Market highlights

- American Bitcoin, backed by the Trump brothers, whipsawed on its first day of trading.

- BTC mining companies reached a record-high market cap of US$39 billion in August.

- The U.S. Federal Reserve announced that it will host a payments innovation conference on Oct 21.

- The Nasdaq filed with the U.S. SEC to launch tokenised securities trading.

- The U.S. Senate amended the Responsible Financial Innovation Act, seeking joint regulatory efforts by the U.S. SEC and CFTC.

Markets Overview

This week was all about the U.S. labour market, as the JOLTS job openings and non-farm employment change for August signalled underlying economic weakness. The JOLTS job openings came in below forecast at almost 7.2 million, while the non-farm employment change missed by over 50,000, coming in at 22,000 new jobs. Risk assets immediately rallied on the non-farm payroll data, presumably as it confirms the U.S. Federal Open Market Committee’s (FOMC) need to cut rates at its September 17 meeting. However, the economic weakness that a slowing labour market represents saw markets sell off the earlier gains. For the first time since April 2021, there are now just 0.99 job openings available for each unemployed person. The ten-year treasury yield declined throughout the week to just over 4%.

All eyes will be on U.S. inflation data and the Bureau of Labour Statistics’ (BLS) annual benchmark revision this week. The August Producer Price Index (PPI) update will be released on September 10, while the latest Core Consumer Price Index (CPI) data will be released on September 11. The BLS annual benchmark revision will be updated to reflect actual job growth for the 12 months to March 31, 2025. A steep revision to the downside could cause short-term sell pressure across risk assets.

Weekly performance: S&P 500 +0.3%, Dow Jones -0.3%, Nasdaq +1.1%.

Looking ahead:

