Market Highlights

- The People’s Bank of China announced the largest stimulus measures since COVID-19.

- Another Satoshi-era Bitcoin wallet has woken up.

- Former co-founder of Binance, Changpeng Zhao, was released from prison.

- Former CEO of Alameda Research, Caroline Ellison, has been sentenced to two years in prison.

Markets Overview

Macro Market Updates:

This week, the People’s Bank of China (PBOC) decided to begin easing monetary policy. In the largest stimulus package since the outbreak of COVID-19, China’s central bank has decreased the reserve requirements for banks, cut the mortgage rate of existing homes by 50 basis points, released plans for a “stock stabilisation fund”, and given assets managers, insurers and other institutions the ability to tap into 800 billion yuan (US$113 billion) in liquidity support.

The PBOC’s stimulus measures will be implemented with the aim of combating the slowdown in housing purchases and consumer spending to help the economy reach its 2024 growth target of 5%. Like the lowering of rates in the US last week, the additional liquidity expected to enter markets through the PBOC’s measures may fuel upside momentum across many asset classes, particularly risk assets.

In Japan, there was a surprise choice for the next prime minister. Japan’s Liberal Democratic Party elected Shigeru Ishiba. He is thought to be supportive of the Bank of Japan increasing interest rates to return the central bank’s monetary policy to normalcy. Naturally, markets have responded with a slight sell-off on the news, given the impacts of the BoJ’s interest rate hike in late July.

Elsewhere, purchasing manager index (PMI) updates and the Reserve Bank of Australia’s (RBA) rate decision dominated the macro news calendar.

- The Reserve Bank of Australia (RBA) left rates on hold at 4.35%.

- Germany’s PMI figures came in below forecast, with the Flash Manufacturing and Flash Services PMI releases coming in at 40.3 and 50.6, respectively.

- The UK’s Flash Manufacturing PMI came in at 51.5, while the Flash Services PMI came in at 52.8 — both under forecast.

- In the US, the Flash Manufacturing PMI came in under forecast at 47, while the Flash Services PMI came in at 55.4.

Crypto Market Sector Performance

Performance across the crypto market was mixed this week. Memecoin and bridging services were the standouts. Data availability services had the largest losses at 10.7%.

The growth in meme coins this week was driven by the explosive growth in Moo Deng (MOODENG). The Solana-based meme coin, based on a baby pygmy hippo in a Thailand zoo, went viral and has grown to a market cap of US$70 million in the last two weeks. Other meme coins, including Dogecoin (DOGE), Shiba-Inu (SHIB), Dogwifhat (WIF) and Mog Coin (MOG), all experienced gains this week, too.

Bridging services made gains this week, as cryptocurrencies like Dia (DIA) and XYO Network (XYO) gained 28.9% and 33.3%, respectively. The gains are presumably due to a flurry of activity and announcements many cryptocurrencies made at crypto events across Asia this week, such as Singapore’s Token 2049.

