Market highlights

- Bitcoin declined following weak consumer sentiment and unemployment data.

- Bitcoin ETFs saw a recovery in inflows following four weeks of net outflows.

- Cryptocurrency is becoming a hot-button issue amongst voters and policymakers as presidential candidates weigh in with their intent if elected.

- A House Joint Resolution was passed aiming to bring due process to crypto regulation, but the White House pre-warned policymakers that it would be vetoed if it were passed.

Bitcoin (BTC)

It was a quiet week in cryptocurrency. Bitcoin and other major coins saw losses amid what’s emerged as sideways price action for many currencies throughout recent weeks.

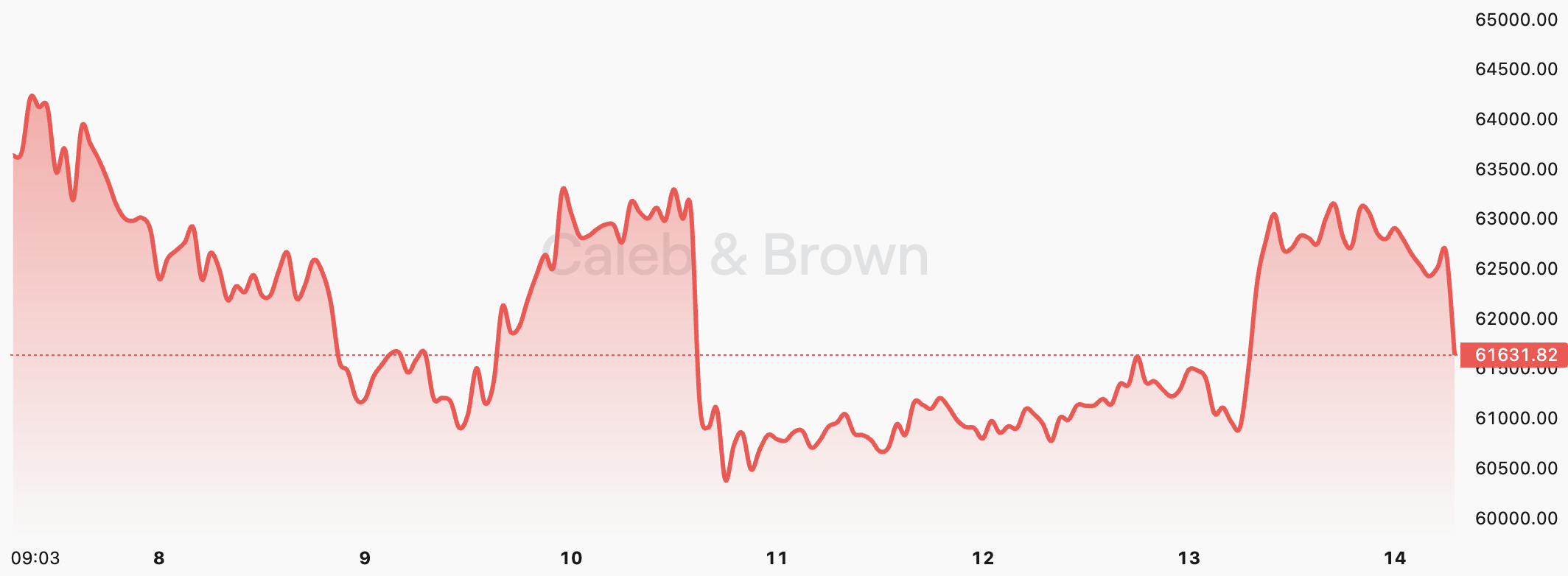

Bitcoin started the week at US$64,212 before descending to US$61,612, hovering around a key support level at US$60,870. The stagnant price action has persisted since the digital asset fell below its 2021 record high of US$69,044 in early April. A lack of volatility in the market has been deemed as the “Bore you to Death” phase by some industry professionals, citing that this is a normal part of the cryptocurrency market cycle.

