Market Highlights

- The Federal Reserve increased interest rates by 25 basis points on Wednesday, sending Bitcoin (BTC) down 6.8% in the hours that followed, before a modest rally.

- Arbitrum (ARB) successfully launched its token airdrop, securing a top 40 spot by market capitalisation.

- Disgraced Terraform Labs founder Do Kwon arrested.

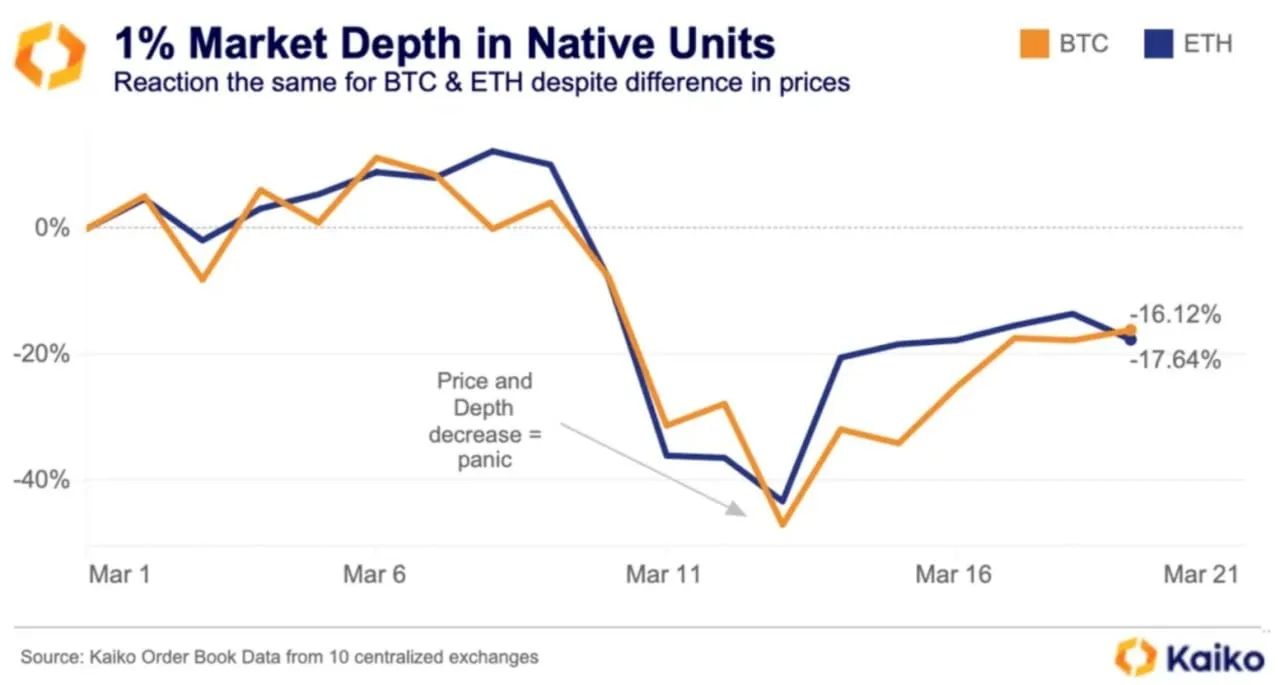

- BTC and Ethereum (ETH) 1% market depth fell to 10-month low after the recent wave of banking crashes, sparking discussion of low-liquidity risks.

- XRP has been the big gainer on the week with Ripple's native token up 25.9% on the back of comments from Ripple’s president.

- XRP has been the big gainer on the week with Ripple's native token up 25% on the back of comments from Ripple’s president.

