Market Highlights

- Sam Bankman-Fried was found guilty on seven counts of fraud and conspiracy in relation to the collapse of FTX.

- Markets rallied on Wednesday following the U.S. Federal Reserve’s decision to pause interest rate hikes for the second consecutive meeting.

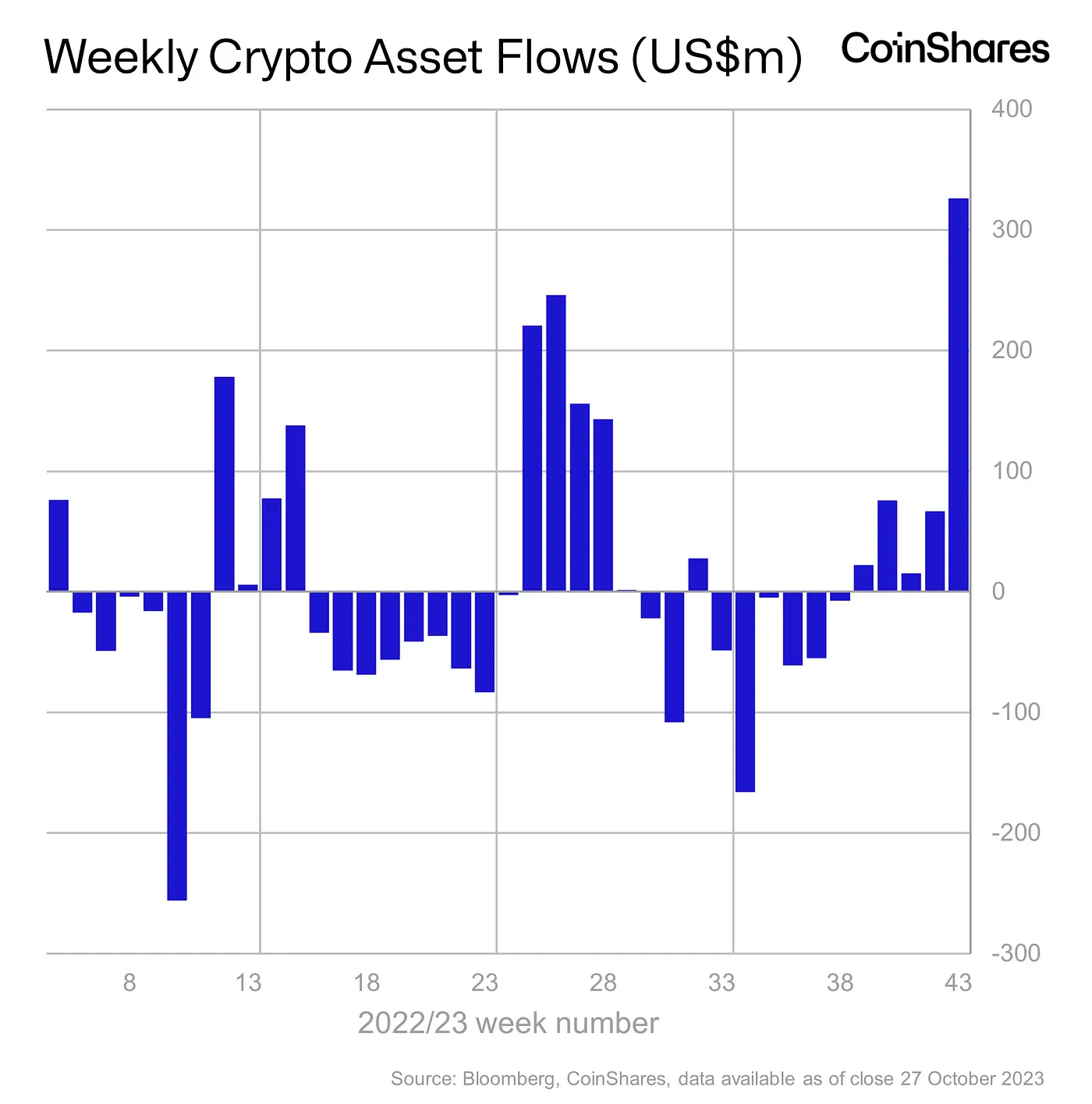

- Digital asset investment products recorded its largest inflow (US$326m) in 16 months, with 90% flowing into Bitcoin (BTC).

