Market Highlights

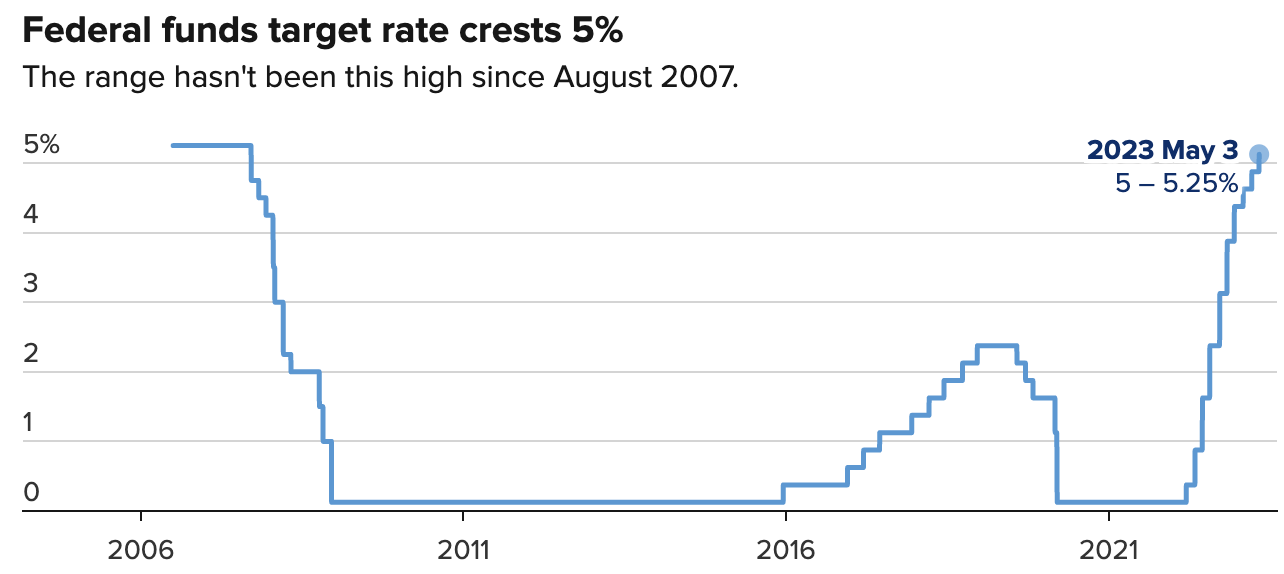

- The Federal Reserve announced its decision to increase interest rates by a further 25 basis points, bringing the interest rate range to 5% to 5.25%, its highest level in 16 years.

- A new layer-1 protocol Sui (SUI) launched its highly anticipated mainnet on Wednesday. The new protocol boasts of transactional throughput speeds of 10,871 to 297,000 TPS.

- The White House published a report on Tuesday, highlighting a suggested 30% excise tax targeted at crypto mining companies.

- Democratic presidential candidate Robert Kennedy Jr. suggests recent turmoil in the U.S. banking sector was fallout from a "war on crypto."

