Market Highlights

- Bitcoin crosses all-time high, ever so briefly.

- Ethereum reaches two-year high.

- More strife for Coinbase platform.

- Memecoins soar, many with triple-digit gains.

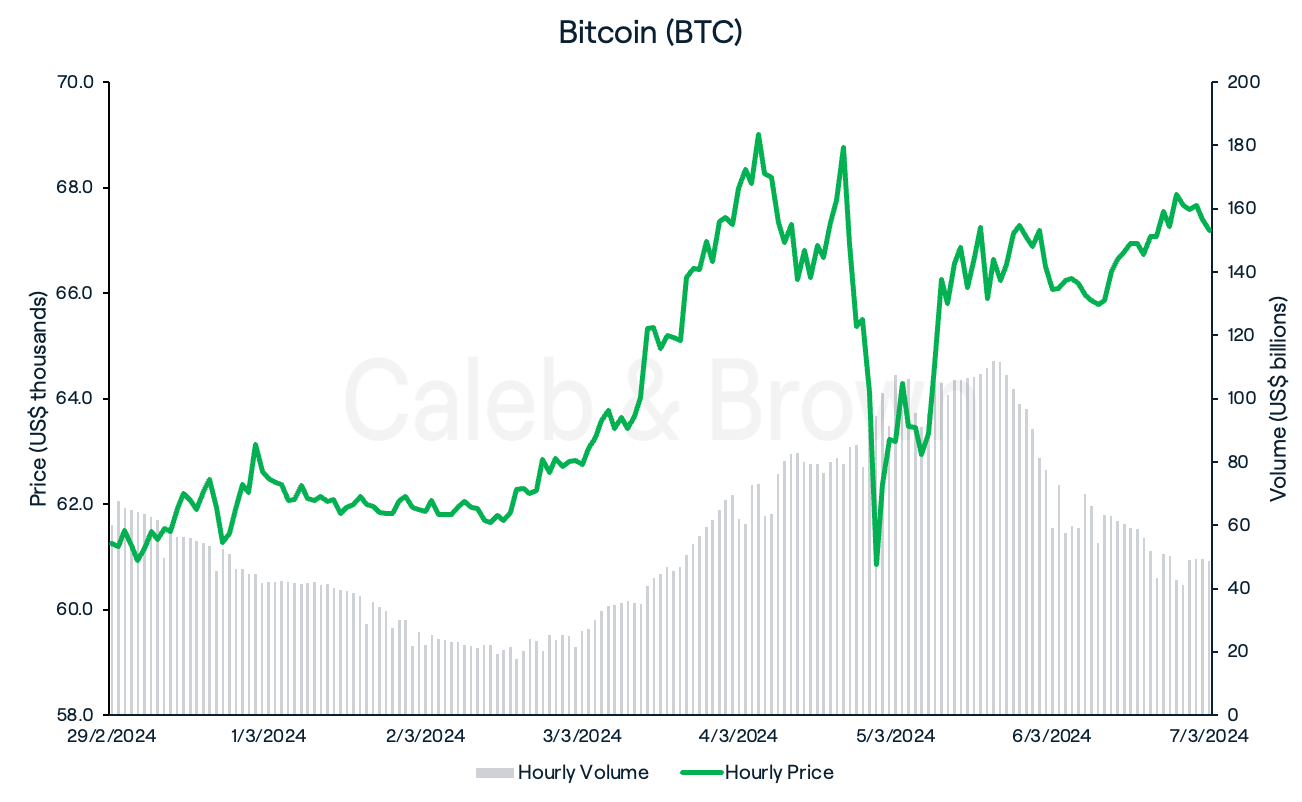

Bitcoin

A crypto market already ascendant was whipped into a full frenzy this week as Bitcoin (BTC) crossed all time highs for the first time since 2021! While only for a brief moment, BTC edged past the previous high of US$69,000 on Tuesday before a drastic sell-off saw prices tumble over 10.0%. BTC however was quick to bounce back, and regain momentum to close the week at US$67,181, up 9.7% over the last seven days.

