Market Highlights

- Crypto prices rebounded in anticipation of a rate cut by the US Federal Reserve.

- Grayscale launched a closed-end Ripple fund.

- Coinbase launched a wrapped bitcoin token.

- Sam Bankman-Fried’s lawyers have sought the dismissal of the former FTX founder’s fraud charges.

Markets Overview

Macro Market Updates:

It was a relatively quiet week in macro data as the majority of data releases came in as forecast. The European Central Bank (ECB) cut interest rates to 3.65% from 4.25%. It’s the second interest rate cut by the ECB this year after rates were cut by 25 basis points in its June meeting. Heading into the week, all eyes are on the US Federal Reserve, which will deliver its rate decision at the Federal Open Market Committee (FOMC) meeting at 2pm EDT on Wednesday, 18 September. It’s anticipated that the Fed will cut rates, but the question remains by how much. Traders have grown more confident in recent days that a 50 basis-point cut may be delivered, given the recent lacklustre jobs and employment data.

- The unemployment claimant count change in the UK came in at 23,700, well below the forecast of 95,500.

- The US consumer price index (CPI) came in at 2.5% for the 12 months to 31 August 2024.

- US unemployment claims came in slightly higher than forecast at 230,000.

Crypto Market Sector Performance

The average sector growth across the crypto market sectors this week was -3.5%. Store of value led the way, followed by data availability and exchange tokens. One of the biggest altcoin gainers this week was Ripple (XRP). It gained 8.4% on the week, taking its market cap to US$33 billion. The gains are presumably due to Grayscale's launch of a closed-end Ripple fund.

Staking services experienced some of the largest losses, declining by 6.9%. The losses are presumably due to selling activity in liquid staking pools like Rocket Pool (RPL), which saw a pullback this week following a surge in market interest in recent weeks. RPL perpetual contracts launched on 9 September 2024, driving almost 50% gains before retracing. Large RPL holders, such as crypto investment firm 1kx, sold US$2.38 million in RPL tokens to capitalise on the price gains.

In meme coins, Baby Doge Coin (1MBABYDOGECOIN) listed on Binance. A price surge of 83% followed. Donald Trump-associated meme coins like MAGA dropped on Monday when a second assassination attempt was made against the former president while he was playing golf at the Trump International Golf Club in West Palm Beach, Florida. Political meme coins for representatives on both sides of the aisle have seen an increase in volatility this year as the US Presidential campaign heats up.

