Market Highlights

- Bitcoin (BTC) and Ethereum (ETH) experienced modest declines despite a midweek pump on news of lower-than-expected inflation readings from the U.S. Bureau of Labor Statistics.

- Tether, the world's largest stablecoin issuer, reported a net profit of US$1.48 billion in quarter 1, outpacing the likes of Blackrock.

- Crypto exchange, Bittrex filed for Chapter 11 bankruptcy after being charged by the U.S. Securities and Exchange Commission for non-compliance with securities regulations and allegedly generating illicit revenue between 2017 and 2022.

Price Movements

Bitcoin

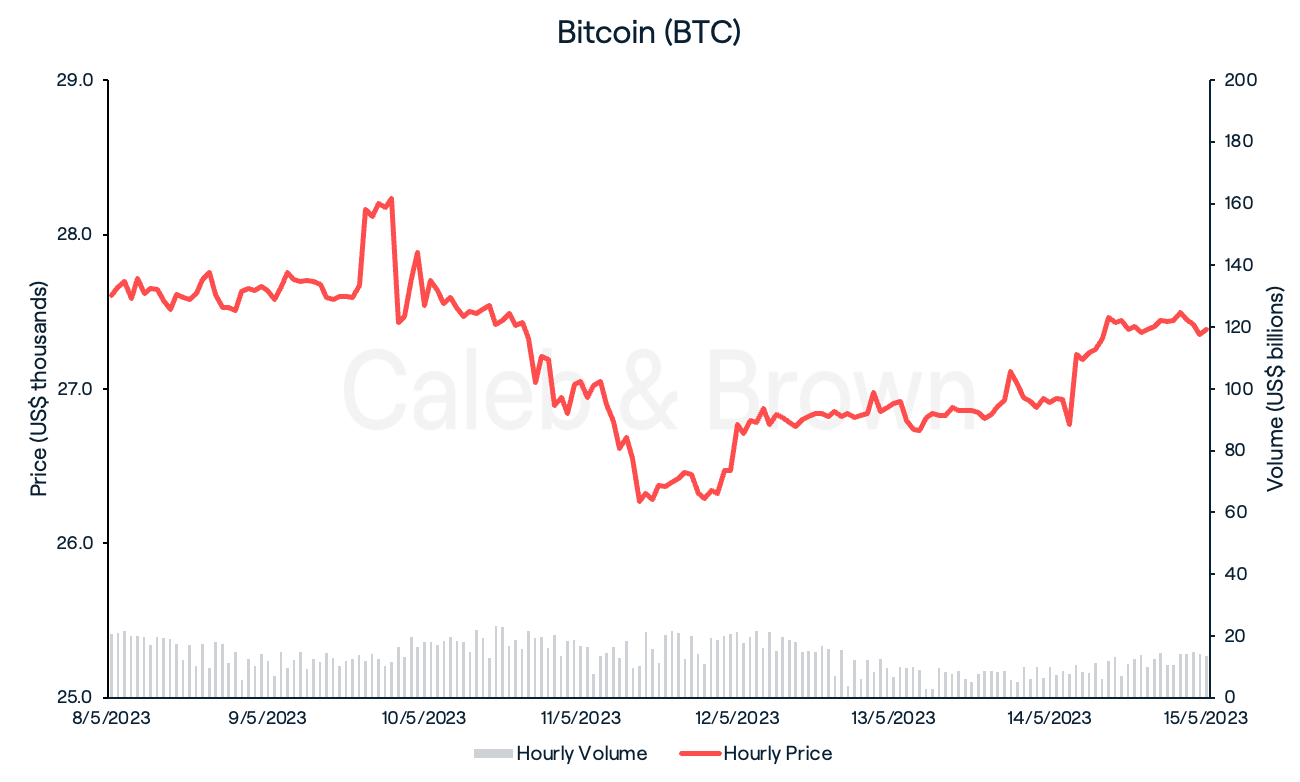

Despite a small midweek pump on news that the U.S. Bureau of Labor Statistic’s (BLS) inflation readings were lower than expected, Bitcoin (BTC) as well as the broader market experienced modest declines over the last seven days.

