Market Highlights

- Major crypto assets were quiet this week, while altcoins and meme coins saw a wave of announcements and new developments.

- A wallet belonging to defunct crypto exchange, Mt. Gox, moved over US$9 billion worth of bitcoin to an unknown wallet.

- Celebrities joined meme coin mania this week, with Caitlyn Jenner the latest celebrity to be associated with a crypto launch through the creation of the JENNER pump.fun token.

- President Joe Biden has vetoed the bill overturning SAB121. He stated that it’s “necessary” for crypto innovation despite the controversy the bill has drawn in recent years and bipartisan support from the House of Representatives and Senate in overturning it.

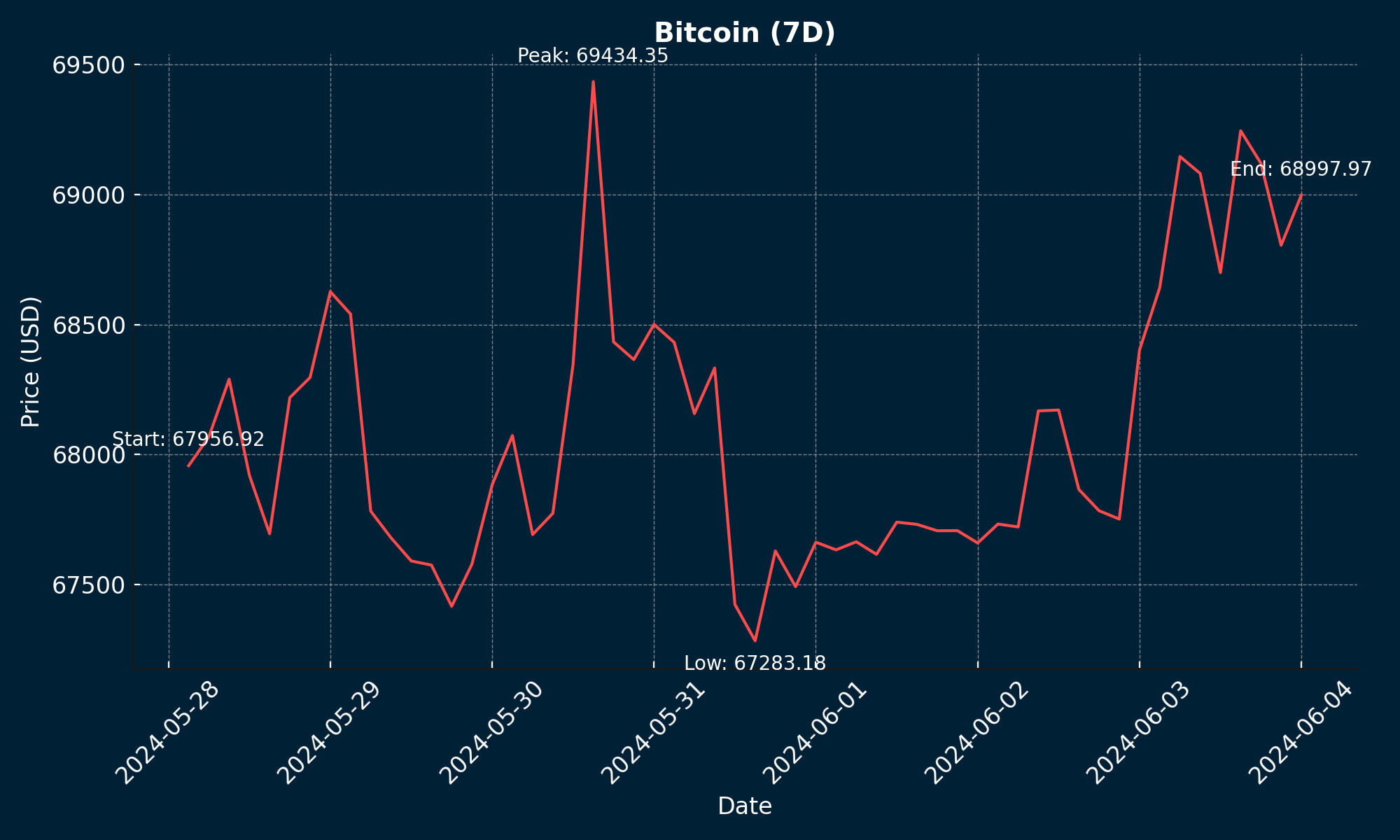

Bitcoin (BTC)

