Market Highlights

- Bitcoin and Ethereum ETF outflows continued, with US$360 million leaving funds in a 24-hour period.

- Judge orders SEC to hand over discovery documents in Coinbase case.

- Three of Japan’s biggest banks will trial stablecoins for cross-border payments.

- VanEck announces the closure of its Ethereum futures ETF, the VanEck Ethereum Strategy ETF (EFUT).

Markets Overview

Macro Market Updates:

Weak jobs and employment data out of the US this week prompted sell-offs in both equities and cryptocurrencies. The non-farm employment change for August came in at 142,000, which was lower than the forecast of 160,000. Further the unemployment rate in the US came in at 4.2%, versus a forecast 4.3%. This week’s unemployment insurance claims came in just under forecast at 227,000. These data points indicate that the US economy could be worse off than analysts expected, adding further speculation over whether the US Federal Reserve will cut interest rates at its 19 September meeting. - The Conference Board’s US consumer confidence figure for August came in higher than forecast at 103.3.

- The Bank of Canada reduced interest rates by 25 basis points to 4.25%.

- Employment data was weak out of Canada, too. The unemployment rate came in higher than forecast at 6.6%, and the employment change for August came in at 22,100 versus a forecast 23,700.

- The US ISM manufacturing purchasing managers index (PMI) came in at 47.2.

- Australia’s gross domestic product rose by 1.5% in the 12 months to 30 June 2024.

Crypto Market Sector Performance

Performance across the crypto market sectors was mixed this week. Data services, data availability and gaming had the most upside, while staking services, utilities and services, and exchange tokens experienced the lowest returns. The average performance across all sectors was 0%. The gains in gaming align with some of the biggest altcoin winners for the week. ApeCoin (APE) saw growth of 44.8%, presumably due to the announcement of its revised roadmap, which will foster Bored Ape Yacht Club-themed community developments. Mines of Dalarnia (DAR) surged 29.3%, boosting its market cap to US$111.8 million, likely driven by the launch of its new Modbots game.