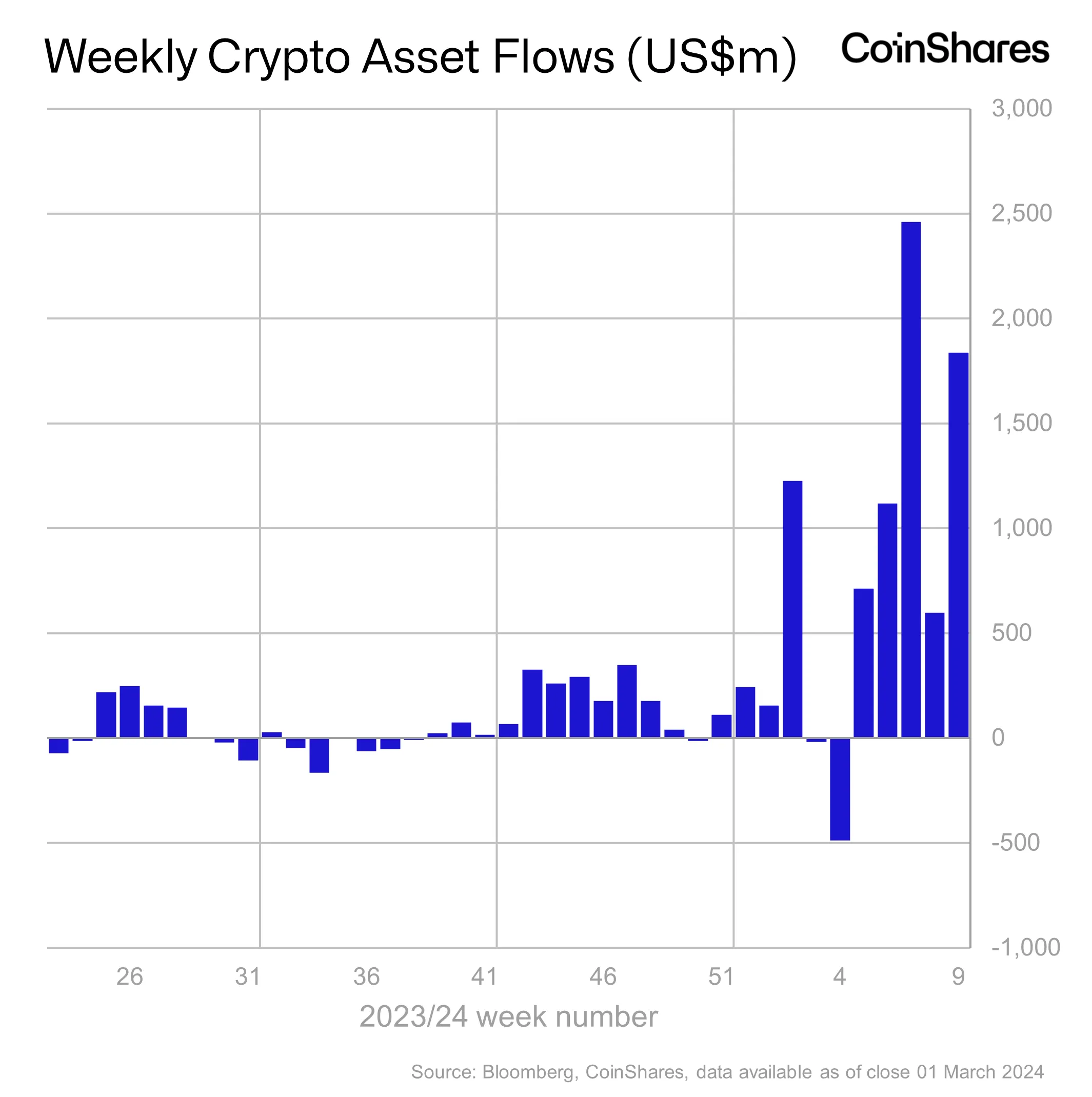

The buzz surrounding the new peak pushed the Bitcoin ETF mania to new heights with BlackRock’s iShares Bitcoin ETF (IBIT) seeing US$3.75 billion worth of trading volume on Tuesday, smashing the fund’s previous daily record of US$3.3 billion from last week. This saw total digital investment products record its second largest weekly inflows of US$1.84 billion, and total trading volume reach over US$30 billion.

BlackRock’s iShares Bitcoin ETF (IBIT) is the fastest ETF to reach US$10 billion in AUM in history.

