Market Highlights

- Markets rallied following rumours that the SEC would approve spot Ethereum ETFs. Whale activity across bitcoin and altcoins is also fuelling gains.

- On Thursday, the SEC approved spot Ethereum ETFs, boosting trade volume amongst exchanges and most cryptocurrencies.

- FIT21, the bill seeking to establish a regulatory framework for crypto in the US, has passed the House of Representatives with bipartisan support.

- Former President Donald Trump has said, if elected, he’ll grant clemency to Silk Road creator Ross Ulbricht and stop “Joe Biden’s crusade to crush crypto”.

Bitcoin (BTC)

Rumours that the Securities and Exchange Commission (SEC) would unexpectedly approve spot Ethereum ETFs drove upwards price movement across crypto markets to start the week. A retrace from these gains occurred for many currencies to finish the week, including bitcoin.

Bitcoin started the week strong, rallying around 8% on Monday, 20 May, before retracing to US$68,569. This was a pattern seen across other cryptocurrencies throughout the week.

It was a quiet week for macroeconomic data. This, coupled with Ethereum’s performance dominating the markets, is presumably why bitcoin’s price may have retraced and hovered sideways throughout the second half of the week. In the US, unemployment claims came in slightly better than expected at 215,000 — 5,000 fewer than the forecast. Both the flash manufacturing purchasing managers index (PMI) and the flash services PMI came in better than forecast at 50.9 and 54.8, respectively. The composite output index, which combines manufacturing and services, grew at the fastest rate since April 2022. The May release also marks the sixteenth consecutive month of growth, potentially indicating that inflation may still take some time to slow.

Bitcoin is currently trading at US$69,623, a decrease of 0.2% on the week.

Ethereum (ETH)

All eyes were on Ethereum this week as the SEC approved spot Ethereum ETFs on Thursday, 23 May. Price rallied ahead of the news, with Ethereum gaining almost 20% on Monday. The gains mark a record in net taker volume on Binance as investors going long on the cryptocurrency created the biggest green candle since Ethereum launched in 2015.

Net taker volume spiked around the SEC’s approval of spot Ethereum ETFs. Source: @JA_Maartun on X

Ethereum is now trading at US$3,882, posting 7.5% gains for the week.

Ethereum Co-Founder and Consensys CEO Joe Lubin weighed in following the approval. He stated that, given recent price action and political developments surrounding cryptocurrency, price is now driven by politics. Also mentioning that the approval and the corresponding price action is a “game changer,” the Consensys team maintain their view that the SEC’s ad hoc approach to approvals in crypto is unlike their approach to other markets and assets.

Much like the early weeks after spot bitcoin ETFs received their final approvals, financial institutions and investors will likely be watching fund flows data to analyse the level of uptake. The SEC still needs to approve registration statements for VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise before these firms can offer Ethereum ETFs.

Exclusive Research Report

Explore the future of blockchain and AI in our exclusive Crypto x AI Research Report. Dive into this rapidly evolving sector to discover emerging projects, strategic insights, and projects to watch, for beginner and expert investors alike.

Don't miss out on this opportunity to stay ahead in the crypto market. Access the full report now for in-depth analysis and actionable insights.

