Up until a week ago, Terra was the hottest thing in crypto. LUNA was a top 10 asset by market capitalisation (50 billion pre-collapse) and its dollar-pegged algorithmic stablecoin UST was a market leader in its sector. And then the floor fell out from beneath their feet. LUNA fell 100% to being traded at a fraction of a cent at $0.00027559, and UST, which is designed to stay pegged at $1, bottomed out at 6 cents. As reference for the scale of this collapse, Lehman Brothers stood at 60 billion market cap during the 08’ collapse.

So what happened? How did one of the most prominent Layer 1 protocols in crypto collapse and what does this mean for the future?

Terra Ecosystem Overview

First, let’s unpack the Terra ecosystem and how UST was designed. Fundamentally, Terra is a smart contract platform with the native/governance token LUNA and stablecoin UST. Unlike other decentralised stablecoins, UST is not directly backed by any crypto assets such as BTC or other stablecoins. Instead, the stability of UST is supported by Terra’s seigniorage mechanism, which always allows for 1 UST to be redeemed for $1 worth of LUNA at any time. Theoretically, this stability mechanism creates an arbitrage opportunity whenever UST loses its $1 peg, providing an incentive to the market to continually reestablish the UST peg.

For example, if UST loses its peg from $1 to $0.50, someone may acquire 100 UST for $50 and redeem it for $100 of LUNA, profiting from the arbitrage. Conversely, if the price of UST increases above $1, users can mint 1 UST by burning $1 worth of LUNA and then selling the UST for a profit.

However, if the price of LUNA is dropping alongside the peg, it becomes a race to redeem for LUNA before the value drops below the redemption price. While this mechanism is designed to push UST back to $1, it poses significant risks if UST cannot reclaim its peg. Market participants will be able to continually profit through redeeming 1 UST for $1 of Luna, which they would likely immediately sell, thus creating immense sell pressure for the token, LUNA. This unfolded to the extreme on May 9th, the first day where UST depegged to a large degree.

How did UST & LUNA Collapse?

