Market Highlights

- Crypto markets took flight as Bitcoin (BTC) soared above US$35,000 for the first time in 16 months.

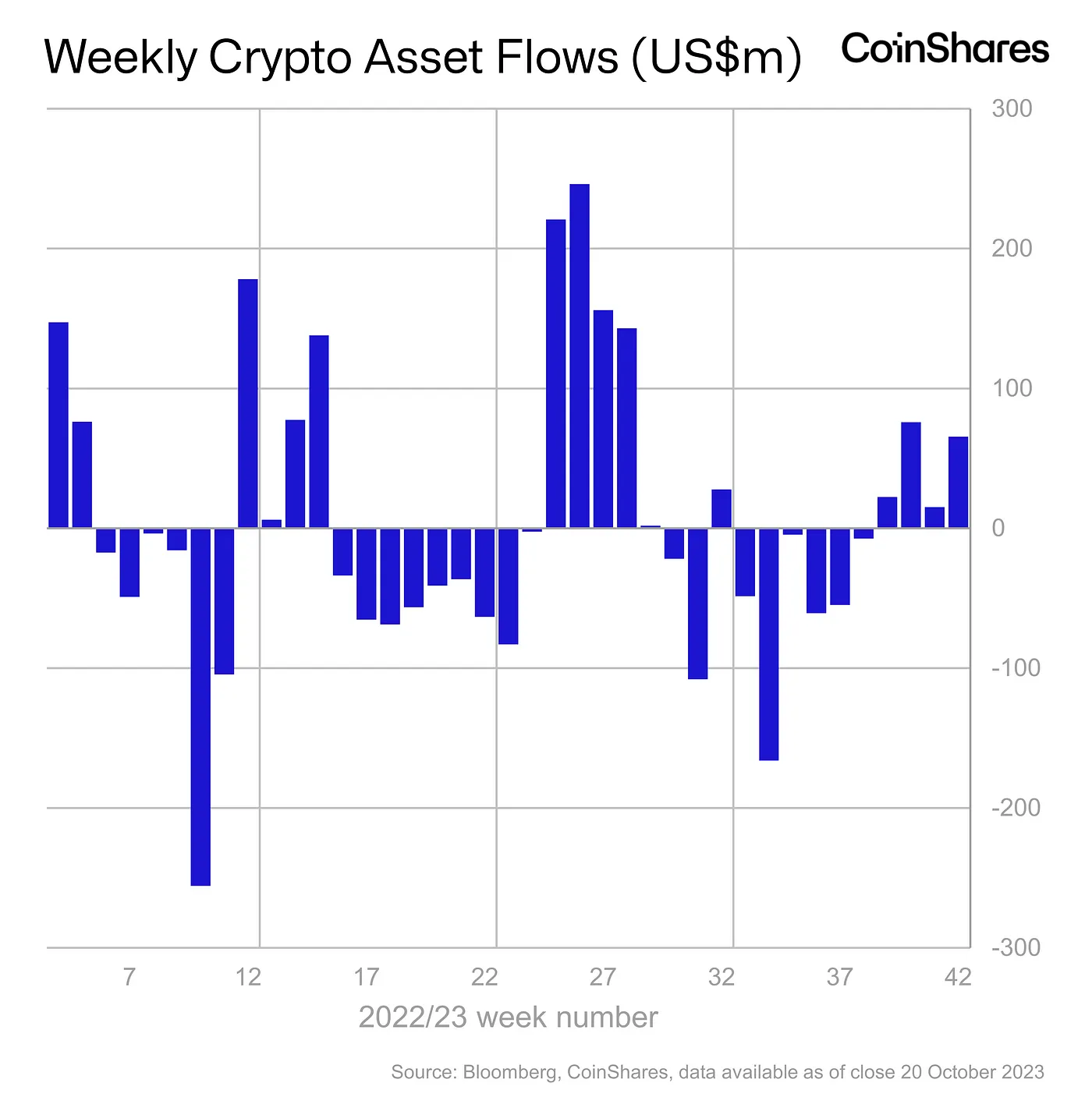

- Digital asset investment products saw positive inflows for the fourth consecutive week.

- Polygon (MATIC) deployed the token contract for its new POL token, as part of its Polygon 2.0 upgrade.

- BlockFi announced its emergence from bankruptcy.