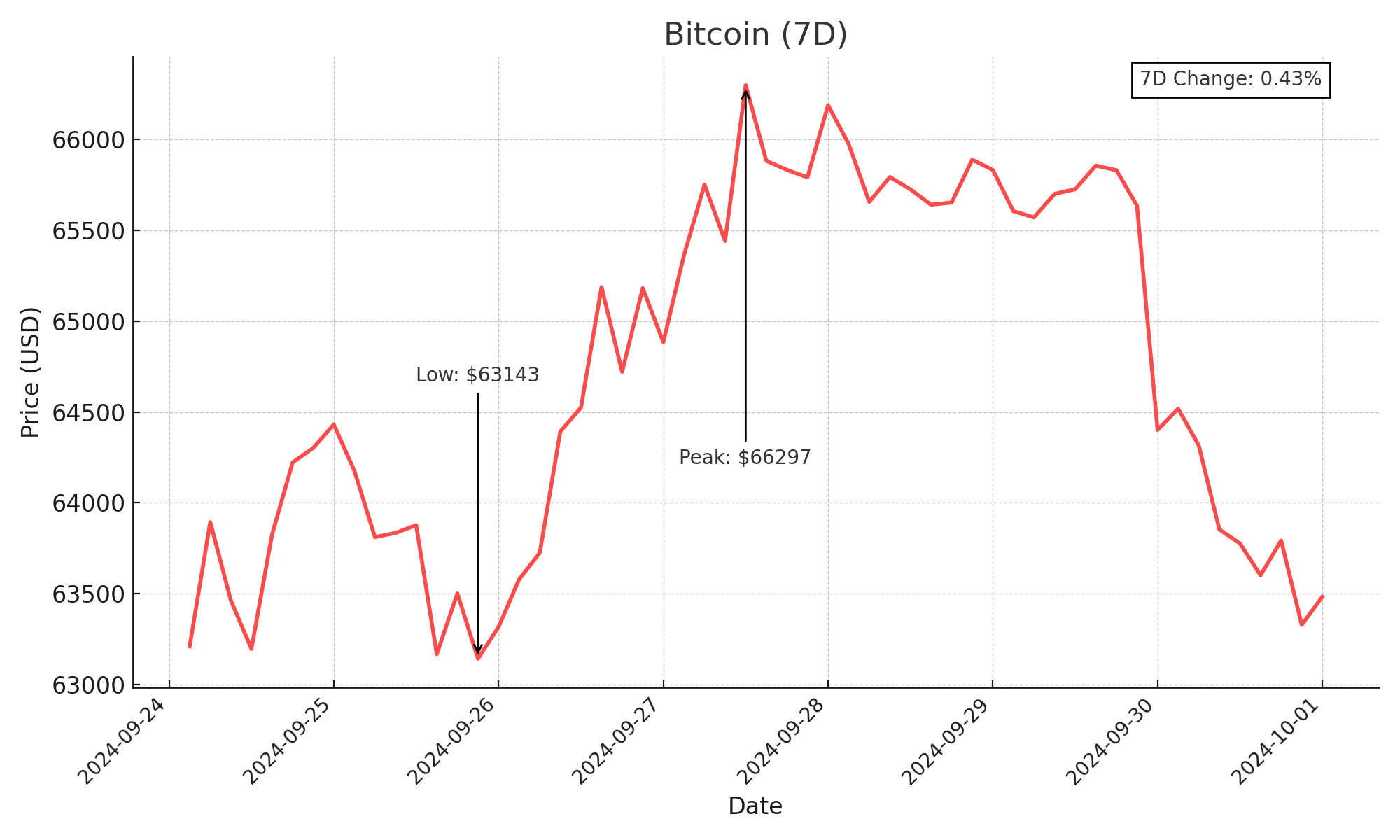

Bitcoin (BTC)

After gains the week prior, bitcoin’s price has declined to start the week. The largest cryptocurrency by market cap opened the week at US$63,663, moved to the upside to the key level around US$65,000 and has since broken this level to the downside.

As an important level, many investors are presumably watching around US$65,000 and have taken profit where applicable. Further, US$8 billion in bitcoin options expired at the end of last week, Japan’s new prime minister appears to be in favour of higher interest rates, US Federal Reserve Governor Jerome Powell spoke on Monday, 30 September, and markets may be awaiting October US non-farm payroll data at the end of the week. All of these factors appear to be converging to drive a pullback from last week’s highs.

Bitcoin asset investment products saw inflows of US$1 billion this week, with US$8.8 million going into short-bitcoin products. This week, bitcoin asset investment products reached a two-month high in total asset value, climbing to US$61.2 billion of bitcoin held across twelve funds. The highest day of inflows since June occurred on Friday, 27 September, when a total net inflow of US$494.3 million occurred.

Another Satoshi-era bitcoin wallet woke up this week. According to Arkham Intelligence, the miner’s wallet “woke up” three weeks ago. After being dormant for ten years, the whale’s BTC holdings grew from US$474,000 to be worth US$80 million. The miner has moved ten bitcoin, worth about US$630,000 at the time of writing, to the centralised exchange, Kraken. This move to send coins to an exchange suggests the miner may be intending to sell some of their holdings to realise their gains made over the last 15 years.

Black Rock’s bitcoin holdings have grown to almost US$24 billion following the asset manager’s acquisition of another US$35 million worth of bitcoin last week. The firm’s holdings equate to around 1.7% of the total bitcoin available.