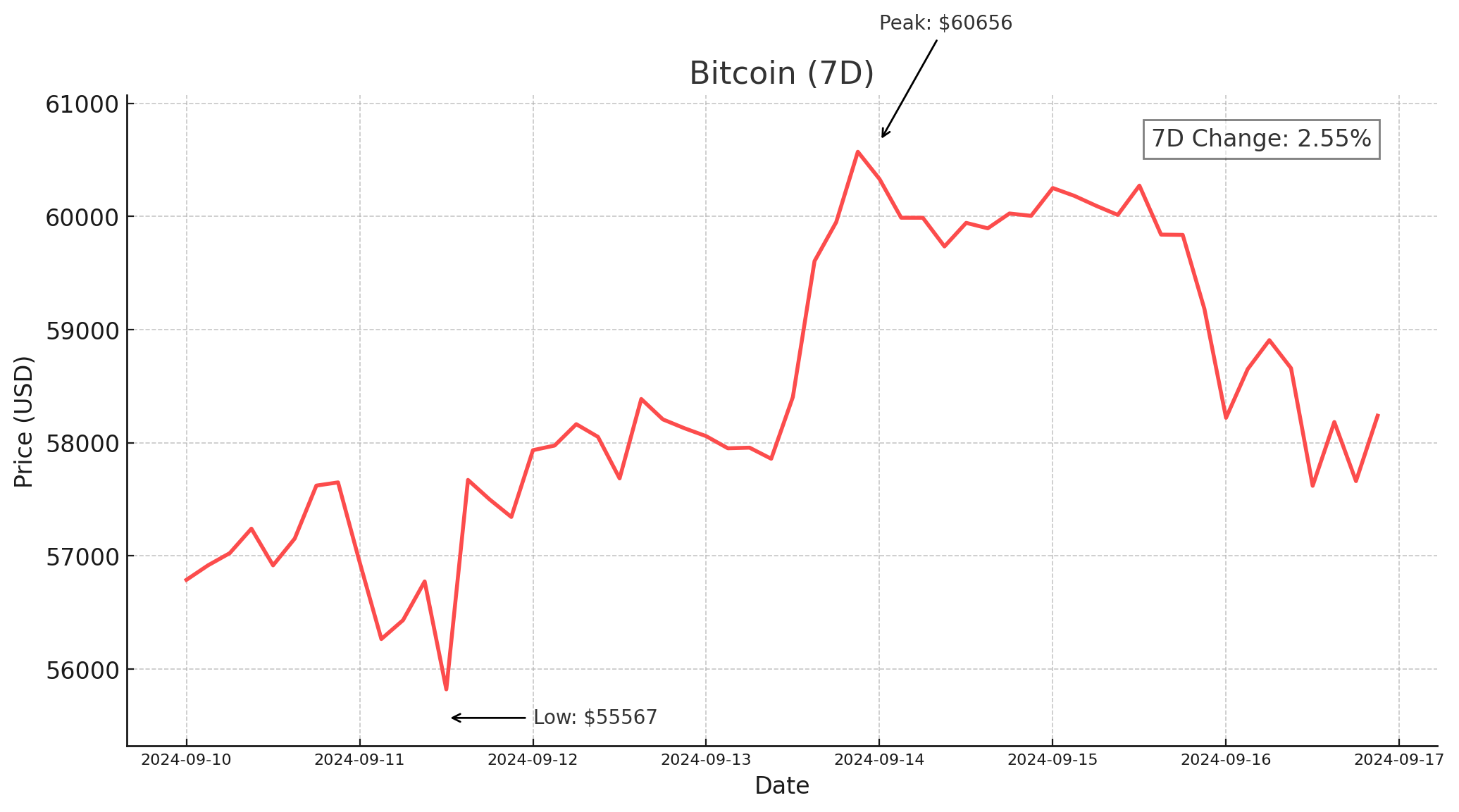

Bitcoin (BTC)

Bitcoin’s price rebounded last week. The biggest cryptocurrency opened the week at US$55,019 and rallied to US$60,730. Price has since found resistance and declined about 4% to the key level around $58,500. This week’s gains are presumably due to markets growing more confident that the US Federal Reserve will deliver a rate cut at its September meeting.

