Market Highlights

- Trump’s election victory, monetary policy easing, and near-term political certainty fuelled a rally across the crypto market.

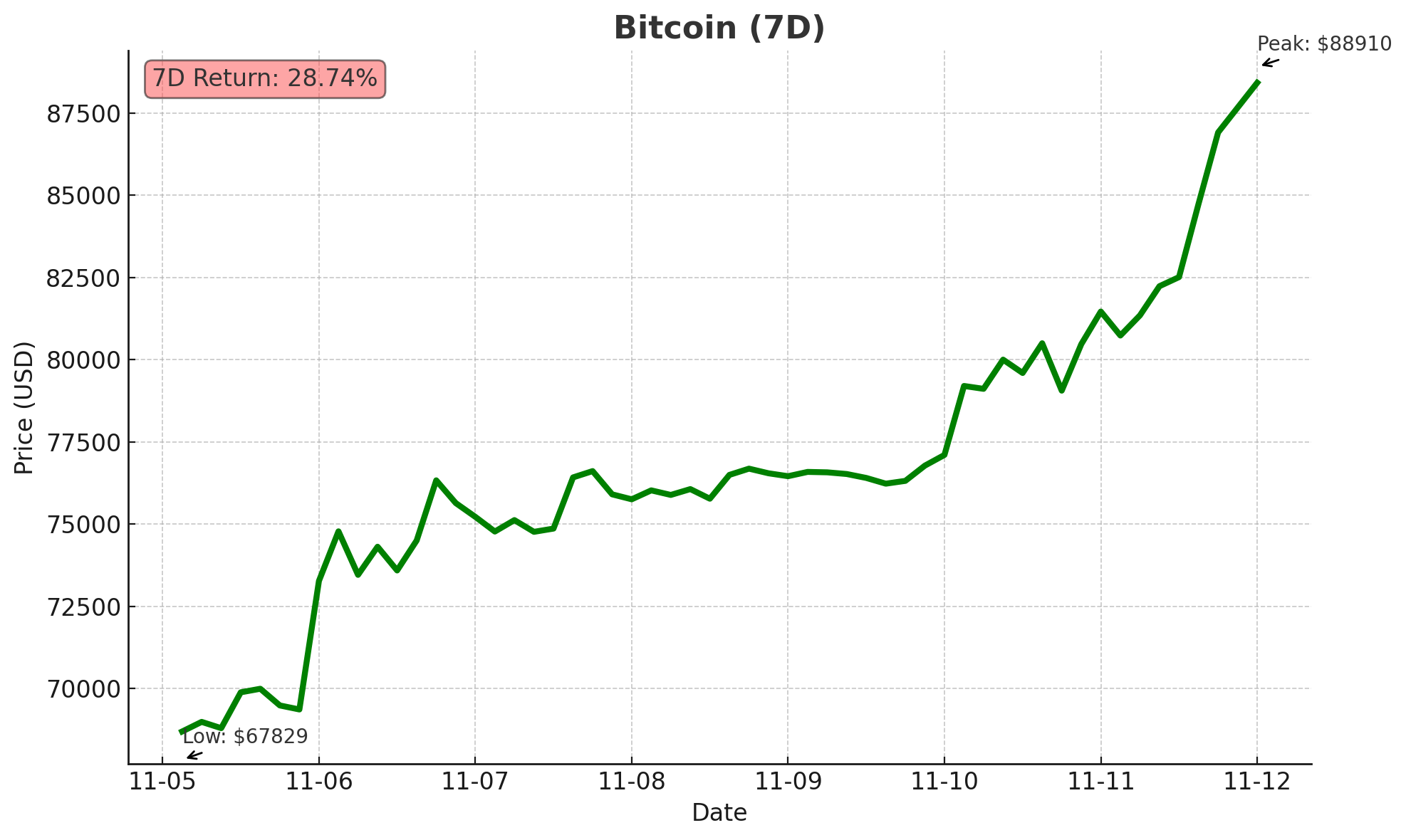

- Bitcoin looks to be speeding towards US$100,000 after breaking March’s previous high of US$73,835 last week.

