Market Highlights

- Bitcoin (BTC) has exploded to yearly highs after BlackRock filed for a spot BTC ETF with the SEC last Thrusday.

- Total crypto market cap tops US$1.2 trillion for only the second time since June 2022.

- On Monday, the Financial Services and Markets Bill was passed by the U.K. upper house of parliament, now entering its concluding phase which will aim to refine the bill.

- The SEC approved its first leveraged Bitcoin futures ETF on Friday, dubbed the Volatility Shares 2x Bitcoin Strategy ETF (BITX).

Price Movements

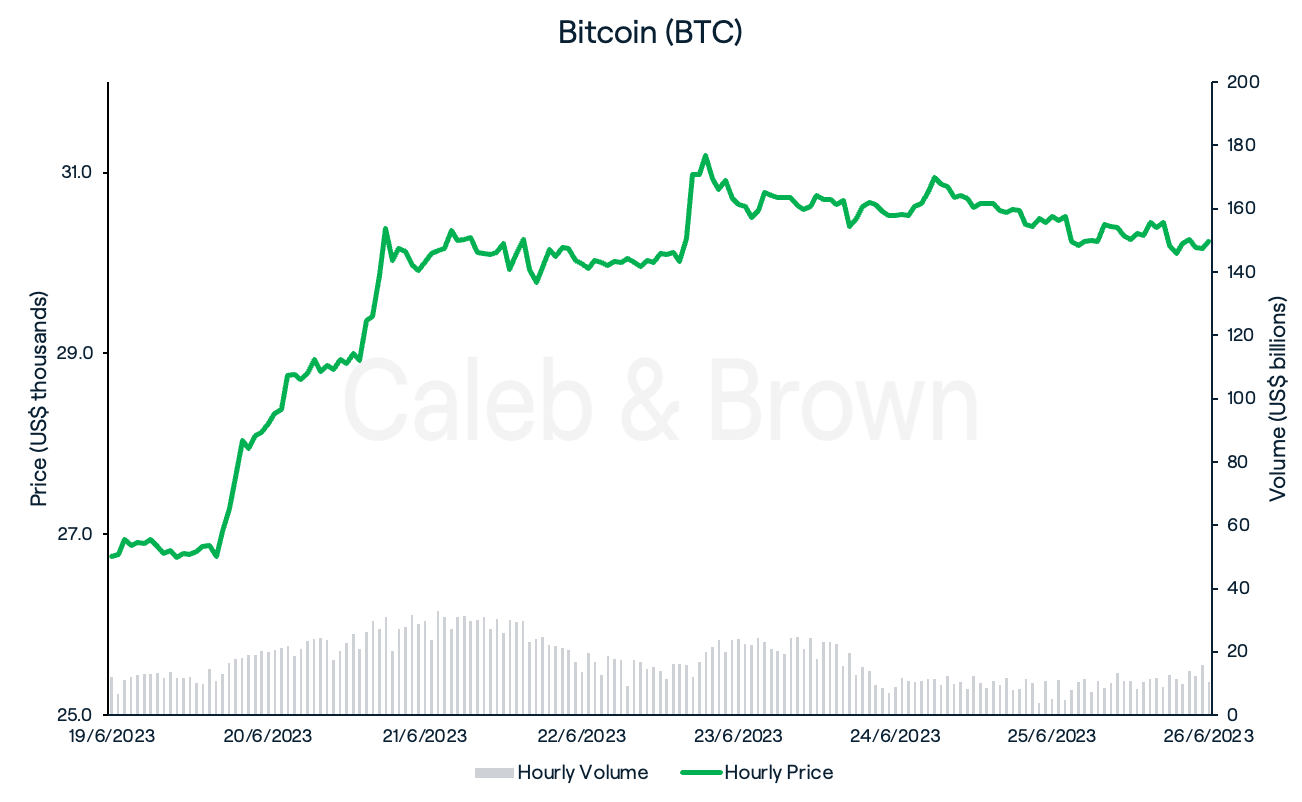

Bitcoin

All eyes have been on Bitcoin (BTC) this week as it continued last week’s recovery rally and established new yearly highs as well as over 50% dominance — the ratio between BTC market cap and total crypto market cap.