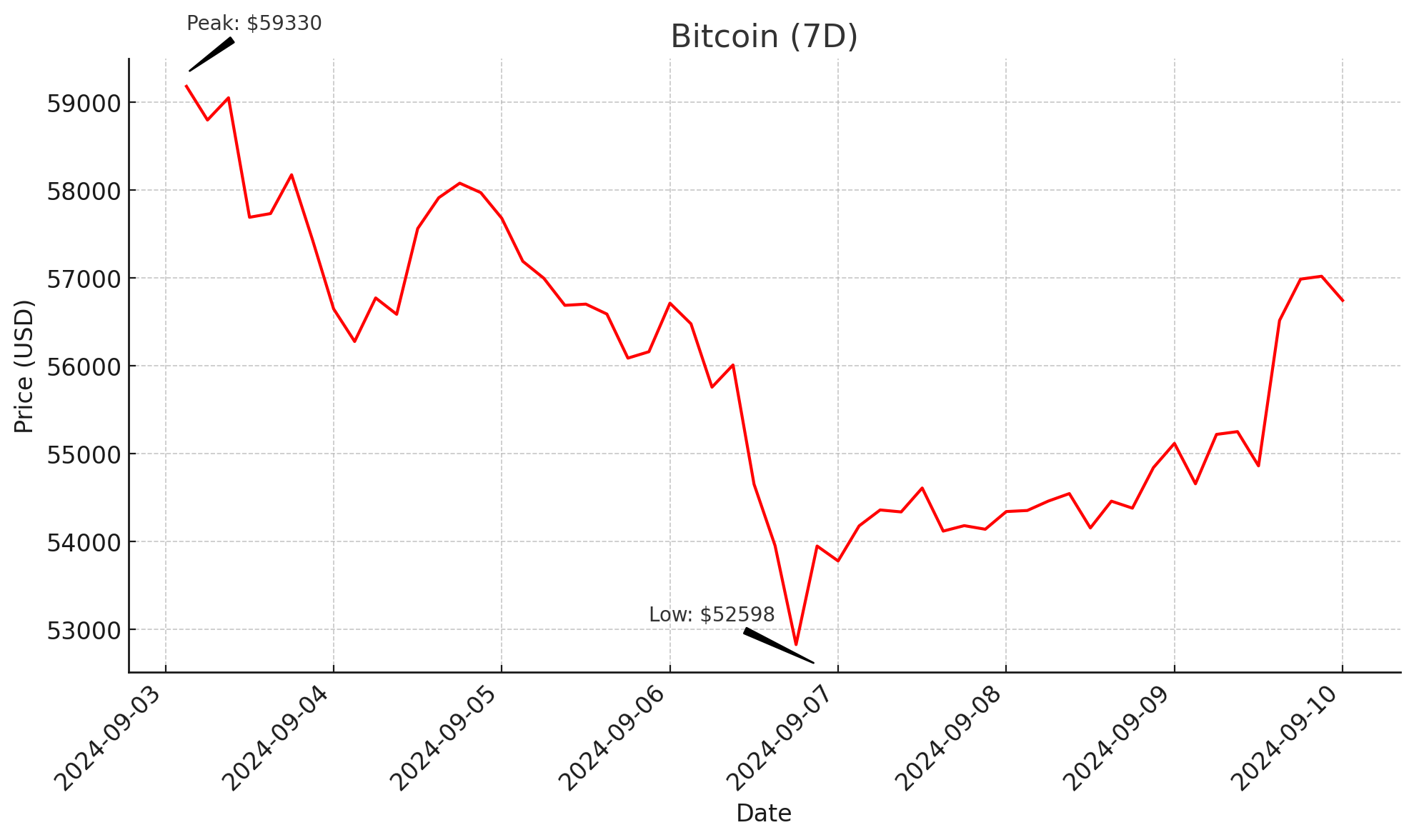

Bitcoin (BTC)

It was another disappointing week for bitcoin. Opening the week at US$57,456, price declined by almost 12% to US$52,756 before bouncing back slightly to around US$54,900. This week’s continuing declines are presumably due to the weak employment data out of the US, which has caused a sell-off across the crypto and traditional finance markets. In more positive news, the network’s hash rate has just hit an all-time high, meaning the decentralised network is stronger than ever.

