Market Highlights

- Bitcoin, Ethereum and other cryptocurrencies started the week strong before a Friday sell-off.

- The Bank of Canada and European Central Bank each lowered their interest rates by 25 basis points, but the US Federal Reserve is expected to keep rates on hold this week.

- Donald Trump has become the first presidential candidate to accept Bitcoin Lightning Network payments for campaign donations, continuing his pro-crypto stance. He announced the partnership a day after President Biden vetoed the bill to overturn SAB 121.

- Roaring Kitty, the influencer who sparked the Gamestop (GME) stock rally in 2021, has returned to the internet, hosting a livestream where 700,000 people watched him discuss his GME positions. Solana-based meme coin GME rallied 467% around the time of the livestream before selling off on Friday.

Bitcoin (BTC)

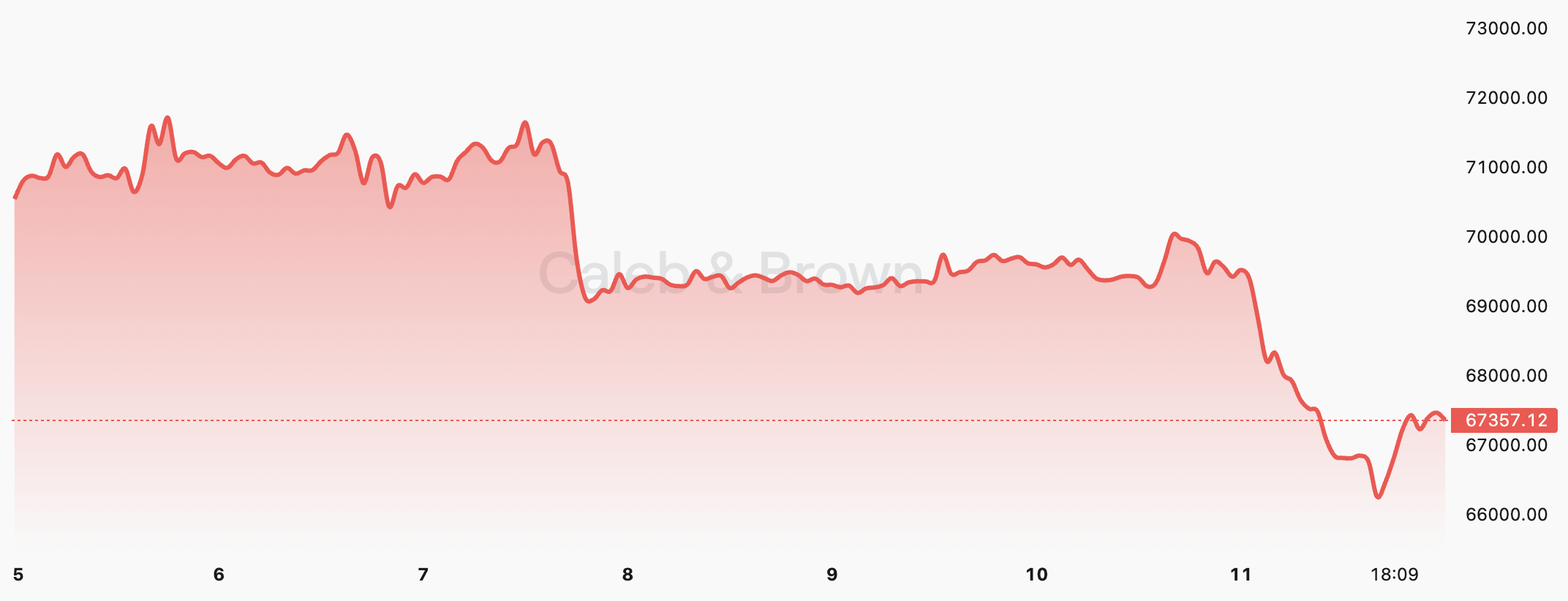

This week was quite the rollercoaster for bitcoin, Ethereum, and meme coins. Positive updates from financial institutions regarding spot bitcoin ETFs saw price rally to start the week, followed by a sell-off on Friday.

Bitcoin reached its highest price since March, breaking US$71,000. This coincided with bitcoin spot ETFs' second biggest day of inflows to date, with US$887 million entering funds. Following the inflows, two high-profile bitcoin ETF supporters said that the market is currently in “the first wave of the early adopters. Bitwise CIO Matt Hougan chimed in to say that progress in the US on a regulatory framework for cryptocurrency was also providing “untapped alpha” for investors. The gains were shortlived as investors presumably took profit on Friday, which sparked the liquidation of almost US$300 million in long positions and US$47 million in short positions.