Altcoins

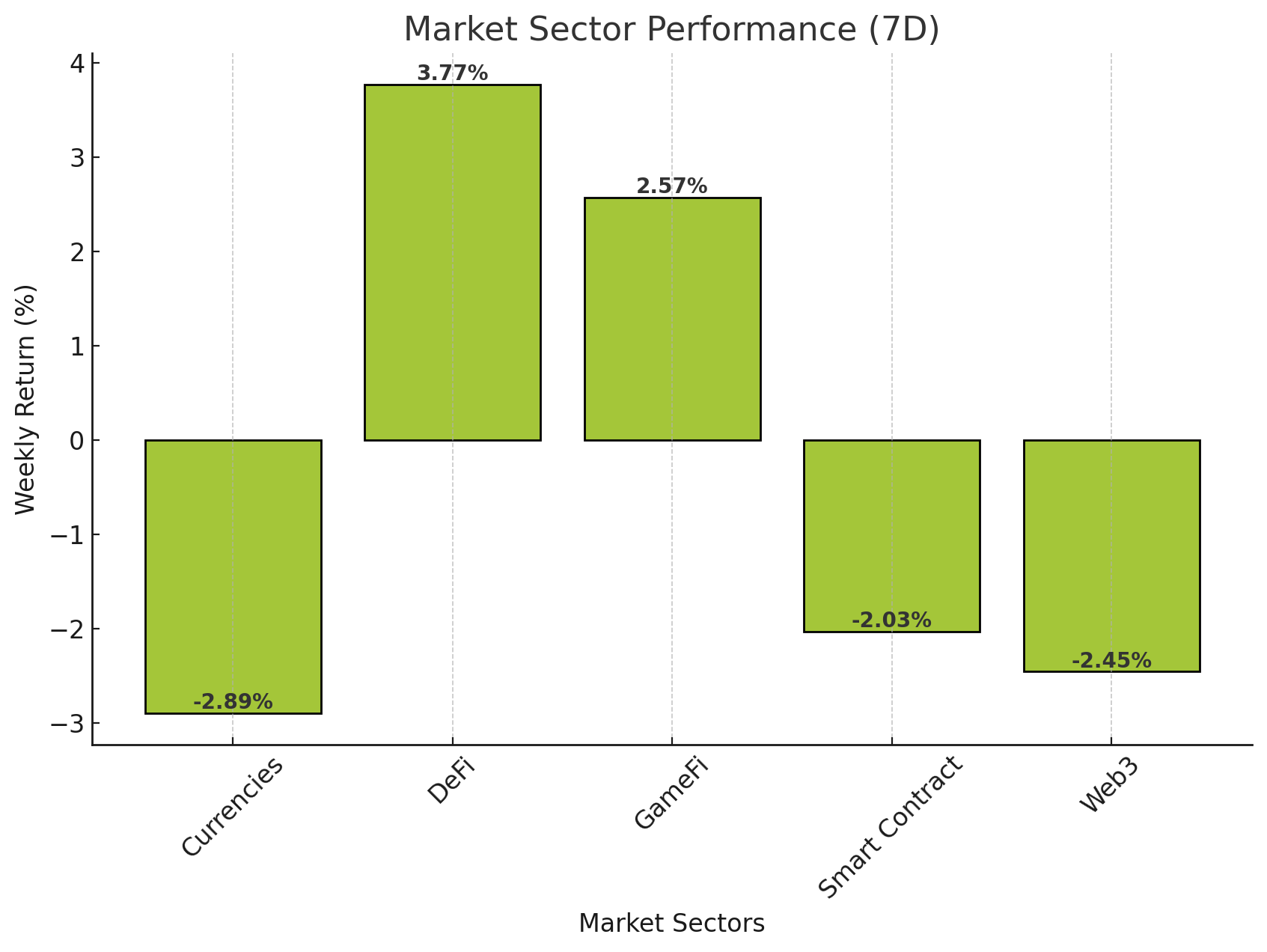

Market sector performance was mixed this week, with DeFi leading the way with a gain of 3.77%. GameFi followed with an increase of 2.57%. However, Currencies, Smart Contract Platforms, and Web3 sectors experienced declines of 2.89%, 2.03%, and 2.45%, respectively.

What’s In A Name?

- Ethereum Name Service (ENS) grew by 79.5% this week, reaching a market cap of $815.4 million. The digitisation network allows users to create a web3 username for use across multiple chains to store addresses and send and receive cryptocurrencies. The strong price action is presumably due to continued interest in investors having the tools to transact more efficiently between different blockchains. Ethereum Founder Vitalik Buterin also said earlier in the week that ENS is the most important non-financial application in the market.