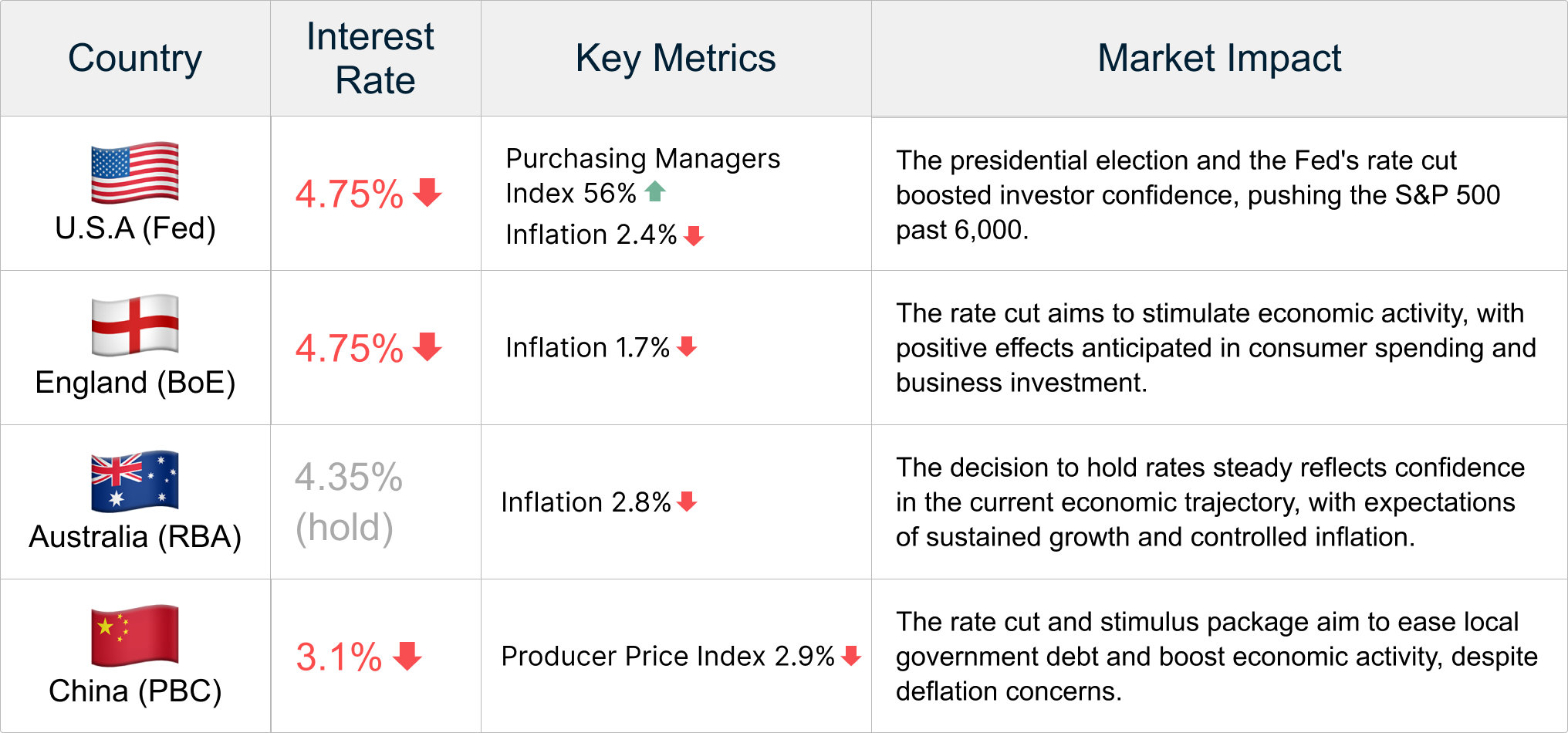

- A number of central banks made their next interest rate decision.

- Solana (SOL) reached a three-year high and broke US$200 for the first time since April.