Ethereum

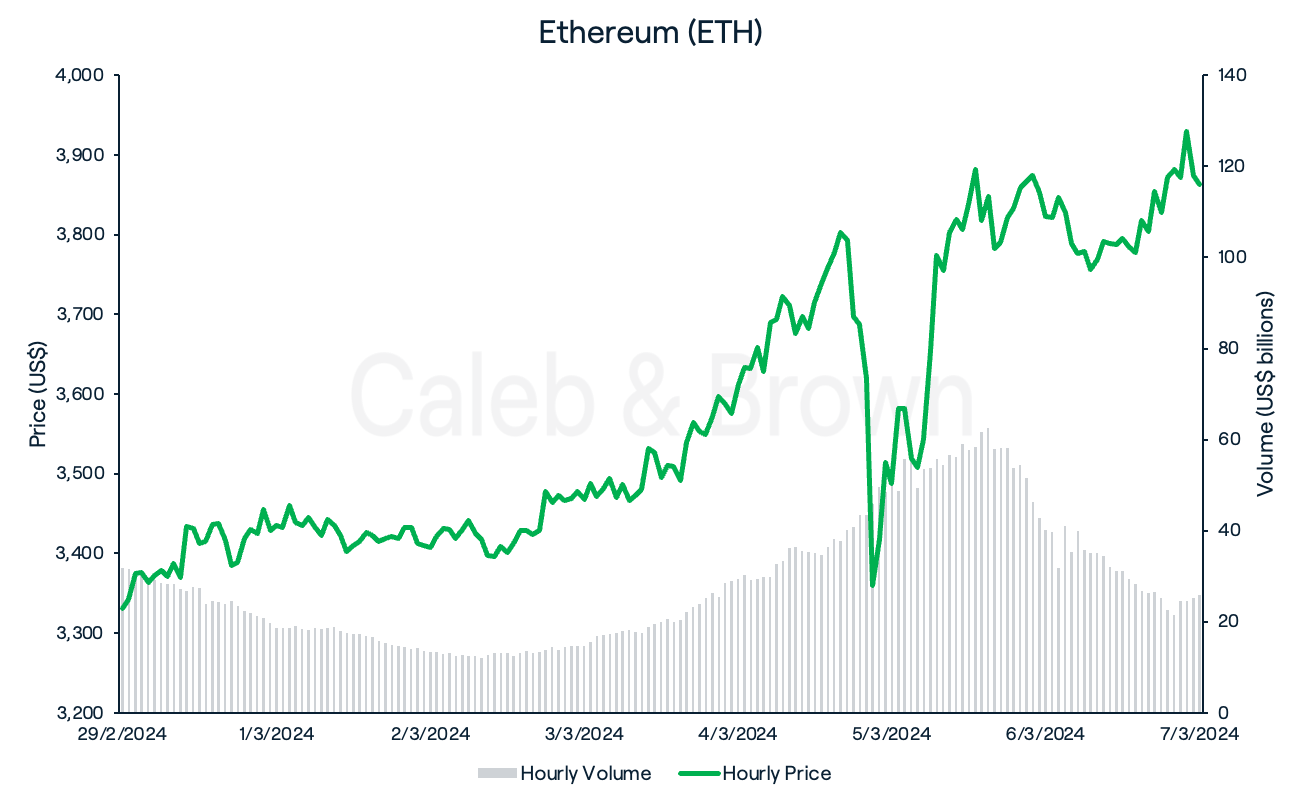

Ethereum (ETH) also took giant strides this week, reaching US$3,900 for the first time since January 2022. The move was likely spurred on by the fast approaching Dencun upgrade, now just a week away. This has correlated with an increase in the amount of ETH staked onto the Beacon chain with it reaching 31.387 million ETH, worth approximately US$116 billion.

Unfortunately this has also caused gas fees on the Ethereum network to spike as high as 174 gwei, with transactions costing users over US$150 during peak hours.

Although gas fees are expensive, this typically indicates high demand in the network, and an elevated underlying asset price. As such, ETH closed the week at US$3,862, up a staggering 16.0%.

