Market Highlights

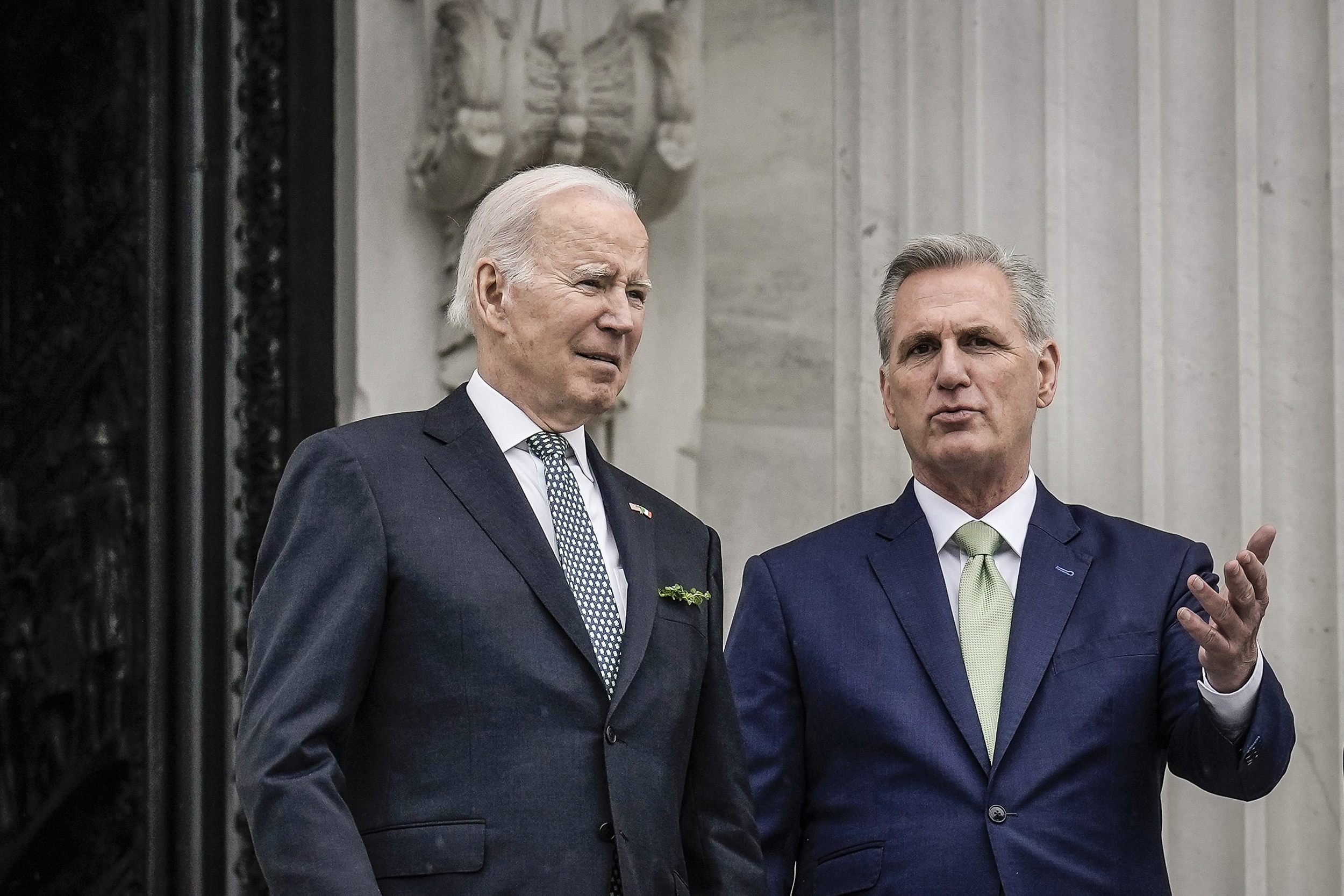

- U.S. President Joe Biden and Republican House speaker Kevin McCarthy reach tentative agreement to suspend debt ceiling, sending BTC above US$28,000 for the first time in three weeks.

- On Tuesday, the International Organisation of Securities Commissions (IOSCO) released a consultation report outlining policy recommendations for global crypto regulation.

- Crypto consortium Fahrenheit has emerged as the winning bidder in the acquisition of the insolvent lender Celsius Network and will assume control over Celsius' institutional loan portfolio, staked cryptocurrency assets, and more.

