Markets Overview

U.S. stock indexes ended the week down, driven by declines in the tech sector. Dell saw declines of almost 9% on news of high manufacturing costs for its AI-optimised servers. Similarly, Nvidia's stock price declined by 3.3% following its Q2 earnings release on Wednesday, August 27, after no H20 chip sales to China were disclosed. Despite tech lagging this week, the U.S. core personal consumption expenditures (PCE) index came in at 2.9% for July, while U.S. GDP for Q2 came in above forecast at 3.3%. These data releases signal economic strength, causing concern that the Fed may not cut rates on September 17.

The week ahead brings a slew of employment updates, including U.S. JOLTS job openings, unemployment claims, and the July non-farm employment change. Traders and investors will also presumably be awaiting the U.S. ISM manufacturing and services PMI releases for August, scheduled for release on Wednesday and Friday, respectively.

Weekly performance: S&P 500 -0.1%, Dow Jones -0.2%, Nasdaq -0.2%.

Looking ahead:

- U.S. ISM manufacturing PMI - September 2

- U.S. JOLTS job openings; unemployment claims - September 3

- ISM services PMI; non-farm employment change - September 4

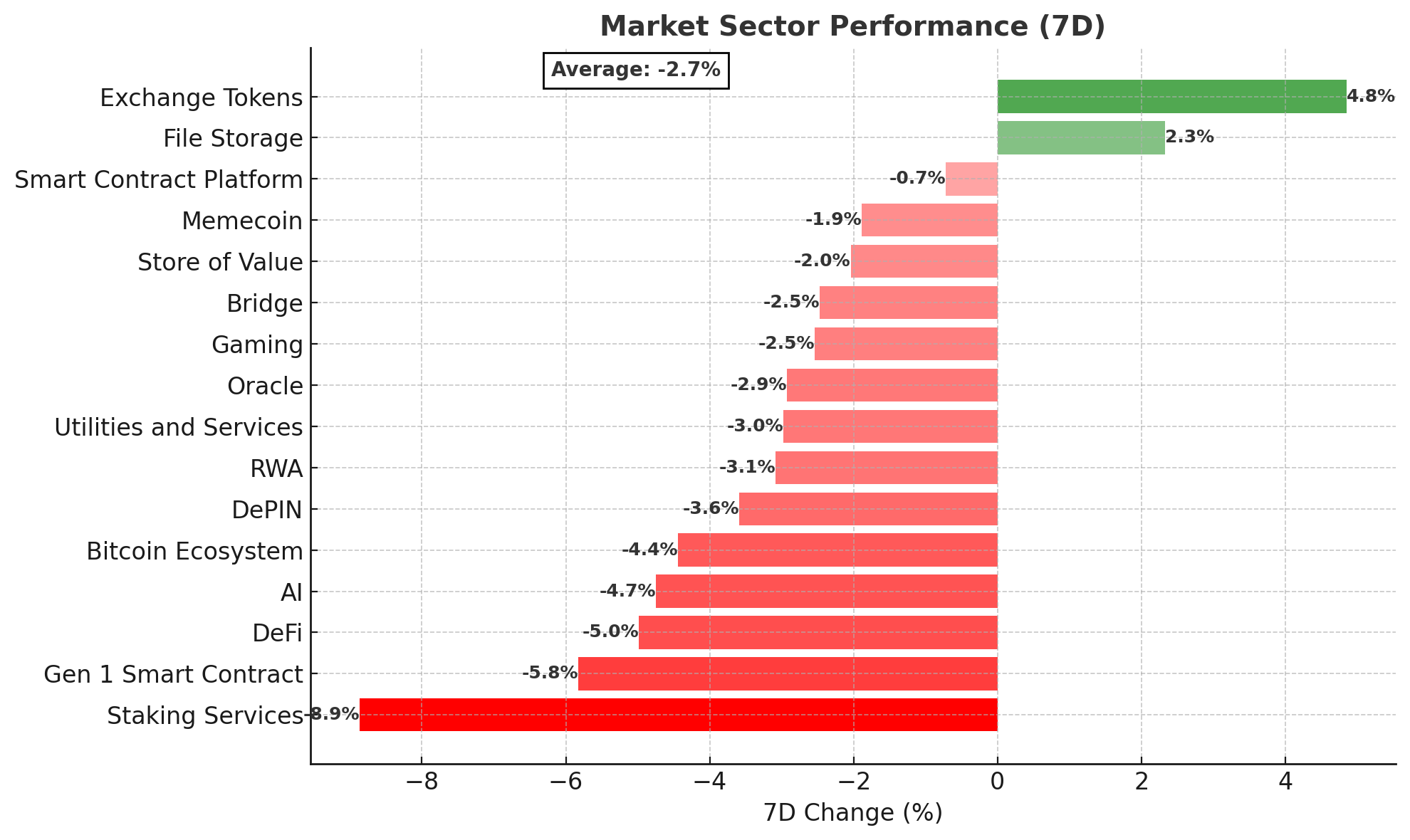

Crypto Market Sector Performance

Many crypto sectors saw minor losses as crypto tokens sold off to end the week, with some giving back gains from earlier in the week or continuing their recent pullbacks.

Biggest gainer:

- Exchange tokens: Cronos (+68.7%) reached a three-year high after Trump Media announced plans to establish a US$6.4 billion CRO treasury. This development aims to integrate CRO into its platforms, Truth Social and Truth+. The announcement led to a 26% gain for CRO within 24 hours.

Biggest loser:

- Staking services: Lido DAO (-10.2%) declined, presumably due to market participants deleveraging and the US$3 billion Ethereum validator queue beginning to withdraw their staking.

