Market Highlights

- Crypto markets had a tough week as prices slid further to break key support levels.

- The Bank of England left rates on hold at 5.25% in its June meeting.

- Worrying signals in Japan’s banking system could be good for bitcoin.

- Bitcoin has broken its short-term holder cost price of US$63,800 and key support at US$61,000.

- The US SEC closed its investigation into whether ETH is classified as a security.

Bitcoin (BTC)

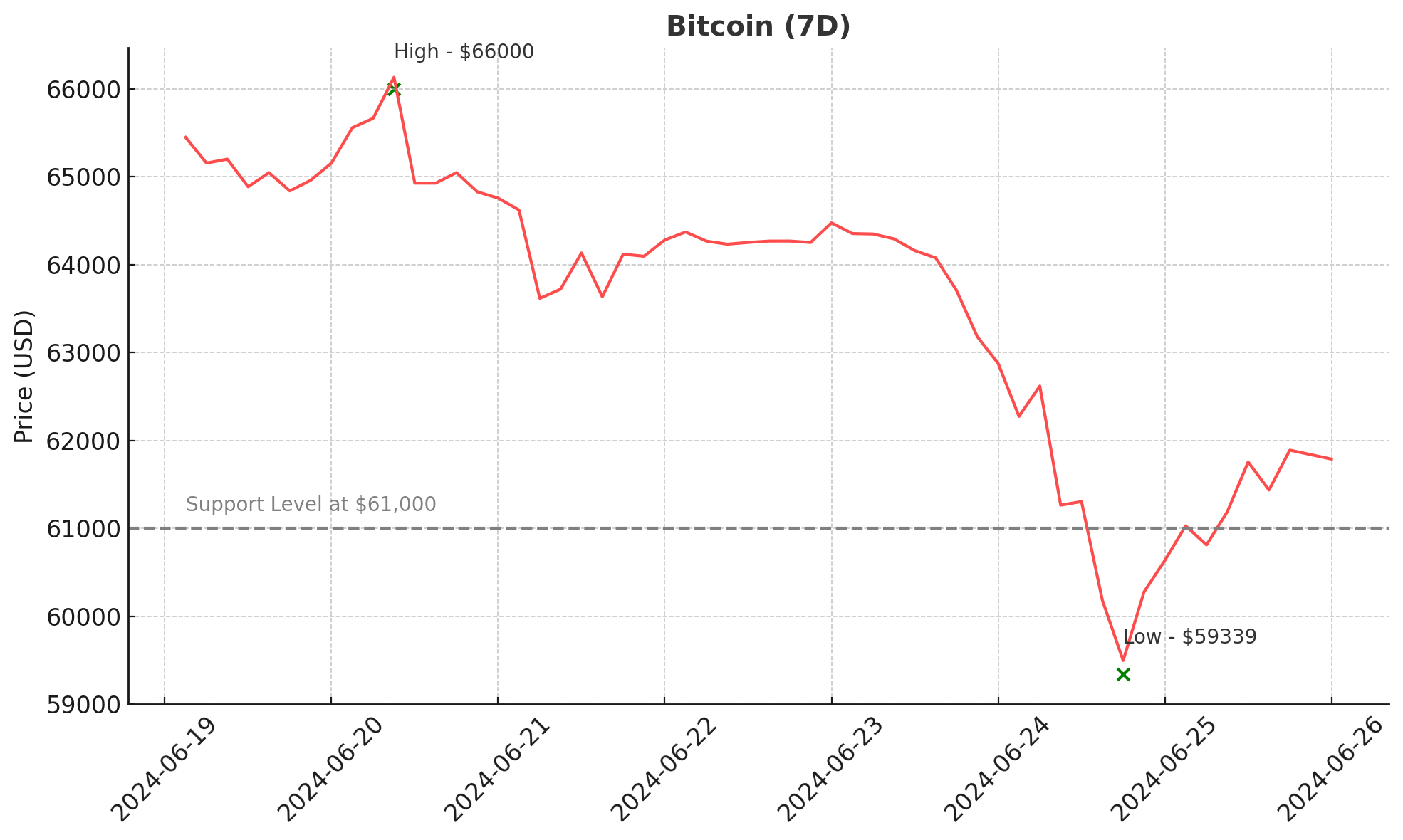

Bitcoin's subdued price action continued to start the week before a major pullback started in the second half of the week. Price slid over 10% from Thursday’s high at US$66,000 through to Monday’s low at US$59,339, with a small 4.5% recovery occurring on Tuesday, 25 June 2024. Over US$100 million in long bitcoin positions were liquidated as price broke below major support at US$61,000. MicroStrategy buying another US$786 million worth of bitcoin was no match for sell-side pressure. Among those selling was the German Government, who offloaded US$325 million worth of bitcoin over two days.

According to analytical experts, the current price declines see bitcoin at a critical level. Reflexivity Research found that bitcoin’s short-term holder cost basis is US$63,800, indicating the price at which recent investors bought the cryptocurrency. However, according to CryptoQuant, the on-chain short-term holder cost price is higher at US$65,800, meaning these two levels of support have been broken. The overall realised price for bitcoin holders is US$30,400, which takes into account the cost of bitcoin for all holding it. The further away the current price is from the realised price, the further the market is into a bull run.

On the macroeconomic front, there weren’t any big surprises this week. Unemployment claims in the US came in slightly higher than expected at 238,000. The Flash Manufacturing Purchasing Managers Index (PMI) and Flash Services PMI came in at 51.7 and 55.1, respectively — each higher than forecast. And across the Atlantic, the Bank of England left the official bank rate on hold at 5.25%, coinciding with headline inflation reaching the central bank’s target of 2% for the first time in three years.

Bitcoin is currently trading at US$62,000 a decrease of almost 4.7% on the week.

Ethereum (ETH)

