Market Highlights

- The world's largest asset manager has confirmed plans for a spot Ethereum ETF, a Nasdaq filing shows.

- Bitcoin mining revenue hit a new yearly high of US$44million, surpassing revenue during the Ordinals craze.

- Digital asset investment products saw inflows of over US$261 million, surpassing US$1 billion total inflows in 2023.

- Poloniex experienced a hack resulting in the loss of over US$114 million worth of crypto assets.

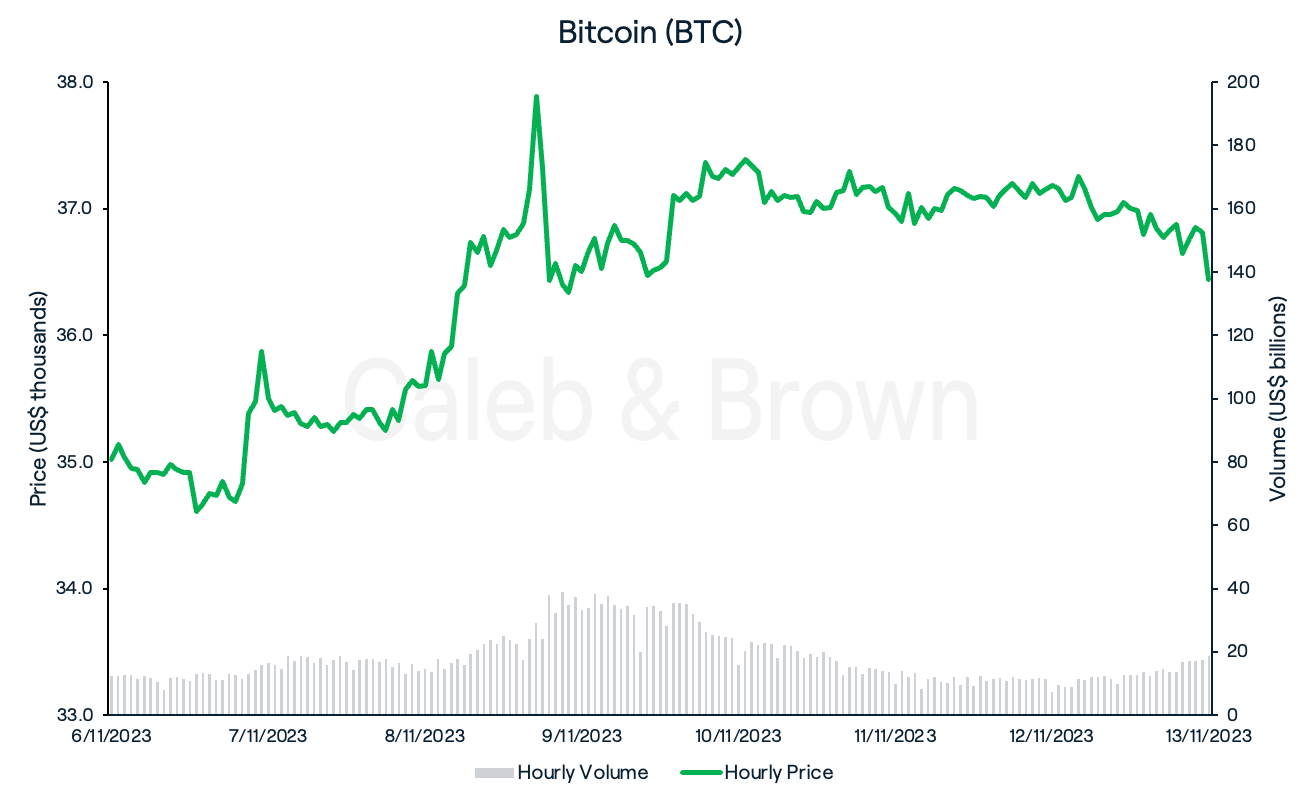

Bitcoin

After briefly cooling down last week, Bitcoin (BTC) has extended its rally, recording an 18-month high on Thursday.

