Market Highlights

- Bitcoin (BTC) continued to reach new heights as it topped US$73,000.

- Ethereum’s (ETH) Dencun upgrade successfully launched on Wednesday.

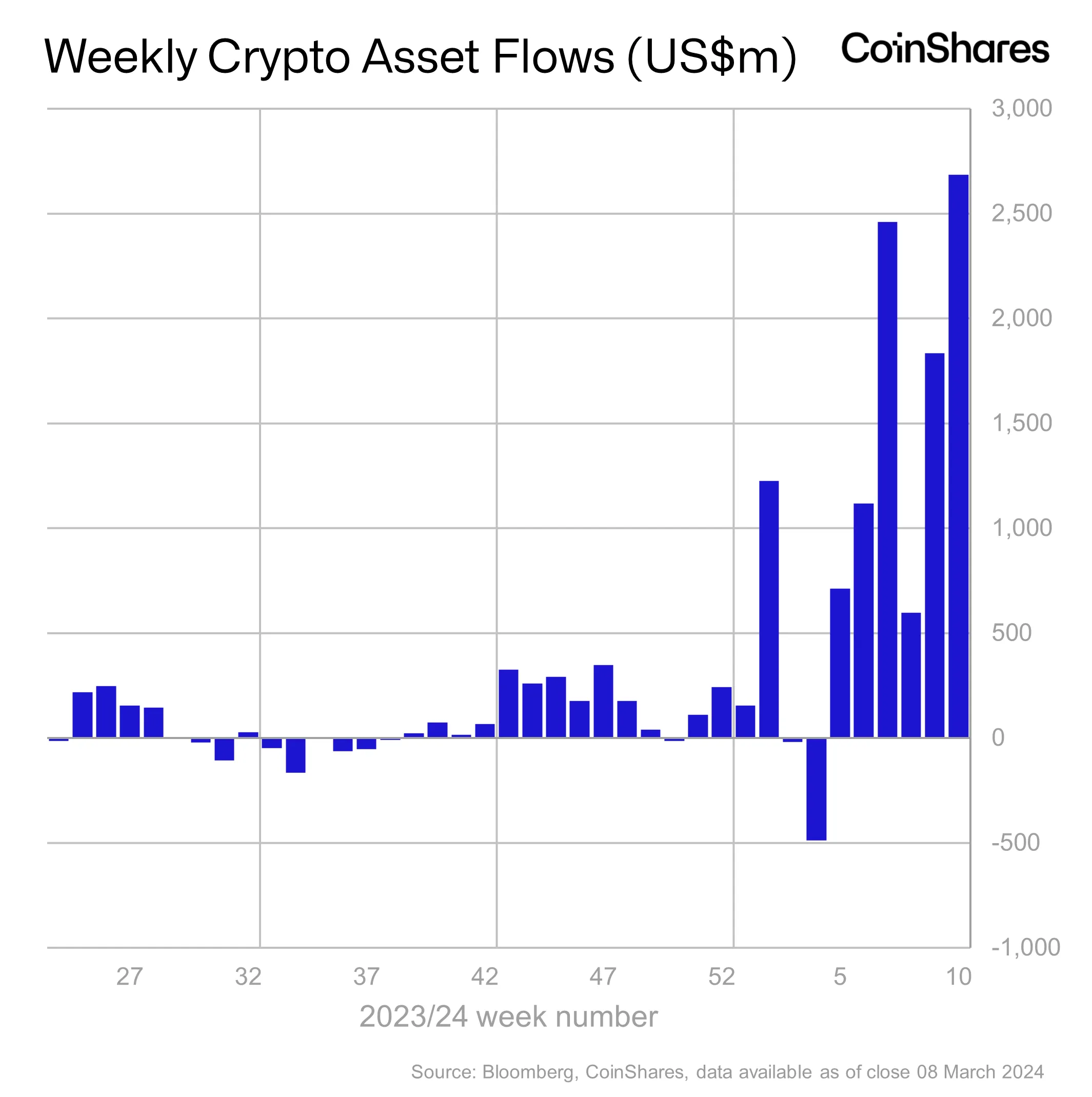

- Digital asset investment products saw record weekly inflows amounting to US$2.7 billion.

