Market Highlights

- U.S. SEC delayed its decision on four BTC ETFs including BlackRock, Invesco, Galaxy Digital, and Valkyrie.

- VanEck announced the launch of its Ethereum (ETH) futures ETF; VanEck Ethereum Strategy ETF (EFUT).

- Circle launched euro-pegged EURC stablecoin on Stellar (XLM).

- OpenTrade partnered with WOO Network (WOO) to launch a tokenised T-Bill product.

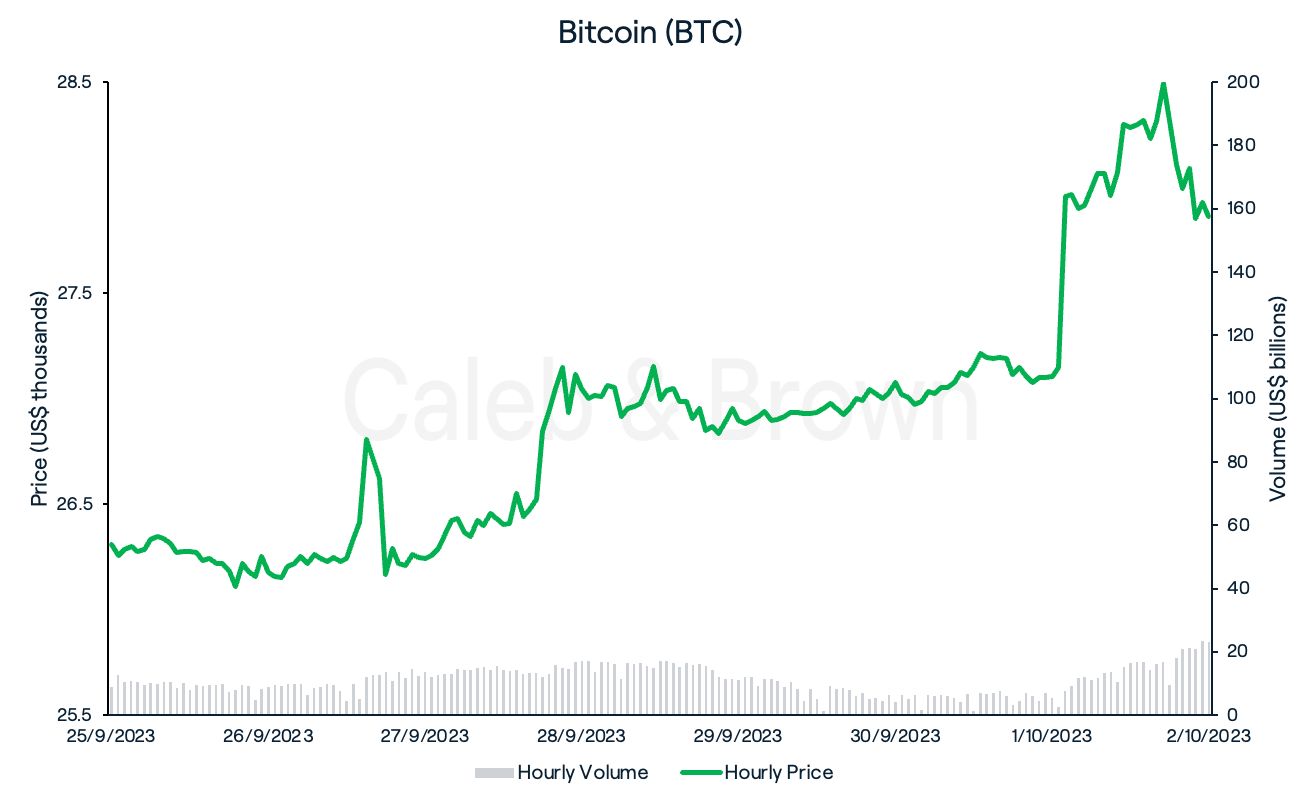

Bitcoin

This week the total crypto market cap grew to US$1.15 trillion, up 6.3% over the last seven days, signalling a positive start to October.

On Monday, prominent Bitcoin (BTC) bull Michael Saylor, announced that MicroStrategy loaded up on another ~5500 BTC, costing US$147 million at an average price of US$27,000/BTC.

Then on Thursday the U.S. Securities and Exchange Commission (SEC) delayed, for the second time, its decision on four BTC ETFs (exchange traded funds). This marks the SEC's second extension for the BlackRock, Invesco, Galaxy Digital, and Valkyrie funds in a month.

BTC closed the week at US$27,862, up 5.9%.

