Market highlights

- New U.S. House bill directs the U.S. Treasury to assess the feasibility of a BTC reserve.

- SEC softens stance; signals clearer crypto rulemaking ahead.

- London Stock Exchange Group goes live with blockchain markets

- Tether announces a dollar stablecoin for the U.S. market (USA₮)

- BBVA picks Ripple to launch crypto custody for institutions in Europe

- Cboe plans to introduce “Continuous Futures” contracts for BTC and ETH.

- Rex-Osprey Doge ETF (DOJE) set to launch on September 18.

Markets Overview

All eyes were on U.S. inflation data this week. The August core producer price index (PPI) came in under forecast at -0.1%. President Trump was quick to comment and continue his call for Federal Reserve Chair Jerome Powell to cut interest rates. The August consumer price index (CPI) reading came in at 2.9% for the 12 months to 31 August 2025. Although the reading showed an increase, the prevailing trend is deflation, with inflation continuing to decline from its recent year-on-year peak of 7% in 2021.

Also this week, U.S. jobs numbers were revised heavily, with the economy adding 911,000 fewer jobs in the 12 months ending March 30, 2025, further confirming an economic slowdown.

Looking ahead, there is a 96% chance that the Fed will deliver a 25-basis-point rate cut at the Federal Open Market Committee (FOMC) meeting on September 17. The ten-year yield hit a five-month low around 4% this week, signalling the FOMC may deliver further rate cuts this year.

Weekly performance: S&P 500 +1.6%, Dow Jones almost +1%, Nasdaq +2%.

Looking ahead:

- Bank of Canada overnight rate decision - September 17

- U.S. Federal Funds Rate decision - September 17

- Bank of England official bank rate decision - September 18

- Bank of Japan policy rate decision.- September 19 (tentative)

