Market Highlights

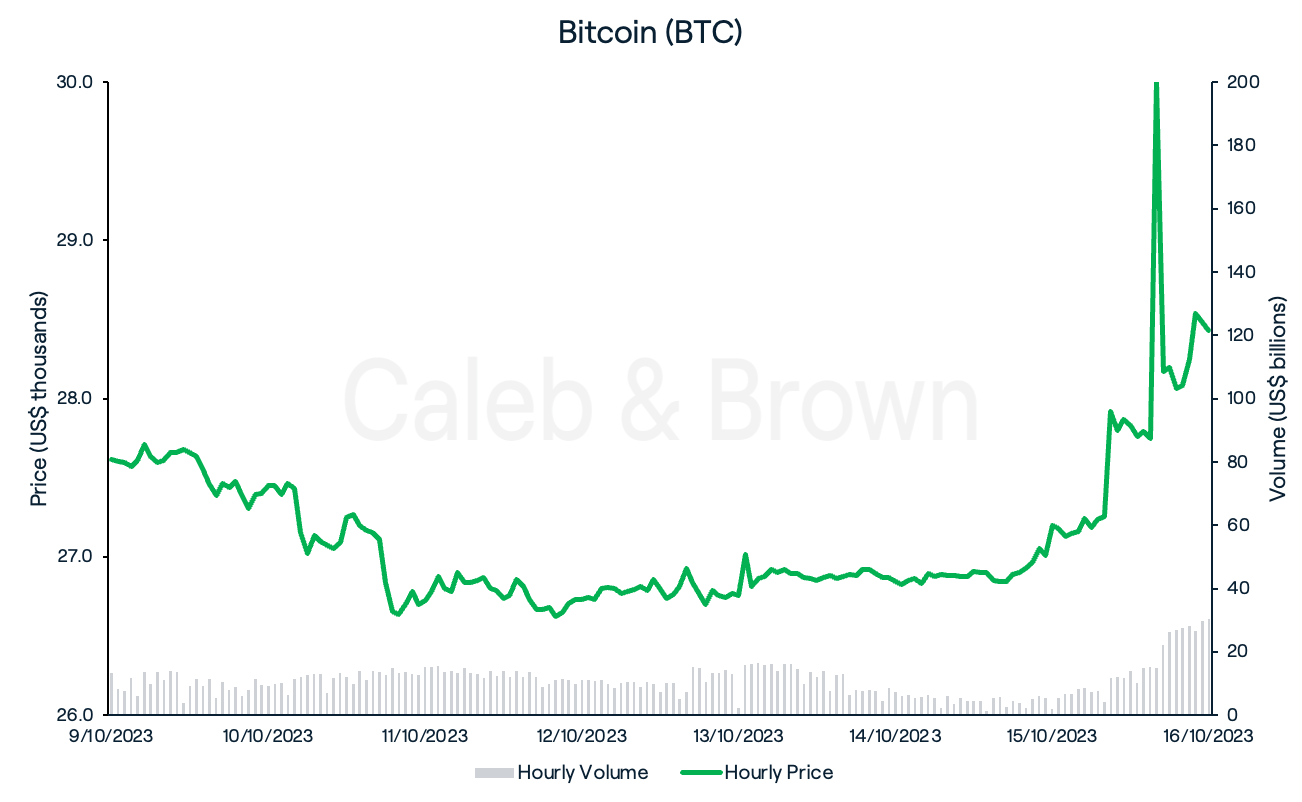

- Rumours of iShares and BlackRock’s spot Bitcoin ETF application approval sent the market into a panic as Bitcoin (BTC) abruptly surged to a 3 month high.

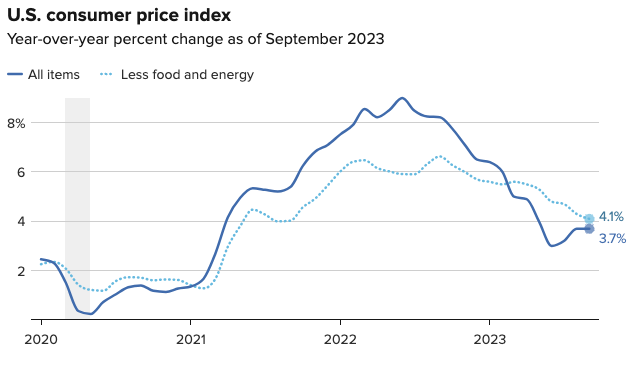

- CPI (Consumer Price Index) increased 0.4% in September and 3.7% annually, above estimates.

