Market Highlights

- The first week of Sam Bankman-Fried’s (SBF) six week trial with the Department of Justice is now over and it isn’t looking good for SBF.

- FTX co-founder, Gary Wang, testified that FTX and Alameda executives, including Caroline Ellison and Nishad Singh, knowingly committed wire fraud, securities fraud, and commodities fraud.

- Ripple secured double victories this week as the SEC’s motion to appeal in the Ripple case and Ripple obtained a payments license to operate in Singapore.

- Hong Kong's police force and SFC launched a joint task force to monitor illegal activities on crypto exchanges.

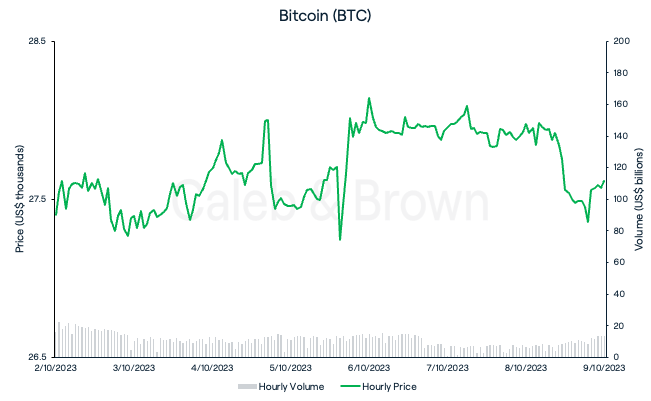

Bitcoin

Bitcoin (BTC) along with the rest of the market experienced a slow week of trading with BTC trading tightly between US$27,000-US$28,200. A small push over the weekend saw BTC close the week at US$27,615, up a slight 0.8% over the last seven days.

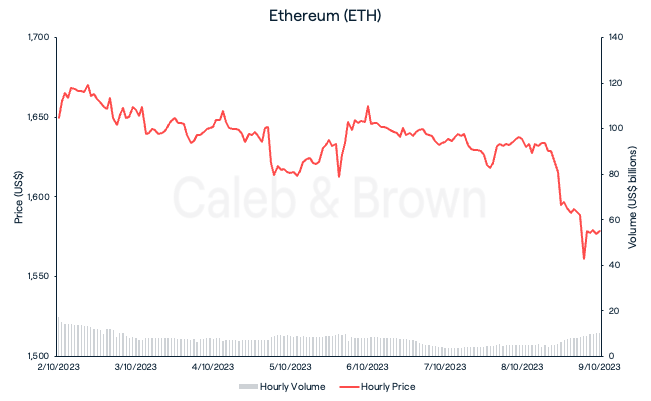

Ethereum

In contrast, Ethereum (ETH) faced a tougher week, falling to a low of US$1,546 on Monday night. The decline occurred despite several positive developments, including the UBS asset tokenisation trial, supported by the Monetary Authority of Singapore (MAS), and the introduction of nine Ethereum Futures ETFs in the United States on Monday.

Grayscale made an announcement on Monday expressing its intentions to transform its Ethereum trust into a spot ETF. This move by the cryptocurrency asset manager stems from a legal victory achieved in August when it successfully appealed against the SEC's rejection of its application to convert its Bitcoin trust into a spot ETF.

Overall, ETH closed the week at US$1,578, down 4.3%.