Markets Overview

Macro Market Updates:

All eyes were on the U.S. and China this week. Former president Donald Trump was elected the 47th president of the United States, securing 312 electoral college votes and the popular vote. In response, the S&P 500 broke 6,000, fuelled by both Trump’s victory and the U.S. Federal Reserve cutting the Federal Funds rate by 25 basis points to 4.75% at its November meeting.

In China, the National People’s Congress (NPC) Standing Committee approved a stimulus package that will provide 10 trillion yuan in hidden debt relief to local governments. Initially, markets were expecting broader and more immediate stimulus, but it appears the NPC Standing Committee’s immediate focus is reducing China’s local government debts from 14.3 trillion yuan to 2.3 trillion yuan over the next four years.

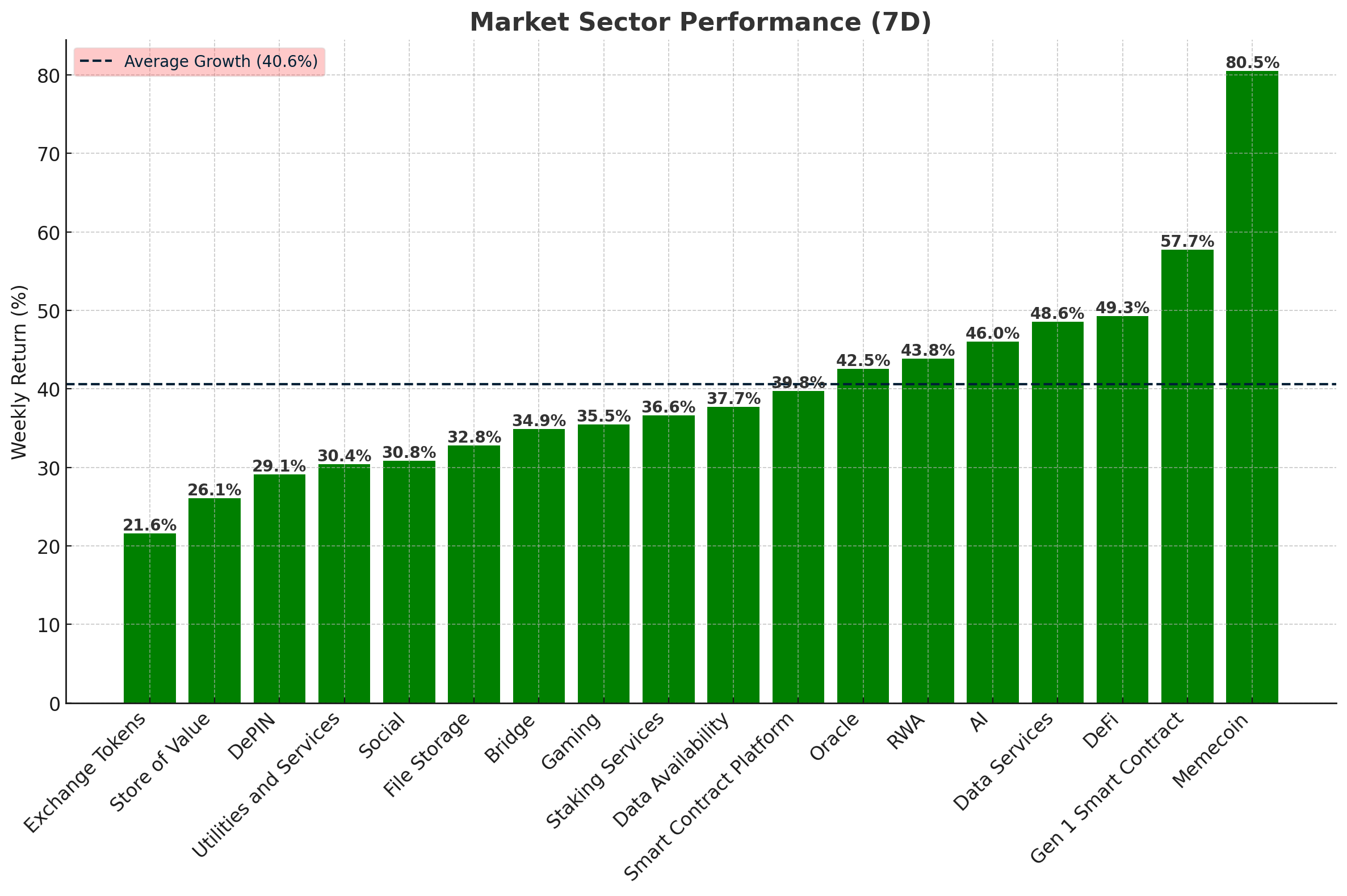

Crypto Market Sector Performance

With an average of 40.6% growth across the crypto market sectors this week, the current bull run saw the largest gains across meme coins, gen 1 smart contracts, and decentralised finance (DeFi). Exchange tokens and store of value experienced the weakest growth, increasing by 21.8% and 22.9%, respectively. The growth across meme coins and DeFi indicate that the crypto market has entered a risk-on phase, where traders and investors are comfortable leveraging up their positions to maximise their gains. One of the biggest meme coin gainers this week was Dogecoin, gaining over 100% on the week (more on that below).

Bitcoin (BTC)