Price Movements

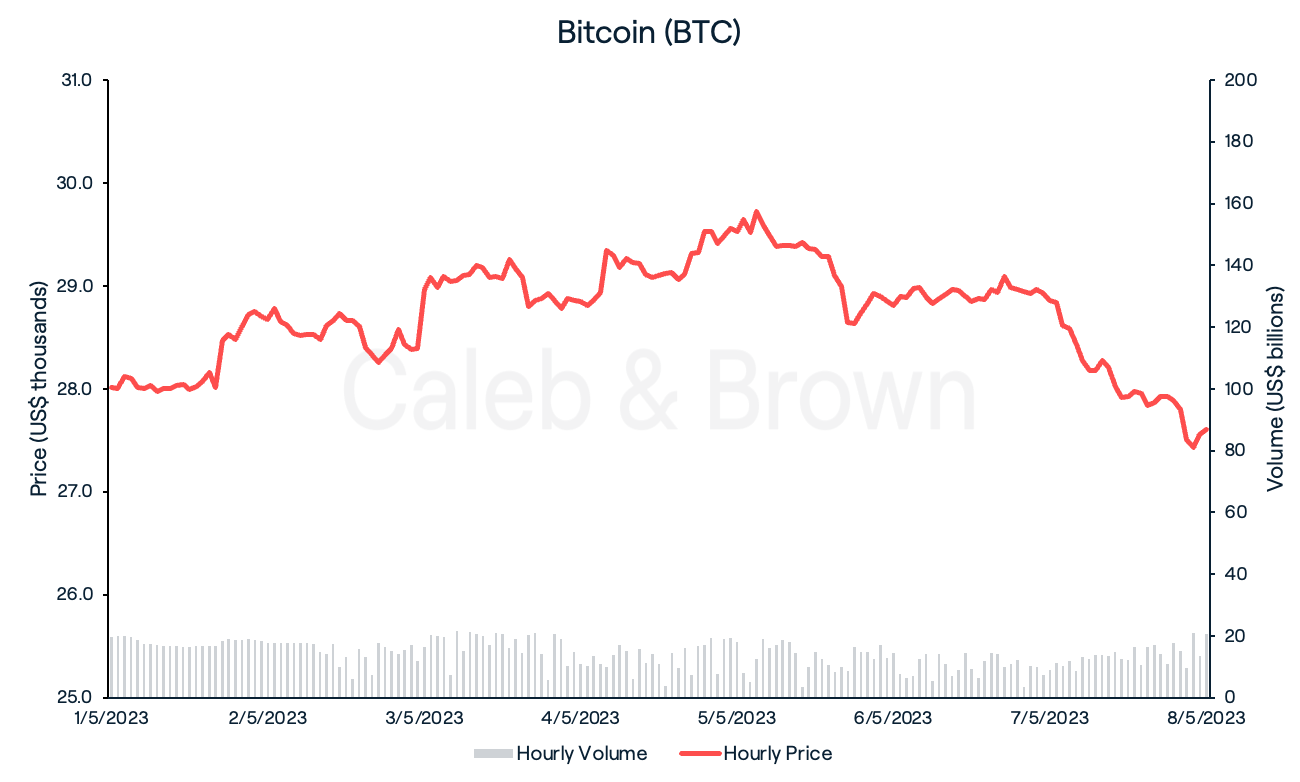

Bitcoin

After two weeks of volatile price movements the crypto space has cooled-off with the price growth of Bitcoin (BTC) slowing to effectively nothing. BTC slowly traded to a high of US$29,820 throughout the week until it took a sharp turn over the weekend. Due to the weekend selling pressure BTC closed the week at US$27,603, falling 1.4% over the last seven days.

The absence of market growth this week could be partly attributed to the Federal Reserve's (the Fed’s) decision to further increase interest rates by 25 basis-points on Wednesday. This marks the tenth consecutive increase since March last year, resulting in an interest rate range of 5% to 5.25%, its highest level since March 2007.