Bitcoin

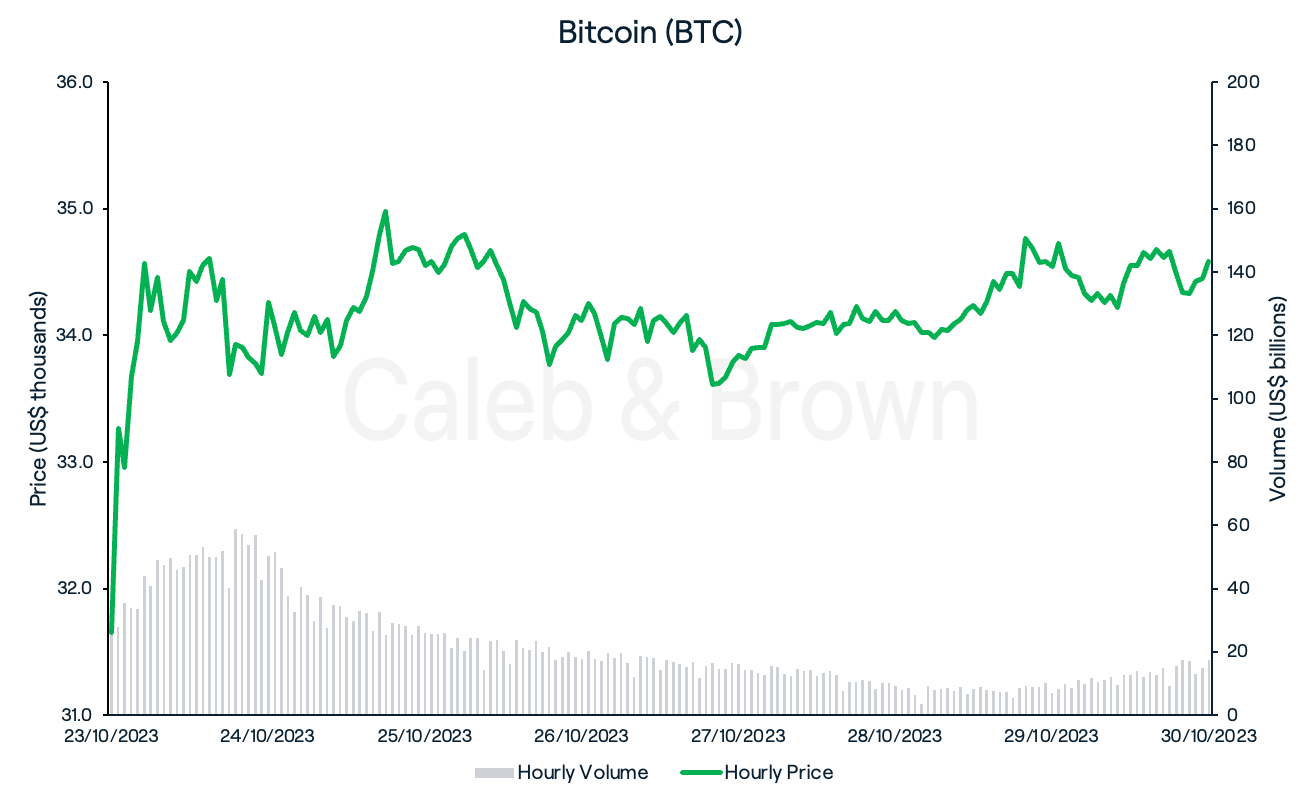

Total crypto market cap topped US$1.3 billion this week as prices rallied for the second week in a row, driven by feverish speculation on whether or not BlackRock will launch a Bitcoin spot ETF in the U.S. soon.

As a result, Bitcoin (BTC) briefly traded above US$35,000 for the first time in 16 months before eventually closing the week at US$34,580, gaining 9.3%.

Meanwhile, digital asset investment products saw positive inflows for the fourth week in a row, totalling ~US$66 million, of which ~US$55 million flowed into BTC-based funds.