Bitcoin

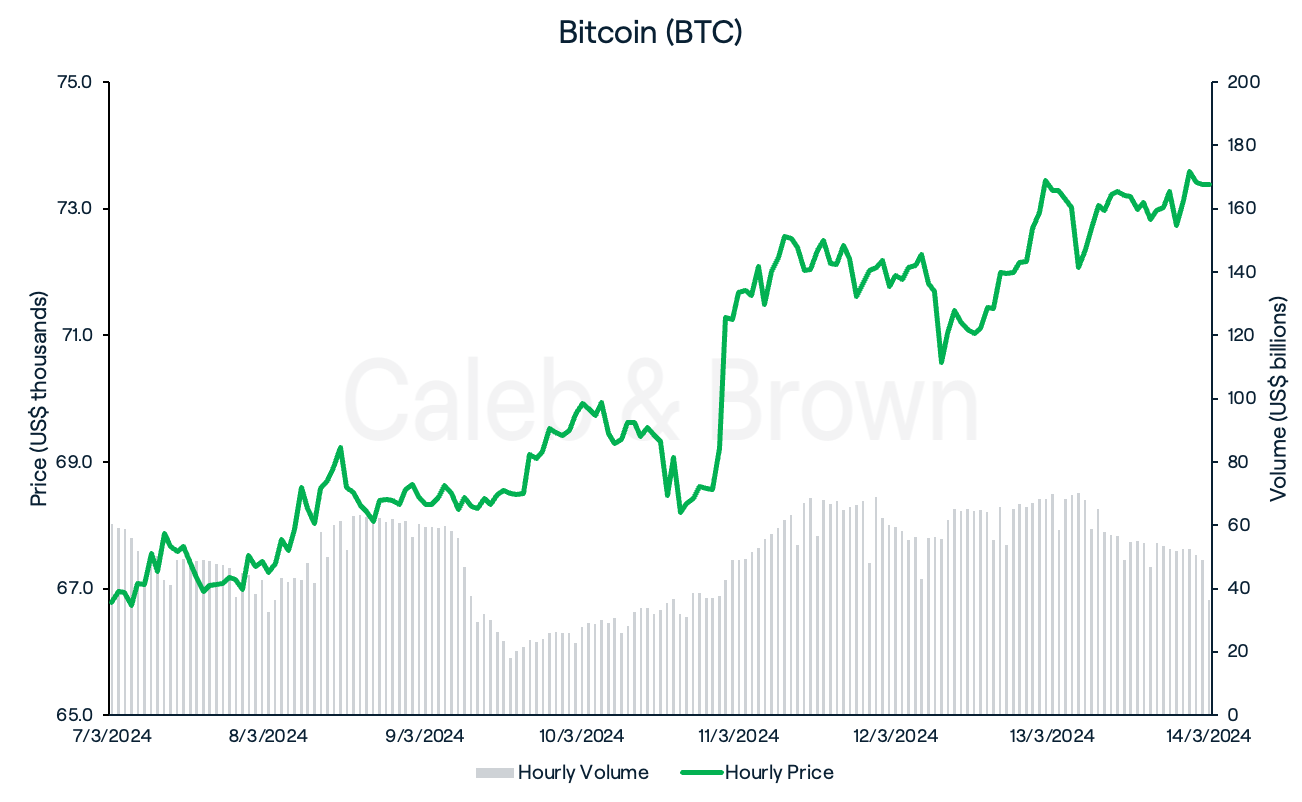

Though it saw many starts and stops, this week continued the crypto market’s phenomenal upwards trajectory, as the total crypto market cap closed in on US$ 3 trillion. Bitcoin (BTC) crossed US$70,000 for the first time ever, overtaking silver’s market cap in the process.

