Market highlights

- Bitcoin fell to a seven-month low of US$80,524 on Friday, November 21.

- New Hampshire’s Business Finance Authority approved a US$100 million BTC bond.

- VanEck, Canary Capital and Fidelity all launched their Solana ETFs this week.

- Cboe Global Markets launched “continuous futures” for bitcoin and Ethereum.

- Crypto industry leaders held a private dinner with U.S. policymakers to discuss crypto tax.

Markets Overview

Risk assets continued to sell off this week on continued uncertainty around the U.S. Federal Reserve’s interest rate trajectory. The non-farm employment change for September was finally released this week, coming in at 119,000, well above the forecast of 53,000.

Markets also weighed the Fed’s October meeting minutes this week, which revealed divisions among the Fed’s governors over whether a December 10 rate cut would be appropriate. Others also raised concerns about inflated asset valuations, especially as AI-related companies continued to post sizable gains. Despite the latent uncertainty around interest rates, the likelihood of a December rate cut has increased to 81%, following Fed Governor John Williams’ statement that interest rates can still fall “in the near term”. In the hours before the Fed’s October meeting minutes were released, President Trump spoke at the U.S.-Saudi investment forum. He stated he would love to fire Powell, whose term as Fed chair ends in May.

The possibility of another unwind in the yen carry trade is also causing concern across markets. The yen is currently trading at a 10-month low. Indications that Prime Minister Takaichi would prefer the Bank of Japan not raise interest rates have sent Japanese bond yields to historic highs. Further global macro uncertainty in the coming weeks may cause an unwind in the yen carry trade, which typically drains liquidity from risk assets.

Elsewhere, the Flash Purchasing Managers’ Index (PMI) data was mixed. The German Flash services and manufacturing PMI both came in under forecast at 52.7 and 48.4, respectively. The U.S. Flash services PMI came in above forecast at 55, while the manufacturing PMI came in around forecast at 51.9.

Weekly performance: S&P 500 -2%, Dow Jones -1.9%, Nasdaq -2.7%.

Looking ahead:

- U.S. core Producer Price Index - Wednesday, November 26

- U.S. preliminary gross domestic product (GDP) q/q - Thursday, November 27 (tentative)

- U.S. core Personal Consumption Expenditures (PCE) price index - Thursday, November 27 (tentative)