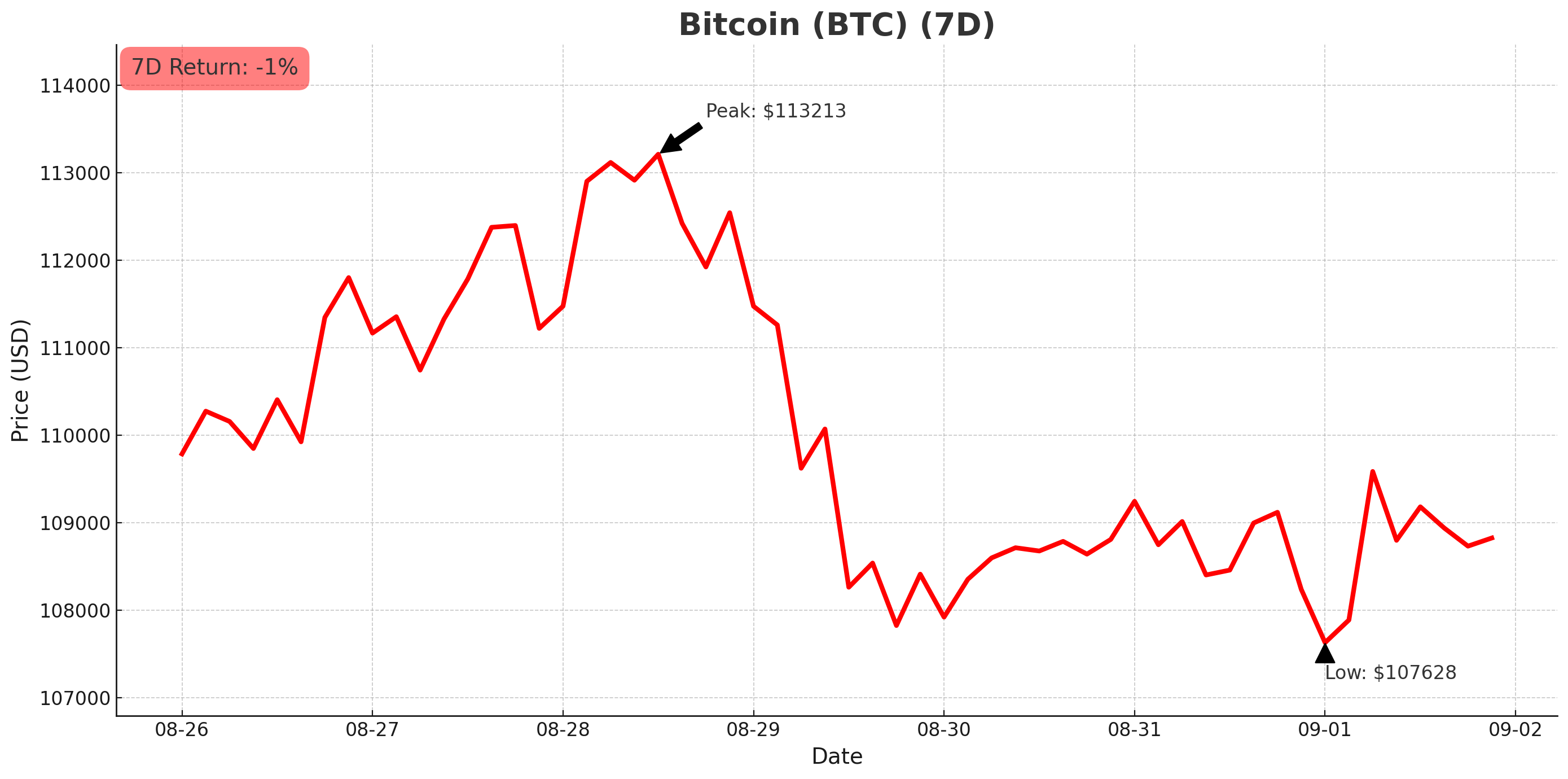

Bitcoin (BTC)

- Opened the week at US$113,478 and declined to a low of US$107,369 on August 31, following a strong PCE reading. The reading raised concerns over persistent inflation, which may delay a rate cut by the U.S. Federal Reserve. Total crypto liquidations reached US$500 million on Friday, August 29 (-1.3% 7D).

- BTC dominance rose to 58.8% before declining to a low of 57.8% on August 31.

- Bitcoin investment products saw US$748 million in inflows this week.

American Bitcoin’s merger with Gryphon Digital Mining is almost complete. The company, with 80% ownership by Hut 8 and 19% ownership by Eric Trump and Donald Trump Jr., plans to launch on the Nasdaq in September.

Eric Trump spoke at a fireside chat at the Bitcoin Asia conference in Hong Kong over the weekend, stating his belief that Bitcoin will reach US$1 million in the future. He attributes increasing institutional adoption and bitcoin’s capped 21 million supply as the core drivers behind his forecast.

Strategy’s investors dropped a lawsuit alleging that the company misled investors about new accounting rules. The case, brought against the company in May, alleged that Strategy overstated the impact of switching to fair value accounting on the company’s earnings.

Metaplanet will be added to the FTSE Japan Index by market close on September 19. The company has progressed to mid-cap status following its establishment of a BTC reserve in April 2024 and routine buys of BTC since.

Tether launched USDT on Bitcoin’s Layer-2 RGB protocol, enabling users to transact stablecoins directly on Bitcoin using BTC wallets. The integration supports fast, private, and scalable payments, leveraging RGB’s off-chain asset issuance model with on-chain proof anchoring via the Lightning Network. In bitcoin buying news:

- Metaplanet purchased 1,009 BTC, increasing its holdings to 20,000 BTC, valued at approximately US$112 million.

- KindlyMD filed an automatic shelf registration to issue up to US$5 billion in shares. It follows this week’s purchase of US$679 million worth of BTC through Nakamoto holdings.

- Sequans Communications, a French chipmaker, is planning to raise up to US$200 million to establish a bitcoin treasury.