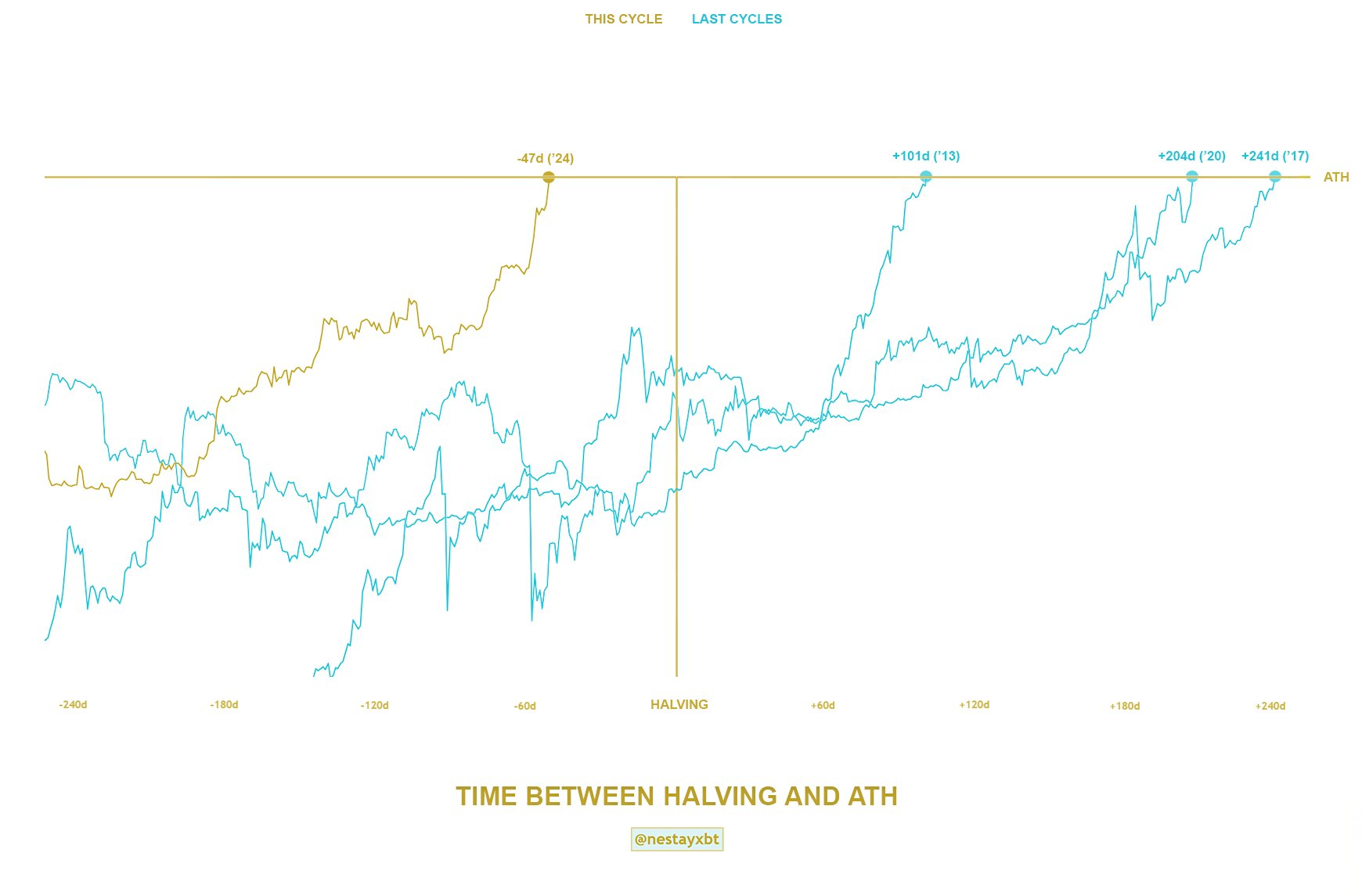

The bullish rally is likely propelled by the fast approaching Bitcoin halving which is now estimated to occur on April 15. Additionally, demand for ETFs has proven relentless since hitting the market on January 11, gathering over US$11.1 billion in net inflows in just two months. Not only has their performance shattered experts’ expectations, but they’ve also helped drive Bitcoin (BTC) to a new all-time high well before its periodic halving, which typically predates record highs.

This has launched BTC into price-discovery mode, causing investors, old and anew, to maintain a sharp eye on crypto, as they eagerly await the next move.

Overall, BTC closed the week at US$73,376, up 9.9% over the last seven days.