It was a quieter week in crypto amongst the major crypto assets like bitcoin and Ethereum. Price has remained relatively stagnant while many altcoins and meme coins made headlines, driving big gains.

Bitcoin broke the key level of US$70,000 to start the week before retracing back to US$67,635. The dip is presumably due to a worse-than-forecast Personal Consumption Expenditure (PCE) Index release for May and the news that a wallet belonging to defunct crypto exchange, Mt. Gox, moved over US$9 billion worth of bitcoin to an unknown wallet earlier in the week. The news prompted speculation that creditors are going to be repaid. From 2010 to 2014, Mt Gox handled over 70% of all bitcoin trading before suddenly ceasing operations and filing for bankruptcy protection from creditors.

There weren’t any big surprises with data out of the US this week. Consumer confidence was slightly higher than the forecast 96, at 102, while preliminary quarter-on-quarter gross domestic product (GDP) growth came in at 1.3%, just 0.1% higher than expected. Unemployment claims remained steady at 219,000. May’s PCE Price Index came in at 0.2%. The PCE Index excludes food and energy prices, making it the preferred inflation measure for the Federal Reserve. The relative stability in May’s PCE Price Index indicates that The Fed could continue with its stance on keeping interest rates on hold in June and July.

Bitcoin is currently trading at US$68,984, a decrease of 0.9% on the week.

