Market Highlights

- Bitcoin (BTC) and Ethereum (ETH) were stuck in limbo this week with both trading tightly rangebound before a Monday dip.

- London Stock Exchange Group will use blockchain technology to build an exchange offering tokenised versions of traditional financial assets.

- Visa announced new stablecoin settlement capabilities via USD Coin (USDC) on the Solana (SOL) network.

- Rideshare app, Grab announced its new crypto wallet integration using layer-2 protocol, Polygon.

- Ripple to acquire Fortress Trust, a startup specialising in crypto infrastructure.

- The International Monetary Fund and the Financial Stability Board released a whitepaper outlining crypto asset policy recommendations and standards.

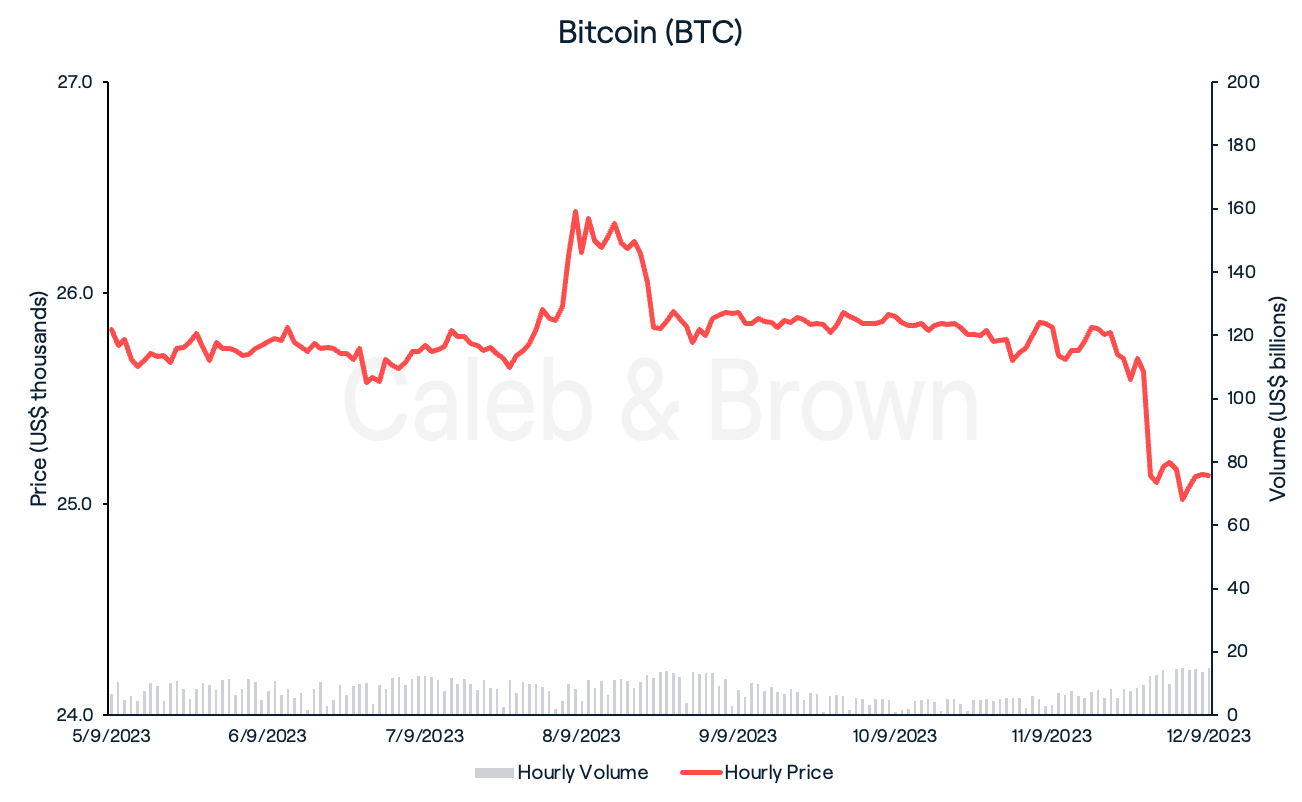

Bitcoin

This week saw very little movement in total crypto market cap with it sitting near where it left off at ~US$1.08 trillion. This was reflected in Bitcoin’s (BTC) price action as it ranged tightly between US$25,600 and US$26,200 for majority of the week, correlating with a 4.5-year trading volume low for August.

A modest sell-off Monday morning saw BTC close the week at US$25,133, down 2.7%.

