Market Highlights

- The U.S. Securities and Exchange Commission (SEC) filed lawsuits against crypto exchanges Binance and Coinbase, causing a wave of panic selling throughout the market.

- The crypto market has experienced a sharp drop in price this week, shedding approximately US$85 billion, or 7.2% week-on-week.

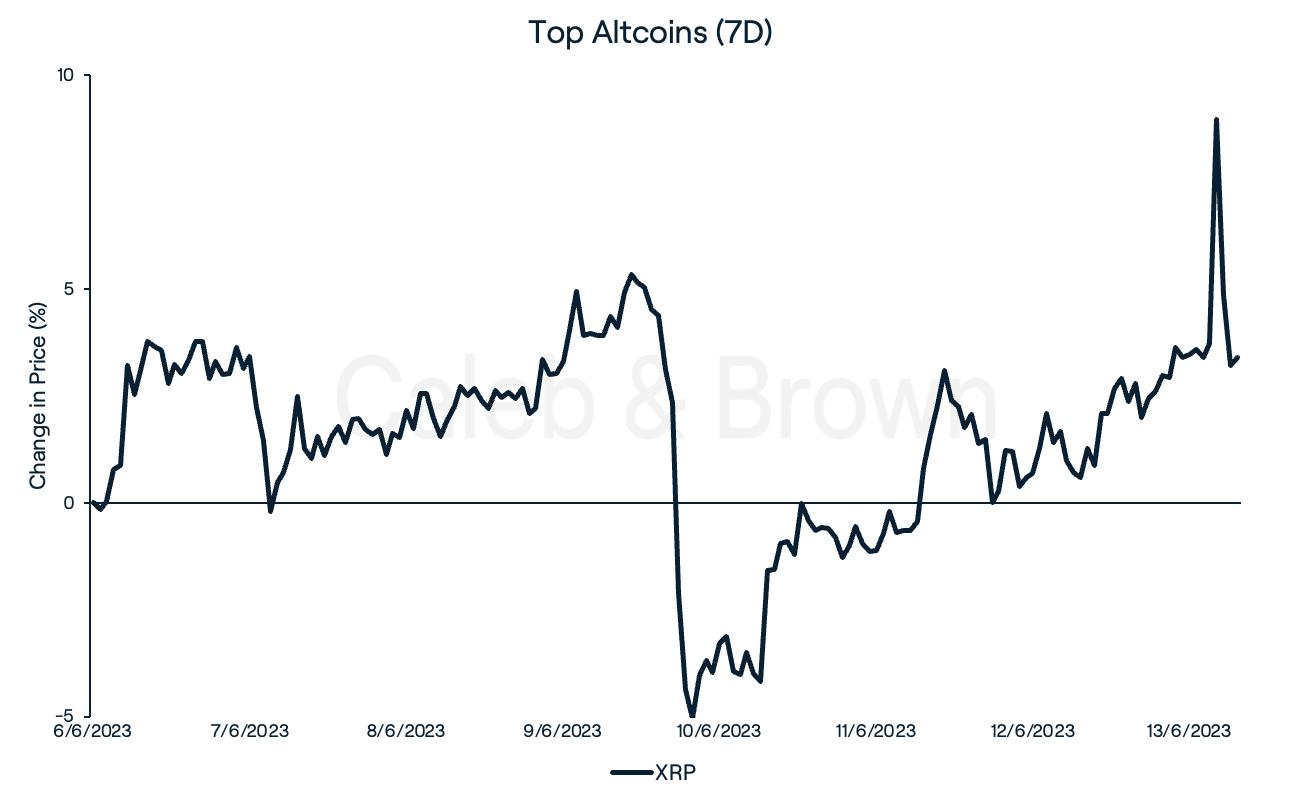

- XRP (XRP) holders remain strong as they welcomed the release of the Hinman documents today.