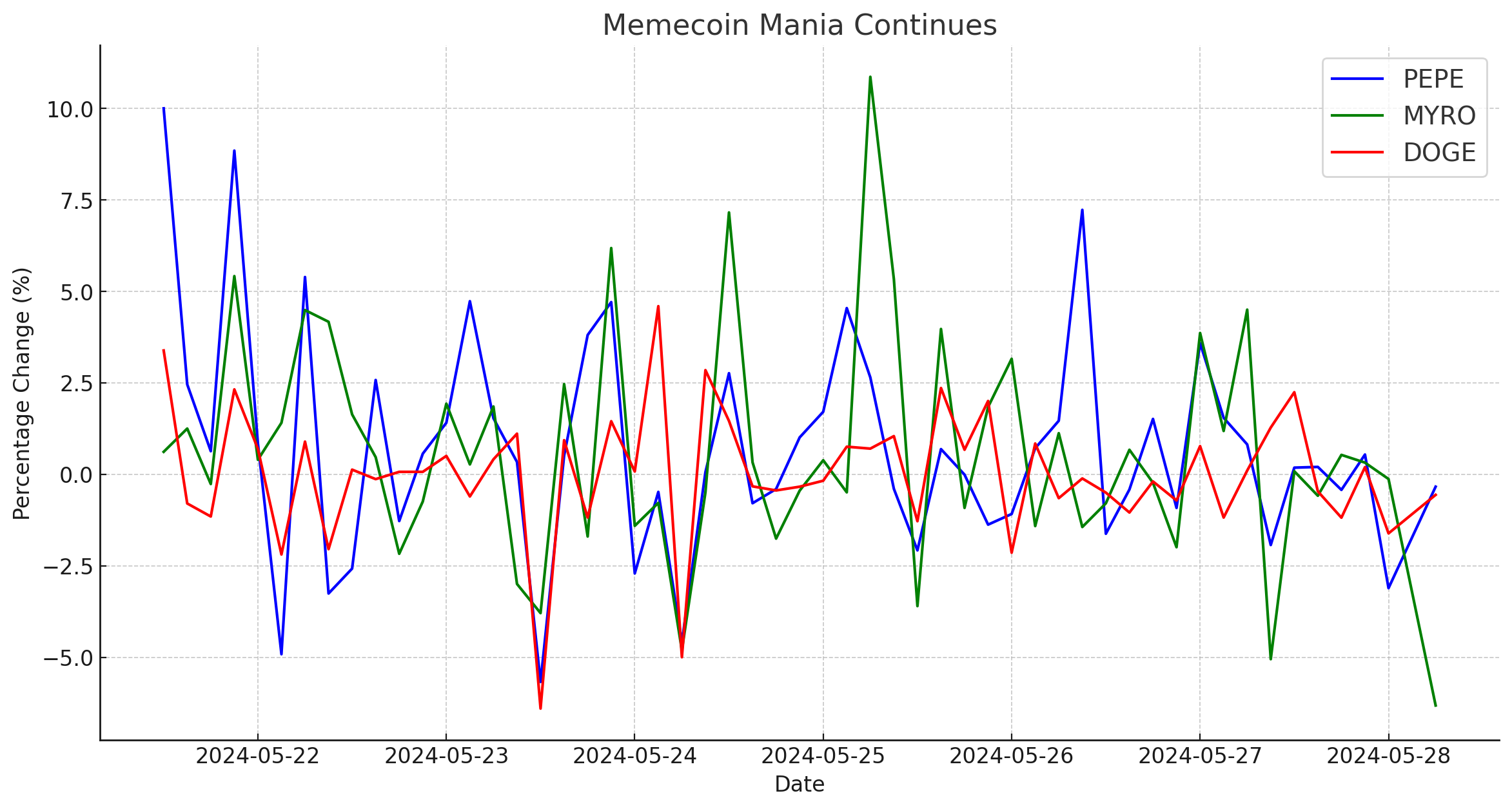

Memecoin Mania Continues

- Pepe (PEPE) saw gains of 74.4%, taking the meme coin’s market cap to $6.7 billion. The price of the token, featuring the face of the internet’s best-known frog, has risen 100% in the last 30 days. The gains are likely due to consecutive weeks of gains for the meme coin that coincided with increased mentions of PEPE on social media.

- Myro (MYRO) grew by 52.3%. It now has a market cap of $258.5 million. The meme coin that is stored and traded on the Solana blockchain is named after Solana Co-Founder Raj Gokal’s dog. MYRO is aiming to change meme coins through community-driven initiatives and accessibility. The price surge follows strong technical price action that indicated a move to the upside.