The surge was spurred on by none other than BlackRock, the world’s largest asset manager and its application to the U.S. Securities and Exchange Commission (SEC) for a Bitcoin spot Exchange-Traded Fund (ETF) last Thursday.

BlackRock holds over US$9 trillion in assets under management and boasts an impressive ETF application record of 575-1. This set in motion a surge in BTC’s price, and a wave of other spot BTC ETF filings to the SEC, including WisdomTree and Invesco.

BTC hit a high of US$31,431 Friday night for the first time since June ‘22 and cooled slightly over the weekend. BTC eventually closed the week at US$30,238, up an astounding 13.0%.

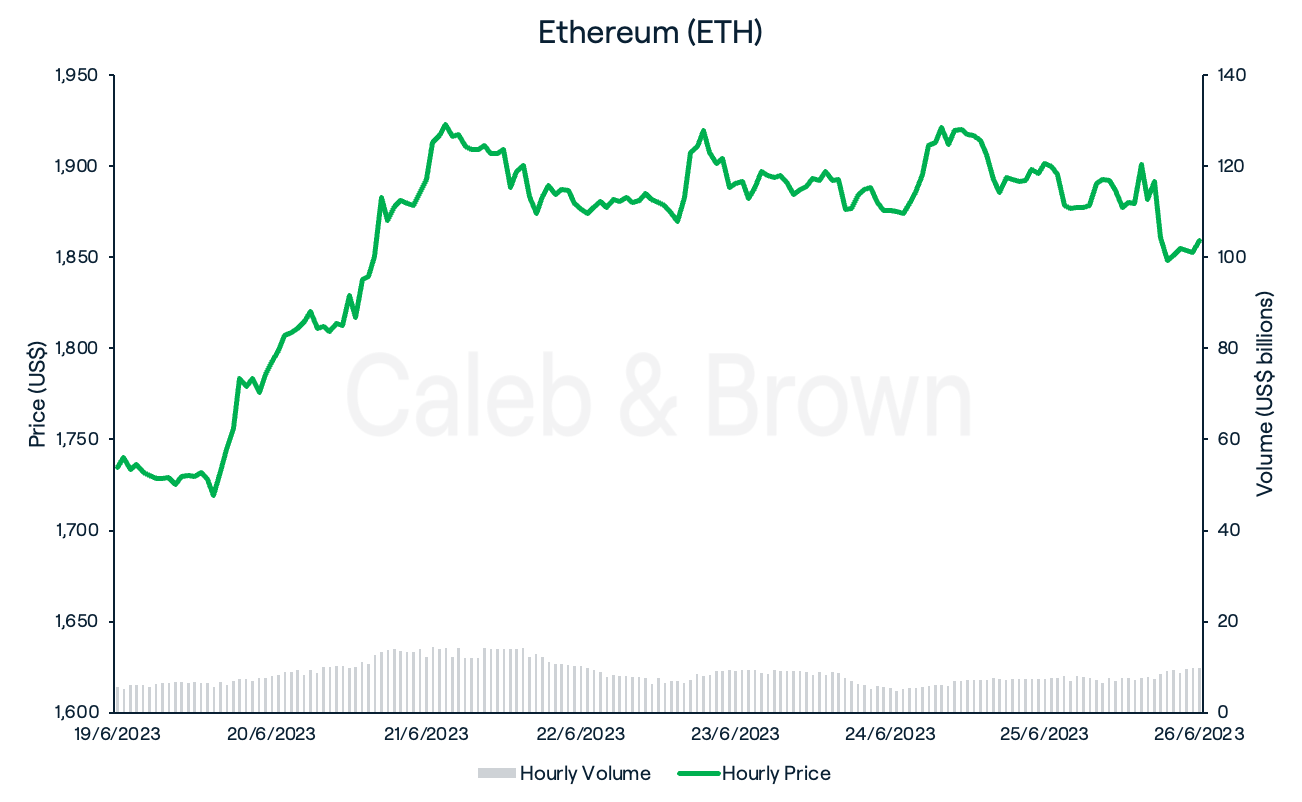

Ethereum

Ethereum (ETH) also enjoyed a great week in price growth hitting a local top of US$1,936 on Friday before closing the week at US$1,859 for a weekly gain of 7.2%.

