Market Highlights

- Bitcoin regained last week’s losses following cooling inflation and employment data.

- Rumors swirl about an imminent SEC approval for spot Ethereum ETFs, prompting updates in filings by major exchanges like NYSE and Nasdaq. The SEC’s decision on rule changes and fund registrations remains eagerly awaited.

- Digital asset investment products saw inflows of US$932 million, while Wall Street disclosures show growing institutional exposure to spot bitcoin ETFs.

- Cryptocurrency remains in the political zeitgeist as another bill seeking further clarity around the regulation of cryptocurrency in the US goes to a vote.

- The US Senate passed the House Joint Resolution seeking to ensure regulators don’t overstep their authority. President Joe Biden has ten days to sign off or veto the bill.

Bitcoin (BTC)

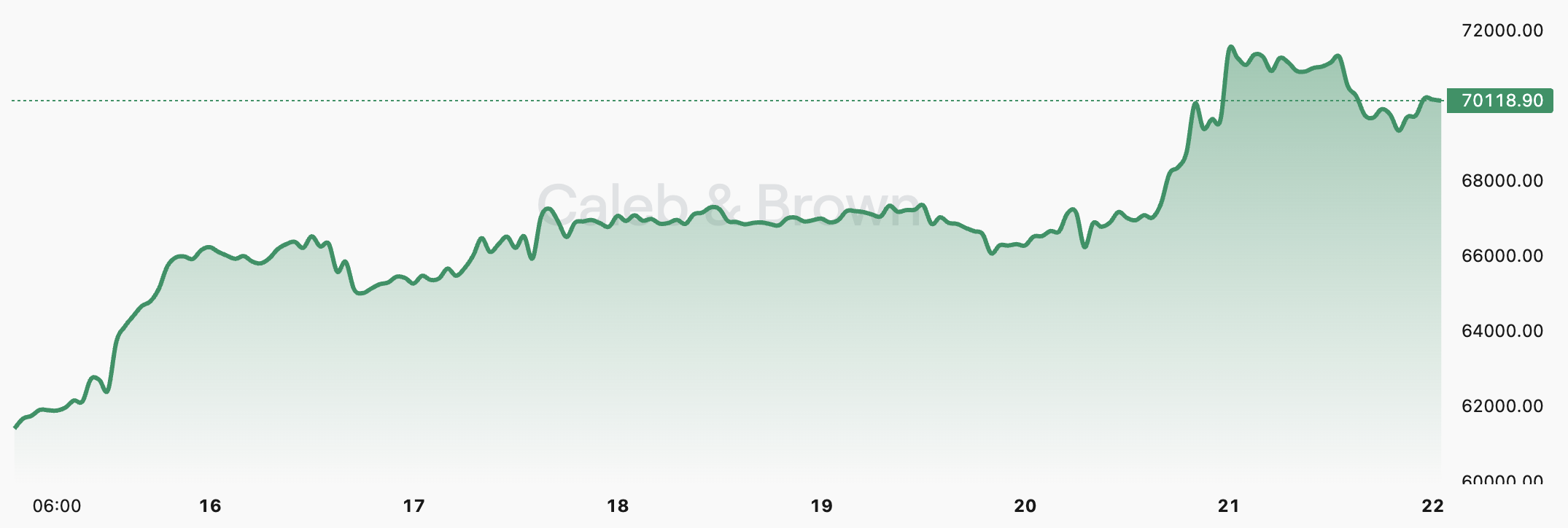

Price bounced back in bitcoin and other cryptocurrencies this week. Modest gains were seen across the major currencies, while meme coin mania continued.

Bitcoin started the week at the key support level of US$61,612 before shooting back up to and breaking US$65,500 (another key level of support and resistance). Wednesday 15 May saw the biggest gains of the week, with price growing around 8%, presumably due to no surprises in inflation and unemployment data out of the US.

All eyes continue to watch inflation in the US as markets look for signs of where the Federal Reserve may decide to take rates in its June meeting. The year-on-year consumer price index (CPI) for May came in at the forecast 3.4%. Unemployment claims came in slightly higher than expected at 222,000, while retail sales remained stagnant at 0% growth for April.

Following the cooling inflation and unemployment data, the Dow Jones Industrial Average reached 40,000 for the first time. The Dow finished the trading day down 0.1% after speeches from three Federal Reserve officials at separate events warned of “higher-for-longer” interest rates until further clarity is gained.