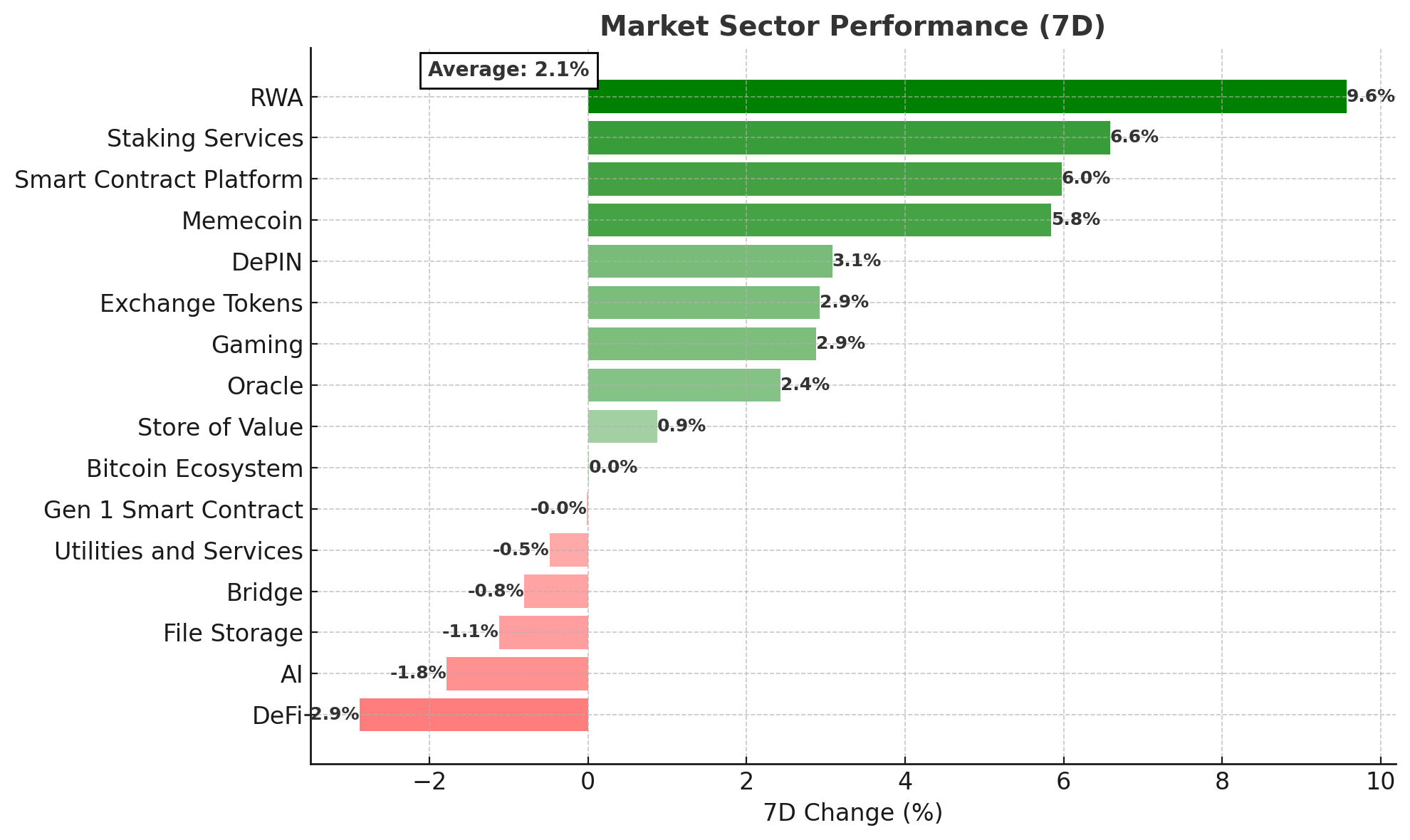

Crypto Market Sector Performance

Sector performance was mixed this week, with several sectors making gains, while others saw minor losses. A pullback throughout Monday, September 15, presumably contributed to these sector performance changes.

Notable gains:

- Real-world assets (RWA): Plume (+20.4%) showed signs of recovery following volatile price action created by its August 20 Binance listing. The network recently announced that it integrated Octane, an AI-powered security platform, to enhance security for RWA developers on Plume’s network.

Biggest loser

- DeFi: Frax (-12.3%) declined, presumably due to its loss in the Hyperliquid USDH stablecoin proposal, which was won by Native Markets (more on that below).