After months of consolidation, bitcoin’s price finally took off this week, buoyed by former president Donald Trump’s election victory and an interest rate cut. Throughout the last week, bitcoin has gained almost 30%. The bull run isn’t showing any signs of slowing down, with almost every day bringing a new all-time high. The largest cryptocurrency by market cap soared past its previous all-time high of US$73,835 seen in March on Wednesday as the presidential election vote count started. At the time of writing, bitcoin’s all-time high reached US$88,000 on Monday, 11 November.

Another key benefactor of the election-fuelled bitcoin rally is BlackRock. On Thursday, 8 November, the BlackRock iShares Bitcoin Trust (IBIT) saw a record US$1.12 billion of inflows, overtaking its October 30 record of US$872 million. Across all bitcoin asset investment products, inflows totalled US$1.8 billion this week.

Coinbase launched its wrapped bitcoin product, cbBTC on the Solana network. It follows the successful launch of cbBTC on the Ethereum network in September. cbBTC allows users to access DeFi services on other networks using their bitcoin.

Jack Dorsey, the co-founder of X and Principal Executive Officer and Chairman of Block (formerly Square), released Block’s Q3 shareholder letter this week. In the letter, Dorsey stated that Block would increase investment in its bitcoin mining business, decrease investment in its music streaming app, Tidal, and wind down its operations in decentralised web platform development at TBD.

A wallet connected to defunct crypto exchange, Mt. Gox, sent 30,371 bitcoin to two addresses on Sunday. The transactions, worth US$2.2 billion, indicate that the next tranche of creditor repayments may be taking place.