Price Movements

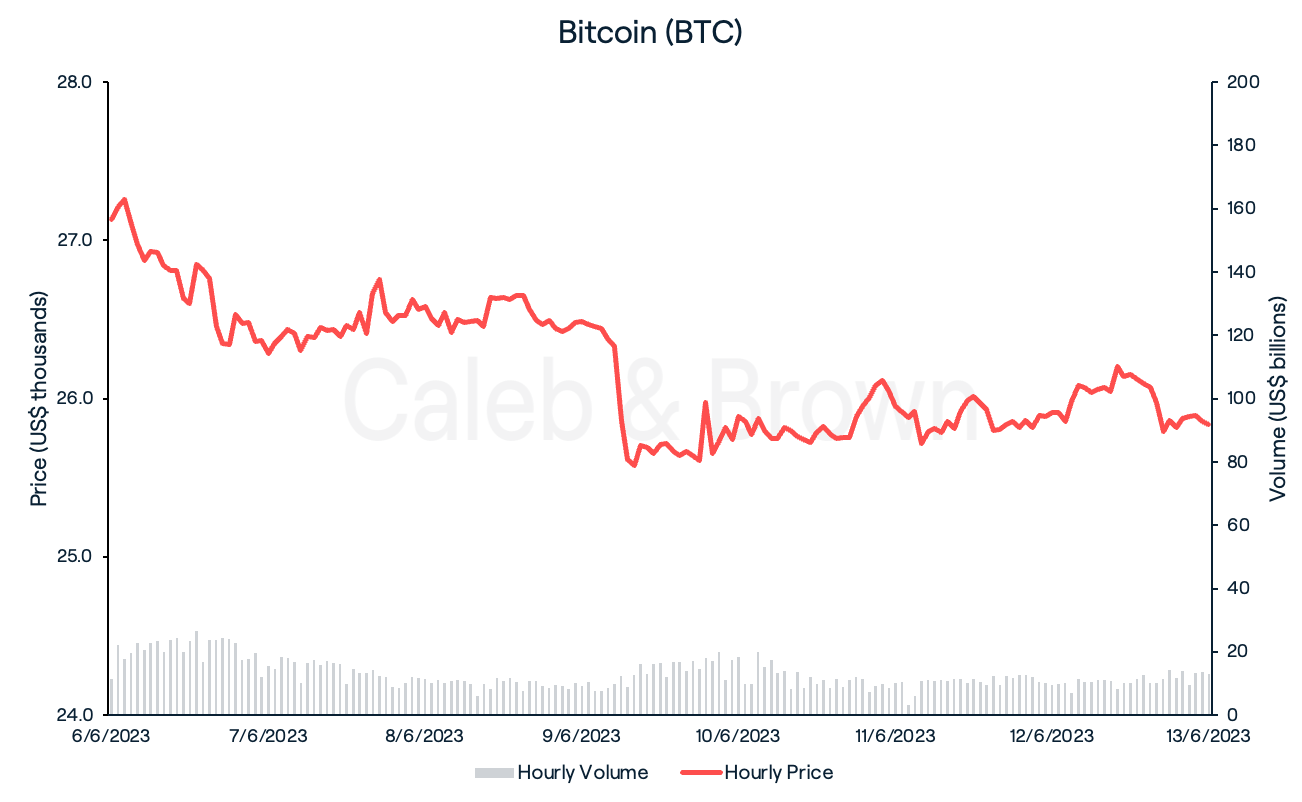

Bitcoin

It’s been a tough week for crypto after the SEC filed lawsuits against the two largest crypto exchanges in the world, Binance and Coinbase, for allegedly operating unregistered securities exchanges.

This led to a range of crypto assets being delisted from a number of major exchanges, including Robinhood and Binance which caused a wave of panic selling and saw the total crypto market shed approximately US$85 billion, or 7.2% week-on-week.

Bitcoin (BTC) sustained among the lighter losses against the leading coins, losing 4.7% over the last seven days to close the week at US$25,835.