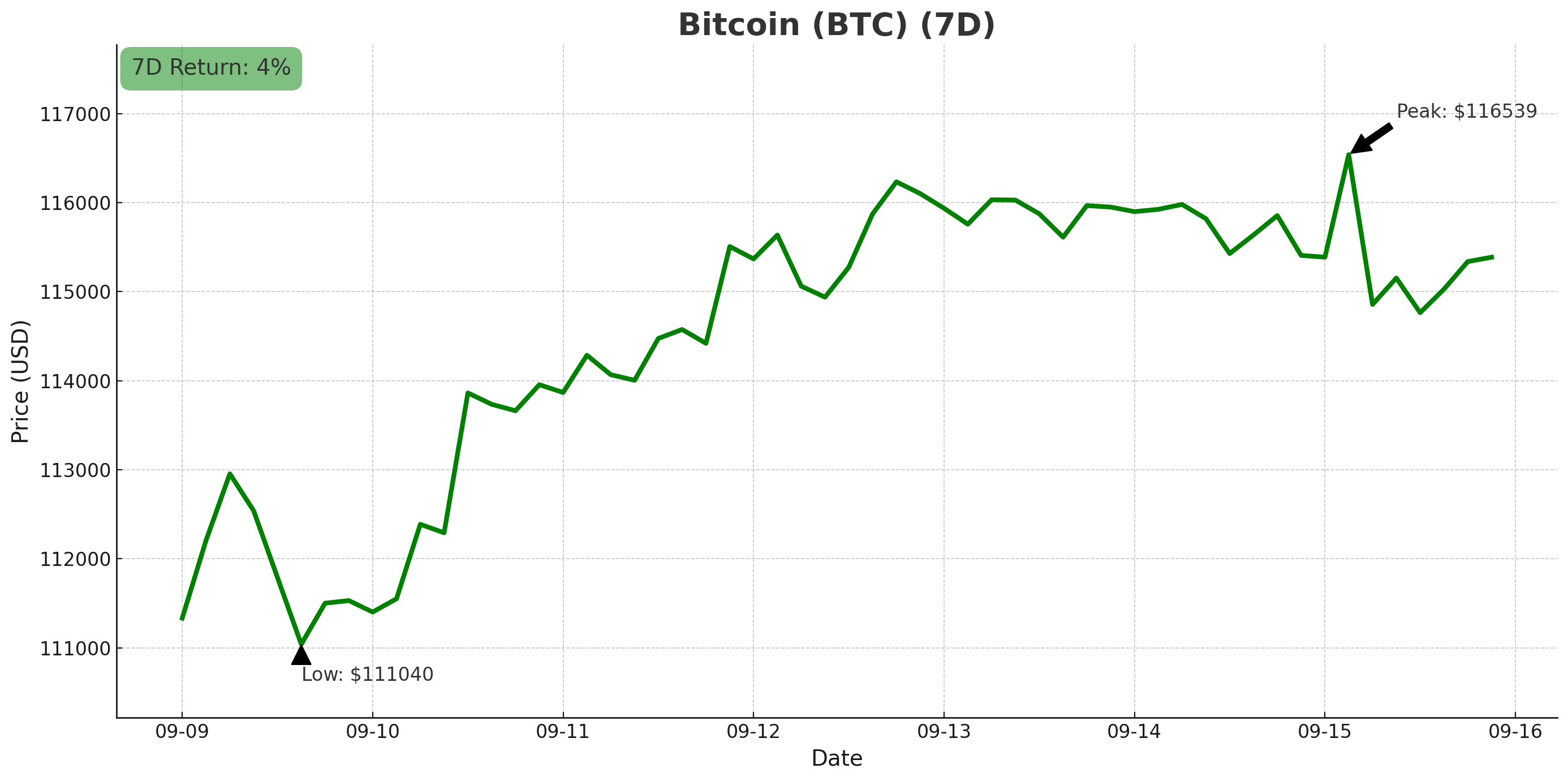

Bitcoin (BTC)

- Opened the week at US$111,120 and rallied to a weekly high of US$116,833 on Friday, September 12, presumably as risk assets rallied on an almost certain likelihood that the Fed will cut rates this week (+2.9% 7D).

- BTC dominance fell to a low of 57.2% on September 13, the lowest level seen since January 2025.