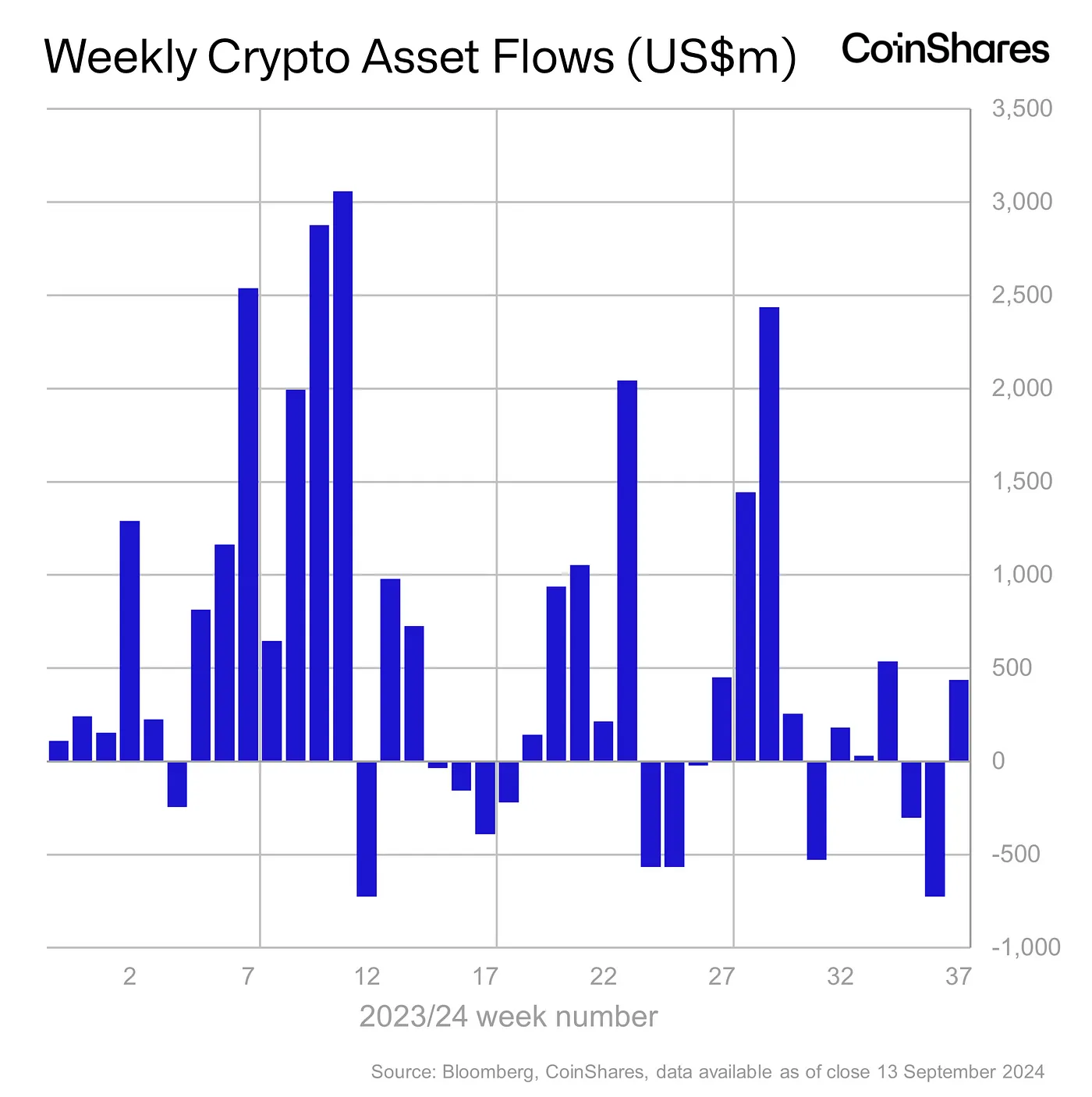

With US$436 million of inflows this week, bitcoin asset investment products have seen a rebound. These inflows followed ten days of outflows totalling US$1.18 billion. Further confirming the change in sentiment, short-bitcoin saw outflows of US$8.5 million after three weeks of inflows to these products.

Coinbase has launched Wrapped BTC (or cbBTC), a wrapped bitcoin token. The token was created so traders can use their bitcoin on the Ethereum blockchain and other DeFi apps built on the network. Running on the network that powers Ethereum, Wrapped BTC is backed 1:1 with bitcoin and will work on the Ethereum mainnet and Base, Coinbase’s layer-2 network.

Also this week, Michael Saylor, the CEO of MicroStrategy and vocal supporter of bitcoin, continued with his bullish stance, saying he expects the price of bitcoin to reach US$13 million per coin in 21 years. It was later revealed that MicroStrategy had bought another US$1.1 billion worth of bitcoin, taking its holdings to over US$14 billion after buying over the last four years. The firm’s average purchase price is US$38,585 per bitcoin.

Bitcoin is currently trading at US$58,194, an increase of 1.8% on the week.