Bitcoin is currently trading at US$70,172, an increase of 14.03% on the week.

Ethereum (ETH)

Ethereum also bounced back from key support at US$2,950 after briefly breaking this level to the downside last week. Posting over 23% gains for the week, Ethereum is now priced at US$3,624

The move to the upside was driven by growing rumours that spot Ether ETFs could be approved by the Securities and Exchange Commission (SEC) this week. Exchanges such as the New York Stock Exchange and the Nasdaq have reportedly been asked to update their filings, though the SEC hasn’t provided any public confirmation. For funds to list spot Ether ETF products, the SEC will need to approve exchange rule changes (19b-4s) and fund registrations (S-1). The SEC hasn’t issued any guidance on whether these changes will be approved at the same time or if the funds’ registration approvals may lag.

Also this week, Vitalik Buterin, Ethereum’s co-founder, proposed an improvement to the network’s gas model. EIP-7706 introduces a new gas model for transaction call data. Aiming to reduce costs for data-heavy transactions, the proposal seeks to introduce a new fee separate from existing gas fees for transactions and data storage. If accepted, the responsibility for setting call data costs independently from other costs will fall to the network.

Altcoins

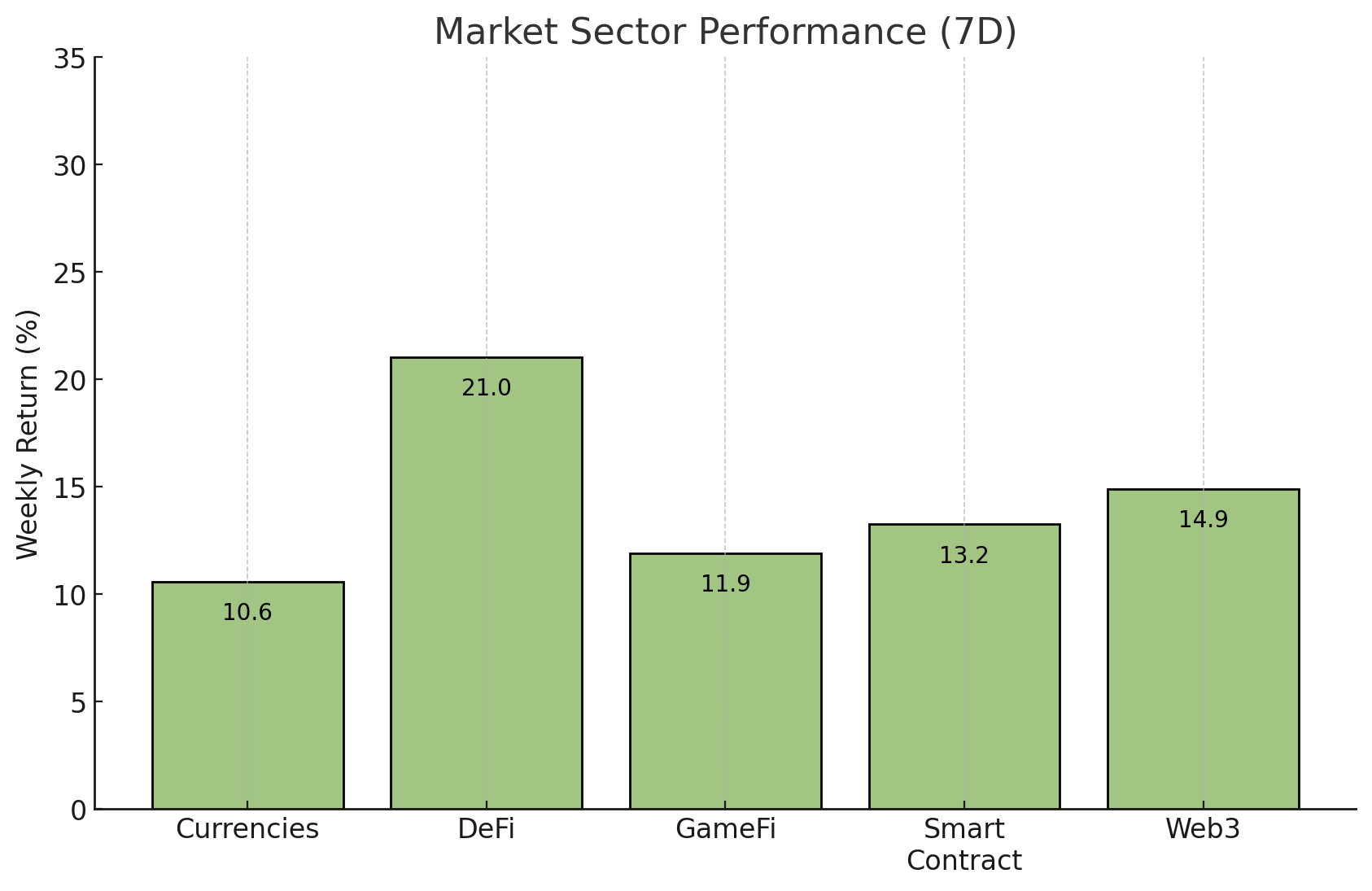

DeFi led market sector performance this week, rallying 21.0%. This was followed by Web3, which added 14.9%, and Smart Contract Platforms, which gained 13.2%. GameFi and Currencies also saw positive returns, gaining 11.9% and 10.6%, respectively.