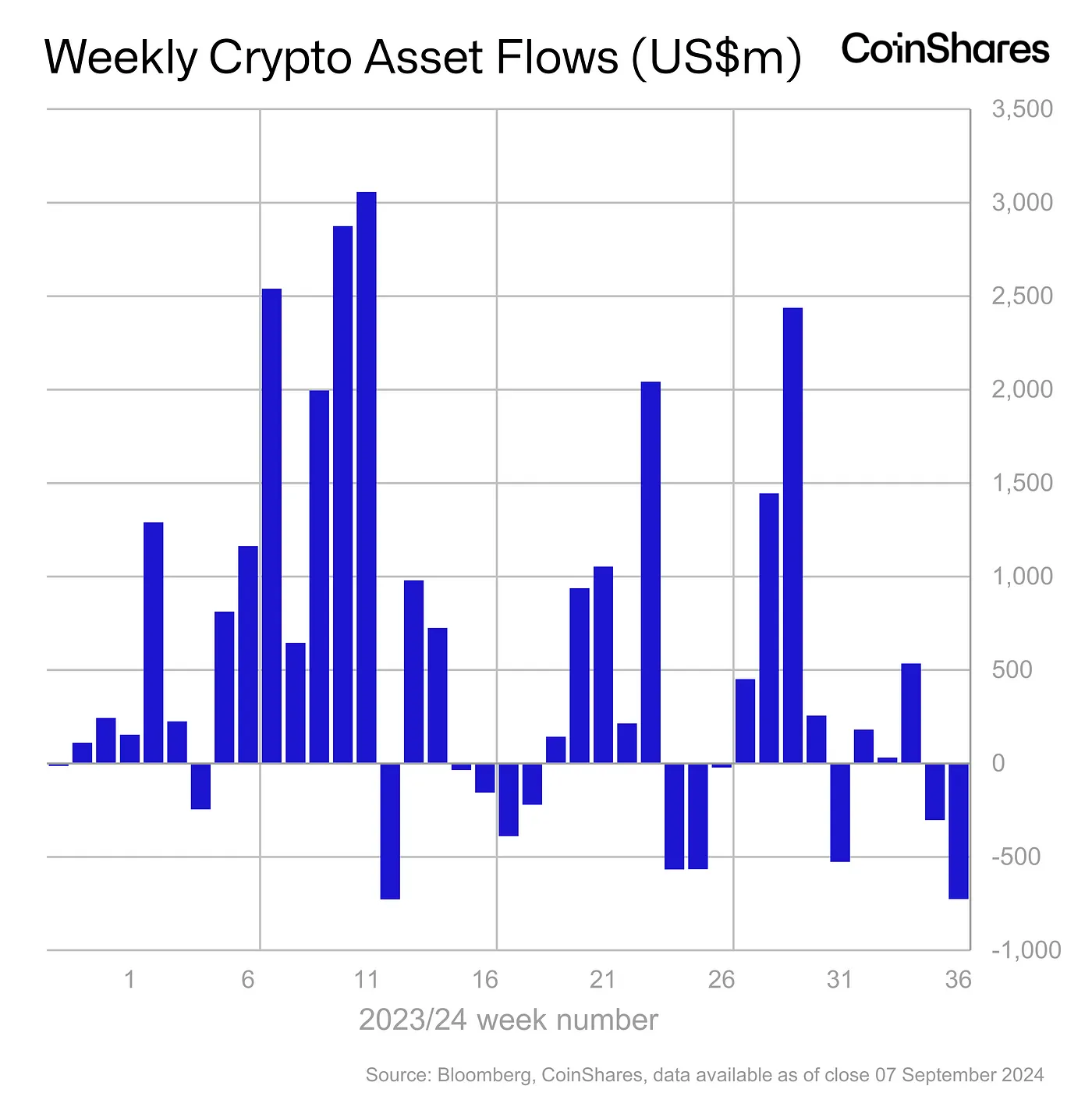

Outflows from bitcoin asset investment products continued this week, with bitcoin and Ethereum funds seeing a combined US$360 million of outflows in 24 hours on Thursday 5 September. Bitcoin asset investment products saw outflows of US$643 million for the week. Short-bitcoin saw inflows of US$3.9 million.

Also this week, the Core Foundation launched LstBTC. An ERC-20 liquid staking token pegged 1:1 with bitcoin, the new coin aims to provide holders with the option of staking without sacrificing their liquidity. It’s a significant development for the biggest cryptocurrency, which hasn’t typically contributed to much of the volume and activity in decentralised finance (DeFi) markets due to the inability to stake.

Bitcoin is currently trading at US$57,109, a decrease of 3.3% on the week.