Ethereum

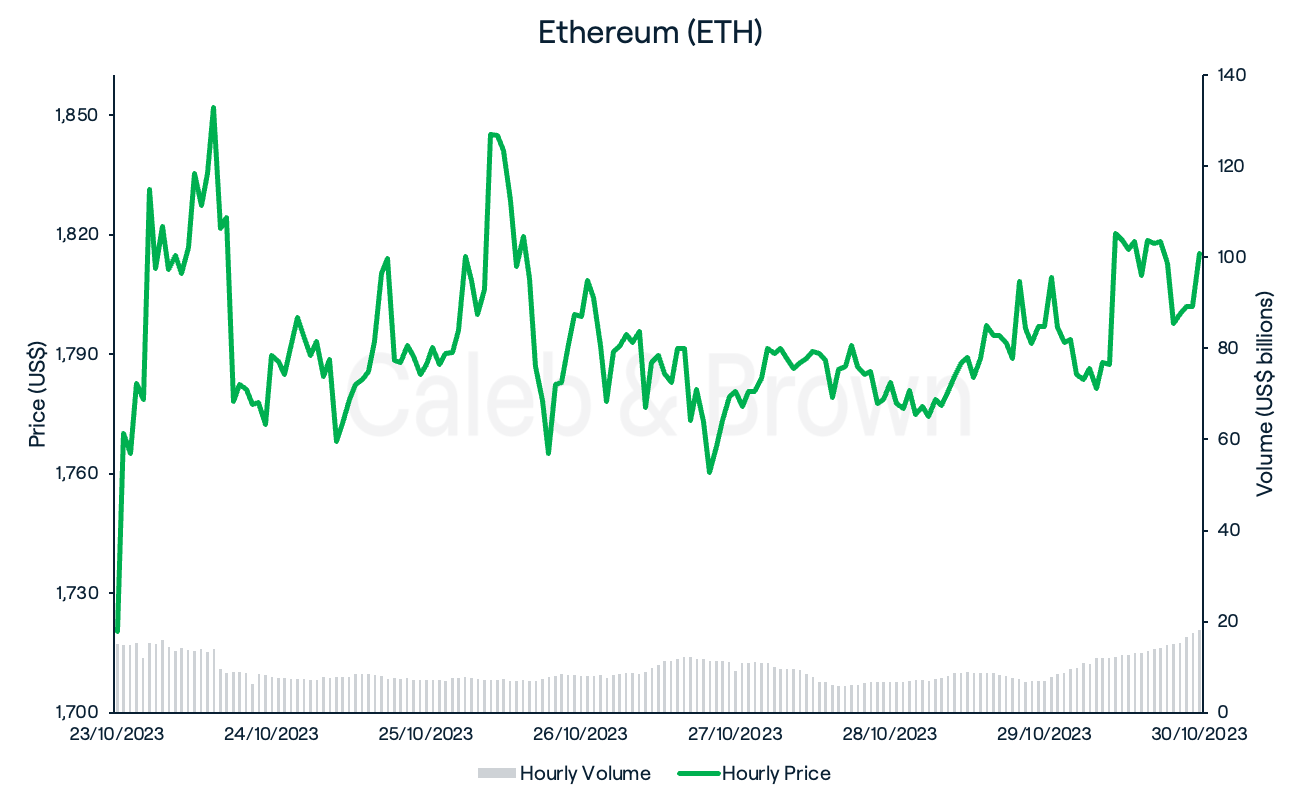

Ethereum (ETH) also showed signs of strength as it crossed US$1,850 for the first time since August, adding on 5.5% over the week and closing at US$1,806.