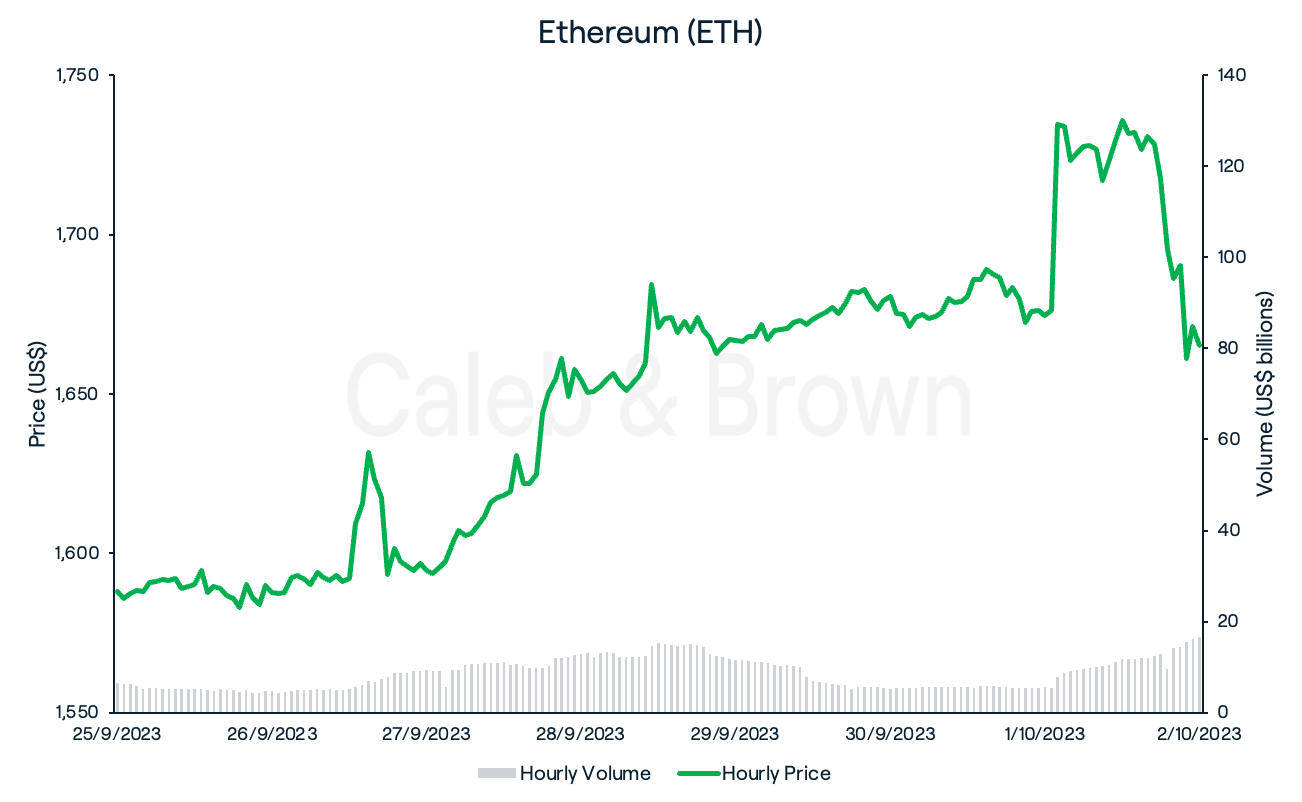

Ethereum

On Thursday, VanEck, an asset management firm with US$80 billion in assets, officially announced the imminent launch of its Ethereum (ETH) futures ETF; VanEck Ethereum Strategy ETF (EFUT).

As a result, ETH surged to a high of US$1,751 on Sunday and closed the week at US$1,665, up 4.9%.