Price Movements

Bitcoin

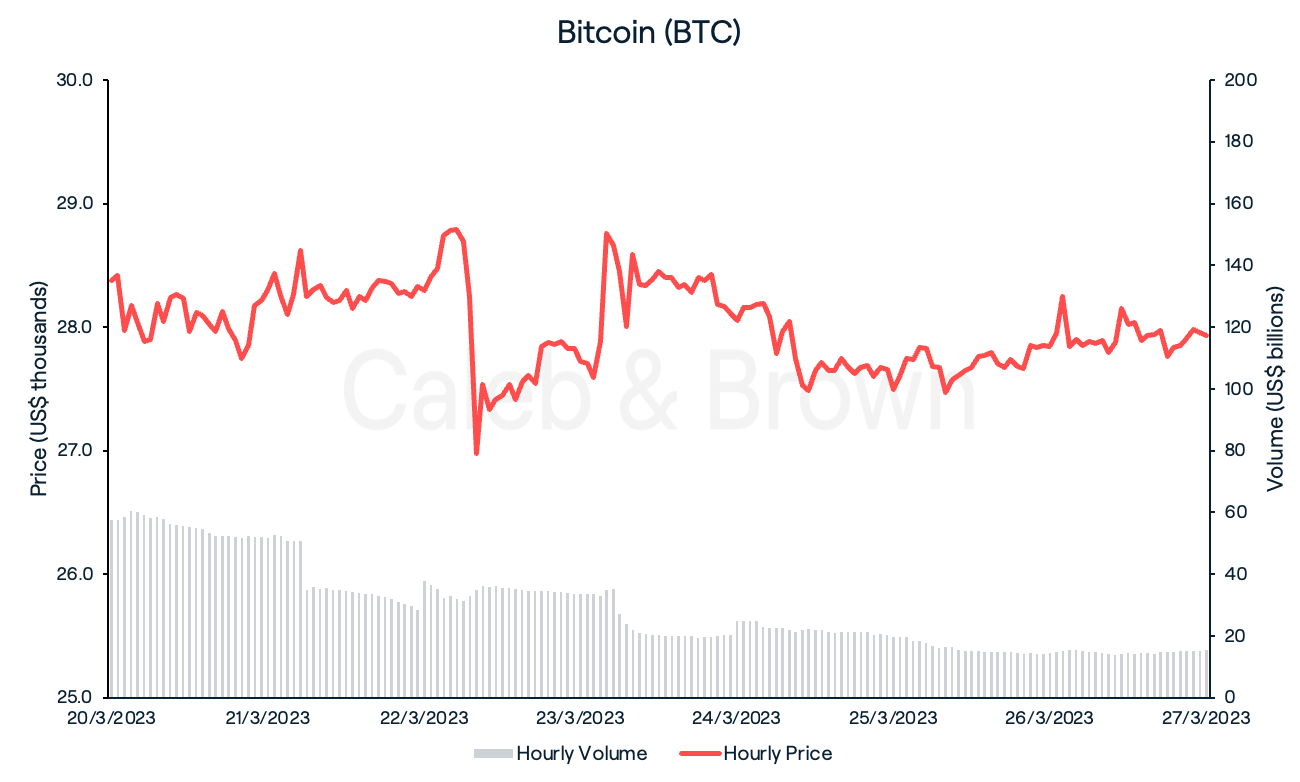

After an eventful week of banking crashes and digital asset surges, the crypto space has cooled off for a relatively flat week of trading. However, the market did see volatility on Wednesday after the U.S. Federal Reserve announced its decision to increase interest rates by 25 basis points (or 0.25%,) as part of its continued efforts to combat inflation. This move was made despite the occurrence of two of the biggest bank collapses in the United States within the last two weeks.

As a result, Bitcoin (BTC) fell 6.8% to a low of US$26,601 before recovering in price the following day. BTC closed the week at US$27,930, down 1.1% over the last seven days.

While the recent series of bank crashes and bailouts has reignited Bitcoin for its original purpose, an alternative payment system, the closure of Silvergate’s SEN and Signature’s Signet network in early March has exposed the crypto market to low liquidity risks. According to Kaiko research, the 1% market depth for Bitcoin and Ethereum is down 16.1% and 17.6%, respectively, just from the beginning of March, marking a 10-month low. Low liquidity generally leads to market inefficiencies such as larger spreads, slippage, and increased volatility.