Price Movements

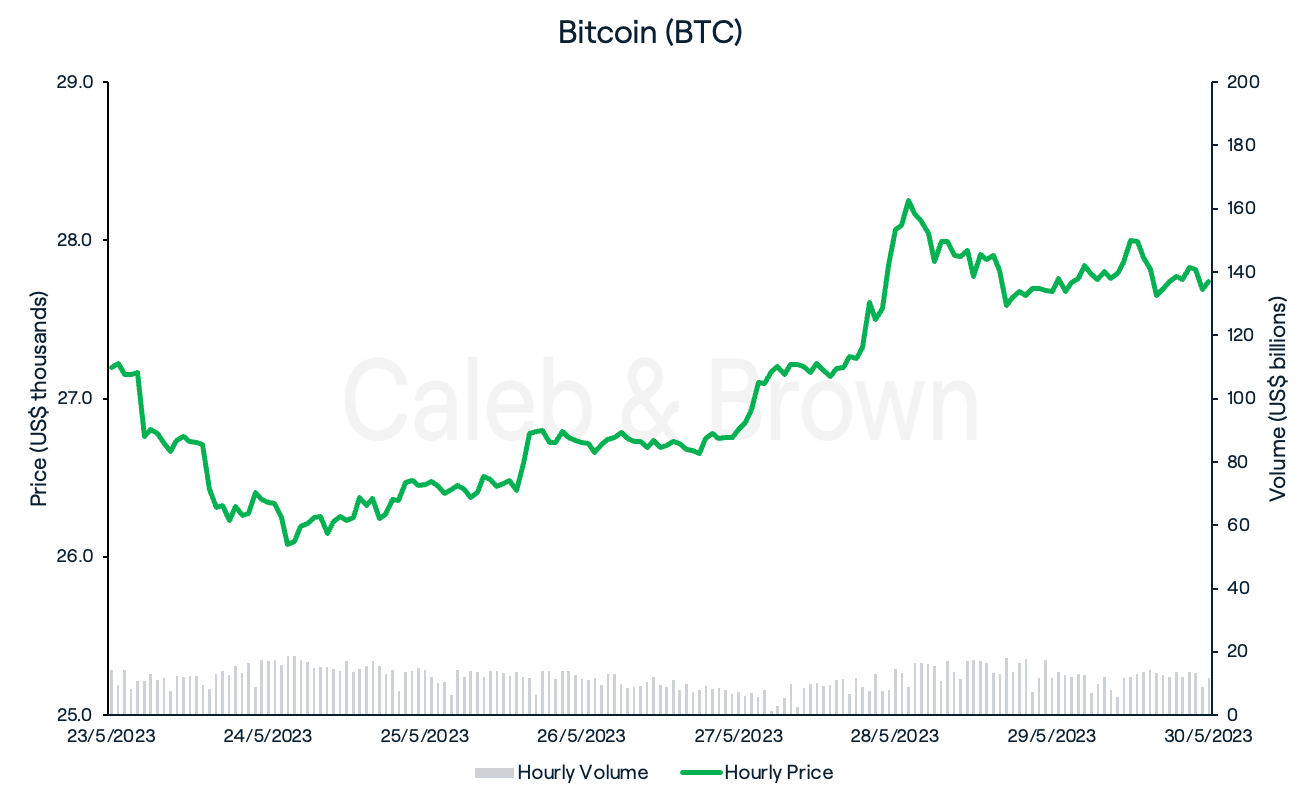

Bitcoin

After three weeks of ranging between US$26,000 and US$27,500, Bitcoin (BTC) has finally seen some life, hitting a low of US$25,872 on Thursday before surging past US$28,000 over the weekend for the first time in three weeks. BTC ended the week at US$27,739, adding 2.0% over the last seven days.