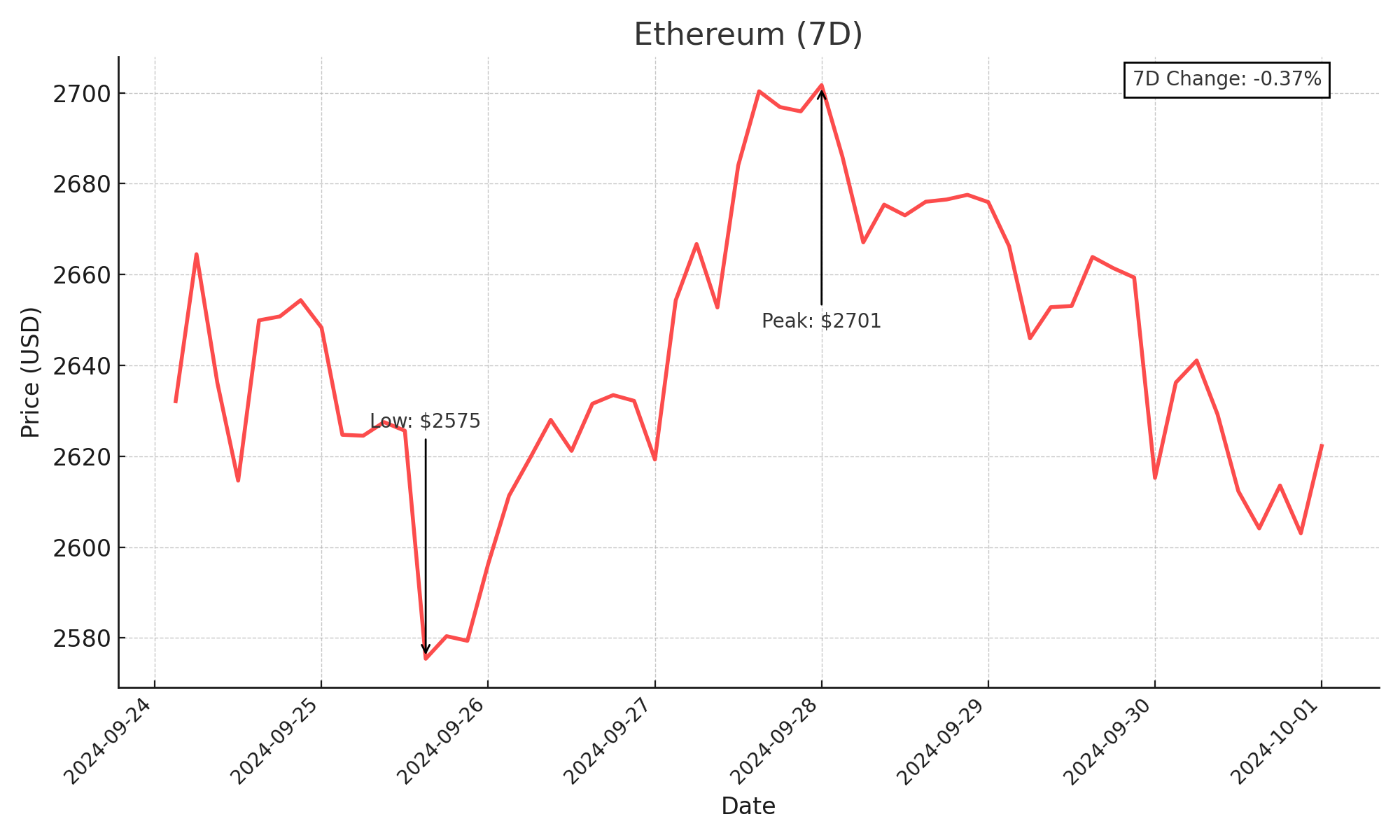

Ethereum (ETH)

Ethereum’s price gained slightly to start the week before retracing. Opening the week at US$2,582, price reached a high of US$2,728 before pulling back slightly. Price has broken the 50-day moving average to the downside. The next key level is around US$2,450.

The five-week run of outflows from Ethereum digital asset investment products has ended. These products saw US$87 million of inflows, taking the total assets under management for Ethereum-based investment products to US$11 million.

Altcoins

Connecting the dots chains

- XYO Network (XYO) gained 33.3%, taking its market cap to US$87.3 million. Price for the decentralised physical infrastructure network (DePIN) gained over 48% on Friday and Saturday before retracing. The gains are presumably due to the market’s positive response to XYO partner IoTeX’s fireside chat on aggregation layers to enhance security, scalability and cross-chain interoperability.