- Bureau of Labour Statistics annual benchmark revision - September 9

- U.S. core PPI - September 10

- European Central Bank interest rate decision - September 11

- U.S. core CPI - September 11

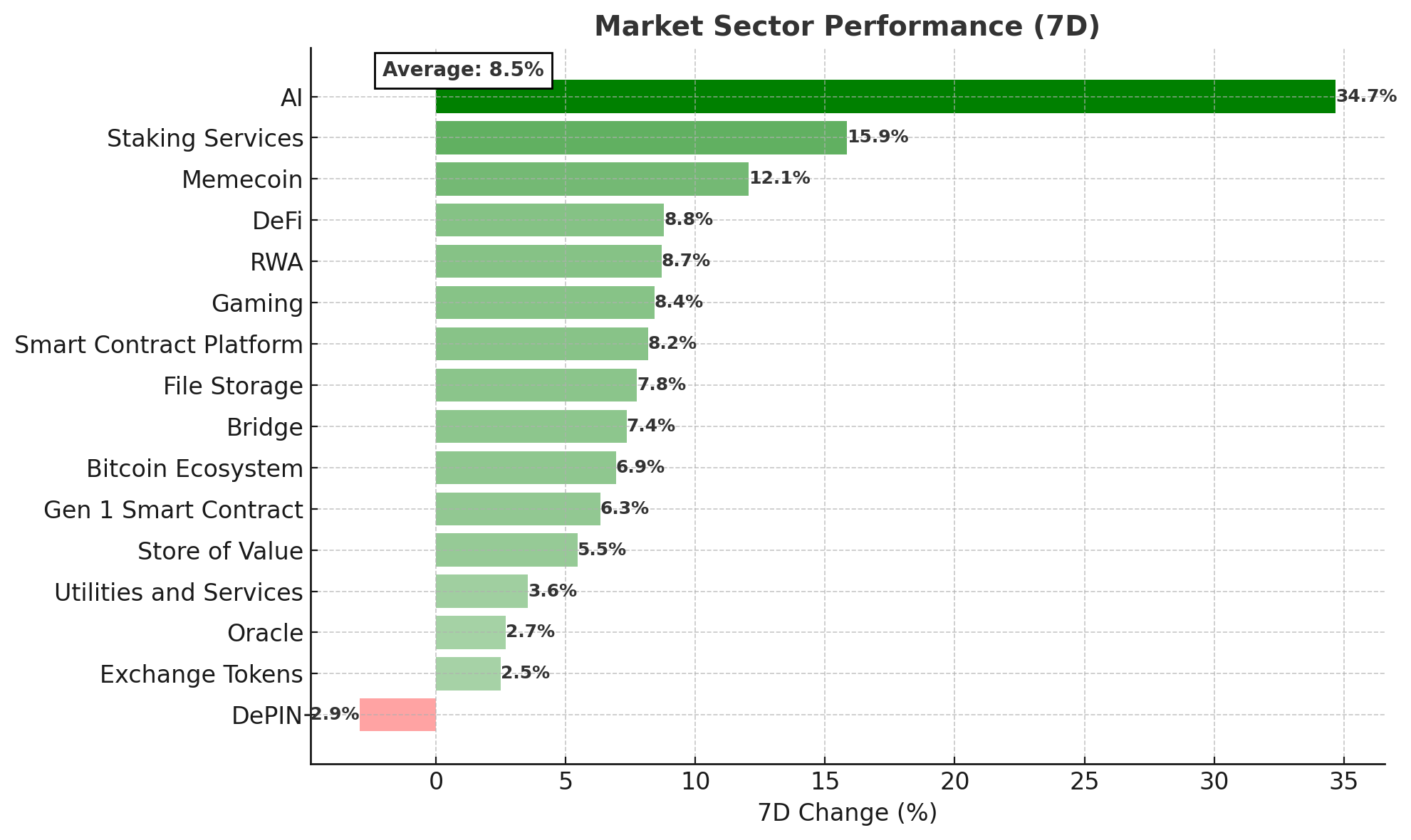

Crypto Market Sector Performance

Most crypto sectors saw gains this week, presumably as the market regained some of the prior week’s losses.

Biggest gainer:

- Artificial intelligence (AI): Worldcoin (+79.3%) gained on the launch of its anonymised multi-party computation initiative with partners including Nethermind, the University of Erlangen-Nuremberg (FAU), and UC Berkeley’s Centre for Responsible Decentralised Intelligence (RDI).

Biggest loser

- DePIN: Hivemapper(-12%) continued its recent declines, presumably as investor interest turned to other sectors currently yielding higher returns, while smaller DePIN tokens made gains (more on that below).

Bitcoin (BTC)

- Opened the week at US$108,247 and declined to a low of US$107,250 on September 1, following July’s strong PCE reading. Bitcoin reached a weekly high of US$113,390 on September 5, followed by a sell-off, presumably due to the weak non-farm payrolls reading, though it still ended the week up (+3.2% 7D).

- BTC dominance rose to 58.8% on September 5 before declining slightly.

- Bitcoin investment products saw US$524 million in inflows this week.

California’s state pension fund (CalPERS) is divided on whether it should gain exposure to bitcoin as new candidates vying for seats on the board expressed their opposing views. The board election, scheduled for November, will provide an indication of the fund’s position on directly holding BTC moving forward. CalPERS currently holds 410,956 Strategy shares, providing indirect bitcoin exposure.

American Bitcoin, the bitcoin mining and treasury firm backed by Eric Trump and Donald Trump Jr., debuted on the Nasdaq under the ticker ABTC. The stock surged 83% to US$13.93 before falling to US$9.26, triggering several trading halts due to volatility. The firm is planning a US$2.1 billion stock sale to expand its BTC holdings and mining operations.

In August, the market capitalisation of publicly traded bitcoin miners, as tracked by JPMorgan, reached a record high of over US$39 billion. This surge is attributed to companies such as Hut 8, Core Scientific and TeraWulf expanding into high-performance computing, including AI applications.

In bitcoin buying news:

- Strategy acquired 6,003 BTC, bringing its total holdings to 638,460 BTC at an average purchase price of US$73,765 per bitcoin.

- El Salvador bought 21 bitcoin, bringing the country’s reserve to 6,313 BTC, valued at approximately US$701 million.

- Sora Ventures is raising US$1 billion to support bitcoin treasuries in Asia, aiming to accumulate over US$800 million worth of BTC in the coming months.