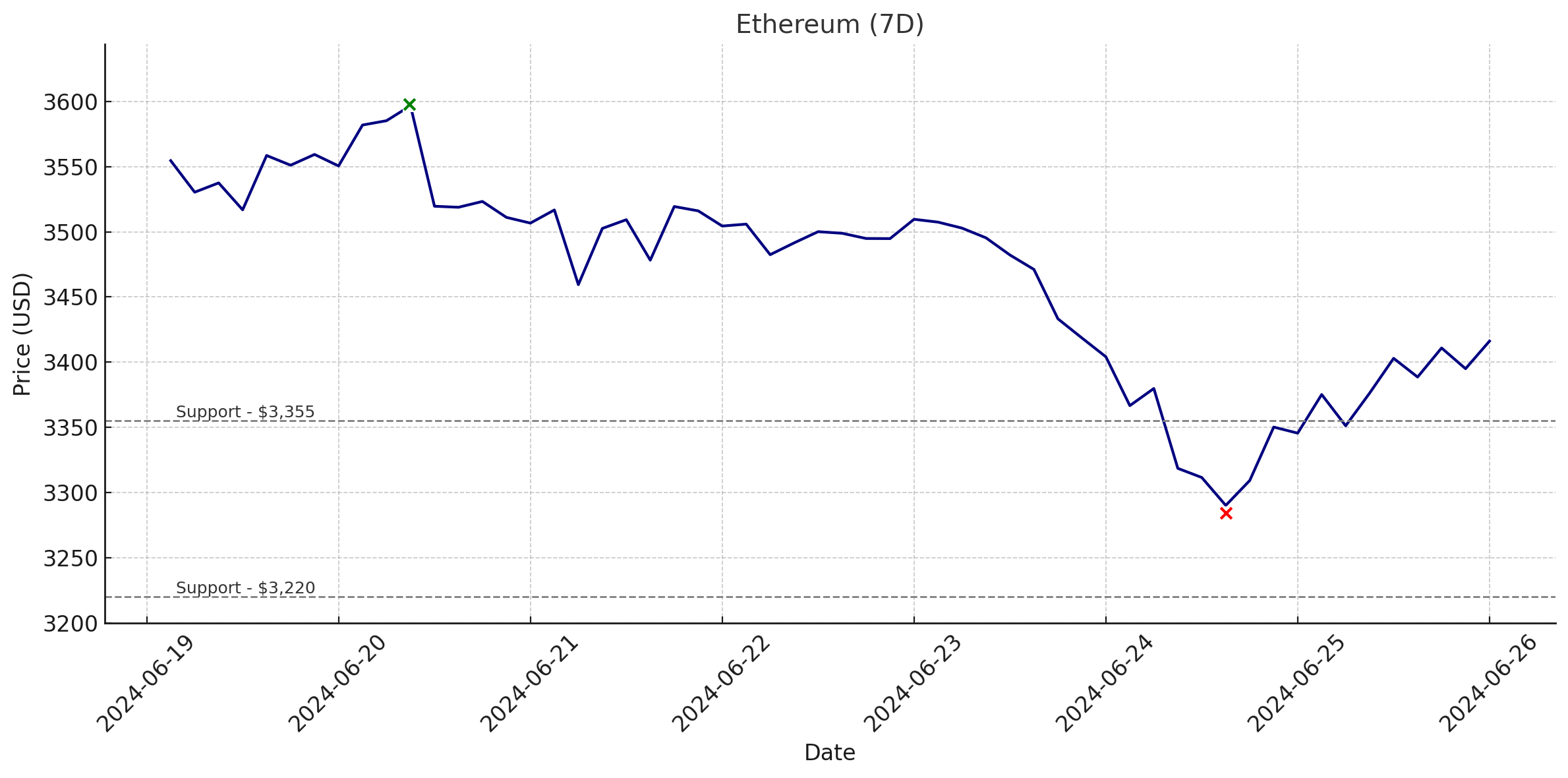

Ethereum declined over 5% in the past week, making a small recovery on Tuesday, 25 June 2024. Like bitcoin, steep price declines occurred throughout the second half of the week, with price breaking key support at US$3,355 and sliding further to test the next level of support at around US$3,220. Price has recovered slightly from this level, currently hovering back around key support at US$3,355.

Asset managers have begun disclosing the fees on their spot ETF products, and Bitwise created an advertisement for TV audiences. The advertisement pokes fun at how traditional banking and investment channels don’t operate 24/7, unlike cryptocurrencies.

The US Securities and Exchange Commission (SEC) has dropped its investigation into Ethereum. Closure of the investigation means that the SEC will no longer be bringing charges alleging that selling ETH is a securities transaction. Ethereum developer Consensys says the decision follows a letter the firm sent to the SEC on June 7 2024, querying whether the investigation would end after spot Ethereum ETFs were approved. This is because the approval, according to Consenys, is “premised on ETH being a commodity.”

Ethereum is currently trading at US$3,412, a decrease of over 3% on the week.

