Market Highlights

- Price declines were seen across the market this week.

- In its June meeting, the US Federal Reserve left rates on hold at 5.5%.

- The Democrats are hosting a meeting on crypto regulation in Washington, D.C., in July.

- A growing number of publicly traded companies are adding bitcoin to their balance sheets as a primary reserve treasury asset.

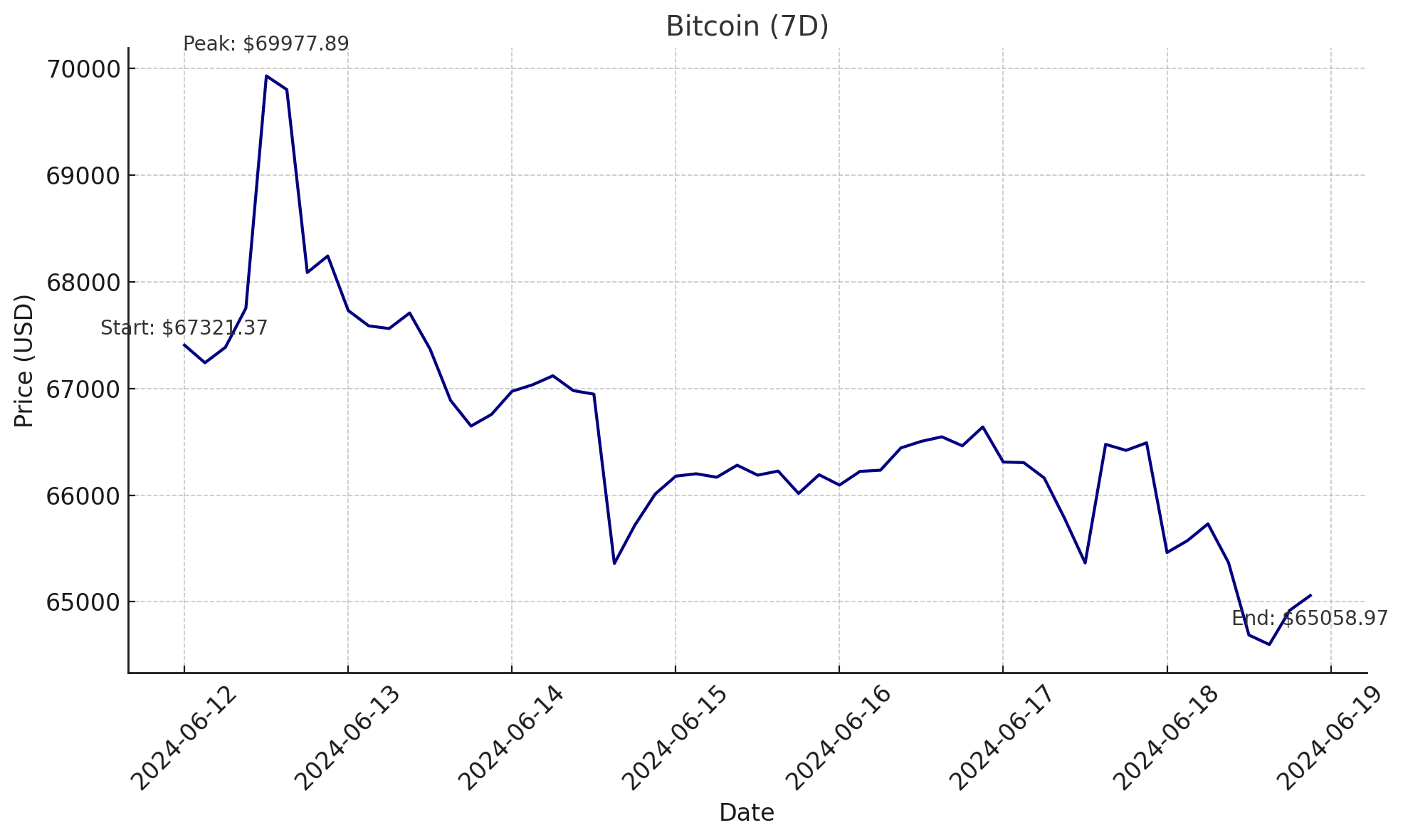

Bitcoin (BTC)

Price action across the entire cryptocurrency market was bumpy this week, with many major cryptocurrencies, including bitcoin, ending up net negative for the week. According to CoinGecko, bitcoin went as low as US$65,018 — a 30-day low.