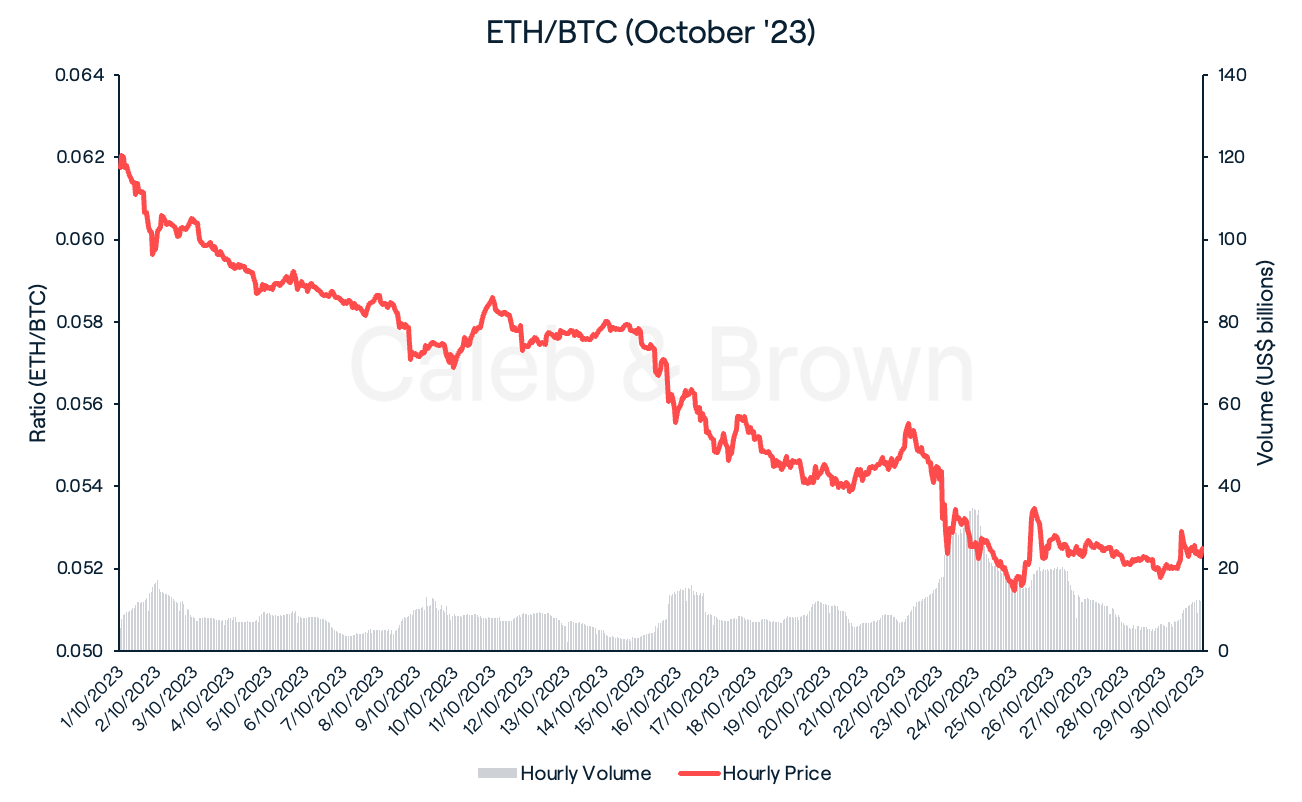

However, BTC remains in the spotlight as the ETH/BTC ratio fell for the fourth consecutive week to ~0.052, a loss of 15.0% over the month.

Altcoins

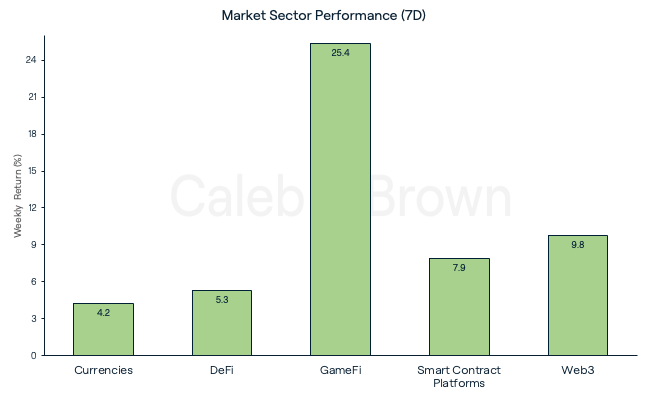

Market sectors soared once again this week as GameFi added a huge 25.4% over the last seven days. Currencies and DeFi lagged the pack with each adding on 4.2% and 5.3%, respectively.