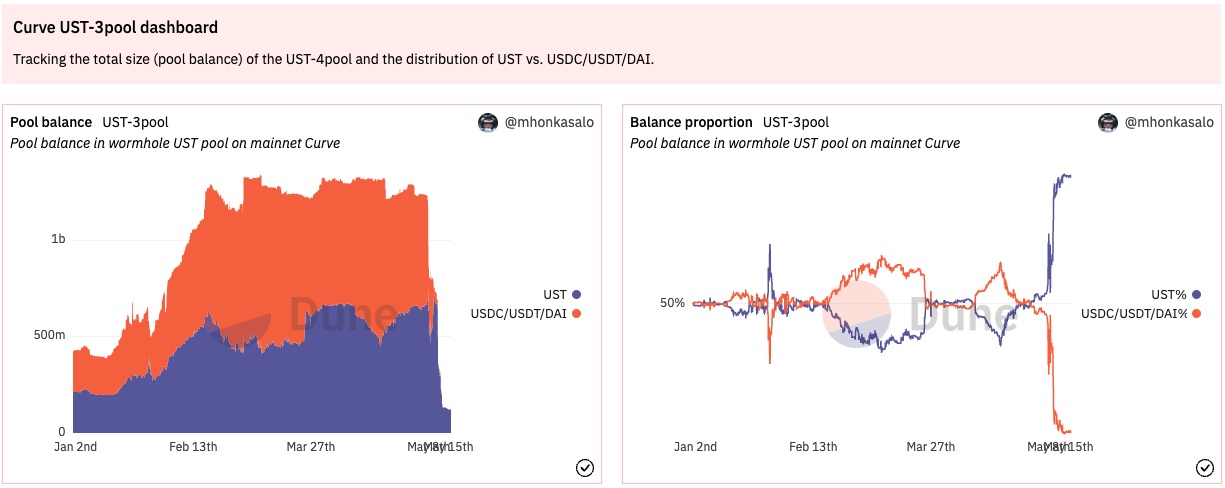

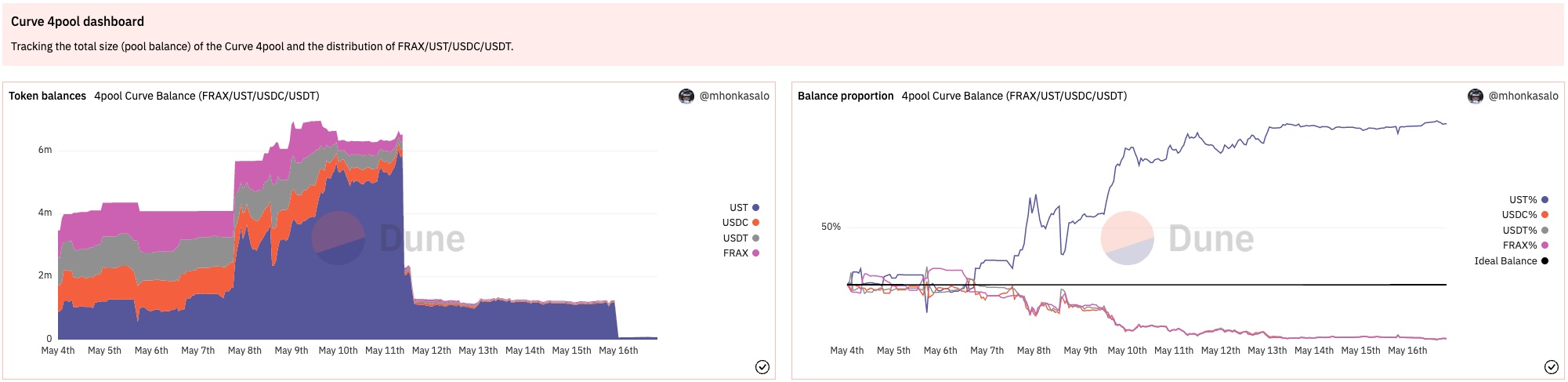

Initially mentioned by 0xHamZ, Binance experienced a slight UST depeg on May 8th, likely due to crypto hedge fund Three Arrows Capital (3AC) and prime broker Genesis selling their UST from the Luna Foundation Guard (LFG) BTC purchases. This led to a significant influx of UST supply on Binance. With a UST supply outflow this large, pressure will be applied on critical peg stabilisation junctions like Curve. Curve is a crucial piece of the DeFi ecosystem, allowing users and dApps to efficiently swap stablecoins. The two key pools on Curve for us are the UST-3CRV pool (UST, USDC, USDT and DAI) and the 4pool (UST, USDC, USDT, and FRAX).

Like clockwork, the UST portions of the pools significantly started to diverge from equilibrium, suggesting traders were selling UST and liquidity providers (LPs) were pulling at-risk capital in the form of USDC, USDT, and DAI. Because the proportion of UST in the pool increases when users swap it for other stablecoins like USDC, USDT, or DAI, this served as an early indicator that demand for UST was beginning to drop. On Monday, May 9th, the trend accelerated when the UST-3pool was almost entirely drained of counter-side liquidity with UST at +95% of the pool. Similarly, the 4pool reached 85% UST share. This massive selling of UST on-chain created an immense imbalance in reserves, leading to the value of UST to largely diverge from the peg on the protocol.

This had knock-on effects to off-chain selling, with the majority supply of UST being withdrawn from Anchor protocol and sold on centralised exchanges such as Binance, driving down the value on those markets as well.