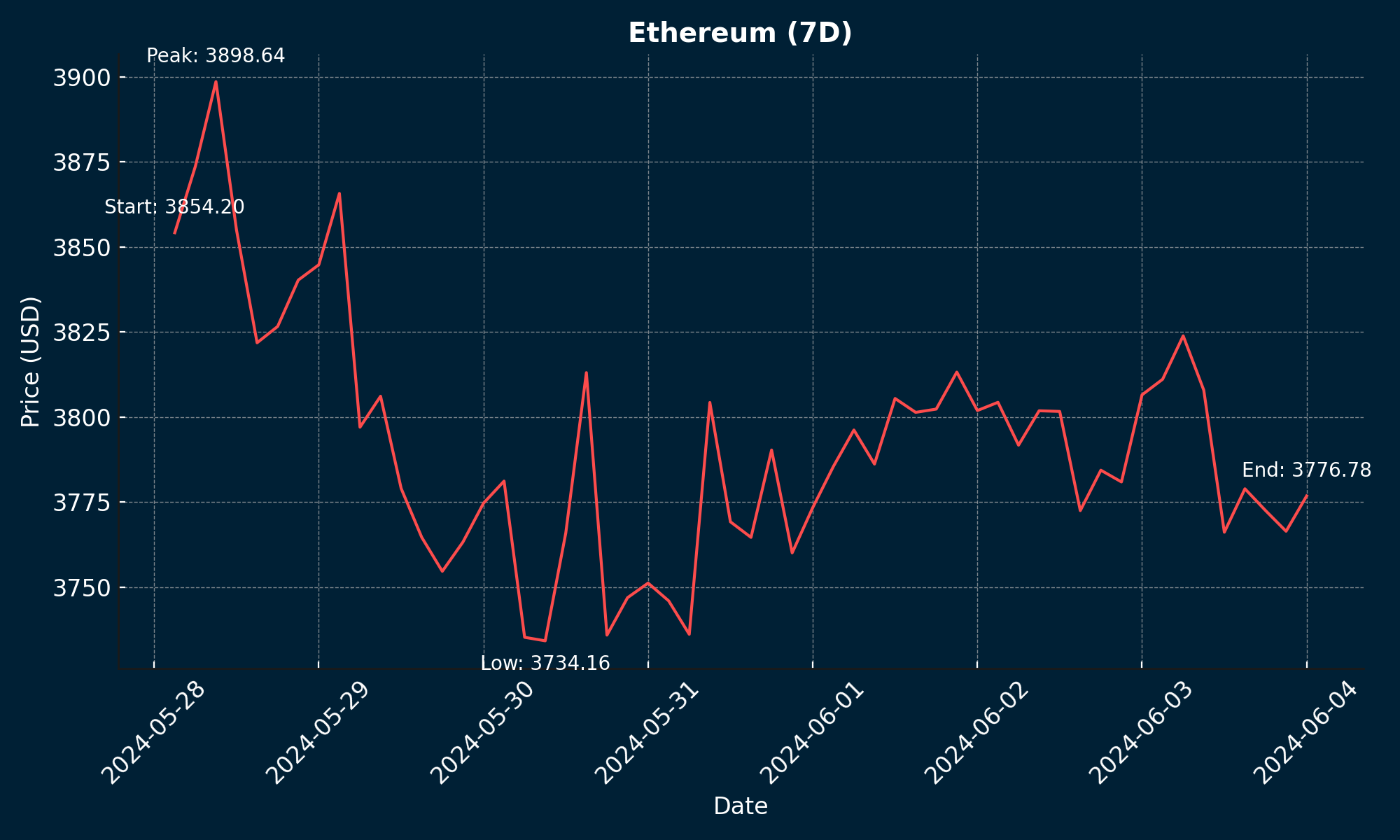

Ethereum (ETH)

Ethereum was flat this week, hovering between US$3,975 and US$3,700. Currently trading at US$3,775, Ethereum lost 2.9% for the week.

Compared to the historic news of the US Security and Exchange Commission’s (SEC) approval of spot Ethereum ETFs, there was little action in the second-biggest cryptocurrency this week. While the financial products have been approved by the SEC, financial institutions are waiting for approval on their registration statements.

One fund has cancelled its plans to offer a spot Ethereum ETF. Amended filings on Friday show that Cathie Wood’s Ark Investment was removed from a partnership originally filed with 21Shares. Wood’s fund will continue its partnership with 21Shares for its Bitcoin spot ETF.