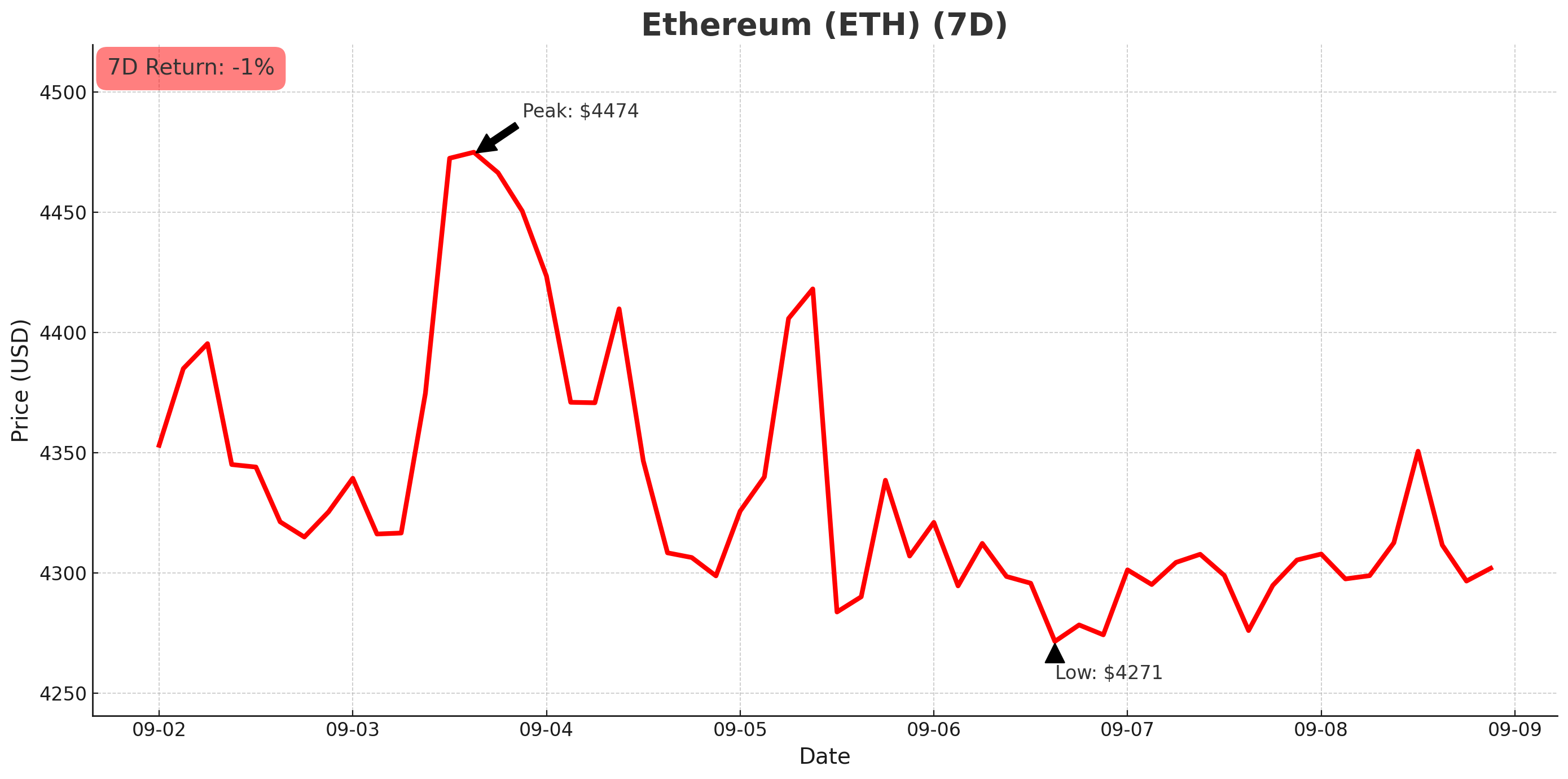

Ethereum (ETH)

- Opened the week at US$4,391 and declined to a low of US$4,209 on September 1 on U.S. inflation concerns. Price regained to around US$4,490 before seesawing on the non-farm employment change for August (+0.6% 7D).

- Ethereum dominance declined to a low of 13.6% as markets sold off across the weekend.

- Ethereum-focused funds saw US$924 million of outflows this week.

SharpLink Gaming plans to stake a portion of its Ethereum treasury, currently valued at approximately US$3.6 billion, on the Linea network from September 10, when it hits mainnet. As corporate holders' ETH balances grow, they are seeking higher risk-adjusted yield opportunities than what is currently available through custodians such as Anchorage and Coinbase.

An Ethereum ICO-era whale from 2015 moved approximately US$645 million worth of ETH from three wallets into a staking service, as tracked by on-chain data. The investor still retains around US$1.1 billion in ETH holdings.

In Ethereum buying news:

- BitMine Immersion Technologies bought more than 153,000 ETH this week, bringing its holdings to over US$8 billion worth of Ethereum and 1.5% of supply.

- SharpLink Gaming purchased 39,008 ETH, increasing its holdings to 837,230 ETH, valued at nearly US$3.6 billion.

Altcoins

While many cryptocurrencies made small moves this week, a handful made considerable gains, predominantly across computing, DeFi and smart contracts. The altcoin season index is currently at 50 (bitcoin season).

In the clouds

- Aethir (ATH) gained 56.8%. The decentralised cloud infrastructure network gained almost 80% on September 8 before retracing, presumably as the broader DePIN sector saw gains to start the week.