- Dia (DIA) gained 28.9%. This takes its market cap to US$54.3 million. The trustless oracle network has seen over 70% growth in recent weeks since Dia launched its Lumina Architecture, which is aimed at strengthening Bitcoin’s layer-2 DeFi capabilities. Most recently, the Dia team announced two partnerships — one with Defolio, a universal platform for identity and asset management and one with Termina, a network that uses the Solana Virtual Machine (SVM) to scale crypto ecosystems.

DeFi developments

- Aerodome Finance (AERO) gained 29.3%, which takes its market cap to US$748.4 million. The automated market maker (AMM) on Base had another strong week, soaring over 50% before retracing. This week’s gains are presumably due to growing interest in the network as total value locked (TVL) reached over US$1 billion.

- Wormhole (W) also gained 29.3%. This takes its market cap to US$798.6 million. Price for the interoperability platform that powers multichain applications and bridges at scale presumably rallied due to the team’s announcement of Era3. The new era for Wormhole includes quick native-to-native swaps, the launch of Wormhole institutional and upgrades to the platform’s user experience.

Taking care of business

- CHEX Token (CHEX) grew by 29.2%, taking its market cap to US$177.5 million. The end-to-end digital asset platform that helps businesses digitise assets showcased its platform at a handful of events throughout Asia last week. The gains could be due to a positive response to these engagements, plus the convergence of the 50-day moving average and 200-day moving average to provide support.

Proof of gains

- Conflux (CFX) gained 26.6%, taking its market cap to US$838.2 million. The gains for the network that enables hybrid proof of work (PoW) and proof of stake (PoS) blockchains are presumably due to a positive response to the announcement of its partnership with digital payments company WSPN. The partnership expands Conflux’s ecosystem, plus the CFX/WUSD trading pair will be launched for enhanced liquidity.