On the macroeconomic front, the Bank of Canada and the European Central Bank lowered their interest rates by 25 basis points. The Bank of Canada’s interest rate is now 4.75%, while the European Central Bank’s is now 4.25%. In the US, the non-farm employment change came in considerably higher than the forecast 182,000 at 272,000. The unemployment rate came in at 4%, just 0.1% higher than the forecast 3.9%. The strong employment data out of the US indicates that the US Federal Reserve may keep rates on hold at 5.5% at its June meeting. This also likely impacted the price of bitcoin in its end-of-week sell-off.

Bitcoin is currently trading at US$69,413 an increase of 0.7% on the week.

Ethereum (ETH)

Ethereum’s price action was similar to bitcoin and many other cryptocurrencies this week. Price reached US$3,800 to begin the week before later selling off to US$3,600.

On the back of the SEC’s approval of spot Ethereum ETFs a couple of weeks ago, VanEck analysts published a report that was strongly bullish on Ethereum. The report called the cryptocurrency “digital oil,” speculating that it would reach US$22,000 by 2030, at which time it would gain financial market share from Apple, Google, and the big banks. The basis for VanEck’s bullish outlook is the way in which Ethereum is at the centre of its own financial ecosystem. Currently, the Ethereum network secures over US$90 billion in stablecoins, US$7 billion in tokenised assets, and US$308 billion in digital assets.

Ethereum is currently trading at US$3,969, a decrease of 2.7% on the week.

Exclusive Research Report

Explore the transformative power of tokenisation in Real World Assets, detailing the bridge between digital and traditional assets like real estate and intellectual property.

Don't miss out on this opportunity to stay ahead in the crypto market! Access the full report now for in-depth analysis and actionable insights.

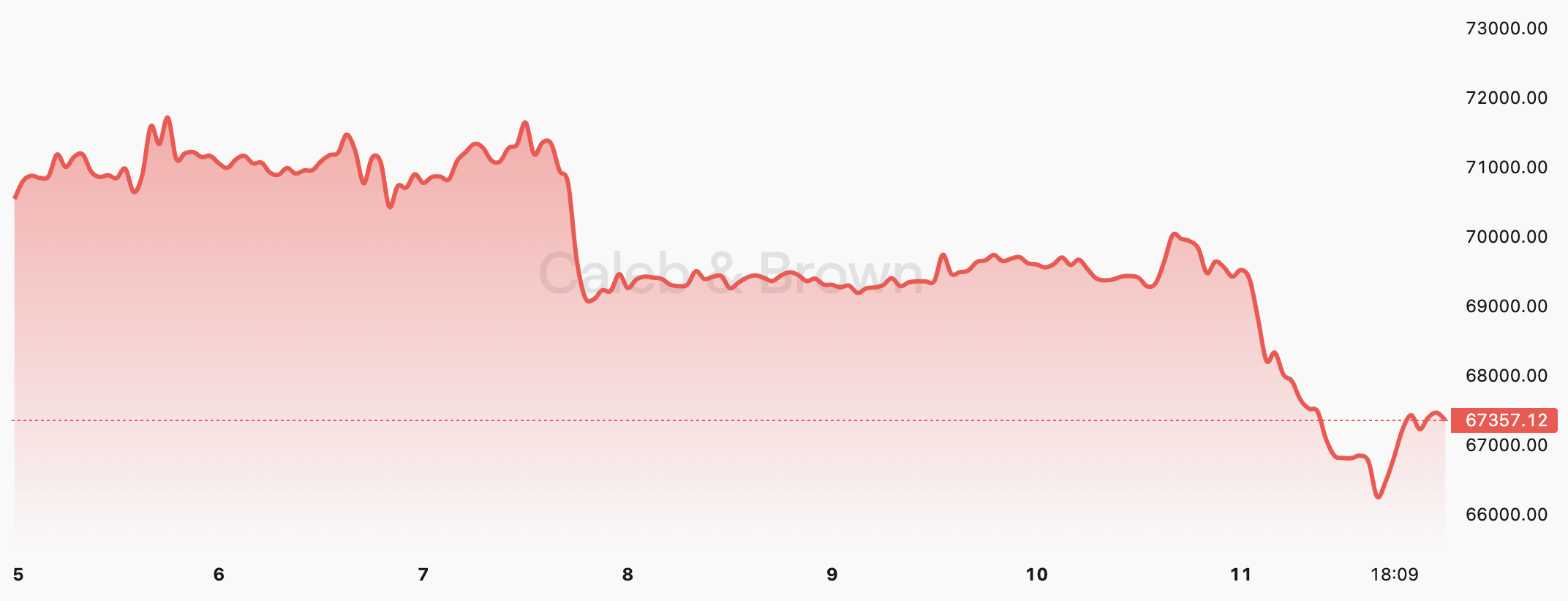

Altcoins

Performance across altcoins was relatively quiet this week, with price action amongst the major cryptocurrencies and meme coins dominating the markets. Bitcoin Ecosystem projects dominated sector growth, rising by 13.8%. Centralised exchanges experienced a small decline of 0.9%, and file storage declined by 3.3%.

