Market Highlights

- Stablecoin use in Argentina grows as the country’s residents battle soaring inflation.

- MicroStrategy reveals its bitcoin strategy endgame: become a bitcoin bank and hit a trillion-dollar valuation.

- Former FTX executive Ryan Salame started his seven-and-a-half-year prison sentence.

- Monochrome Asset Management is launching the first Ethereum exchange-traded fund (ETF) in Australia.

Markets Overview

Macro Market Updates:

This week, the Reserve Bank of New Zealand left its cash rate on hold at 4.75%, while U.S. consumer price index (CPI) data and the U.S. Federal Open Market Committee’s (FOMC) minutes from its September meeting did little to rattle markets. Core CPI in the U.S. came in slightly higher than forecast at 2.4% for the twelve months to 30 September 2024. The FOMC’s September meeting minutes showed that debate had occurred amongst U.S. Federal Reserve officials over how much rates were to be eased, with some members expressing concern about the 50 basis-point cut.

Elsewhere, there were few surprises:

- U.S. unemployment claims came in higher than forecast at 258,000.

- Canada’s unemployment rate for September came in at 6.5%.

- The UK’s gross domestic product (GDP) grew by 0.2% in August.

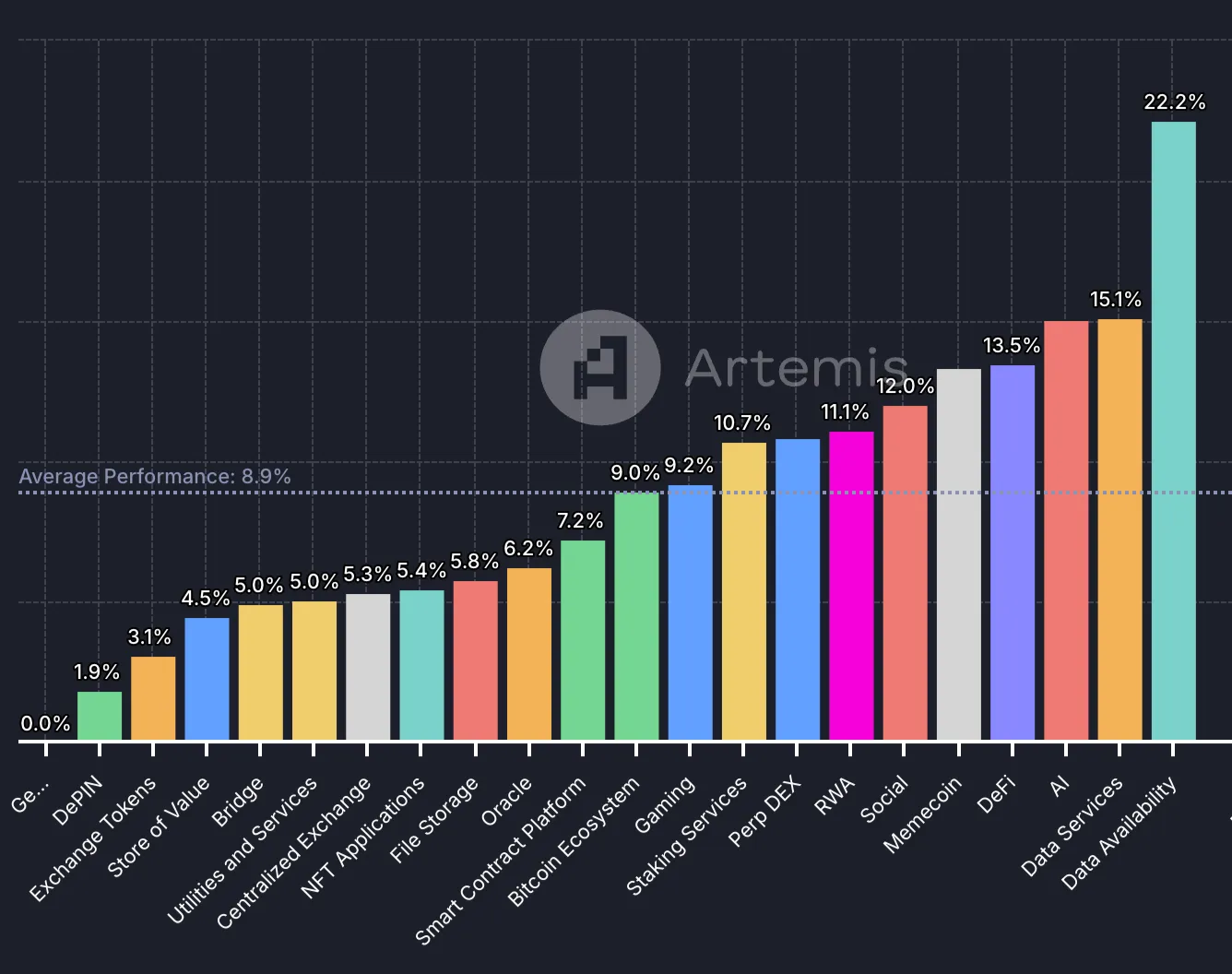

Crypto Market Sector Performance

Almost all crypto market sectors experienced growth this week, with average performance sitting at 8.9% across the market. Data availability and data services led the way, while DePIN and exchange tokens lagged. Some of the biggest gainers in data availability were Celestia (TIA) and EigenLayer (EIGEN). Celestia, the modular data availability network, found support at US$4.75 on Thursday, 10 October, with price rising over 30% in the following days. EigenLayer, a network that provides developers with access to the Ethereum staked capital base and validator set, launched in June 2023. Its recent listing on centralised exchanges, including WhiteBIT, Bitfinex, and BingX has presumably buoyed price.

Meanwhile, in culture and entertainment coins, meme coins dominated the list of the biggest crypto gainers this week. Myro (MYRO), Brett (BRETT) and BOOK OF MEME (BOME) gained 24.2%, 29%, and 27%, respectively. As the meme coin that connects other dog meme coin lovers, Myro’s growth this week shows that investor interest in these novel coins isn��’t slowing. Myro’s social mentions, the share of social activity and price are currently sitting at a one-month high.

Bitcoin (BTC)

Bitcoin was flat for most of the week before starting the new week with a rally of over 6%. The largest cryptocurrency by market cap opened last week at US$62,895, broke the 50- and 200-day moving averages to the downside, then found support around US$60,350. Price has now rallied and broken the key level at U$66,000 to the upside, which has been an area of resistance since late August.

The gains followed the announcement that Mt. Gox has extended its payment deadline by 12 months from 31 October 2024 to 31 October 2025. The gains are also presumably due to a recent shift in polling for the U.S. presidential election, which has seen former President Donald Trump closing the five-point lead that Vice President Kamala Harris has held for many weeks.

