What Is Bitcoin Halving?

Bitcoin (BTC) shares just one similarity with elections and leap years—its halving process occurs (roughly) every four years. The Bitcoin halving does not mean the price gets cut in half, so you might be wondering, “What is a Bitcoin halving?”

To limit the rise of the circulating supply of Bitcoin, the Bitcoin halving process reduces the reward for adding transactions to the blockchain. Halving is a feature of a small number of cryptocurrencies including Bitcoin, Litecoin and others. If you are interested in learning more about how the Bitcoin halving works and what the next halving event means for the Bitcoin market, read on for a detailed explanation.

How Does Bitcoin Halving Work?

To ensure network security, Bitcoin incentivises a network of miners to validate transactions through a mining process. Bitcoin mining is the process of verifying and adding transaction records to the public ledger (known as the blockchain). Miners solve complex mathematical problems that allow them to chain together blocks of transactions (hence the blockchain). Bitcoin miners form a consensus of the transactions that belong on the blockchain through this proof-of-work consensus mechanism.

As the popularity of Bitcoin mining grew, the difficulty of these mathematical problems increased, and it became more expensive to participate in. As a result, Bitcoin mining is now mainly done by large firms or mining pools with specialised equipment.

For their efforts in adding blocks to the chain, miners are rewarded with a specific number of bitcoins. Bitcoin halvings reduce the rewards distributed per block by half after each halving takes place (roughly every four years). At the moment, miners receive 6.25 Bitcoins per verified block as a reward. After the next Bitcoin halving, set to take place on April 19 2024, the reward will be 3.125 Bitcoins.

Bitcoin has a finite supply of 21 million coins, with approximately 19 million in circulation currently. The rate at which new bitcoins are created slows after each Bitcoin halving takes place until the maximum supply is reached.

Does Bitcoin Halving Increase Price?

Given that only a finite amount of Bitcoin will ever exist, halvings play an important role in controlling its supply and inflation rate. The rate of inflation slows after each halving event as the supply increases slower, too. The circulating supply of Bitcoin is approximately 19 million coins as of December 2022, though it is lower when factoring in lost or forgotten wallets.