- Dogecoin (DOGE) had modest gains of 5.5%, taking its market cap to $24.4 billion. Kabosu, the Japanese shiba inu who was the face of the memecoin, passed away on 24 May following a battle with leukaemia. DOGE retraced its gains for the day when the news broke, finding support at the key level of 0.155, which also coincides with the 50-day moving average. Price consolidated sideways in the days following Kabosu’s death. The iconic photo of Kaobosu went viral in 2010 and became the face of Dogecoin three years later.

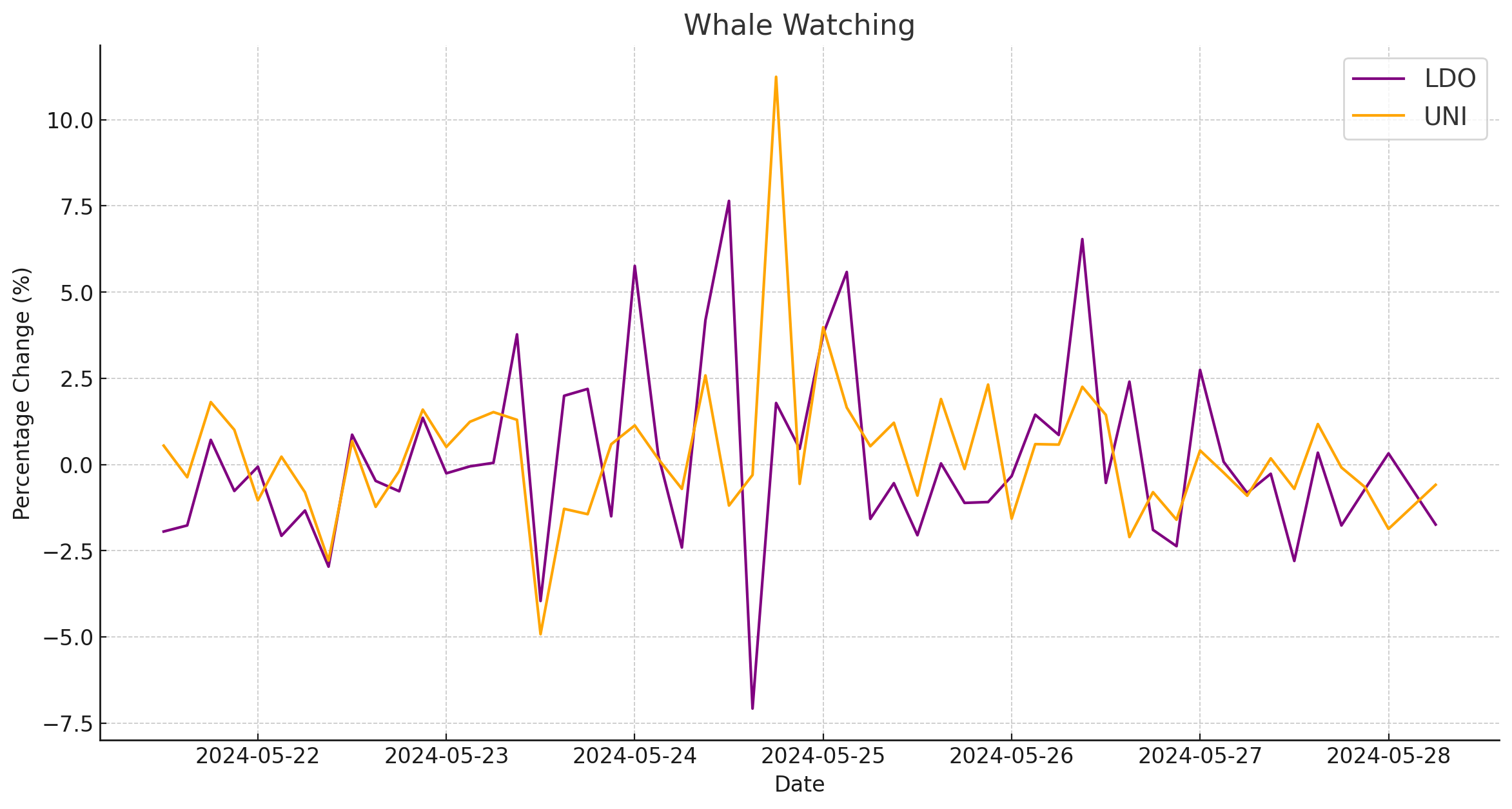

Whale Watching

- Lido DAO (LDO) grew by 46.5%, taking its market cap to $2.3 trillion. The decentralised finance (DeFi) network provides users with liquid staking for digital tokens. Recent gains are likely due to strong buying action, including LDO being the second-most purchased altcoin by whales. One whale purchased US$19.8 million worth of altcoins, including US$7.5 million worth of LDO.

- Uniswap (UNI) gained 45.9%, presumably driven by whale activity in key altcoins. Its market cap is $8.4 billion at the time of writing. Trading volume on the decentralised exchange surged following the SEC’s approval of spot Ethereum ETFs. Uniswap comprised almost half the volume (48.9%), equating to US$5.5 billion. This week, on-chain voting will occur for a new fee mechanism that will see autonomous fee collection and distribution to token holders who stake or delegate their tokens. The SEC has been investigating Uniswap Labs since 2021 after alleging that it violated securities laws.

Get Gaming

- RFOX (RFOX) grew by 45.9%, taking its market cap to $10.6 million. The VR-first, AI-enabled metaverse allows users to create new experiences in the metaverse. The gains followed significant declines in March and a period of consolidation from April to May. Recent growth is potentially due to growing interest in the metaverse builder and the ability to stake RFOX tokens with an APY of 25%.