Ethereum

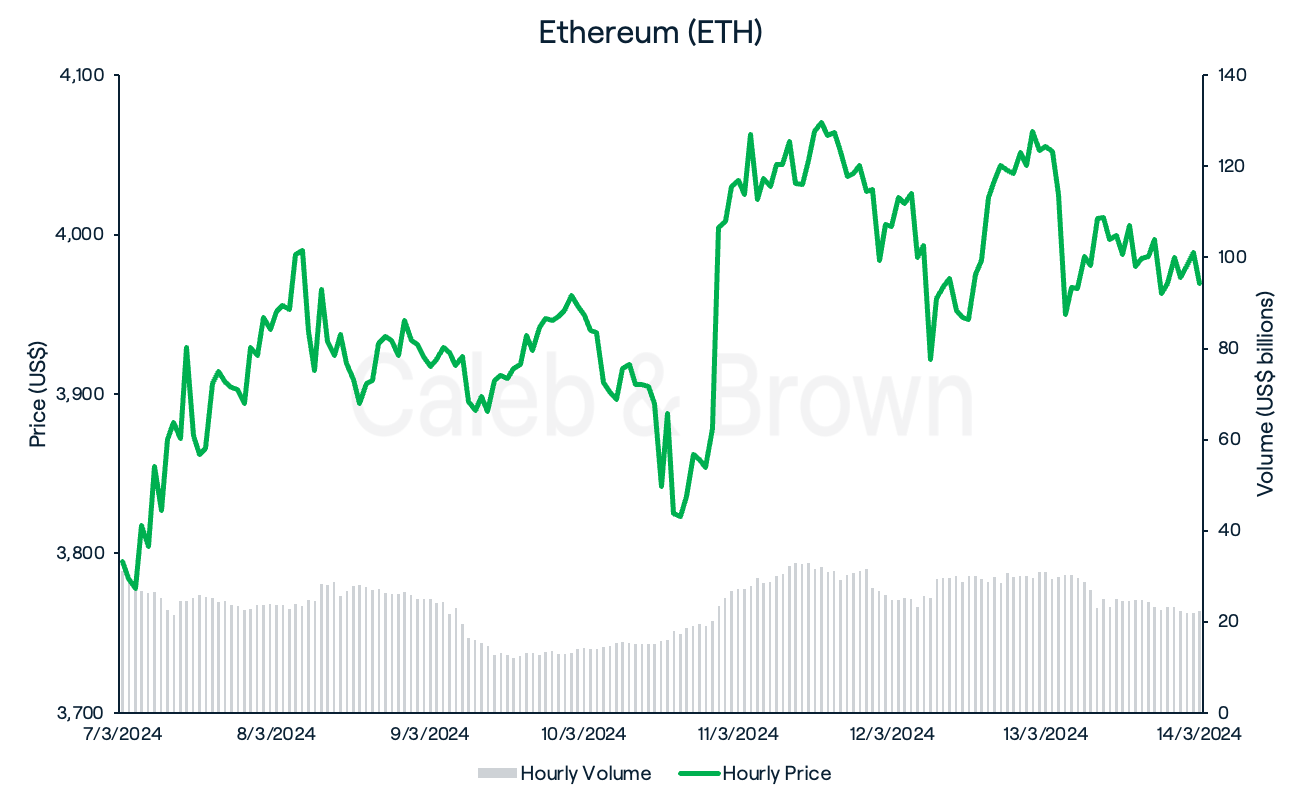

Ethereum (ETH) did not shy away this week as it crossed US$4,000 for the first time since 2021, sharing the spotlight with BTC. Its rally was spurred on by the successful launch of its long-awaited Dencun upgrade on Wednesday morning, ushering in a new era for Ethereum and layer-2 settlements. Accounting for a 1-2 month period for these protocols to incorporate the new upgrade, gas fees on layer-2 networks are expected to fall by 75%.

This saw ETH close the week at US$3,969, up 4.6%.