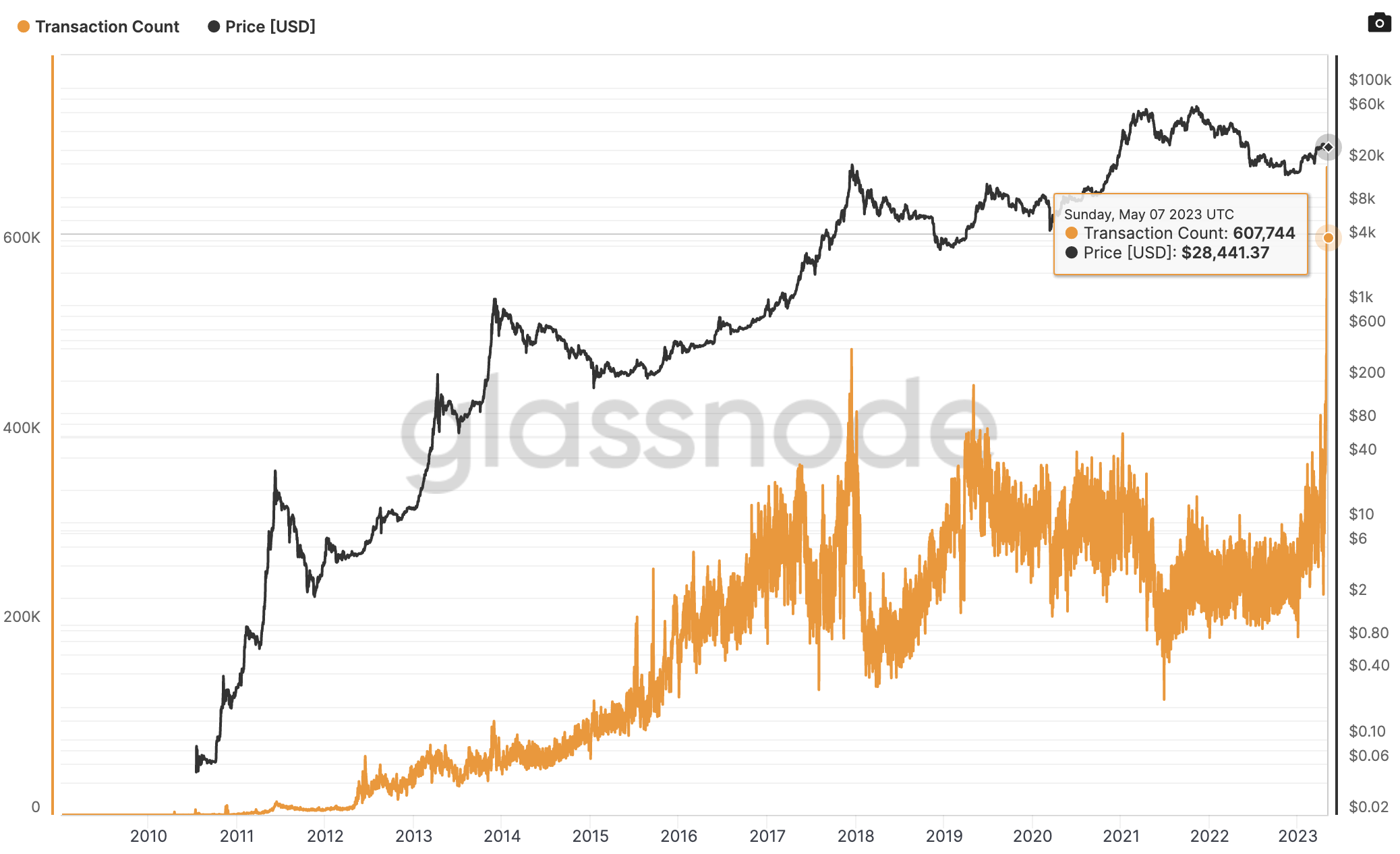

The Ordinals inscription trend has continued from last week as Ordinals cleared over 400,000 daily inscriptions on Sunday. This contributed to over 600,000 daily BTC transactions that same day, and generated over US$2.7 million in fees paid to miners, or 19.3% of the total fees generated since inception. With the successful launch of Ordinals on the Bitcoin network, new use cases have been unlocked to bring in liquidity, new users and developers which could help reach mass adoption through an improved user experience.