FLIP the script

- Numeraire (NMR) grew by 27.8%, continuing its gains on the back of JP Morgan’s investment in the project.

- Chainflip (FLIP) gained 26% as the cross-chain swaps platform launched its first native BTC lending protocol on September 8.

Get glowing

- Neon (NEON) gained 27.5%. The Solana network extension for Ethereum virtual machine (EVM) dApps recently launched its Developer’s Playbook, which may have increased interest in the network.

Good as gold

- Chintai (CHEX) grew by 24.9% on news of its partnership with SmartGold to tokenise US$1.6 billion worth of gold held in Roth IRA accounts.

In it to win it

- Frax (FRAX) gained 22.9% due to its participation in competing for the Hyperliquid USDH stablecoin contract (more on that below), plus its new custody deal with crypto.com.

Crypto ETF News

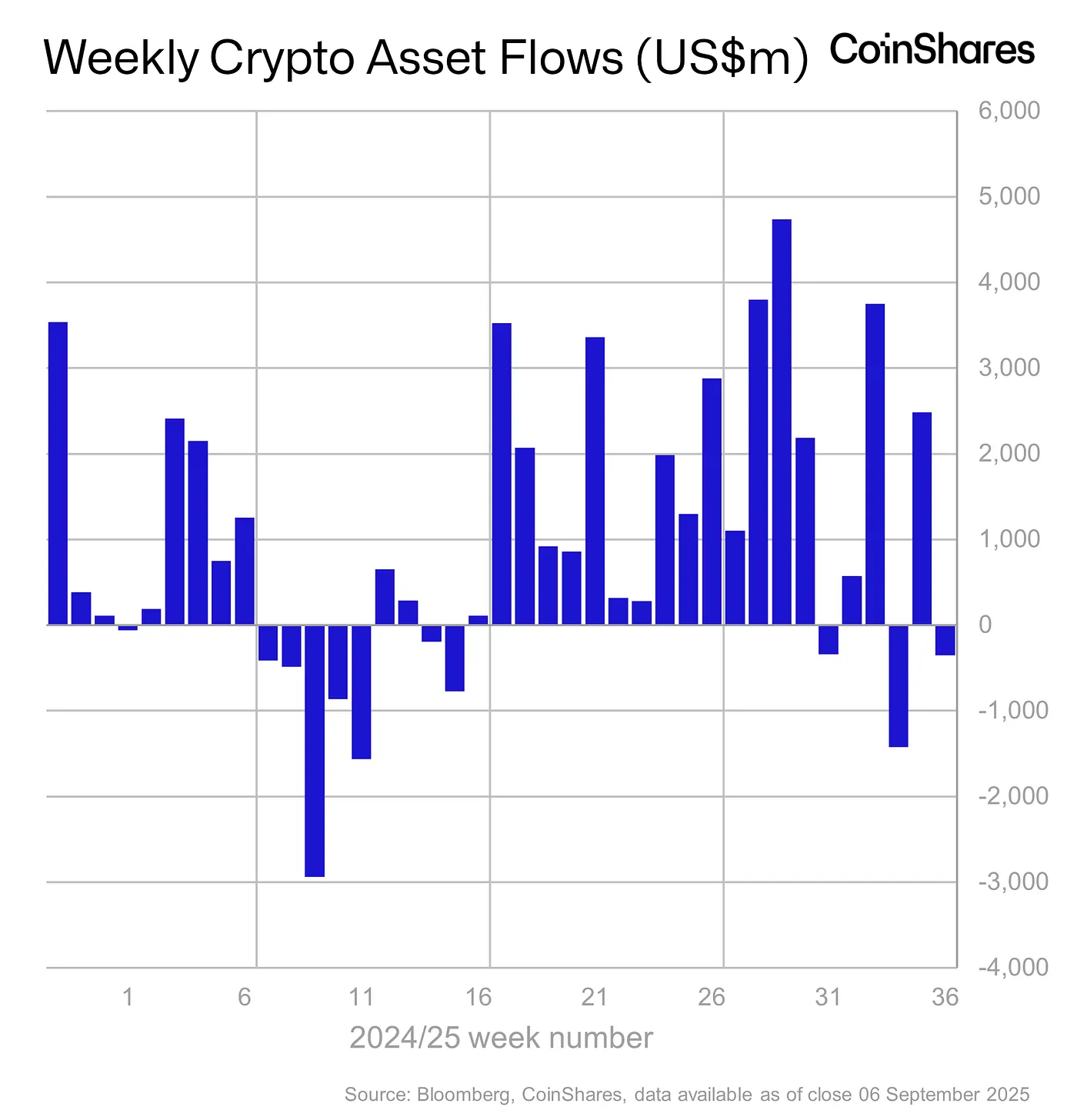

Digital asset investment products saw outflows of US$352 million last week due to weak market sentiment following the August non-farm employment miss. Trading volumes also declined by 27% last week.

