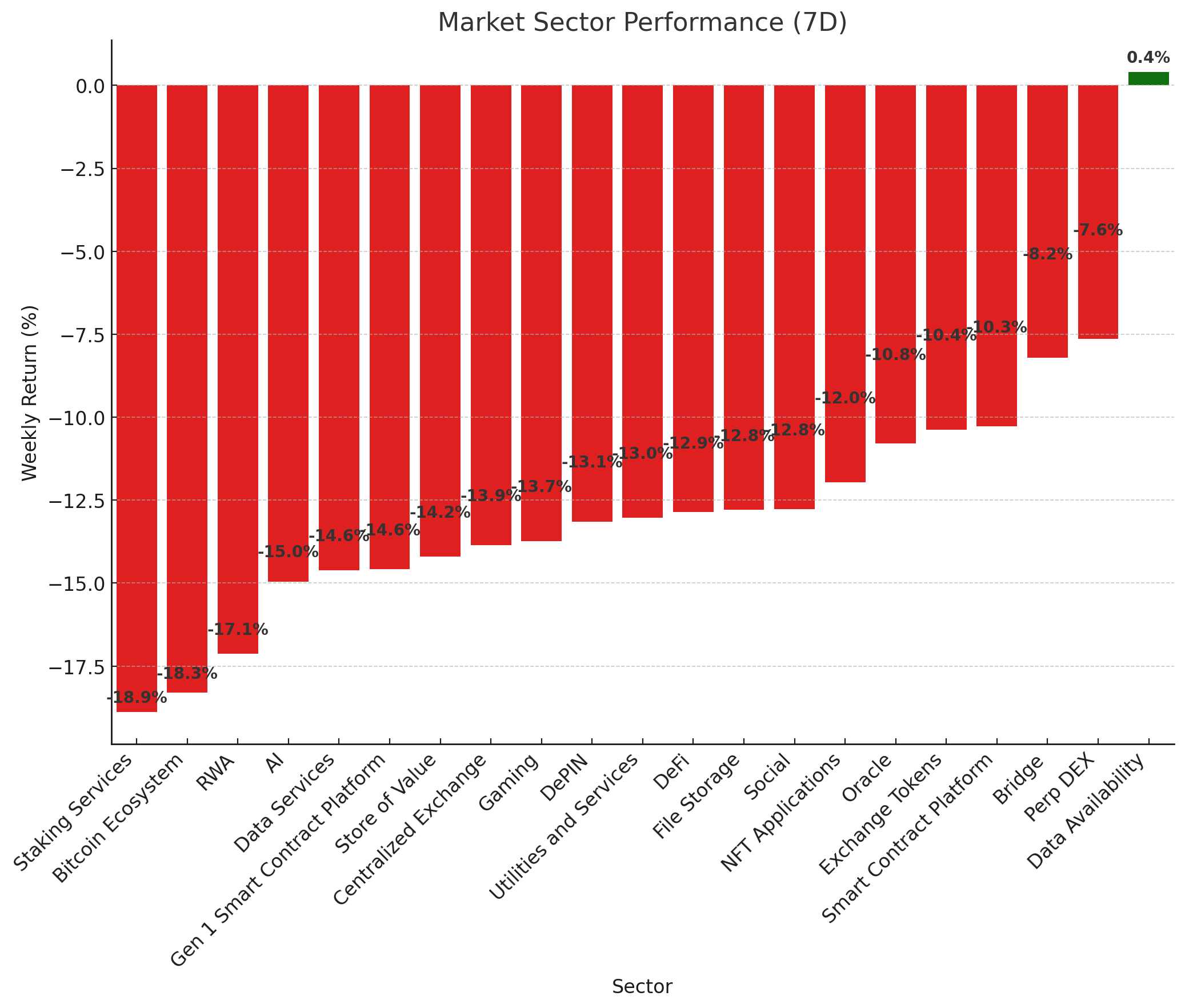

Market sector performance echoed the bearish sentiment across most cryptocurrencies this week. Data availability had a small gain of 0.4%. Following this, decentralised perpetual futures exchanges (Perp DEXs) fell by 7.6%. Oracles and smart contract platforms each contracted by around 10%. Staking services fared the worst this week, falling by 18.9%. This is presumably due to the correlation between market performance and the strength of staking platforms, given that market shocks are seeing investors liquidate their positions.

