Key Points

- Binance Coin (BNB) was founded in 2017 by tech entrepreneur Changpen Zhao (AKA CZ).

- BNB is the native utility token of the Binance exchange, the largest cryptocurrency exchange in the world.

- The BNB Chain uses a unique combination of Proof of Stake (PoS) and Proof of Authority (PoA) consensus mechanisms to validate network transactions. The combination of both models leads to comparatively lower fees and faster transaction speeds on the network.

- The 2022/23 BNB Chain roadmap seeks to introduce even faster transactions, lower fees, and open-source capabilities for developers seeking to build within the Binance ecosystem.

Is it a utility token? Is it a discount token? Is it a governance token?

No, it's Binance Coin (BNB) - and it's everything all rolled into one.

Native token to one of the largest exchanges in the world, BNB powers a small—yet growing—ecosystem of decentralised apps (DApps), decentralised finance (DeFi), and Binance exchange users. In this guide, we’ll dive deep into what BNB could offer to potential investors, show you how the network operates, and take a look at the future roadmap for this unique cryptocurrency.

What is Binance & the BNB Chain?

Since its inception in 2017, Binance has become one of the largest brands in the blockchain industry. Aside from being the largest crypto exchange, it has launched an entire ecosystem of crypto-related functionalities. BNB is an integral component of this ecosystem.

In the weeks before the launch of the exchange, the company offered BNB to early investors via an initial coin offering (ICO). The coin was priced at about $0.11 per unit during this phase, and is now valued at $279 today. Outside of operating as an exchange, Binance has its own blockchain ecosystem called the BNB Chain. This chain consists of two parallel blockchains:

- BNB Beacon Chain: handles governance across the network, which includes staking and voting on proposed changes to the network. (Previously known as Binance Chain.)

- BNB Smart Chain: handles smart contract creation and execution. (Previously known as Binance Smart Chain.)

BNB lives on the BNB Chain as a utility token and is currently one of the top 10 crypto assets by market cap. Its newly abbreviated meaning is Build’N’Build; a motto that reflects the network’s gradual move towards a collaborative, participatory, open-source project.

How is the BNB Chain Different from Ethereum?

Ethereum and the BNB Chain do share some functional similarities. Below the surface though, the networks couldn’t be any more different.

Ethereum started as a not-for-profit, decentralised, open-source project that sought to build upon concepts established by Bitcoin. While Binance (the organisation) started as a for-profit, centralised, private company attempting to create the largest crypto exchange ever. While both organisations share the same drive to innovate, their motivations probably differ.

The BNB Chain and Ethereum also use different consensus mechanisms. Ethereum uses Proof of Stake since The Merge in September 2022. The BNB Chain uses a hybrid Proof of Stake Authority (PoSA) to validate network transactions.

The ethos behind the BNB Chain is different. Through implementing a PoSA consensus model, network creators have actively chosen to sacrifice decentralisation in favour of scalability potential. This is the fundamental difference between the BNB Chain and Ethereum.

Lastly, when compared to Ether (ETH) in terms of utility, BNB use cases start to decline as users move further away from the Binance ecosystem. ETH powers a much wider variety of DApps, which has led more users to adopt Ethereum over the newer BNB Chain.

How Does The BNB Chain Work?

Proof of Stake Authority

The BNB Chain combines elements from a PoS model with PoA to uphold the network.

- Users need to stake at least 10,000 BNB for a chance to be selected as a validator.

- Users without this amount can delegate their stake to an elected validator, receiving a portion of any rewards the validator receives.

- Outside of staking 10,000 BNB, validators also stake their own reputation, operating in public as opposed to anonymously.

- While operating publicly is not an uncommon practice among mining companies on other blockchains, is it a requirement on the BNB Chain, not a choice.

PoSA on the BNB Chain uses significantly fewer validators than networks such as Bitcoin or Ethereum. By giving up decentralisation at this stage of the validation process, the network hopes to weed out bad actors from becoming validators. By centralising control amongst a few validators, the network is also able to accompany a relatively higher transaction volume across fewer validators.

Smart Contracts

In 2020, Binance launched the BNB Smart Chain, offering smart contract functionality to the BNB Chain. Using a set of predetermined conditions, smart contracts allow two separate parties to conduct and carry out agreements without relying on an intermediary.

The use of smart contracts on the BNB Smart Chain has helped the network gain more utility while reducing the overall cost to create and implement contracts between two parties.