On Wednesday, the BLS reported that Consumer Price Index (CPI) rose 4.9% in the 12 months through April, coming in slightly below economists' estimates of 5.0%, and marking May the lowest annual rate for CPI since April 2021.

BTC rallied 2.6% following the report however it was not enough to shake the weekly downtrend, sliding 0.8% over the last seven days to close the week at US$27,382.

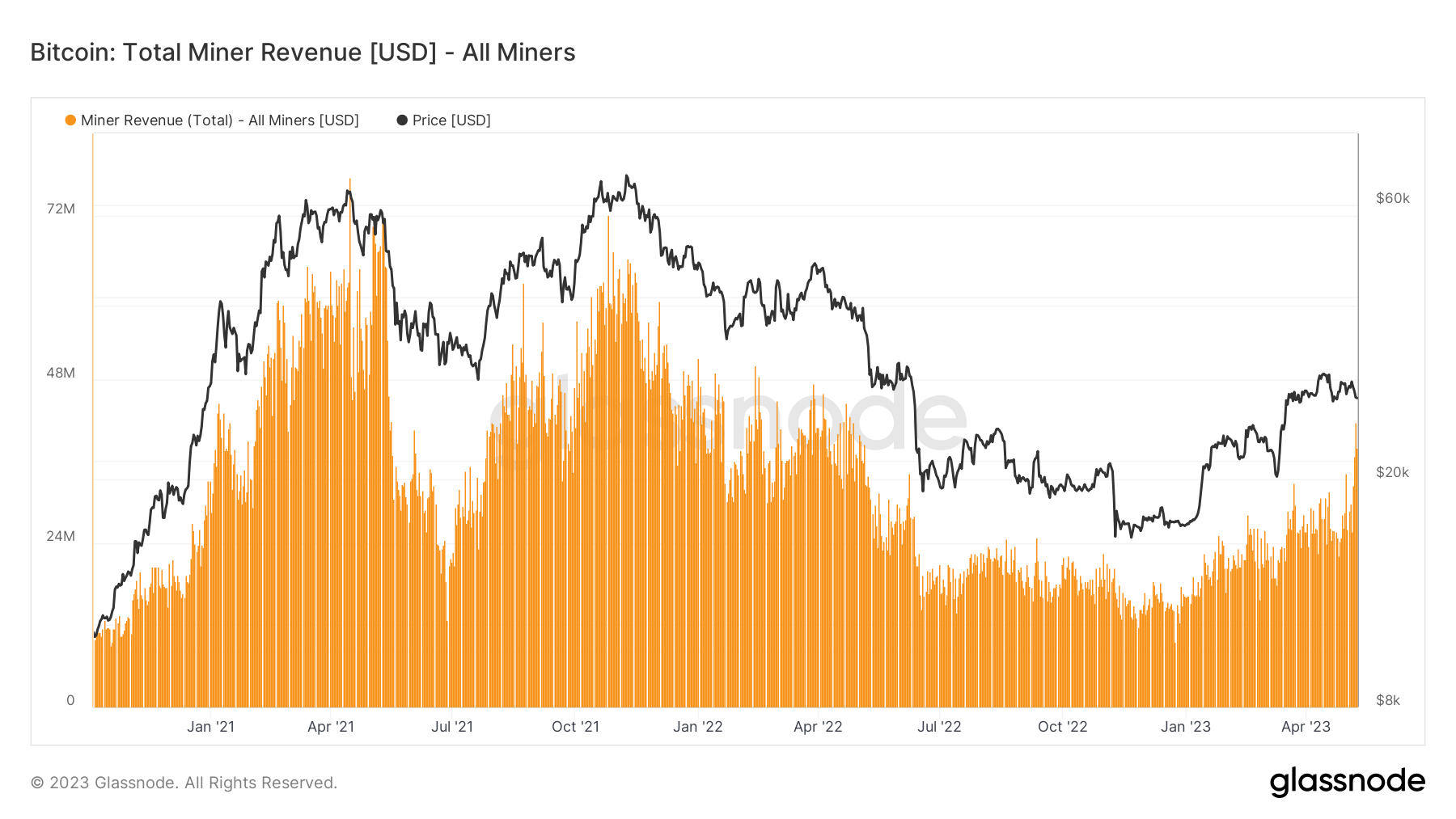

While 2022 was a difficult year for the crypto market, BTC has found success so far this year, trading ~65% higher year-to-date. Additionally, due to the current Ordinals inscription hype, BTC miners have also found success with mining fees hitting US$40 million per day, the highest they have been in almost a year.

Ethereum

Ethereum (ETH) followed in the footsteps of BTC this week, also pumping 2.6% in response to Wednesday’s CPI report. This was only a short lived rally however as ETH traded down for the remainder of the week, hitting a low of US$1,740 on Friday morning. A small recovery over the weekend saw ETH close the week at US$1,826, down 0.9% week-on-week.

It has not been all smooth sailing since the launch of the Shapella upgrade last month. On Friday, Ethereum encountered a technical problem that resulted in a temporary pause in block finality for over an hour.

Finality refers to the guarantee that a block cannot be altered or removed from the blockchain, and a pause could mean ‘non-finalised’ transactions may be ignored or re-ordered. While the cause of the issue is still unknown, the network is up and running at full capacity, with blocks being finalised again.

