Market Highlights

- CEO Changpeng “CZ” Zhao and Binance have plead guilty to federal charges involving violations of anti-money laundering laws, leading to him stepping down as CEO and for Binance to withdraw from the U.S. market.

- On Thursday, the U.S. Consumer Price Index (CPI) report revealed the annual inflation rate to have slowed down to 3.2% from 3.7% in September.

- BlackRock, the world's largest asset manager, filed a form S-1 registration for a spot Ethereum (ETH) ETF with the SEC on the same day.

Bitcoin

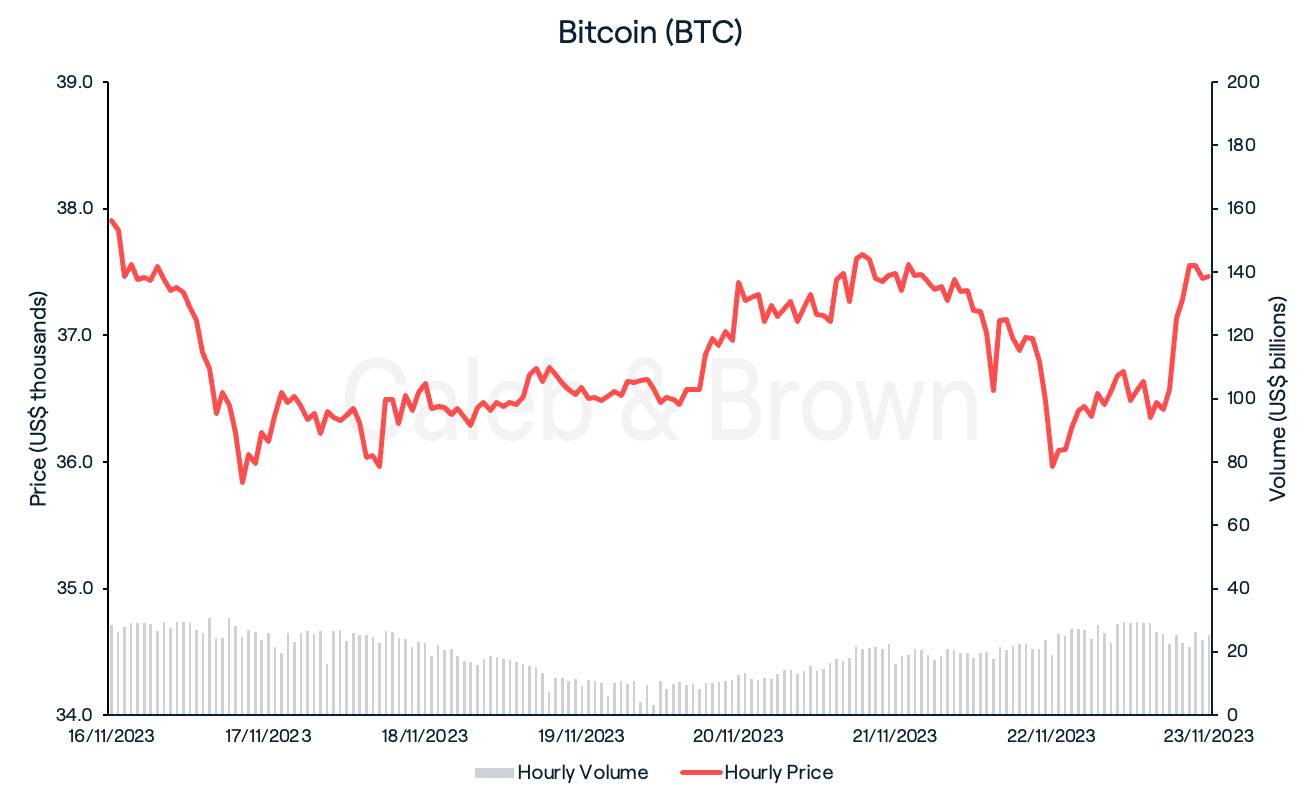

Bitcoin (BTC) started the week strong surging to a high of US$37,800 shortly after the U.S. Bureau of Labor Statistics released its Consumer Price Index (CPI) report on Thursday. It revealed the annual inflation rate to have slowed down to 3.2% from 3.7% in September, beating the estimated 3.3%. On a month-to-month basis, inflation was unchanged after a 0.4% jump in September.

BTC was unable to hold the line however after the Securities and Exchange Commission (SEC) missed the 8-day window to approve a spot Bitcoin ETF, delaying the decision.

BTC closed the week at US$37,465, down 1.2% over the last seven days.

Ethereum

Ethereum (ETH) traded similarly to BTC for majority of the week, hitting a high of US$2,090 after Thursday’s CPI report, before closing the week at US$1,985, up a very slight 0.2%.

Meanwhile BlackRock, the world's largest asset manager, has set its sights on Ethereum after filing a form S-1 registration for a spot Ethereum ETF with the SEC.

Altcoins

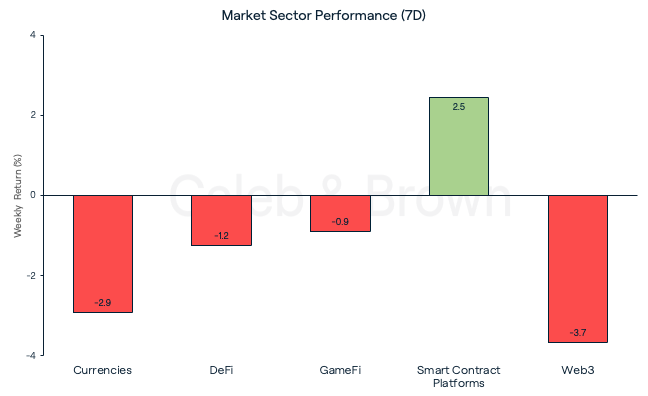

After 4 weeks of consecutive rallying, market sector performance finally slowed down. Smart Contract Platforms was the only sector to stay positive, adding on 2.5% week-on-week while Web3 and Currencies fell 3.7% and 2.9%, respectively. As BTC loses momentum, the powerful altcoin rally also begins to fade.