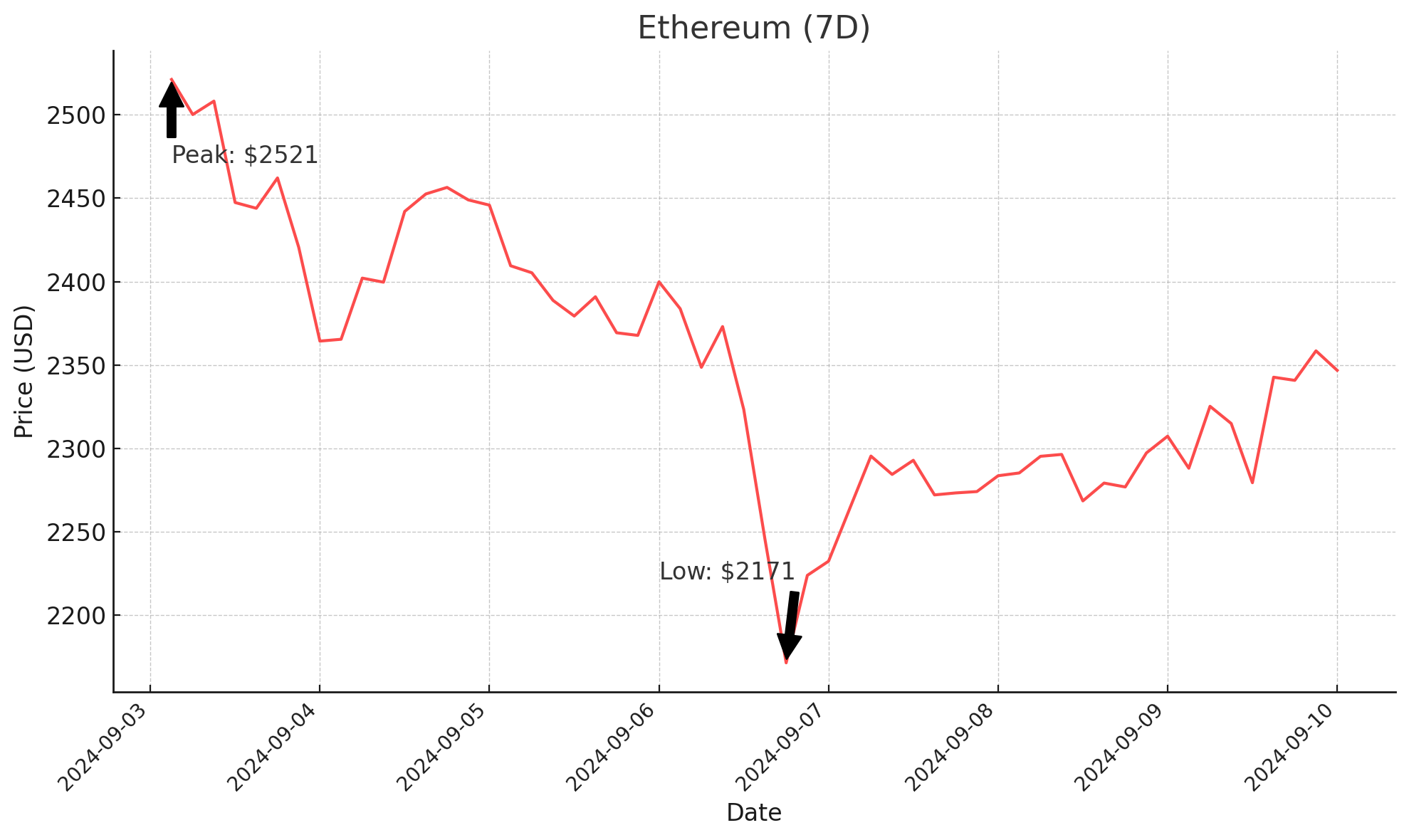

Ethereum (ETH)

Ethereum’s price was heavily impacted by the sell-offs across crypto and other asset classes last week. The second largest cryptocurrency opened the week at US$2,423.60 and declined over 16% to US$2,150. Price has now rebounded slightly to the key level at US$2,320. To open the new week, Ethereum’s price climbed over 4%, regaining some of last week’s losses.

Much like the rest of the market, outflows occurred from Ethereum digital asset investment products. Totalling US$98 million for the week, the outflows were mostly from the Grayscale Ethereum Trust (ETHE).

Ethereum is currently trading at US$2,365, a decrease of 7% on the week.

Altcoins

DeFi-ing the odds

- Reef (REEF) gained 100.5%, taking its market cap to US$36.7 million. Price for the layer-1 blockchain, which provides functionality for DeFi, NFTs and gaming, has gained almost 200% since its lows in late August. Last week’s gains are presumably due to recent announcements about its growth. The network gained more than 5,000 new wallets in August, representing an increase of over 22% for the month.

- Velo (VELO) grew by 28.5%. This takes its market cap to US$131.8 million. The Web3+ financial ecosystem has gained over 125% since its August lows. Now trading at US$0.019, Velo announced that the Laos Bullion Bank will begin operating this month, with plans to be fully operational by November. Velo is the designated clearing house for the newly established bank.