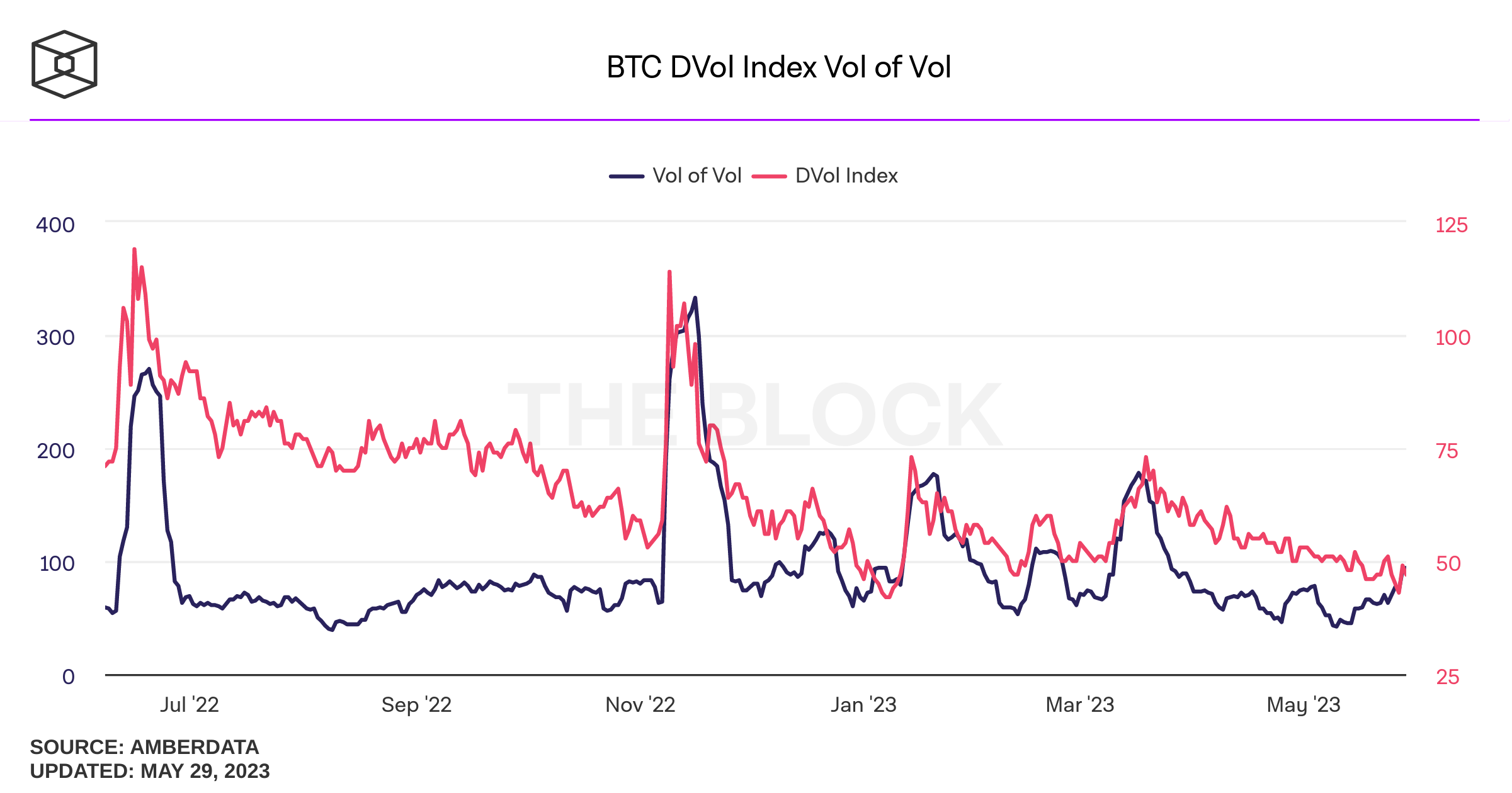

The recent ranging price action correlates with BTC’s current exchange balance sitting at 5-year lows, as well as BTC’s volatility index sitting near yearly lows.

The surge to US$28,000 followed the news of U.S. President Joe Biden and Republican House speaker Kevin McCarthy reaching a tentative agreement On Sunday to suspend the debt limit until January 2025. The agreement will prevent the U.S. government from defaulting on its own debt, as well as exclude mining tax on crypto, however it must still pass a vote in Congress. President Biden “strongly urged both chambers to pass the agreement right away.”

