On September 15, 2022, Ethereum’s long-awaited Merge was executed, marking the network’s transition from a Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism. As this content was written pre-Merge, any mentions of Ethereum using PoW are in reference to the network’s previous consensus mechanism, not its current one.

Summary

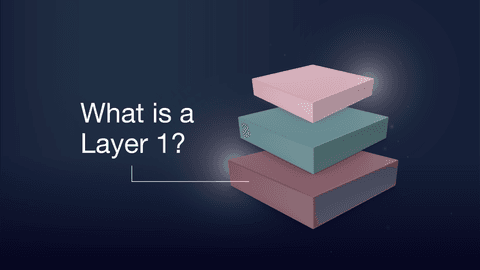

Layer 1 refers to the base blockchain network, like Bitcoin or Ethereum, and their underlying infrastructure. Layer 1 blockchains are responsible for the settlement of transactions within their ecosystem. Every Layer 1 protocol has a native token that provides access to the networks resources. Scaling Layer 1 networks is difficult due to technological constraints. As a solution, developers have created various design alternatives and added Layer 2’s to overcome their challenges.

Introduction

To develop a sound understanding of the blockchain or Web 3 stack, it’s important to first grasp the foundations and build up from there. As this space continues to innovate, different terminology enters the lexicon to differentiate between protocols, projects and infrastructure. Blockchain layers refer to the level of scaling solutions; whether they are implemented directly on the blockchain or if they function on top of it as a seperate but dependent protocol. Layer 1s are a great starting point for your learning journey because thats where this industry began, with the original Layer 1 itself, Bitcoin.

What is Layer 1?

A Layer 1 is another name for a base protocol or blockchain within an ecosystem. Bitcoin, Ethereum, Solana, Avalanche, and Luna, are some of the most well known Layer 1s. As the name suggests, these networks function as the foundational architecture for other apps, protocols and networks to build on top of.