Trading & Meme Coins & Liquidity, Oh My!

- DexTools (DEXT) gained 29.4%, taking its market cap to US$67.2 million. The gains for the DeFi trading app started on Tuesday. This coincides with the week’s big gains (467%) in Solana-based memecoin, GME, which likely caused activity to spike across DeFi and other exchanges. DexTools also announced that the Ton blockchain is now integrated on its trading platform.

- Kyber Network Crystal (KNC) gained 15.8%, taking its market cap to US$126.2 million. The multi-chain crypto trading and liquidity hub's price rallied following the announcement that its KyberSwap Aggregator user base had grown 1,260% from January 2023 to May 2024.

Crypto Getting Creditworthy

- TrueFi (TRI) grew by 29%. This takes its market cap to US$274.7 million. As DeFi’s first and largest credit pool, it provides users with transparent yields on real-world and crypto-native lending. Price spiked following the announcement that it has partnered with Cicada Partners to offer uncollateralised loans onchain on the Arbitrum network.

- Maple (MPL) gained 25.7%, taking its market cap to US$137.9 million. The DeFi institutional lending platform launched Syrup this week. Syrup is a DeFi protocol that provides permissionless access to secured institutional credit. Users who deposit Circle’s USD coin will receive syrupUSDC liquidity pool (LP) tokens. These tokens can be used to earn yield. Maple Finance says collateralised loans to large crypto institutions will generate yield. The announcement was met with some scepticism from investors, given its potential parallels with the FTX-Alameda fallout.

- Mantra (OM) had another strong week, gaining 25.5%, taking its market cap to $897.2 million. Price presumably continued its run due to a chain of announcements and activity, including that Mantra and the Ondo Foundation will incentivise a multi-chain USDY vault, offering contributors access to short-term US treasuries yields, a couple of hackathons, and the signing of a memorandum of understanding for real-world asset (RWA) compliance in the United Arab Emirates.

Building on Bitcoin

- Stacks (STX) grew by 21.5%, taking its market cap to US$3.3 billion. The Layer 2 solution uses the Bitcoin network to facilitate smart contracts and decentralised applications (DApps). Price presumably took off due to finding support at the key level of US$1.80, an all-time high in total value locked in STX, and anticipation of its “Ask Me Anything” (AMA) session scheduled for June 13, 2024.

