Market highlights

- Harvard tripled its BTC exposure in Q3 via exchange-traded funds.

- Canary Capital’s Spot XRP ETF opened this week, with US$58M trading volume on day one.

- U.S. SEC Chair Paul Atkins said most crypto tokens are not classified as securities.

- The Czech Republic’s National Bank launched a US$1 million pilot crypto portfolio.

- U.S. Senate discussion draft would give the CFTC authority to regulate crypto.

Markets Overview

The record-long U.S. government shutdown ended this week, though it wasn’t enough to improve sentiment across risk assets. The bill, which passed on the 43rd day of the shutdown, extends funding for federal agencies until 30 January 2026. Market participants have now turned their attention to when the backlog of economic data will be released. The September jobs report will be published on Thursday, November 20. Notably, October is set to be a “lost” month of data, due to an apparent lack of human resources to collect, analyse and disseminate the necessary inputs. Producer price index data, one of the key inputs for measuring the consumer price index, was also not collected in October.

The lack of complete employment and inflation data is presumably adding to uncertainty around whether the U.S. Federal Open Market Committee (FOMC) will cut rates at its December 10 meeting. The likelihood of a 25-basis-point cut in December dropped to 45.8% this week.

In earnings, Nvidia reports its Q3 results on November 19. Investors will presumably watch these results closely, given the recent concerns that artificial intelligence (AI) is in a bubble (AI and tech companies currently account for over 25% of the S&P 500).

Weekly performance: S&P 500 +0.1%, Dow Jones +0.3%, Nasdaq -0.5%.

Looking ahead:

- FOMC meeting minutes - November 19

- U.S. non-farm employment change (September) - November 20

- Flash manufacturing and services PMI (France, Germany, U.K. and U.S.) - November 21

