Market Highlights

- Bitcoin (BTC) daily transactions weekly average hit a 5-year high thanks to Ordinals protocol inscription spike.

- Federal court ordered South African CEO of Mirror Trading International Proprietary Limited to pay over US$3.4 billion, making it the largest CTFC fraud case involving BTC.

- Hong Kong to introduce guidelines on its upcoming retail crypto exchange licensing regime this month as it competes to establish itself as a major crypto hub.

Price Movements

Bitcoin

Bitcoin (BTC) experienced another volatile week, ranging from US$27,000 to US$30,000 over the past seven days. BTC was able to reclaim US$30,000 on Wednesday when it rallied 5.7% after San Francisco-based First Republic Bank released its quarterly report. It reported a US$100 billion plunge in deposits in Q1, raising concerns relating to the solvency of the regional lender, which caused its stock price to plummet 50.0%.

The rally abruptly halted when an alert from blockchain analytics firm Arkham was sent out, linking significant BTC transfers being made from wallets linked to defunct crypto exchange Mt. Gox and the US Government. Arkham responded and denied any ties with the market downturn, stating that “the drop occurred between 19:17 and 20:01 UTC” while the alerts and tweet were sent afterwards at 20:07 UTC and 20:08 UTC. Over US$80 million in BTC long positions liquidated which resulted in BTC crashing 7.0%, falling back below US$28,000. BTC recovered slowly for the remainder of the week where it eventually closed at US$28,007, up 2.0% over the past seven days.

Blockchain analytics company IntoTheBlock tweeted on Sunday that the weekly average of daily Bitcoin transactions had grown to approximately 396,000, a figure that has not been seen since December 2017. The growth in activity stems from the highly active Ordinals protocol which is used to inscribe digital assets onto BTC, similar to NFTs. Ordinals daily inscriptions hit an all-time-high on Sunday, clearing over 300,000 daily inscriptions.

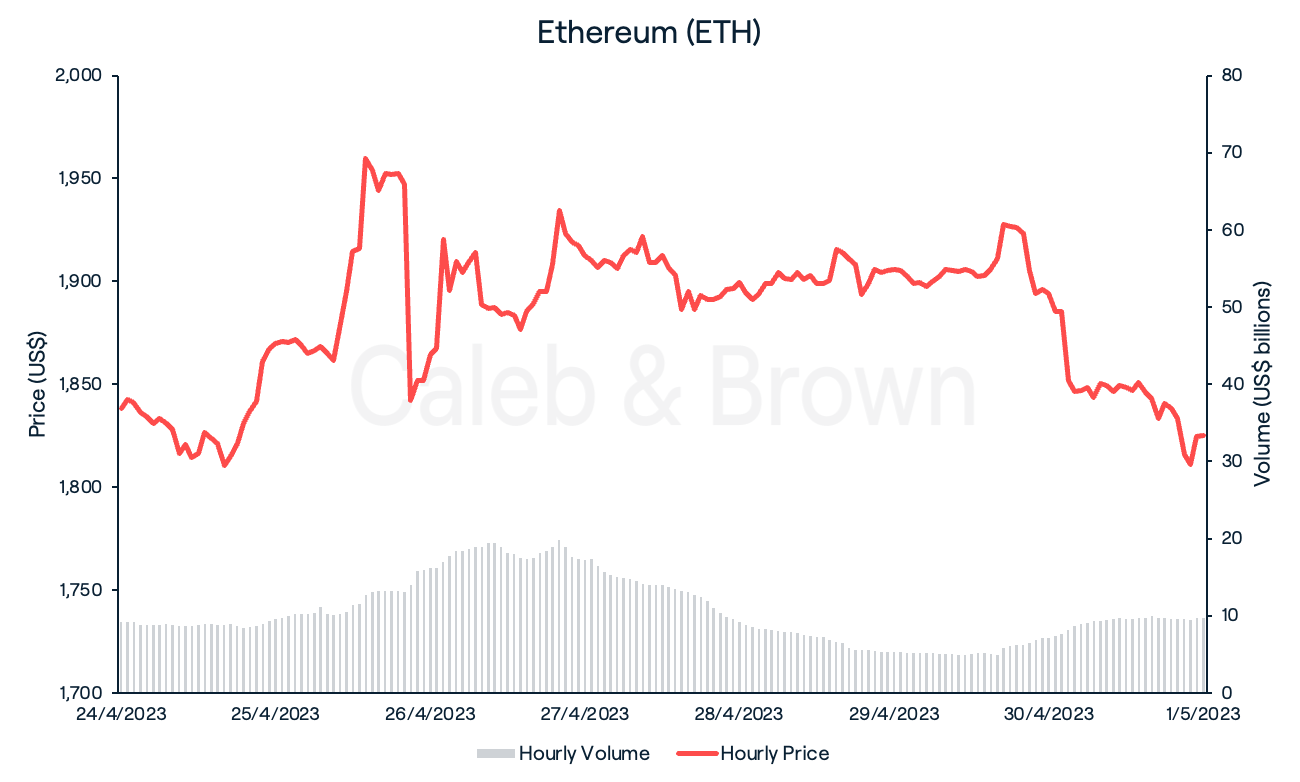

Ethereum

Ethereum’s (ETH) price action reflected that of BTC’s this week, surging to a high of US$1,964 on Wednesday before quickly declining 7.4% to US$1,818. ETH also recovered slowly throughout the week but late-week volatility saw it close the week at US$1,825, down a slight 0.7%.