Altcoins

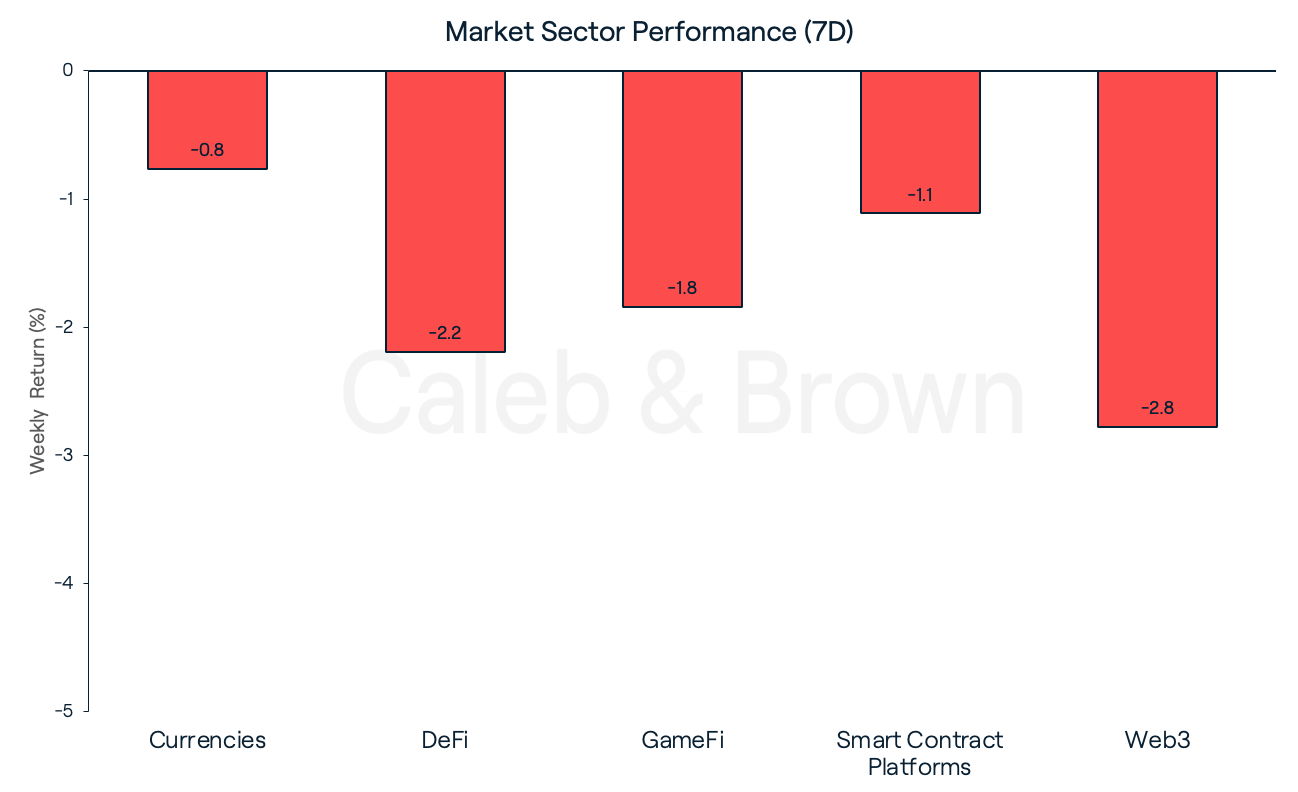

With BTC and ETH down, the rest of the market followed suit, and all sectors finished the week in the red. Web3 was the worst performing sector losing 2.8% week-on-week while Currencies held up the strongest falling just 0.8%.