The surge in price was most likely brought upon by a note from Bloomberg Intelligence analysts explaining that the U.S. Securities and Exchange Commission now has an eight-day window to approve the applications for a Bitcoin ETF, including BlackRock iShares Spot Bitcoin ETF, and Grayscale Bitcoin Trust.

BTC closed the week at US$36,437, up 4.1% over the last seven days.

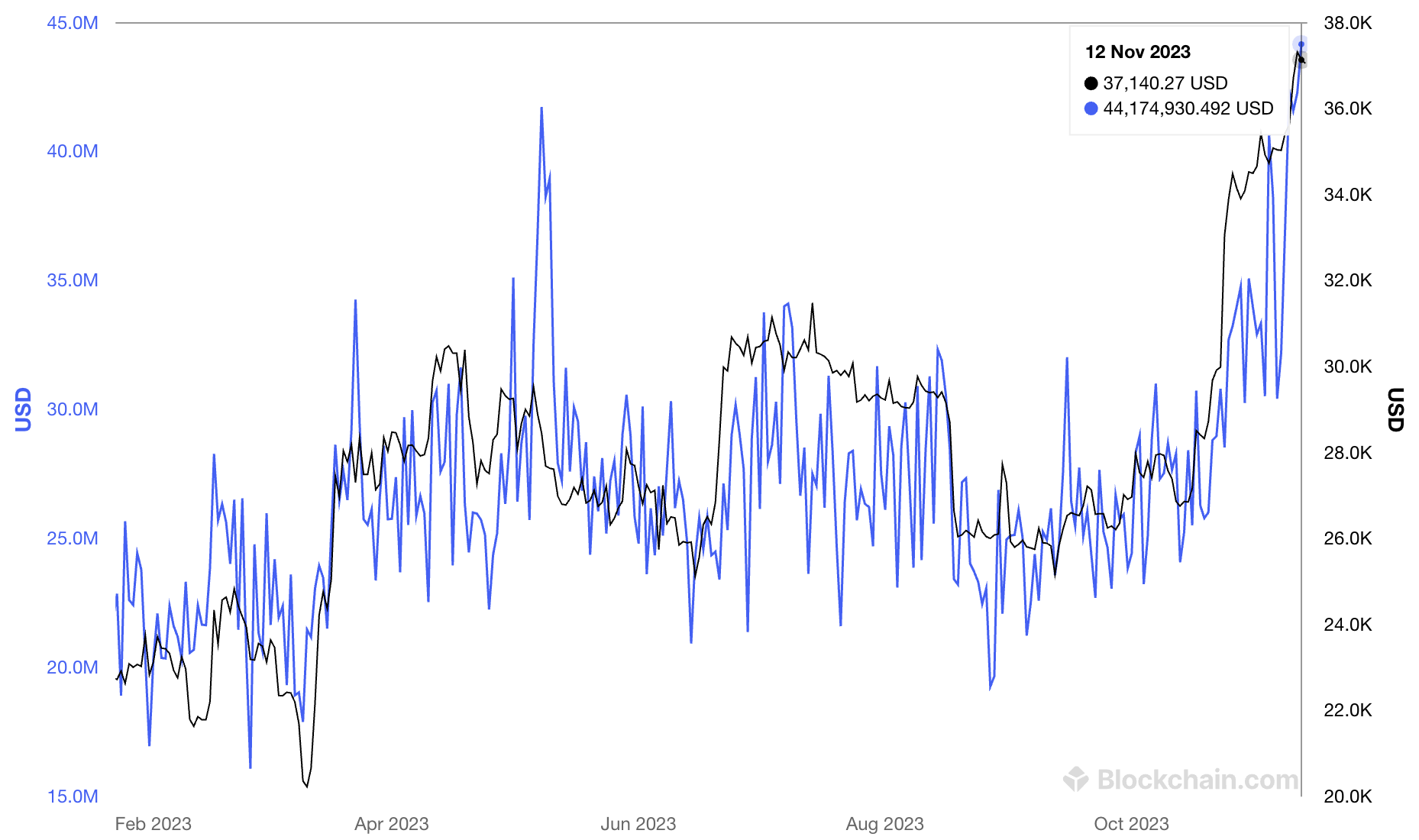

BTC’s recent price surge also helped Bitcoin mining revenue hit a new yearly high of US$44 million. For context, this is even higher than mining revenue during the Ordinals craze in May.