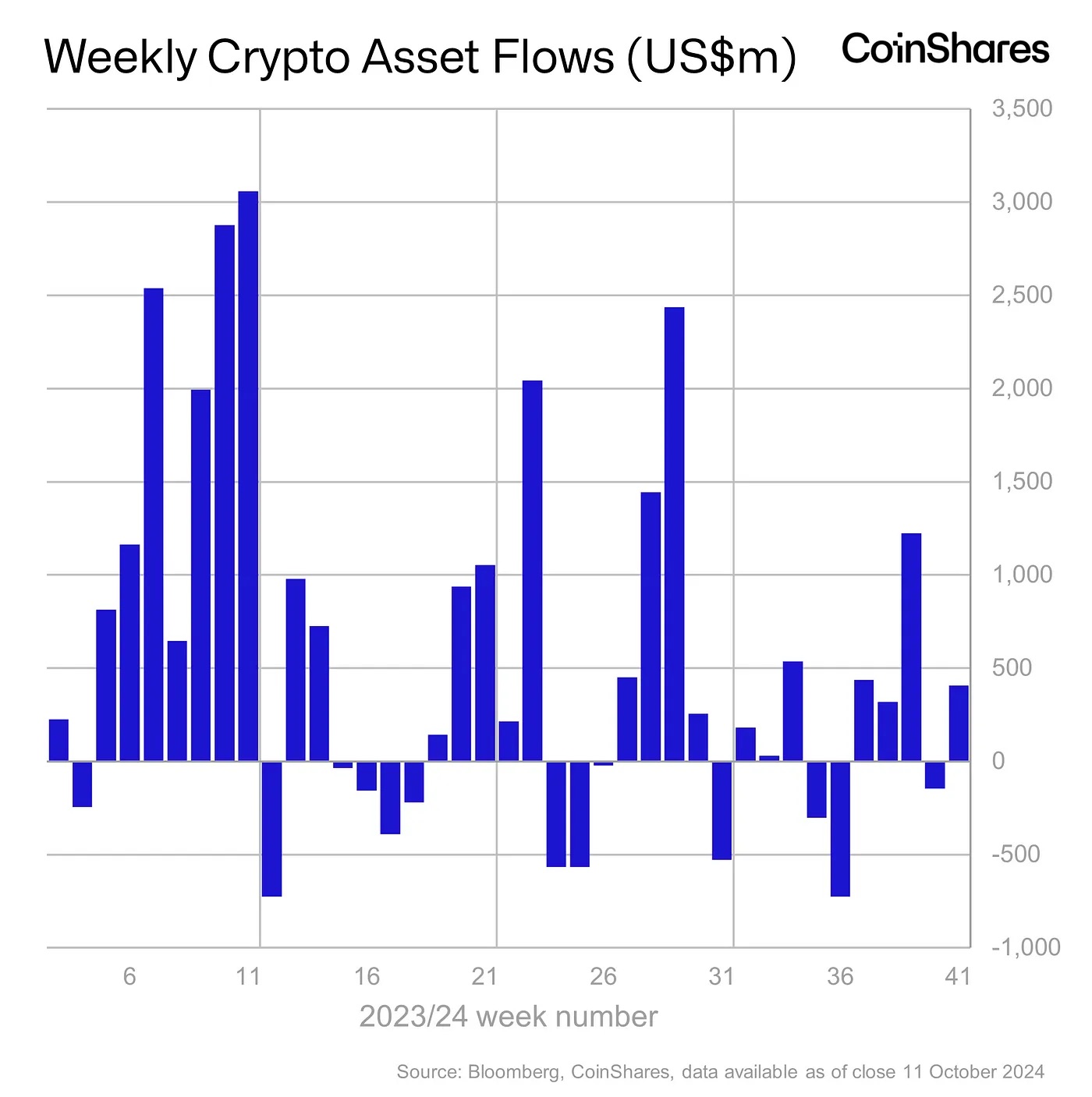

Bitcoin asset investment products saw inflows of US$419 million this week. Short bitcoin saw outflows of US$6.3 million.

After a big week of press, Money Electric: The Bitcoin Money Mystery went live on HBO’s Max streaming service. Articles, videos, and social posts leading up to the documentary’s release said that the film may confirm the identity of pseudonymous bitcoin creator Satoshi Nakamoto. While some viewers have credited the film for showing a detailed overview of bitcoin’s early days, it didn’t do much to provide definitive proof of who created the cryptocurrency. Bitcoin Core developer Peter Todd was one of the candidates unveiled in the film. He replied to a Twitter (aka X) post on Tuesday, shortly before the documentary became available for streaming, stating, “I’m not Satoshi.”

Tokyo-listed firm Metaplanet added more bitcoin to its holdings, buying a further 108.999 bitcoin, worth approximately USD$6.5 million. The latest addition to the company’s bitcoin reserves takes its total holdings to 748.5 BTC. In conjunction with buying bitcoin, the firm sells put options to generate further yield from its bitcoin strategy. Metaplanet’s average BTC purchase price currently stands at US$62,409.

MicroStrategy’s executive chairman and co-founder, Michael Saylor, shared the company’s “endgame” for its bitcoin strategy. The company, which currently holds 252,000 bitcoin worth US$15.8 billion at the time of writing, is the largest publicly traded corporate holder of the cryptocurrency. Saylor spoke at an event hosted by Bernstein Research earlier in the week, stating that “We saw Bitcoin as a big tech monetary network, like Google for money or Facebook for money.” Their endgame? Saylor says it’s to evolve MicroStrategy into a “bitcoin bank” that would offer investors capital market instruments tied to bitcoin and potentially see MicroStrategy reach a trillion-dollar valuation.