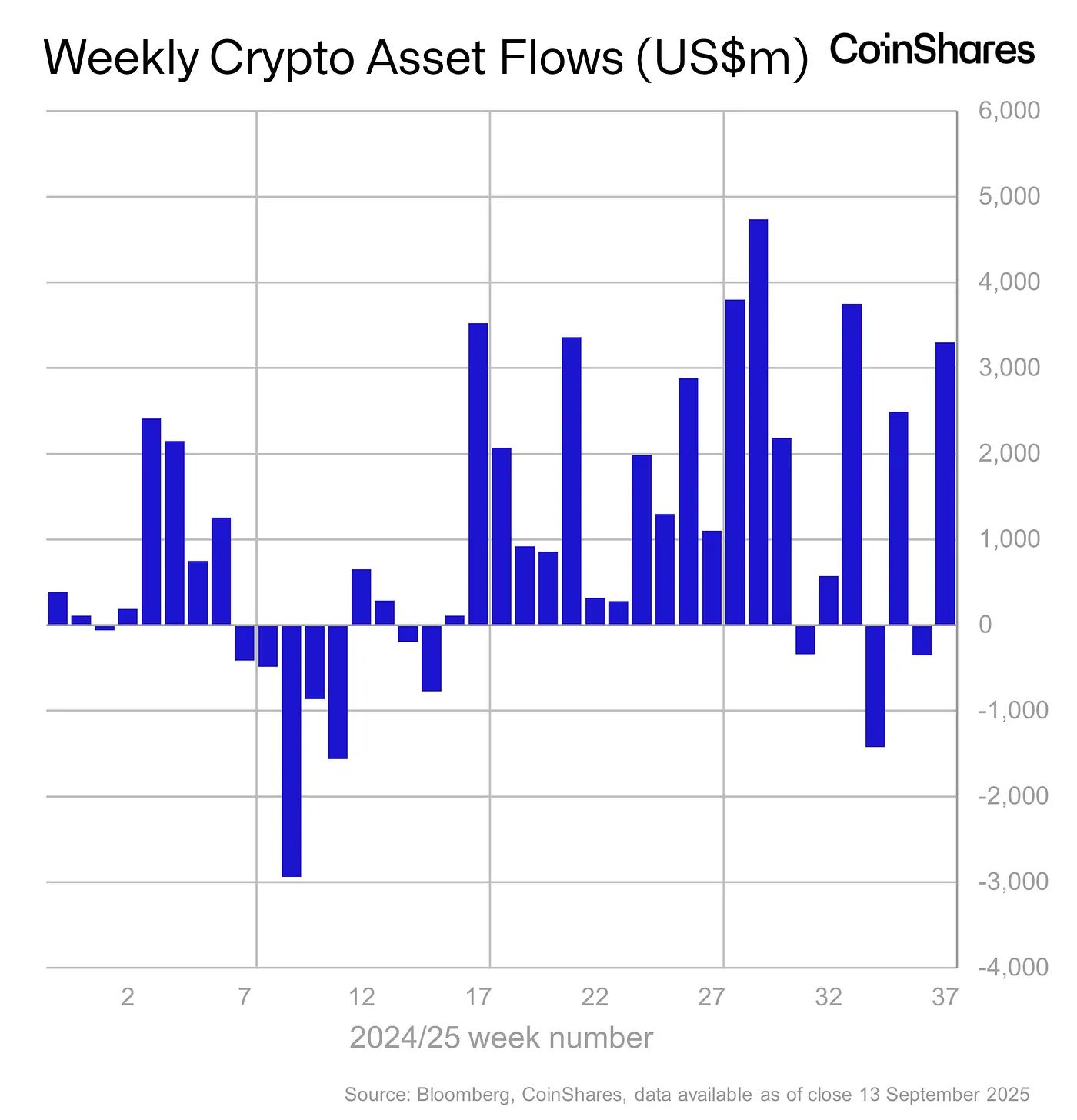

- Bitcoin investment products saw US$2.4 billion in inflows this week.

A lawsuit against bitcoin treasury firm, Strategy, has been dismissed. Like the class action lawsuit dropped in August, the shareholder suit alleged that Strategy breached its fiduciary responsibilities, among other accusations.

The U.S. House Appropriations Committee introduced a spending bill directing the Treasury Department to assess the feasibility and security of a Strategic Bitcoin Reserve. If the bill is passed, the U.S. Treasury will have 90 days to produce a report that covers aspects such as custody, legal authority, and cybersecurity measures for government-held digital assets.

Cantor Fitzgerald launched the Cantor Fitzgerald Gold Protected Bitcoin Fund, a five-year structured investment product offering 45% participation in bitcoin's appreciation with gold-based downside protection.

In bitcoin buying news:

- Metaplanet finalised an almost US$1.5 billion international share sale on September 10. The majority of proceeds will be used to buy more bitcoin. The firm currently holds 20,136 BTC, worth about US$2.3 billion.

- Strategy acquired 525 BTC, bringing its total holdings to 638,985 BTC at an average purchase price of US$73,913 per bitcoin.