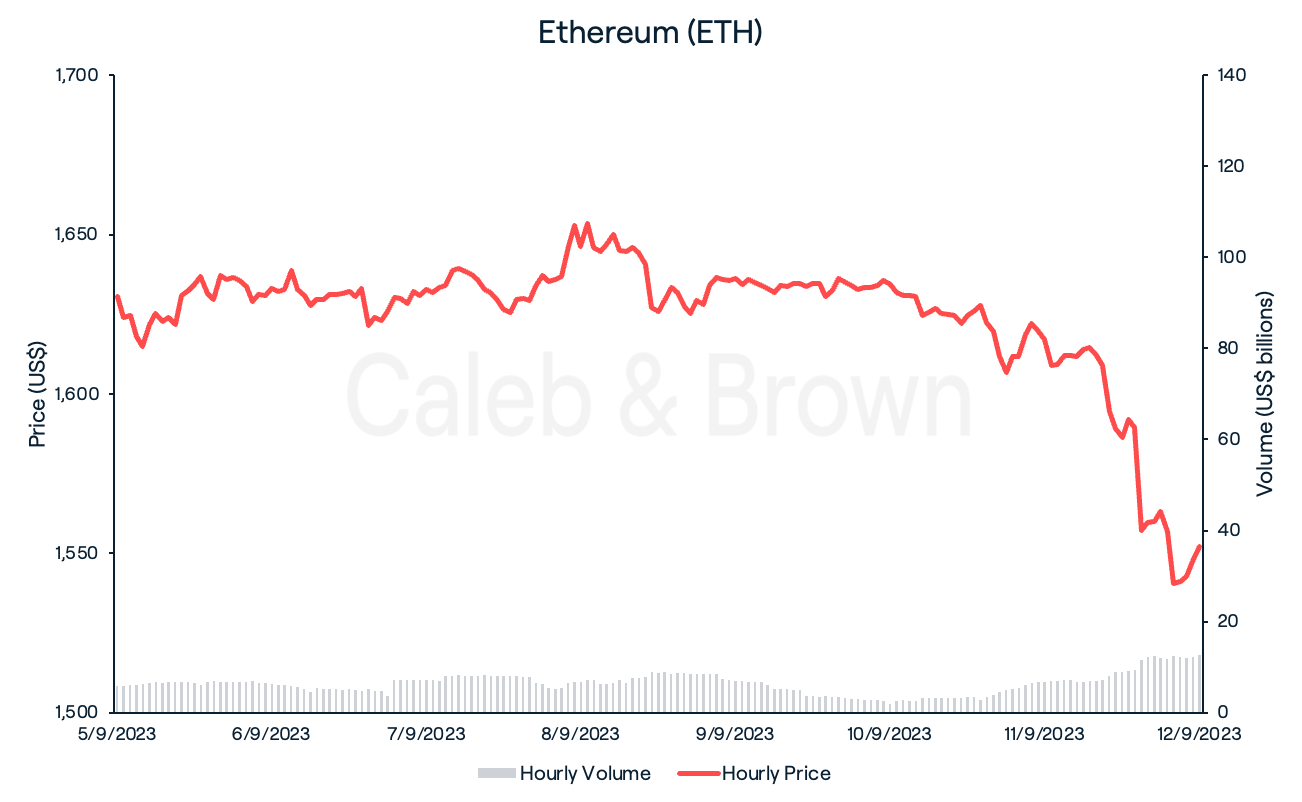

Ethereum

Ethereum (ETH) also found itself trading rangebound between US$1,620 and US$1,650 for most of the week, however fell 3.0% on Monday to underperform BTC.

ETH eventually closed the week at US$1,552, down 4.8% over the last seven days.

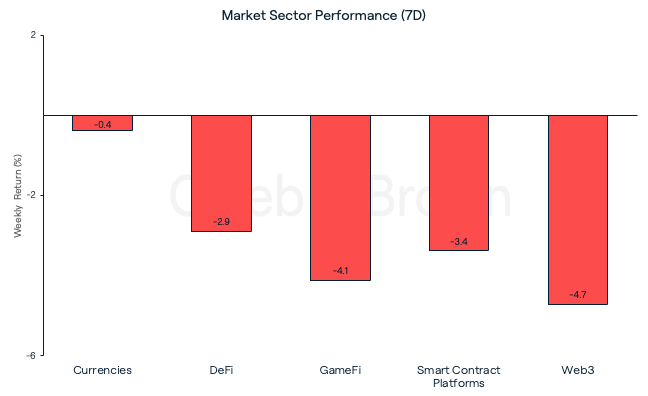

Altcoins

Market sectors saw moderate losses across the board this week with Currencies declining just 0.4% over the week. Web3 and GameFi were hit hardest, falling 4.7% and 4.1%, respectively.