In Other News

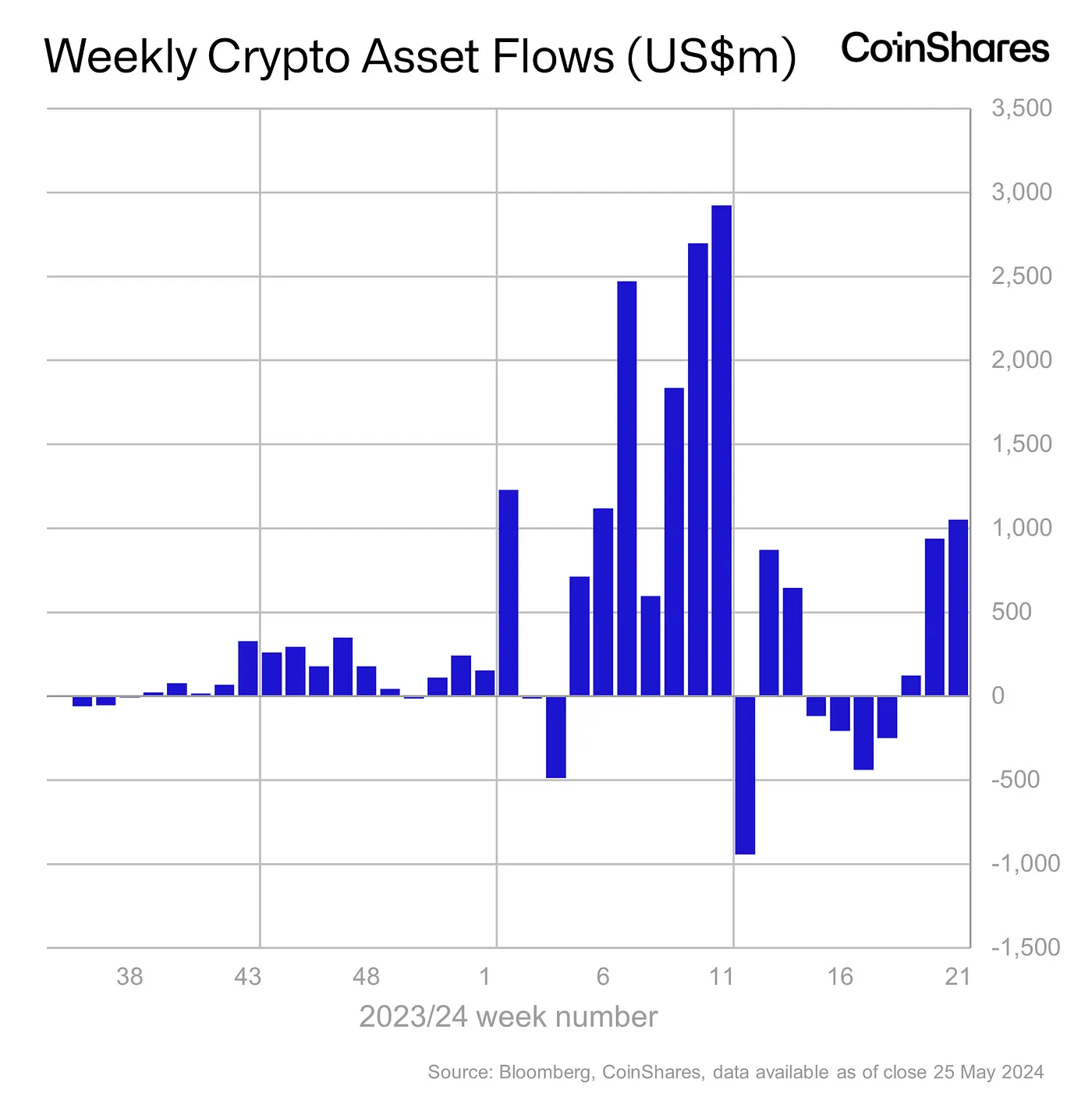

Digital asset investment products had inflows of US$1.1 billion, marking the third consecutive week of inflows. This takes the cumulative flows for the year to date to US$14.9 billion. Bitcoin exchange-traded products saw the majority of inflows, totalling $US1 billion. Inflows for Ethereum products came in at US$36 million — the highest since March, presumably as a result of the SEC’s approval of spot Ethereum ETFs.

According to the on-chain and market analytics tool CryptoQuant, whale appetite for bitcoin has grown since it reached its all-time high in March. At the start of May, the accumulation rate for whales was 4.3%. It has since returned to 5.5%, indicating buying by whales could be back on the rise. A whale is a holder of between 1,000 BTC and 10,000 BTC, excluding those held by mining firms or crypto exchanges.

- The money laundering case against Binance executive Tigran Gambaryan has been adjourned to 20 June 2024 after the exchange’s Head of Financial Crime Compliance fainted in a Nigerian courtroom. He has been hospitalised in Abuja, Nigeria. Earlier this month, Gambaryan was denied bail after being jailed in Nigeria’s Kuje Prison. He pleaded not guilty to money laundering charges in April. A letter from Gambaryan’s lawyers states that the former Binance executive is ill and being given “intravenous treatment for malaria.”