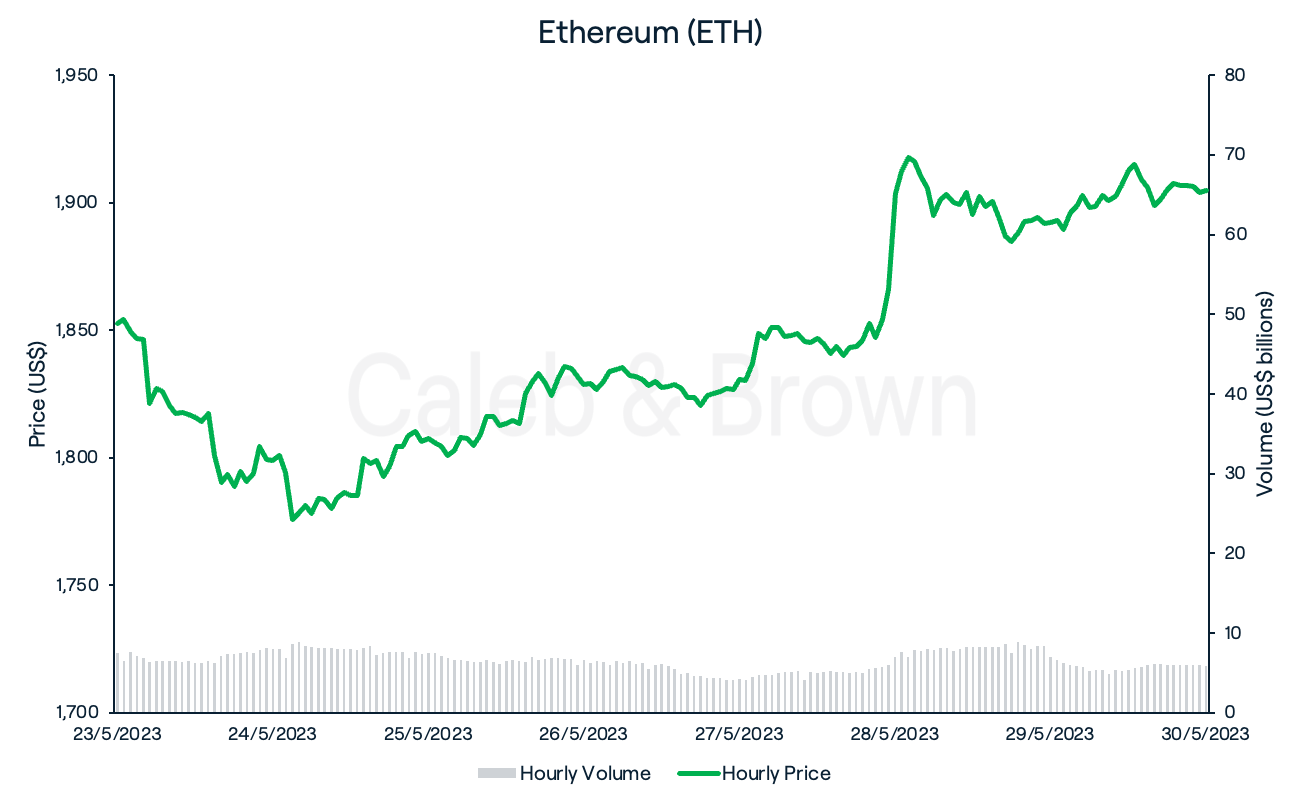

Ethereum

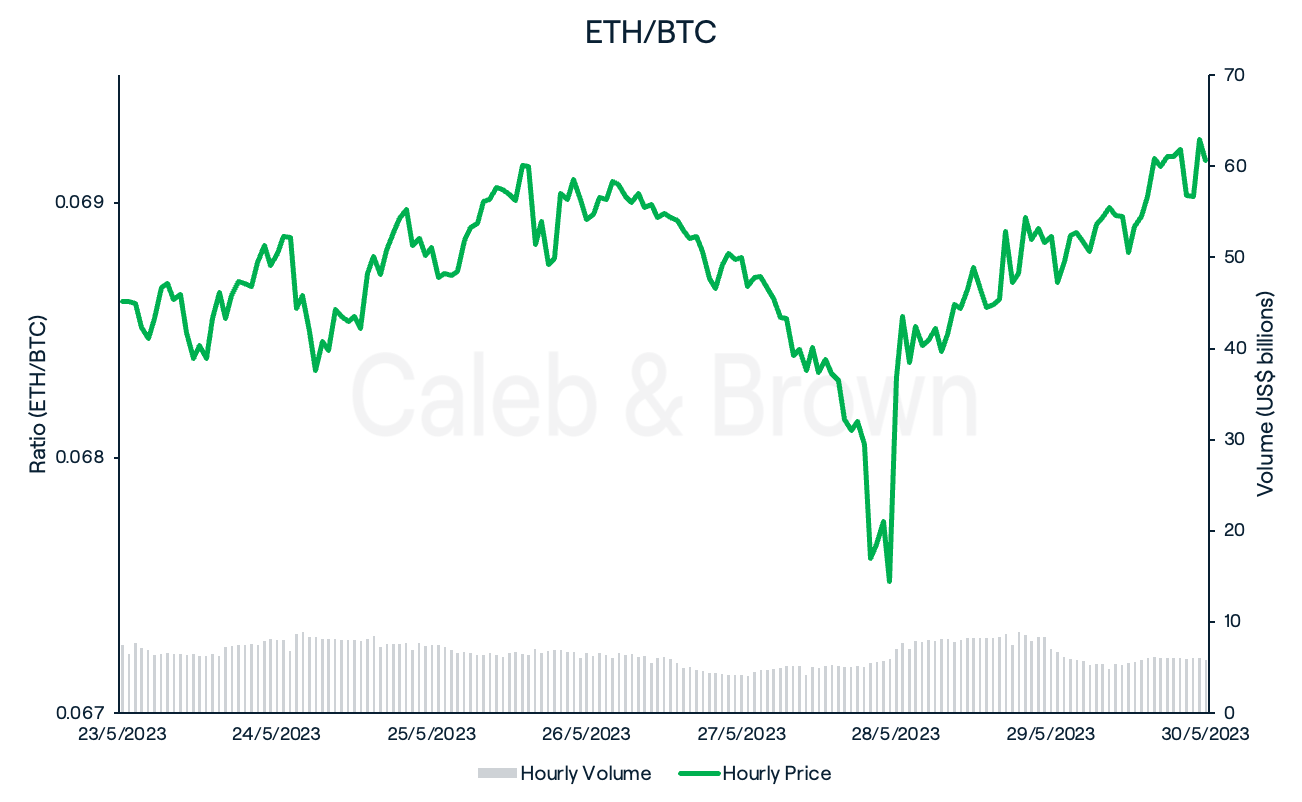

Ethereum (ETH) followed in BTC’s footsteps this week as ETH clawed its way back above US$1,900 for the first time three weeks, rallying nearly 10.0% from its low of US$1,761 on Thursday. ETH closed the week at US$1,904, up 2.8% week-on-week.

This has seen the ETH/BTC ratio increase another 0.9% this week, steadily increasing over the last month to regain 6.9% relative market share against BTC in May.