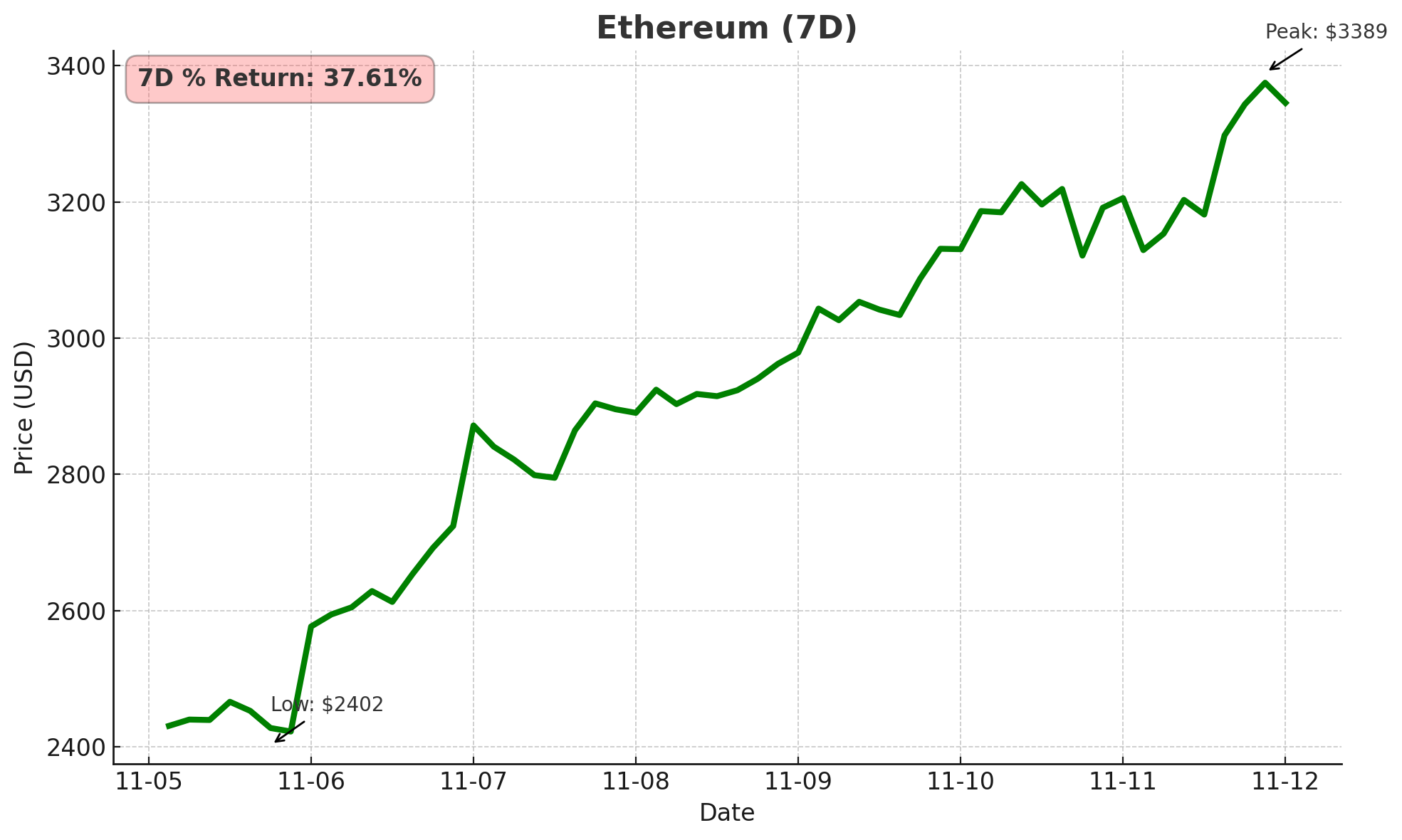

Ethereum (ETH)

Ethereum also saw a rally this week. The second largest cryptocurrency by market cap opened the week at US$2,456.60 before gaining over 36% to break the key level at US$3,220 with strong upward momentum. Ethereum hasn’t traded above US$3,000 since August and looks to be moving towards its all-time high of US$4,878, which was reached in November 2021.

Whale activity on the network reached a 14-week high last week, with transactions with a value of over US$1 million growing to 8,482. Also, last week, Ethereum’s transaction volume reached US$10.4 billion — the highest levels seen since early August. If price finds support around US$3,300, Ethereum’s rally could continue, but this will be largely dependent on whether long-term holders choose to sell or keep holding their Ether.

Ethereum asset investment products saw the largest inflows since July, with US$157 million flowing into funds. This brings assets under management for Ethereum investment products to US$12.1 billion.

The U.S. Securities and Exchange Commission (SEC) delayed its decision on whether to approve the listing of spot Ethereum ETF options on the New York Stock Exchange. The agency said it’s delaying its decision, originally due by Monday, 11 November, to allow time for further analysis and public input.

The Ethereum Foundation’s annual financial report was released this week. The Foundation’s treasury holds US$970 million worth of Ethereum, which is divided between $788.7 million in crypto and US$181.5 million in non-crypto investments.