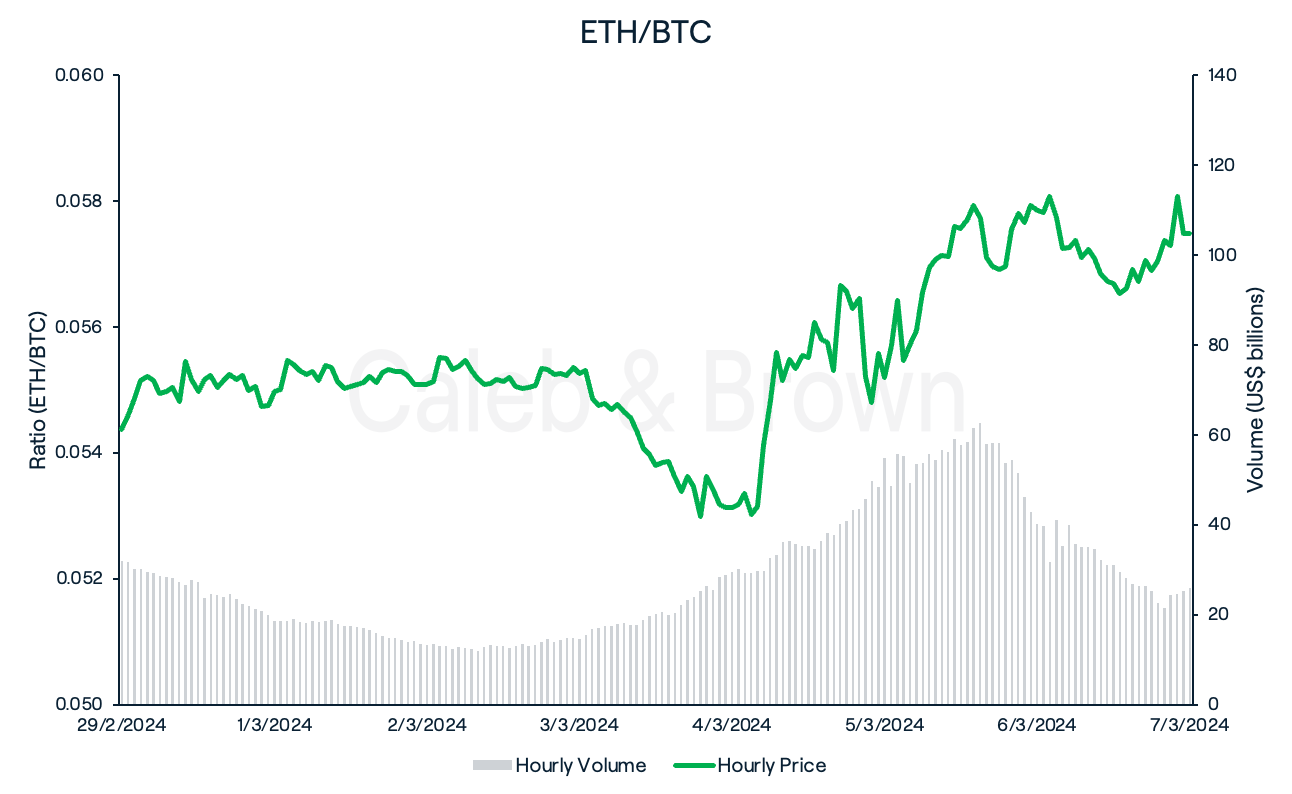

This has seen the ETH/BTC ratio continue to climb this week as ETH gained 5.7% relative market share against BTC.