Altcoins

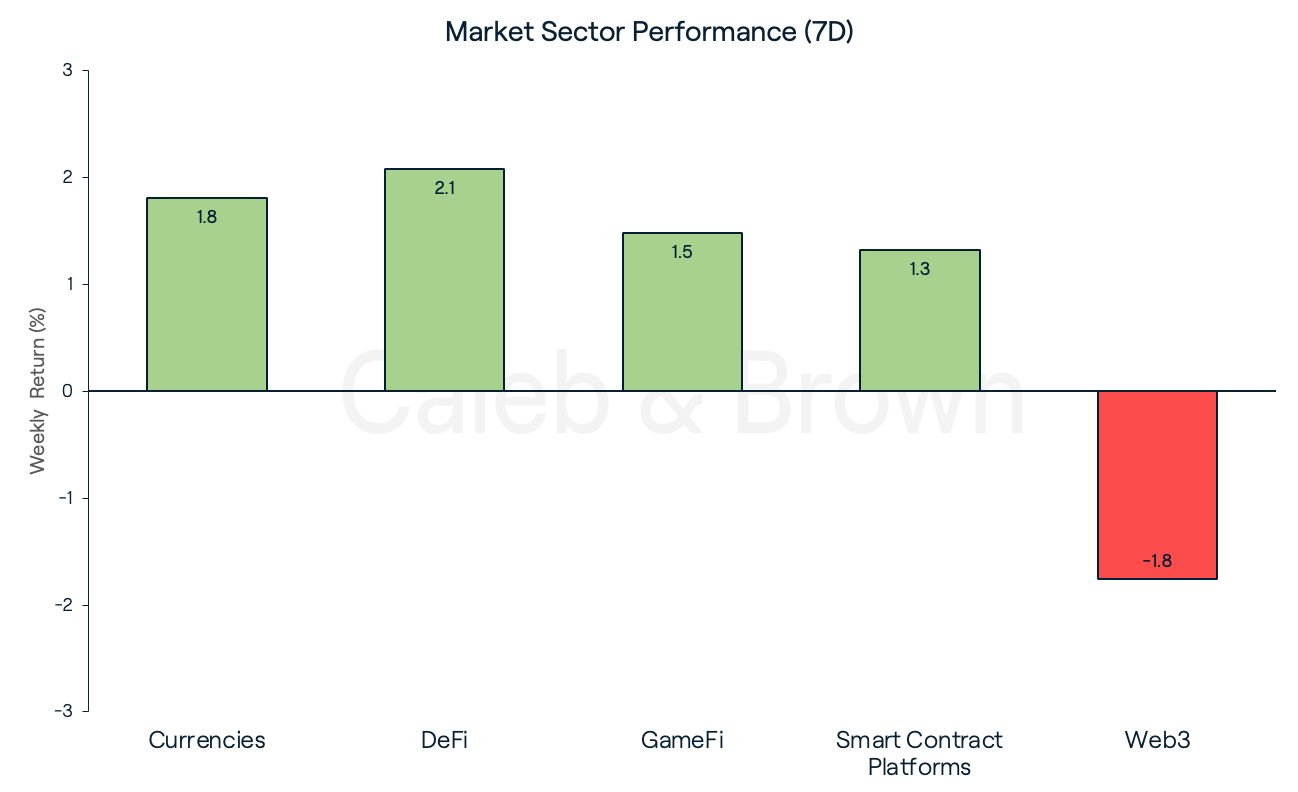

Market sectors were up across the board except for Web3 which saw a modest loss of 1.8% over the last seven days. DeFi and Currencies were the best performing sectors for the week, adding 2.1% and 1.8%, respectively. Overall, movements remained minimal for another relatively flat week of trading.

