Bitcoin

Unlike the month of March, April has been one of downwards price action for Bitcoin. Beginning April at approximately $46,000, it has slowly slipped to $40,000, an overall decline of 16%. Traditional stock market indices have also experienced similar price action this month, with correlations remaining at extremely high levels. Investors may find value in keeping an eye on the traditional financial markets during these times of financially tighter conditions (rising costs, rising interest rates), as these are significantly larger markets than those of Bitcoin and cryptocurrencies in general. This means any major moves in significant indices (e.g. Nasdaq, S&P 500) are likely to influence the price action of Bitcoin, with correlations between these markets remaining extremely high as of late.

Price action of Bitcoin & Nasdaq over the last two and a half months

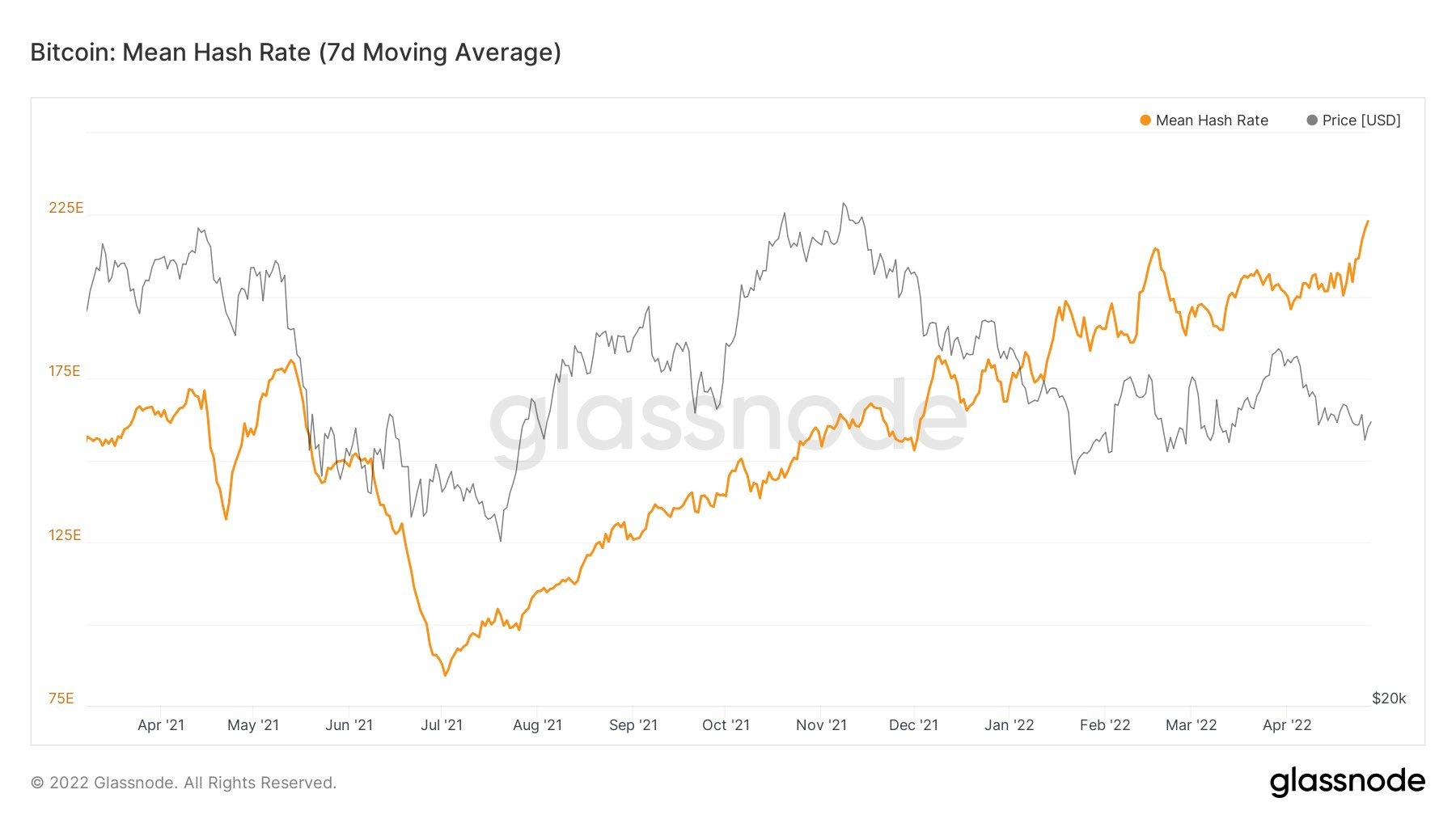

Even though price action has not been in favour of Bitcoin this month, the hash rate (computational work directed to the network) continues to climb upwards hitting a new all time high of 223.20 exahashes per second (EH/s). This indicates that there is still capital flowing into the infrastructure underpinning this network, even as consumers face increasing costs for energy. These rising costs in energy can be attributed to the conflict in Ukraine, Russian sanctions and ongoing supply chain disruptions. Historically, this divergence between the increasing hash rate and declining price has been resolved over time, either through a reduced hash rate or increased price.