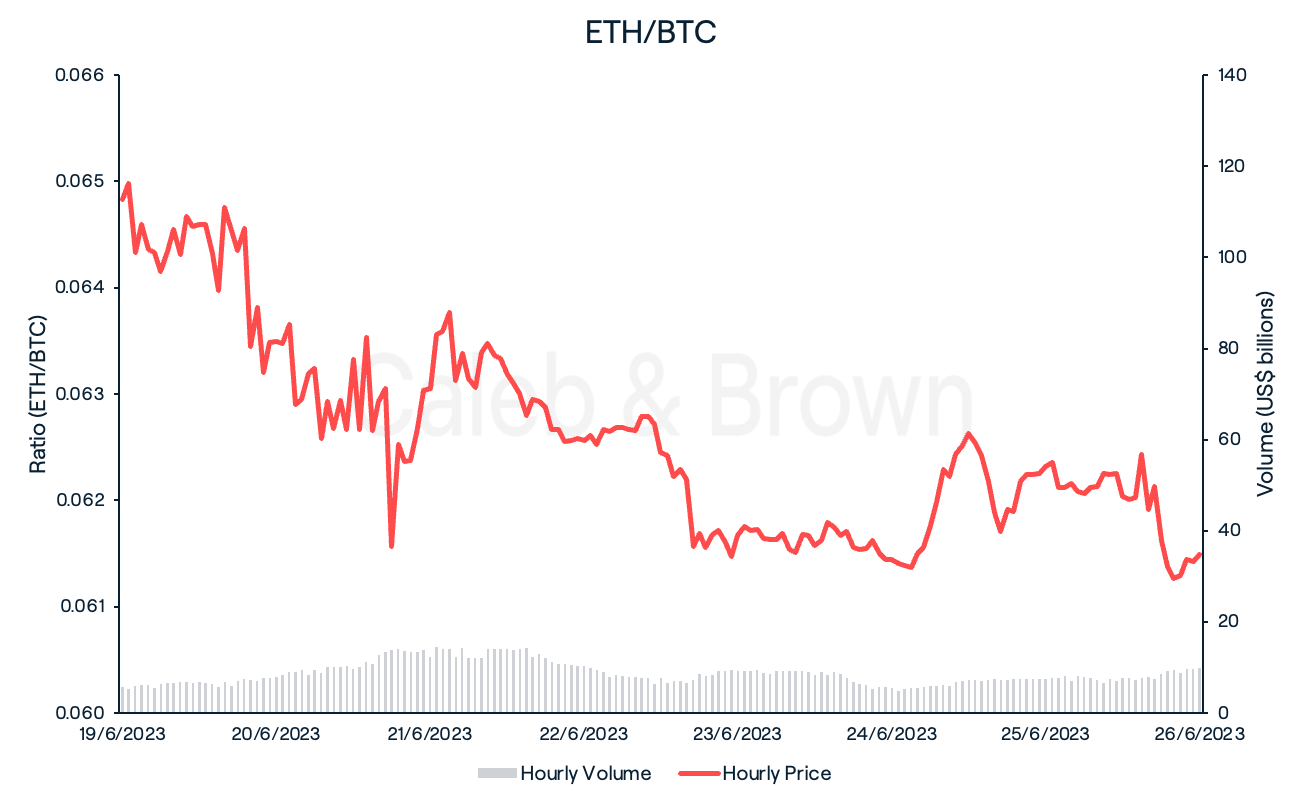

With BTC regaining over 50% dominance, the ETH/BTC ratio has declined again this week, falling to ~0.0614, down 5.2% over the last seven days.