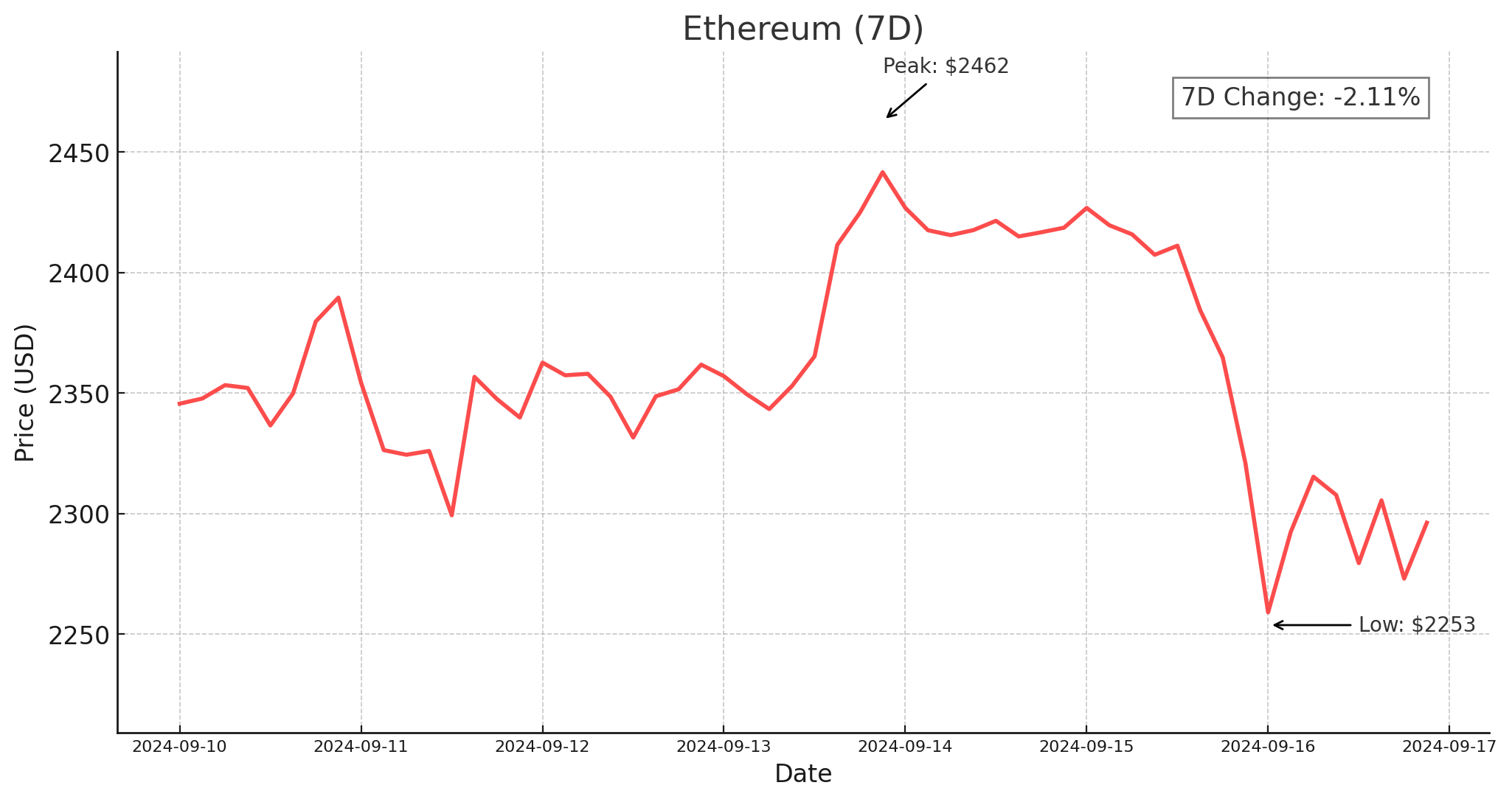

Ethereum (ETH)

Ethereum’s price action was choppy this week. Price grew by almost 11%, recouping last week’s losses, then declined over 7%. After hitting US$2,150, close to the lowest levels seen for ETH in 2024, price rallied to US$2,464. In recent days, a pullback has seen US$2,300 broken to the downside again, though the key level at US$2,200 has provided support in recent months.

Digital asset investment funds for the second-largest cryptocurrency struggled this week. Ethereum investment products saw US$19 million in outflows. The continued outflows are thought to be due to market concerns about the profitability of layer 1 chains following Ethereum’s Decun upgrade in March 2024. The upgrade aims to make the network more scalable and address high transaction fees.

Ethereum is currently trading at US$2,292, a decrease of 2.5% on the week.

Altcoins

Single chain gains

- Nervos Network (CKB) gained 106.7%, taking its market cap to US$746.2 million. The gains are presumably due to CKB listing on Korean exchange, Upbit. CKB gained 18% on the news, with further gains over the following days. Nervos Network is the first Bitcoin-isomorphic layer 2 solution. It uses Proof of Work (PoW) and unspent transaction output (UTXO) and aims to enhance bitcoin’s programmability and scalability.

- OMG Network (OMG) grew by 41.1%. This takes its market cap to US$42.8 million. The gains are presumably due to continued investor interest in decentralised, low-cost peer-to-peer transactions and continued volume on the network despite being completely community-led. The OMG Network’s original founders moved on in November 2023. The uptick in volume could be due to OMG’s recent low prices attracting trading volume. The relative strength index (RSI) indicator currently signals that the token is overbought, so a pullback may be imminent.

DeFi predictions and progress

- Drift Protocol (DRIFT) grew by 54.6%, which takes its market cap to US$148.3 million. The gains came after investment firm Multicoin Capital predicted that DRIFT may reach US$3.58. It’s currently trading at US$0.71. The decentralised exchange that runs on Solana’s blockchain aims to provide features that other decentralised exchanges don’t offer, such as perpetual futures, leverage, and betting.

- Reef (REEF) gained 38.7%, taking its market cap to US$53.1 million. It marks another strong week for the layer-1 blockchain, after gaining 100% last week on news that the network gained 5,000 new wallets in August. The REEF team shared a list of updates on its progress this week, including a meeting with a centralised exchange about listing and meeting with fiat on-ramp providers about integrating Reef.