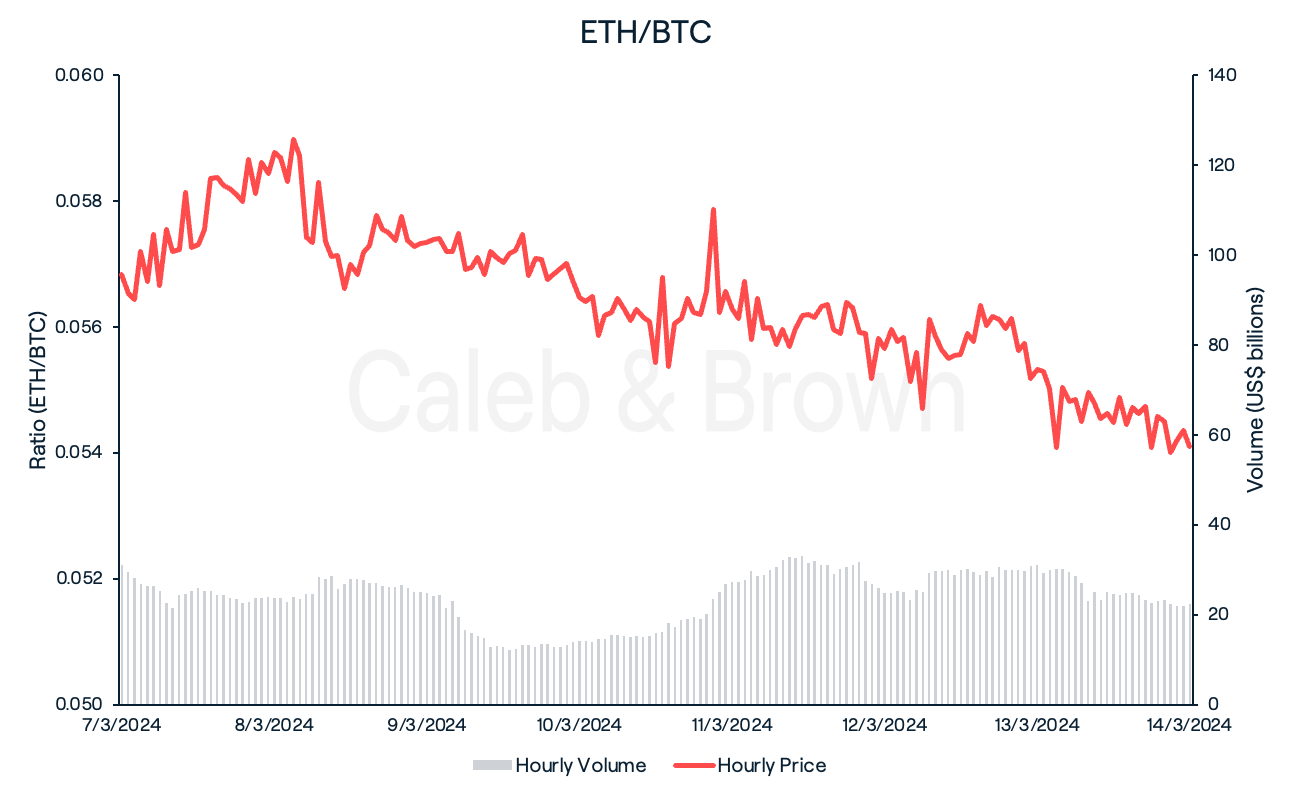

Furthermore, the ETH/BTC ratio fell slightly over the last seven days, losing 4.8% relative market share against the market leader.