Macroeconomic data and trading activity were quiet this week, too. Unemployment claims in the US came in at 18,000 higher than expected, and consumer sentiment fell to 67.4, almost 10 points lower than forecast. Tuesday, 10 May 2024, marked the “quietest day of the year” as trading desks reported the lightest notional trading session in the year to date in the US. The lack of volatility in bitcoin this week, coupled with minimal economic data, indicates that perhaps its price action is shifting back to the interest rate narrative after price was heavily influenced by the approval of spot bitcoin ETFs in the US in January.

Bitcoin is currently trading at US$62,905, a decrease of over 3% on the week.

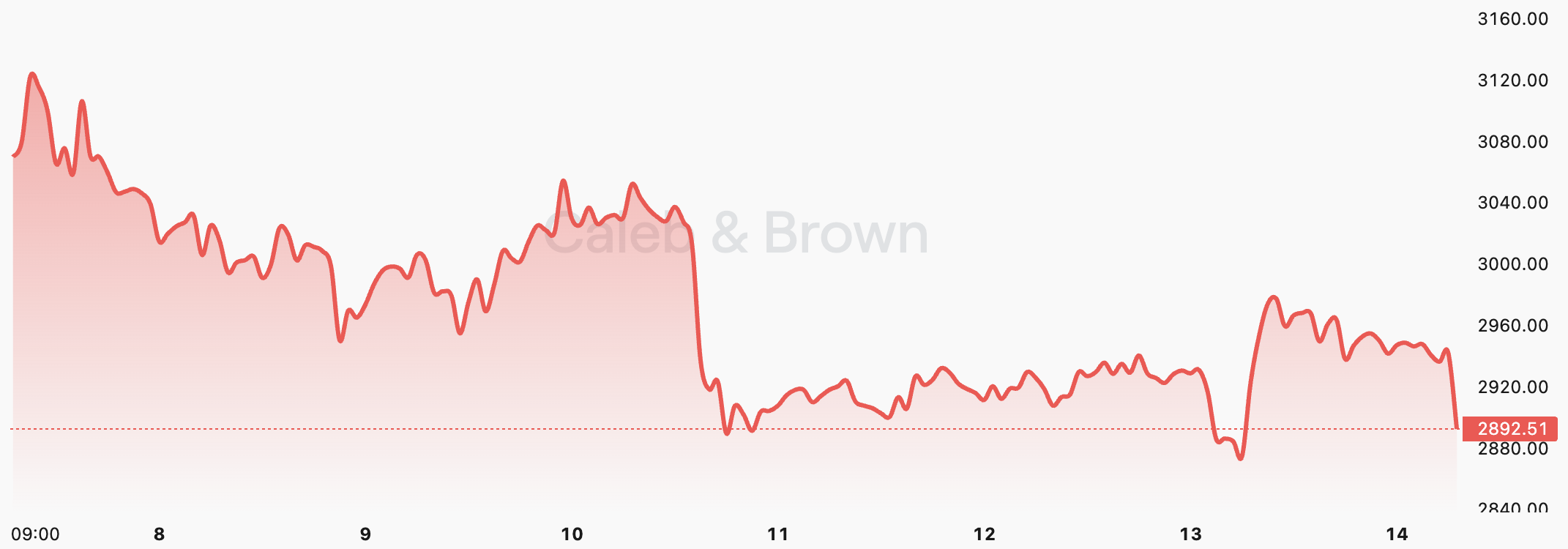

Ethereum (ETH)

Ethereum followed the movements of other cryptocurrencies this week. It dropped by over 7% and is now priced at $2,947. The larger losses compared to other cryptocurrencies are a result of whales selling their Ethereum holdings at a loss. One whale sold 6,714 ETH, which equates to US$19.5 million at US$2,903 — a loss of US$6.45 million.

