Market Highlights

- Bitcoin reached another all-time high of US$93,318 before retracing.

- XRP is trading at three-year highs, with open interest reaching US$2 billion.

- Tether launched Hadron, an asset tokenisation platform.

- Bitfinex hacker Ilya Lichtenstein was sentenced to five years in prison.

Markets Overview

Macro Market Updates:

Markets retraced slightly this week, handing back some of the gains seen as the U.S. presidential election result was decided the week prior. Across both the traditional finance (TradFi) and crypto markets, prices stagnated and slid in the second half of the week, presumably due to U.S. Federal Reserve Governor Jerome Powell’s commentary around the trajectory of interest rates in the U.S. With inflation cooling and employment data remaining strong, Powell indicated that the strength of the economy necessitates some patience about future rate cuts. The ten-year yield hovered around a four-month high of 4.4% on the news.

In other macro news:

- The core U.S. Consumer Prince Index (CPI) for October came in at 2.6% for the 12 months to 30 October 2024.

- U.S. unemployment claims came in better than forecast at 217,000.

- Australia’s employment change for October came in lower than forecast at 15,900.

- The United Kingdom’s Gross Domestic Product contracted 0.1% in September.

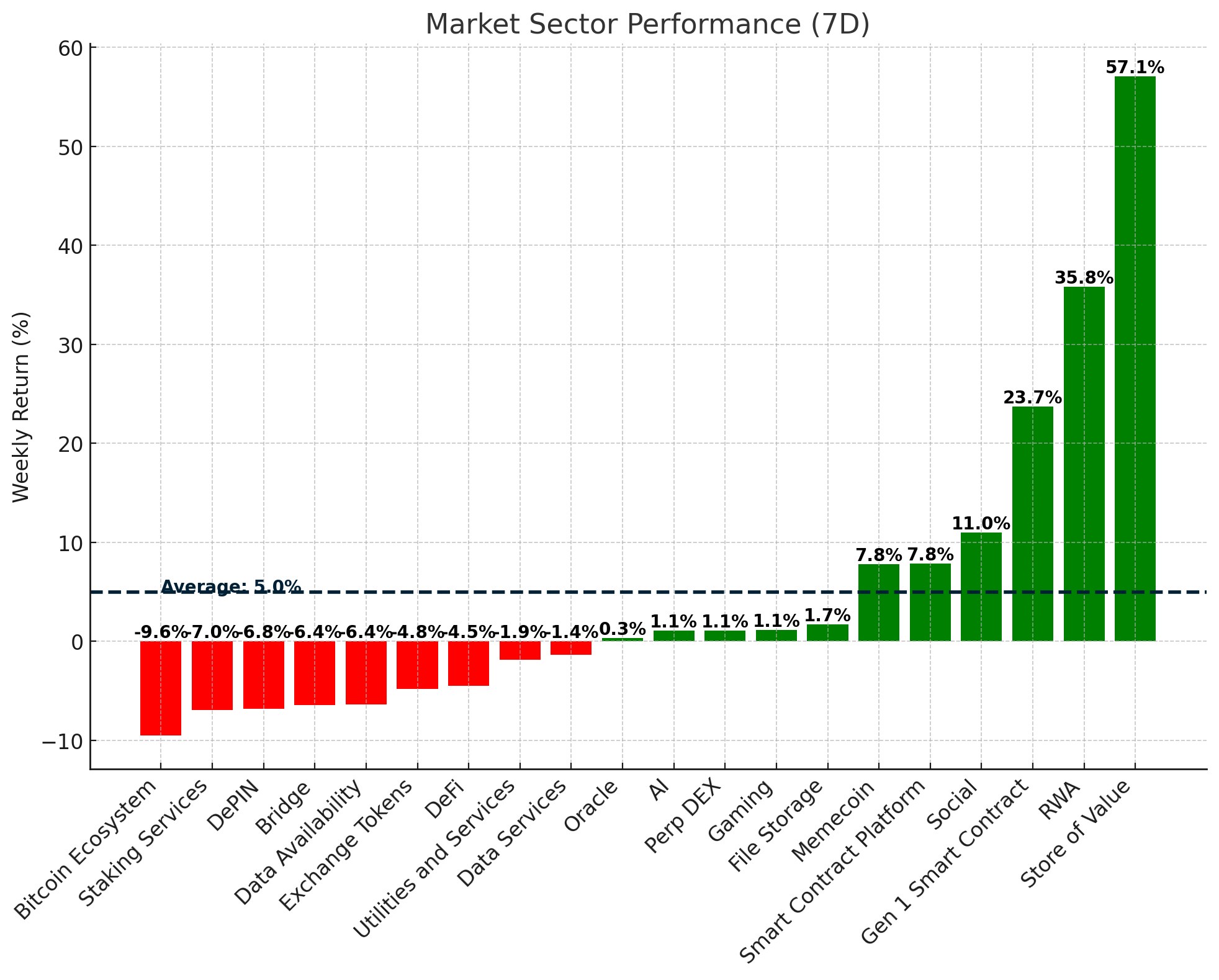

Crypto Market Sector Performance

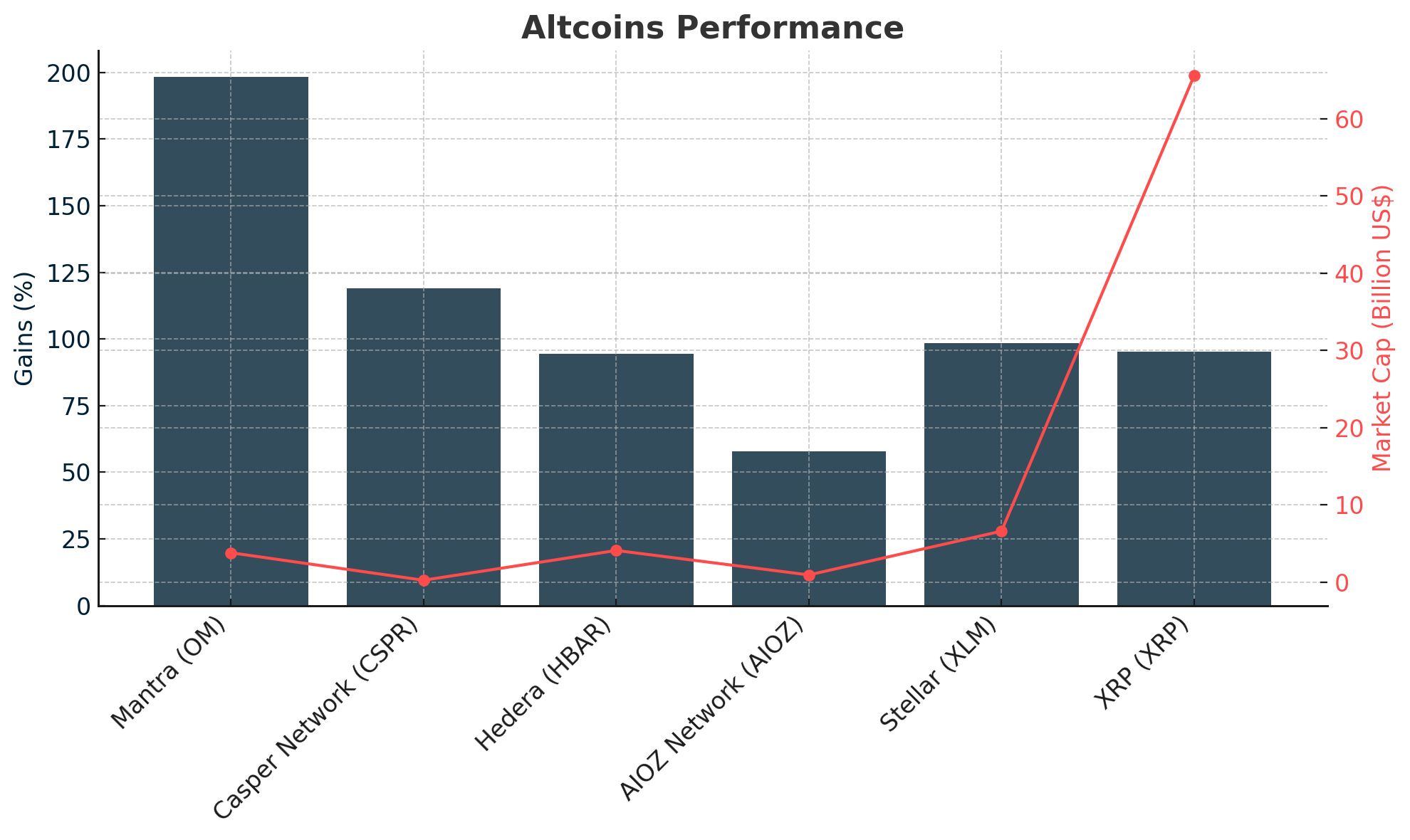

With an average of 26.4% growth across the crypto market sectors this week, store of value, real world assets and generation 1 smart contracts experienced the highest growth. This is reflected in the coins that made the biggest gains, such as Stellar (XLM) and XRP, which gained 98.4% and 95.3%, respectively. Smart contract gains were dominated by Mantra (OM), which almost doubled in value, growing by 198.4% on the week. More on these coins below.

The Bitcoin ecosystem and staking services were this week’s biggest losers, decreasing by 9.6% and 7%, respectively. These losses are presumably due to growth occurring in other parts of the market and, in the case of staking services, investors deleveraging or taking profit from liquidity pools in the second half of the week as markets pulled back slightly.

Crypto Market Sector Performance (7D)