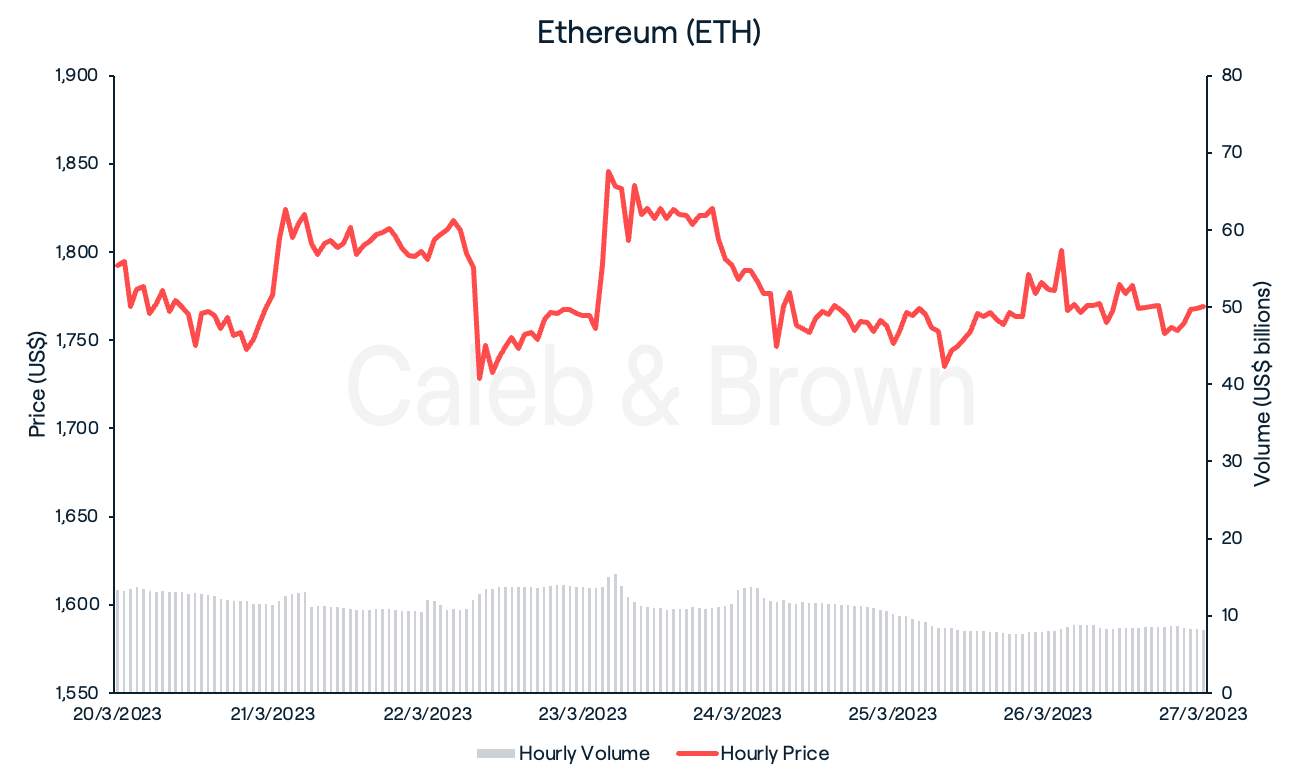

Ethereum

Ethereum (ETH) saw similar price action to BTC week, see-sawing between US$1,700 and US$1,850 for majority of the week. ETH dipped a smaller 5.8% following the Fed’s interest rate increase announcement on Wednesday however was unable to hold its recovery over the weekend and closed at US$1,769, down a slight 0.2%.