BTC’s six-week bullish run came to an end as institutional investors turned their attention to ETH, which enjoyed inflows of US$17 million last week. The shift in institutional investment is likely driven by the successful “Shapella” upgrade which has provided investors with the ability to freely withdraw staked funds. This development could suggest that the cryptocurrency market is evolving, with institutional investors diversifying their portfolios and exploring alternative investment opportunities beyond Bitcoin.

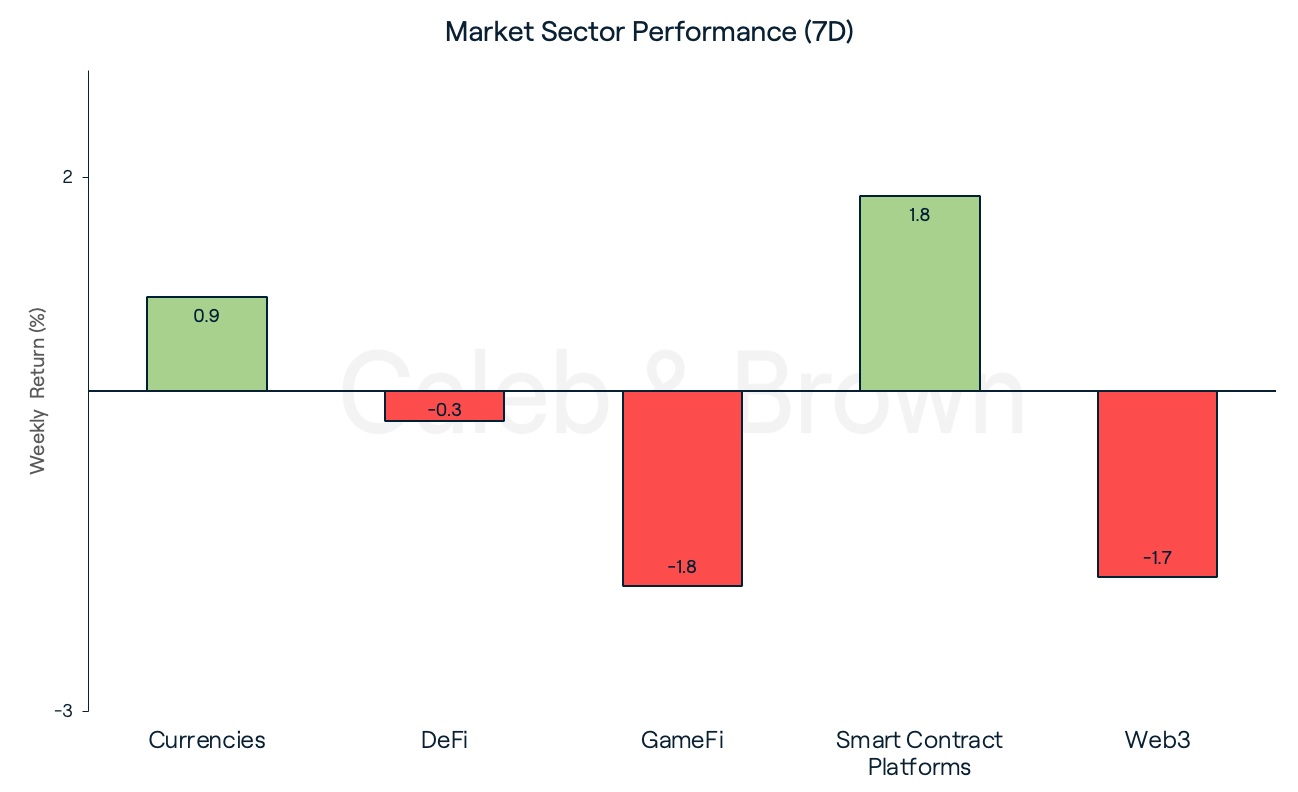

Altcoins

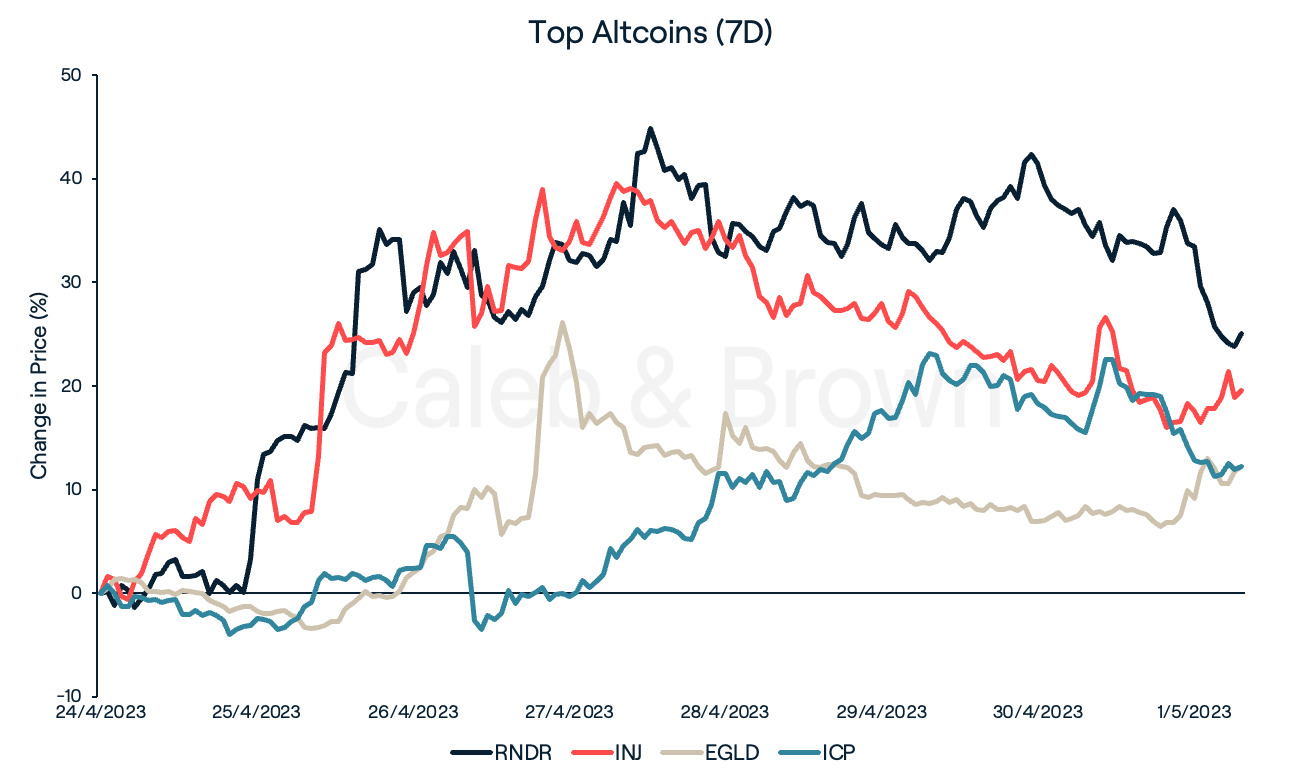

Sector performance was a mixed bag this week but for the most part remained relatively flat. Smart Contract Platforms and Currencies grew 1.8% and 0.9% respectively. GameFi, Web3, and DeFi were all in the red and each lost 1.8%, 1.7%, and 0.3% week-on-week. Despite the relatively flat week a number of tokens pulled through with double-digit gains.

Render (RNDR) secured top spot this week, gaining 25.0% on the news of approved improvement proposals which will expand its network to Solana (SOL). The news saw the RNDR token surge 50% in two days where it has since corrected.

Injective Protocol (INJ), Internet Computer (ICP), and MultiverseX (EGLD) also managed to secure double-digit gains, with each adding 19.3%, 12.2%, and 12.1%, respectively.

Regulatory

CFTC’s Largest Case Involving Bitcoin, Orders Offender to Pay $3.4B Penalty

Cornelius Johannes Steynberg, CEO of Mirror Trading International Proprietary Limited (MTI), has been ordered by a Texas court to pay a staggering US$3.4 billion in connection with a massive fraud case involving Bitcoin. As part of the settlement, half of the amount will be allocated towards providing compensation to the victims of MTI's fraudulent activities, while the other half will serve as a civil penalty, marking the highest civil monetary penalty ever ordered in any CFTC (Commodity Futures Trading Commission) case.

The CFTC's investigation revealed that Steynberg, both individually and as the principal and agent of MTI, accepted at least 29,421 BTC (worth approx. US$1.7 billion) from over 23,000 individuals across the world, to participate in the commodity pool without being registered as a commodity pool operator (CPO), as mandated by the law.

Hong Kong SFC to Issue Crypto Exchange License Guidelines This Month

Hong Kong is set to release guidelines on the long-awaited retail crypto exchange licensing regime (which itself is set to take effect in June 2023), as it competes to establish itself as a major crypto hub.

The Securities and Futures Commission (SFC) CEO, Julia Leung, has announced that the final guidelines for crypto exchanges seeking to operate in the region will be released in May. Over 150 responses were received during the public consultation process that was initiated last year to determine the most effective way to grant retail investors access to cryptocurrencies, as well as explore the possibility of introducing crypto exchange-traded funds (ETFs) in Hong Kong.

It is expected that the new regulatory framework will enable retail investors to trade major cryptocurrencies like BTC and ETH from June 1st.

Recommended reading: What is Crypto Liquidity?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3kNKhthOjzAm5KDmata5AV%2Fcdbefe17b21deb8009202b7ca907cdce%2FMarch_15__2023__6_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-05-02T05%3A31%3A45.092Z)