Some developers have flocked to the BNB Smart Chain because smart contracts are comparatively cheaper to create on the network. Yet these fees are low because traffic on the BNB Smart Chain is lower (when compared to Ethereum). Binance is competing with Ethereum and other smart contract blockchains, only time will tell how BNB Smart Chain will grow.

Decentralised Apps (dApps)

Smart contracts also have paved the way for the creation and use of DApps. Like smartphone or computer applications, DApps have a wide range of functionalities. Rather than running on a central server, the code of a DApp is committed via a smart contract to the blockchain. The BNB Chain’s peer-to-peer network can then execute the app’s smart contract without the need for a centralised authority.

NFTs

The network has also added functionality for creating, collecting, and selling non-fungible tokens (NFTs). As Binance NFTs are very new, time will tell whether their popularity exceeds the likes of an earlier blockchain like Ethereum.

Tokenisation

BNB Chain also functions as a foundational layer (known as a Layer 1) for other crypto projects. The native tokens for these projects are known as BEP-2 tokens. Think of BEP-2 as a set of standardised instructions all assets created on the blockchain must follow. This standard works to ensure that anything created on the BNB Chain can seamlessly interact with any other tokens within the ecosystem.

Recommended reading: What is Proof of Stake in Crypto?

What is BNB?

BNB is the native token on the BNB Chain. It can be used to pay for goods and services within and outside of the network. BNB is also used to pay gas fees on the BNB Smart Chain.

Outside of this, BNB has a range of useful functions on the BNB Chain. These include:

- Trading fee discounts when you pay in BNB on Binance’s exchange

- Access to exclusive token sales

- Access to the BNB Chain ecosystem of DeFi gaming, DApps, and more

BNB uses an auto-burn mechanism to continuously reduce its total supply to 100,000,000 BNB. This mechanism helps the network manage ongoing supply and demand pressures.

Recommended reading: 10 Most Popular Types of Crypto & Their Use Cases

Advantages & Disadvantages of BNB

Binance, as the world’s most well-known exchange, has helped BNB grow in popularity. But an exchange and a blockchain are two different things. Success in one of these areas doesn’t indicate perfection in the other. Let’s explore what advantages BNB Chain brings to potential investors, along with some disadvantages that it could improve upon.

Advantages

- Low Fees: Because of the unique PoSA consensus mechanism, the BNB Chain processes more transactions with less validator participation and computational energy. As a result, fees are quite low when compared to other smart contract blockchains like Ethereum.

- Great For Binance Users: If you already use the Binance exchange, having BNB on hand is comparable to having airline reward points. You can use BNB to reduce fees on every trade, for payment on various supported platforms, and to gain access to exclusive NFT drops.

- Unique Burning Mechanism: BNB’s auto-burn feature works to ensure that the coin can deal with the ongoing pressures of supply and demand. Auto-burning will continue until 100 million BNB remain in the market.

- Programmability: Although in its early stages, the use of smart contracts means that the BNB Smart Chain is highly programmable. Any app or protocol built on the network can interact with one another. If the network’s community continues to grow, we may see innovative use cases arise from this programmability.

- Tokenisation: Any item that can be registered in a digital format can be tokenised on the BNB Chain. While tokenisation is commonly used in the NFT space, it has real-world applications in real estate, art, and even gold. Think of it as a digital certificate of ownership for an asset.

Disadvantages

- New Project: Compared to Bitcoin and Ethereum, the BNB Chain is a relatively new project. While it has had much success and consistently ranks among the top crypto by market cap, the project will have to continue to innovate and find more utility and adoption in order to scale.

- Centralised: The BNB Chain is attached to a private company, Binance. It also uses the PoSA consensus model. In this model, transaction verification is concentrated in the hands of a small group of validators who can afford to participate in the process. These validators also need to give up information that could be used to identify them. When compared to other networks, the BNB Chain leans more towards centralisation, which flies in the face of some of the foundational ideas of crypto. This set-up also creates a very centralised point of failure since attackers only need to target a few key nodes to compromise the system.

- Target for Cyber Attacks: While the BNB Chain itself is safeguarded by cryptographic blockchain technology, Binance the exchange is frequently targeted by hackers seeking to penetrate hot wallets. This could be a concern for security-conscious investors.

Who Created BNB?

Changpeng Zhao, a veteran of traditional Wall Street finance and cryptocurrency, launched Binance in 2017. Changpeng is famously known as CZ in the crypto community.