Altcoins

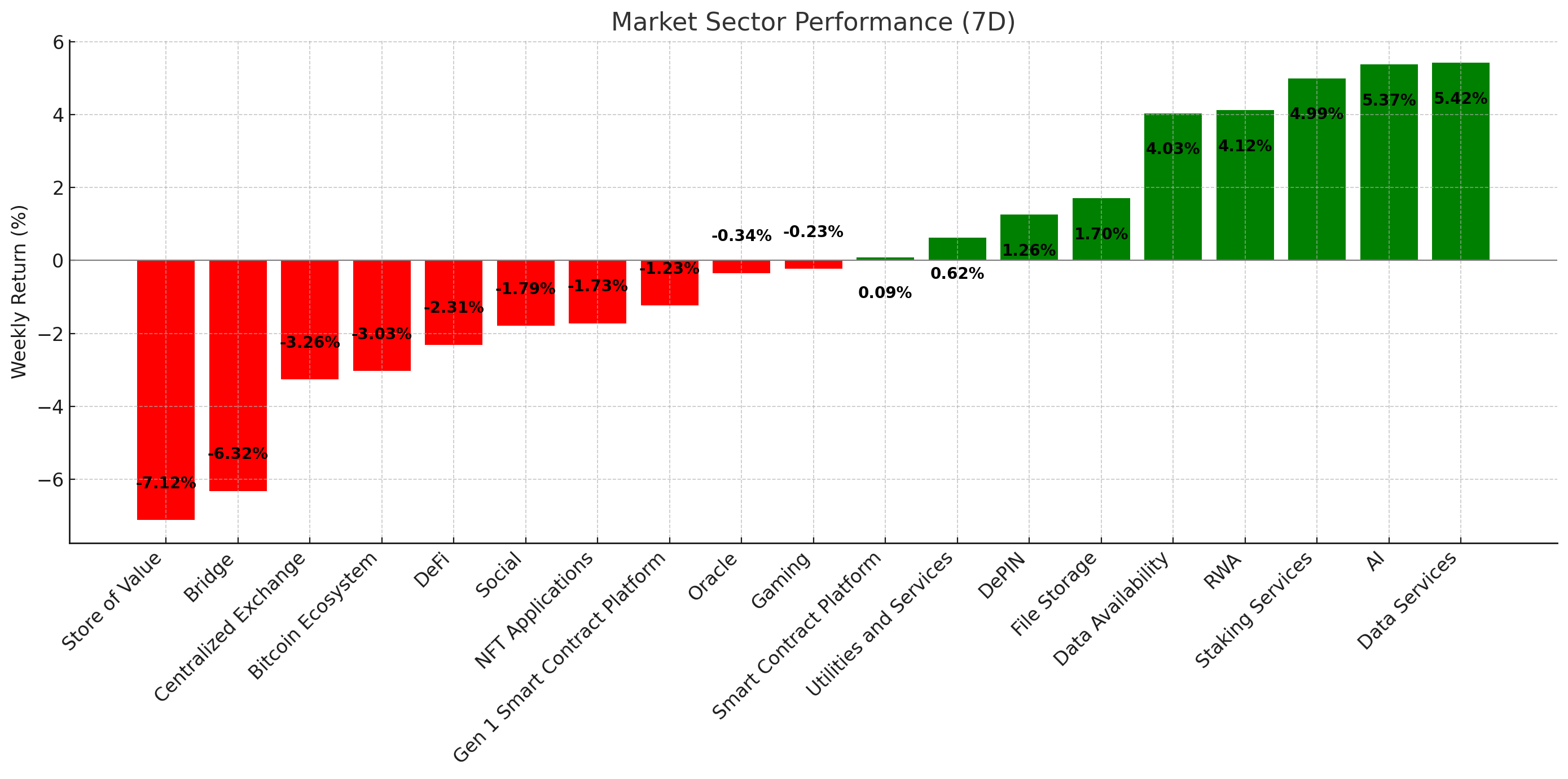

The AI sector showcased robust growth, leading the pack with a 5.4% increase. Following closely were the Data Services and Staking Services sectors, which grew by 5.4% and 4.99%, respectively, indicating strong positive momentum. On the downside, the Centralised Exchange sector struggled the most, experiencing a drop of 3.3%. Other sectors, such as the Store of Value and Bridge also saw significant declines, with reductions of 7.1% and 6.3%, respectively, underlining challenges in these areas. This week's performance highlights a clear divide between sectors leveraging technological advancements and those facing more traditional market pressures.

Developments in DAOs

- Unifi Protocol DAO (UNFI) gained 19.5%, taking its market cap to US$36.3 million. Price took off on Monday, June 17, after bouncing off key support at US$3.This week's strong price growth indicates continued investor interest in DeFi platforms that offer yield through advanced DeFi strategies and arbitrage opportunities.

- Metal DAO (MTL) grew by 17%, taking its market cap to US$86.5 million. The payments platform found key support at US$1.04 earlier in the week. To close the week, Binance announced that it will support Metal DAO with its mainnet swap from June 24, 2024, when old MTL tokens will be suspended. Old MTL tokens will be swapped with new MTL tokens at a ratio of 1:1.