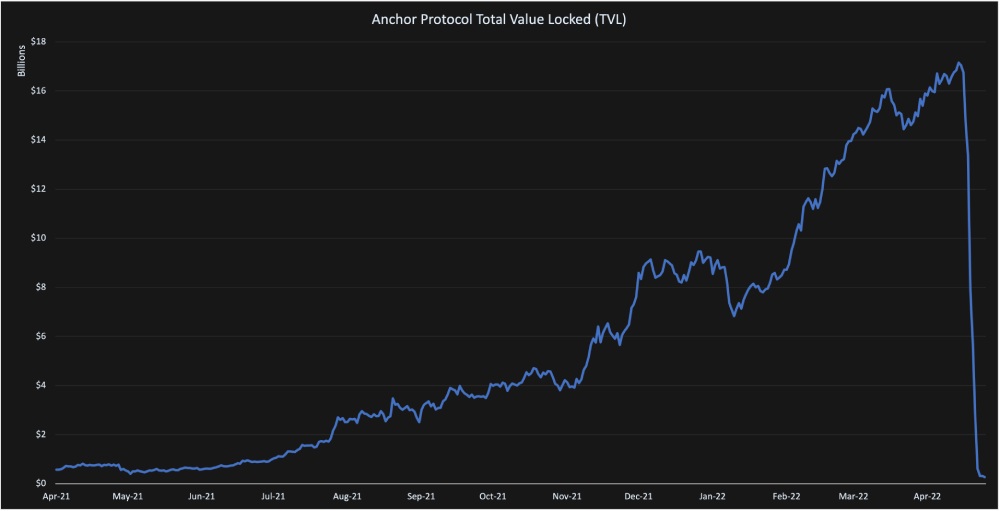

What happened next was analogous to a bank run. After months of collecting 20% APY in UST rewards on Anchor, users began to withdraw their tokens and cash out. This resulted in Anchor’s Total Value Locked (TVL) plummeting from nearly $18b to $280m in just seven days as users rushed to move out of their UST positions. This was likely due to a combination of the declining price in LUNA and UST, protocol liquidations and flight to safety.

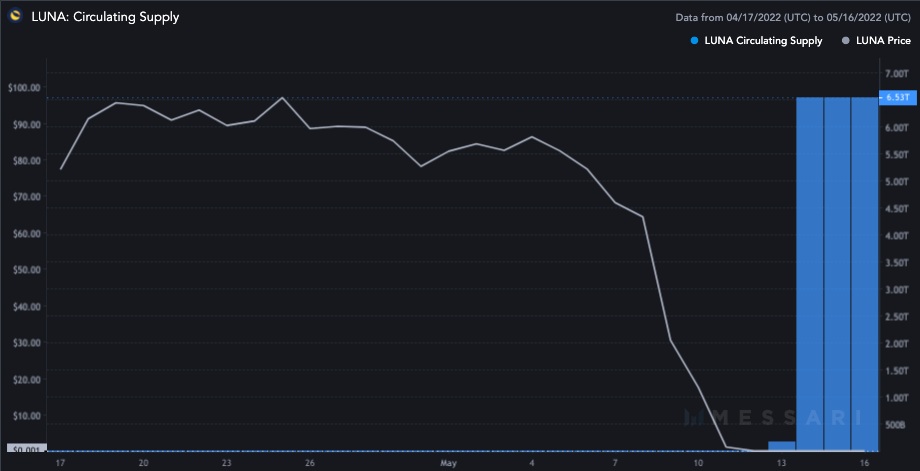

With UST trading below its peg of $1, market participants were able to execute a profitable arbitrage by purchasing UST for less than $1 and swapping it for $1 of LUNA. Because the depeg lasted for a prolonged period of time, the arbitrage contributed to a large influx of LUNA supply. In addition to the colossal amount of UST being withdrawn from Anchor, LUNA suffered severe hyperinflation. The supply of LUNA soared from 343 million on May 9th up to 6.53 trillion a week later. Thats an increase of +1,908,651.08% in a week! Almost all of this newly introduced supply was sold at market, causing LUNA to lose virtually 100% of its value.

During this chaos, LFG, the organisation created to defend the peg, mobilised its reserves of 70,736 bitcoins (worth over $2 billion) with repeated attempts made to restore the UST peg. As seen by the current price of UST, these attempts have been mostly futile. In a sort of last-ditch effort, the LFG began reaching out to investment firms to gather more than $1 billion to safeguard the UST peg. The conditions would involve selling LUNA at a 50% discount to investors, as well as two years of vesting. However, the transaction appears to have fallen through, leaving little prospect for the foundation to restore the peg solely via its own acts.

As of yesterday, LFG broke its silence on the state of its crypto reserves. LFG’s reserves have been depleted from 80,394 bitcoin on May 7, to just 313 bitcoin today. Based on the tweet, it is estimated that LFG has gone from having reserves worth roughly $3.1 billion to $87 million in just a little over seven days. This has left many users of Terra to wonder how LFG would move to compensate the vast amounts of money lost.

The Future of Terra

So, what is next for Terra and UST? At this moment, the future of the faltering protocol and its stablecoin appears to be bleak. Liquidity in the Curve UST-3pool has largely dried up, limiting on-chain users' ability to perform arbitrage transactions that would assist keeping the UST pegged.

Overall, the failure of the Terra protocol and UST will be remembered as one of the most significant events in crypto history. Never before has a stablecoin collapsed so dramatically after achieving such a large market cap and prominence in the crypto community.

Recommended reading: Stablecoins Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1PjLgWLIMUO2pzaZiPx5Dh%2F3348eab4e3ed605ef2edb43ec8e1f74f%2FBlog-Cover__15_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-02-28T02%3A58%3A44.085Z)