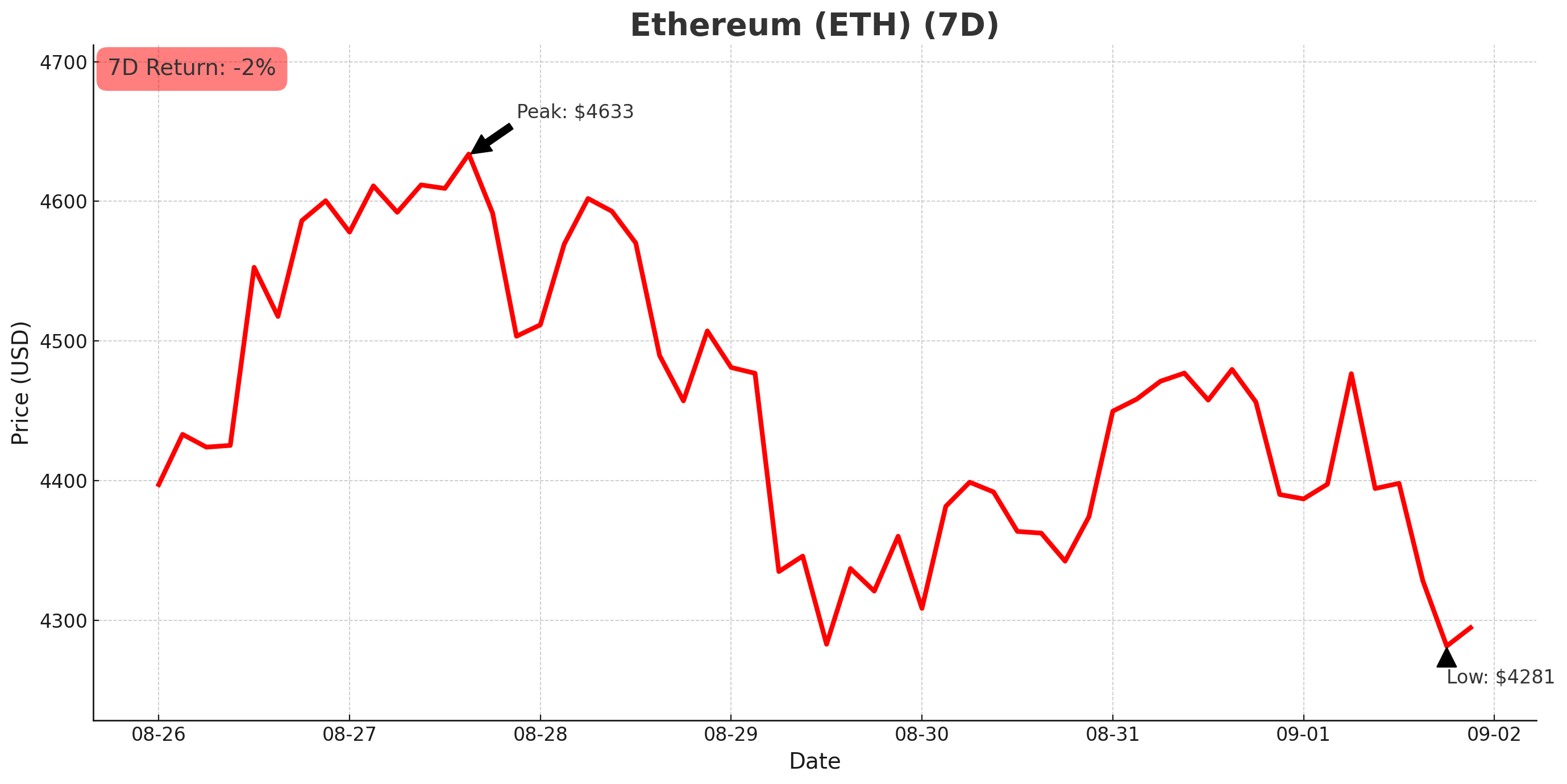

Ethereum (ETH)

- Opened the week at US$4,779 and declined to a low of US$4,209 on September 1 as concerns grow that U.S. inflation may be too high to cut rates in September (-2.2% 7D).

- Ethereum dominance declined to a low of 14% as price retraced throughout the week.

- Ethereum-focused funds saw US$1.4 billion in inflows last week.

As bitcoin sold off following a strong PCE reading on Friday, August 29, a BTC whale swapped US$216 million worth of BTC for Ethereum, indicating that smart money is getting positioned for further upward ETH momentum.

Fundstrat's Tom Lee predicts that Ethereum has reached a temporary bottom and is poised for a rally that will surpass US$5,000. He anticipates that ETH will not fall below US$4,000 in the near term, citing technical analysis from Fundstrat's Mark Newton.

In Ethereum buying news:

- BitMine Immersion Technologies bought more than 190,500 ETH this week, bringing its holdings to almost US$8 billion worth of Ethereum.