CZ started from humble beginnings. Having immigrated from China to Canada at age 10, he often worked various hospitality jobs to support his family during his teenage years. He later majored in computer science at McGill University.

Afterwards, CZ landed an internship on the Tokyo Stock Exchange, developing software to match trade orders. He then acquired a full-time position as a developer at Bloomberg, creating software for futures trading.

He is the founder and CEO of BijieTech, a company that supplies exchange operators with cloud-based exchange solutions. CZ was previously the co-founder and CTO of OKCoin and the co-founder of Fusion Systems.

Around 2013 he became more involved in crypto and worked for various crypto projects (like Blockchain.info). Four years later, CZ launched Binance. He used the funds generated from BNB’s ICO to further build out the exchange.

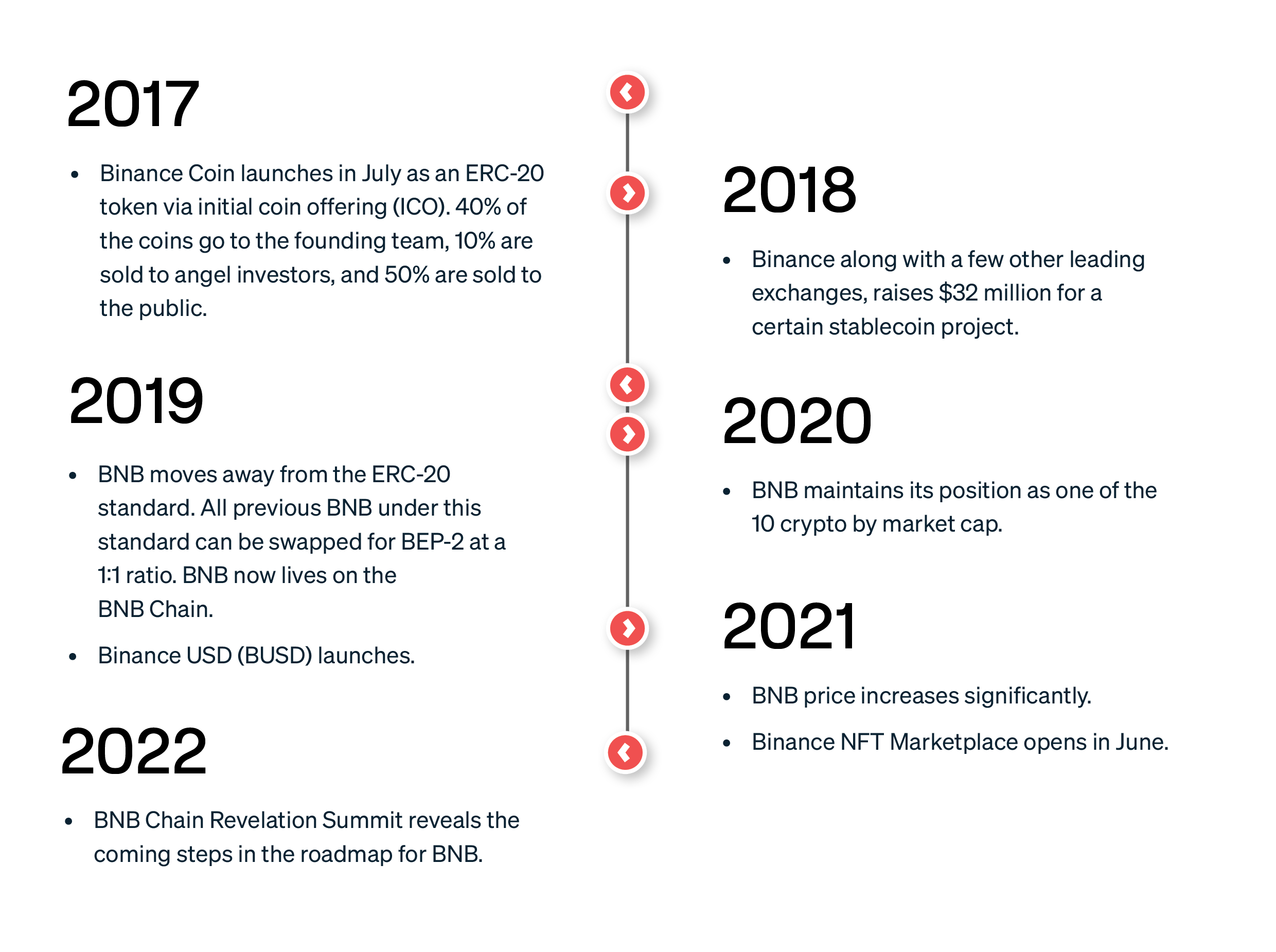

A Brief History of BNB

How to Invest in BNB in 2023

Buying BNB

There are three primary ways to obtain BNB - buying, earning, or staking. Staking is considerably expensive as a validator, but investors can alternatively delegate their stake to an existing validator. Buying BNB outright is considerably easier than staking.