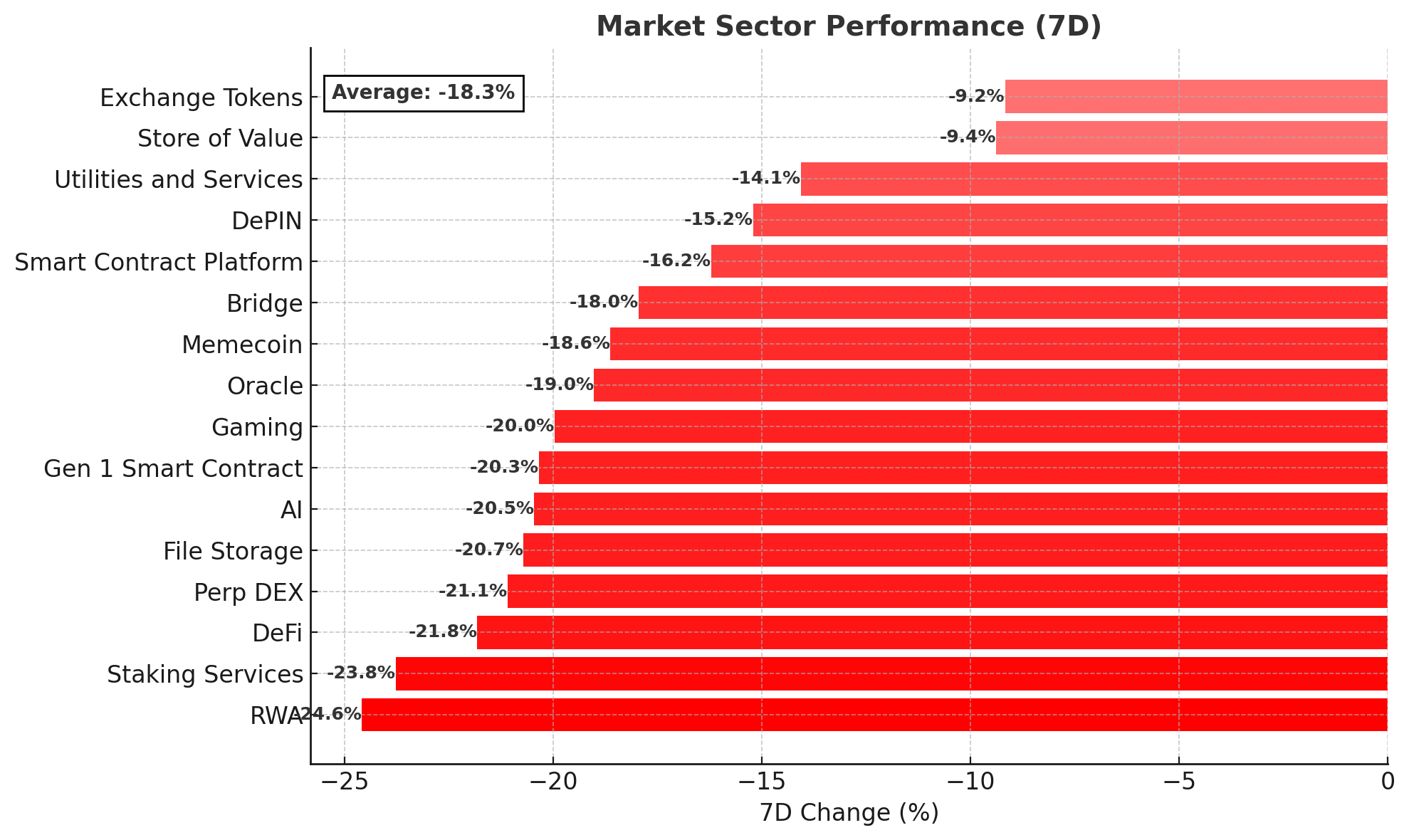

Crypto Market Sector Performance

All crypto sectors saw declines this week as bearish sentiment persisted due to uncertainty around the state of U.S. employment and inflation, given that the country didn’t have the human resources to complete the necessary reporting in October. As the sell-off continued, daily liquidations rose to US$500 million on Friday, November 14. Bitcoin positions accounted for US$165 million of this total, while long positions across crypto accounted for US$380 million of positions liquidated. The crypto fear and greed index reflects the weak sentiment, declining to 17 — extreme fear.

Crypto Market Sector Performance (7D)