- SharpLink Gaming bought 55,463 ETH, bringing its total holdings to 797,704 ETH, valued at US$3.6 billion.

Altcoins

Friday’s PCE reading saw crypto sell-off throughout the weekend as markets grew concerned that persistent inflation could give the FOMC cause to leave rates on hold at its September meeting. The altcoin season index is currently at 48 (bitcoin season).

Hedging bets

- Numeraire (NMR) gained 68.7%. The native token of Numerai, a crypto hedge fund utilising AI, surged over 100% following JPMorgan Asset Management's announcement of a US$500 million investment to expand Numerai's hedge fund capacity.

Computing gains

- Pyth Network (PYTH) grew by 46.2% when the U.S. Department of Commerce selected the network to deliver GDP data on-chain.

- iEXEC RLC (RLC) grew by 22.9%. The trust layer for DePIN and AI gained on a cryptic X post referencing a “Secret September Mission”.

DeFi-ing the odds

- IDEX (IDEX) gained 35.7% due to strong whale-buying activity and institutional derivatives positioning across the broader market, some of which is held on IDEX.

Single chain gains

- Loopring (LRC) gained 23.7% due to its loose connection to the Trump family’s WLFI project. Dolomite, a DeFi platform founded by Corey Caplan, who is also an advisor to WLFI, initially launched on Ethereum using the Loopring protocol. The protocol’s powering of Dolomite and launch of spot trading for WLFI on September 1 presumably drove the gains.