Market Sector Performance (7D)

Computing Rewards

- aelf (ELF) gained 18.7%, taking its market cap to US$301.9 billion. Price for the multi-chain layer one blockchain presumably grew due to the announcement of its partnership with TapUp, a Web3 gaming platform. aelf and Tap-Up are running a campaign throughout the first half of July, which allows users to earn rewards by participating in aelf’s Zealy requests.

DeFi Developments

- Enzyme (MLN) grew by 13.5%, taking its market cap to US$28 million. The protocol, which is designed to accelerate project outcomes with smart, tokenised wallets and facilitate on-chain asset management, initially saw a 52% spike in one day after Binance removed its “monitoring” label. This means that MLN is no longer in danger of being delisted from the exchange.

- Rook (ROOK) gained 9.8%, which takes its market cap to US$614 thousand. The DeFi platform, which distributes maximum extractable value (MEV) to users, found support around US0.66, where price has been hovering sideways since the end of June. As KeeperDAO’s native governance and utility token, the week’s gains suggest continued investor interest and participation in decentralised autonomous organisations (DAOs).

Single Chain Gains

- MultiversX (EGLD) gained 10.6%, taking its market cap to US$898.5 million. Price found key support around US$28, continuing its recent rebound in price driven by announcements in late June. These announcements included the ability to use MultiversX’s xPortal card with Apple Pay, a trading competition, and a listing on Bit2Me, a cryptocurrency exchange based in Spain.

- Mantra (OM) continued its strong price action of late, with 8.7% growth. This takes its market cap to US$706.9 million. Mantra’s price gained upon the announcement that it will tokenise US$500 million worth of assets owned by Dubai-based real estate developer MAG Group. The assets will be tokenised in multiple tranches. The first tranche will include a residential project and a US$75 million mega-mansion in the Ritz-Carlton Residences Creekside development, which makes up part of the Keturah resort.

- Chromia (CHR) grew by 2.2%, taking its market cap to US$194.1 million. A couple of announcements this week likely drove some of the upward price action. Its minimum viable product (MVP) will be launched on Chromia’s mainnet on July 16. On the same day, its relational bridge will go live.