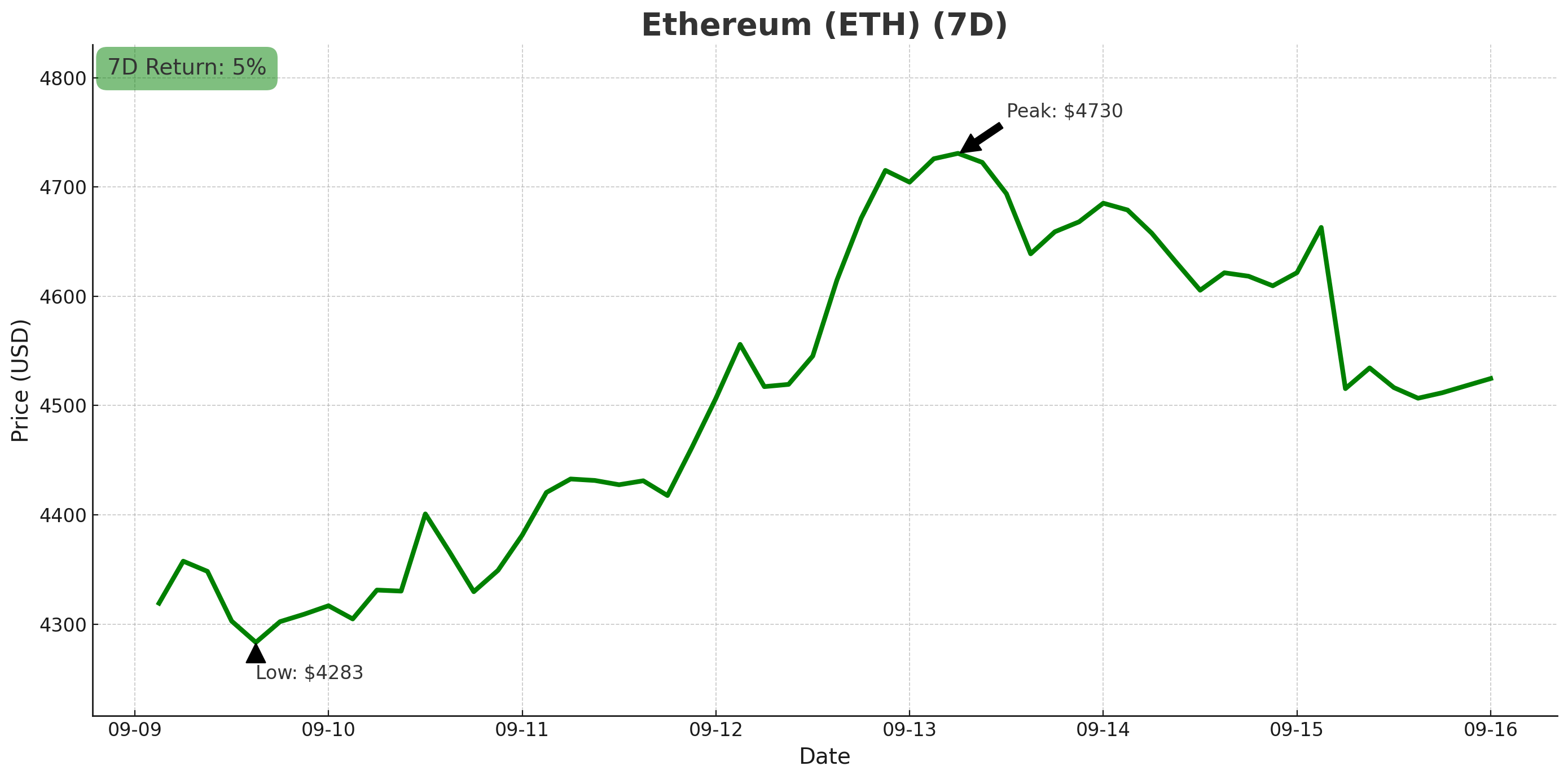

Ethereum (ETH)

- Opened the week at US$4,305 and rallied to a weekly high of US$4,768 on September 13 on rate cut hopes. Ethereum declined almost 2% to start the week, presumably due to a broader pullback across the market following recent gains (+5.1% 7D).

- Ethereum dominance gained this week, reaching a high of 14.2%.

- Ethereum-focused funds saw inflows of US$646 million this week.

Ethereum's Market Value to Realised Value (MVRV) ratio has reached 1.97, indicating that investors are holding significant unrealised profits. While this suggests continued bullish momentum, the ratio is approaching the 2.40 threshold, a historically significant level associated with increased profit-taking and potential price corrections. When Ethereum’s MVRV reaches 3.2, it typically indicates that the market has reached peak euphoria.

Altcoins

The altcoin season index has almost reached 75, indicating that the top 100 altcoins are nearing outperformance of bitcoin over the past 90 days, which signals the start of altseason.

Solana to Wall Street

- Solana (SOL) hit $249 (highest since January) as SOL Strategies (STKE) began trading on Nasdaq (Sep 9); the firm holds ~435k SOL (~US$89m) and operates validators with >3m SOL staked adding to the ecosystem’s institutional momentum. Project 0 launched Solana’s first multi-venue DeFi-native prime broker with unified margin across Kamino, Drift, and Jupiter. In other Solana news, investment firm Galaxy Digital bought over US$700 million worth of SOL.

Buybacks PUMP price

- Pump.fun (PUMP) gained 77.5% and reached a new all-time high of US$0.0088 on September 14, as token buybacks reach US$95 million, following steep declines in recent months. The buyback strategy, implemented from July 17, uses platform revenue to repurchase PUMP tokens on the open market, which reduces circulating supply and boosts upward price momentum.

Back to the future(s)

- Mantle (MNT) gained 40% due to continued exchange support for MNT pairs. The team also announced several community events that will take place in Seoul from September 22 to 25, which resulted in MNT gaining 5%.

Into the Aethir

- Aethir (ATH) gained almost 40%. The decentralised physical infrastructure (DePIN) network rallied on news of its partnership with Arizona State University to integrate its decentralised GPU technology into the university’s AI and gaming labs. The team continued to hype the developments with a post on X, stating, “DePIN SZN has started,” and teased a potential partnership with Chainlink. ATH was also featured in several charts this week, referencing its healthy price-to-earnings ratio of 14.6.