- The SEC elected to not appeal against Grayscale’s court ruling in August, increasing the likelihood of an approval for the first spot BTC ETF.

- Mastercard completed a CBDC (central bank digital currency) pilot with the Reserve Bank of Australia and tested buying Ethereum-based NFTs.

Bitcoin

What started out as a tough week for crypto, with news of war and persistent inflation dragging prices down, turned green as rumours of the U.S. Securities and Exchange Commission (SEC) approving iShares and BlackRock’s spot bitcoin ETF application circulated Monday.

Bitcoin (BTC) exploded to a three month high of US$30,000 after the erroneous post (below), but soon settled once the rumours were denied.

Earlier in the week, figures from the U.S. Bureau of Labor Statistics showed that the CPI (Consumer Price Index) increased 0.4% in September and 3.7% annually, above the respective forecasts of 0.3% and 3.6%.

After a chaotic week of news and events BTC eventually closed the week at US$28,433, up a modest 3.0%.

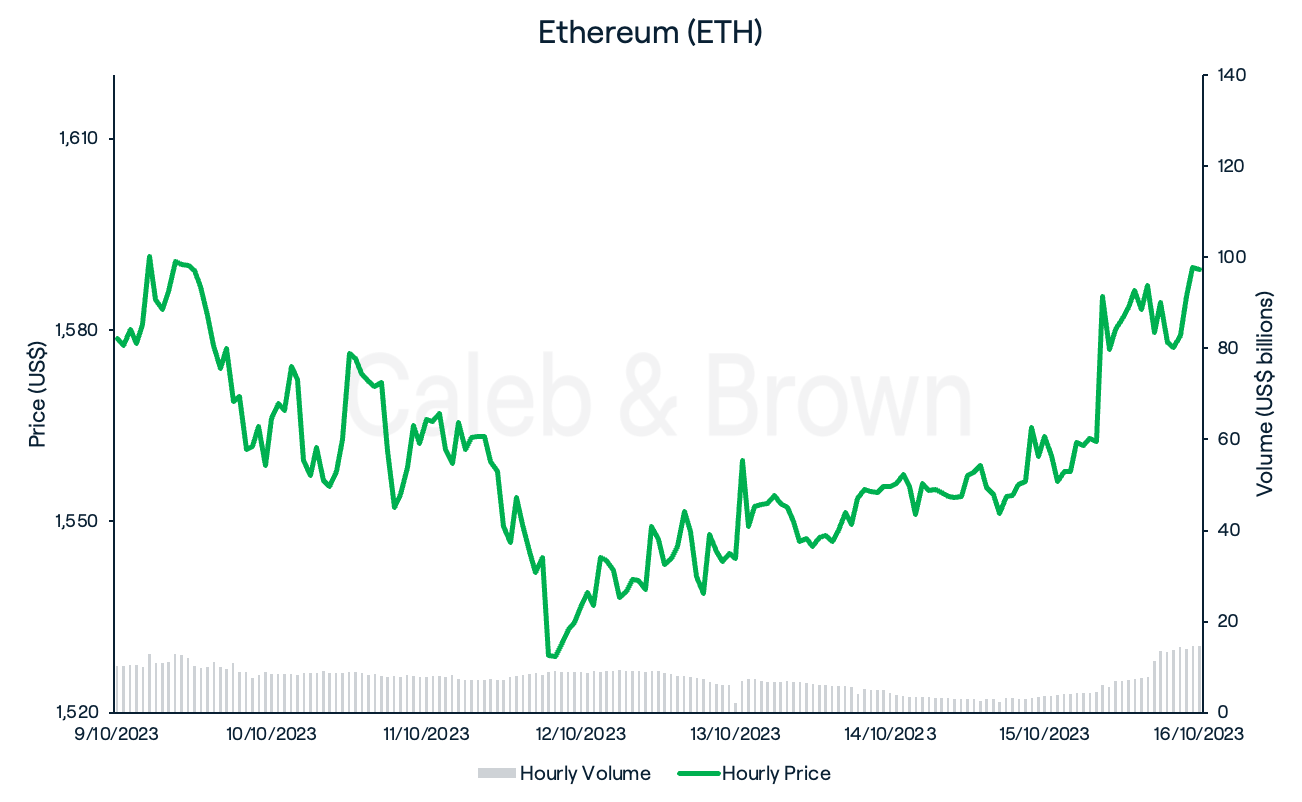

Ethereum

Ethereum (ETH) underperformed BTC again this week, hitting US$1,521 on Thursday, a seven month low. Fortunately for the Bitcoin ETF news, ETH was able close the week in the green, up 0.7% at US$1,589.