Living in a digital world

- Civic (CVC) gained 20.69%, taking its market cap to US$84.8 million. Finding support at US$0.87, price for the network that offers identity tools for Web3, identification and age verification grew by over 40% before retracing back to around US$0.1070. Recent articles about Civic’s aims to make airdrops more secure may also be contributing to the recent price gains.

This week’s biggest losers

- Mdex (HECO) (MDX) declined by 22.8%, taking its market cap to US$14.3 million. The automated market maker (AMM) that integrates decentralised exchanges (DEX), initial model offerings (IMO), decentralised autonomous organisations (DAOs) and perpetual contracts presumably saw price declines due to the wider market sell-off. In its third anniversary note in January, the team announced its plans for 2024. The fourth quarter includes implementing aggregation trading and getting involved in BRC-20 token development.

- NULS (NULS) lost 20.8%, which takes its market cap to US$38.5 million. Price for the blockchain infrastructure network that provides customisable services and an open-source community presumably declined due to selling pressure across the crypto market and a pullback from its recent run of over 120% in August. The gains seen in August were likely a result of NULS listing on Binance Futures.

In Other News

Digital asset investment products saw outflows of US$726 million this week due to uncertainty about the US Federal Reserve’s agenda on cutting interest rates amidst weak employment data. It’s the largest week of outflows since March. While many investment products saw outflows, Solana was the outlier, with inflows of US$6.2 million. If this week’s inflation data out of the US also underperforms, a potential 50 basis point rate cut could be on the table at the Fed’s 19 September meeting.

- Three of Japan’s major banks, MUFG, SMBC and Mizuho announced they will trial a stablecoins platform to facilitate cross-border payments. Named “Project Pax”, the trial will be run by blockchain firms, such as Progmat, Datachain and TOKI. The stablecoins will be issued by Progmat, which is a blockchain startup funded by the three banks. SWIFT’s existing API framework will be used to prompt Progmat to settle transactions on its blockchain.

- Investment manager VanEck is going to close and liquidate its Ethereum futures ETF, the VanEck Ethereum Strategy ETF (EFUT). The closure is due to investors opting for its spot Ethereum ETF (ETHV). The EFUT invested in ETH futures contracts, not the asset directly. EFUT holders will have until 16 September 2024 to liquidate their holdings. Investors who don’t sell their shares before this date will have their shares liquidated for cash.

- Tether has invested US$100 million to buy a 9.8% stake in Adecoagro, a Latin American milk producer. In the past, Tether has invested in emerging technologies, including AI, peer-to-peer platforms, bitcoin mining operations, and digital education initiatives. This recent investment into Adecoagro marks the stablecoin issuer’s first investment into the agriculture and food sector.

Regulatory

- The US Commodities and Futures Trading Commission (CFTC) filed an emergency motion aimed at blocking prediction market, Kalshi, from listing US Presidential election contracts for two weeks. This follows an earlier decision by the United States District Judge for the District of Columbia, Jia Cobb, to dismiss the order. The CFTC filed the emergency motion for a stay of the judge’s decision for at least two weeks while the agency prepares its appeal.

- A New York judge has allowed Coinbase to access some of the US Securities and Exchange Commission’s (SEC) discovery documents as part of its ongoing legal case. According to Coinbase’s Chief Legal Officer, the judge ordered “huge discovery into internal memorandum and other documents reflecting the SEC’s Howey analysis”. The crypto exchange’s motion to subpoena SEC Chair Gary Gensler was dismissed.

In Case You Missed It

Missed our announcement? Don't worry—there's still time to register for our upcoming Crypto High-Net-Worth Strategy & Insights Masterclass, co-hosted with Collective Shift.

Why Attend?

- Adapt to Market Shifts: Learn how U.S. economic policies and global events are shaping the market.

- Manage Risk: Discover strategies to minimize volatility and safeguard your portfolio.

- Profit from Corrections: Find out how to effectively seize opportunities to buy the dip.

- Expert Strategies: Get exclusive insights from portfolio managers handling nine-figure assets.

Learn how you can position yourself for success in this market.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.