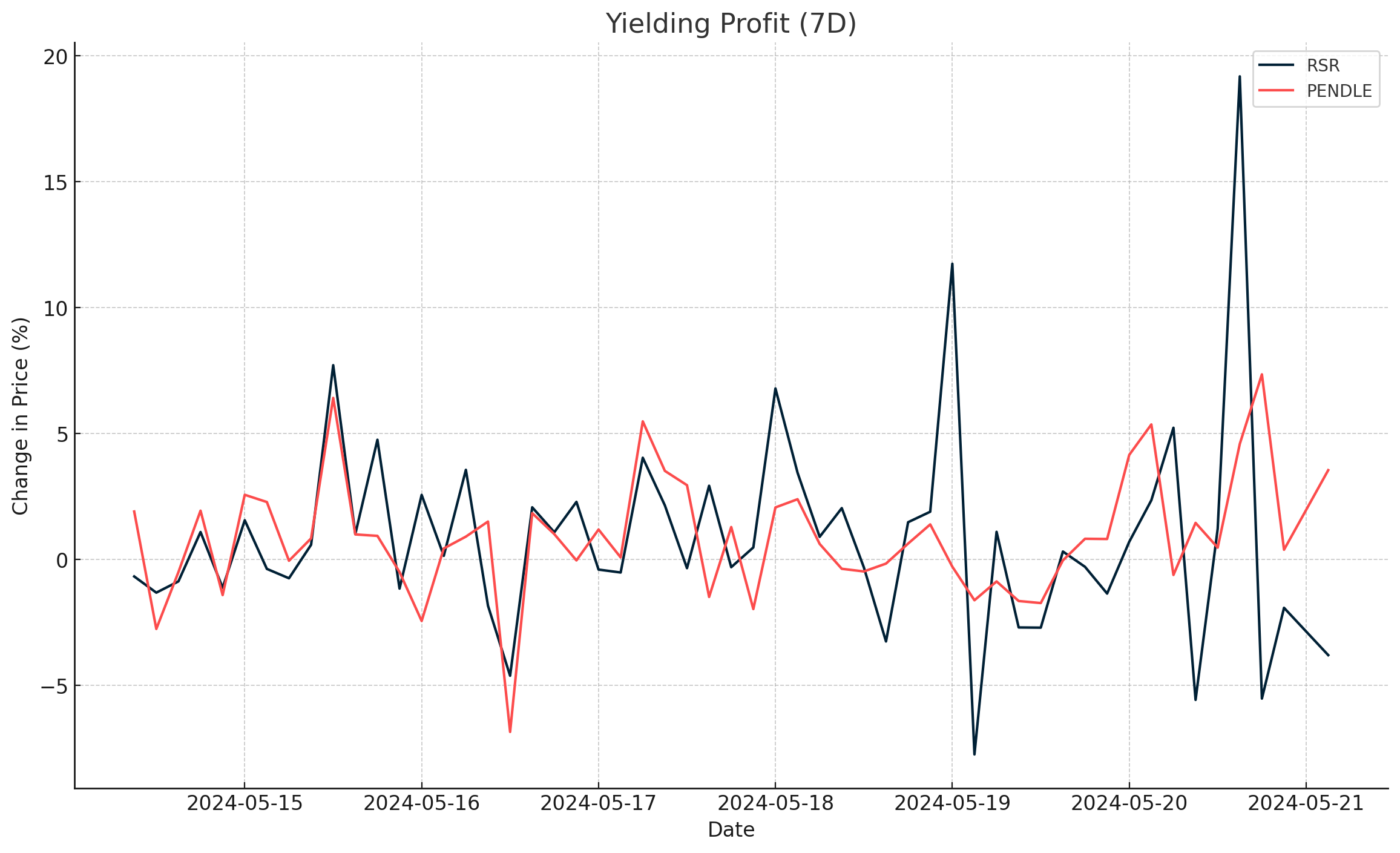

Yielding Profit

- Reserve Rights (RSR) rose by 58.26%, reaching a market cap of $440.45 million. The network allows users to create a token backed 1:1 by a collection of other tokens. Most of the gains were seen in the second half of the week when ETH Plus (ETH+), an RToken, grew to a market cap of US$37 million in minutes.

- Pendle (PENDLE) rose by 29.62%, reaching a market cap of $804.54 million. The gains were presumably due to the Swell layer 2 launch going live on Pendle. The launch allows users to leverage their layer 2 airdrop rewards and boost their earnings through additional Pendle yield.