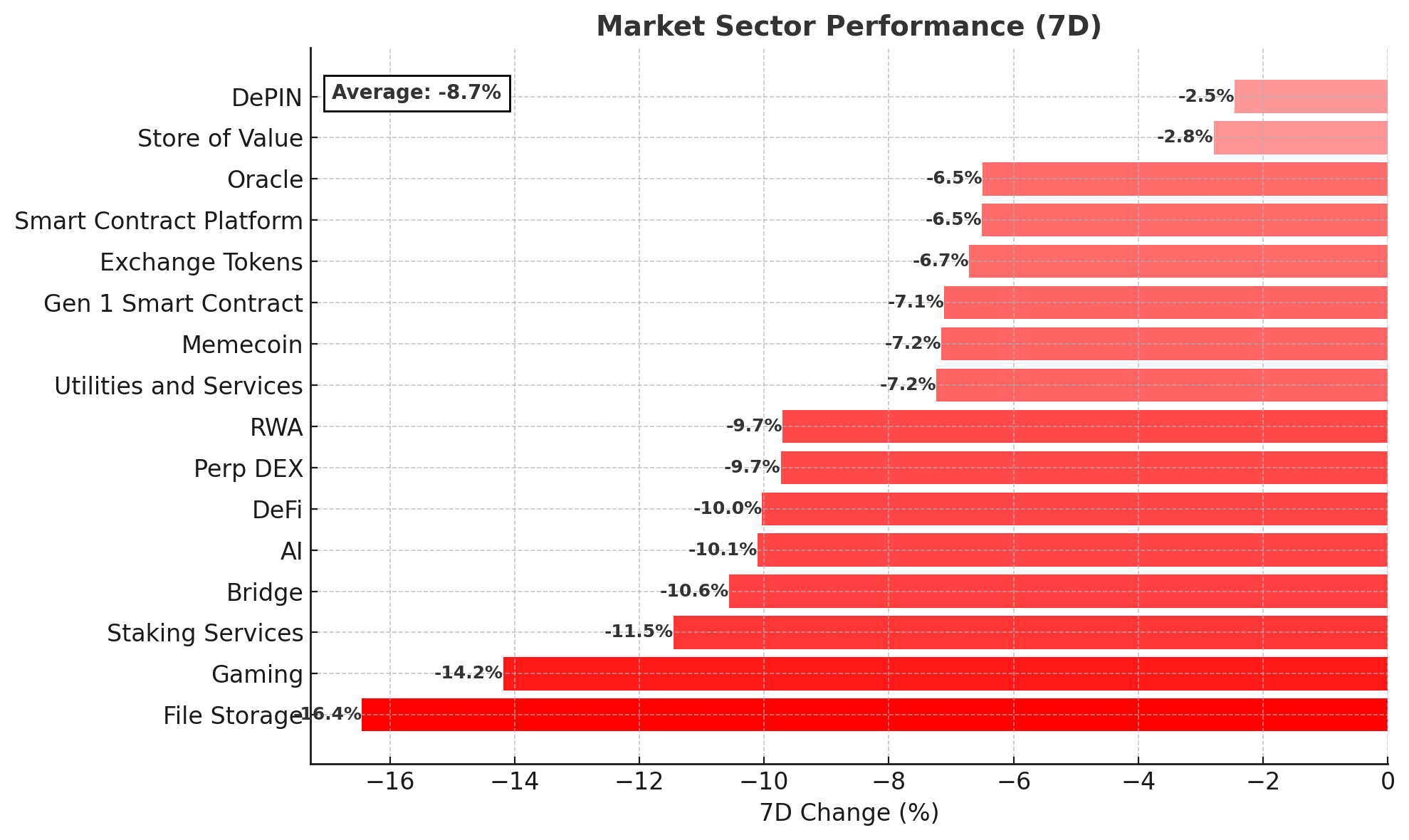

Crypto Market Sector Performance

Most crypto sectors saw losses this week, except for social and store-of-value. The declines are due to persistent global macro uncertainty. Total crypto market liquidations in this most recent sell-off reached US$2.2 billion, while the crypto fear and greed index declined further to 12 (extreme fear). Almost US$1 billion of the total liquidations occurred early Friday morning as leveraged positions unwound.

Biggest loser

- File storage: Filecoin (-17.6%) declined, presumably due to broader market uncertainty, while the team’s launch of the Filecoin Onchain Cloud, a decentralised cloud storage platform, didn’t do much to buoy prices.