In Other News

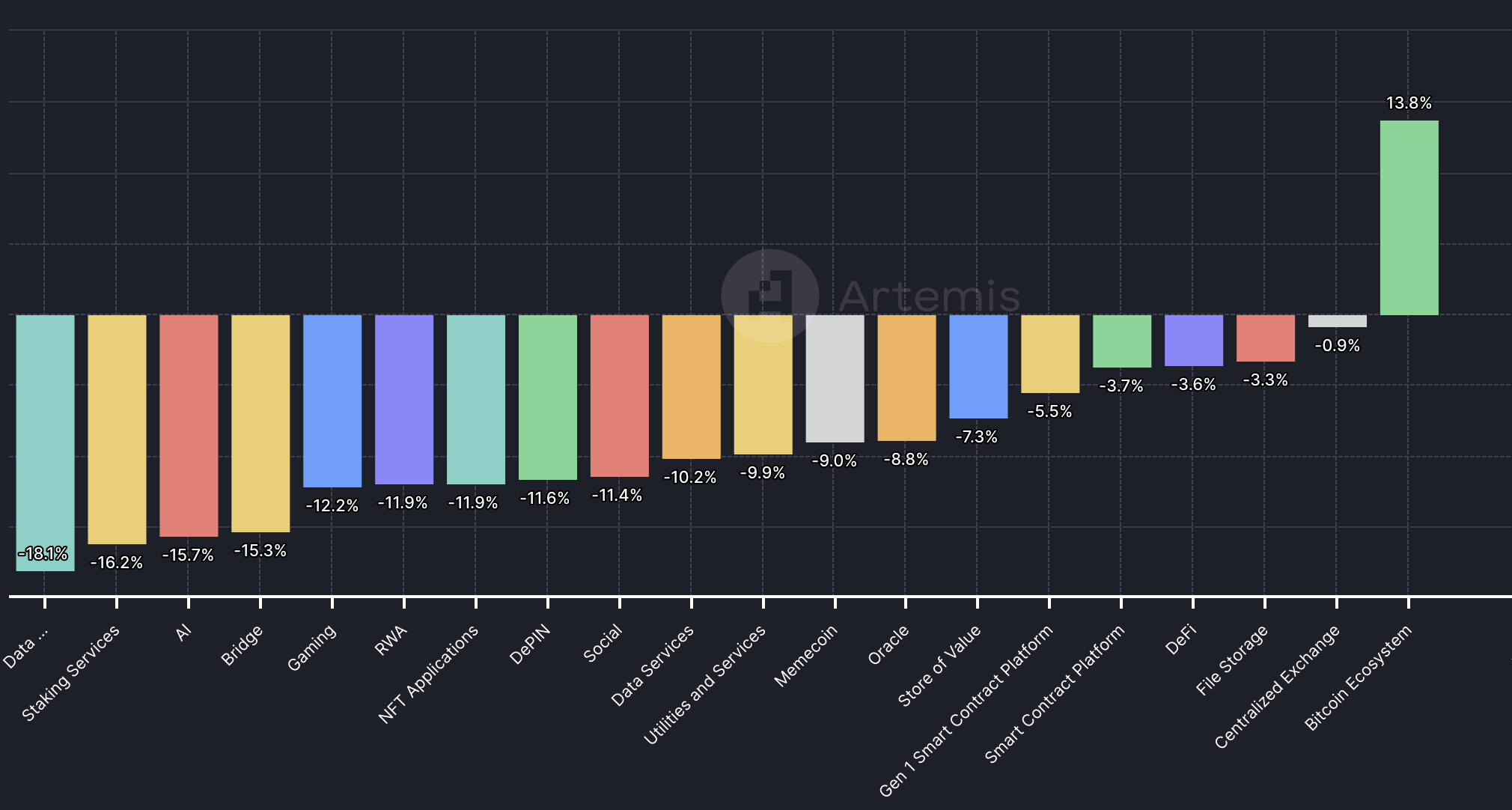

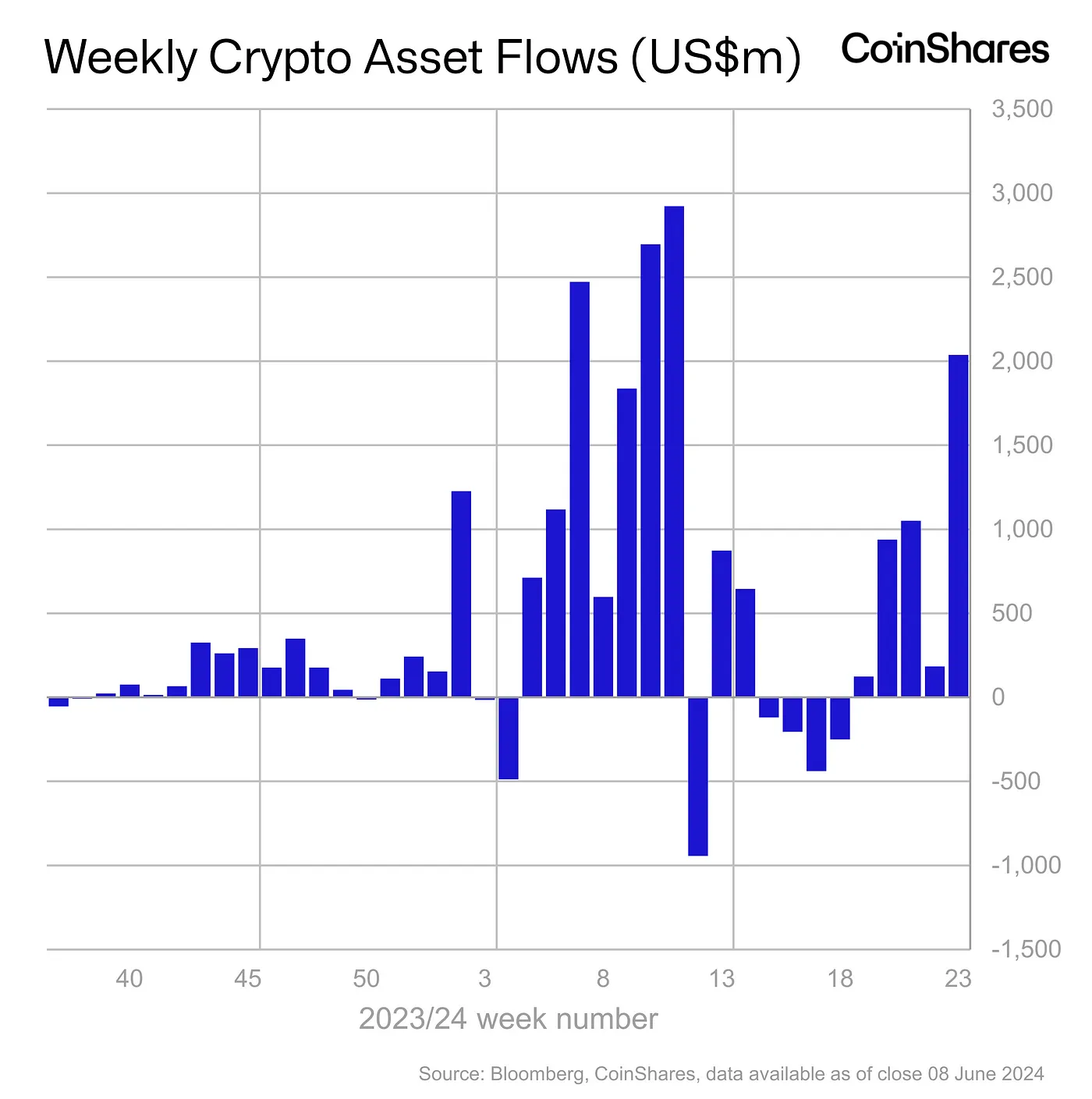

In anticipation of rate cuts, following the Bank of Canada and European Central Bank’s cuts this week, digital asset investment products saw US$2 billion of inflows. This brings the last five weeks of inflows up to US$4.3 billion, with exchange-traded product volumes growing to US$12.8 billion for the week — an increase of 55% on the previous week. It’s important to note that while The Fed could begin cutting rates, the strong employment data released this week could be cause for them to keep rates on hold at its June meeting.

Bitcoin products dominated the inflows, with US$1.97 billion entering exchange-traded products. And Ethereum inflows saw their best week since March, with US$69 million, presumably driven by the US SEC’s approval of spot Ethereum ETFs.

- Donald Trump has become the first presidential candidate to accept Bitcoin Lightning Network payments for campaign donations. The Trump campaign has partnered with OpenNode, a Bitcoin and Lightning Network infrastructure provider. The move follows recent speeches where Trump declared his support for a crypto-friendly environment in the US. The Trump campaign announced the partnership a day after President Joe Biden vetoed pro-crypto regulation, demonstrating that crypto remains a hot-button issue in the 2024 Presidential race.

