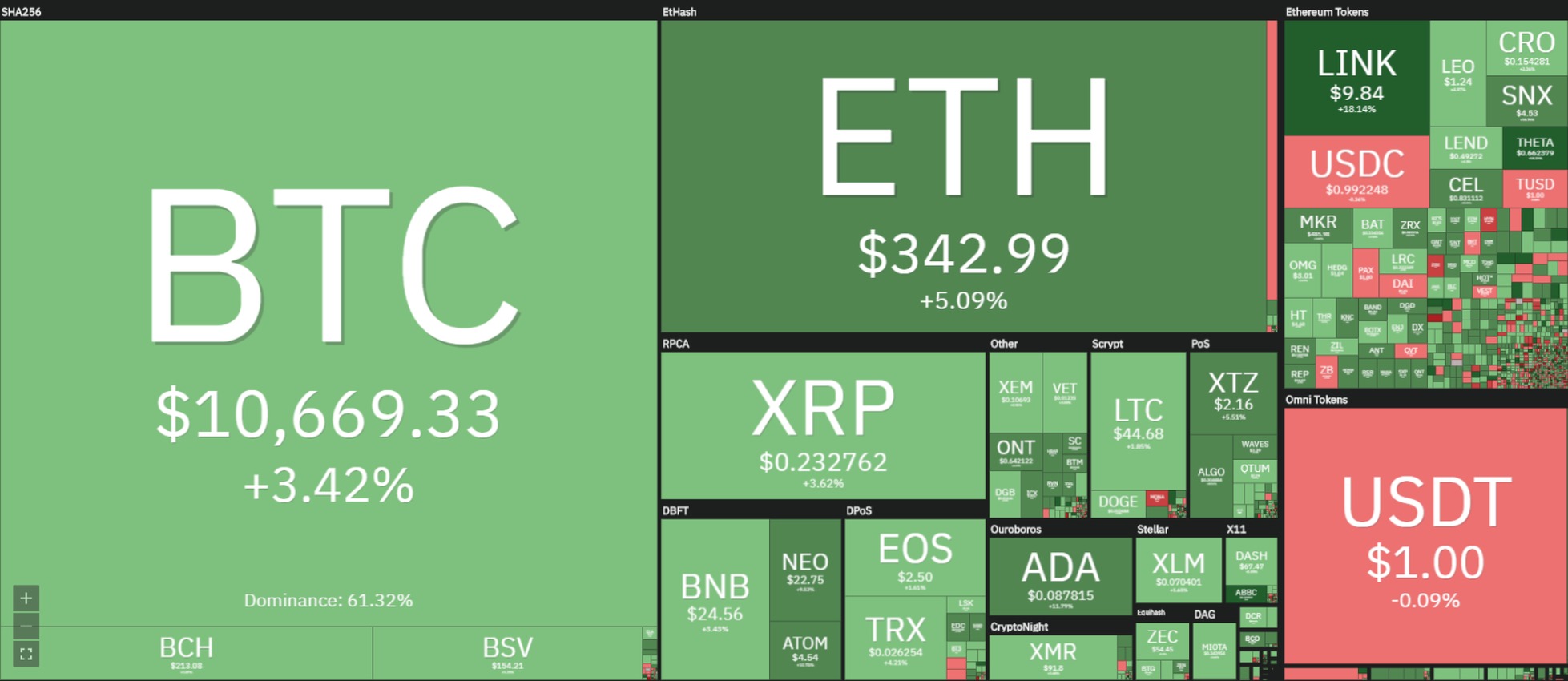

Market Snapshot

As the week nears its end, BTC price is continuing to hover around the $11,000 mark. While Bitcoin’s momentum has been tapering, the total value locked in UniSwap has almost doubled, surpassing $1.5 billion.

- Bitcoin trading around $10,670 as of 18:00 AEST (25/09).

- Bitcoin’s 24-hour range: $10,285-$10,786.

- The market has experienced a quick recovery after a week of mostly large price corrections.

After failing to hold the $11K mark there has been a general display of apathy in trading BTC at these levels - a disinterestedness that may be as a result of major developments in other areas of the crypto-sphere. UniSwap, a decentralized exchange, airdropped 400 UNI tokens to all users before September. That is a ≈$1300 stimulus that was claimed by some 13,000 UniSwap users in the first three hours. As some crypto pundits have pointed out, this is a larger amount than the USA’s economic stimulus check and it didn’t take months to reach recipients. This highlighted some key value in the speed of which Cryptocurrency transactions can be made.