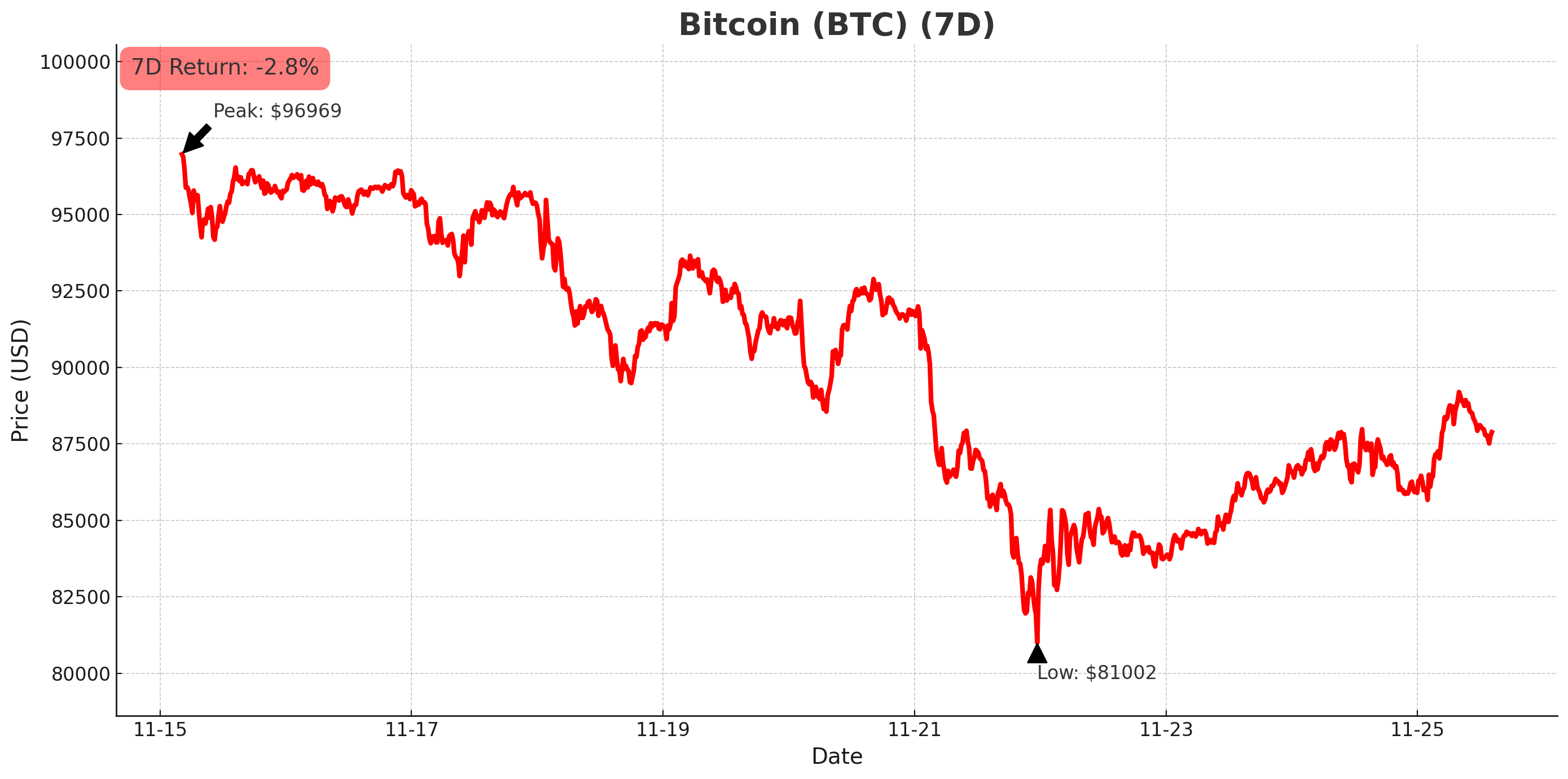

Bitcoin (BTC)

- Opened the week at US$94,182 and declined to a seven-month low of US$80,524 on Friday, November 21, as crypto bears the brunt of broader global macro uncertainty. Price has since regained some strength, with bitcoin trading around US$88,900 to start the new week(-3.1% 7D).

- BTC dominance ranged between 59.5% and 59% this week.

- Bitcoin investment products saw almost US$1.3 billion of outflows this week. Short bitcoin saw inflows of US$19 million.

Owen Gunden, a bitcoin whale who first bought BTC in 2011, may have sold his 11,000 BTC stash, valued at US$1.3 billion. While analysts are unable to track Gunden’s coins once they reach a centralised exchange, periodic moves since October suggest he may have been selling in intervals following the October 26 all-time high.

Metaplanet is issuing new perpetual preferred shares (“Mars” and “Mercury”) to raise approximately ¥21.2 billion (about US$135 million) for aggressive bitcoin accumulation. The Mercury shares offer a fixed 4.9% dividend and can convert into common shares, aligning with the company’s long-term bitcoin treasury strategy. In other bitcoin buying news, Strategy’s Michael Saylor says the company will continue to purchase BTC for its corporate treasury, despite the possibility it may be excluded from certain equity indexes next year. MSCI says it’s debating how to treat crypto treasury firms whose digital asset holdings account for more than 50% of the company’s total assets.

A newly proposed “Bitcoin for America Act” would let Americans pay federal taxes in bitcoin, with no capital-gains tax, by treating the payment as full tax liability. BTC collected through citizens’ tax payments would be deposited into a U.S. Strategic Bitcoin Reserve.