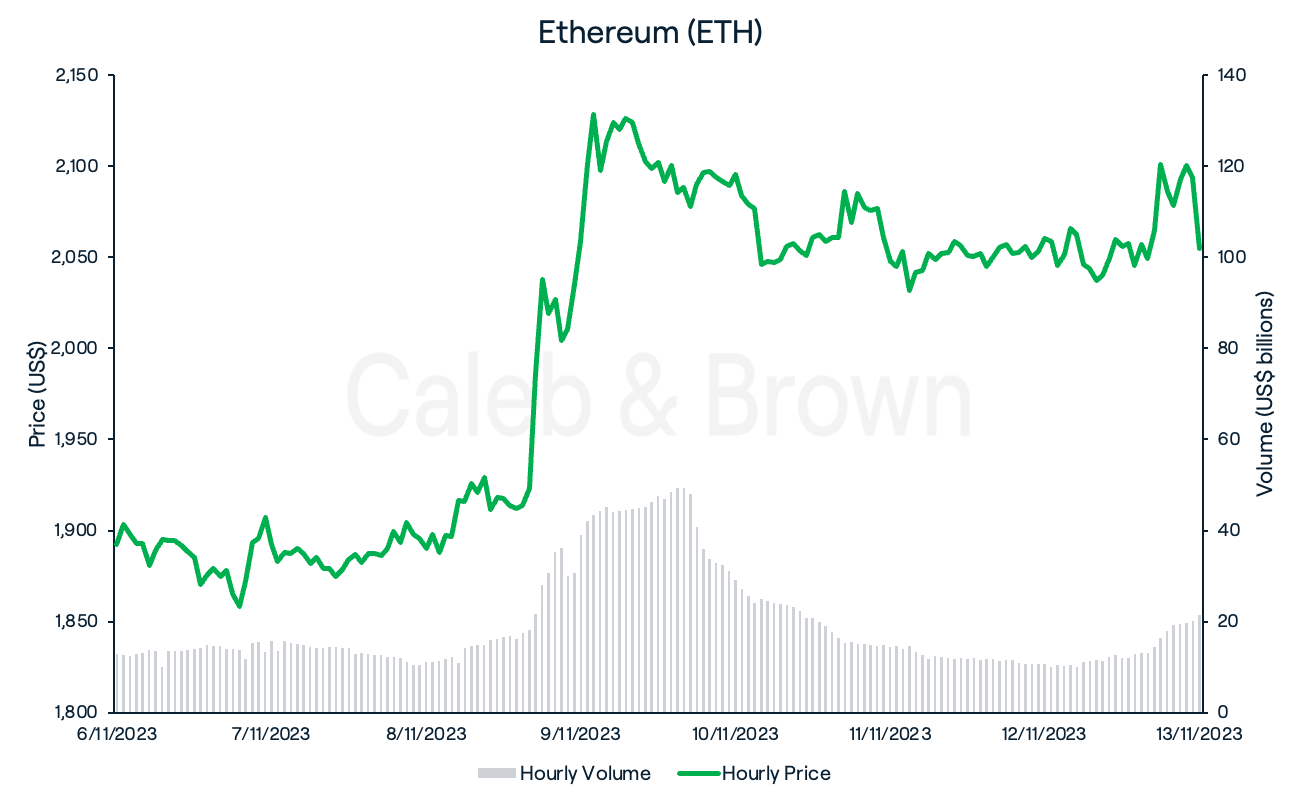

Ethereum

Ethereum (ETH) stepped into the spotlight this week after BlackRock proposed “iShares Ethereum Trust” in its filing with Nasdaq on Thursday, signalling its plans to launch a spot Ethereum ETF.

This saw ETH climb past US$2,100 for the first time since April and return to a deflationary issuance.

ETH eventually closed the week at US$2,054, up 8.6%.