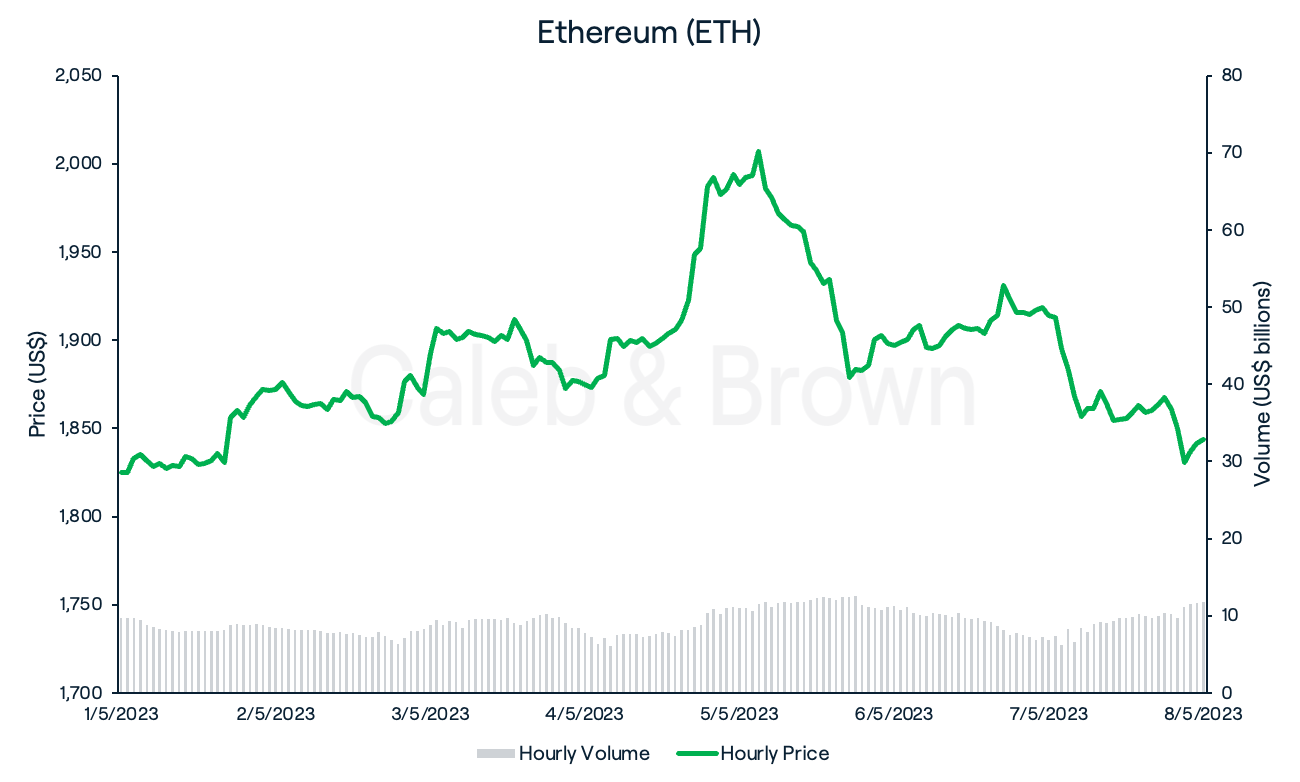

Ethereum

Ethereum (ETH) traded very similarly to BTC this week, hitting a high of US$2,019 on Friday night before selling off over the weekend. ETH held on to week-on-week gain of 1.0%, closing the week at US$1,843.