Battle of The Assets: Gold & Bitcoin

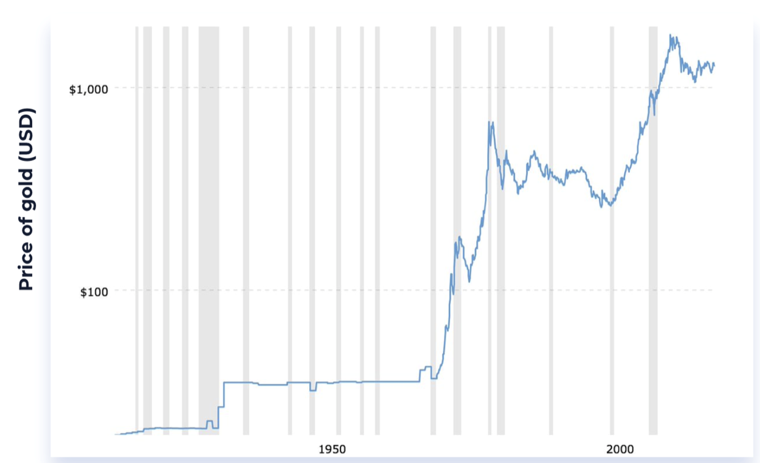

In times of rising financial and political uncertainty, amidst the myriad of social commentaries, financial advice, explanations and future indicators, you will most likely hear consensus on one thing: invest in ‘hard assets’ as a way to hedge against global uncertainties.

Hard assets have traditionally referred to tangible property or physical commodities that can hold value due to their limited supply. Unlike soft financial assets - such as fiat currencies and stocks and bonds that are susceptible to restructuring, default and inflation - hard assets have been proven to perform during economic instability and frequently increase during global recessions.

“In gold we trust” has been the mantra of investors for centuries, as it has provided a safe-haven in extreme and unexpected events. During the COVID-19 crisis, gold’s appeal has soared, driving its price to historic highs (eclipsing its past record set back in August, 2011). Conversely, many have touted Bitcoin as the hardest of assets and it has been forecast to steal the safe-haven crown from gold. But how can something that is barely a decade old rival gold’s proven ability to store and hold value for some 5000 years?

A lengthy paper under the name of, “Is Bitcoin the New Digital Gold?”, conducted by the Department of Economics of the University of Pretoria, investigates the potential benefits of Bitcoin during extremely volatile periods, finding that: ‘from a portfolio management perspective bitcoin (along with gold) improves the performance of equity positions under tail risk constraints and is among the ranks of safe-haven assets.’

Bitcoin as the Ultimate Financial Safe-Haven

Bitcoin’s software protocol ensures that it has a hard cap of 21 million coins - no more. Bitcoin’s fixed and algorithmically determined supply is an in-built deflationary feature which means that supply will become scarcer over time. Eighty-six percent of Bitcoins finite supply has already been mined and the existing supply of bitcoin’s is growing at less than 4% per year; over the next decade it will drop below 1%. This is what differentiates Bitcoin from all other assets.

The supply dynamics for gold are not fixed. As its price increases, gold that was previously unprofitable to mine will be brought to market. Looking ahead, asteroid mining poses serious doubts to the future value of gold. Elon Musk’s Space X, has already secured the launch contract for NASA’s 2022 mission to explore the mineral-rich asteroid known as Psyche, which is estimated to contain $10,000 quadrillion worth of nickel and iron.

Reason’s Against

Gold has been universally accepted throughout the history of mankind and as a result there is always a ready and liquid market to trade it. This is a crucial element in Gold’s favor but will be less of a factor as Bitcoin continues to be adopted globally.

While who holds the safe haven crown is up for debate, from a portfolio management perspective, investing in both assets seems the safest way to protect equity positions in turbulent times. By the same token, this article has explored Bitcoin’s worth purely as a store of value. To call bitcoin ‘digital gold’ understates its utility and potential as a growing technology platform for non-monetary means - of which we will see more of as it matures as part of a new asset class.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)