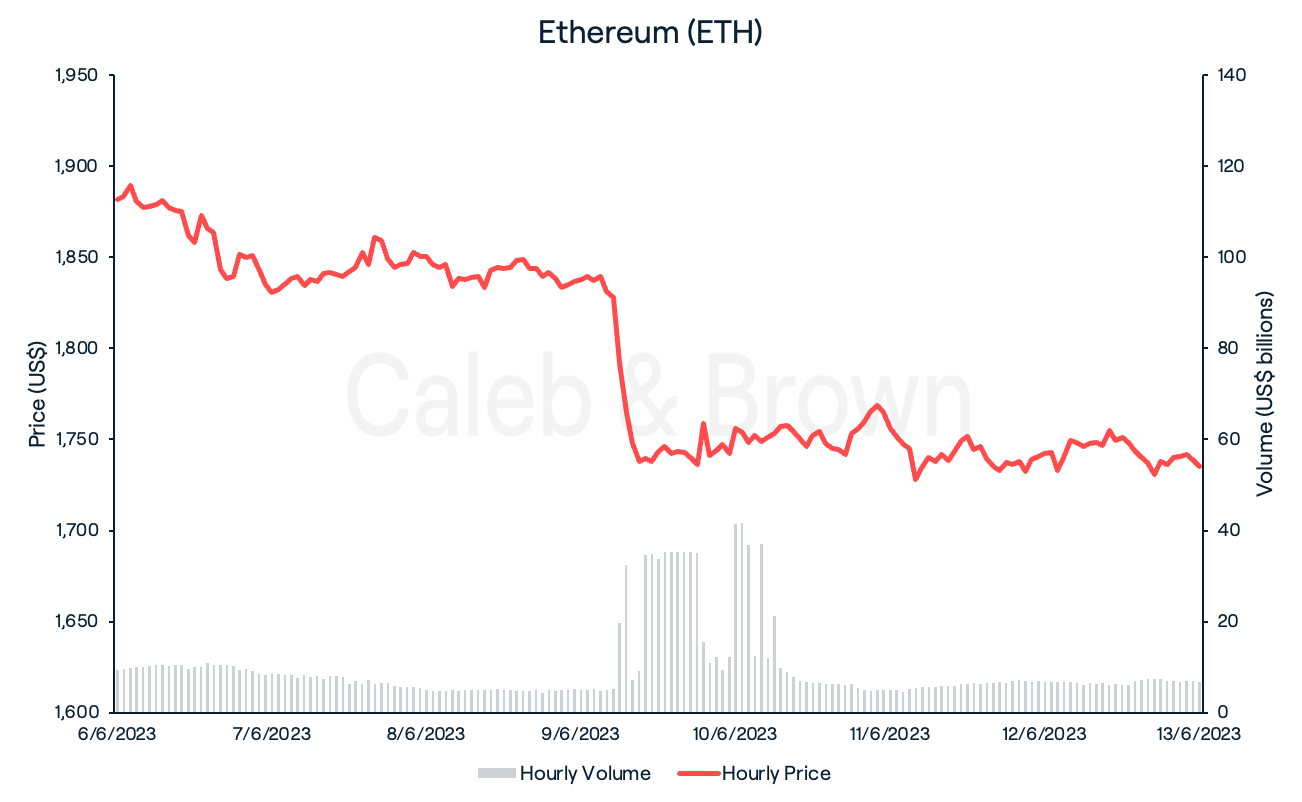

Ethereum

Ethereum (ETH) help up relatively well compared to the other leading coins, however still decreased by 7.8% over the week, closing at US$1,734.