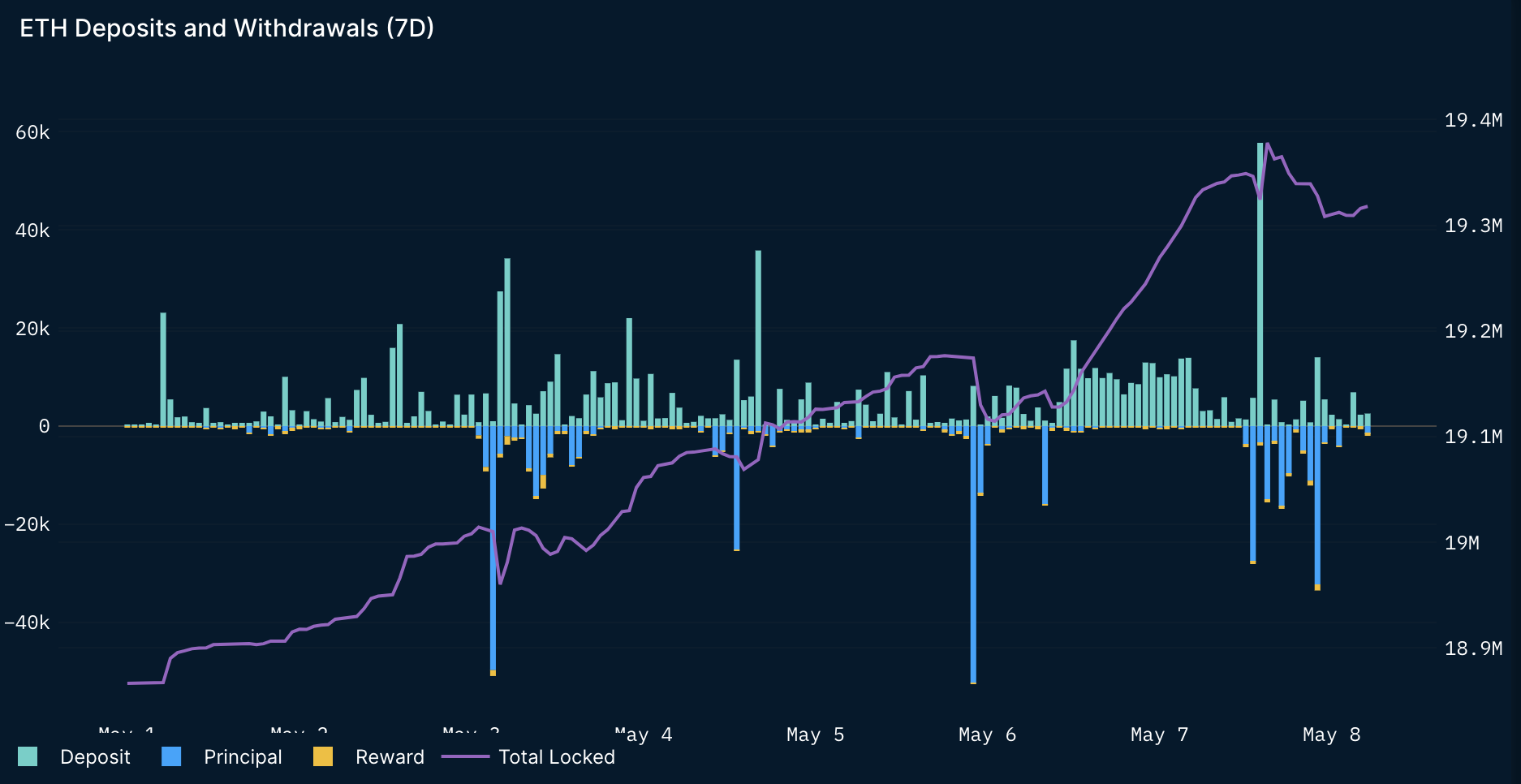

It has now been nearly a month since the Shapella upgrade went live which unlocked staked ETH withdrawals after over two years since staking was first introduced. While some investors were keen to get their ETH back, the net flow of ETH being staked flipped positive, meaning more investors are currently depositing their ETH rather than withdrawing it. This could signal a boost in investor confidence for the staking product.