Crypto ETF News

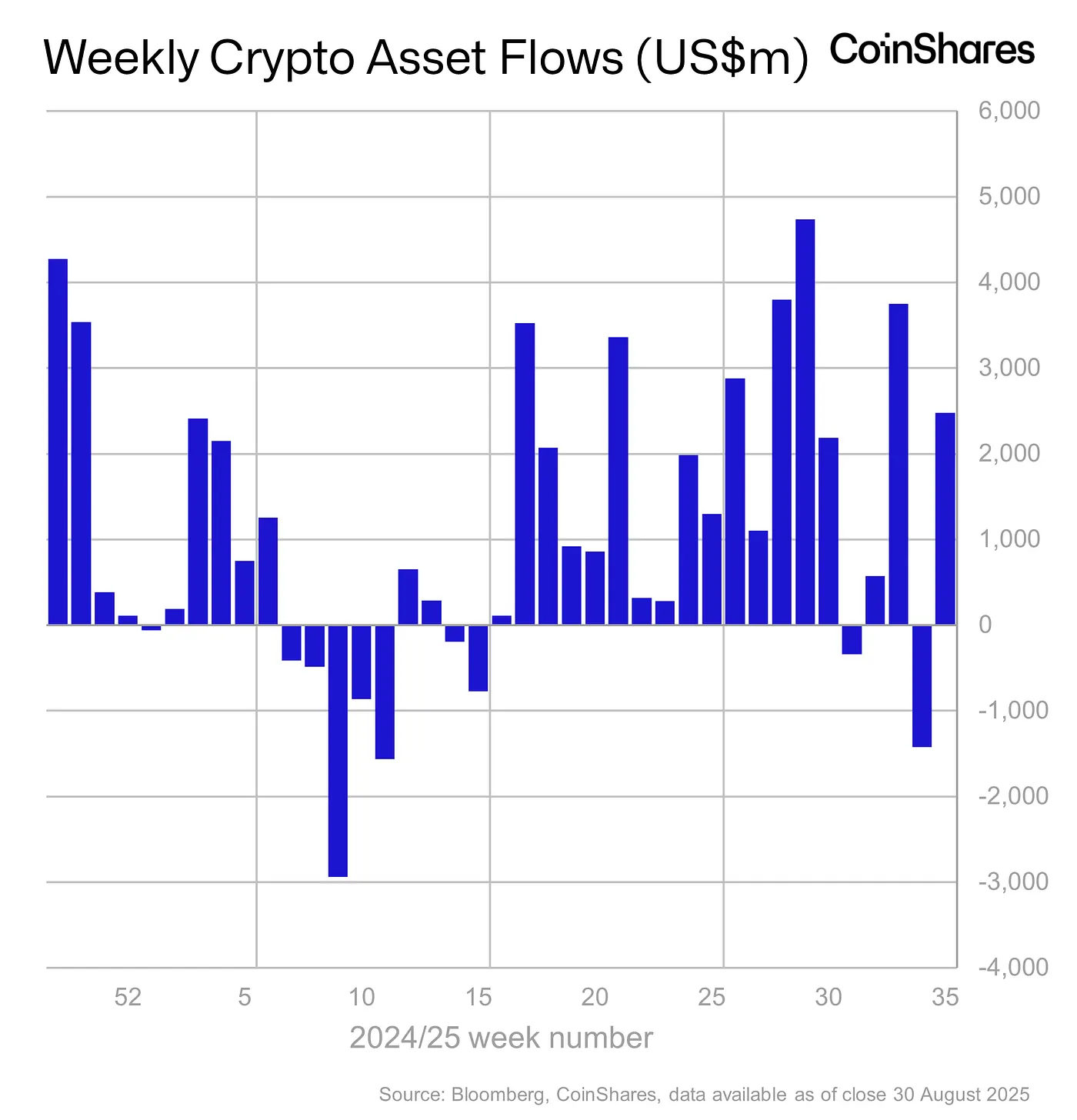

Digital asset investment products saw inflows of US$2.4 billion last week. This brought August’s total to almost US$4.4 billion in inflows, while the year-to-date total stands at US$35.5 billion.

The U.S. Securities and Exchange Commission (SEC) is now considering over 90 applications for crypto exchange-traded funds (ETFs). Industry experts anticipate that many of these funds will be approved before the end of the year.

Several new applications were filed this week. 21Shares filed with the U.S. SEC to launch an SEI ETF with potential staking yield. Rex Shares and Osprey Funds submitted a joint application to list a BNB staking ETF on the Cboe BZX Exchange. Bitwise filed to launch a Chainlink ETF with in-kind creations and redemptions. Grayscale filed to convert its Avalanche trust into an ETF.

Canary Capital filed for the first Trump meme coin spot ETF. Analysts are doubtful the application will be approved, given that spot ETFs typically need a related futures product to be trading for at least six months before an ETF is established. The company also filed for an “American-Made” crypto ETF earlier in the week, which would track crypto projects made in the U.S.

Other crypto news

- World Liberty Financial’s WLFI token, backed by the Trump family and its affiliated entities, began trading on the Ethereum network on September 1. Only a small portion of the 33 billion total supply will be unlocked at launch, with the majority of tokens held by insiders and early investors. Analysts have raised concerns about the WLFI’s token's political ties and potential liquidity issues that may materialise around the launch. WLFI launched at US$0.40 and is currently trading at US$0.23. Its market cap is currently US$5.7 billion.