Altcoins

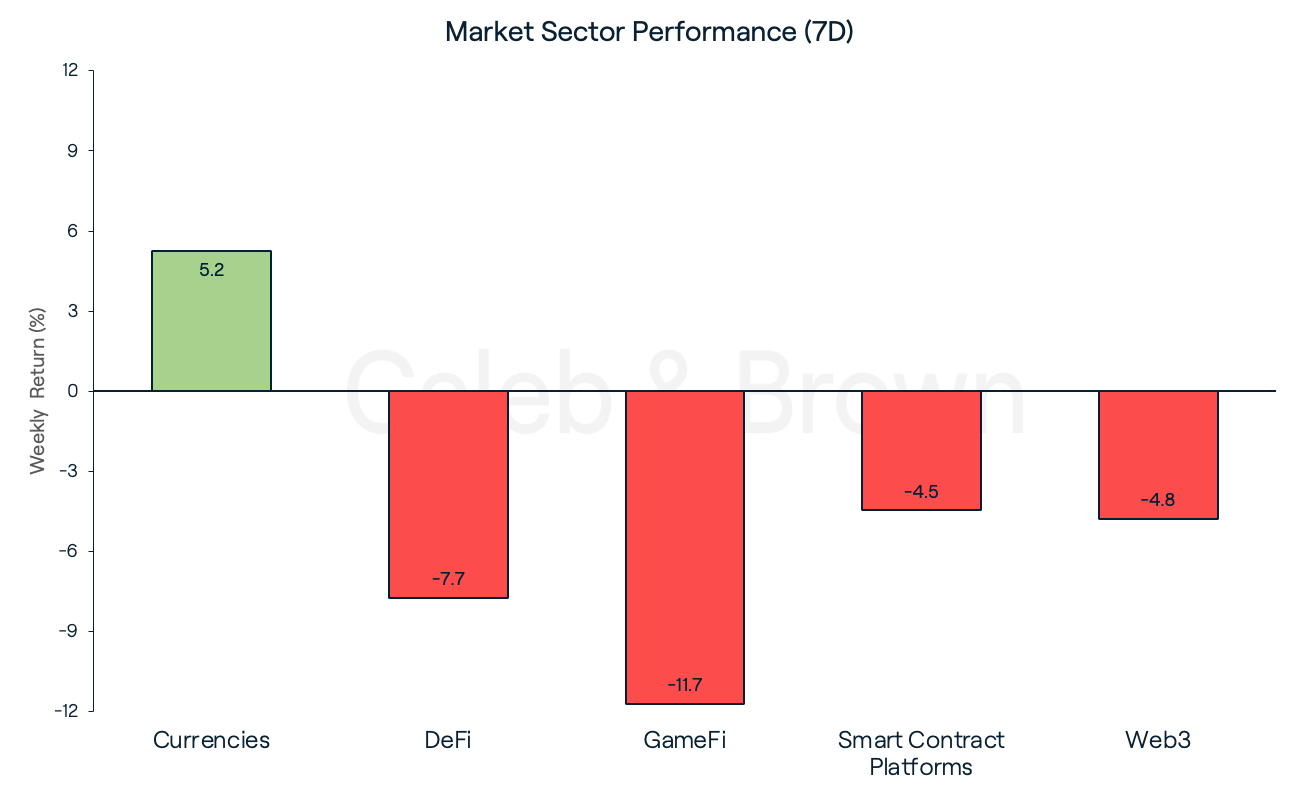

Currencies was the only surviving sector this week, gaining 5.2% over the last seven days. GameFi was the worst hit and lost 11.7% week-on-week, followed closely by DeFi which lost 7.7%.