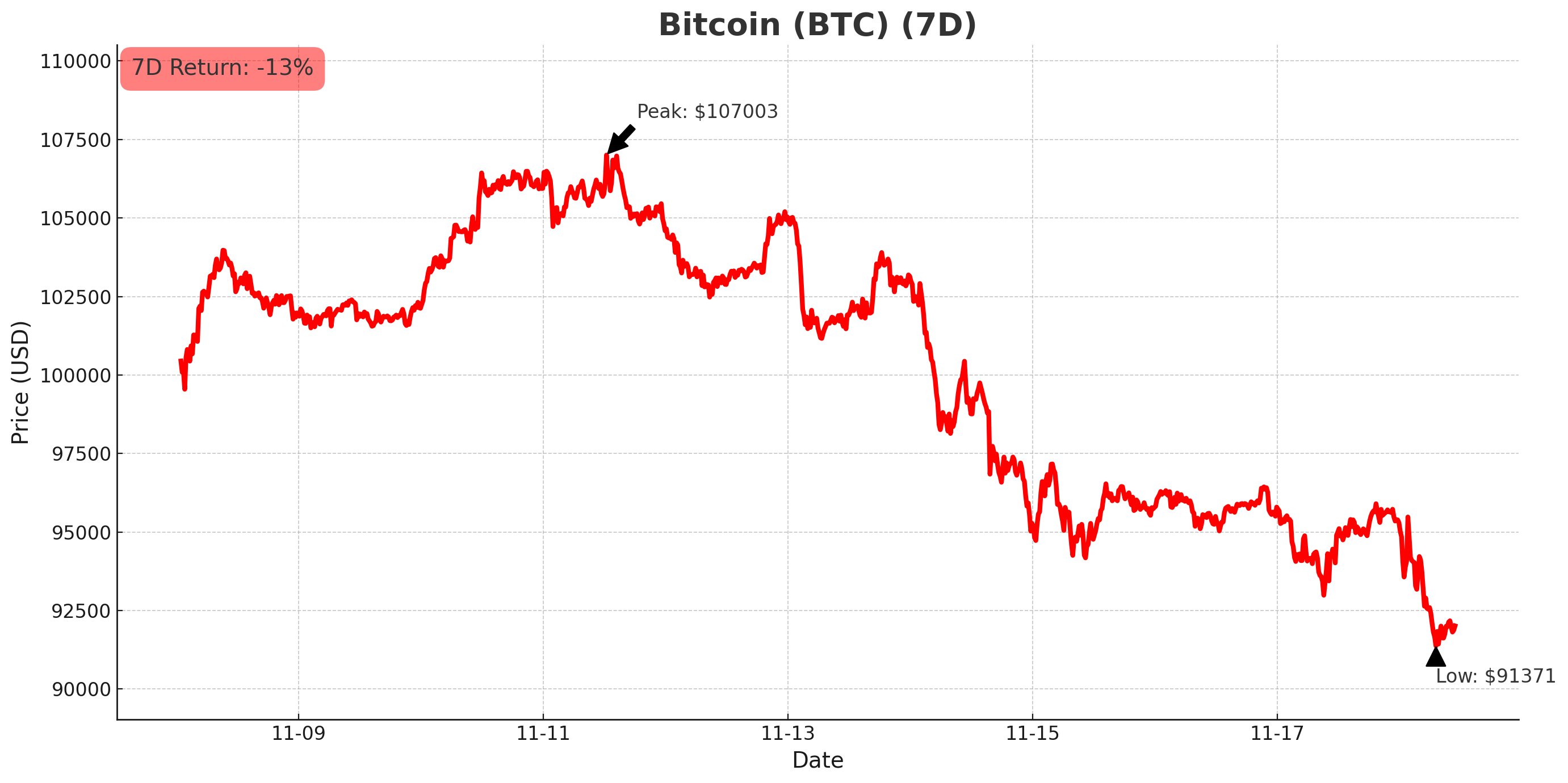

Bitcoin (BTC)

- Opened the week at US$106,694 and declined to a low of US$92,943 on Sunday, November 16, as bearish sentiment due to the unclear macro picture persists. Price continued its decline to start the week, with bitcoin now trading around US$92,000 (-12.8% 7D).

- BTC dominance ranged between 59.9% and 59.3% this week.

- Bitcoin investment products saw US$1.4 billion of outflows this week. Short bitcoin saw inflows of US$9.1 million.

Trump family-backed American Bitcoin (ABTC) released its Q3 results. The BTC treasury and mining company more than doubled its revenue from Q3 2024. ABTC shares gained 4% on the news. The company holds over 4,000 BTC, worth around US$381 million.

Rumours circulated this week that Michael Saylor’s Strategy was selling some of its bitcoin holdings. On-chain data showed that the company’s holdings declined by 47,000 BTC. However, it was later confirmed that the movement was due to internal transfers.

Block (formerly Square), led by Jack Dorsey, has enabled BTC payments for around 4 million Square merchants. Transactions settle instantly via Bitcoin’s Lightning Network, and sellers can optionally convert payments to fiat. Block is waiving all processing fees through 2027 to accelerate adoption.

In bitcoin buying news:

- Harvard tripled its BTC exposure in Q3 via exchange-traded funds (ETFs), bringing its holdings to 6.8 million IBIT shares, worth US$443 million.

- Emory University increased its holdings by 50%, with the institution now holding 1 million Grayscale Bitcoin Mini Trust shares, valued at US$52 million, and 4,450 iShares Bitcoin Trust shares, worth about US$289,000.

- Strategy bought 8,178 BTC, bringing its total holdings to 649,870 BTC at an average purchase price of US$74,433 per bitcoin.