- Crypto continued to be a focus in the 2024 Presidential race this week as Donald Trump became the first candidate to endorse clemency for Ross Ulbricht. Ulbricht has served 11 years of his life sentence for building Silk Road, a dark web marketplace. Speaking at a Libertarian Party convention, former President Trump continued, saying that he would put an end to “Joe Biden’s crusade to crush crypto” by ensuring people have a right to self-custody their assets and stop the development of a Central Bank Digital Currency (CBDC).

Regulatory

- The Financial Innovation and Technology for the 21st Century Act (FIT21) has passed through the US House of Representatives with bipartisan support in a 279-136 vote. The bipartisan support for FIT21 indicates the continuing shift towards crypto on Capitol Hill. FIT21 creates a federal framework in the US for regulating digital assets. Notably, it establishes clear jurisdiction between the Commodity Futures Trading Commission (CFTC) and the SEC. It also enables issuers to self-certify assets as digital commodities. SEC Chair Gary Gensler and President Joe Biden spoke out against the bill, stating that it doesn’t offer sufficient investor protections.

- The final decision on overturning SAB 121 remains uncertain. Congress didn’t send House Joint Resolution 109 to the White House until 22 May. This means that President Joe Biden has until Monday, June 3, to veto the resolution.

New Asset Listings

Buy and sell these crypto assets, or swap them directly with hundreds of other popular crypto assets through your personal crypto broker. To see our full list of available crypto assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.