Altcoins

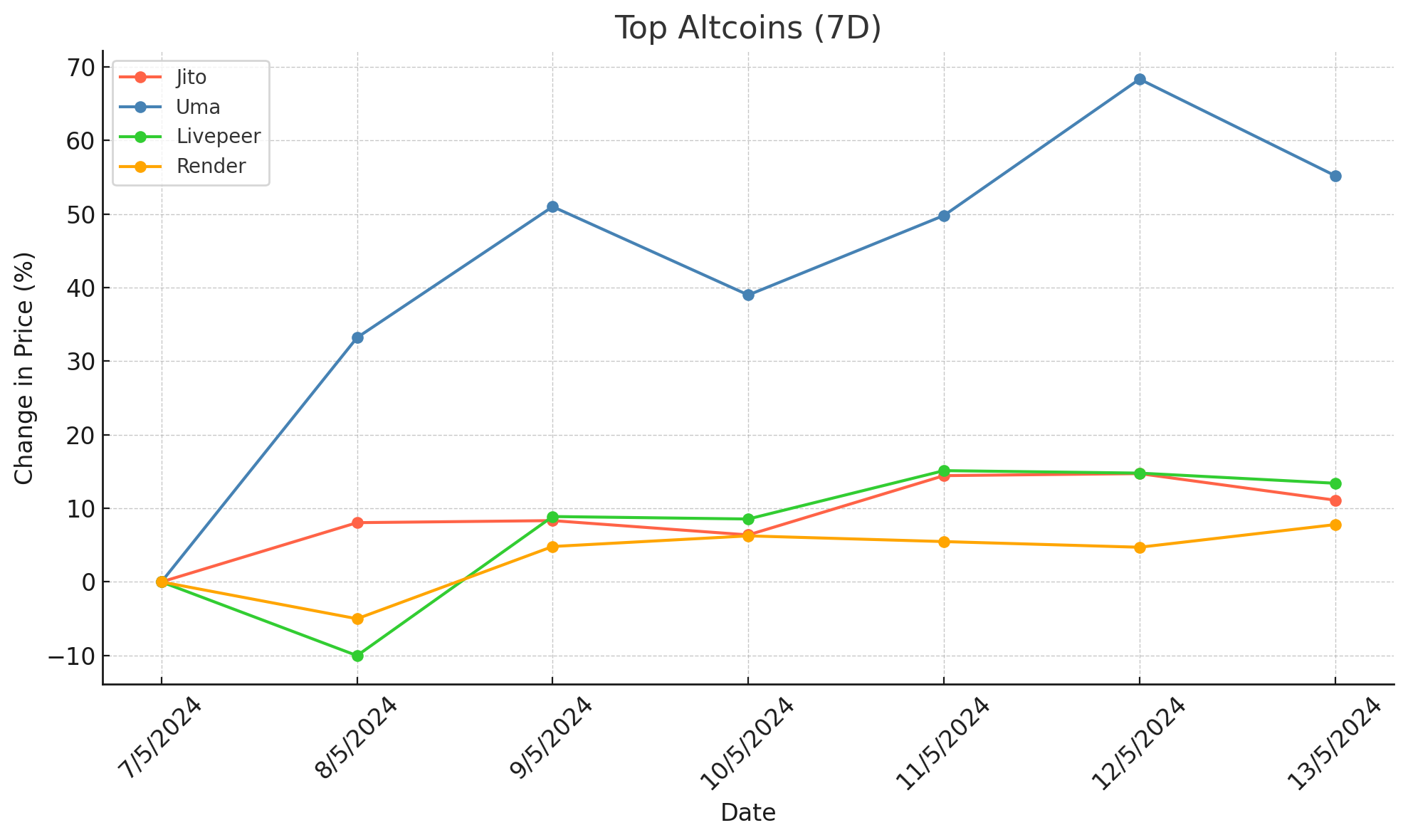

DeFi-ing the Odds

- UMA (UMA) rose by 48.57%, reaching a market cap of $324.15 million. The price of the dispute arbitration system took off, presumably due to the announcement that gitcoin integrated oSnap onto its crowdfunding platform. The integration enables GTC holders to vote on treasury distributions and automatically execute approved transactions on chain.