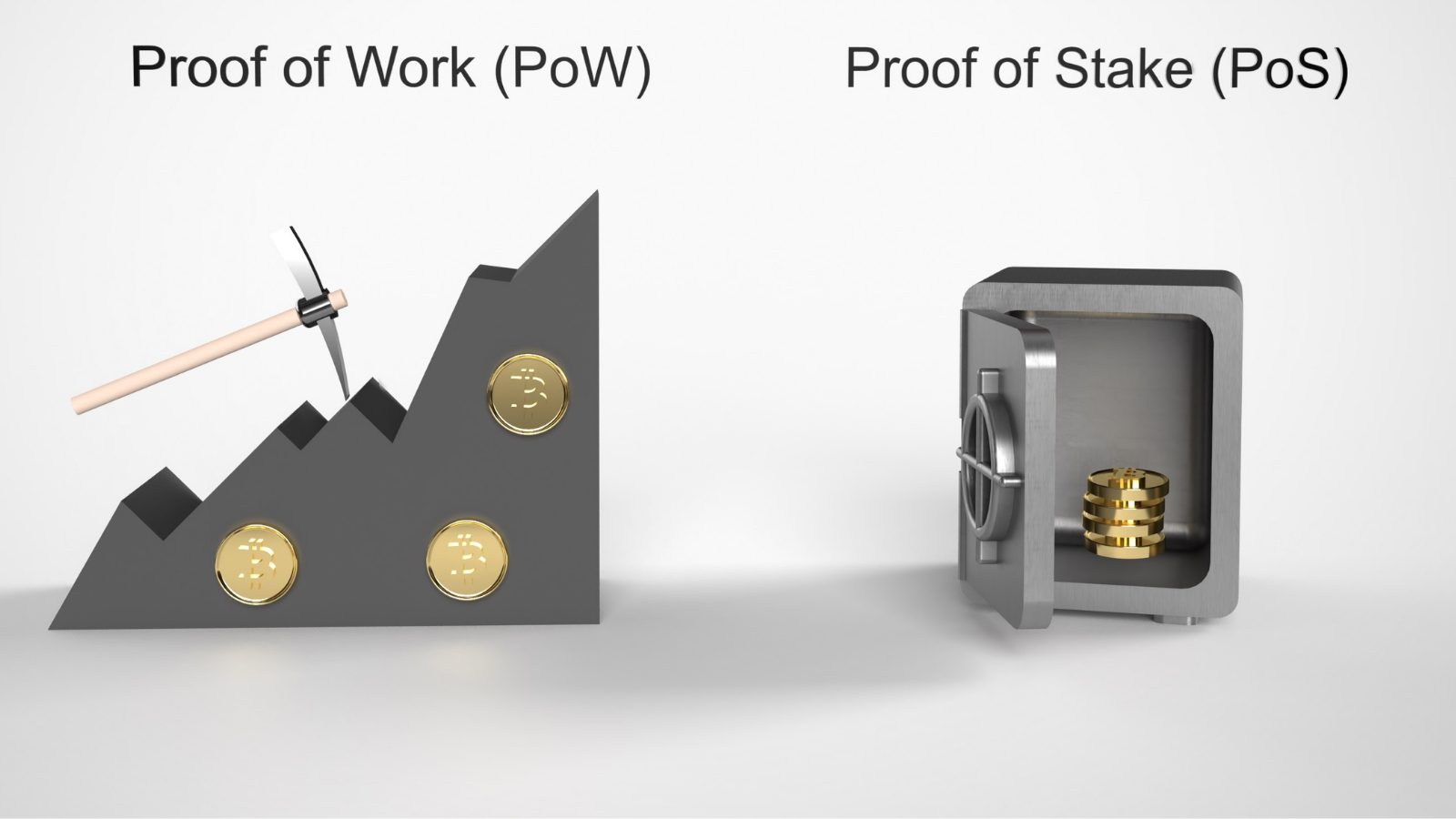

A Layer 1s primary characteristic is its consensus mechanism. Consensus mechanisms are the systems used by blockchains to validate transactions and secure the network. Different consensus mechanisms provide different levels of speed, security and throughput. The two most common categories of consensus mechanisms are proof of work (PoW) and proof of stake (PoS). PoW is used by the Bitcoin, Ethereum, Litecoin and others, while PoS is utilised by Solana, Avalanche, Luna and many more.

Layer 1s are responsible for the settlement of transactions on their own blockchain. All Layer 1 protocols have a native token that provides access to the network’s resources. This token can be used to pay for network services like sending a token to another wallet. For example, the Ethereum network uses ETH to pay for ‘Gas Fees’ to use its network.

Any apps or projects built on top of a specific Layer 1 protocol, inherit the properties of the underlying blockchain. As a result, they both leverage the benefits of it and are susceptible to its limitations. For example, projects built on the Ethereum network enjoy the benefits of its exisiting ecosystem and large market share, but they are also prone to high Gas Fees when the Ethereum network is congested.

Layer 1 Blockchain Limitations

Layer 1 blockchains come with inherent challenges native to cryptographic technology. The consensus mechanism involved generally comes with trade-offs to do with blockchain scalability. Within the crypto world, scalability refers to a blockchains ability to support increasing load of transactions, as well as increasing the number of nodes in the network.