Get Smart (contracts)

- Aleph Zero (AZERO) gained 9.5%, which takes its market cap to US$194.7 million. The price gains are presumably due to the ecosystem advancement it announced this week. Aleph Zero Foundation released its ZK-privacy EVM Layer 2 solution, enabling almost instantaneous ZK proving times and making on-chain privacy faster and easier.

- Ontology Gas (ONG) grew by 5.4%, taking its market cap to US$136.8 million. Like other altcoins this week, ONG bounced off a key level of support around US$0.28 during the week. The network announced its new collaboration with GT Protocol to offer decentralised fund management and investment.

New DeFi Rewards

- Maple (MPL) gained 2.2%, taking its market cap to US$100.6 million. This follows strong price action earlier this month when it launched its institutional lending platform, Syrup. As part of Syrup, a new rewards program called “Drips” will go live on June 25, 2024.

In Other News

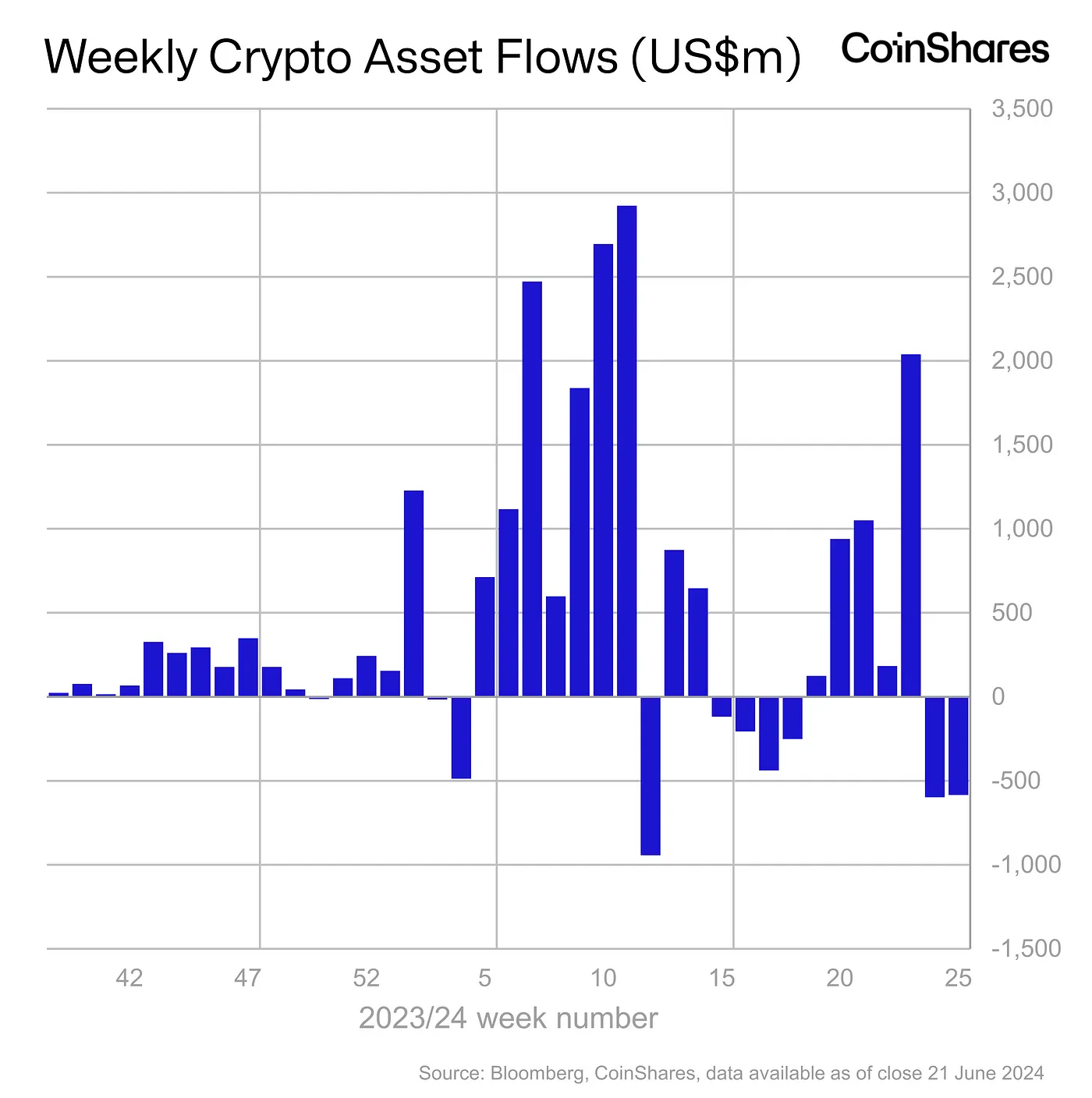

Another week of outflows occurred for crypto assets, with US$584 million leaving funds. This, combined with bearish price action, indicates that a correction may be underway. The correction is presumably driven by investors’ concern that the US Federal Reserve won’t be making interest rate cuts anytime soon.

Bitcoin saw the largest outflows, totalling US$630 million. Investors didn’t add to their short bitcoin positions, though. Short bitcoin also saw outflows, with US$1.2 million leaving funds.

Ethereum investment products saw US$58 million outflows. Small inflows occurred in altcoins, presumably due to investors taking advantage of weak price action. The biggest inflows were to Solana, Litecoin, and Polygon, with US$2.7 million, US$1.3 million, and US$1 million, respectively.

- BitMEX co-founder Arthur Hayes said this week that a bailout of the Japanese banking system could fuel crypto prices. Norinchukin, Japan’s fifth largest bank, recently announced that it intends to sell US$63 billion in US and European bonds. The paper losses on the bonds have become too large, and the sale of the bonds is expected to happen by March 2025. Hayes stated that Norinchukin's losses could be among many in the Japanese banking system, as Japanese banks held US$850 billion in bonds, including US$450 billion in US bonds in early 2022. The sale of the bonds could cause yields to spike, requiring the Bank of Japan (BOJ) to purchase the bonds by leveraging its Foreign and International Money Authorities (FIMA) repo facility. This would allow the BOJ to pledge US Treasuries as collateral for US dollars, meaning money printers will fire up again, which is typically good news for assets with a capped supply.