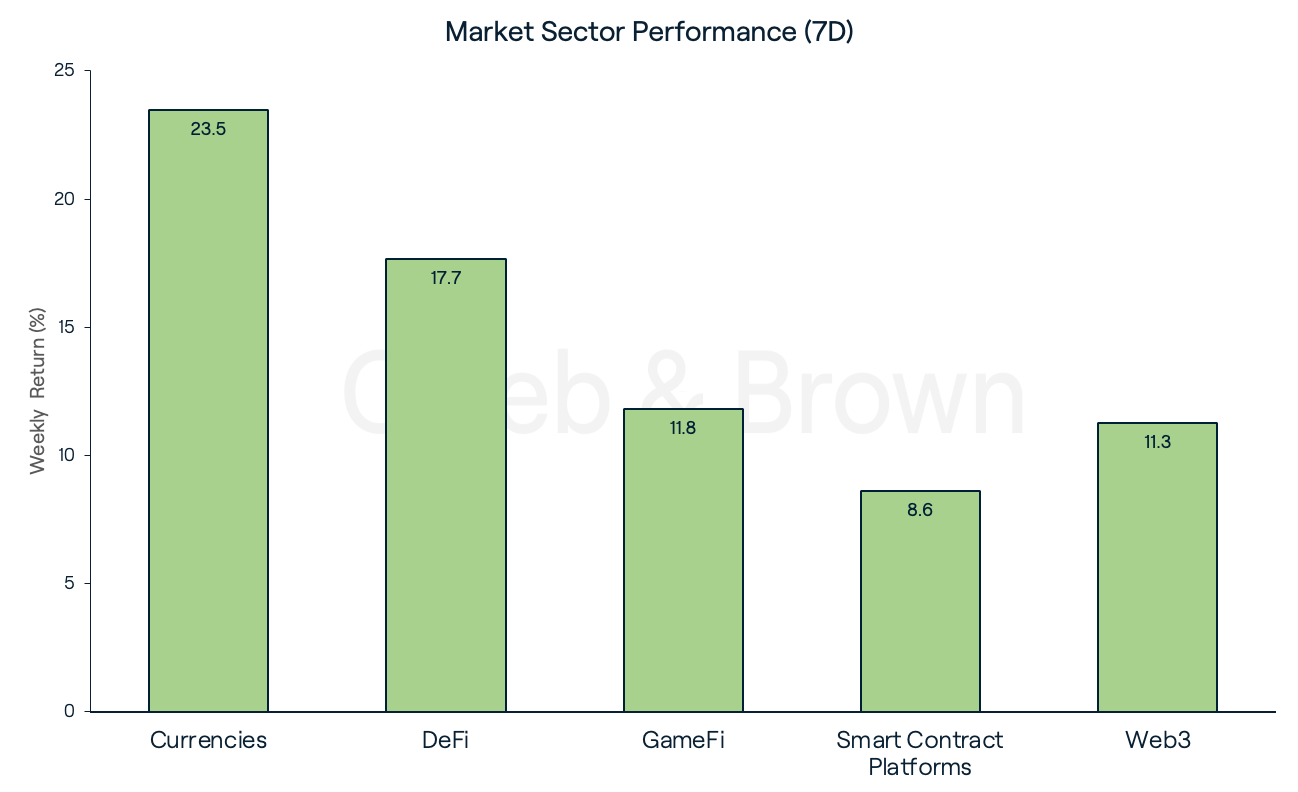

Altcoins

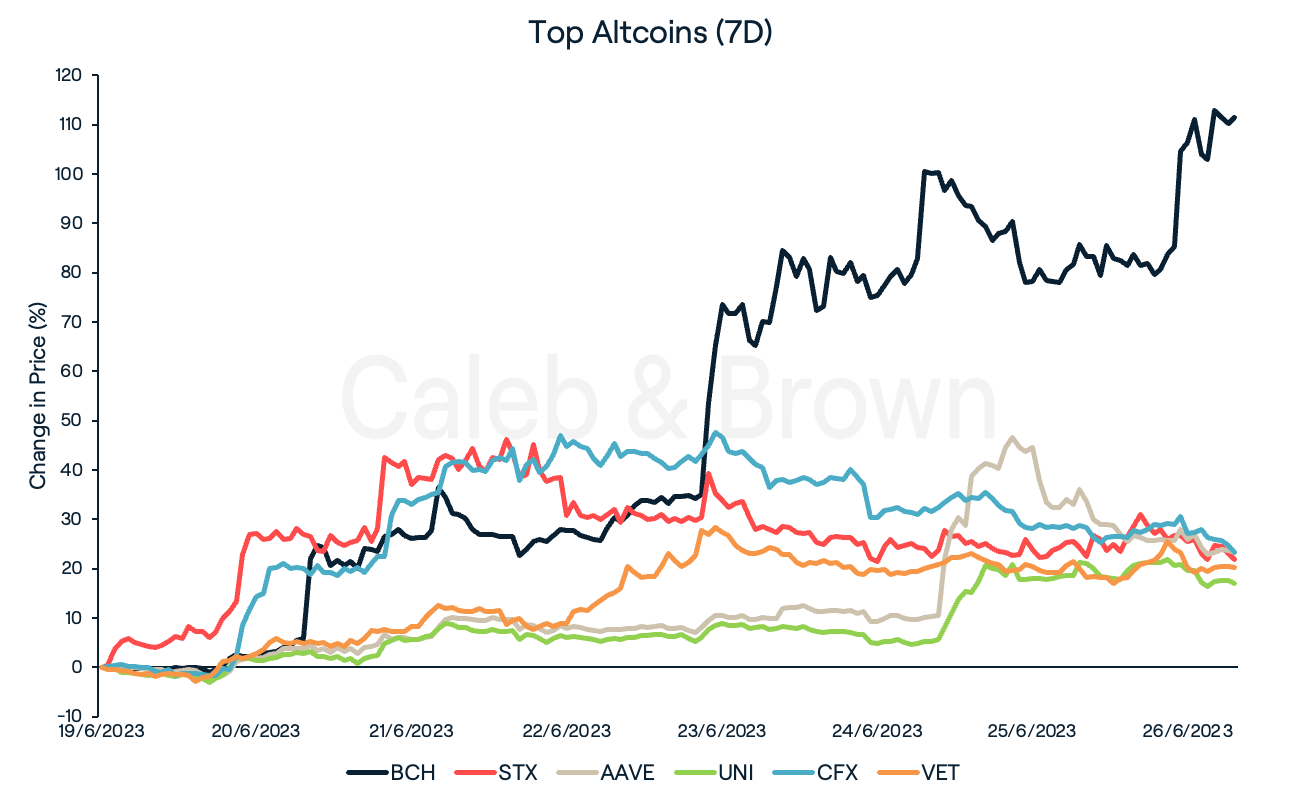

With BTC’s return to glory, Currencies led market sector performance this week, rising 23.5%. This was followed by DeFi and GameFi which added 17.7% and 11.8%, respectively. Smart Contract Platforms was the lagging sector this week, however still gained 8.6%.

Perhaps unsurprisingly, many top performers this week were BTC-related. Bitcoin Cash (BCH) and Stacks (STX) each gained 111.5% and 22.0% over the last seven days. BCH has been the biggest beneficiary of the recent launch of EDX Markets— a crypto exchange backed by firms such as Charles Schwab, and Citadel Securities— setting new volume highs for 2023.

DeFi protocols Aave (AAVE) and Uniswap (UNI) also secured double-digit gains this week, with each rallying 23.2% and 16.9%, respectively. AAVE is rising ahead of it’s stablecoin (GHO) mainnet launch with the Aave V3 Facilitator and FlashMinter Facilitator.

Finally, layer-1 protocols Conflux (CFX) and VeChain (VET) added 23.2% and 20.3%, respectively week-on-week. Coinbase recently announced VET and mutually dependent VeThor (VTHO) to its new listings.

Regulation News