In Other News

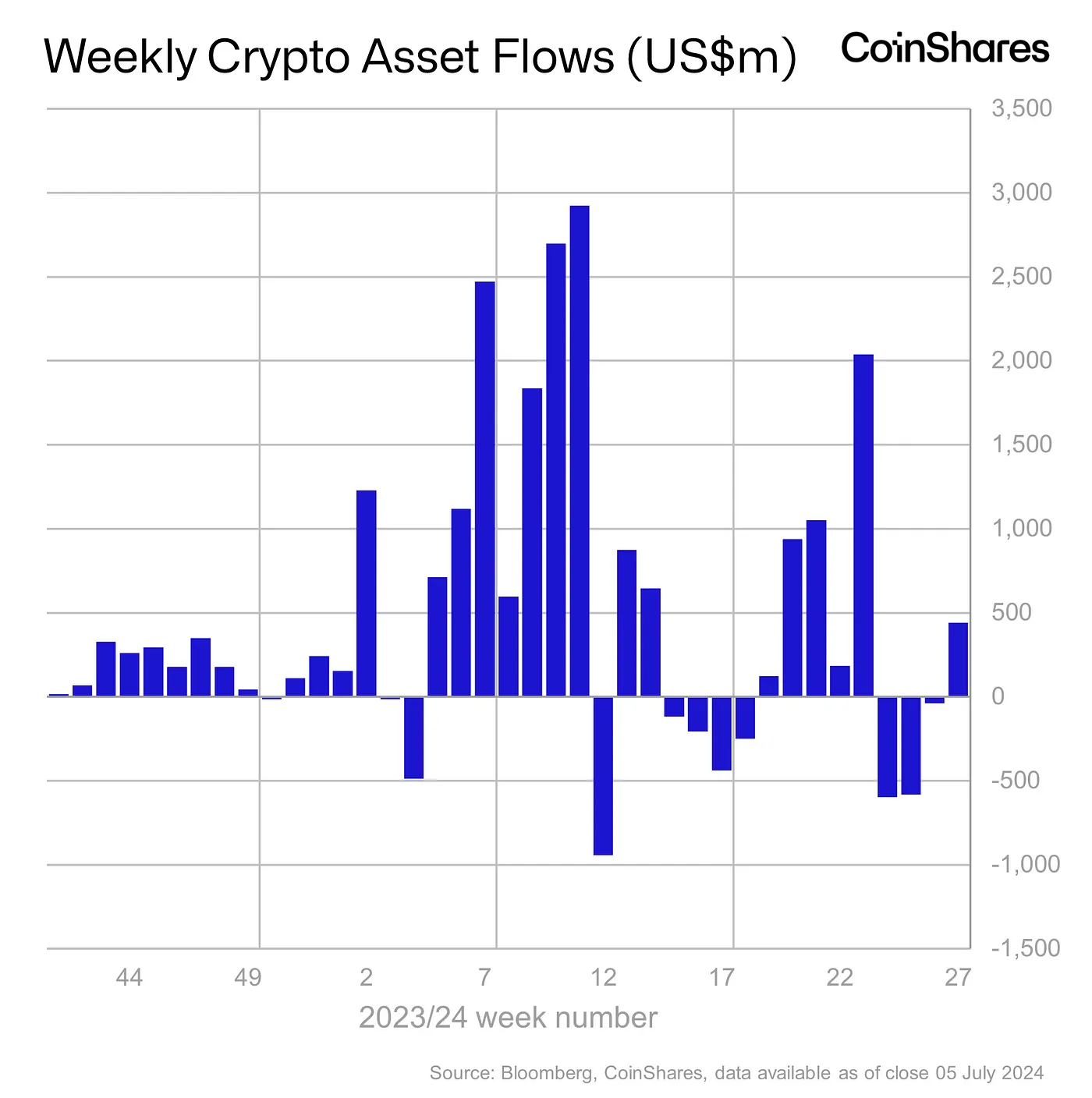

Investors have seen this week’s pullback across the cryptocurrency market as an opportunity to buy. Digital asset investment products saw inflows of US$441 million this week, the highest week of inflows in over three weeks. Bitcoin products had US$398 million of inflows, totalling 90% of investor funds. The remainder of investor funds flowed into altcoin products, such as Solana.

Blockchain equities didn’t experience inflows. These products saw a further US$8 million of outflows, which brings outflows for the year-to-date to US$556 million.

- A recent report from DappRadar, a blockchain analytics platform, found that the number of Web3 users reached a record high in the second quarter. Throughout the quarter, daily active unique wallets (dUAW) stood at around 10 million. This represents growth of 40% from the first quarter. The graph below from DappRadar shows that gaming led the way in web3 wallet growth throughout the second quarter. The report warns that some of the spikes in dUAW could have been driven by “airdrop farming,” which is when users complete specific tasks and actions to receive tokens as a reward in an upcoming airdrop. Two notable airdrops occurred in June — Blast and zkSync.

- Memecoin mania driven by developments in the US presidential race continued this week. Users on crypto betting site Polymarket have bet over US$326 million throughout the race on the outcome of the 2024 presidential election and, most recently, whether President Joe Biden will drop out of the race as concerns grow around his age and mental fitness. Vice President Kamala Harris is the favourite on Polymarket to get the Democratic nomination. The price of a Kamala Harris-themed meme token (KAMA) on Solana grew by 400% this week.

- The “Firedancer” independent validator client for the Solana blockchain goes live this week. Built by Jump Crypto, the bug bounty program will distribute $1 million amongst developers who find bugs in the first version of Firedancer. The program will run for six weeks. Firedancer aims to boost resiliency on the Solana blockchain. It’s implemented on C/C++ to optimise performance.

Regulatory

- A resolution to overturn the veto of Staff Accounting Bulletin 121 (SAB 121) will be voted on in the US House of Representatives this week. President Biden vetoed the bill in May. The vote is a constitutional obligation, with the resolution likely to be considered when the house sits on Tuesday or Wednesday. To overturn the veto, a two-thirds majority from both the House of Representatives and the Senate is required. This equates to 290 members in the House of Representatives. When the bill originally passed, 228 House of Representatives members voted to overturn SAB 121.

- William Longergan Hill, one of the two founders of Samurai Wallet, has been granted bail by the US Government. Hill was arrested in April 2024 with his co-founder Keonne Rodriguez on federal charges of money laundering and operating an unlicensed money-transmitting business. His bail package includes around US$3 million in assets. The next hearing will go ahead this week, where Hill reportedly plans to contest the charges.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.