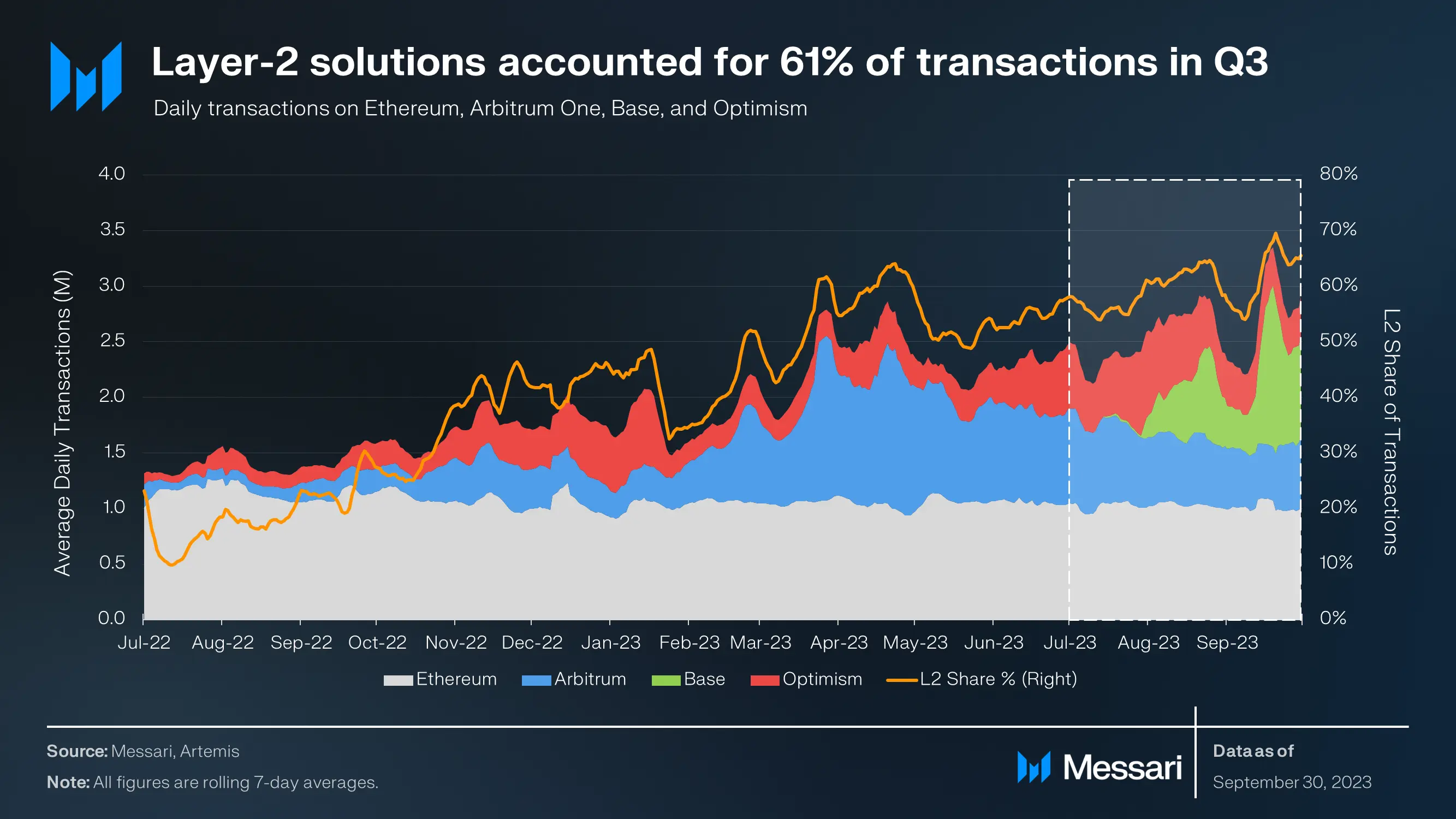

While ETH’s price is lagging, its layer-2 transaction count has boomed over the past quarter, representing twice as many layer-1 mainnet transactions. Upcoming in Q4 is Ethereum’s ‘Dencun’ upgrade which will aim to make these layer-2 transactions more cost effective.