New Hampshire’s Business Finance Authority approved a US$100 million municipal bond collateralised by bitcoin. Borrowers must over-collateralise at 160%, and if BTC value drops below 130%, the position liquidates to protect investors. The bond generates fees and gains for the Bitcoin Economic Development Fund, which supports business and economic innovation in New Hampshire.

Mt. Gox wallets moved almost US$1 billion worth of BTC this week, raising questions around whether the defunct crypto exchange is about to begin its next round of bitcoin repayments.

In bitcoin buying news:

- El Salvador added almost 1,100 BTC worth US$100 million to its national reserves. The move brings the country’s total holdings to around 7,474 BTC, reflecting a bold accumulation strategy despite criticism from the International Monetary Fund.

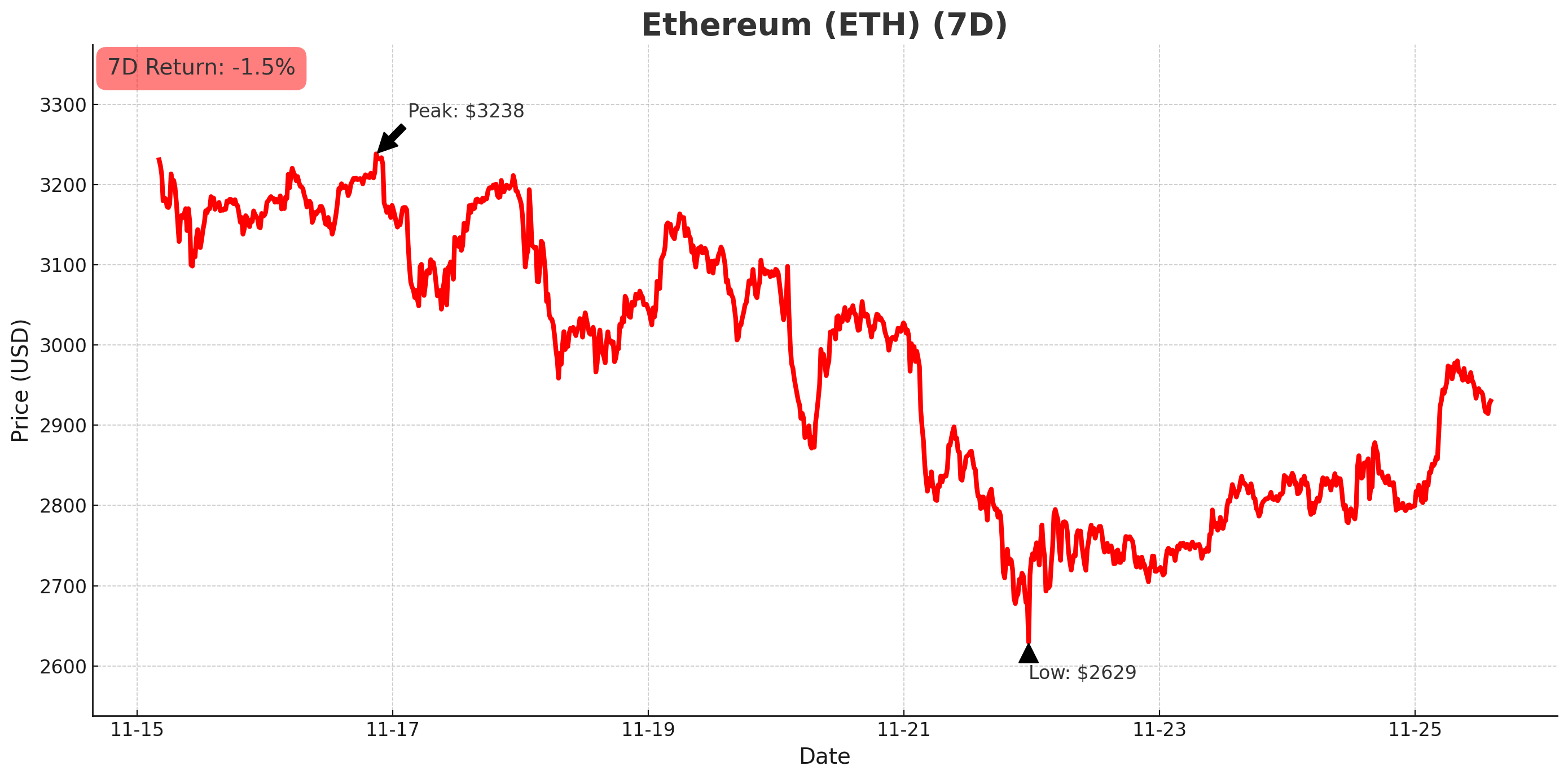

Ethereum (ETH)