Multi-Chain Growth

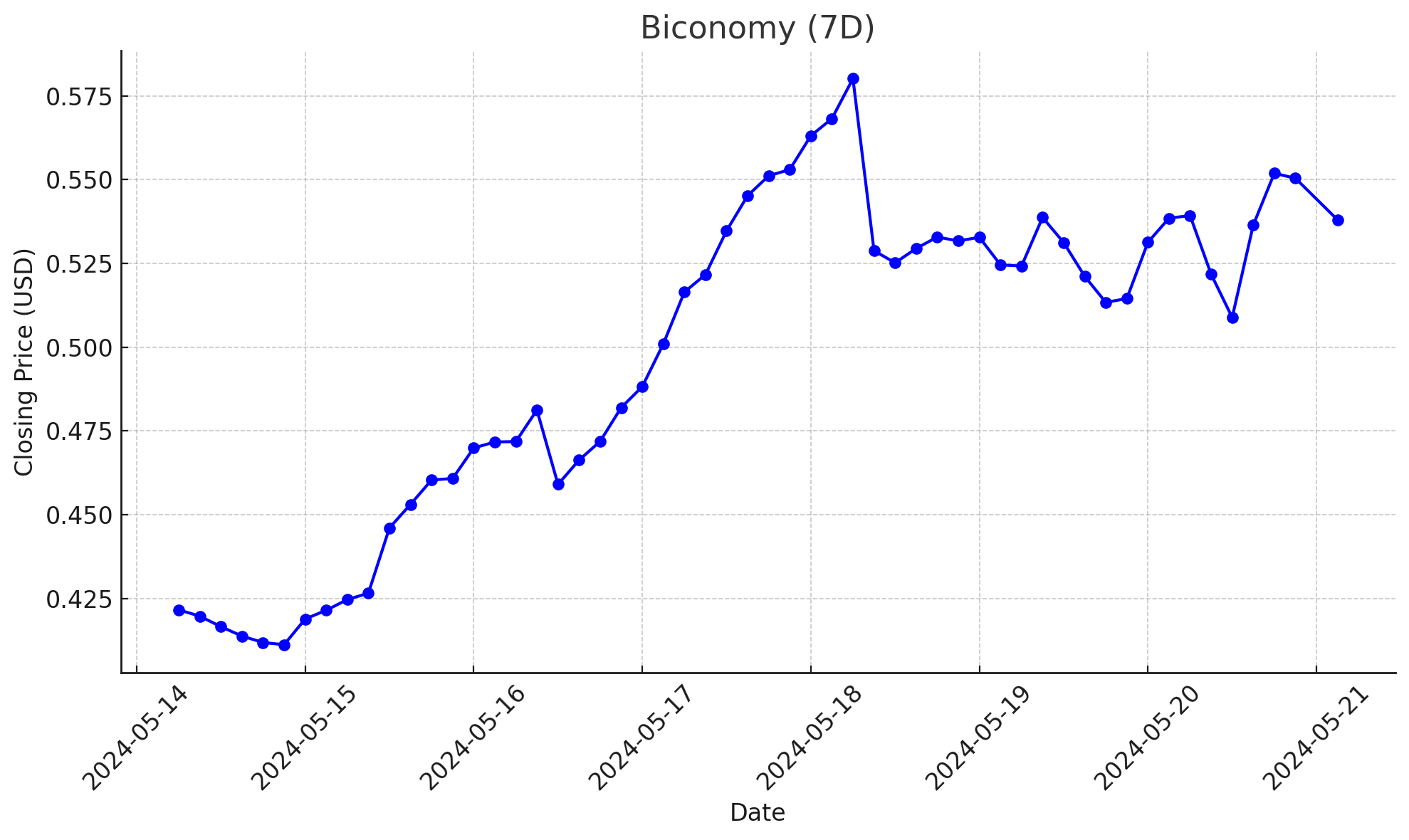

- Biconomy (BICO) had a strong week, with its price growing 35.40%. The smart contract platform now has a market cap of $418.13 million. Price presumably grew due to a couple of announcements. First, AlfaFrens, a SocialFi app that allows users to pay for gas using other tokens through Biconomy’s account abstraction technology, saw over 500,000 transactions in three weeks. This is the biggest use case to date of paying gas in any token across all of web3. And second, Dexter Exchange integrated Biconomy, allowing their users to take advantage of Account Abstraction for more efficiency and flexibility.