Altcoins

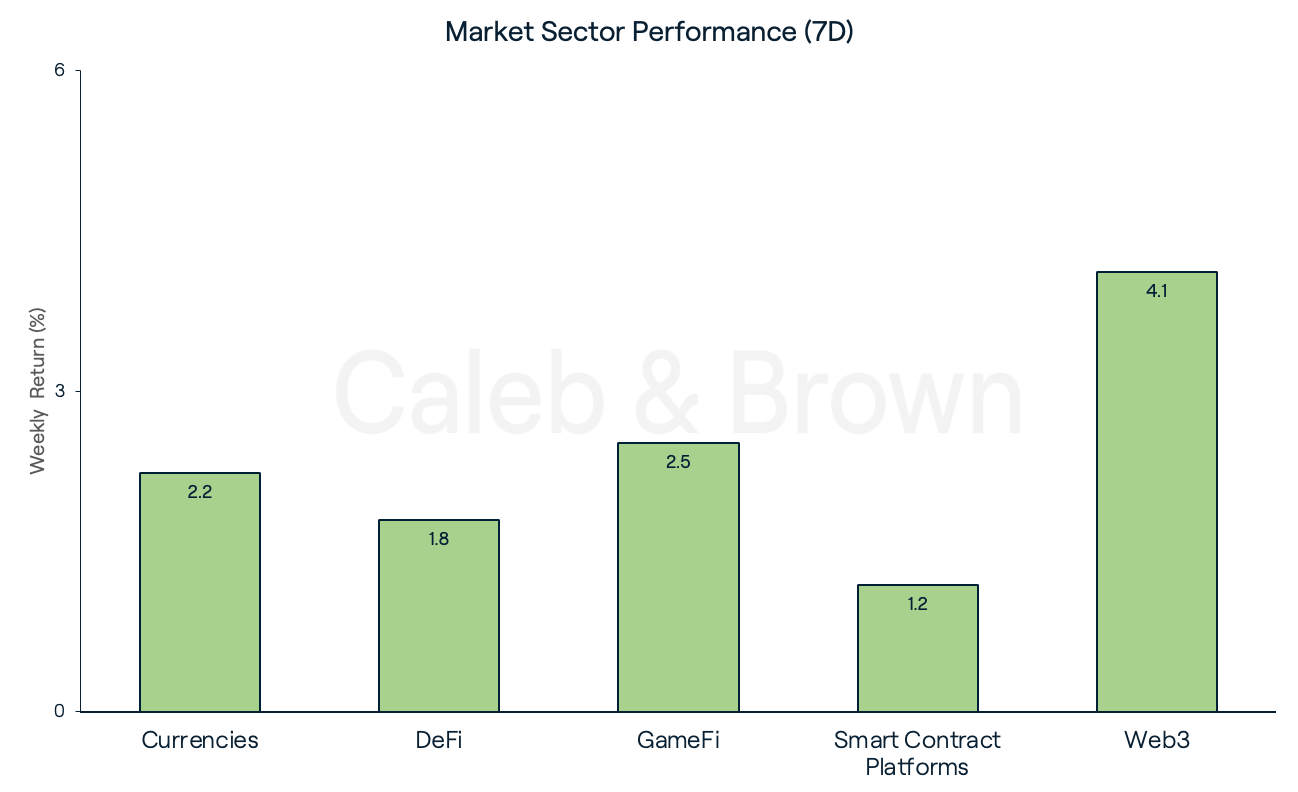

Due to the end-of-week rally all sectors managed to close the week positively. Web3 was the strongest performing sector, gaining 4.1% week-on-week, followed closely by GameFi and Currencies adding on 2.5% and 2.2%, respectively.