Altcoins

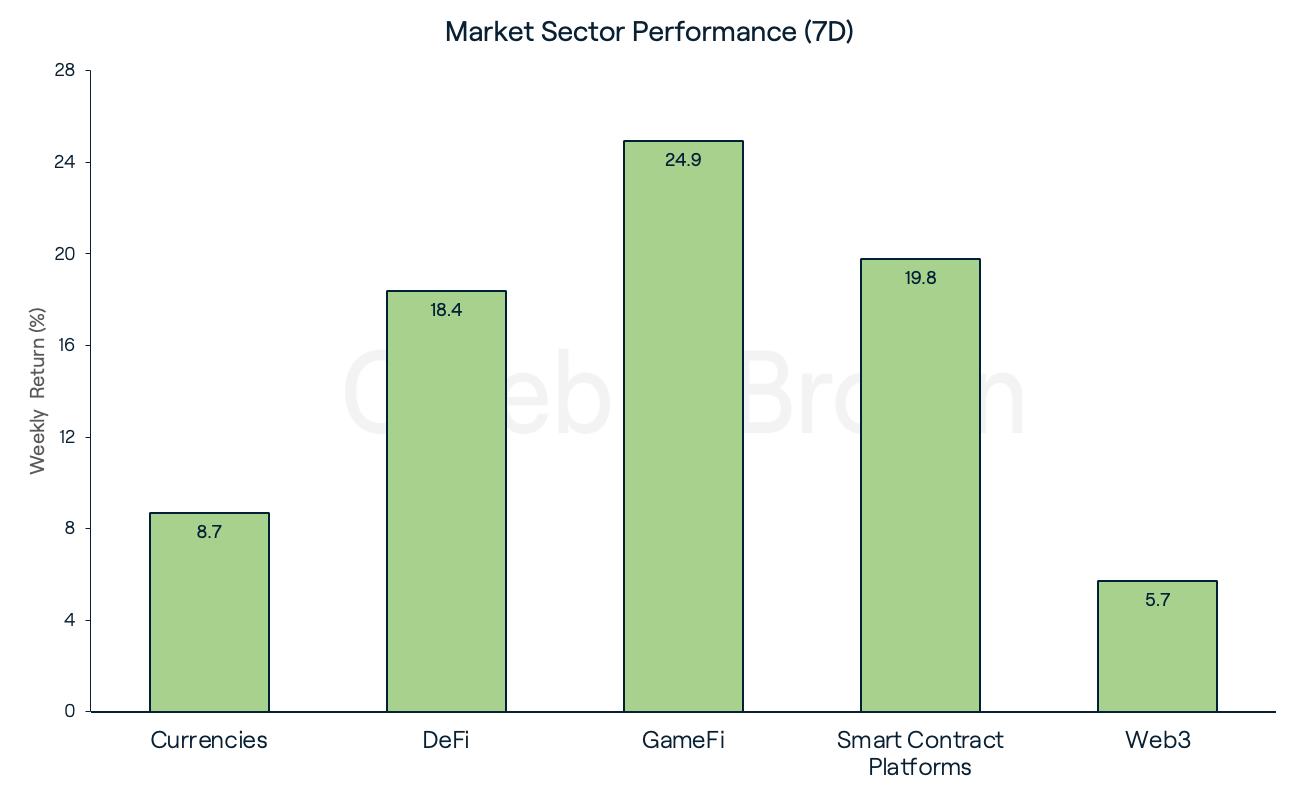

To no surprise, all market sectors enjoyed positive performance this week with GameFi leading the pack after surging 24.9%. Smart Contract Platforms and DeFi followed closely with each gaining 19.8% and 18.4%, respectively.