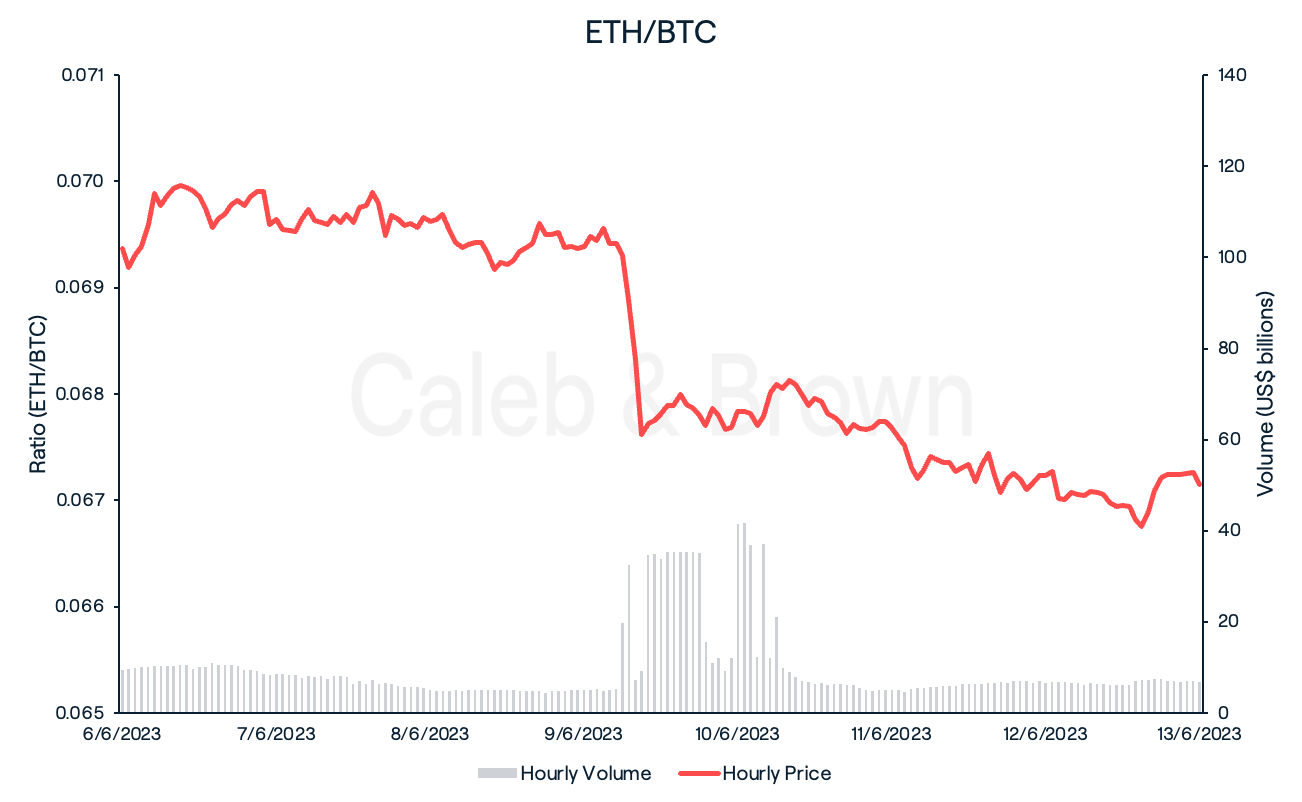

The sharp drop in price this week brought an end to ETH’s five-week rally against BTC with the ETH/BTC ratio falling 3.2% to ~0.0671.