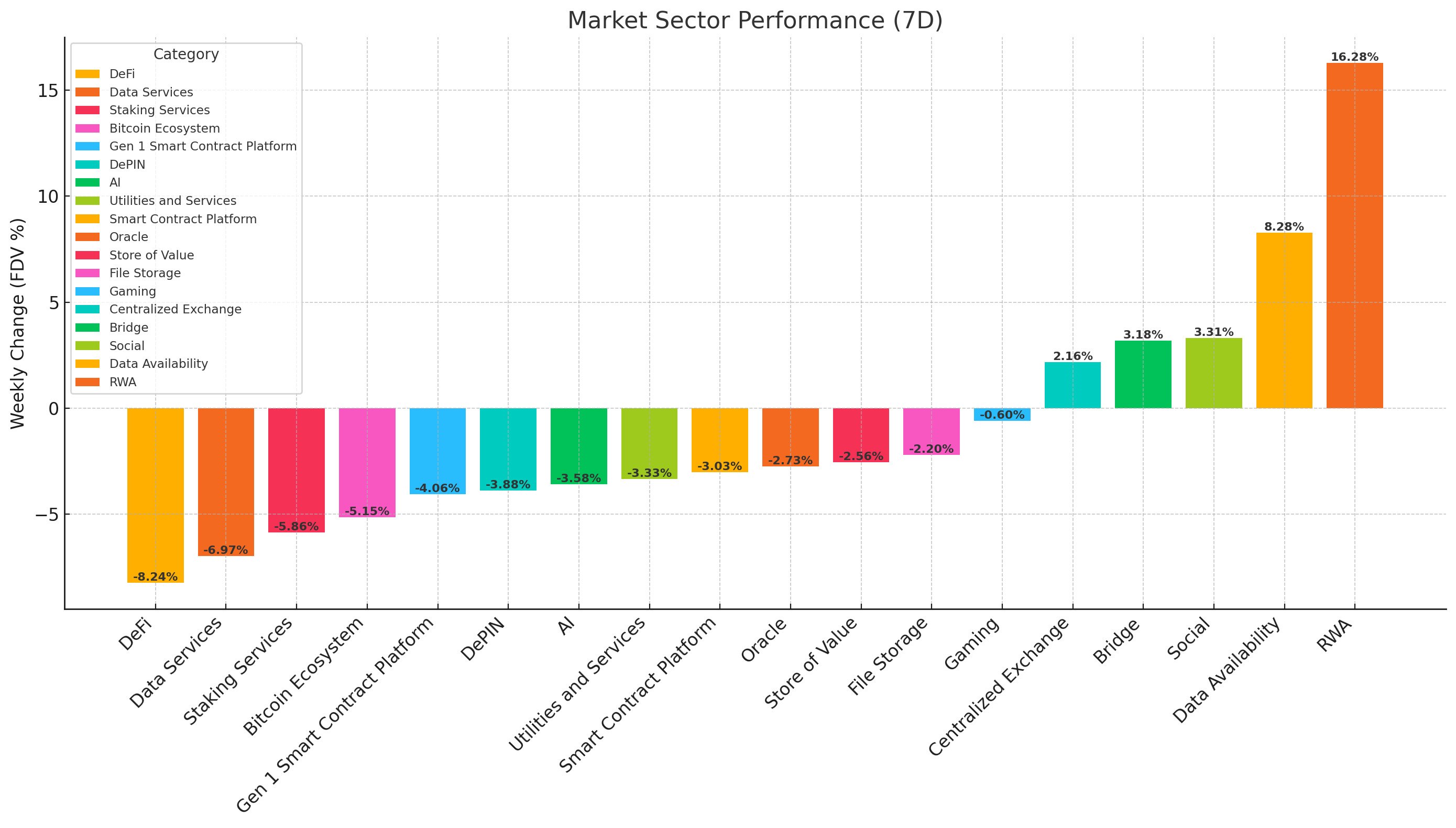

Altcoins

Real World Assets (RWA) dominated altcoin growth this week, gaining 16.3%. This was followed by Data Availability, which rallied 8.3%. Social and Bridging followed, with gains of 3.3% and 3.2%, respectively.