- Stablecoin supply has stopped falling and recorded net inflows for the first time this year, indicating a possible shift in market sentiment.

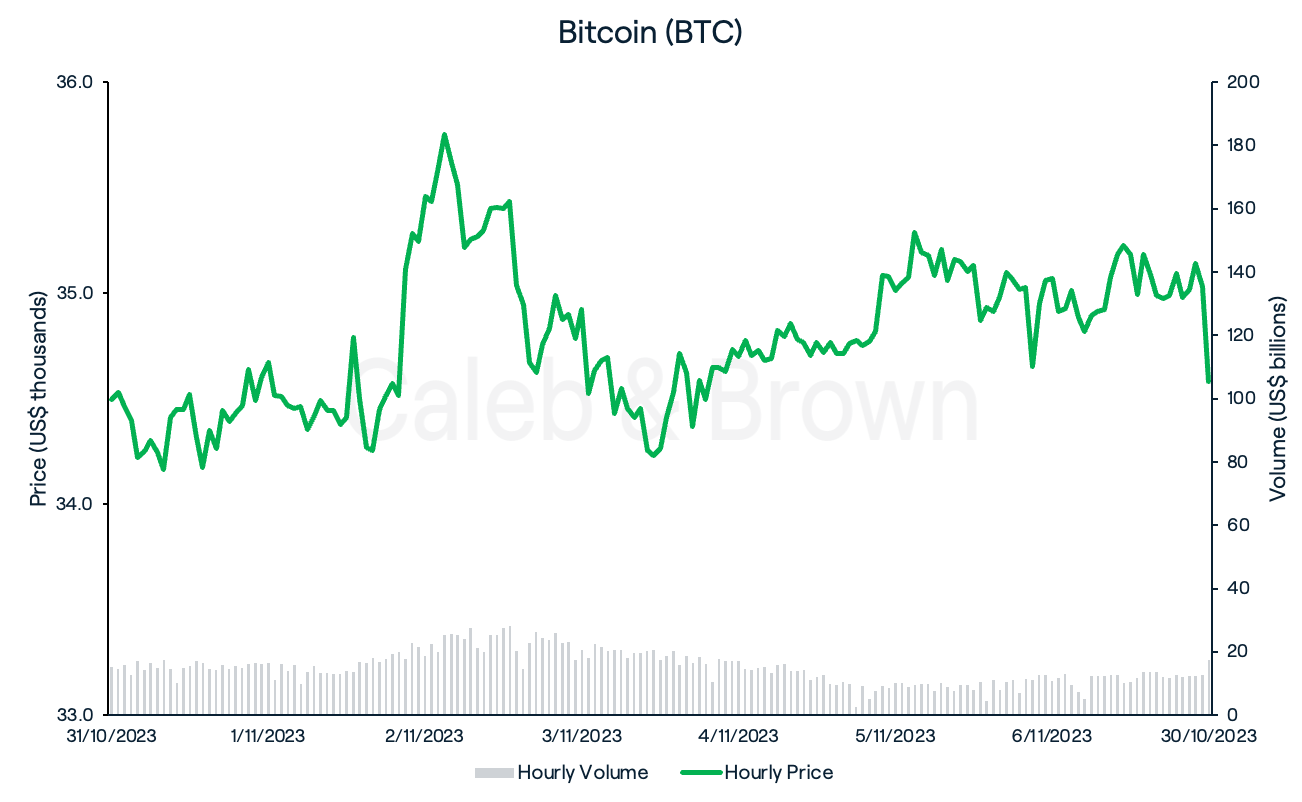

Bitcoin

After a fortnight of rallying Bitcoin (BTC) has finally slowed the pace down, spending the majority of the week trading between US$34,000 to US$35,500.

BTC edged towards a new 17-month high on Wednesday after the U.S. Federal Reserve announced it would leave interest rates at 5.25%-5.50% for the second consecutive meeting.

As such, BTC closed the week at US$34,580 up a slight 0.3% over the last seven days.

Digital asset investment products also recorded their largest inflows (US$326m) in 16 months, with 90% of all funds flowing into BTC.