- Jito (JTO) had a week of gains, with its price growing by 13.79%. The liquid staking and maximum extractable value (MEV) project is now the largest protocol on the Solana blockchain, with US$1.4 billion in total value locked.

Culture Shock

- Pepe (PEPE) had a week of gains, with its price growing by 16.39%, likely fuelled by the meme coin mania currently sweeping across altcoins and a surge in whale activity.

- Livepeer (LPT) grew by 15.91%, taking its market cap to $576.12 million. The price rise follows announcements about progress in the network’s AI video capabilities and that its technology is cutting live streaming and transcoding costs for creators by up to 80%.

Computing Power

Tellor Tributes (TRB) grew by 38.36%, taking its market cap to $333.45 million. Price grew rapidly to the upside after finding key support at USD$45. The gains have accelerated as a result of whales capitalising on the price surge, with eight whales taking US$3.56 million in profits after this week’s growth. The current price is US$128.

- Render (RNDR) grew by 12.98%, taking its market cap to $4.4 billion. Price jumped 11% on May 7 after Octane, 3D design software powered by the Render Network, was briefly mentioned in a keynote presentation by Apple.

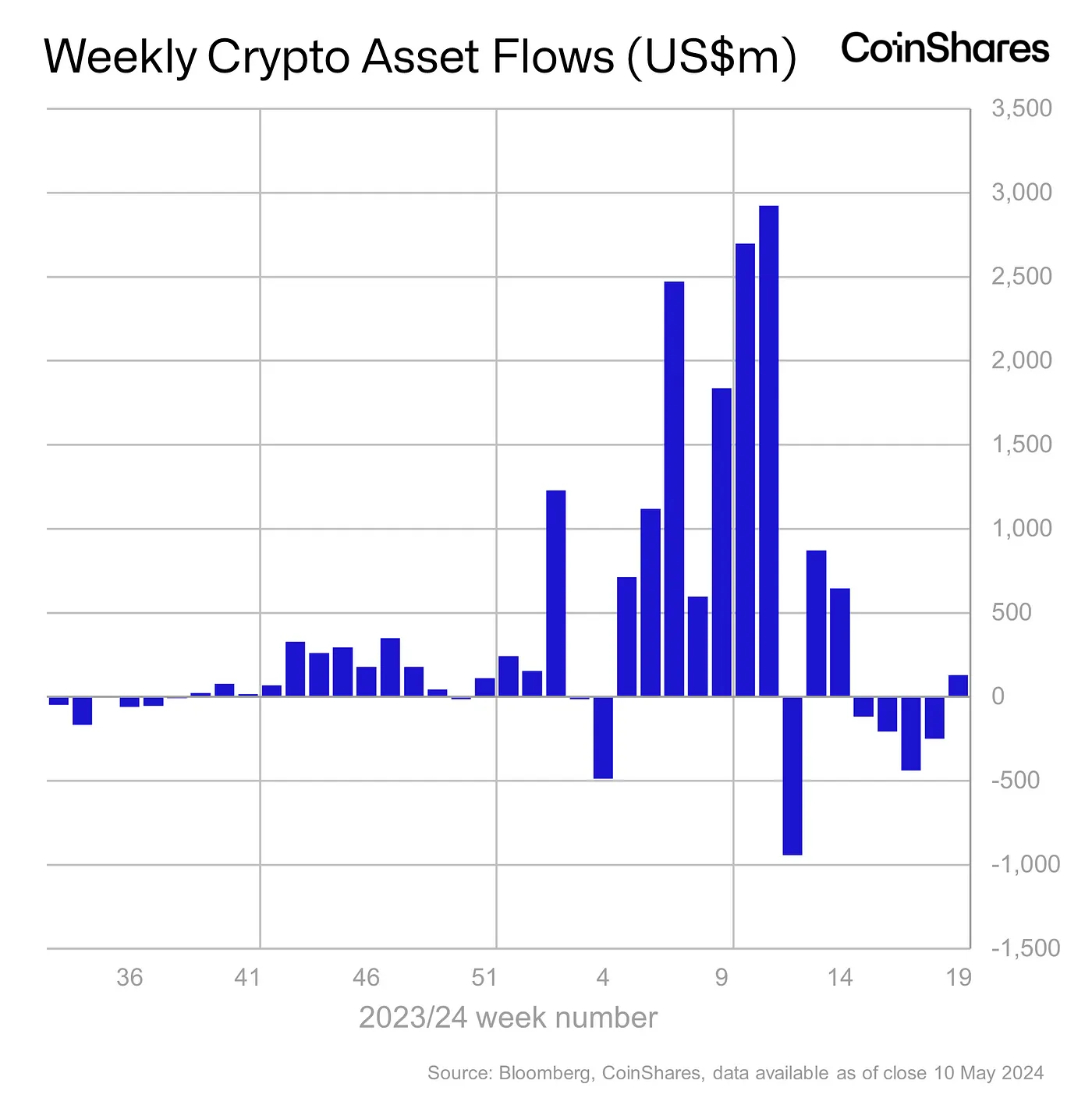

In Other News

Net inflows occurred for digital asset investment products for the first time in five weeks. The inflows totalled US$130 million, while Grayscale’s Bitcoin Trust (GBTC) saw the lowest weekly outflows since January. The rebound in flows started with US$217 million entering funds on Monday, 6 May, where all bitcoin ETFs had net inflows for the first time since the funds launched earlier this year. Meanwhile, in other countries, funds in Switzerland saw inflows of US$14 million, and Hong Kong had US$19 million inflows, a significant decline from the inflows that followed ETF approvals in Hong Kong.

-