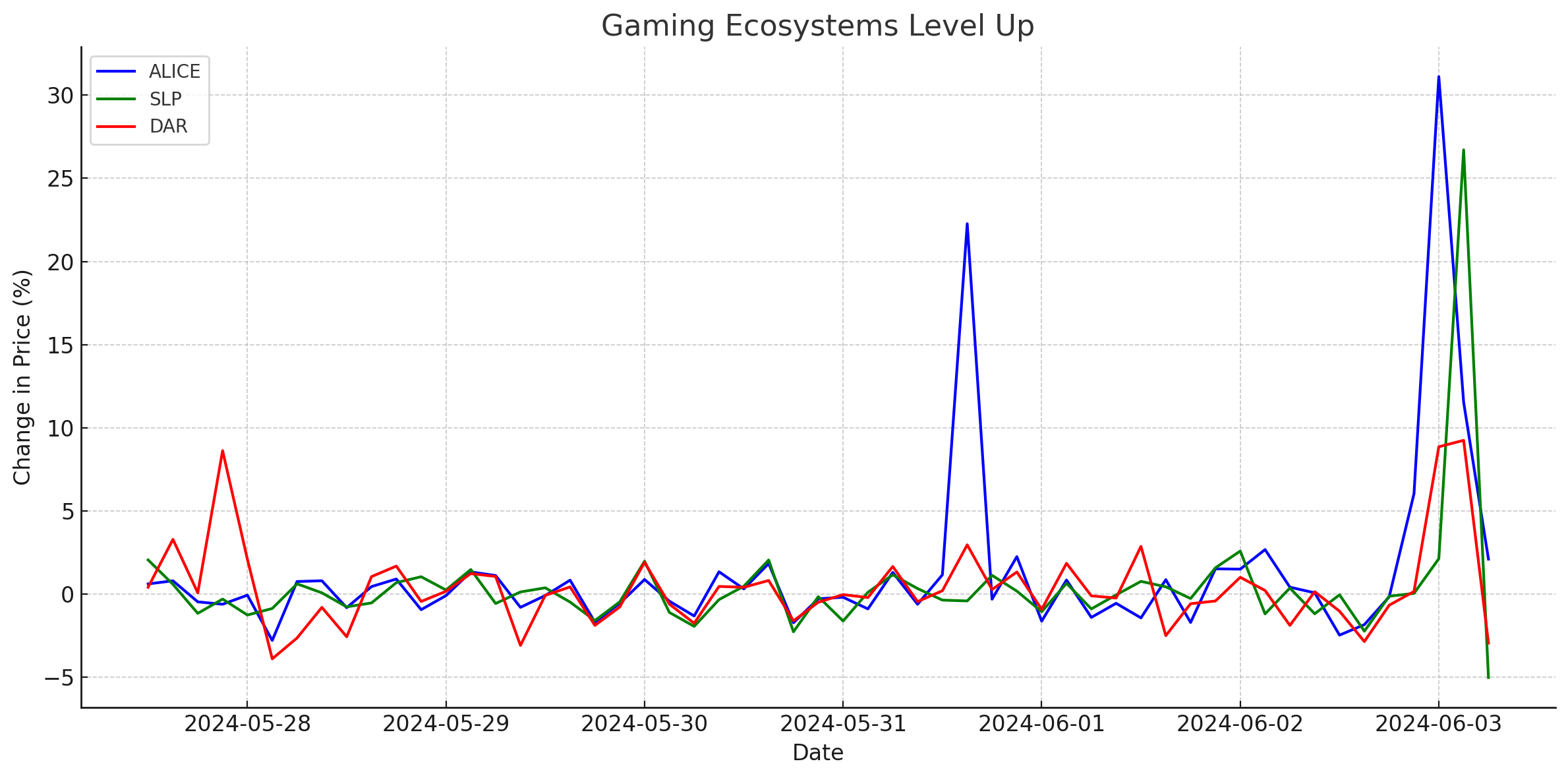

Gaming Ecosystems Level Up

- My Neighbor Alice (ALICE) gained 87.9% this week, reaching a market cap of US$223.7 million. The ALICE token is a utility token within the My Neighbour Alice gaming ecosystem, allowing users to complete in-game functions and governance tasks. Price spiked at the end of the week as the network announced the winners of a contest where users created places in the Metaverse. One of the ten winners created a digital version of Versailles.

- Smooth Love Potion (SLP) grew by 31.8%. This takes its market cap to US$213.2 million. The token, which users earn by playing Axie Infinity, is an ERC-20 token. The Axie Infinity gaming universe is about breeding fictional, token-based characters known as Axies. The growth shows continued user interest in virtual gaming worlds where tokens can be earned. The Smooth Love Potion team just announced its upcoming town hall, saying many updates have been shipped, while the first Axie Classic Guild Wars (a gaming contest) is coming later in June.

- Mines of Dalarnia (DAR) grew by 25.6%. Its market cap now sits at US$118.8 million. The platform-mining blockchain game allows for single and multiplayer games. Price rallied when it was announced that the ability to deploy “modbots" had returned. The bots help players conquer new levels of the game. The price action coincides with increased interest and growth across gaming ecosystems this week.