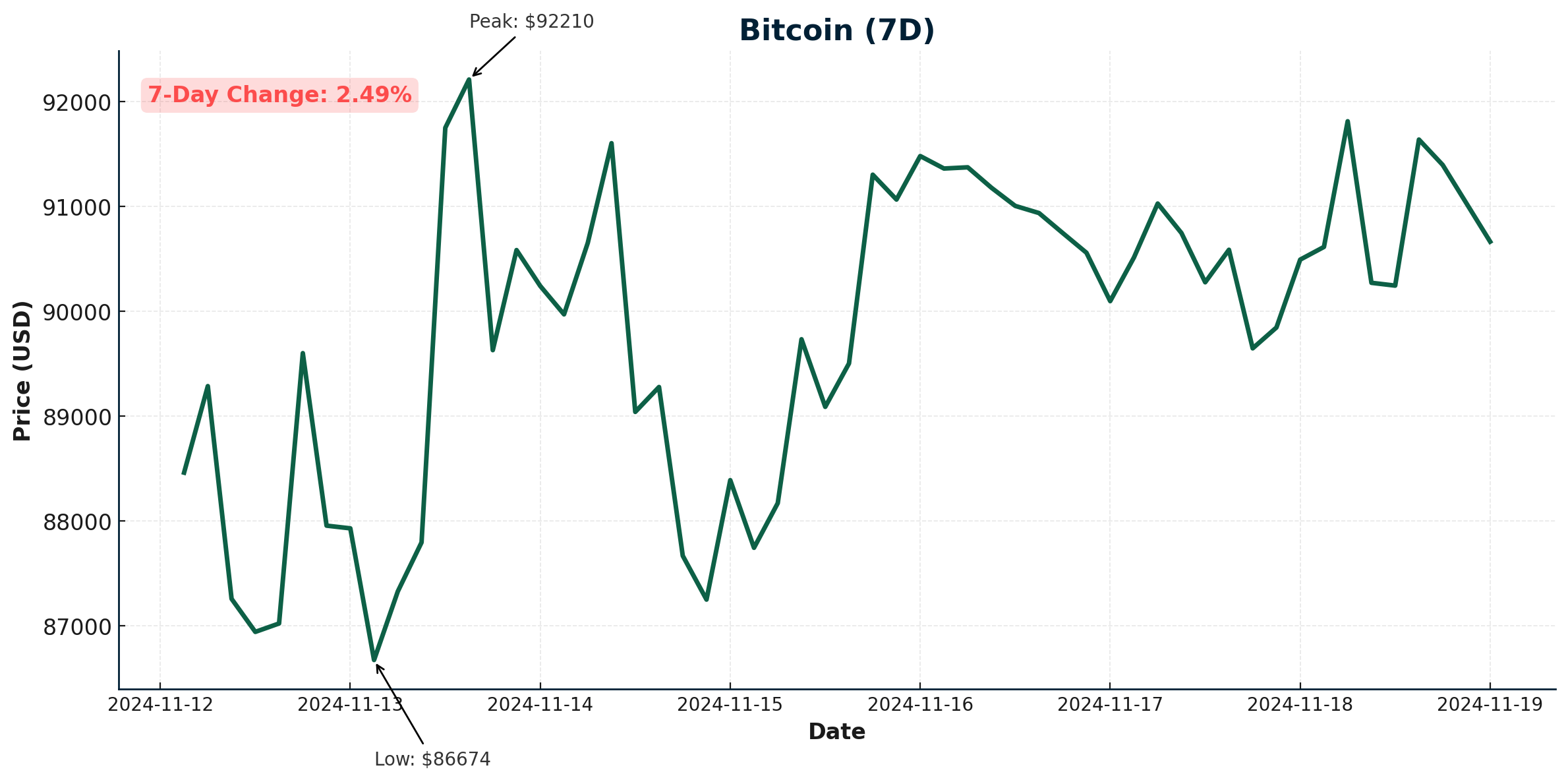

Bitcoin (BTC)

Bitcoin built on the recent upward momentum to start the week. The largest cryptocurrency opened the week at US$80,366 and rallied over 16% to reach a new all-time high of US$93,318 on Wednesday, 13 November. It even overtook silver as the world’s eighth-largest asset, with a market cap of US$1.75 trillion. Price has since stagnated around US$90,000, presumably due to news about the U.S. Federal Reserve's interest rate trajectory and that bitcoin miners are taking profit following last week’s price surge. In the last 48 hours, miners have sold over 3,000 BTC, valued at around US$273 million.