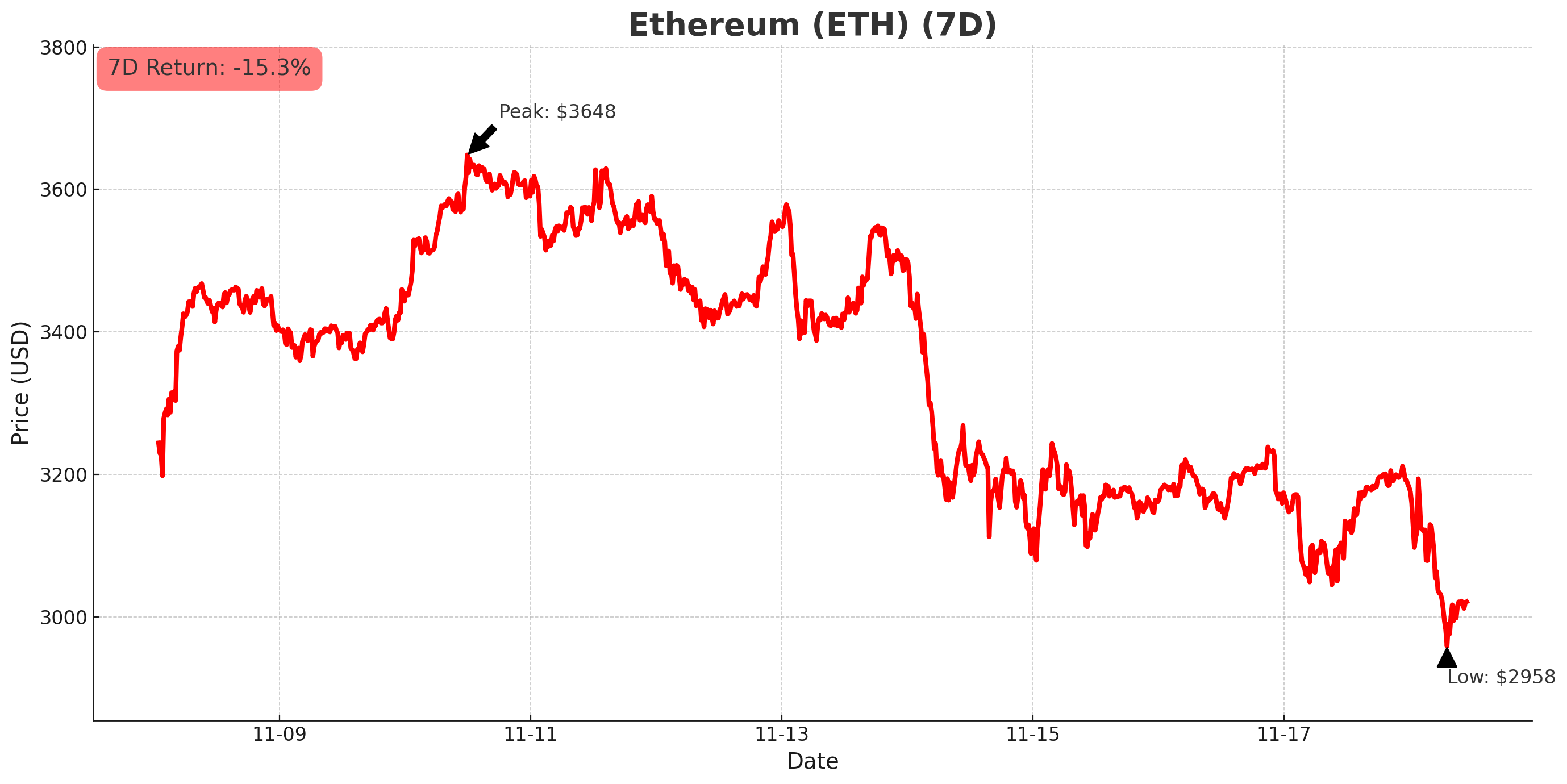

Ethereum (ETH)

- Opened the week at US$3,582 as the sell-off continued on bearish macro sentiment. Ethereum declined to a weekly low of US$3,001 on Sunday, November 16, and has since remained around this level (-14.5% 7D).

- Ethereum dominance started the week at 12.4%, declined to 11.4%, and currently sits at 11.9%.

- Ethereum-focused funds saw outflows of US$689 million this week.

BitMine Immersion Technologies appointed Chi Tsang to the role of CEO and board member. Most recently, Tsang was the founder and Managing Partner of venture fund m1720 and spent a decade at HSBC. The company currently holds over 3.5 million ETH, worth approximately US$11.2 billion.

Despite the recent sell-off and weak sentiment, Ethereum whales continued to buy. On-chain data indicates that institutional investors bought over US$350 million worth of ETH in the recent pullback.

In Ethereum buying news:

- BitMine added 54,000 ETH to its treasury, bringing its holdings to over 3.6 million ETH, worth US$14.2 billion.

Altcoins

The altcoin season index is currently at 43 as bearish sentiment continues.

TEL the world

- Telcoin (TEL) gained 92.5% on the news that it has became the first U.S. digital asset bank, with a bank charter granted under Nebraska’s Financial Innovation Act. The team worked with Nebraska policymakers in 2021 on shaping this legislation. The bank charter gives Telcoin authorisation to issues its eUSD stablecoin, plus its native blockchain will launch in the coming months, enabling users to send and receive money via their telco providers, who will act as validators on the network.