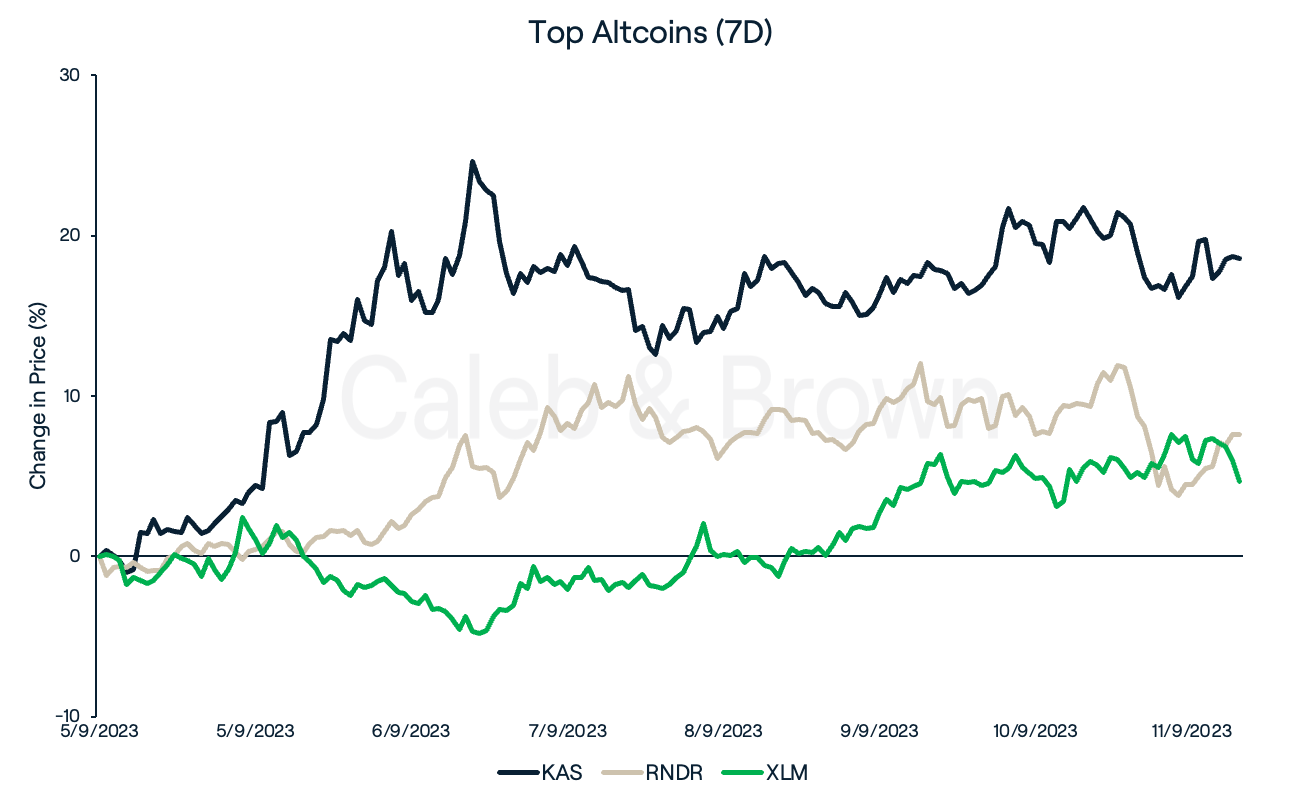

This week’s top performers were Kaspa (KAS), Render (RNDR), and Stellar (XLM) which each added on 18.6%, 7.6%, and 4.6%, respectively.

Kaspa surged on the news of a new listing on major exchange, ByBit, while Stellar rallied after it made a preliminary post on its Twitter account, hinting at a major update on the 13th of September.

In Other News

- On Monday, the London Stock Exchange Group (LSEG) announced that it will be using blockchain technology to build an exchange offering tokenised versions of traditional financial assets.

- On Tuesday, payments giant Visa expanded its crypto ambitions after announcing new stablecoin settlement capabilities via USD Coin (USDC) on the Solana (SOL) network. The collaboration aims to improve the speed if cross-border settlement and provide modern options for the ever-expanding payments landscape.

- Asia’s largest rideshare company, Grab, announced its new crypto wallet integration using layer-2 protocol, Polygon (MATIC). The integration will allow for crypto payments as well as NFT functionality, providing real-world use cases for crypto, and streamlining worldwide adoption.

- Ripple Labs announced on Friday it will acquire Fortress Trust, a startup specialising in crypto infrastructure, providing Ripple with a license in Nevada, and allowing it to expand beyond its bread and butter of blockchain-enabled payments.

Regulatory

- The Financial Accounting Standards Board (FASB) voted unanimously on Wednesday to change how companies account for and disclose holdings of digital assets like Bitcoin. The new rules will take effect starting in 2025 and are aimed at providing investors and other financial statement users with more transparency around these volatile assets.

- On Thursday, two global financial regulators, the International Monetary Fund (IMF) and the Financial Stability Board (FSB), released a whitepaper outlining crypto asset policy recommendations and standards.

- The Securities and Exchange Commission (SEC) filed a response on Friday against Ripple Labs' efforts to block its appeal of Judge Torres’ ruling that largely favoured the crypto company in its legal fight with the regulator.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F40eQXvm2a4TJ0UNVz0vlG0%2F7ae4dcb16074709f631fa9c375620c82%2FWeekly_Rollup_Tiles__14_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-09-12T01%3A54%3A23.551Z)