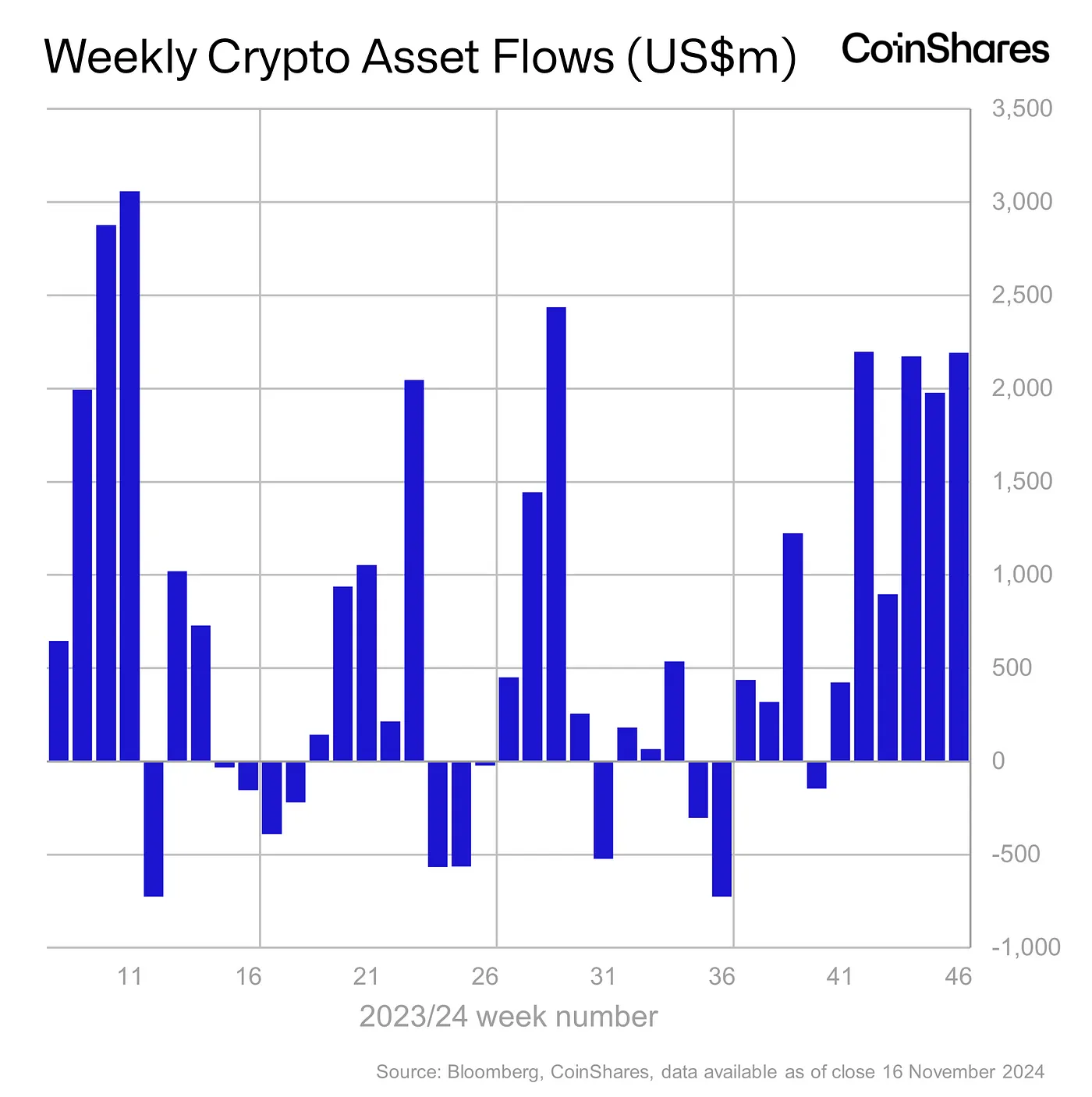

Inflows of US$1.48 billion went into bitcoin asset investment products this week. Short-bitcoin products gained US$49 million. This brings year-to-date inflows for bitcoin investment products to US$30.9 billion.

Goldman Sachs submitted its Q3 13F filing with the U.S. Securities and Exchange Commission (SEC), revealing that the firm holds US$710 million across numerous bitcoin exchange-traded funds (ETFs). At the time of filing, its largest holdings are BlackRock’s iShares Bitcoin Trust (IBIT), with 12.7 million shares worth US$461 million. This makes Goldman Sachs the second-largest holder of IBIT, behind hedge fund Millenium Management.

Bitcoin ETF options got one step closer to being approved for trading this week. The U.S. Commodity Futures Trading Commission (CFTC) released a notice stating that bitcoin ETF options are cleared. The next step is for the Options Clearing Corporation to provide approval.

Bitcoin is currently trading at US$92,012, an increase of 5.2% on the week.