Bitcoin closed the week at US$66,361, ending the day in the green as it bounced off key support at US$65,500 on Friday. Also this week, global investment firm AllianceBernstein released a research note stating that it expects bitcoin’s price to reach US$200,000 over the next twelve months. Supply constraints and growing demand due to institutional buying and exposure through ETFs were noted as two drivers of price. Bitcoin ETFs currently have US$53 billion in assets under management (AUM). AllianceBernstein expects AUM in bitcoin ETFs to grow to US$190 billion by the end of 2025.

As anticipated, following strong US employment data last week, the US Federal Reserve left rates on hold at 5.5% in its June meeting. At their two-day meeting, the Federal Open Market Committee (FOMC) removed two rate reductions from the three they initially indicated would occur throughout the remainder of 2024. The statement released after the meeting said that while inflation has eased, further signals that the economy is nearing the Fed’s 2% goal are required before any potential rate cuts. Despite indicating that a rate cut may not occur until later this year, investors were buoyed. The S&P 500 rose to a record high on Wednesday, closing above 5,400 for the first time.

Bitcoin is currently trading at US$66,495, a decrease of over 4% on the week.

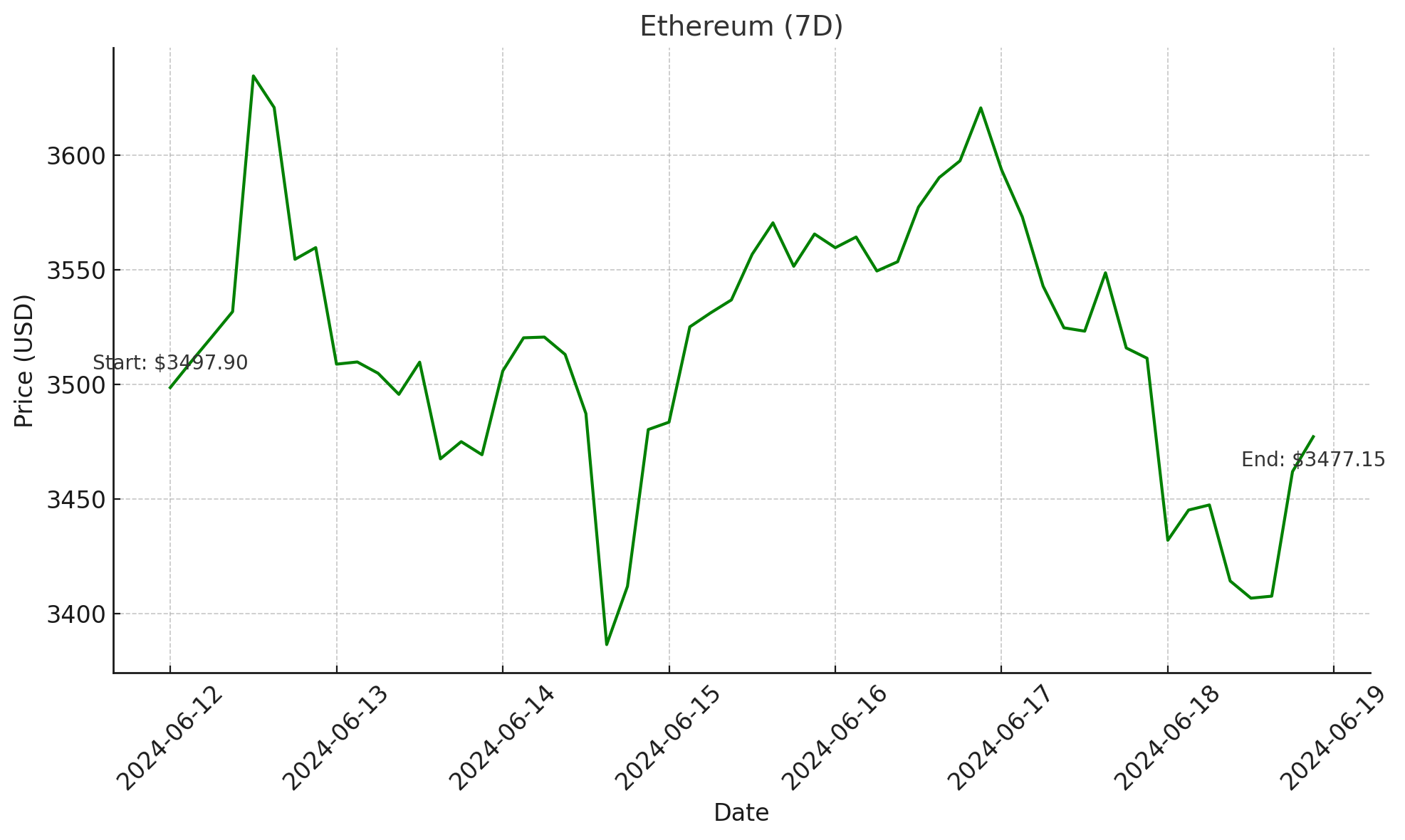

Ethereum (ETH)

Ethereum also experienced a week of declines. Ether fell to a low of US$3,574 on Friday, and has since found support at the key level of US$3,355.

The US Securities Exchange Commission’s (SEC) chairman, Gary Gensler, provided an update on when spot Ethereum ETFs will launch. The S-1 registration forms submitted by investment institutions will likely be approved over the summer months (June 2024 to August 2024) in the US. Analysts expect the products to see US$4 billion of inflows in the first five months. While Gensler provided clarification on when spot Ethereum ETFs will go live, he didn’t provide a direct answer on whether the SEC classifies Ethereum as a commodity or security. Some legal experts argue that approving single-asset ETF products indicates that Ethereum could be considered a commodity.

Ethereum is currently trading at US3,513, a decrease of over 4% on the week.