In Other News

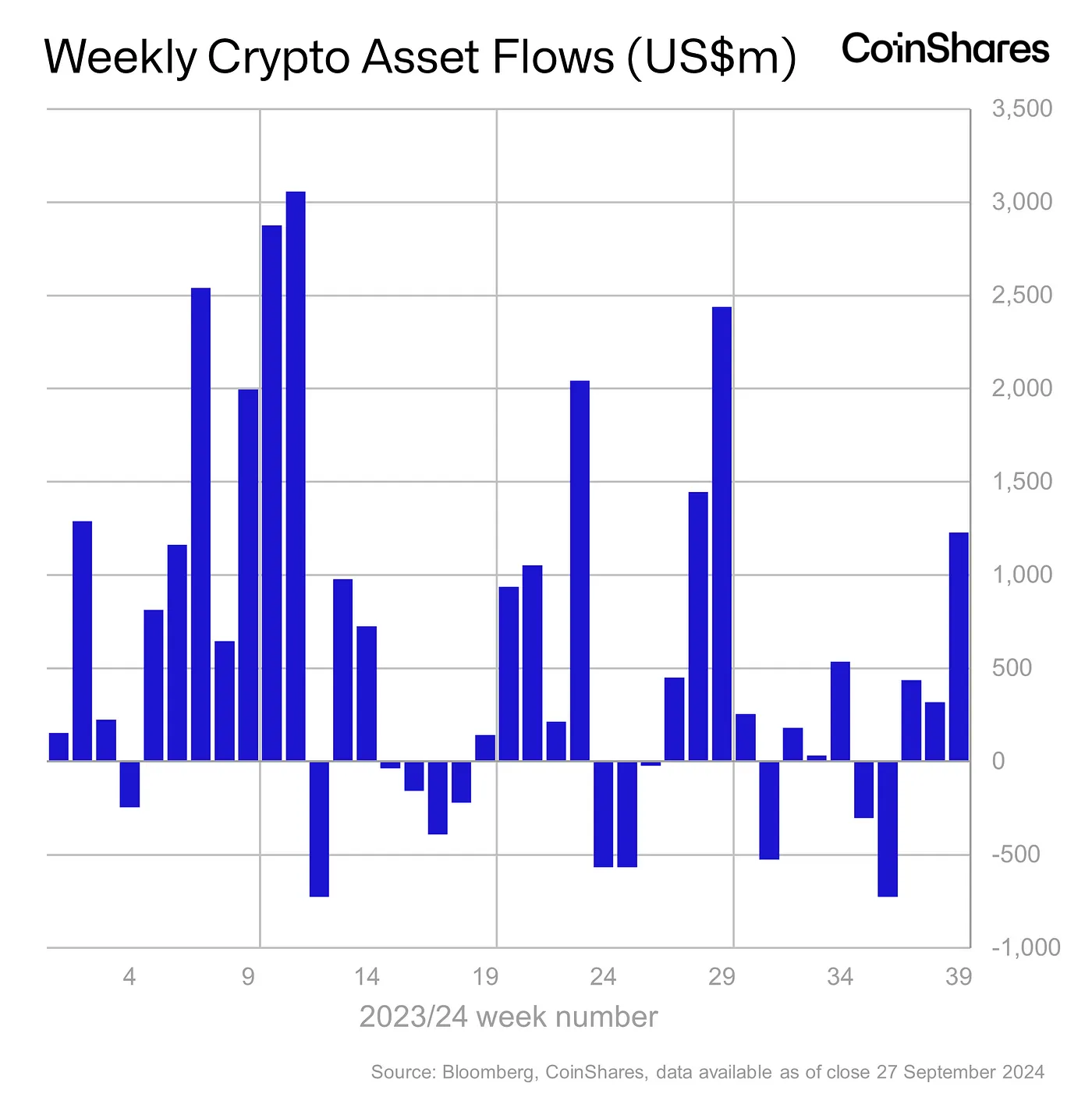

Despite macro uncertainty, digital asset investment products had a big week of inflows, with US$1.2 billion entering funds. The inflows are thought to be a result of dovish commentary from the US Federal Reserve, although US Federal Reserve Governor Jerome Powell’s speech on Monday, 30 September, may ease inflows in the coming week. At a conference hosted by the National Association for Business Economists, Powell said the “base case” for the Fed is two small rate cuts before the end of the year.

- Guggenheim Treasury Securities, the global investment firm, issued the first Digital Commercial Paper (DCP) on Ethereum. As the latest example of real-world asset (RWA) tokenisation, Amp.Fi Digital, a blockchain platform, issued US$20 million worth of tokenised commercial paper. Guggenheim Treasury Securities’ RWA tokenisation and issuance comes as tokenised government securities like US Treasury Bills hit a market cap of over US$2 billion, while BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) holds over US$513 million.

- PayPal’s US business users can now buy, hold and sell digital assets. Merchants using the platform will also be able to transfer cryptocurrency on chain to eligible third-party wallets. The move by the fintech giant was made to satisfy business owners’ requests to be able to use crypto in their business accounts. PayPal’s Senior Vice President of blockchain, cryptocurrency and digital currencies said, “Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers”.

Regulatory

- Former co-founder of Binance, Changpeng Zhao, was released from prison on Friday, 27 September. Zhao was sentenced to four months in prison in April after pleading guilty to not maintaining an "effective anti-money laundering program.” On top of the sentence, he was also ordered to pay a US$50 million fine, plus Binance agreed to pay US$4.3 billion in one of the biggest corporate settlements negotiated in history. A separate lawsuit brought by the US Securities and Exchange Commission (SEC) against the crypto exchange is ongoing. The SEC has accused Binance of operating as an unregistered exchange, lying to customers, failing to restrict US visitors’ access to the site, and misdirecting capital to separate investment funds owned by Zhao.

- Caroline Ellison, the former CEO of Alameda Research, has been sentenced to two years in prison due to her involvement in defrauding FTX investors. The light sentence was given to Ellison as she agreed to be a government witness and testify against FTX CEO and Alameda Research Co-Founder Sam Bankman-Fried. She has also been ordered to forfeit her US$11 billion in ill-gotten gains. Bankman-Fried was sentenced to 25 years in prison late last year.

- Defunct crypto exchange FTX will set aside US$230 million of proceeds from government forfeitures to reimburse specific, preferred stakeholders. Typically, shareholders are the last group in bankruptcy proceedings to be reimbursed, but FTX has argued that reimbursing some shareholders first will help the FTX estate avoid costly litigation. In a June filing, it was estimated that the proceeds from forfeiture actions would total around US$626 million, and 18% would be set aside to reimburse shareholders. The next hearing will take place on October 7, where Judge John Dorsey of the United States Bankruptcy Court for the District of Delaware will decide whether or not to approve FTX’s plan.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.