Altcoins

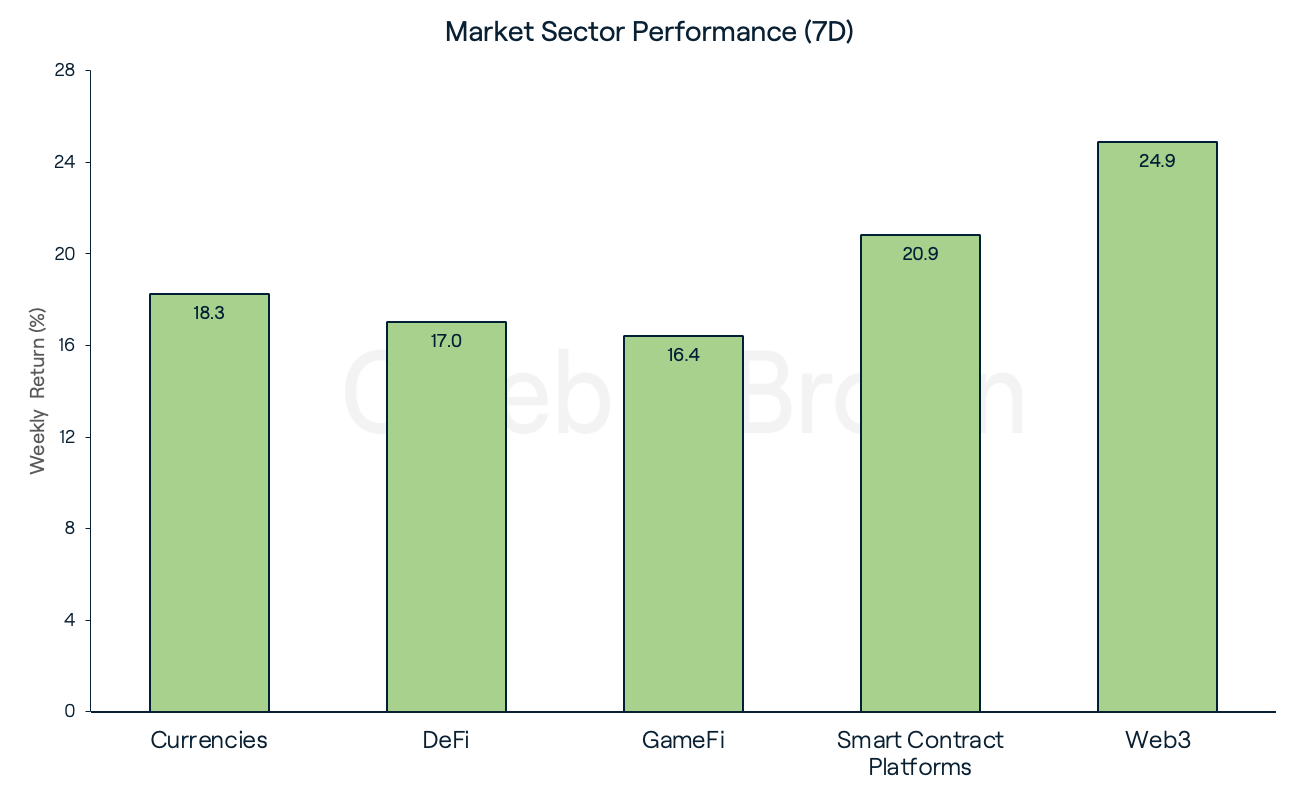

Market sectors were green across the board for the fifth consecutive week and were led by Web3 which added on an impressive 24.9% over the last seven days. Smart Contract Platforms and Currencies followed closely, gaining 20.9% and 18.3%, respectively.