The easiest way to buy BNB is through a brokerage like Caleb & Brown. If you’re ready to dive in and make your first BNB purchase, Caleb & Brown is here to help. Trusted by over 21,000 investors across 100 countries, our dedicated team of experts works around the clock to carry out all your trades.

Recommended reading: How to Buy Binance Coin (BNB) in 2023

Selling BNB

Selling your BNB with Caleb & Brown is as simple as buying. You can trade your BNB for any of the 100s of assets available through our brokerage.

Should you decide to exchange your BNB for fiat currency, there are $0 withdrawal fees as well.

Recommended reading: How to Invest in Crypto

How to Store BNB

There are multiple ways of storing BNB, from a cold wallet, hot wallet or with a custodian. Individual risk tolerance and preferences will determine the method employed by most users.

Cold wallets are completely disconnected from the internet. As such, they cannot be easily hacked and are often seen as a safer option for infrequent traders. These storage devices often resemble USB flash drives. Cold wallets have additional built-in layers of security to prevent a data breach once you connect it to the internet for trading.

Hot wallets are connected directly to the internet, usually through a phone or desktop application. Their popularity lies in their ease of use and ability to make trades quickly.

Many of these storage methods can seem complex, especially if you are not tech-savvy. Caleb & Brown provide end-to-end custody solutions for hassle-free storage and peace of mind investing. We have a battle-tested security infrastructure, through the leading asset security platform Fireblocks. All clients receive a free security consultation to ensure they follow security best practices.

Recommended reading: Crypto Security Part 1: Best Practices

What's Next For BNB?

The BNB Chain Revelation Summit in June 2022 unveiled the following plans for network development.

- Increasing the block size (a.k.a. gas cap) to hold more transactions per validated block

- Increasing the validator set from 21 to 41, potentially introducing more decentralisation to the network

- Implementation of a next-generation sidechain, which could open up transaction speeds to 10,000 TPS

These changes are expected to roll out over the 2022/23 financial year.

FAQs

Is BNB a good investment?

Choosing to buy BNB depends largely on your investment goals. Investors also weigh a variety of factors before choosing a project to invest in. Ultimately, it’s up to you to determine whether you decide to invest in BNB, and what strategies you use to maintain that investment.

At Caleb & Brown, we follow the facts; not opinions. We encourage you to do your own independent research before making an investment. Our team of crypto experts are more than willing to answer any questions you have along the way.

Why does BNB have value?

BNB plays an essential role in maintaining and operating the multi-blockchain network that is BNB Chain.

Validators and delegators can earn rewards based on the amount staked and the current interest rate.

By owning BNB, users can also access a whole library of projects built on the BNB Smart Chain. And when trading on Binance, users also save on fees whenever they use BNB to cover the transaction costs.

Like other smart contract blockchains, the BNB Chain enables developers to run custom smart contracts, allowing them to create Web3 applications for digital products and services. The community of developers, DApp, and smart contract users is fueled entirely by BNB.

How many transactions can the BNB Chain do per second?

Currently, the BNB Chain is achieving up to 300 transactions per second (TPS). It aims to increase this to 10,000 TPS in 2023.

What consensus mechanism does Binance Coin use?

Binance Coin currently uses a hybrid Proof of Stake Authority consensus mechanism.

Invest in BNB with Caleb & Brown

Investing in crypto doesn't have to be complex.

Caleb & Brown is the world's leading cryptocurrency brokerage for those looking to invest in BNB or other digital assets.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest in BNB, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Recommended reading: What is Crypto Liquidity?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1PjLgWLIMUO2pzaZiPx5Dh%2F3348eab4e3ed605ef2edb43ec8e1f74f%2FBlog-Cover__15_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-02-28T02%3A58%3A44.085Z)