Altcoins

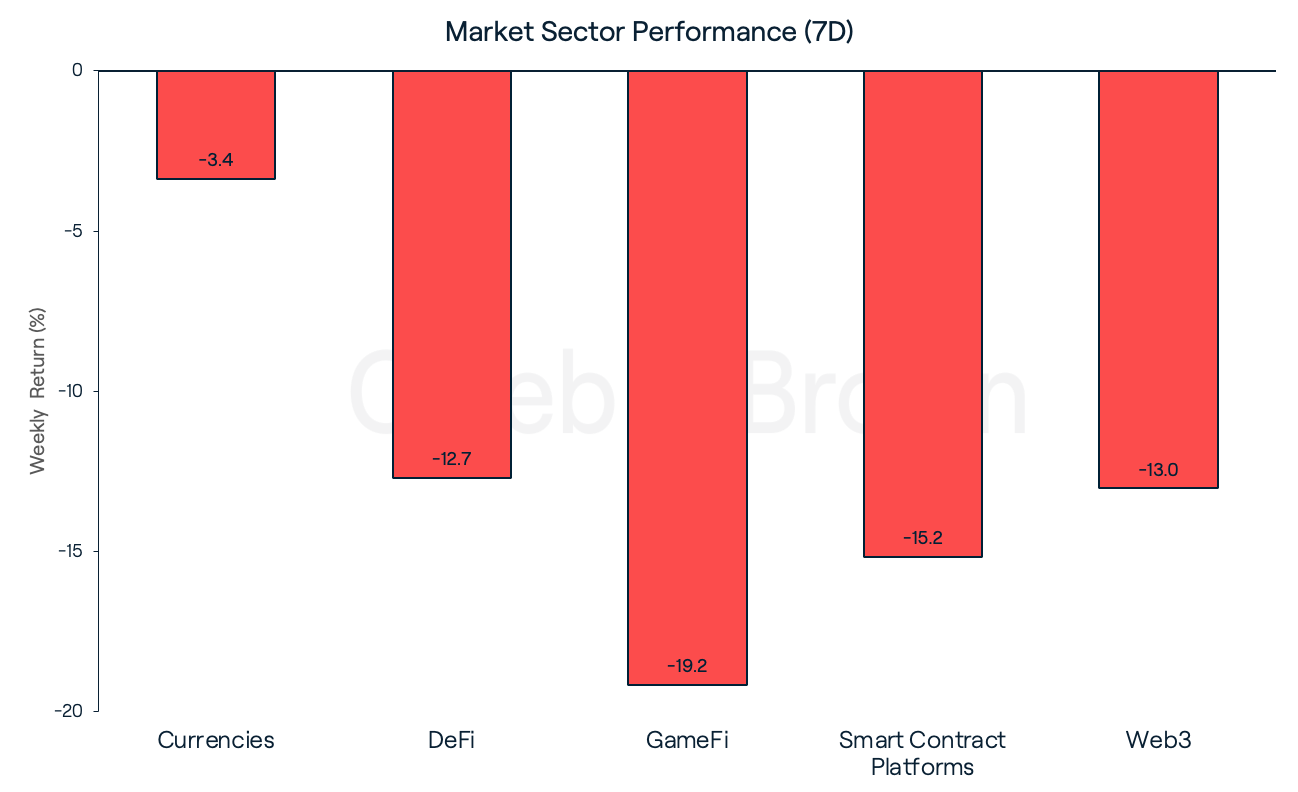

It was a bloodbath across all market sectors this week with all but one sector locking in double-digit losses. GameFi and Smart Contract Platforms took the biggest hits, losing 19.2% and 15.2%, respectively week-on-week.

In a show of resilience XRP (XRP) has not only managed to hold on to last week’s gains but extend it further by another 3.4%. Despite all that is going on in the market XRP holders remain determined on the release of the Hinman documents scheduled for the 13th. Extending his confidence in the release of the documents was Ripple CEO, Brad Garlinghouse who recently commented “they [Hinman documents] were well worth they wait.”

In Other News

The SEC Takes Action

Binance and Coinbase are facing a fresh wave of legal actions from the U.S. Securities and Exchange Commission (SEC) targeting cryptocurrency businesses.

On Monday June 5, the SEC filed 13 charges against Binance, accusing the company of engaging in unregistered token offerings and sales, as well as failing to register as a broker-dealer or exchange. The commission also pursued similar allegations against Coinbase, claiming that the exchange's popular cryptocurrencies are classified as securities.

In response to the SEC's lawsuit, Binance swiftly criticised the regulator, describing its actions as unreasonable and expressing disappointment in the agency's aggressive enforcement approach. Meanwhile, Paul Grewal, Coinbase's chief legal officer, was present in Washington, D.C., to participate in a hearing on the Digital Asset Market Structure Discussion Draft when news of the enforcement action emerged. Grewal briefly deviated from his prepared remarks and expressed his disappointment in the lawsuit, but emphasised that Coinbase would continue “business as usual.”

Later on Tuesday, SEC Chairman Gary Gensler made critical remarks about the crypto industry's overall business model, stating that it is founded on non-compliance. In an interview with CNBC, he declared, "We don't require additional digital currency." Additionally, alongside the Coinbase lawsuit and Gensler's appearance on CNBC, the primary U.S. securities regulator submitted an emergency motion, seeking court authorisation to freeze Binance.US's assets. Binance.US rebutted this motion just today.

By Wednesday, Binance.US took action in response to the SEC lawsuit by suspending more than forty trading pairs and the following day, further announced its decision to suspend dollar deposits, transitioning to a "crypto only" approach.

With these two lawsuits the total number of cryptocurrencies the United States securities regulator has labelled as a ‘security’ has reached an estimated 67. The application of the "security" label now encompasses a market value of over US$100 billion, accounting for approximately 10% of the total crypto market capitalisation of US$1.09 trillion.

Robinhood Spooked

By the weekend, Robinhood, a popular trading app, declared that it would no longer support three major cryptocurrencies—Cardano (ADA), Polygon (MATIC), and Solana (SOL)—due to the SEC categorising them as unregistered securities. Additionally, Crypto.com, a crypto exchange based in Singapore, revealed its plans to discontinue services for institutional traders based in the United States later this month.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F297OaYuIhRqLvz5zsWtfUf%2Ff1e91e03b69aebcffa0f74f4a08505c6%2FMarch_15__2023__11_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-06-14T07%3A51%3A11.671Z)