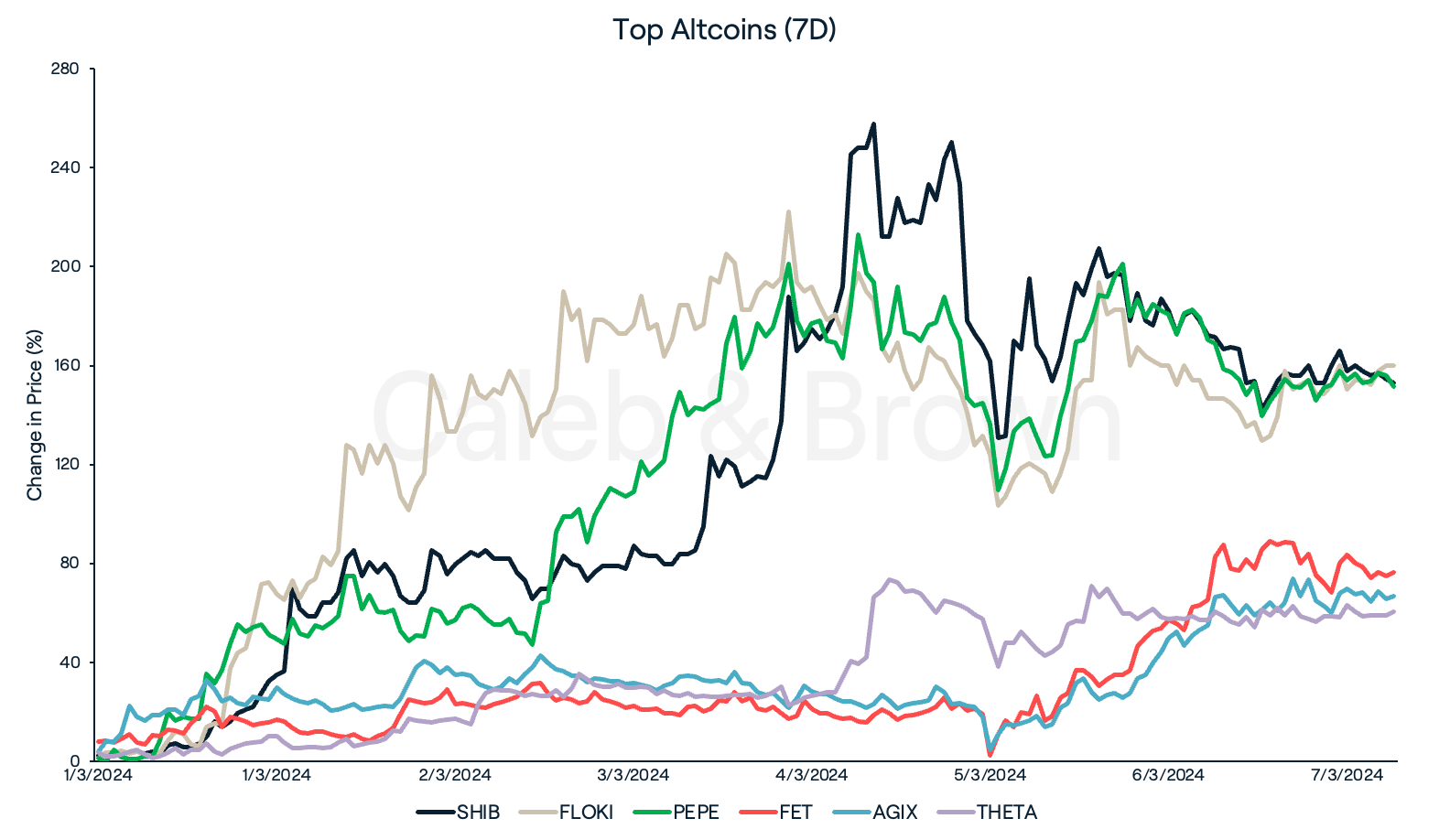

With BTC back behind the helm, flows began to flood altcoins, as memecoins and AI tokens dominated the charts. Shiba Inu (SHIB), Floki (FLOKI), and Pepe (PEPE) each made triple-digit gains this week after surging 152.8%, 159.9%, and 151.7%, respectively.

Just behind them were AI protocols Fetch.ai (FET), SingularityNET (AGIX), and Theta Network (THETA) which rallied 76.4%, 66.8%, and 60.5%, respectively. Many of which have made their way into the top performers for the second week running, and are up as high as 600% over the past 30 days.

In Other News

-

Following years of consistent outages during peak times, U.S. cryptocurrency exchange, Coinbase announced on Tuesday that "some users may be encountering errors when conducting transactions" as the price of Bitcoin reached a new all-time-high. The status update, posted around 3 pm EST, followed just four minutes after the company announced that its previous instances of "intermittent transaction failures" had been resolved.

-

For the second time, the U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding a proposed spot Ethereum ETF from the investment behemoth, BlackRock. Additionally, the SEC has deferred its decision on numerous other spot Ethereum ETF applications, including those from Fidelity, Invesco, and Galaxy Digital. According to Bloomberg ETF analyst James Seyffart, these delays are anticipated to persist until May 23, which marks the deadline for applications from VanEck and Cathie Wood's investment firm, Ark Invest.

Regulatory

-

On Tuesday, Do Kwon, the disgraced founder of Terra, achieved a significant victory when an appeals court overturned a previous ruling for the second time. The overturned ruling had intended to extradite him to the United States to face various criminal and civil charges. The appeals court specifically criticised the lower court's decision, which claimed that the extradition request from the United States preceded that of South Korea. Contrary to the lower court's finding that U.S. prosecutors submitted the extradition request in March 2023, a day ahead of their South Korean counterparts, the Appellate Court determined today, based on email records, that South Korea had initiated the process several days earlier.

-

The U.S. Securities and Exchange Commission (SEC) is encountering an increasing number of demands to curtail its supervision of the cryptocurrency industry. Initially, in October, a report by the Government Accountability Office criticised the implementation of SAB 121, highlighting concerns about the SEC's failure to submit a report to Congress and its subsequent use as a substitute for more definitive regulatory directives. Additionally, just this week, eleven state attorneys general filed a joint amicus brief in the SEC's lawsuit against Payward Ventures—the parent company of the crypto exchange, Kraken—to contest the SEC's jurisdiction over cryptocurrency companies.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)