DeFi Gains

- Stargate Finance (STG) saw gains of 33%, taking its market cap to US$137.6 million. The decentralised finance (De-Fi) project allows users and decentralised apps to transfer assets cross-chain. Users also get access to liquidity pools with guaranteed finality, ensuring security and preventing double-spending. Price presumably grew due to the network��’s announcement that Stargate Version 2 is live, offering some of the cheapest bridging in DeFi.

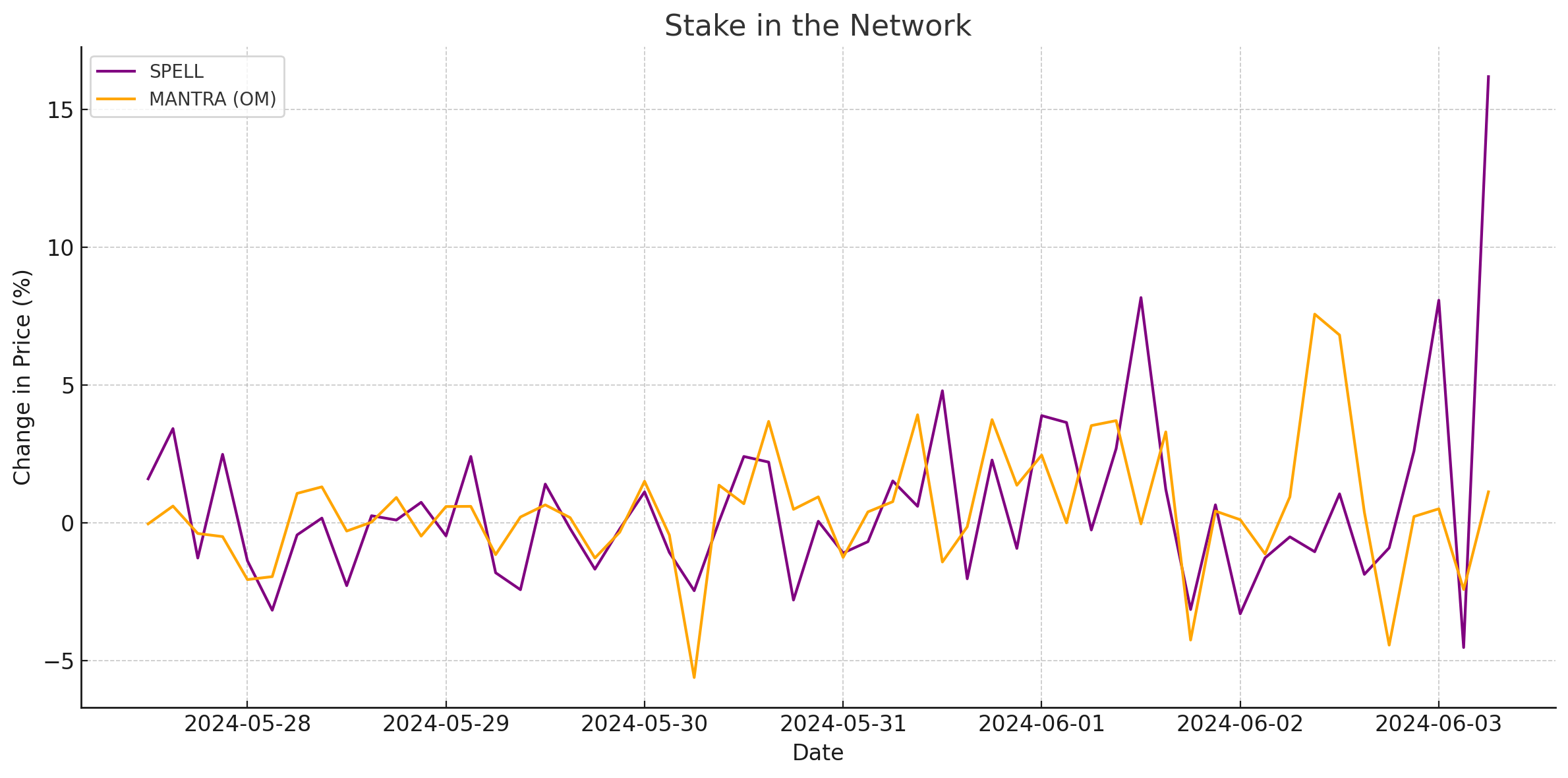

Stake in the Ground Network

- Spell (SPELL) saw gains of 22.8%, taking its market cap to US$161.8 million. An Ethereum token that governs Abracradabra money, Spell allows users to deposit collateral to mint MIM, a stablecoin aimed at maintaining a value of US$1. SPELL can be staked, allowing users access to governance rights and other rewards. Price presumably grew due to continued investor interest in staking and rewards, plus it was announced that Spell’s request for proposal is live on Layer Zero Labs. The proposal aims to retroactively reward mSPELL stakers, $MIM beamers and $MIM holders who put their tokens in the liquidity pool.

- Mantra (OM) gained 31.8% this week, taking its market cap to US$714.7 million. The Security First RWA Layer 1 Blockchain allows real-world assets to be fractionalised and tokenised while adhering to real-world regulatory requirements. The gains started in the second half of the week when it was announced that 200 million $OM are staked on Mantra, which equates to 25% of the circulating supply.