Bitcoin is currently trading at US$65,943, an increase of 4.3% on the week.

Ethereum (ETH)

Ethereum had similar price action, with price flat for most of the week followed by a rally of over 6% on Monday, 14 October. The second largest cryptocurrency opened the week at US$2,439.50 and declined to US$2,320, where it found key support. The next key level that Ethereum needs to break to the upside is around US$2,700.

Outflows continued for Ethereum asset investment products this week, with US$9.8 million leaving funds. This brings the month-to-date outflows for these products to US$35 million.

As much as US$1.3 billion of Ethereum that was seized from the PlusToken Ponzi scheme could be transferred to cryptocurrency exchanges. According to on-chain data, some of the seized funds have been sent to centralised exchanges, including BitGet, Binance and OKX. Selling pressure for Ethereum could grow if the seized coins are sold.

Australian asset management firm Monochrome Asset Management is launching the first Ethereum exchange-traded fund (ETF) in Australia. Monochrome’s Ethereum ETF (IETH) will begin trading on the Chicago Board Options Exchange (Cboe) in Australia at 10am AEDT on Tuesday, 15 October. The fund is setting itself apart from global ETF funds by being the first to offer in-kind Ethereum subscriptions and redemptions. This structure will provide holders with improved tax efficiencies as the dual-access bare trust structure prevents a capital gains event when ETH holders transfer to the Monochrome ETF.