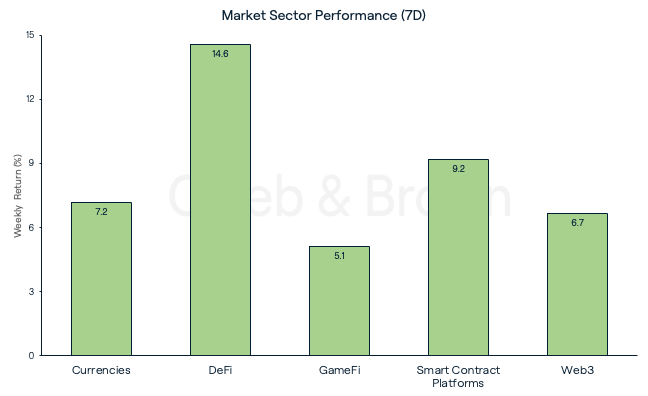

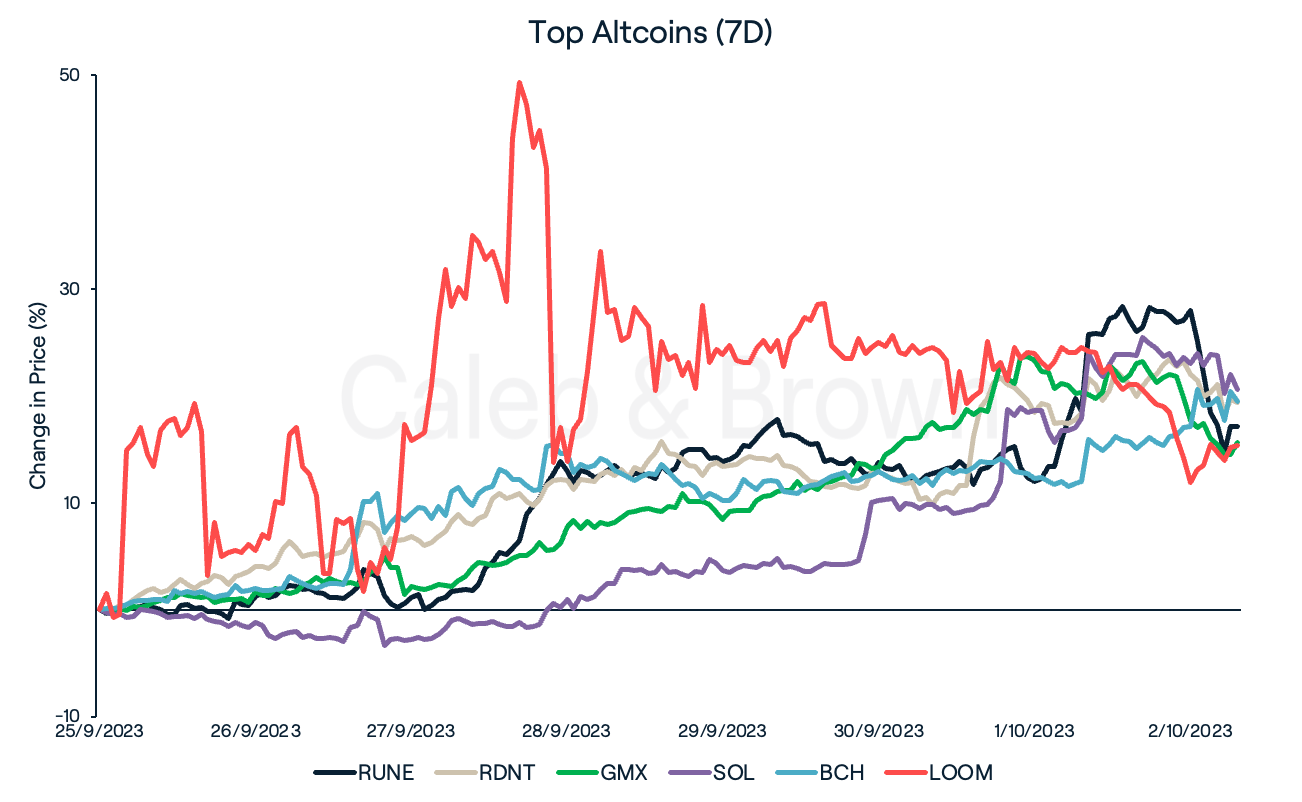

Altcoins

All market sectors were up this week with DeFi leading after it rallied 14.6%. Smart Contract Platforms and Currencies followed with each adding on 9.2% and 7.2%, respectively.

From DeFi, THORChain (RUNE), Radiant (RDNT), and GMX (GMX) were the leading performers with each gaining 17.1%, 19.4% and 15.7%, respectively. RUNE is up after the successful launch of Streaming Swaps and its lending protocol which has already seen over 1 million RUNE burned, while Radiant’s mainnet launch draws closer to launch date.

Other performers this week include Solana (SOL), Bitcoin Cash (BCH), and Loom Network (LOOM) which each increased by 20.6%, 19.5%, and 15.4%, respectively. LOOM has extended its rally after already gaining 175% last week.

In Other News

- USDC stablecoin issuer, Circle launched its fiat-backed euro-pegged EURC stablecoin on Stellar (XLM), the third blockchain to host the coin after Ethereum (ETH) and Avalanche (AVAX).

- Institutional DeFi player OpenTrade has partnered with WOO Network (WOO) to launch a tokenised treasury bill (T-Bill) product for accredited investors. The company will be utilising Perimeter Protocol, an open-source platform developed by Circle, to expand USDC into the world of real world assets.

- Binance has urged its European Paysafe customers to change their EUR balances into Tether's stablecoin, USDT, by October 31. This move comes in response to Paysafe, its banking partner, making an independent choice to cease processing EUR deposits for Binance users.

Regulatory

On Monday, the Securities and Futures Commission (SFC) of Hong Kong released a statement introducing a set of fresh measures designed to bolster transparency and safety within the cryptocurrency sector. The initiative comes as authorities in the city-state grapple with the JPEX incident: a case of suspected fraud involving a Dubai-based crypto exchange operating in Hong Kong’s turf without licensing.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4hMAVaQUp14NSPck0wsp1S%2F7acf5a0c8e563af95ad78f343fcc6faf%2FWeekly_Rollup_Tiles__17_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-10-03T09%3A15%3A27.455Z)