In altcoins, Solana saw its 21st straight week of inflows, while XRP saw inflows, too. Year-to-date inflows for both coins reached US$1.2 billion each this week.

Other crypto news

- The U.S. SEC and U.S. Commodity and Futures Trading Commission (CFTC) are considering a proposal to allow TradFi markets to trade 24/7 like the crypto market. The announcement followed an earlier development in which the agencies issued a joint statement announcing their proposal for spot crypto assets to be traded directly on U.S. SEC-regulated exchanges. The agencies were called on this week to further coordinate on future crypto regulation as U.S. Senators amended the Responsible Financial Innovation Act of 2025 to clarify how the agencies can work together for efficient crypto regulation.

- The U.S. Federal Reserve will host a Payments Innovation Conference on October 21, focusing on emerging technologies including stablecoin applications, artificial intelligence in payments, and the tokenisation of financial products and services.

- The U.S. SEC released its latest rulemaking agenda with nearly 50% of its 20 proposed rules aimed at easing crypto regulations. Proposals include safe harbours, redefined broker-dealer terms, and permission for crypto trading on national securities exchanges.

- World Liberty Financial blacklisted a wallet linked to Tron founder Justin Sun after it moved over US$9 million worth of WLFI tokens. Sun claimed the transfers were simple exchange deposit tests and urged the project to restore access. It’s unclear why Sun’s wallet was blacklisted, though some speculate it's due to early investors like Sun being subject to token warrants, which stipulate a minimum holding period.

- Wyoming’s state-backed stablecoin, the Frontier Stable Token (FRNT), which is already live on seven blockchains, has expanded onto the Hedera blockchain. Hedera was selected for its speed, low fees, environmental efficiency, and institutional governance, though it can’t be purchased on the Hedera chain yet.

- Nasdaq filed a proposal with the U.S. SEC to allow tokenised securities, like blockchain-based stocks and ETFs, to trade alongside their traditional counterparts on its main market. The move could enable token-settled trades by Q3 2026.

- HashKey Group, Hong Kong’s largest licensed crypto exchange, has launched a US$500 million Digital Asset Treasury (DAT) fund targeting bitcoin and Ethereum. The perpetual, institutional-only vehicle supports regular subscriptions and redemptions, aiming to bridge traditional finance with emerging Web3 infrastructure through strategic digital asset investments.

- Portage Biotech, a publicly traded company, is rebranding as AlphaTON and launching a crypto treasury focused on TON (The Open Network), the blockchain linked to Telegram. It will start its treasury with US$100 million worth of TON.

- Hyperliquid (HYPE) is inviting teams to propose a native stablecoin, USDH, on its network. Validators have five days to vote on the proposals, and the winner will gain access to the USDH ticker once a quorum is reached. Existing stablecoin issuer Hyperstable has objected, citing previous exclusion from the ticker and calling the process unfair.

- Ondo Finance launched tokenised versions of over 100 U.S.-listed stocks and ETFs on the Ethereum blockchain. These tokenised assets, backed by real assets held at U.S.-registered broker-dealers, enable 24/7 trading and fractional ownership of U.S. securities.

- Solana's (SOL) upcoming Alpenglow upgrade aims to reduce transaction finality from over 12 seconds to approximately 150 milliseconds, enhancing scalability and efficiency. With over 99% validator support and US$1.7 billion in SOL locked in corporate treasuries, some analysts project that SOL could reach US$250 per token by year-end.

- Canadian firm SOL Strategies, which focuses on building a Solana treasury and infrastructure, has received approval to list its common shares on the Nasdaq, trading under the ticker symbol STKE, starting September 9. Shares will continue to trade on the Canadian Securities Exchange under the ticker symbol HODL. HODL shares gained 20% on the news.

- Stripe and venture firm Paradigm unveiled Tempo, a new Layer-1 blockchain purpose-built for stablecoin-based payments and real-world financial use cases. The Ethereum-compatible network, designed with input from OpenAI, Visa, Shopify, and others, features the ability to process over 100,000 transactions per second, low fees, stablecoin gas via a built-in AMM, and optional privacy.

New Crypto Listings

Buy & sell these digital assets, or swap them directly with hundreds of other popular assets through your personal broker.

- World Liberty Financial (WLFI)

- Useless Coin (USELESS)

To see the full list of available cryptocurrencies, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.