Crypto sell-off continues

- Story (IP) declined by 28.2%, presumably as capital flows away from altcoins, especially those with newer use cases, such as tokenising intellectual property. The network recently introduced tokenising digital ad space, which is a trillion-dollar industry, but this has not driven any upward momentum yet.

- Aerodrome Finance (AERO) declined by 27.8%. The selling pressure came as Dromos Labs, the developers behind the decentralised exchange announced an overhaul of its infrastructure to launch Aero, which will see it expand to the Ethereum mainnet in Q2 2026, while maintaining its central hub on the Base network.

- Virtuals Protocol (VIRTUAL) declined by 26.3%. The network that powers autonomous AI agents has seen declines, presumably as weaker sentiment increases selling pressure across altcoins. The network recently launched its agentic fund of funds, which facilitates automated DeFi yield allocation.

- Arbitrum (ARB) declined by 25.7% to three-month lows, presumably due to its unlock of 2% of circulating supply on November 16.

- Sui (SUI) declined by 24.5% on broader market weakness. The layer-1 chain launched its USDsui stablecoin in partnership with Bridge this week, enabling compliant cross-chain payments.

Crypto ETF News

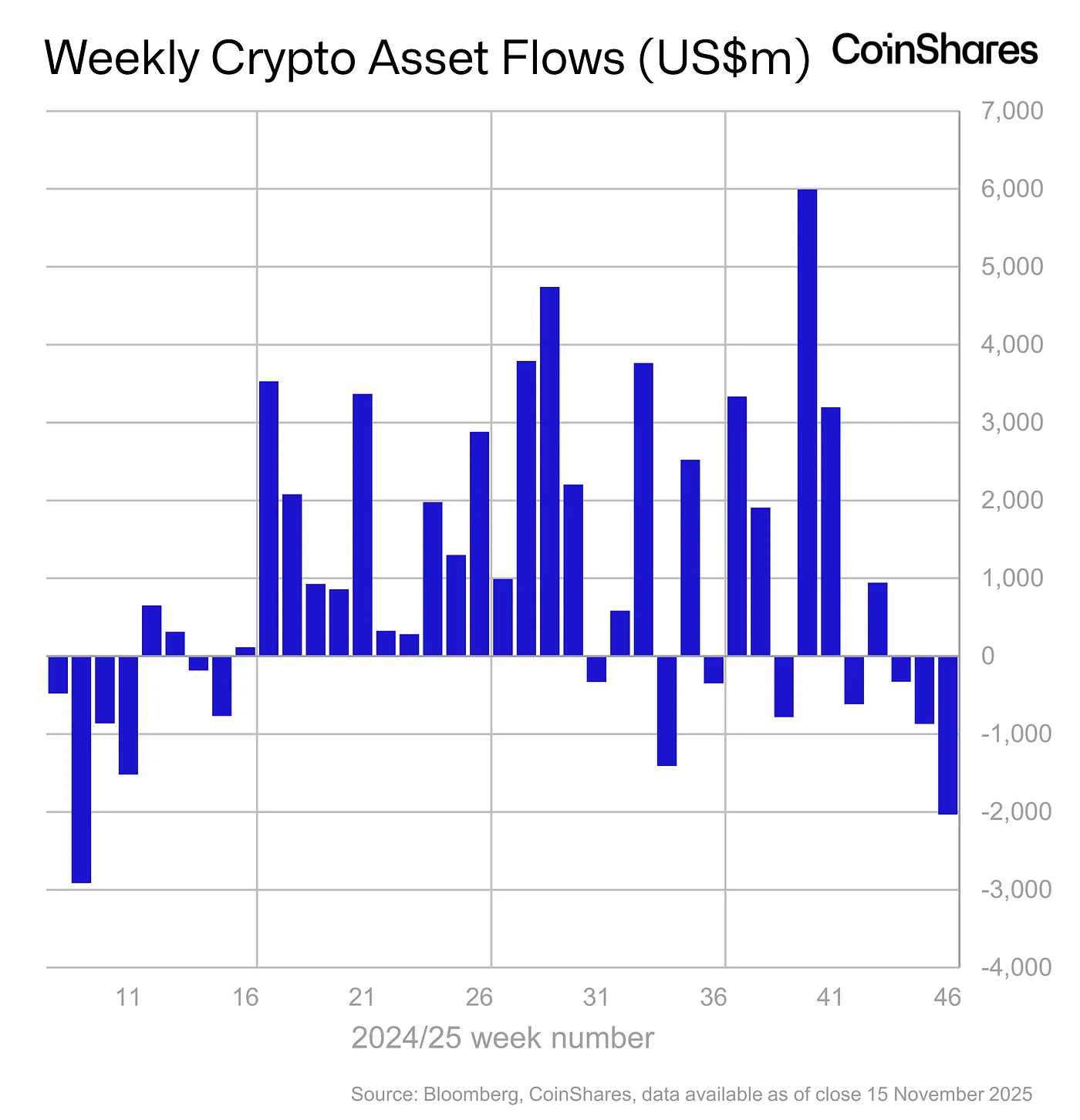

Digital asset investment products saw outflows of US$2 billion this week due to macroeconomic policy uncertainty. The largest inflows were seen in multi-asset products, where US$31.2 million of capital flowed.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is expanding to Binance and BNB Chain. According to Securitise, BUIDL shares will be accepted as collateral to trade on the exchange.

Canary Capital’s Spot XRP ETF (XRPC) launched this week, with US$58 million of trading volume on the first day. It’s the strongest first-day performance of any new crypto ETFs this year.

Grayscale filed with the U.S. Securities and Exchange Commission (SEC) to go public. The firm would list on the New York Stock Exchange and trade under the ticker GRAY.

21Shares launched two new ETFs this week: the 21shares FTSE Crypto 10 Index ETF (TTOP) and the 21shares FTSE Crypto 10 ex- BTC Index ETF (TXBC).

Other crypto news

- U.S. SEC Chair Paul Atkins said most crypto tokens, such as network tokens (e.g. Ethereum), meme coins, and digital tools (tickets, badges) are not ****securities. He argued only tokens tied to clear managerial promises qualify, and that “investment contract” status can expire. Atkins also outlined that he supports “super-app” platforms where securities and non-securities trade together.