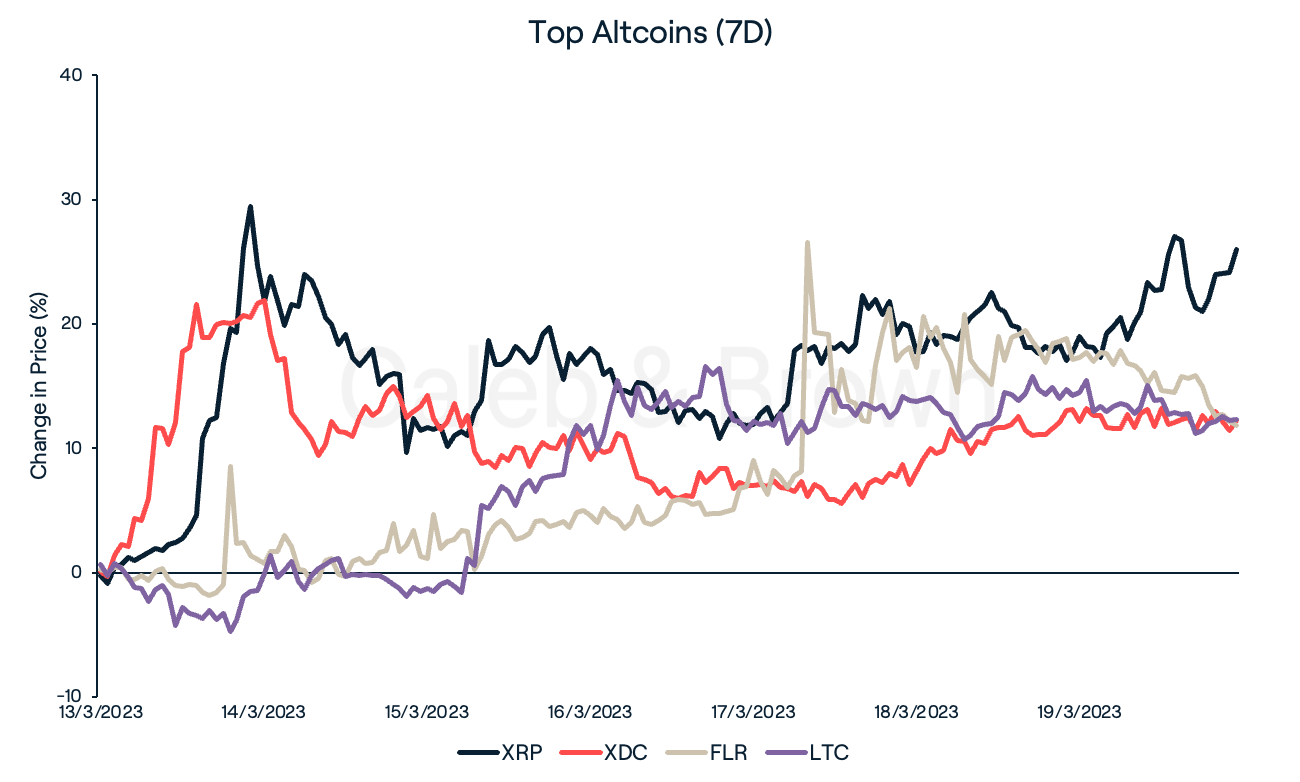

Despite the relatively flat week of trading, a few tokens emerged with double-digit gains.

XDC Network (XDC) secured its second consecutive week amongst the top performers and surged 12.2%. While no major developments have recently occurred, investors might be speculating on XDC’s ISO 20022 compliancy. ISO 20022 is an open global standard for financial information which will replace the previously implemented legacy format SWIFT, this year.

Flare (FLR) and Litecoin (LTC) rallied 11.8%, and 12.2%, respectively week-on-week. LTC’s highly anticipated halving event, which will reduce block rewards, is now only a few months away. Halving events have historically resulted in bullish price movements following the event and may explain this weeks price action.