RWA upside

- Chex Token (CHEX) gained 50.9%, taking its market cap to US$126.1 million. Price for the real world asset (RWA) digitisation network gained after finding support around US$0.075. CHEX also found support in this area in early August. Currently trading at US$0.013, the next key level is around US$0.014.

Privacy-centric layer 2 finds key support

- COTI (COTI) gained 35.5%, which takes its market cap to US$189.7 million. The privacy-centric layer 2 network on Ethereum gained after finding support around US$0.075. Recent announcements that the COTI team will host a community call in early October and participate in the upcoming TEE Conference in Singapore on 19 September are presumably driving price to the upside as well. Further, an AI chatbot was recently introduced, allowing developers to get instant support when building on COTI’s network.

In Other News

Investment flows rebounded this week, with digital asset investment products seeing inflows of US$436 million. This follows a two-week period of outflows totalling US$1.2 billion. The uptick in inflows is presumably due to growing expectations by markets that the US Federal Reserve will deliver a 50 basis-point rate cut on 18 September.

- Tether’s bad press continued this week, with a report from consumer protection group Consumers’ Research saying a lack of transparency about the stablecoin issuer’s Tether US dollar reserve is a “disaster for consumers waiting to happen.” Making comparisons between the collapses of crypto exchange FTX and crypto trading firm Alameda Research, the lack of an audit from a reputable accounting firm to assure Tether’s USDT 1:1 backing with the US dollar raises concerns. Tether’s team says it has taken steps to improve its transparency, including the hire of former Chainanalysis chief economist, Philip Gradwell. His role includes producing usage reports on USDT for regulators and investors.

- Grayscale introduced a new closed-end fund focused on XRP. The fund aims to provide investors with exposure to the cryptocurrency while mitigating some of its inherent risks. The fund will be listed on the NYSE Arca and offers a structured investment vehicle that holds XRP directly. This latest development follows the launch and closure of Grayscale’s XRP fund in 2021. The fund was closed when the SEC brought a case against Ripple, asserting that its tokens were securities under US securities law. Ripple gained 8% on last week’s news, and it’s currently trading at US$0.5859.

- Nillion has integrated with NEAR Protocol to enhance privacy tools for developers working on decentralised applications (dApps). The partnership combines Nillion's privacy solutions with NEAR's scalable blockchain, aiming to offer developers robust privacy features while maintaining high performance and scalability. The integration allows developers to build more secure and privacy-focused dApps, leveraging Nillion's advanced cryptographic techniques and NEAR's blockchain infrastructure. Founded in 2021, Nillion is backed by crypto firms, such as HashKey and OP Crypto. They successfully closed a US$20 million seed round in 2022.

Regulatory

- Sam Bankman-Fried’s lawyers filed to have his fraud charges overturned. Bankman-Fried is currently serving a 25-year sentence following the criminal activities that led to FTX’s 2022 collapse. In the court filing, the former founder’s lawyers argue that he didn’t receive a fair trial and was presumed guilty by the media, FTX debtor estate and lawyers, US federal prosecutors and the judge that presided over his trial. They have also argued that FTX always had the funds available to reimburse customers despite its liquidity issues. Upon the collapse of FTX, it was found that customer deposits were used on risky investments via sister investment firm Alameda Research.

- Kraken has requested a jury trial in response to the US Securities and Exchange Commission’s (SEC) lawsuit accusing it of operating an unregistered securities exchange and violating federal laws. The exchange argues that the SEC’s claims are unfounded, seeking to have the case decided by a jury rather than a judge. Kraken’s motion to dismiss the suit was denied in August.

- After losing its initial case against predictions marketplace, Kalshi, the Commodities and Futures Trading Commission (CFTC) filed a new motion to stop the company from offering prediction markets for the 2024 US presidential election. District Court Judge Jia Cobb said in her ruling that "...Congress did not authorise the CFTC to conduct the public interest review it conducted”. The CFTC is, again, arguing that the ruling be paused so it can work on an appeal.

In Case You Missed It

Catch the Crypto High-Net-Worth Strategy & Insights Masterclass! 🎓 Missed out? You can still watch the recording co-hosted with Collective Shift.

Why Attend?

- Adapt to Market Shifts: Learn how U.S. economic policies and global events are shaping the market.

- Manage Risk: Discover strategies to minimize volatility and safeguard your portfolio.

- Profit from Corrections: Find out how to effectively seize opportunities to buy the dip.

- Expert Strategies: Get exclusive insights from portfolio managers handling nine-figure assets.

Learn how you can position yourself for success in this market.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.