Another interesting development regarding crypto adoption has been the Central African Republic’s (CAR) declaration that Bitcoin is legal tender, making it the second nation state to do so. On Wednesday the 27th, the Central African Republic (CAR) passed the Regissant la Cryptomonnaie en Republique Centrafricaine (”law”) after President Faustin Archange Touadera signed the bill, resulting in Bitcoin being legal tender alongside the CFA franc. This is a historic milestone, with CAR being the first African nation to make this step in adoption and potentially the catalyst for further nations’ adoption. Overall, adoption in the Bitcoin ecosystem continues to expand, notwithstanding bearish price action this month.

Ethereum

Ethereum's (ETH) performance in April was somewhat lacklustre in comparison to March, mimicking the price action of BTC. ETH experienced some positive price action within the first five days of the month, rising from approximately $3,250 to $3,500, a 7.7% increase. However, following this bullish price action, ETH gradually began to decline for the remainder of April, reaching a monthly low of approximately $2,800.

A key talking point surrounding the ETH network was the exploit of the stablecoin known as BEAN that runs on the ETH Network. Hackers managed to steal $182 million (comprised of 24,000 ETH and 100m BEAN tokens) which resulted in BEAN losing its peg to the dollar. When diving deeper into this exploit, we can see that it involved Beanstalk’s governance token, STALK. This token was accumulated via flash loans on Aave, a lending platform also running on Ethereum. Due to having a large supply of these tokens, the hacker(s) used their voting power granted by the tokens to pass a proposal that moved BEAN funds into a private ETH wallet. Following the attack, the hacker moved their funds via Tornado Cash, a non-custodial ETH privacy solution, which improves transaction privacy by mixing the on-chain link between the recipient and final destination addresses. Due to this mixing, it is unlikely for the stolen funds to be tracked and returned to their rightful owners.

Altcoins

The majority of altcoins have experienced a similar overall trend to BTC and ETH this month with a steady decline in price. There were some exceptions to the overall trend, with some coins achieving superior gains such as ApeCoin (APE), STEPN (GMT), and Lido DAO (LDO).

Lido DAO has steadily emerged as one of the most popular liquid staking protocols, which allows users to stake the most popular tokens and earn yield. The protocol saw its Total Value Locked (TVL) reach above $20b at the start of April, an increase of ~20x since April last year. This has most likely resulted in anticipation of Ethereum’s merge to Proof-of-Stake (PoS), which will allow users to secure the network and earn rewards by staking at least 32 ETH. Lido addresses this high barrier to entry by removing the minimum investment amount, enabling users to use their staked ETH as collateral in other DeFi protocols and now represents over 80% of the market share in liquid ETH staking.

A sector that has garnered a lot of attention as of late is the ""move-to-earn"" sector. The leader of this movement is STEPN, which has experienced a 30% price increase on its native governance token (GMT) this month, achieving a new all-time high of $4.11. STEPN is a Web3 lifestyle app with social-fi and game-fi elements. To use the app, users first need to purchase NFT sneakers from the STEPN in-app marketplace. There are different types of sneakers that users can select based on their fitness level. Users wearing these sneakers can earn GST (STEPN’s game utility token) by walking, jogging, or running. Furthermore, GST can be used to mint new NFT sneakers or simply level up in the game. Both tokens featured in the STEPN ecosystem have burn mechanisms to help people stay active. Moreover, via many varying in-app actions, these mechanisms will help reduce the GMT and GST token circulation, which is meant to help increase their long-term price action.

NFTs

Moonbirds has taken the NFT space by storm by becoming one of the most highly traded NFTs in its first week on the market. The Moonbird collection (featuring 10,000 items), generated over $250 million in sales, sending it up the OpenSea rankings for weekly trade volume. Additionally, the demand surrounding the project helped increase the floor price to over 30 ETH in just 5 days following its launch on OpenSea.

Lastly, Yuga Labs, the startup behind Bored Ape Yacht Club (BAYC), minted its highly anticipated metaverse land sale ‘Otherside’ on Sunday. This generated Yuga Labs over USD$560m in NFT sales in just 24 hours. Unfortunately, this also saw a huge spike in gas fees, with some transactions costing users upwards of $4,000 in gas. While the minting process was suboptimal, the underlying token APE rallied 76% leading up to the land sale, where it has since settled back to its pre-mint price.

Regulatory

As part of recent attempts by the UAE to encourage investment in crypto, the Abu Dhabi Global Market, the local regulator, has provided in-principle approval for Binance to operate as a broker-dealer in digital assets, including cryptocurrencies. This approval comes after FTX was separately awarded an operational license to conduct activities in Dubai.

Meanwhile, in Australia, the Commonwealth Bank of Australia’s (CBA) planned retail crypto services have been stalled due to pushback by the Australian Securities & Investment Commission (ASIC). The CBA’s plans to roll out access to a select number of crypto assets through its CommSec retail trading platform have been delayed after ASIC objected to the launch based on consumer protection concerns. ASIC has objected on the basis that sufficient target market and product disclosures, ordinarily required in relation to a financial product, were found to be lacking or missing entirely.

The Brazilian Senate has approved a bill that serves to introduce a regulatory framework for the local crypto industry in Brazil, with a particular focus on imposing similar or parallel obligations on crypto entities as those that apply to traditional financial institutions. In order to progress further, the Brazilian Congress’s Lower House must vote in favour of the bill. It is anticipated that, should the bill progress, any legislative changes will not be effective before the end of 2022. This development is significant with Brazil constituting the most populated South American country, potentially paving the way for the mass adoption of crypto by other countries in the region as well.

Further reading: Stablecoins Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)