Ethereum is currently trading at US$2,620, an increase of 6.9% on the week.

Altcoins

Clear roadmap

- Axelar (AXL) gained 20.6%, taking its market cap to US$657.2 million. Price for the Web3 interoperability platform grew by almost 30% on Friday, 11 October. The gains are presumably due to the roadmap that the Axelar team shared in an AMA with the Sui network team. Axelar’s team is currently focused on developing its interchain amplifier, which is currently in the testnet. AXL is currently trading at US$0.7836.

Sui-eet thing

- Sui (SUI) grew by 20%, which takes its market cap to US$6.3 billion. The layer 1 blockchain likely saw gains following Binance’s announcement that trading bots will now be enabled on SUIFDUSD, plus the arrival of stablecoin $USDC to the network, expanding the DeFi, gaming and commerce capabilities available to users and investors.

DeFi and digitised declines

- Civic (CVC) lost 26%, taking its market cap to US$123.8 million. Following weeks of gains since early September, where price grew over 130%, a pullback for the web3 identity tools network was to be expected. Civic’s team recently released its Q3 update, where it shared more about its partnership activities with Rentality, a decentralised car rental marketplace. CVC is currently trading at US$0.1544.

Past performance is not a reliable indicator of future results.

In Other News

Digital asset investment products saw inflows of US$407 million this week. The recovery, after last week’s outflows, is presumably due to a shift in the U.S. political zeitgeist following the U.S. vice presidential debate. There has been a shift in polling as support for the Republican party increased. This perceived support has driven a rally in inflows and crypto to start the week, as the Republican party has had an accommodative stance on digital assets throughout the campaign. The U.S. led the way with this week’s inflows, accounting for US$406 million of funds being allocated to digital asset investment products.

- A new survey from Charles Schwab revealed that almost 50% of U.S. investors are planning to buy crypto ETFs in the next 12 months. Last year, 38% of respondents said they were planning to buy crypto ETFs. Now trailing behind U.S. equities, which 55% of investors said they plan to invest in over the next year, it demonstrates that digital asset investment products have grown in popularity and sophistication as global financial institutions and asset management firms have created products to provide investors with exposure to crypto. Amongst the investors who were planning to buy crypto ETFs in the coming year, 62% were millennials, 44% were Generation X, and 15% were baby boomers.

- Research from blockchain data firm Chainalysis detailed that Argentina’s use of stablecoins is some of the highest in South America, with 61.8% of all crypto transaction volume being via stablecoins. The report suggests that the Argentinian population’s uptake of stablecoins is due to growing inflation. In the 12 months to 31 August 2024, Argentina’s inflation rate was 236.7%, and over half of the population was living in poverty as a result of President Milei’s austerity measures.

- World Liberty Financial tokens, the cryptocurrency for the DeFi project backed by former president Donald Trump, are launching this week. The “initial sale” of WLFI tokens is looking to raise US$300 million, where 20% of the total supply will be sold at a US$1.5 billion fully diluted valuation. WLFI is only available to accredited investors in the U.S., qualified investors in the UK, and investors in other countries. The first phase of WLFI is to launch a DeFi lending platform on the Ethereum mainnet and Layer 2 network Scroll.

Regulatory

- The U.S. Securities and Exchange Commission (SEC) has charged Chicago-based crypto trading firm Cumberland DRW with numerous securities charges. The announcement from the SEC stated that Cumberland has been operating as an unregistered dealer by trading over US$2 billion in “crypto assets that are offered and sold as investment contracts on third-party crypto asset exchanges.” In its complaint, the SEC mentioned it considers five of the firm’s available assets to be securities, including Solana, Polygon, Cosmos, Algorand, and Filecoin. Cumberland published a post on X (formerly Twitter) stating that the company won’t be “making any changes to our business operations or the assets in which we provide liquidity”.

- Former FTX executive Ryan Salame has started his seven-and-a-half-year prison sentence. Salame is in custody at the FCI Cumberland in Maryland. It’s a medium security federal correction institution and has an adjacent minimum security satellite camp. According to the prison’s website, it has over 1,000 inmates. In September 2024, Salame pleaded guilty to violating U.S. political campaign finance laws and conspiring to run an unlicensed money-transmitting business.

New Asset Listings

- Mother Iggy (MOTHER)

- Notcoin (NOT)

- Mog Coin (MOG)

- Tether Gold (XAUt)

- Metaplex (MPLX)

Buy & Sell these crypto assets, or Swap them directly with hundreds of other popular assets through your personal crypto broker.

To see our full list of available assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.