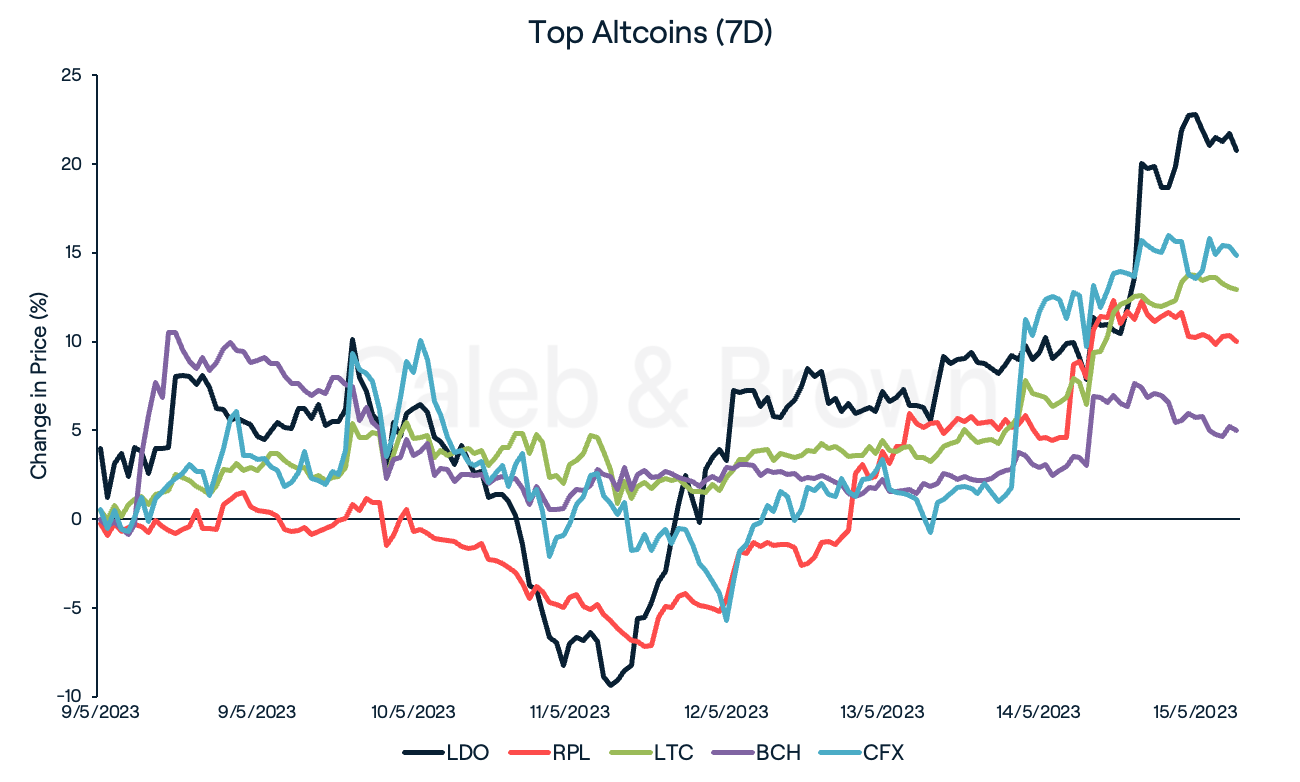

Despite the broader market sell-off, a few tokens succeeded in producing a positive return this week. Liquid staking providers Lido DAO (LIDO) and Rocket Pool (RPL) led the charge with each gaining 20.7 % and 10.0%, respectively. While some network issues are emerging, investors continued to deposit ETH onto the staking contract, signalling increased confidence in the product.

From the Currencies sector, Litecoin (LTC) and Bitcoin Cash (BCH) both enjoyed a bump in price this week. Each rallied 12.9% and 5.0% over the last seven days, and may be correlated with the upcoming halving events which typically see ‘pre-halving’ rallies. Halving events occur roughly every four years and will halve block rewards each time. Litecoin’s next halving event is less than three months away while BCH also has an upcoming network upgrade.

Lastly, Conflux (CFX) rallied 14.8% on the news of Binance now facilitating deposits and withdrawals of the mainnet CFX token.

In Other News

Tether Posts Giant First Quarter Profits of US$1.48 Billion

The world’s largest stablecoin issuer, Tether, announced on Wednesday a net profit of US$1.48 billion for the first quarter of 2023. The report revealed that its reserves reached an all-time high of US$2.44 billion, a US$1.48 billion increase over the same quarter last year.

Additionally, the company revealed that the majority of its reserves, primarily consisting of cash and cash equivalents, were predominantly invested in U.S. Treasury Bills, while 1.8% was allocated to Bitcoin holdings. This means it comfortably outpaced Blackrock, the largest asset manager in the world, which reported a net income of US$1.16 billion in Q1 2023.