- Tokyo investment firm Metaplanet Inc. plans to buy US$6.3 million of bitcoin with the capital it’ll raise through an upcoming bond issuance. Metaplanet’s stock price soared 12.2% in the morning session following the announcement. The bonds, which equate to 1 billion yen, have an interest rate of 0.5% and will mature on June 25, 2025. Earlier this month, Metaplanet bought US$1.6 million worth of bitcoin. The company has stated that it is accumulating bitcoin as a “strategic treasury reserve asset” due to persistent economic pressure in Japan.

- Solana-based developers, Light Protocol and Helius Labs have launched technology that will allow applications on Solana to scale. The technology, called “ZK Compression,” works using a process called “state compression”. This technology allows specific types of data to be stored using Solana’s cheaper ledger space. The data is then stored on-chain using a “hash” (a fingerprint of the off-chain data) for verification, resulting in a 5000x reduction in storage prices.

Regulatory

- The US SEC rebutted Ripple Lab’s request for a lower civil penalty. Ripple cited its settlement with Terraform Labs when asking Judge Analisa Torres from the United States District Court for the Southern District of New York for a lower penalty. The company asked for a penalty of “no more than US$10 million’, which is substantially lower than the SEC’s proposed US$876.3 million civil penalty. The SEC and Ripple have been in court since 2020, when the SEC alleged that Ripple sold unregistered securities.

- The United States Justice Department has denied the motion to reduce former Ethereum developer Virgil Griffith’s sentence for violating sanctions on North Korea. Griffith was sentenced to 63 months in prison and fined US$100,000 in April 2022 after speaking at a crypto and blockchain conference in Pyongyang in 2019. At the conference, he delivered presentations on using cryptocurrency for money laundering and to evade sanctions. His expected release date is January 2026.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.