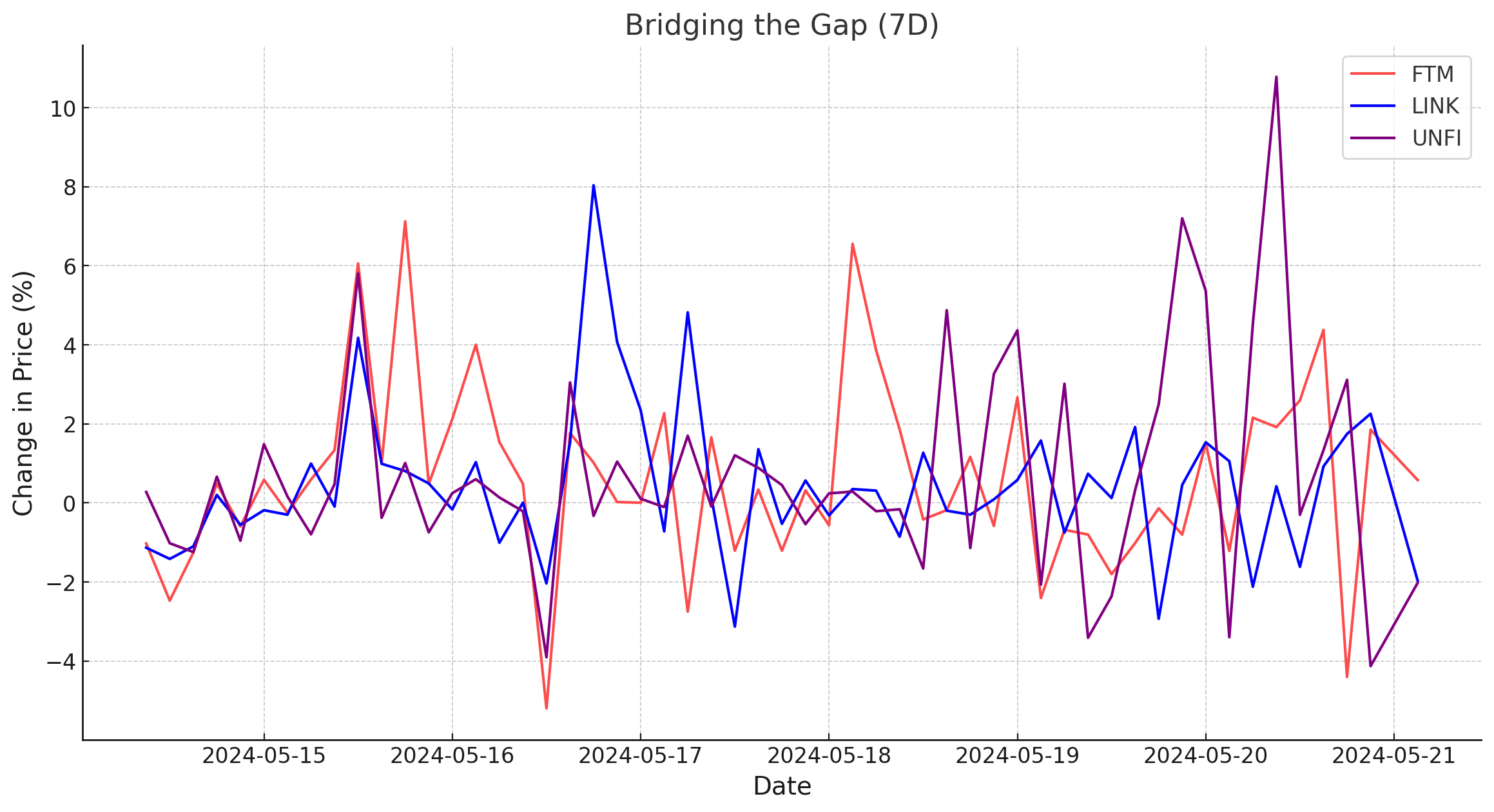

Bridging the Gap

- Unifi Protocol DAO (UNFI) grew by 30.33%, reaching a market cap of $34.44 million. The project, which aims to use blockchain to modernise the financial world, incentivises users to engage across multiple blockchains using bridging. Its price gains indicate continued positive sentiment and investor interest in bridging networks.

- Chainlink (LINK) grew by 28.47%. Now at a market cap of over $10 billion, the price of LINK took off, likely due to the announcement that the Depository Trust & Clearing Corporation (DTCC) successfully completed its Smart NAV pilot. Using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), the DTCC was able to transform and transmit price and rate data across multiple blockchain networks.

- Fantom (FTM) rose by 28.38%, taking it to a market cap of $2.40 billion. Big announcements have likely driven the price this week, with the long-anticipated Sonic upgrade promising technology improvements and better scalability without needing a hard fork. The upgrade allows users to complete bidirectional swaps between Fantom and Sonic using a bridge.