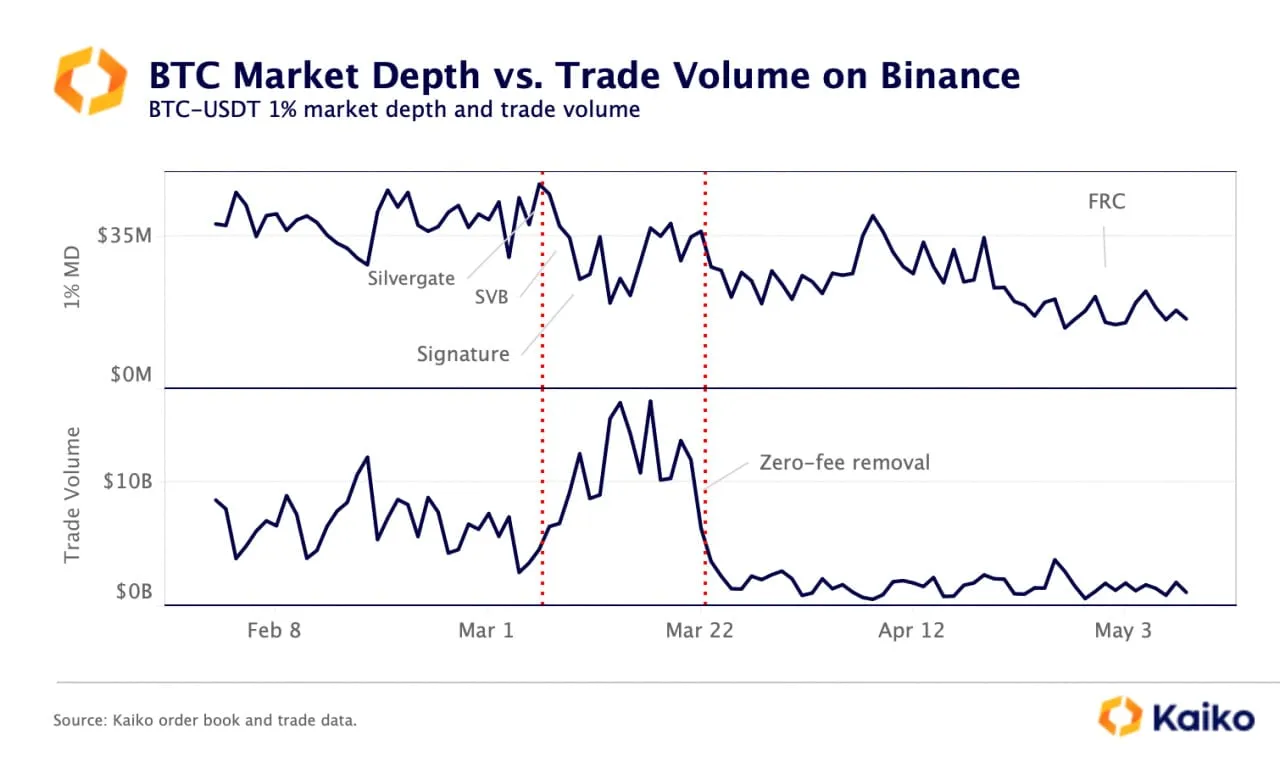

Bitcoin Liquidity and Trading Volume on Binance Declining Fast

During the first quarter of 2023, crypto exchange Binance experienced consistent decreases in both trading volume and liquidity. In particular, the liquidity (or 1% depth) of Bitcoin on Binance decreased by more than 50% since the beginning of February, dropping from approximately US$45 million to US$16 million in early May.

The removal of Binance's 10-month zero-fee promotion for 13 different Bitcoin pairs played a significant role in this liquidity decline, causing market makers to withdraw from the platform. Notably, the monthly trading volumes for the most frequently traded pair on the exchange, BTC-USDT, plummeted from US$16 billion in March to US$2 billion in April.

Bittrex Files for Chapter 11 Bankruptcy

In a Chapter 11 bankruptcy filing made on Monday, the American cryptocurrency exchange, Bittrex disclosed that it had over 100,000 creditors and estimated liabilities and assets ranging from US$500 million to US$1 billion.

This filing comes shortly after the U.S. Securities and Exchange Commission (SEC) brought charges against Bittrex, accusing the exchange of non-compliance with securities regulations for failing to register with the financial regulatory body. The SEC's criminal complaint asserted that Bittrex had not registered as a broker-dealer, exchange, or clearing agency, and had allegedly generated at least US$1.3 billion in illicit revenue between 2017 and 2022.

Regulatory

Texas Votes to Include Use of Digital Currencies in State's Bill of Rights

With a significant majority, Texas legislators have voted to approve an amendment to the state's Bill of Rights that would recognise the right of individuals to possess, hold, and utilise digital currencies. However, despite this positive development, the amendment is still in the early stages of the legislative process and must undergo further voting, including one in the House, one in the Senate, and a public referendum. If the amendment successfully passes all necessary stages and is signed into law, it will grant the residents of Texas the explicit right to utilise crypto, such as Bitcoin.

Recommended reading: Timing the Market vs. Time in the Market - Crypto Investing Strategies

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4rF21r350ibCxUXTbiSCCl%2Fbd51e0aa2570ea4108cb48aa7d759590%2FMarch_15__2023__8_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-05-16T00%3A49%3A00.054Z)