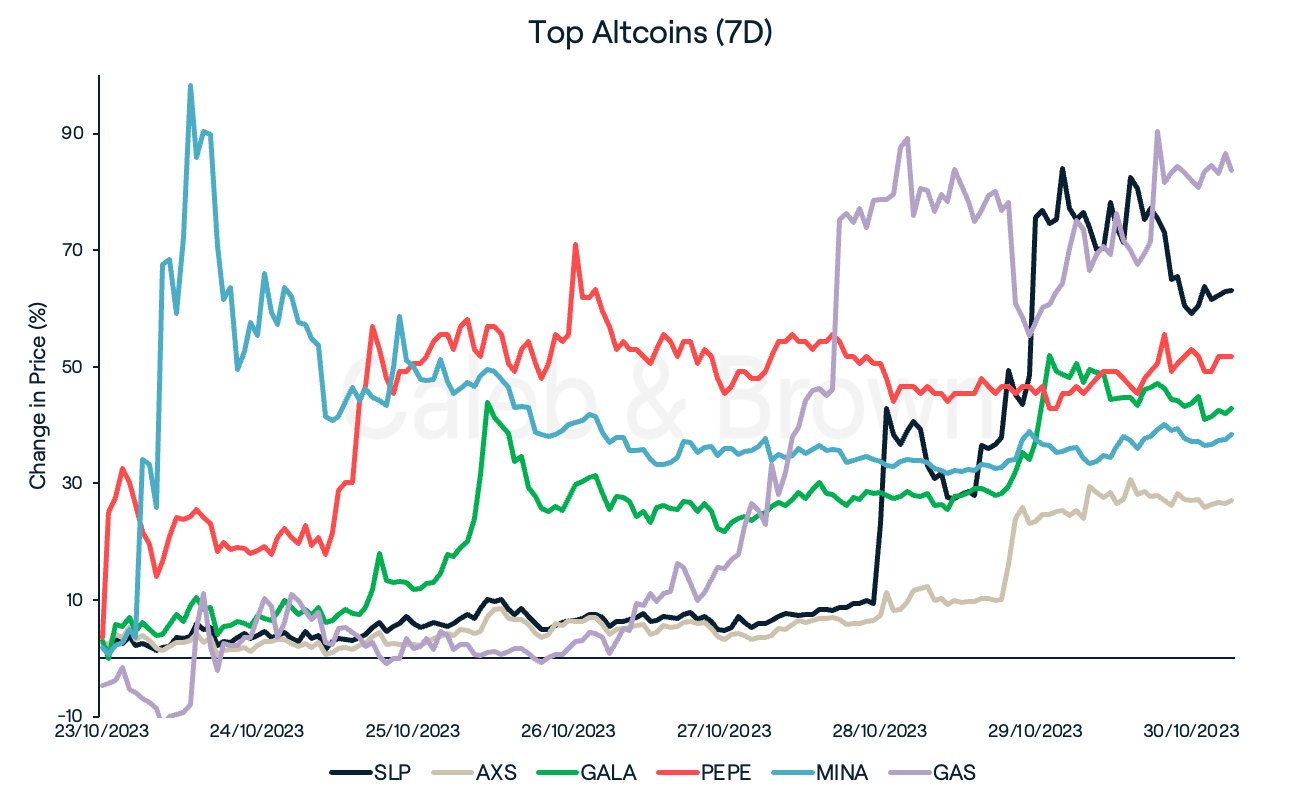

Amongst GameFi, Smooth Love Potion (SLP), Axie Infinity (AXS), and GALA (GALA) were the top performers with each surging 63.1%, 27.1% and 42.9%, respectively. AXS and its in-game token SLP, both rallied following a new integration into its game while GALA recently launched a new play-to-earn blockchain game, Legacy.

Memecoins also saw explosive growth as news of a US$5.5 million token burn saw Pepe (PEPE) add 51.8% this week.

Finally, Mina Protocol (MINA) and Neo blockchain’s Gas (GAS) gained 38.5% and 83.8%, respectively.

In Other News

- On Wednesday, layer-2 scaling solution, Polygon (MATIC) deployed the token contract for its new POL token. POL will replace the network's current MATIC token whereby MATIC holders will have four years to migrate their holdings to the new token.

- DYdx (DYDX) released the open-source code for its independent blockchain on Tuesday. Once approved, the migration involves a transition from an Ethereum-based layer-2 blockchain to a Cosmos-based one, secured and governed by DYDX token holders.

- Fallen crypto lender BlockFi, which filed for bankruptcy soon after FTX, announced its emergence from bankruptcy.

Regulatory

Two U.S. senators introduced a bipartisan bill that will establish safeguards against another FTX-type collapse. The proposed Proving Reserves of Others Funds (PROOF) Act intends to guard against unethical co-mingling of customer funds and require a monthly proof-of-reserves (PoR) report from a neutral, third-party auditing firm.

Learn with Caleb & Brown

Cryptocurrency Market Cap Explained

Explore the dynamics of the Crypto Market Cap!

From small-cap wonders to the giants like Bitcoin & Ethereum, our blog breaks it down for you!

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F33BSlsaGVBVb6j4AMAgjfJ%2F036c2578d1cf00e66b6b233bf223ca12%2FWeekly_Rollup_Tiles__21_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-10-31T01%3A59%3A50.687Z)