- Australia’s first bitcoin ETF went live this week. The Monochrome Bitcoin ETF (IBTC) started trading on the Cboe Australia exchange, an alternative to the Australian Stock Exchange (ASX), which uses its own trading system. Monochrome is the first ETF in Australia to hold bitcoin directly. Monochrome’s Responsible Entity partner was among the first to receive the Australian Securities & Investment Commission’s (ASIC) approval to operate spot-based crypto-asset ETFs in 2022.

- Memecoin mania shows no signs of slowing down or being less volatile. Solana-based meme coin GME rallied 467% this week on the back of increased trading and price growth for Gamestop (GME) in the stock market. Influencer, Roaring Kitty, who started the 2021 GME stock rally, held a live stream this week. On the live stream, he told people, “I’m alive”, and talked through his Gamestop positions to the 700,000 people watching. He wore bandages, a sling on his right arm, and bandaids — a comedic ode to the deep sell-offs happening in GME meme coin and GME stock that day. Recent price gains in GME in the stock market and the meme coin GME presumably have been partly driven by Roaring Kitty’s return to YouTube and live streaming. His net worth stands at almost US$1 billion at the time of writing.

Regulatory

- The New York Attorney General, Letitia James, has brought a billion-dollar lawsuit against crypto exchange NovaTech and mining firm AWS mining. James’ office has accused the defendants of “engaging in illegal pyramid schemes,” robbing investors of over a billion dollars worth of cryptocurrency. It’s alleged that the firm was paying investor returns using inflows from new investors. Prosecutors say that only US$26 million in crypto trades actually occurred on the platform, despite taking over a billion dollars from 2019 to 2023.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.