In Other News

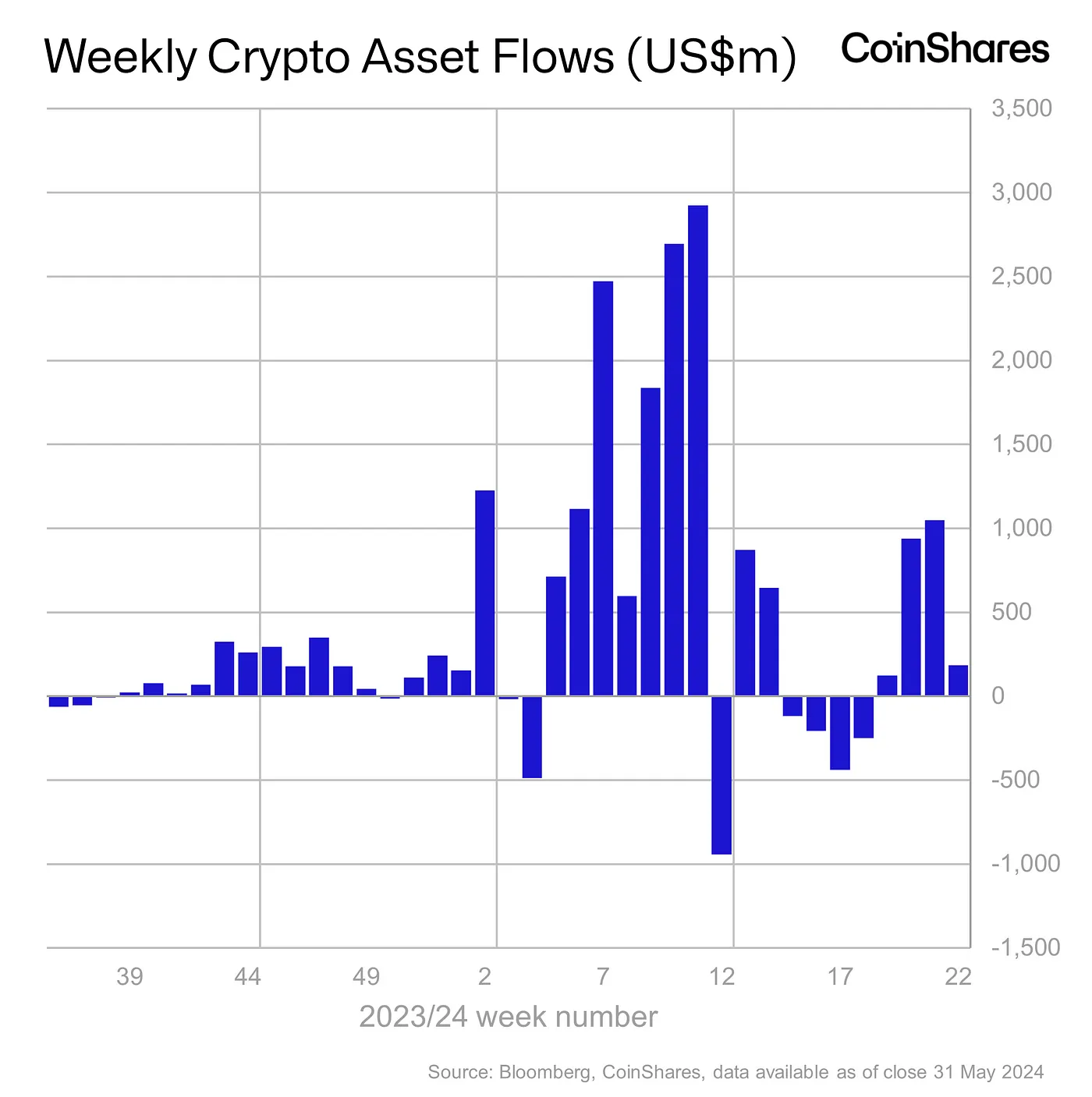

May finished with US$2 billion of inflows, taking inflows for the year to date to over US$15 billion. Digital asset investment products had the fourth consecutive week of inflows. Bitcoin investment products saw inflows of US$148 million and short-bitcoin products had outflows of US$3.5 million.

Ethereum investment products had inflows of US$33.5 million, marking the second consecutive week of inflows. The expected launch date for spot-based Ethereum ETFs is July 2024.

- Altcoins and meme coins saw endless developments this week. Sahil Arora, a promoter who launches crypto projects with celebrities, created and launched a pump.fun meme token with Caitlyn Jenner on the Solana network. In a Twitter post, Jenner said, “Make America great again!!! And we love crypto!” to caption a photo of Jenner shaking hands with Donald Trump. A top goal for Pump.fun tokens is making it onto the decentralised exchange Raydium. The JENNER token quickly made it to the exchange, where it’s up almost 25,000% since its creation. Social media users are dubious over whether the project is legitimate, given the string of celebrities and public figures who have had their accounts compromised to promote fraudulent crypto projects.

- Former FTX executive Ryan Salame has been sentenced to 7.5 years in prison. A co-conspirator of Sam Bankman-Fried, the prosecutors argued that Salame took over US$5 million of crypto from FTX as customer outflows sped up in late 2022. After he’s served his sentence, Salame may still have a luxury