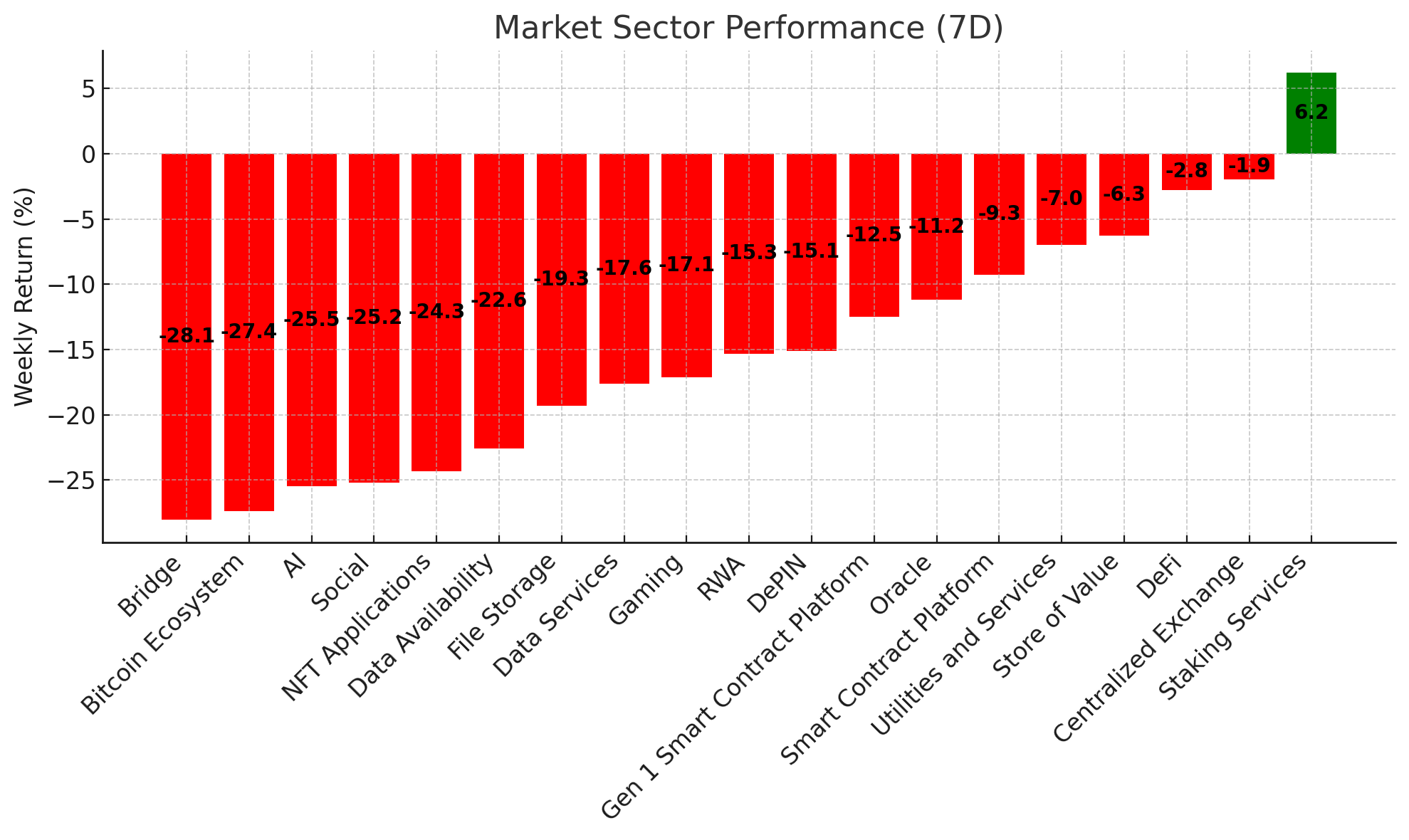

Altcoins

Staking services dominated sector performance this week, growing 7%. Other sectors saw declines, with centralised exchanges and utilities and services declining by 2% and 6.7%, respectively

DeFi Developments

- Convex Finance (CVX) gained 63.9%, taking its market cap to US$325.9 million. The decentralised exchange and automated market maker, which allows Prisma staking, shared that an on-chain vote on Prisma Finance occurred on Friday, June 14. To minimise the impacts caused by instability in the mkUSD peg following the compromise of Prisma Finance’s vault in March, a limit order has gone live for victims to swap mkUSD to wstETH.

- Rocket Pool (RPL) grew by 34.8%, taking its market cap to US$551.9 million. The decentralised Ethereum liquid staking protocol took off on Friday after the team released a proposal to rework its tokenomics while the $RPL Houston Upgrade went live on 17 June. The team also announced that $RPL will no longer be used for collateral. Instead, it will capture value directly. Other features, such as ETH staking, will also be added to the network.

Living in a Digital World

- PERL.eco (PERL) grew by 35.32%. The network, which aims to democratise the biosphere economy, provides access to liquidity pools and exposure to carbon credits through tokenisation. PERL’s price grew to USD$0.001 on Sunday, as it found support at the key level of US$0.0008, which has occurred repeatedly over the last two months.