Altcoins

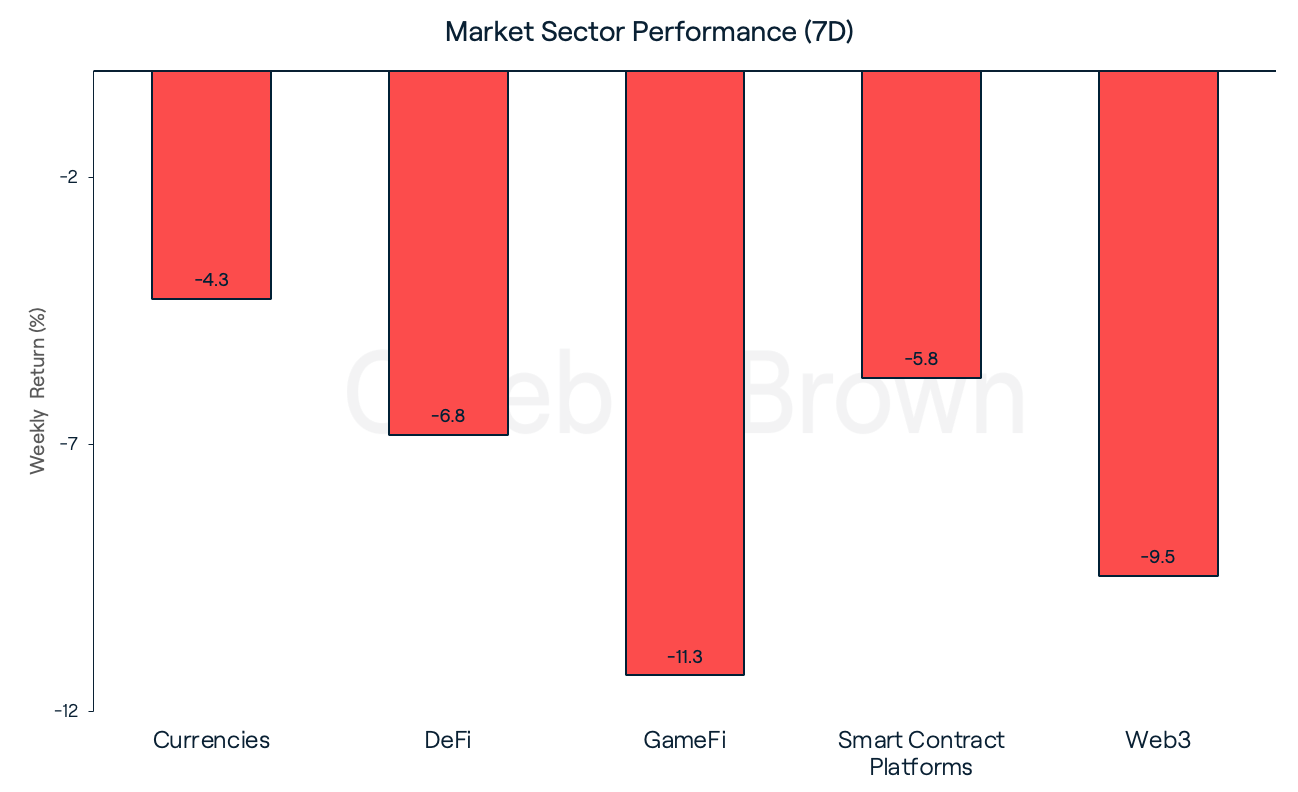

While BTC and ETH managed to hold on to gains this week the rest of the market bled with market sectors down across the board. Currencies held on the strongest losing 4.3% over the last seven days while GameFi suffered the biggest loss, shedding 11.3% week-on-week.

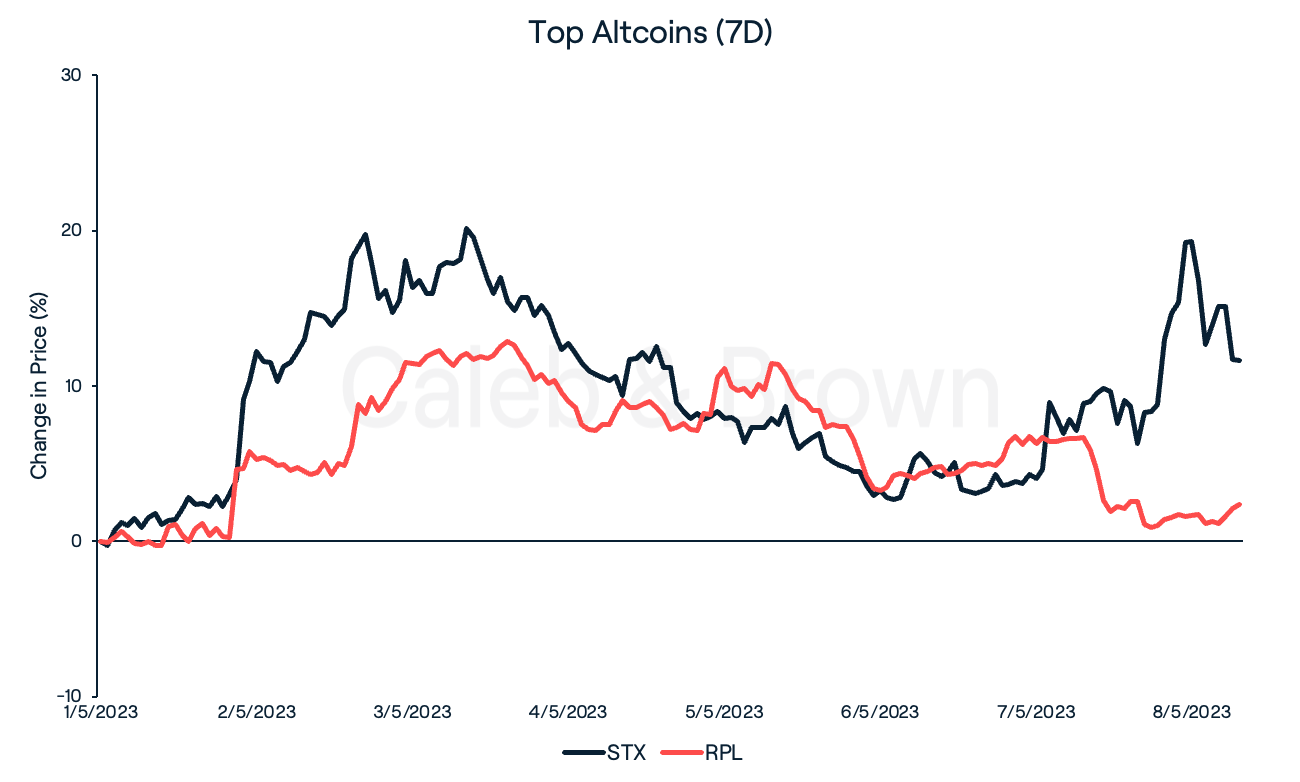

Two tokens that managed to emerge with gains this week were Bitcoin smart contract layer platform, Stacks (STX), and liquid ETH staking protocol, Rocket Pool (RPL), which added 11.6% and 2.4%, respectively. STX was able to capitalise from the current Ordinals hype while RPL benefitted from Ethereum’s Shapella upgrade and has increased 22.7% in TVL (total locked value) since the launch of the upgrade.