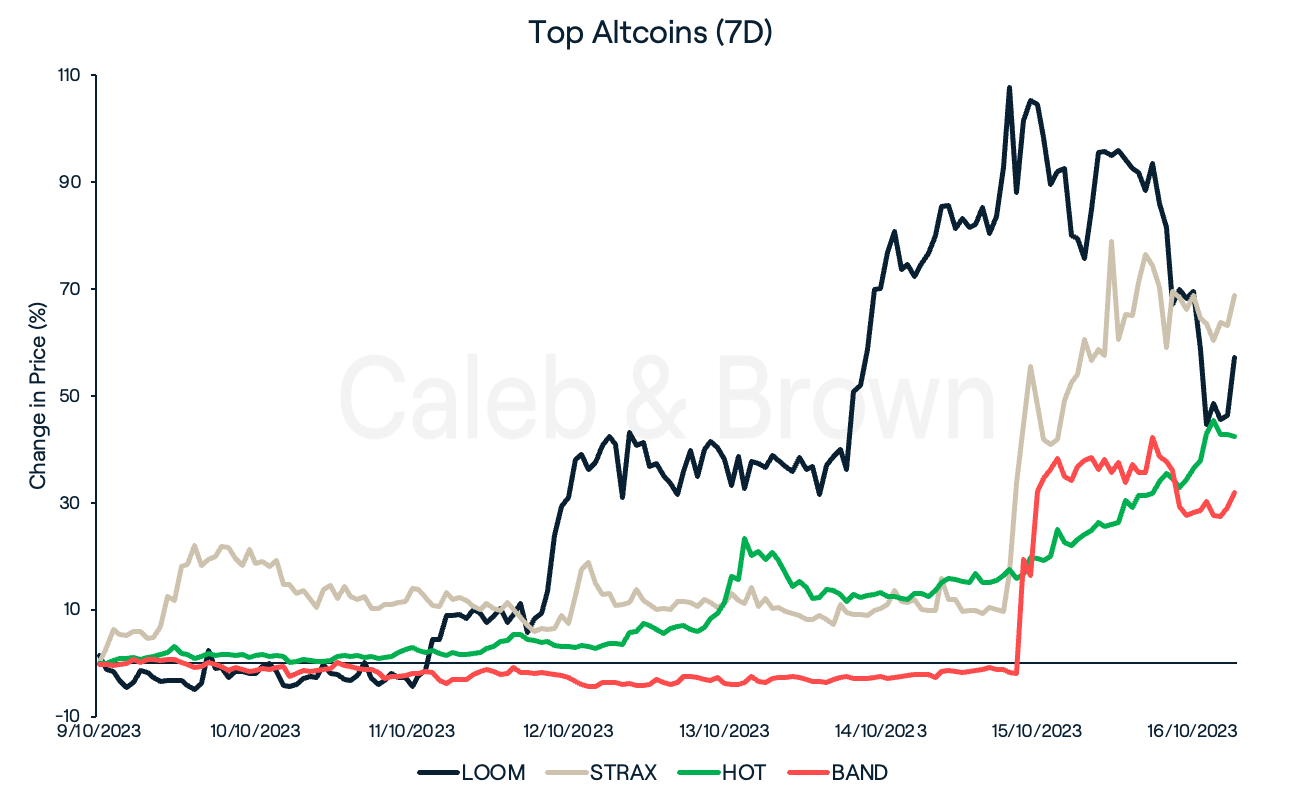

Rallying for the fourth consecutive week was Loom Network (LOOM), which extended its rally another 57.1% this week, and is up 600% over the last 30 days. The move followed the announcement of collaborative software company, Atlassian is to acquire Loom Network for US$975 million on Thursday.

Also securing double-digit gains were Stratis (STRAX), Holo (HOT), and Band Protocol (BAND) which each respectively added on 68.8%, 42.3%, and 31.9%.

In Other News

- Mastercard has completed a CBDC (central bank digital currency) pilot with the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre. The project tested how authorised parties could use CBDCs and buy Ethereum-based NFTs by locking CBDC and minting equivalent ETH tokens.

- On Friday, stablecoin giant Tether (USDT) appointed the company’s CTO Paolo Ardoino as CEO, assuming the role formerly held by Jean-Louis van der Velde in December.

Regulatory

- There is potential that crypto asset manager Grayscale will be cleared to convert its Grayscale Bitcoin Trust (BTC) into a spot market Bitcoin ETF after the SEC elected to not appeal an August court ruling.

- Terraform Labs, the creators of Terra Classic (LUNC), has filed a motion against U.S.-based American market-making firm, Citadel Securities LLC, accusing them for intentionally destabilising its TerraUSD (UST) stablecoin in May 2022, alleging that the firm was the result of a "concerted, intentional effort" rather than an algorithmic failure.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3QL7POqcWj52JinEUTI4iV%2F299994cb3f85e4bba503bfb87602e6a7%2FWeekly_Rollup_Tiles__19_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-10-17T04%3A06%3A56.332Z)