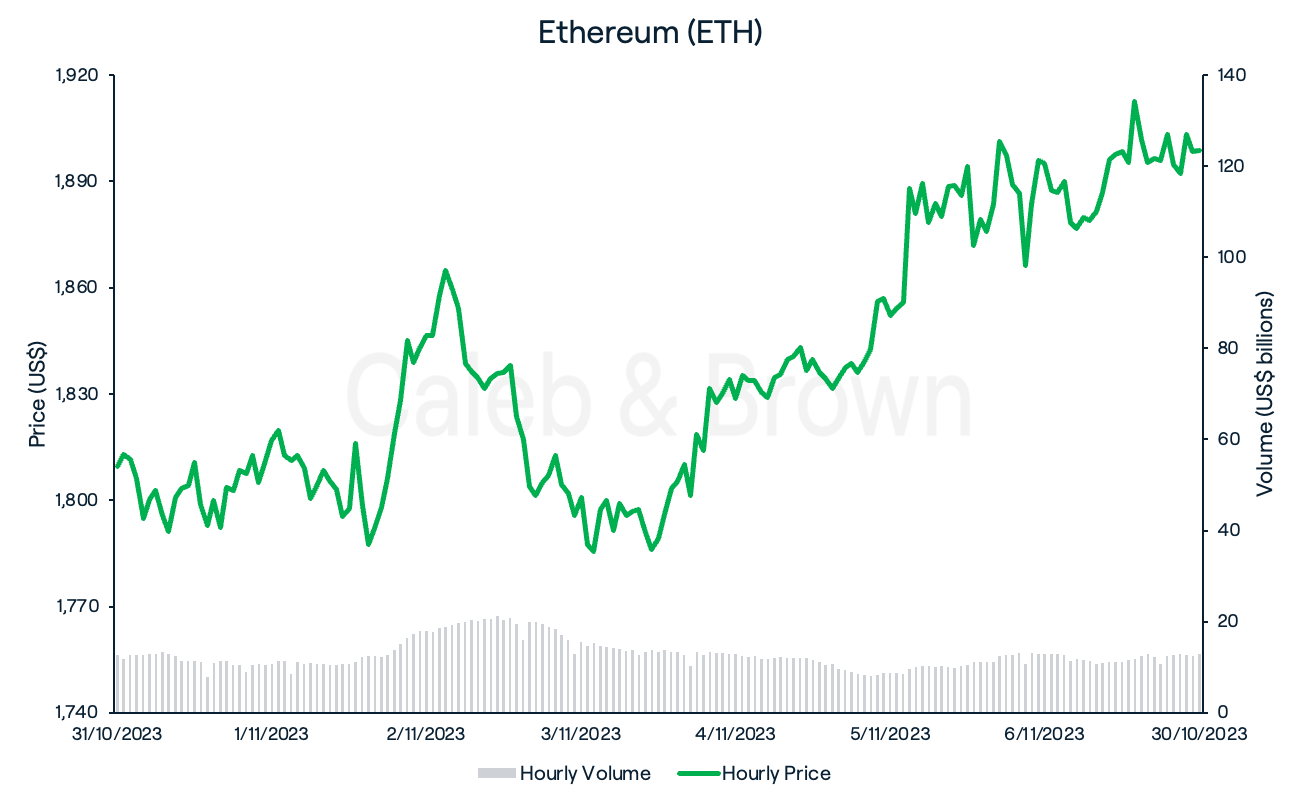

Ethereum

Ethereum (ETH) picked things back up this week as it briefly traded above US$1,900 for the first time in four months.

This saw ETH gain back 4.7% relative market share against BTC and close the week at US$1,899, adding on 4.9% over the last seven days.