Tokenise this

- Ondo (ONDO) gained 10% due to the launch of its tokenisation platform. Previously restricted to institutional investors, the platform now supports global participation, facilitating the tokenisation of securities, private credit and fintech assets.

- Binance Coin (BNB) grew by 4.5%, hitting a new all-time high of US$907 as the company built on its previously announced partnership with asset manager Franklin Templeton to build tokenised financial products and speed up mainstream adoption of digital asset technologies.

Crypto ETF News

Digital asset investment products saw inflows of US$3.3 billion this week, following below-forecast PPI data and the jobs numbers revision, which point to an almost certain U.S. rate cut on Thursday.

In altcoins, Solana saw its largest-ever single-day inflow of US$145 million on September 12, bringing its weekly inflows to US$198 million. Aave and Avalanche saw outflows of almost US$1.1 million and US$0.7 million, respectively.

The U.S. SEC has delayed its decision on whether to allow staking in the iShares Ethereum ETF to October 30. The agency also pushed back its deliberations on Franklin Templeton’s funds, which will track Solana and XRP, to November 14. Meanwhile, a decision on Grayscale’s Hedera Trust has been delayed until November 12.

The Rex-Osprey Doge ETF (DOJE) is set to launch on September 18, making it the first U.S. crypto ETF to launch and hold an asset with “no utility on purpose”.

Other crypto news

- Senator John Kennedy (R-LA) stated that the U.S. Senate is “not ready” to advance the proposed comprehensive crypto market structure bill, citing numerous unresolved questions among lawmakers. A group of Democratic Senators even released their own version of crypto market structure legislation, which also includes provisions for regulatory clarity, how the U.S. SEC and Commodity Futures Trading Commission (CFTC) can regulate digital assets, and guidelines around “corruption and abuse,” particularly elected officials owning tokens or launching crypto projects.

- Paul Atkins, Chair of the U.S. SEC, is shifting away from aggressive regulatory enforcement seen in previous administrations toward a more accommodative crypto regulation agenda. The agency plans to take fewer enforcement actions and is expected to adopt a slower, more deliberate approach under Atkins, who was appointed by President Trump earlier this year.

- The London Stock Exchange Group (LSEG) completed its first transaction using a blockchain-powered system. The new system enables blockchain-based transactions for the full lifecycle, from issuance to post-trade settlement and servicing.

- Cboe Global Markets plans to introduce “Continuous Futures” contracts for Bitcoin and Ether starting November 10, 2025. If approved, the contracts will have a 10-year expiration, be cash-settled, and use a transparent funding rate to reflect real-time spot prices.

- The Bank of England has proposed caps on individual holdings of “systemic stablecoins” used in UK payments: GBP10,000 to GBP20,000 for individuals and GBP10 million for businesses. The objective is to prevent stablecoins from undermining traditional banking. Industry groups argue the limits would be hard to enforce and disadvantage the UK compared to the US and EU.

- Gemini, the crypto exchange founded by the Winklevoss twins, went public on the Nasdaq under the ticker GEMI. The company raised US$425 million by offering 15.2 million shares at $28 each. Its shares opened at $37.01, valuing the company at around US$4.4 billion. Crypto lending firm, Figure, also debuted on the Nasdaq this week at a US$5.3 billion valuation.

- Ripple has agreed to provide its institutional-grade custody technology to Spanish bank BBVA. BBVA will integrate Ripple Custody into its new retail service for trading and holding Bitcoin and Ether, complying with the EU’s Markets in Crypto-Assets (MiCA) regulation.

- Native Markets won the USDH stablecoin ticker in a Hyperliquid validator vote, outperforming other contenders, including Paxos, Frax, and Agora. The vote focused solely on granting the USDH ticker, not exclusive issuer privileges. Max Fiege, founder of Native Markets, announced the rollout plan, stating that the team will deploy USDH HIP-1 and its corresponding ERC-20 tokens within days.

- Tether plans to launch USAT, a new U.S.-based stablecoin, by the end of 2025. The token will be issued by Anchorage Digital Bank and led by Bo Hines, former director of the White House’s digital assets working group. USAT is designed to comply with the GENIUS Act’s regulatory requirements for U.S. stablecoins.

In Case You Missed It!

The Caleb & Brown iOS App is here — trade, deposit, and chat with our team anytime. Download Now!

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.