In Other News

Presidential Candidate Keen on Crypto

Robert Kennedy Jr. has recently expressed his support for Bitcoin, believing it can be a tool to help protect individuals from government surveillance and control over their finances. Kennedy also criticised central bank digital currencies (CBDCs), stating that they could lead to a loss of privacy and freedom for individuals. Kennedy sees Bitcoin as a decentralised alternative to CBDCs, which could allow people to maintain control over their finances and avoid government interference.

Sui Blockchain Officially Launches its Mainnet

Sui (SUI), a layer-1 blockchain platform built by former Meta engineers who were involved in the now-defunct Novi project, went live on Wednesday, 30 minutes before its scheduled launch. The new protocol will rival other layer-1’s such as Ethereum and Solana with the blockchain demonstrating impressive throughput capabilities, ranging from 10,871 transactions per second (TPS) to 297,000 TPS across various workloads. To put this in perspective, Solana, recognised as one of the swiftest layer-1 blockchains, achieves approximately 4,000 TPS.

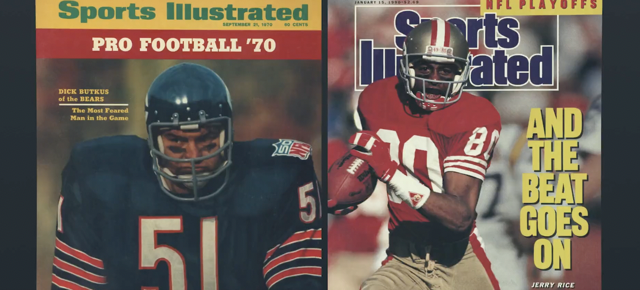

Sports Illustrated Launched New NFT Ticketing Platform

SI Tickets, the ticketing arm of Sports Illustrated, has introduced Box Office, a novel NFT ticketing platform developed on Polygon, an Ethereum scaling network. This strategic step signifies the renowned sports media brand's foray into primary ticket sales, complementing its existing SI Tickets secondary marketplace that debuted in 2021.

The NFT tickets offered by Box Office will be accessible within the SI Tickets mobile app. Apart from providing entry access, event organisers have the opportunity to enhance tickets with captivating content such as photo and video highlights, collectibles, personalised messages, promotional offers, and loyalty rewards, thereby fostering meaningful interactions with fans and introducing everyday people to Web3 technology.

Voyager Digital to Liquidate After Binance Deal Goes Bust

Voyager Digital, a cryptocurrency lending platform, announced its decision to liquidate assets and cease operations following Binance US's withdrawal from the US$1 billion agreement to purchase Voyager’s assets. According to the court filing, Voyager customers will receive an initial recovery rate of 36% for their crypto holdings. This recovery rate is significantly lower compared to the estimated 72-73% recovery rate anticipated if either of the acquisition proposals had succeeded, leaving a significant impact on retail investors.

Regulatory

White House Defends 30% Crypto Mining Tax Proposal

The White House published a report on Tuesday, highlighting a suggested 30% excise tax targeted at crypto mining companies. The administration restated its position that imposing this tax on miners' profits would benefit American communities and the environment. If successful, this excise tax, known as the Digital Asset Mining Energy (DAME) tax, is set to affect crypto miners starting from 2024. The tax would be based on the electricity expenses of these firms, commencing at 10% and gradually increasing each year until it reaches 30%.

As part of the 2024 budget, the White House introduced the aforementioned tax in March. According to the budget, DAME tax has the potential to assist the government in reducing its deficit by US$74 million in the initial year, with the possibility of this figure growing to US$444 million by the fiscal year 2033.

Recommended reading: 10 Most Popular Types of Crypto & Their Use Cases

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F2UUV0axCV6PybL1rmwcufK%2F237417808af84f71bb95cfd81544547e%2FMarch_15__2023__7_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-05-09T04%3A59%3A49.823Z)