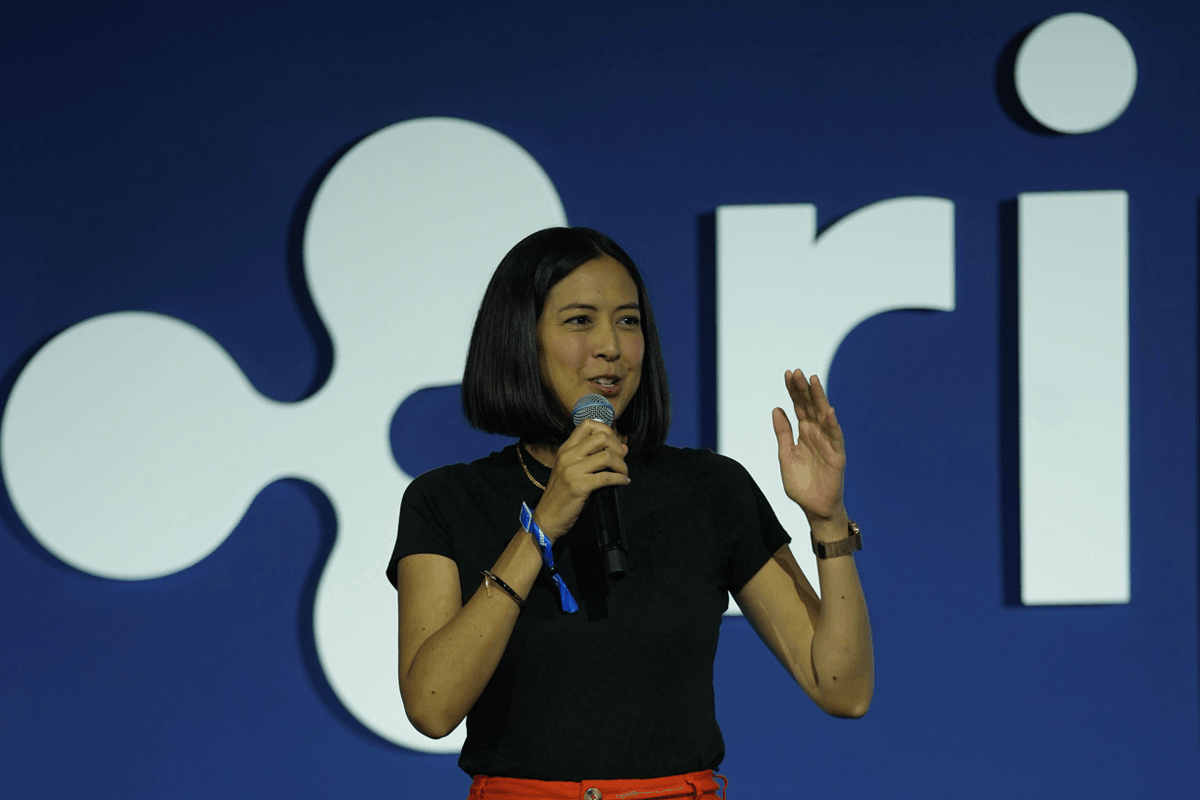

The largest gainer this week was XRP which gained 25.9% over the last seven days. XRP soared 11% on Wednesday after Monica Long, president of Ripple, said Wednesday morning that she was “very hopeful” about achieving a positive resolution to the SEC battle, adding she thinks it will reach a conclusion sometime this year. The XRP case remains a crucial case for the crypto industry as it will set the grounds for regulation within the space.

In Other News

Arbitrum (ARB) Airdrop Lands Top 40

Arbitrum (ARB) has secured a spot amongst the top 40 cryptocurrencies after a successful airdrop last Thursday. With 1.275 billion tokens now in circulation, ARB currently trades at a market capitalisation of US$1.6 billi

on, making it the second largest layer-2 scaling protocol, only behind Polygon (MATIC).

Caleb & Brown has listed Arbitrum - trade ARB in the Portal or through your personal broker.

Do Kwon Arrested

A man identified as Kwon Do-hyeong, also known as Do Kwon, the disgraced founder of a failed crypto company wanted in South Korea and the United States for fraud and other offences, was apprehended in Montenegro, according to Interpol.

A South Korean citizen, Do Kwon established the blockchain platform responsible for TerraUSD stablecoin and its companion currency Luna. In May 2022, the value of both coins plummeted within days, causing $40 billion in losses across the cryptocurrency market and further contagion in the industry.

SEC Serves Coinbase With Wells Notice

The U.S. Securities and Exchange Commission (SEC) has threatened to sue Coinbase Global Inc. over some of the crypto exchange's products. Following the issuance of a Wells notice - a formal declaration that SEC staff intend to recommend an enforcement action - Coinbase's shares fell by nearly 13% to US$67.33 in extended trading. The potential enforcement actions would be related to various aspects of Coinbase's offerings, including its spot market, Earn, Prime, and Wallet products.

Coinbase said its services continue to operate as usual after the notice was issued.

Recommended Reading: What is XRP (Ripple)? A Beginner’s Guide

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.