- Opened the week at US$3,092 and declined to a low of US$2,620 on Friday, November 21, due to persistent bearish sentiment across the crypto market. Ethereum has since seen a small rally, trading around US$3,000 to start the week(-0.9% 7D).

- Ethereum dominance hovered between 11.8% and 11.6% this week.

- Ethereum-focused funds saw outflows of US$589 million this week.

Tom Lee, chair of BitMine, has predicted a 100× “supercycle” for Ethereum, drawing parallels with bitcoin’s historic rise. His company added 54,156 ETH to its treasury this week.

In Ethereum buying news:

- BitMine added 68,992 ETH to its treasury, bringing its holdings to over 3.6 million ETH, worth US$10 billion.

Altcoins

The altcoin season index is currently at 37 as bearish sentiment continues.

XRP staking coming?

- XRP gained 4.8%. The gains came as Ripple announced it’s exploring adding native staking to the XRP Ledger to boost XRP’s DeFi potential and align incentives between token holders and validators. The company’s engineering leads have proposed a dual-layer validator model or using transaction fees for zero-knowledge proofs. To start the new week, XRP gained 9% on the launch of Franklin Templeton’s XRP exchange-traded fund (ETF) on the New York Stock Exchange.

In the cloud

- Internet Computer (ICP) declined by 20.4%, pulling back from its recent rally driven by the launch of the team’s DFINITY 2.0 vision.