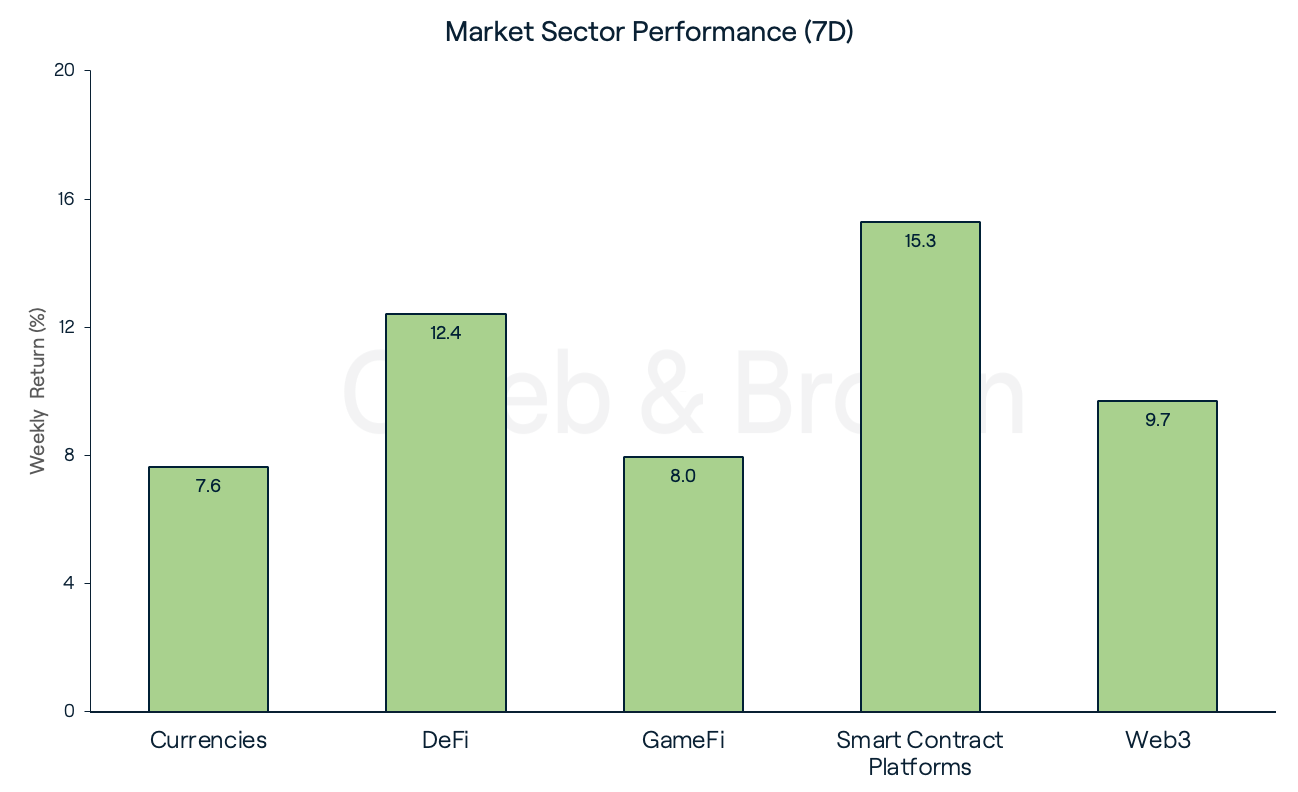

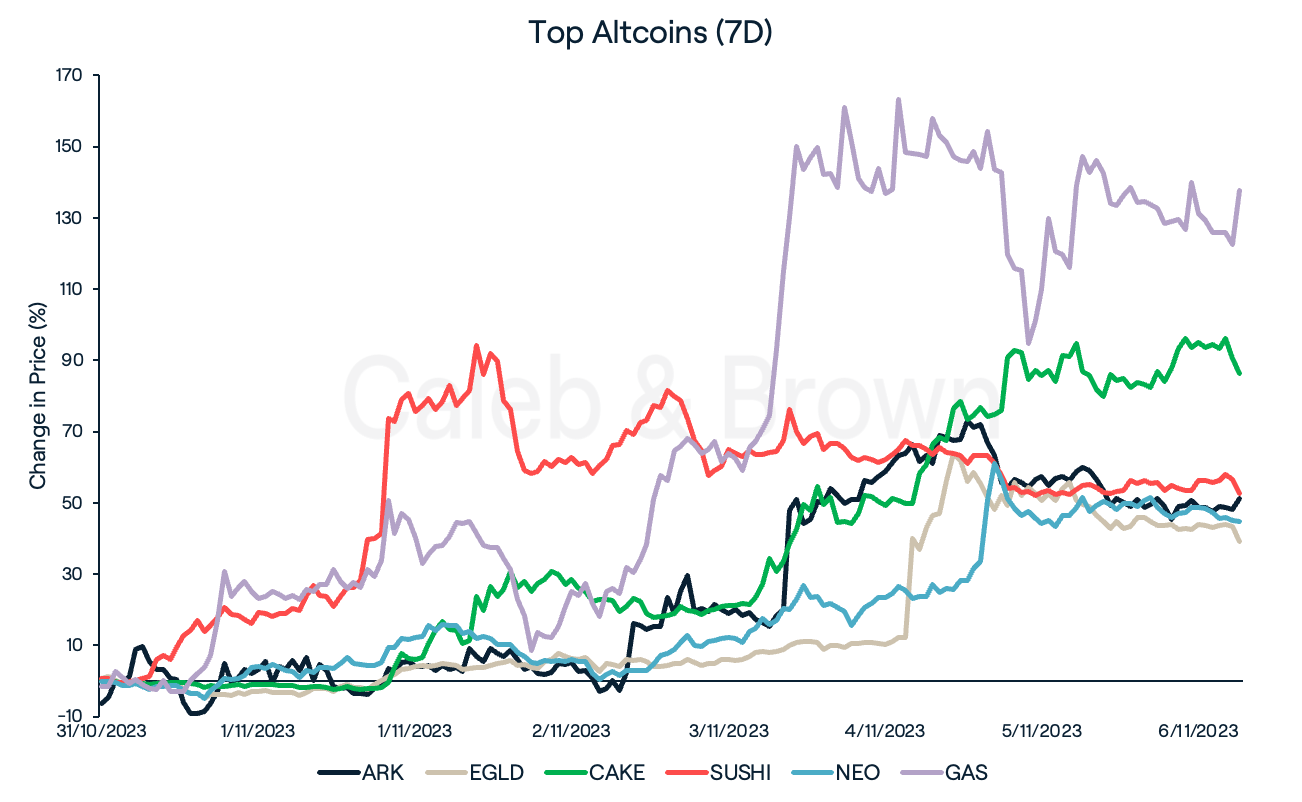

Altcoins

While BTC cooled off, altcoins showed no signs of slowing down as all sectors rallied for the third consecutive week. Smart Contract Platforms led the pack, increasing by 15.3%, followed closely by DeFi and Web3 which grew 12.4% and 9.7.%, respectively.

Amongst Smart Contract Platforms, Ark (ARK) and MultiversX (EGLD) took top spot with each surging 51.2% and 39.1%, respectively. MultiversX recently partnered with Google Cloud to expand its Web3 presence while Ark has made huge developments in its major codebase refactor dubbed Mainsail.

Decentralised exchanges PancakeSwap (CAKE) and Sushi (SUSHI) also rallied 86.4% and 52.7% to lead the DeFi sector.

Neo (NEO) blockchain and its Gas token (GAS) were this week’s top performers with each gaining 44.8% and 137.7%, respectively. The entire ecosystem surged following Neo’s announcement to launch a new EVM-compatible sidechain.

In Other News

For the first time this year, stablecoin supply has stopped falling and recorded net inflows. This may signal a positive indication for overall market sentiment as investors prepare to position themselves ahead of a Bitcoin spot ETF approval.

Payments giant PayPal revealed in its recent quarterly report that the Securities and Exchange Commission (SEC) had subpoenaed Paypal over its PayPal USD stablecoin, requesting the production of relevant documents.

Regulatory

On Thursday, Sam Bankman-Fried was found guilty for his role in the collapse of crypto exchange FTX. After 15 days of testimony, jurors required less than 5 hours of deliberations to deliver a verdict that found him guilty on seven counts of fraud and conspiracy.

The so-called ‘ETH-killer’ is up a whopping 320% in 2023!

But what exactly is Solana, and how is it different to Ethereum?

Learn everything there is to know about the Layer 1 blockchain and its native $SOL token in our latest blog.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5jGWG3EDwNzj5azFdnLvot%2F49b273ace8cab046e07660f98d4de508%2FWeekly_Rollup_Tiles__23_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-11-07T23%3A46%3A14.316Z)