vehicle to drive. His 2021 Porsche 911 Turbo S does “not have sufficient equity to further pursue forfeiture,” according to government submissions. The car was purchased in October 2021, the same month FTX secured over US$420 million in a Series B-1 fundraise.

- Bitcoin exchange-traded products (ETPs) have debuted on the London Stock Exchange. Following approval from the UK’s Financial Conduct Authority (FCA), asset management firms WisdomTree and 21Shares listed Bitcoin ETPs. 21Shares Bitcoin ETN (ABTC) and 21Shares Core ETN (CBTC) were listed, while WisdomTree listed a Physical Bitcoin ETN (BTCW). The products are currently available to professional investors as the FCA’s ban on retail access to bitcoin ETNs continues.

Regulatory

- President Joe Biden has vetoed the bill overturning SAB121, stating that it’s “necessary” for crypto innovation. In the last year, the bill has been controversial due to its use in making sweeping policy changes, including the way banks can custody cryptocurrency. With SAB121 in place, banks are required to hold the assets as a liability on their balance sheets. Standard Accounting Bills are typically used to communicate administrative updates and changes. Explaining his decision further, President Biden said that "limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty."

New Asset Listings

Buy and sell these crypto assets, or swap them directly with hundreds of other popular crypto assets through your personal crypto broker. To see our full list of available crypto assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.