Crypto has entered the discussions of voters, policymakers and presidential candidates this week. At a dinner party for holders of his NFTs, former president Donald Trump said he is “fine with it” while stating that he intends to embrace crypto if he’s re-elected. It’s a contrast to President Joe Biden backing the SEC earlier in the week on a bill that would allow banks to custody cryptocurrency. Commentators see a wedge issue emerging that may sway voters in the upcoming presidential election.

-

New data from BTC.com shows Bitcoin mining difficulty fell around 6% to 83.1 trillion hashes last week. Bitcoin is harder to attack when the mining difficulty — the energy and resources required to secure the network — is high. The drop is expected following the April halving event, which saw the reward for new blocks drop from 6.25 bitcoins to 3.125 bitcoins. With the decreasing profit margin, some miners may have stopped mining coins, which causes the hash rate to go down.

-

Cardano blockchain founder Charles Hoskinson made a statement expressing his views on the upcoming US presidential elections. Hoskinson believes the fundamental concept of cryptocurrency is to create a new social contract, holding governments, corporations and other authorities accountable to the people. Further, he cautioned that restricting innovation and adoption in crypto could make central bank digital currencies (CBDCs) the only alternative.

Regulatory

The U.S. House of Representatives approved a resolution to overturn a 2022 Securities and Exchange Commission (SEC) bulletin, demanding that the SEC roll back its anti-crypto banking policies. The resolution passed with bipartisan support, 228-182, but the White House released a statement hours before the vote stating it would be vetoed if passed. The key issue policymakers were looking to address in overturning Staff Accounting Bulletin (SAB) 121 was that instead of clarifying existing rules, which is what the bulletins are designed to do, SAB121 enacted sweeping policy changes.

New Asset Listings

Buy and sell these crypto assets, or swap them directly with hundreds of other popular crypto assets through your personal crypto broker.

To see our full list of available crypto assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.