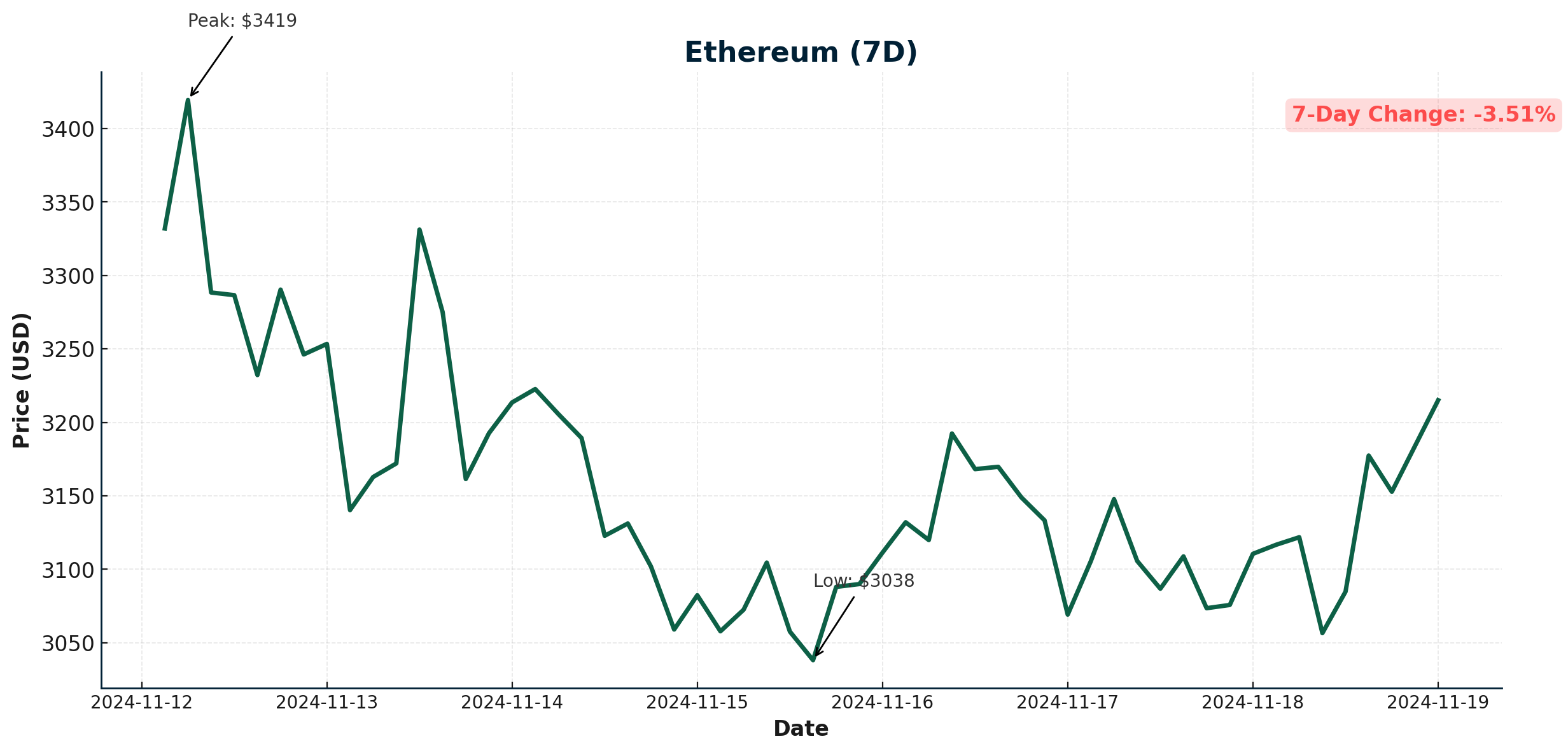

Ethereum (ETH)

It was a tough week for Ethereum. After a rally of almost 9% on Monday, 11 November, price found resistance at US$3,385, broke US$3,220 to the downside and has since tested this level as resistance.

This week’s price declines came as on-chain activity surged. Data from on-chain analytics firm IntoTheBlock found that US$1 billion of Ether was moved out of crypto exchanges. Activity like this typically indicates that investors are looking to hold their crypto assets throughout the next leg of the bull run, withdrawing them from centralised exchanges for more secure long-term storage.

Ethereum asset investment products saw inflows of US$646 million this week. The inflows are presumably due to political certainty following the U.S. presidential election result and Ethereum researcher Justin Drake’s proposal to redesign Ethereum’s consensus layer.

Drake’s proposal, “Beam Chain,” outlines a suggested redesign of the consensus layer. He said the upgraded layer should include the “latest and greatest” ideas from the Ethereum roadmap and be organised into a single upgrade package. Other proposed changes include how blocks are produced and how the network manages staking and zero-knowledge cryptography.

After tokenising its crypto investment options on different blockchains, Franklin Templeton launched the On-Chain U.S. Government Money Fund (FOBXX) on the Ethereum network. FOBXX enables investors to buy U.S. government securities, cash, and repurchase agreements and hold them in digital wallets. FOBXX is also available on Avalanche, Stellar and Aptos, plus Arbitru, Polygon and Base (Ethereum scaling networks). The move to launch on the Ethereum network is the first time that Franklin Templeton has launched anything on the Ethereum mainnet.

Ethereum is currently trading at US$3,168, a decrease of 5.4% on the week.

Altcoins

Smart contract gains

- Mantra (OM) gained 198.4%, taking its market cap to US$3.8 billion. The layer 1 blockchain for real-world assets found support around US$1.40, coinciding with the 50-day moving average. The gains are presumably due to growing investor interest in tokenising real-world assets, the well-received Mantra-sponsored Cosmoverse conference, and announcements such as the network’s new partnership with Pyse Earth to tokenise electric motorcycle ownership in the UAE.