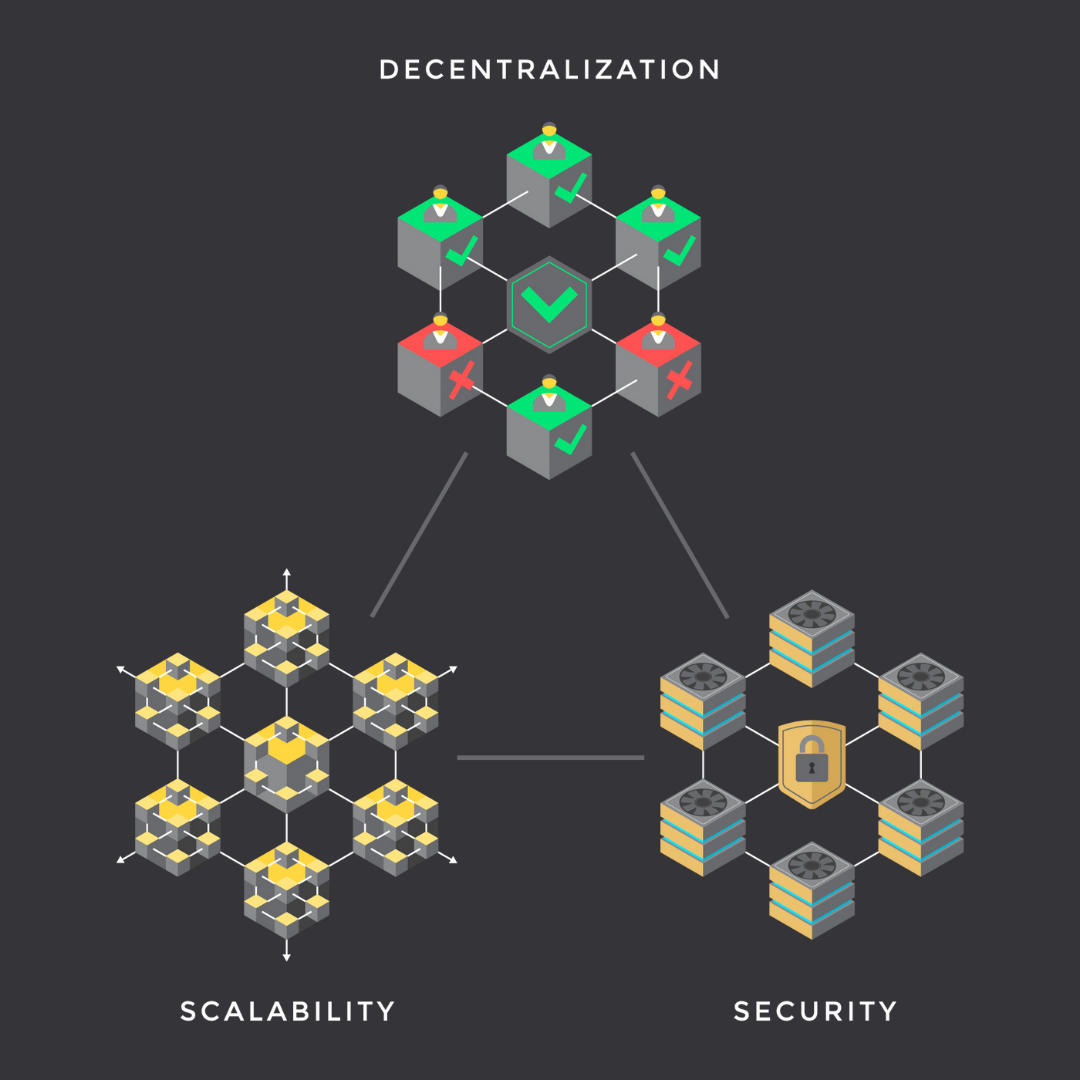

The term ‘scalability trilemma’ was coined by Ethereum founder Vitalik Buterin. It refers to the trade-off blockchains must make when optimising their architecture. It posits that while the ideal blockchain should be decentralised, secure and scalable, it can only optimise for two out of the three. In other words, a Layer 1 must sacrifice one property, to avail of the other two properties.

Layer 1 protocols differ in how they approach the ‘scalability trilemma’. It is a hotly debated topic within the crypto community and does raise some contention, especially amongst the more ideologically-minded. However, it is generally accepted that Bitcoin and Ethereum prioritise decentralisation and security, and sacrifice scalability. Whereas most newer Layer 1s take the opposite approach, compromising on decentralisation, to prioritise security and scalability.

Layer 1 Scaling

Blockchain developers have been working on scalability solutions for many years, but there is still much work to be done. Some of the most popular options for scaling a Layer-1 include:

- Increasing block size - Allowing more transaction to be processed in each block.

- Changing the consensus mechanism - Many projects, like Ethereum, are transitioning away from older PoW systems to newer and faster PoS systems.

- Implementing sharding - This breaks the job of authenticating and validating blockchain transactions into small bits called 'shards'.

Direct Layer 1 improvements require significant work to implement from a technological perspective. Ethereum’s transition to a PoS system has been in the roadmap for over 4 years. Similarly, it is also challenging to get the protocol community onboard, as not all network users may agree to the change. This can lead to community splits or even hard forks, as happened with Bitcoin and Bitcoin Cash in 2017.

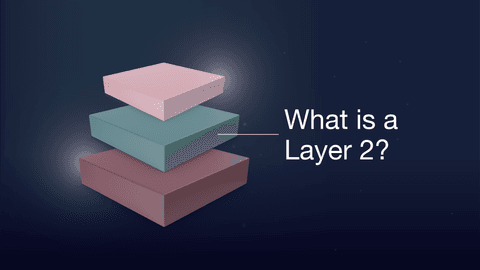

Scaling with Layer 2

Due to technological constraints, certain changes are difficult or almost impossible to do on the main blockchain network. As a solution, developers have begun building on top of the networks with Layer 2 solutions. Layer 2s extend the functionality of their Layer 1 counterpart. This can be to increase the Layer 1 networks performance, reduce transaction fees or increase programmability. For example, on Ethereum, where Gas Fees can be highly variable, it is increasingly common for app developers to allow their users to interact with a Layer 2 network, like Polygon, to decrease users’ fees and transaction latency.

Future state of Layer 1

The scalability of Layer 1s is one of the most important challenges facing the crypto space. As demand for crypto grows, pressure to scale blockchains will also mount. However, solutions are emerging to solve the puzzle. We are witnessing a transition away from monolithic blockchains to a more modularised design architecture. The development of Layer 1 and Layer 2 scaling solutions is shifting the paradigm towards more balanced networks with regards to decentralisation, security and scalability.

Recommended reading: What is a Layer 2?

from Caleb & Brown Cryptocurrency Brokerage.