- Ethereum Name Service (ENS) continued its growth, rising 16.7% this week, taking its market cap to US$754.9 million. The digitisation network that allows users to create a web3 username for use across multiple chains held its much-anticipated AMA on June 12, sharing several positive updates. PERL also topped the NFT market to start the week, with over US$4.3 million in revenue. While PERL isn’t an NFT, the network uses the technology for its decentralised URL method.

Swapping, Staking and Liquidity Innovation

- Uniswap (UNI) grew by 13.9%, taking its marketing cap to US$8.3 billion. The on-chain marketplace had an exciting week. The team completed its acquisition of interactive crypto survival game, Crypto: The Game, reached US$300 billion in layer-two volume, and launched ZKsync on the Uniswap interface, allowing users to swap and access liquidity on ZKsync.

- Lido DAO (LDO) grew by 12.4%, taking its market cap to $1.9 trillion. The liquid staking network for Ethereum surged when it announced that it was introducing advanced DeFi strategies for stETH through its partnerships with Mellow Finance and Symbiotic. The strategies include staking through permissionless Liquid Restaking Token (LRT) creation, based on a user's risk profile and investing strategy.

In Other News

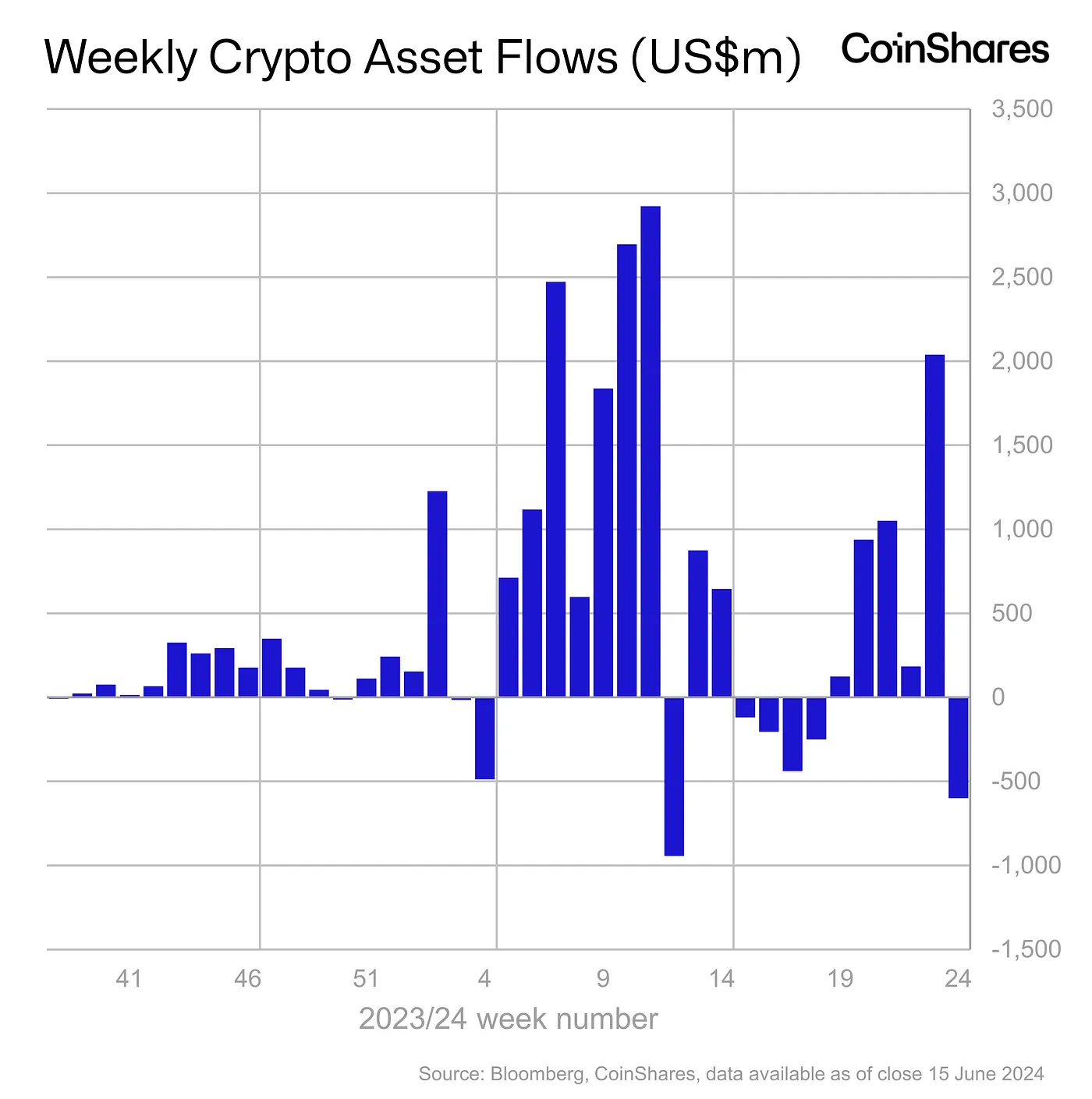

This week saw outflows of US$600 million across digital asset investment products. In the biggest week of outflows since March 22, 2024, investors presumably reduced their exposure to crypto investment products due to the FOMC’s hawkish outlook in its June meeting. This outlook included eliminating the prospect of more than a single rate cut throughout the remainder of 2024.

Bitcoin investment products experienced outflows of US$621 million, with US$1.8 million flowing to short-bitcoin products. Altcoins saw inflows, with Ethereum gaining US$13.1 million and Ripple (XRP) gaining US$1.1 million.

- Prominent bitcoin whale MicroStrategy (MSTR) was the first publicly traded company to acquire and hold bitcoin as a primary reserve treasury asset on its balance sheet. The firm started buying bitcoin in August 2020. While MSTR’s stock fell 6% this week, presumably linked to weak price action in bitcoin, the firm has a US$7.4 billion profit in their bitcoin treasury. This comes as other