- A bipartisan U.S. Senate discussion draft released this week would give the Commodity Futures Trading Commission (CFTC) authority to regulate crypto spot markets. Platforms, brokers, and dealers would need to register, maintain customer fund protections, and enable dispute resolution. The proposal preserves self-custody rights and promises new CFTC resources.

- The Czech Republic’s National Bank launched a US$1 million pilot crypto portfolio, consisting of mostly bitcoin, U.S. dollar-pegged stablecoins and tokenised deposits. The trial portfolio gives the bank hands-on experience in buying and managing digital assets. Officials say the experiment could lead to crypto becoming part of the country’s official reserves.

- The Monetary Authority of Singapore (MAS) is finalising legislation to regulate stablecoins, prioritising strong reserve backing and reliable redemption. It will also expand its wholesale central bank digital currency (CBDC) trials, including tokenised MAS bills, and will publish a new guide on tokenised capital market products to standardise disclosure. Also this week, Singapore Exchange announced that it’s launching bitcoin and Ethereum perpetual futures trading from November 24, the first major national exchange to do so.

- J.P. Morgan has launched a deposit token called JPM Coin (JPMD) on Base, Coinbase’s public Layer-2 blockchain. The token represents U.S. dollar deposits, enables 24/7, near-instant settlement for institutional clients, and earns interest.

- Franklin Templeton is extending its Benji tokenisation platform to the Canton Network, a private blockchain for regulated institutions. The integration enables the firm to offer its tokenised funds on Canton’s Global Collateral Network, providing institutional investors with a new source of regulated liquidity and collateral.

- Hyperliquid temporarily paused USDC deposits and withdrawals on its Arbitrum bridge after a trader allegedly manipulated meme-coin Popcat. Using US$3 million across 19 wallets, the trader opened large leveraged long positions and removed a US$20 million buy wall, triggering a crash and US$4.9 million in losses for the community vault.

- Solana Company (formerly Helius Medical, ticker HSDT) plans to tokenise its shares via Superstate’s regulated Opening Bell platform. Investors would hold digital versions of its SEC-registered shares, trading 24/7 on Solana with real-time settlement, while preserving existing investor protections and regulatory structure.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.