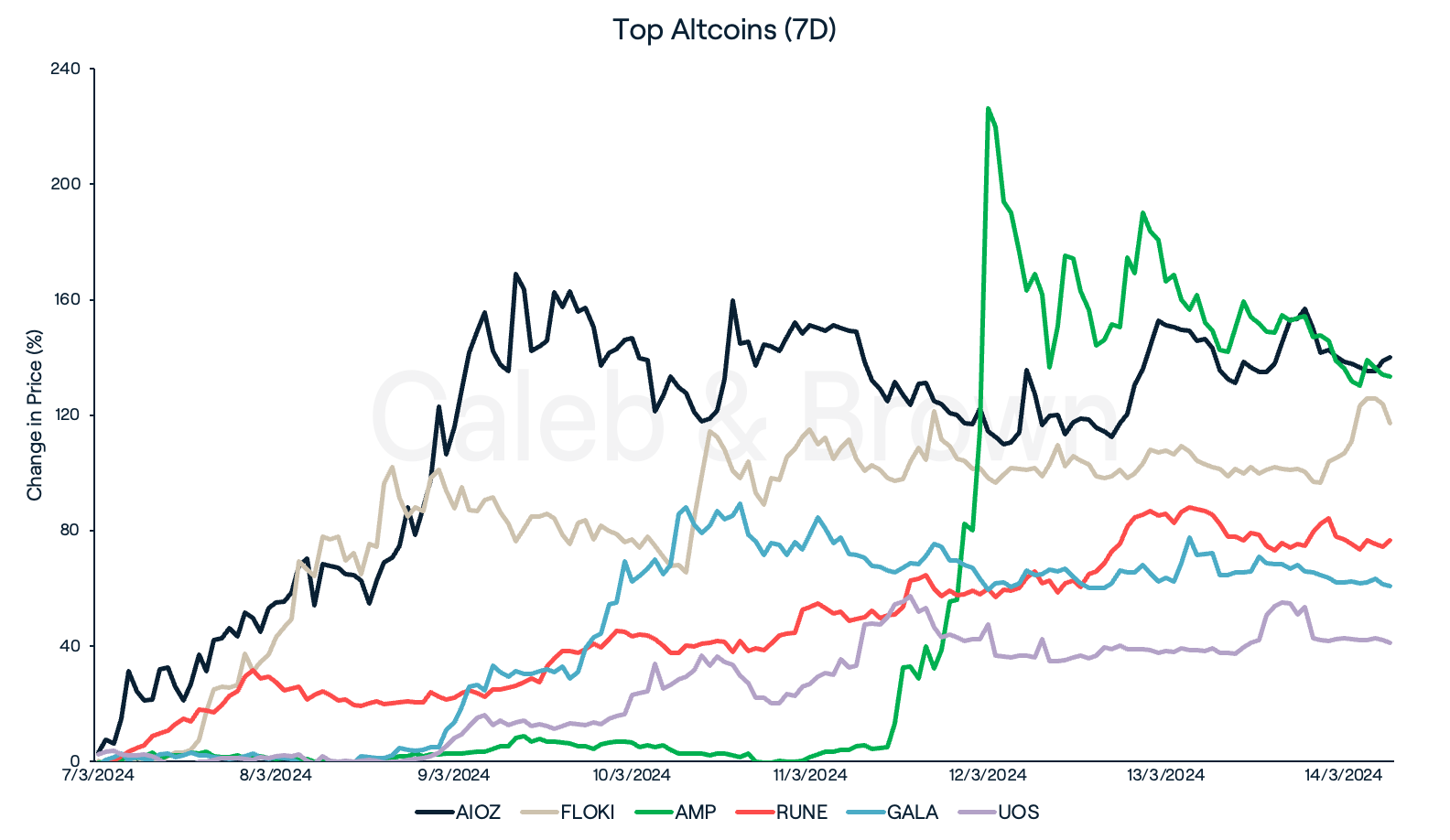

Top altcoin performers were once again led by AI protocol, AIOZ Network (AIOZ) and memecoin FLOKI (FLOKI), which added 140.0% and 11.7.3%, respectively. AIOZ recently unveiled its new file sharing product, AIOZ dTransfer, while FLOKI was the biggest benefactor this week from the current memecoin frenzy.

DeFi protocols, Amp (AMP) and THORChain (RUNE) also gained a considerable 133.4% and 76.7%, respectively while gaming/metaverse projects GALA (GALA) and Ultra (UOS) surged 60/7% and 41.0%, respectively. RUNE’s price rise correlated with its 60 million token burn which aimed to raise the cap for its Lending Protocol, while GALA games recently announced its own native DEX, GalaSwap.

In Other News

- Digital asset investment products experienced unprecedented weekly inflows amounting to US$2.7 billion, elevating the total inflow year-to-date to US$10.3 billion, and nearly matching the US$10.6 billion of inflows recorded for the entire year of 2021.

- On Monday, a CryptoPunk was sold for an astonishing 4,500 ETH (worth approx. US$ 16 million), marking the second-highest price ever achieved by an item in the esteemed Ethereum NFT collection. Crypto enthusiasts celebrated this event as an indication that the NFT market, which has faced challenges for an extended period, might now be on track to benefit from the bullish market momentum currently driving many cryptocurrencies to new heights.

Regulatory

Last week, representatives from the Securities and Exchange Commission held discussions with legal representatives from Grayscale and Coinbase regarding Grayscale's proposed Ethereum ETF. Coinbase's analysis uncovered a correlation between Ethereum (ETH) futures and spot markets, which is comparable in strength to Bitcoin's correlation. Additionally, Coinbase highlighted ETH’s mechanisms that effectively mitigate ETH's vulnerability to fraud and manipulation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.