public companies announced that they will buy bitcoin in 2024. DEFI Technologies (OTCMKTS: DEFTF), Selmer Scientific (NASDAQ: SMLR), and Metaplanet’s (TYO: 3350) stock prices have grown 200%, 70% and 400%, respectively, after announcing they will hold bitcoin in their treasuries. Stock price growth for publicly traded companies announcing they are adding bitcoin to their balance sheets indicates that markets are receptive to traditional companies diversifying with crypto.

- President Biden’s administrative officials and other congressional leaders will attend a crypto industry meeting in Washington, D.C., in July. The meeting, which California Democratic Congressman Ro Khanna will host, will discuss how to keep Bitcoin and blockchain innovation on US shores. Businessman Mark Cuban, who has been vocal about a lack of progress on crypto regulation in the US, will also attend. The meeting could be interpreted as a response to former President Donald Trump’s public support of bitcoin and crypto, including accepting Bitcoin Lightning Network payments for campaign donations.

- The Nigerian Federal Inland Revenue Service (FIRS) has dropped tax charges against Binance executives Tigran Gambaryan and Nadeem Anjarwalla. FIRS agreed to revise the case, so Binance is now the sole defendant. This means that Gambrayan and Anjarwalla won’t have to appear in court on these charges. However, the executives are still named in the money-laundering case brought by the Nigerian Economic and Financial Crimes Commission.

Regulatory

- El Salvador President Nayib Bukele has proposed that a private investment bank be established to offer broader financial services to investors holding bitcoin and US dollars through a bill designed to reform current banking law. The proposal comes after President Bukele was sworn in for his second term two weeks ago. If the bill passes, sophisticated investors with more than US$50 million in capital will be able to access economic risk management, a range of financial products, investment management, hedging, and other financial derivatives.

New Asset Listings

Buy & Sell these crypto assets, or Swap them directly with hundreds of other popular assets through your personal crypto broker.

To see our full list of available assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.