Altcoins

DeFi gains

- Drift Protocol (DRIFT) gained 288%, taking its market cap to US$417.3 million. The decentralised on-chain trading platform for Solana found support at US$0.38 before gaining almost 700% and then retracing. The gains are presumably due to the wider crypto market rally this week, growing transaction volume on the Solana network, and the low fees on the Drift Protocol’s network.

- Kamino gained 79.7%. This takes its market cap to US$206.7 million. Price for the Solana lending, liquidity and leverage network presumably gained due to growing activity on the Solana network, plus Kamino reaching a new all-time high of US$1.8 billion in total value locked (TVL). This indicates that traders and investors are gravitating towards platforms like Kamino to invest in and trade cryptocurrency.

Good DOGE

- Dogecoin (DOGE) gained 94.1%, which takes its market cap to US$43.3 billion. Price for the open-source, peer-to-peer cryptocurrency presumably made most of its gains due to Elon Musk’s continued mention of Dogecoin in recent public appearances. He’s discussed creating a “Department of Government Efficiency” (D.O.G.E), which has led markets to believe DOGE will become more mainstream in the future. This week’s growth has also seen DOGE rise to become the sixth-largest cryptocurrency by market cap, overtaking USDC and XRP

Ripple.

Centralised currency

- Cronos (CRO) gained 93%. This takes its market cap to US$3.8 billion. The network that interoperates with Ethereum and Cosmos likely made gains due to the wider market rally and their unveiling of an AI agent-powered ecosystem on Cronos. This development will enable AI agents to autonomously interact and transact on Cronos.

Single chain gains

- Cardano (ADA) gained 78.8%, taking its market cap to US$21.3 billion. Price found support at US$0.32 before rallying over 110% and then retracing. The tenth-largest cryptocurrency rallied throughout the week, with upside momentum growing on the news that Cardano’s Founder, Charles Hoskinson, will lobby the Trump administration for accommodative cryptocurrency policy.

Going PRO

- Propy (PRO) gained 76%, taking its market cap to US$91.5 million. Price for the network that brings real estate title and escrow transactions on chain gained over 100% on Saturday, 9 November, before retracing. The gains are presumably due to Propy’s conference hosted across the weekend, where industry professionals and crypto-friendly U.S. Senator Cynthia Lummis discussed bringing the world’s real estate on chain.