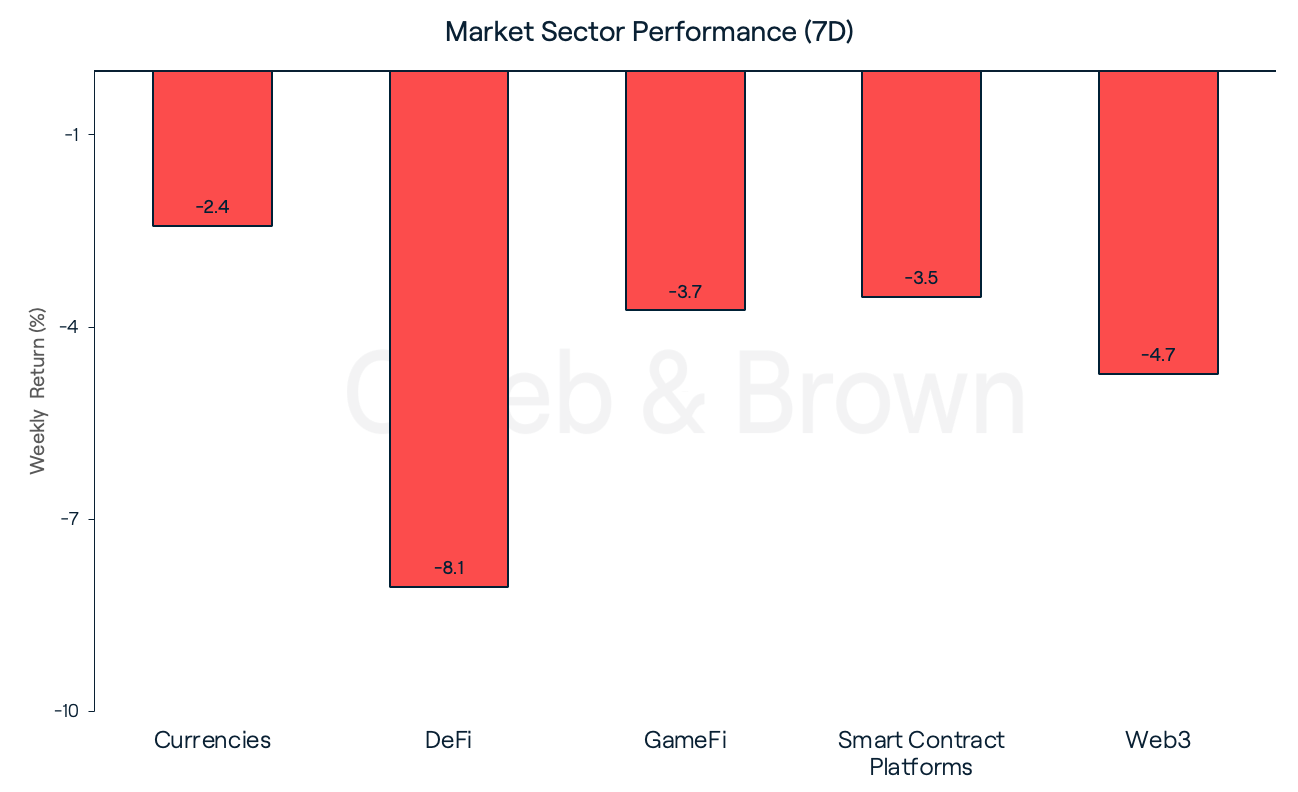

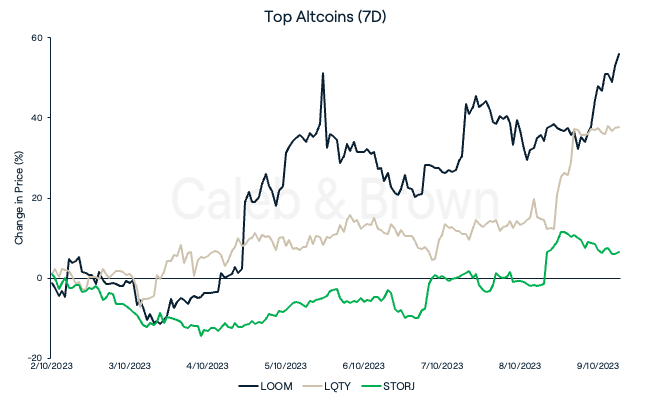

Altcoins

Market sectors bled this week giving back most of last week’s gains. DeFi was the most affected, falling 8.1% week-on-week. Currencies and Smart Contract Platforms held on to a 2.4% and 3.5% weekly loss, respectively.

While sectors were down, just a few tokens managed pull through with gains. Smart Contract Platform, Loom Network (LOOM) continued its rally after it gained another 55.9% this week. The rally has held strong ever since LOOM listed on Gate.io a couple weeks ago, and is up a staggering 397.0% over the last 30 days.

DeFi player Liquity (LQTY) and file storage protocol, Storj (STORJ) were also up this week with each rallying 37.8% and 6.5%, respectively. Storj surged on the news of its recent partnership with media storage provider, GB Labs.

In Other News

The first week of disgraced FTX founder, Sam Bankman-Fried’s (SBF) trial is now over, and general consensus would suggest things have not been going in his favour. Prosecutors for the U.S. Department of Justice (DOJ) are establishing the case that the FTX founder was deeply involved in a long-term scheme to defraud customers and investors.

In a trial that could last up to six weeks, FTX co-founder Gary Wang, admitted to fraud and giving special privileges to SBFs hedge fund Alameda Research to allow it to withdraw unlimited funds. Wang also testified FTX and Alameda execs, including Caroline Ellison and Nishad Singh, knowingly committed wire fraud, securities fraud and commodities fraud.

Read more about it here.

On Thursday, Hong Kong’s police force and Securities and Futures Commission (SFC) launched a joint task force to monitor suspicious activities on crypto exchanges following the suspension of trading on the JPEX exchange.

Regulatory

The SEC lost in its motion to file for an interlocutory appeal against the Ripple ruling this week. District Court Judge Analisa Torres said in her ruling that the SEC had failed to demonstrate that the decision was faulty or that it had substantial grounds for differences of opinion.

Additionally, XRP as well as Coinbase were granted Major Payments Institution licenses to offer key services in Singapore, which caused XRP’s price to instantly pump 6.0%, however all gains were shortly given up.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4uTYCnc0OtitlpCKLxL67r%2Fa5bf40b2d519a3c3d3b3c29279b16fc0%2FWeekly_Rollup_Tiles__18_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-10-11T00%3A11%3A30.583Z)