- Pantera Capital is planning to raise US$1.25 billion to transform a Nasdaq-listed company into a Solana-focused treasury firm, dubbed "Solana Co." It follows Sharp Technology’s announcement of a US$400 million capital raise to establish a Solana corporate treasury, and reports that three major crypto firms, Galaxy Digital, Jump Crypto and Multicoin Capital are planning to raise US$1 billion to establish a Solana treasury fund.

- Caliber (CWD), a publicly traded Arizona-based real estate asset manager became the first firm to establish a Chainlink (LINK) corporate treasury when its board approved a strategy to allocate part of its reserves to acquire LINK. CWD shares gained 60% on the news.

- Following recent controversy over adjustments to U.S. jobs data, the U.S. Department of Commerce has initiated the publication of GDP data on several blockchain networks, including Bitcoin, Ethereum, and Solana, to name a few.

- The U.S. Commodity Futures Trading Commission (CFTC) is enhancing its market surveillance capabilities by integrating Nasdaq's Market Surveillance platform. This collaboration aims to monitor digital assets and prediction markets more effectively, enabling the CFTC to detect and prevent illicit activities.

- Tron users voted to reduce network transaction fees by 60%, the largest cut since the blockchain’s inception. Tron founder Justin Sun confirmed the reduction has taken effect and noted that the fee structure will be reviewed quarterly based on TRX price, network activity, and growth metrics.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.