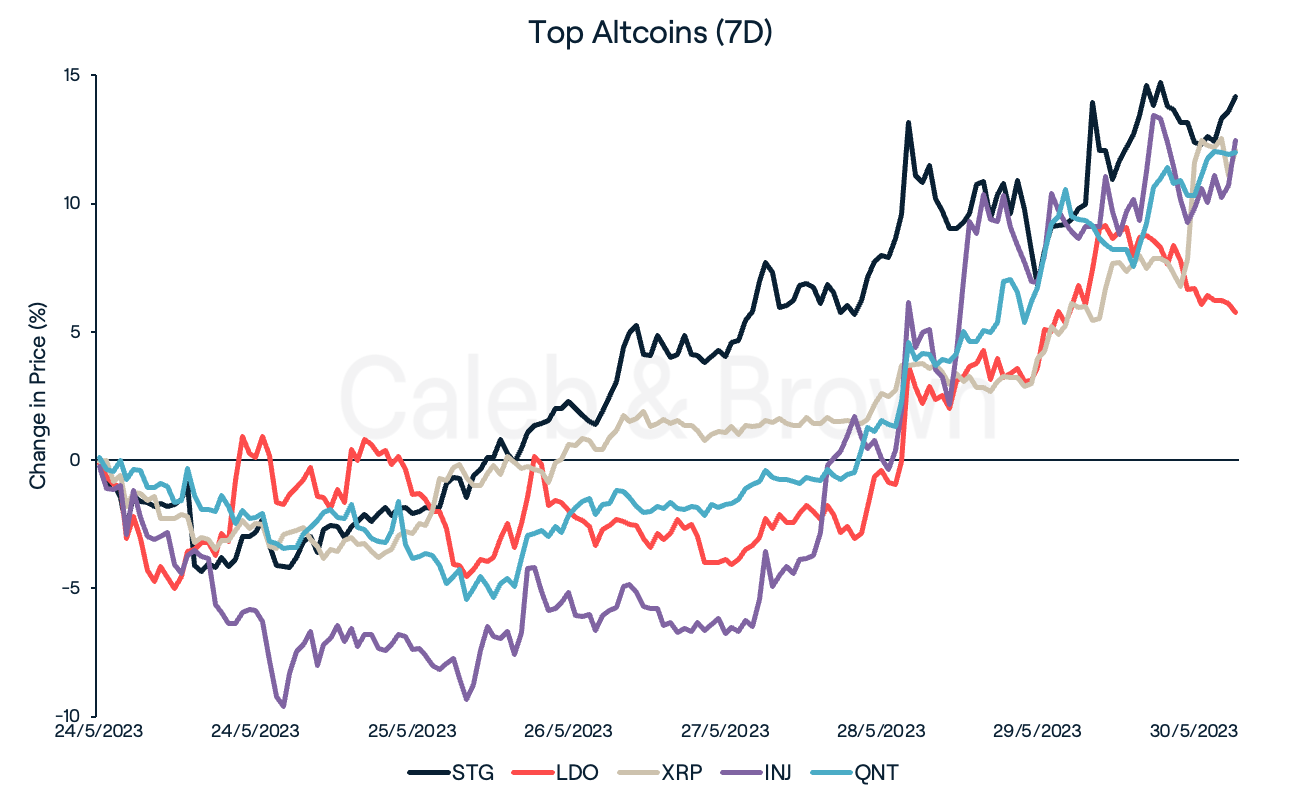

Leading the DeFi sector were Stargate (STG) and Lido DAO (LDO) which added 14.1% and 5.7%, respectively. STG recently added bridging support for meme token PepeCoin (PEPE) while LDO enjoyed the successful launch of its V2 upgrade which will add staked ETH withdrawal support. LDO also continues to benefit from the current liquid staking derivatives (LSD) narrative which gained momentum after Ethereum’s ‘Shapella’ upgrade last month.

XRP (XRP) increased 12.0% week-on-week after prominent XRP advocate and legal expert John Deaton offered commentary on XRP’s current price.

Layer-1 protocols Injective (INJ) and Quant (QNT) rallied 12.4% and 12.0%, respectively. INJ just launched its Avalon Upgrade which will improve on its DEX performance, scalability and user experience.

In Other News

Fahrenheit Wins Bid to Acquire Bankrupt Celsius' Assets

According to court documents published on Thursday, the successful bidder in the acquisition of bankrupt lending protocol, Celsius Network is the Crypto consortium, Fahrenheit. The consortium will assume control over Celsius' institutional loan portfolio, staked cryptocurrency assets, the company's Bitcoin mining division, and other investments linked to cryptocurrencies. As a component of the agreement, the newly established company will obtain a significant quantity of readily usable crypto, which is estimated to range from US$450-500 million.

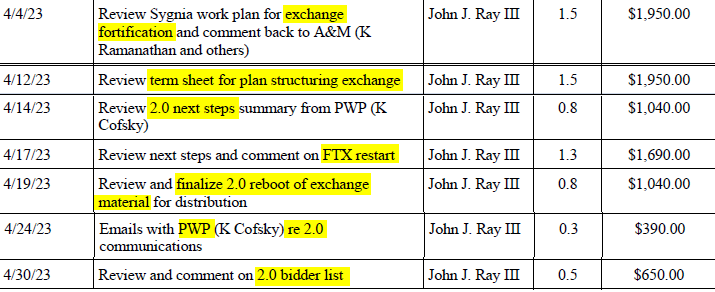

FTX 2.0?

In light of FTX’s most recent court filing, the potential revival of the bankrupt crypto exchange could be possible. The document emphasises that John Ray III, the newly appointed CEO has actively organised a series of meetings with creditors and debtors over the past month. These meetings have covered crucial subjects such as strategising the exchange's structure, examining plans for relaunching the platform, and completing the necessary materials to establish the rebooted crypto exchange, referred to as FTX 2.0. The filing suggests that FTX will participate in a bidding procedure moving forward.

Regulatory

IOSCO Release Report Outlining Policy Recommendations for Global Crypto Regulation

As part of the public consultation process, the International Organisation of Securities Commissions (IOSCO) has published a consultation report that presents policy recommendations for the global regulation of crypto. Comprising of regulators from various jurisdictions, IOSCO is a global policy forum responsible for overseeing 95% of the world's securities market. Last year, the organisation established a Fintech Task Force to develop its policy recommendations concerning cryptocurrencies.

The report introduces eighteen new recommendations that encompass six key areas, including addressing conflicts of interest arising from vertical integration, managing cross-border risks, facilitating regulatory cooperation, and combating market manipulation, insider trading, and fraud.

Recommended reading: The Metaverse Part 2: The Major Players

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F41LptApZojkbbUE3T3IMtp%2F5563cb6d4ec47a8115c2ea87af6c01ff%2FMarch_15__2023__9_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-05-31T03%3A09%3A33.888Z)