In Other News

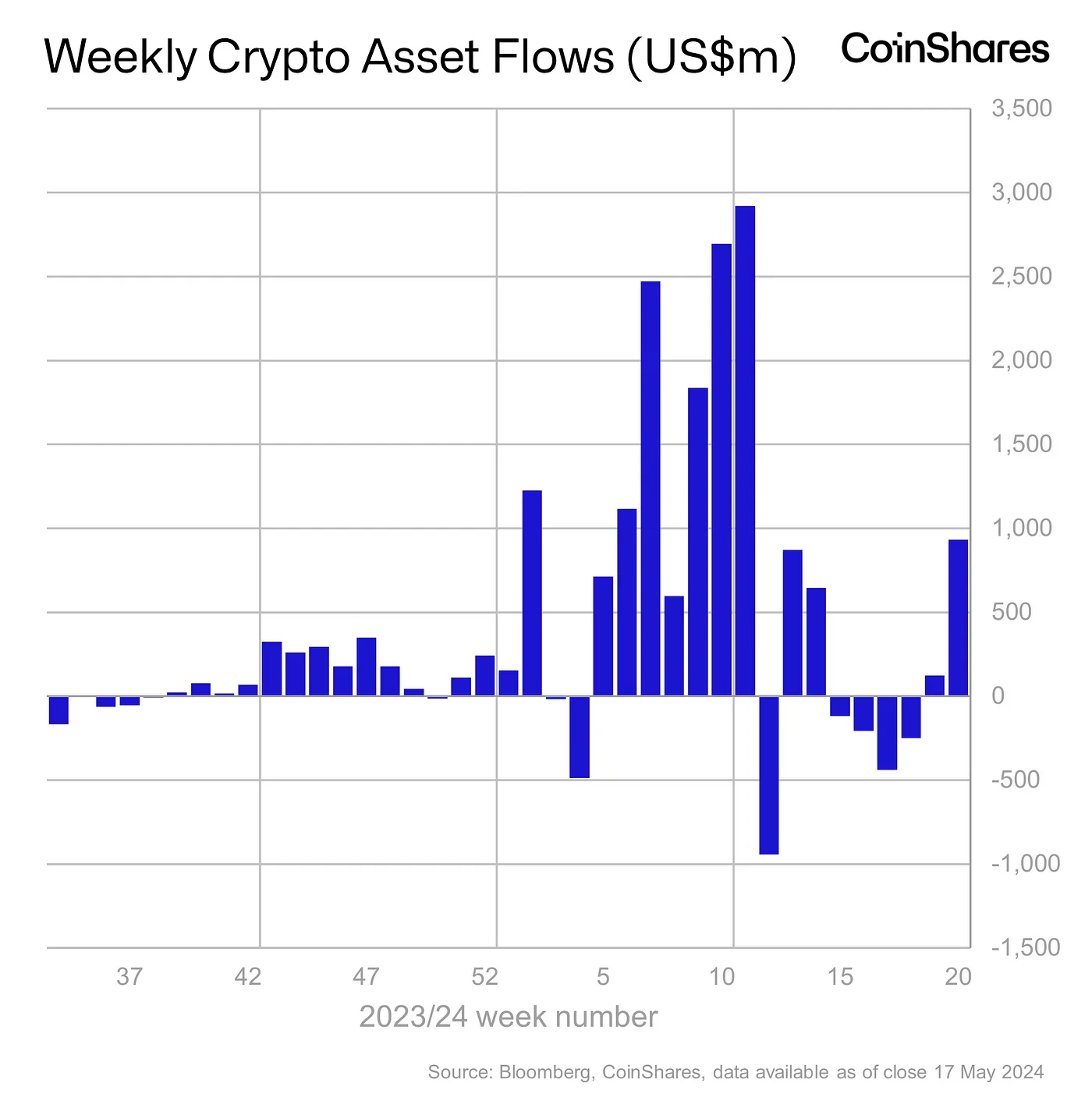

Net inflows continued this week, reaching US$932 million following the cooling CPI and employment reports. The three trading days following the CPI report saw 89% of the inflows. This provides further confirmation that bitcoin’s price movements are again becoming correlated with interest rate expectations. Grayscale’s Bitcoin Trust (GBTC) had another successful week, with only one day of outflows totalling US$50.9 million on Tuesday, 14 May.

A bearish outlook continues in Ethereum spot-based ETFs as investors continue to await SEC approval. Further outflows of US$23 million continued this week.

- Morgan Stanley has gained exposure to bitcoin. Its first-quarter disclosures revealed that the Wall Street giant bought US$269.9 million worth of GBTC. This makes Morgan Stanley one of the largest institutional holders of GBTC. Growing institutional investment in bitcoin ETFs indicates a shift that’s been building in the crypto markets. Both growing client demand and general warming towards crypto demonstrate legacy institutions are starting to see the value of cryptocurrency.

- The Chief Investment Officer of the Houston Firefighters Relief and Retirement Fund, Ajit Singh, has joined the Proof of Workforce Foundation’s Board of Directors. The Houston Firefighters Relief and Retirement Fund was the first in the USA to add bitcoin to its balance sheet in 2021. His appointment aims to educate organisations on bitcoin adoption. He noted in his statement that “Bitcoin was created for everyday workers, with its greatest attributes discovered through meaningful learning”.

- Another crypto bill is before the House of Representatives in the US this week. The Financial Innovation and Technology for the 21st Century Act (Fit21) seeks to promote the Commodity Futures Trading Commission (CFTC) to become the major crypto regulator. Passage of the legislation would also see the CFTC carve out the specific areas of crypto that will be overseen by the Securities and Exchange Commission (SEC). If passed, it could place further pressure on President Joe Biden to adopt a more accommodative stance on crypto, following his promise to veto a resolution to overturn Staff Accounting Bulletin (SAB) 121.

Regulatory

Following passage through the House of Representatives last week, the US Senate has passed the resolution seeking to overturn SAB 121. Industry and grassroots concern has grown since the bulletin was first published in 2022. The policy change, enacted through the bulletin, requires firms to record customer crypto holdings as liabilities on their balance sheets. Policymakers remain concerned about the way the bulletin was used to enact major policy changes, while industry professionals and public figures (Mark Cuban is the latest to weigh in) are concerned that it’s slowing crypto innovation and adoption in the US. President Biden has around ten days to veto the bill or sign it off.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.