- Casper Network (CSPR) gained 119%, which takes its market cap to US$241.7 million. The layer 1 blockchain that’s configured for builders soared after a number of positive announcements over the weekend. The announcements included CSPR becoming available to buy directly in the Ledger Live app, the launch of the Outlaw Dogs NFT project on the network, and more.

- Hedera (HBAR) gained 94.5%. This takes its market cap to US$4.1 billion. The open-source, leaderless proof-of-stake network has been rallying since Tuesday, 5 November, presumably due to U.S. election momentum. The continued rally is likely due to updates, such as Hedera being included in Coinbase’s COIN50 and positive sentiment at the Hedera Forum that took place in Miami this week.

DePIN delight

- AIOZ Network (AIOZ) grew by 57.9%, taking its market cap to US$931.6 million. The decentralised physical infrastructure network (DePIN) has gained almost 120% in recent weeks. The gains are presumably due to the wider market rally, growing investor interest in and the increasing capability of AI, and AIOZ Network’s collaborations on real-world projects, including using 3D printing to reconstruct surgical tools.

Crypto without borders

- Stellar (XLM) grew by 98.4%, taking its market cap to US$6.6 billion. Trading volume has grown since the golden cross occurred, surging to US$2.96 billion on Sunday, 17 November. The gains are also thought to be driven by XLM’s close correlation to XRP’s price action. The former co-founder of Ripple, Jed McCaleb, co-founded Stellar, and the projects share many similarities.

- XRP (XRP) gained 95.3%. This takes its market cap to US$65.6 billion. XRP reached a three-year high of US$1.30 on Wednesday, 13 November, before retracing to around US$1.15. The coin has seen strong upward momentum since Donald Trump was elected, with open interest in the futures market hitting just under US$2 billion, according to CoinGlass. High open interest typically indicates an uptick in speculative trading and bullish sentiment as positions are leveraged to amplify traders’ gains.

In Other News

Digital asset investment products saw inflows of US$2.2 billion this week. This brings year-to-date inflows to a record US$33.5 billion, while assets under management reached US$138 billion. The U.S. had the lion’s share of inflows, totalling US$2.2 billion. Hong Kong, Australia and Canada saw much smaller inflows at US$27 million, US$18 million, and US$13 million, respectively.

Other crypto news

- Tether has launched Hadron, a tokenisation platform for digital and real-world assets. The platform allows users to tokenise a range of assets, such as stocks, bonds and funds. Users can also issue and manage digital tokenised assets for individual and institutional investors. Alloy by Tethered Assets assets can also be tokenised on the platform. Tethered Assets track the reference asset’s price using stabilisation strategies, such as over-collateralisation with liquid assets and secondary market liquidity pools.

- The United Kingdom is going to pilot a Digital Gilt instrument using distributed ledger technology. The instrument, known as DIGIT, will issue tokenised UK government bonds. The roadmap indicates that DIGIT will be rolled out over three stages, starting with a short-dated digital Treasury bill to limited market participants. Within the first 12 months, a medium-term digital gilt will be introduced, followed by the final phase, where digital gilts will be traded and used in repurchasing agreements. This offering is expected to make capital markets more efficient.

Regulatory

- Larry Harmon, the man who helped criminals launder money with the Helix cryptocurrency mixer, has been sentenced to three years in prison. Harmon was arrested in 2020 and faced up to 20 years in prison. He was given a lighter sentence due to his assistance in the Bitcoin Fog mixer case, where operator Roman Sterlingov was sentenced to 12.5 years in prison. The sentencing also ordered Herman to forfeit approximately US$311 million in cash, plus a range of crypto and traditional assets worth over US$400 million.

- In Washington DC, Ilya Lichtenstein was sentenced to five years in prison for stealing billions worth of Bitcoin from crypto exchange Bitfinex in 2016. He has also been ordered to serve three years of supervised release following his prison time. In exchange for assisting in other investigations, Lichtenstein drastically reduced the 20 years of jail time that he was facing. His lack of prior record and only being able to launder 25,111 of the 119,754 bitcoin that he stole also helped to reduce his sentence.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.