Crypto ETF News

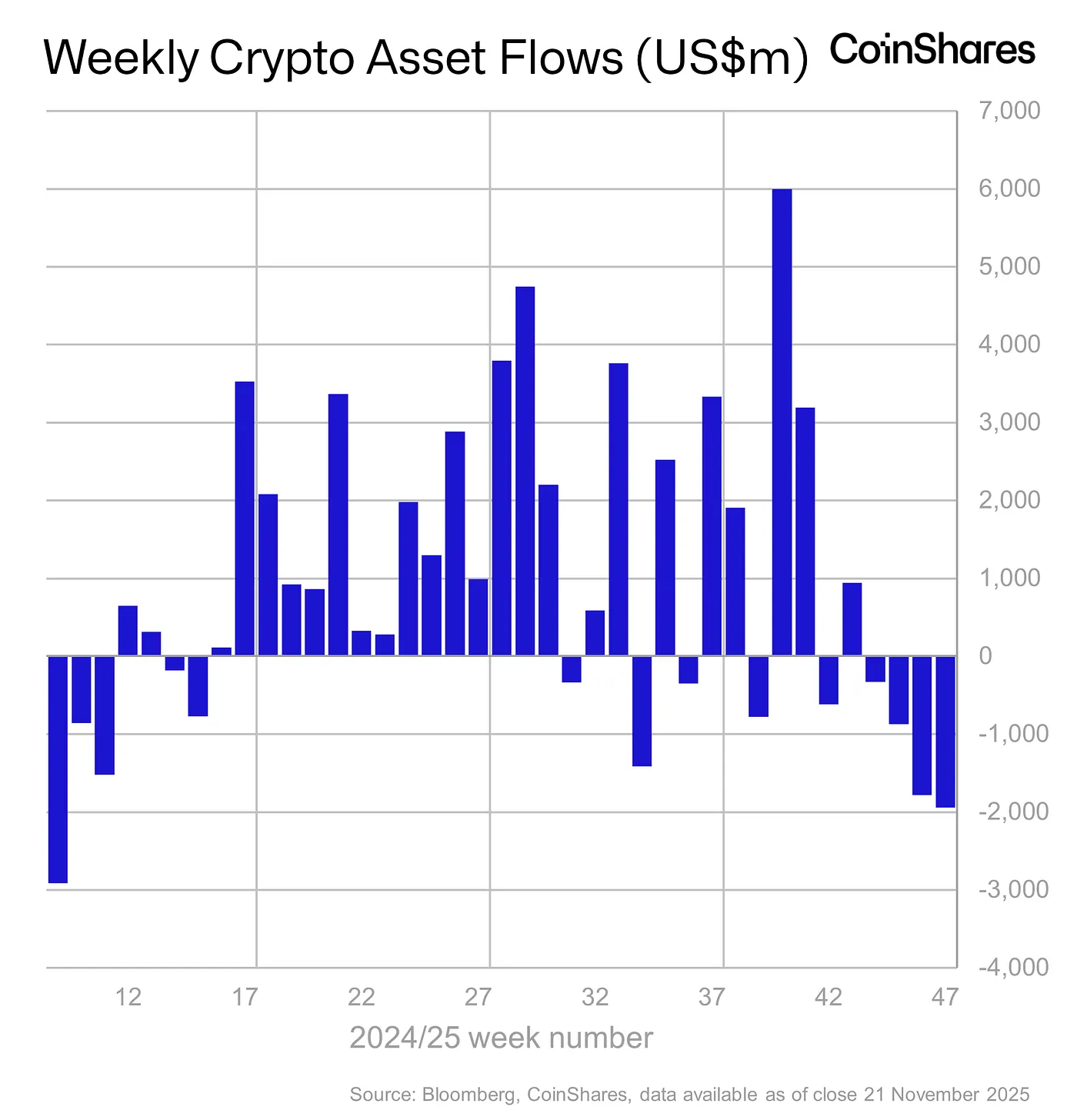

Digital asset investment products saw outflows of US$1.9 billion this week, marking a fourth straight week of outflows. It’s the third-largest outflow streak since 2018.

In altcoins, Solana saw outflows of US$156 million, and XRP saw inflows of US$89.3 million.

Leverage Shares is launching two crypto exchange-traded funds (ETFs) on the SIX Swiss Exchange. The products go live this week and will offer 3x leverage on short and long bitcoin and Ethereum positions.

BlackRock established a new Delaware statutory trust this week, the iShares Staked Ethereum Trust ETF. Forming such a trust is typically an early step in an ETF issuer’s listing process.

21Shares’ 2X Long Dogecoin ETF (TXXD) launched on Thursday, November 20, while Grayscale launched its non-leveraged Dogecoin ETF and XRP ETF on Monday, November 24.

Several Solana ETFs launched, including VanEck’s VSOL, Canary Capital’s staking-enabled SOLC and Fidelity’s FSOL.

Other crypto news

- Crypto industry leaders held a private dinner, organised by the American Innovation Project, with members of the House Ways and Means Committee to press for clearer crypto tax rules. The group is pushing for a de minimis exemption on small crypto transactions and more favourable treatment of staking rewards. Meanwhile, they’re coordinating with other pro-crypto groups and the White House on broader tax reforms.

- The U.S. Treasury’s Office of the Comptroller of the Currency clarified that national banks may hold crypto on their balance sheets in certain cases, specifically, to pay blockchain network fees and to test crypto-related platforms. The policy lifts previous restrictions and allows banks to expand into on-chain operations.

- The White House is reviewing a Treasury proposal to join the global Crypto‑Asset Reporting Framework (CARF), which would give the IRS access to Americans’ foreign crypto account data. CARF, backed by most G7 countries, aims to curb offshore tax evasion through automatic information-sharing. Implementation is expected by 2027.

- Cboe Global Markets launched “continuous futures” for bitcoin and Ethereum. The contracts are designed to mimic perpetual-style trading but with a 10-year expiry. These futures will be cash-settled, use daily funding adjustments anchored to spot prices, and offer long-term exposure in a U.S.-regulated, centrally cleared environment.

- Core Foundation won a Cayman Islands court injunction against Maple Finance, accusing it of misusing confidential information from their joint lstBTC project. Core claims Maple breached a 24-month exclusivity agreement by developing a competing bitcoin yield product, syrupBTC. Maple denies wrongdoing, maintaining its broader business is unaffected.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.