In Other News

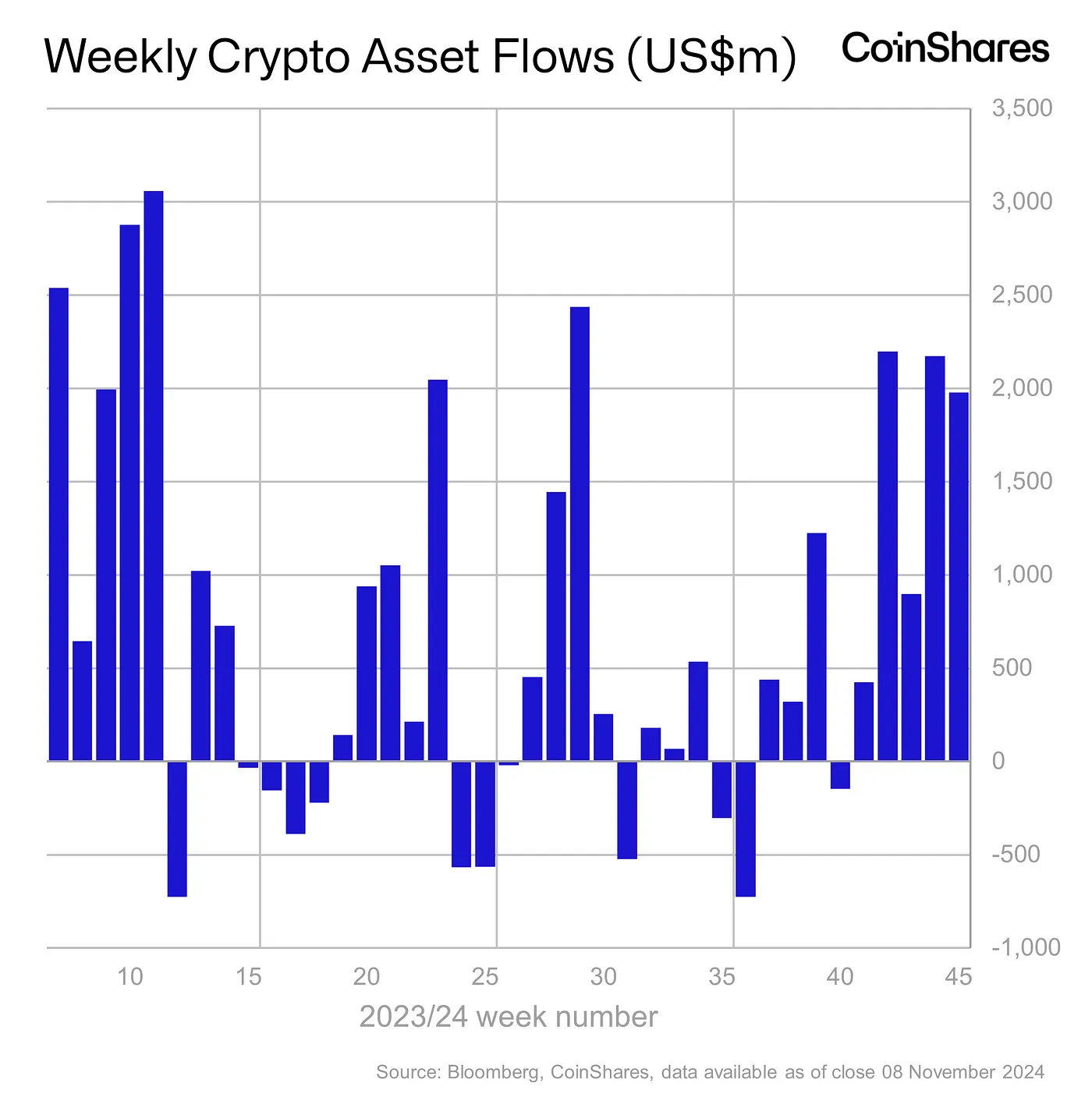

The post-election upward momentum saw US$1.98 billion of inflows into digital asset investment products. This marks the fifth consecutive week of inflows into these products, while year-to-date inflows reached a record-breaking US$31.3 billion. The U.S. presidential election result, monetary easing and near-term political certainty are presumably the reason for this week’s inflows, much like the bullish price action seen across the crypto market.

Other crypto news

- Solana (SOL) broke above US$200 for the first time since April, marking a three-year high. Throughout the week, the fourth-largest cryptocurrency gained 30% and reached a market cap of almost US$100 billion. Solana’s previous all-time high came before the network’s app, pump.fun, where people buy meme coins, launched. On Thursday, 7 November alone, 32,000 meme coin tokens were launched on pump.fun, demonstrating that the Solana network and meme coins may see further gains throughout the next leg of the crypto bull market.

- Muneeb Ali, the co-creator of Stacks (STX) and CEO of Trust Machines, announced that Stacks’ upcoming sBTC token may be released in December. sBTC aims to solve the challenge of writing data to Bitcoin’s main blockchain. The new token will allow smart contracts to send sBTC to an address where it can be pegged as BTC. Stacks’ decentralised two-way peg is designed to provide an alternative to wBTC and cbBTC, which are both provided by centralised custodians.

Regulatory

- Detroit is going to start accepting crypto payments for taxes and fees from the middle of 2025. Residents will be able to pay the city using a PayPal-managed platform that enables crypto payments. The development is part of Detroit’s strategy to modernise its municipal services and improve financial inclusivity, especially for people who have limited access to traditional banking channels.

- Former FTX Founder Gary Wang has asked a judge that he not serve a prison sentence after FTX’s former Chief Engineer, Nishad Singh, avoided prison by cooperating as a key witness in legal proceedings against FTX. Wang’s lawyers argued that he faces the fewest criminal counts and was one of the first within FTX’s team to admit wrongdoing. He pleaded guilty in December 2022.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.