While the focus remained on the SEC and prominent asset managers this week, a few other narratives emerged, signifying the ongoing global embrace of cryptocurrencies. Among these developments, the British House of Lords (the upper house of parliament,) successfully endorsed the Financial Services and Markets Bill on Monday. This legislation aims to regulate stablecoins, cryptocurrencies, and crypto promotion.

Having already secured approval from the House of Commons, the bill has now entered its concluding phase: the Consideration of Amendments. During this stage, both chambers engage in debates and refine the proposals until they reach a mutual consensus. Ultimately, the bill becomes law once it has been given Royal Assent and depending on the circumstances, will have practical effect on a certain date.

Meanwhile, on Friday the SEC approved the first leveraged Bitcoin futures exchange-traded fund (ETF); Volatility Shares 2x Bitcoin Strategy ETF (BITX). It is scheduled to launch on the Chicago Board Options (CBOE) BZX Exchange on Tuesday, June 27.

According to the SEC filing, BITX “seeks daily investment results that correspond to two times (2x) the return of the Chicago Mercantile Exchange (CME) Bitcoin Futures Daily Roll Index for a single day.”

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5crUHsV1g5ZDV1BzXWpiwx%2Fedbcbf3ac81d74c071c15bfc7d0a144b%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-06-27T03%3A21%3A15.232Z)