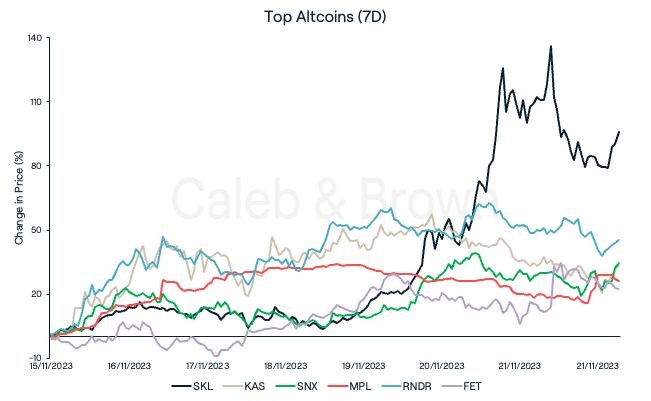

Amongst Smart Contract Platforms Skale (SKL) and Kaspa (KAS) were the biggest gainers, adding on 96.0% and 33.4%, respectively. Skale pumped after its recent partnership with Cryptopia which will emerge with a free-to-play-and-earn game.

Defi players, Synthetix Network (SNX) and Maple (MPL) gained 34.8% and 26.3%, respectively. SNX soared after it unveiled its plans for Perps V3 which will unlock new features such as multi-collateral and cross-chain lending.

Finally, decentralised GPU rendering protocol, Render (RNDR) and AI-focused protocol, Fetch.ai (FET) each gained 45.2% and 22.3%, respectively. RNDR’s surge in price followed a new listing on Binance Japan last week.

In Other News

- Crypto exchange Bittrex Global, announced that it will be winding down operations in the next two weeks, on December 4th. The announcement was made nine months after its United States-based arm, Bittrex, said it planned to wind down operations.

- Taking a step towards transforming asset and wealth management, J.P. Morgan and Apollo Global, through their collaboration Onyx, have introduced a portfolio management system proof-of-concept in partnership with Avalanche as part of the Monetary Authority of Singapore's Project Guardian.

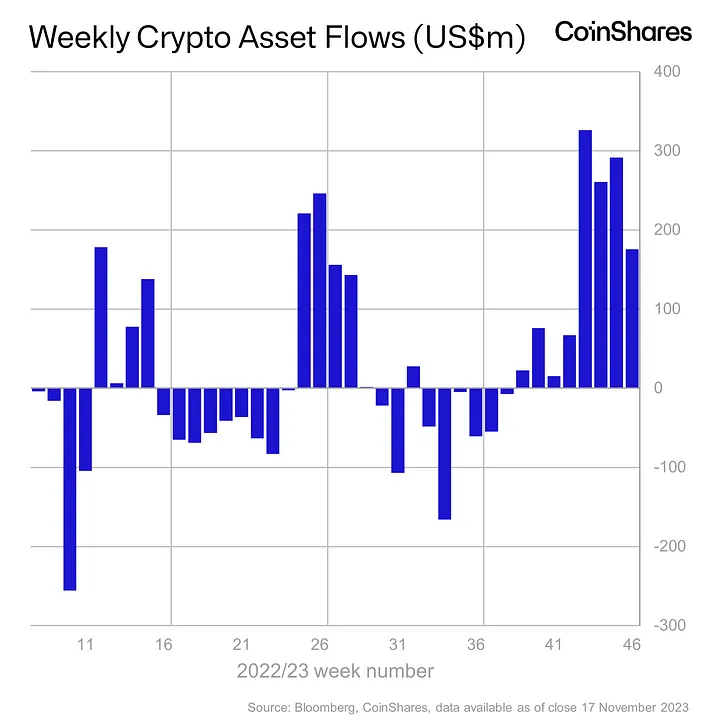

- Digital asset investment products saw inflows for the eighth consecutive week after netting another US$176m. Bitcoin (BTC) represented 88.1% of the funds followed by Solana (SOL) which represented 7.7%.

Regulatory

-

Binance is set to withdraw from the U.S. market and has agreed to pay a hefty US$4.3 billion, marking the largest penalty in the history of the Treasury Department. This resolution, announced by the Department of Justice on Wednesday, stemmed from a comprehensive criminal investigation spanning several years into the company and its leadership.

-

Additionally, CEO Changpeng “CZ” Zhao resigned and plead guilty to anti-money laundering violations, consenting to a separate US$50 million fine. The terms of the plea agreement further mandate that Zhao refrains from any current or future involvement with the company for a minimum of three years. There were no allegations of misuse of user funds of market manipulation.

-

The SEC filed charges against crypto exchange Kraken on Monday, for “operating Kraken’s crypto trading platform as an unregistered securities exchange, broker, dealer, and clearing agency." Kraken has since responded.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6tHXoISSSPUYB2wghvDnr3%2F57c3370cb3929f4892d40f35beebc408%2FWeekly_Rollup_Tiles__25_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-11-23T05%3A56%3A01.886Z)