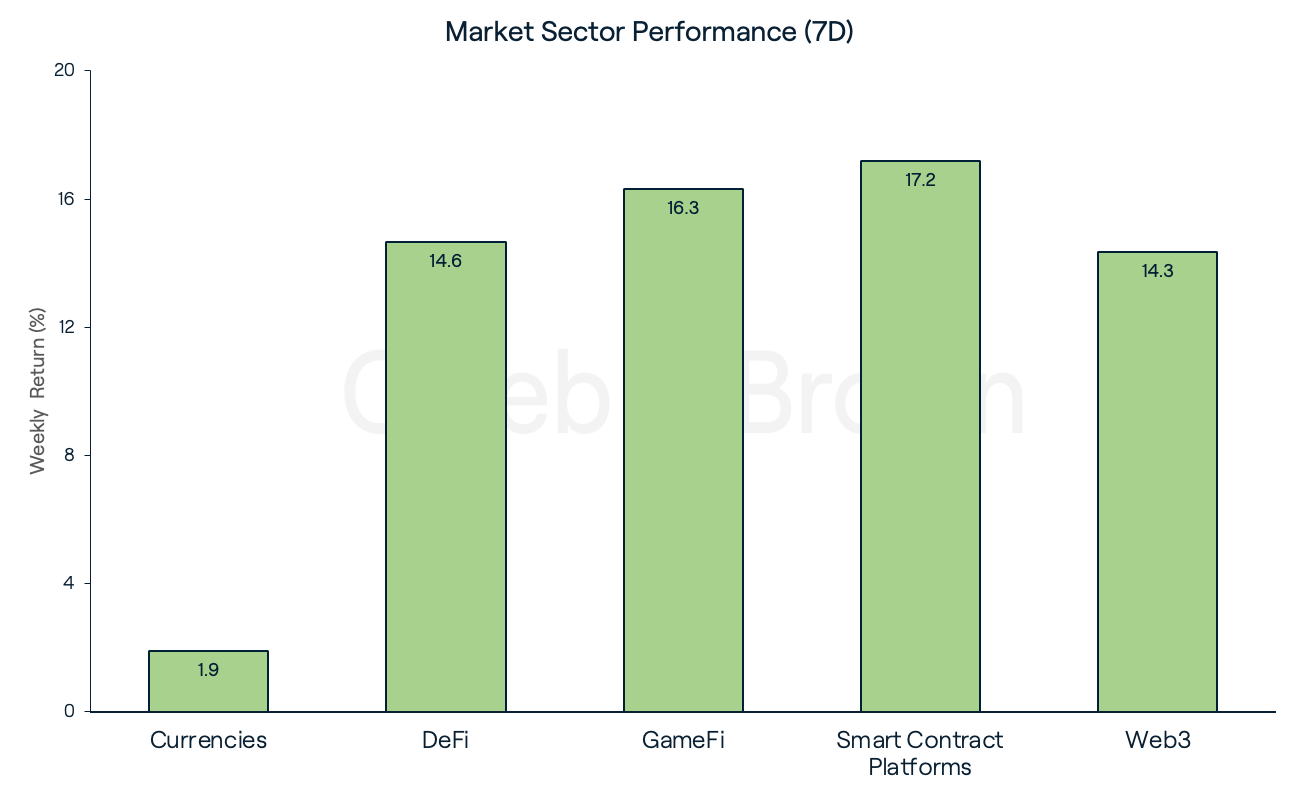

Altcoins

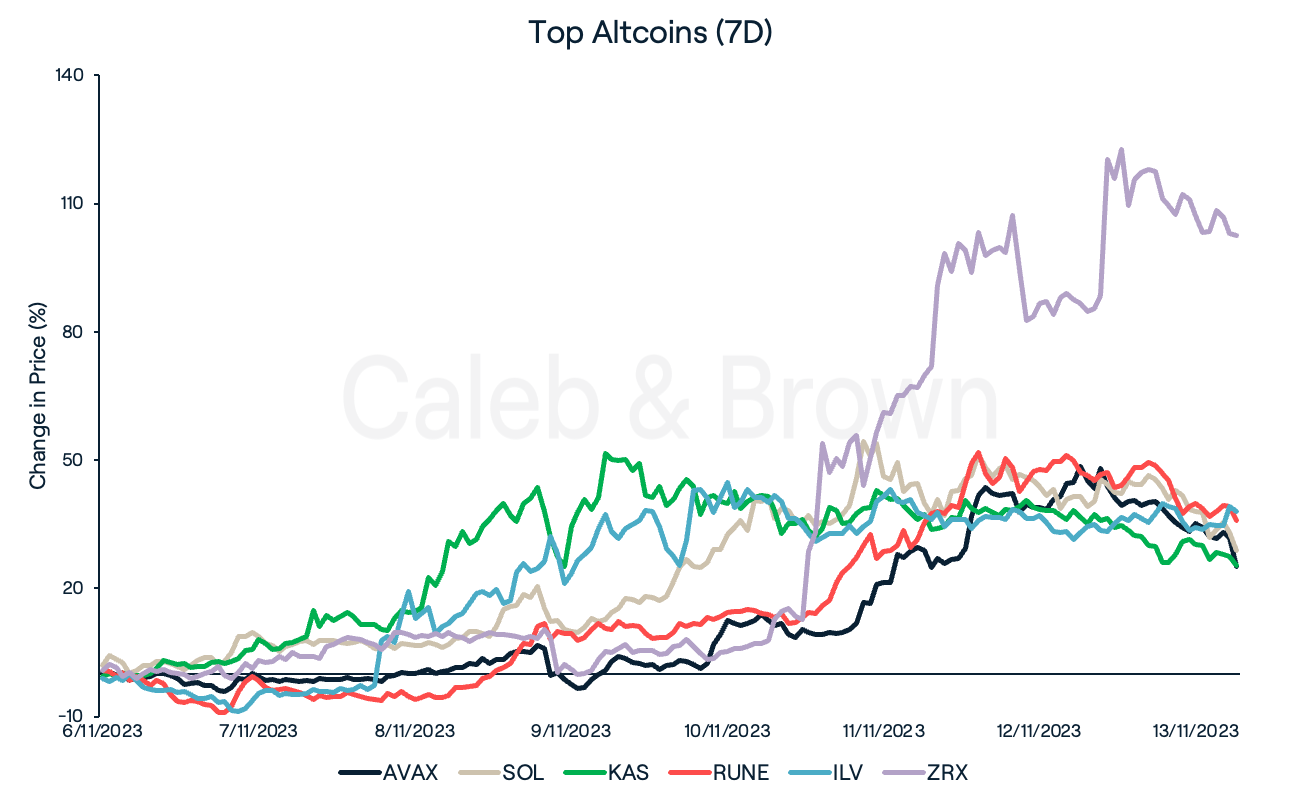

Market sectors performed exceptionally well again this week with Smart Contract Platforms and GameFi leading the pack, gaining 17.2% and 16.3%, respectively. Currencies trailed, adding on just 1.9%.

Showing the most strength from Smart Contract Platforms were Avalanche (AVAX), Solana (SOL) and Kaspa (KAS) which rallied 25.2%, 28.9%, and 25.4%, respectively.

Decentralised exchange, THORChain (RUNE) jumped 35.9% after recording the third highest volume amongst DeFi exchanges last week while Illuvium (ILV) surged 37.9% after being listed on the Epic Games Store.

Securing top spot this week however was 0x Protocol (ZRX) which added on 102.5%. The price pump could be possibly attributed to increased whale activity, potentially indicating institutional interest in the token.

In Other News

Digital asset investment products saw inflows totalling US$261 million, representing the 6th week of consecutive inflows. This means crypto fund investments have now surpassed US$1 billion in 2023.

Poloniex, a crypto exchange owned by Tron founder Justin Sun, has seen more than $114 million worth of crypto assets exit one of its wallets as the result of a "hack incident” on Friday.

Circle, the issuer of the USDC stablecoin, is reportedly considering going public in early 2024, according to Bloomberg.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4HGHuPTDrM4HbYOVHdJnDX%2Fac25c272725a15e26a1fa70298820ea7%2FWeekly_Rollup_Tiles__24_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-11-14T04%3A35%3A46.085Z)