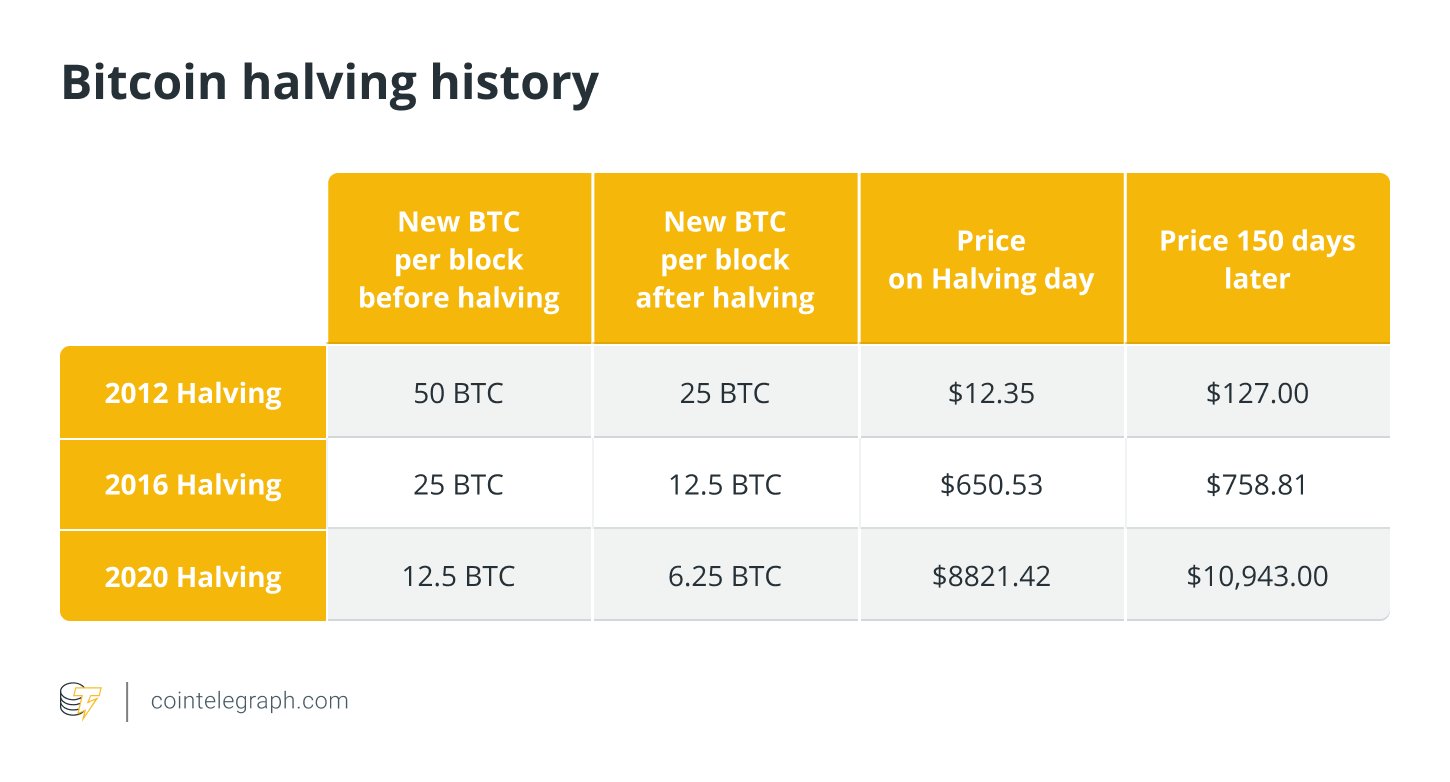

By decreasing the rate at which new Bitcoins enter circulation, additional supply becomes scarcer over time, which could make Bitcoin more valuable. So far, three halvings have occurred, and prices have generally risen exponentially afterward before dropping again. After the last halving on May 11, 2020, Bitcoin rose from around $8,800 to around $69,000 the following year before dropping below $40,000. Previous Bitcoin halvings have followed similar trajectories.

Of course, the increase in the Bitcoin price could also be the result of other factors like the growing popularity, speculation, and wider usage of the cryptocurrency, often referred to as its network effects. Given Bitcoin’s volatility compared with many other non-crypto assets, the time period chosen to track pricing also matters. When assessing its performance over the past decade, no other asset has come close to bitcoin’s extraordinary price appreciation.

How Often Is Bitcoin Halved?

Bitcoin halving dates occur after every 210,000 blocks are mined, which happens roughly every four years. The block reward started at 50 Bitcoins in 2009, halved to 25 Bitcoins in 2012, halved again to 12.5 in 2016, then halved to 6.25 Bitcoins in 2020. The next halving will be on April 19, 2024, where miners will receive 3.125 Bitcoins per verified block as a reward.

How Many Bitcoin Halvings Are Left?

So far, three halvings have already occurred: in 2012, 2016, and 2020. Only 32 halving events will ever take place. Once the 32nd halving is complete in approximately 2140, no more new Bitcoin will be created.

The next halving after April 2024, will be in 2028, where the block reward will be 1.5625 bitcoins.

What Happens When There Is No Bitcoin Left to Mine

After the last halving occurs, block rewards will no longer exist. However, miners will continue to collect a share of the transaction fees, denominated in BTC, according to how many transactions take place within each block. While the total supply of Bitcoin will remain static after the final halving, the circulating supply can decrease as coins are lost or forgotten.

How Bitcoin Halving Effects the Crypto Market

The halving process is written into Bitcoin’s code and cannot be changed. As a result, the event has implications for investors, miners, and the cryptocurrency market as a whole.

Investors: Bitcoin halvings present an opportunity for investors to buy Bitcoins before new coins are created at a slower rate. If the price seems likely to increase, similar to during previous halvings, investors may look to speculate on a price hike and buy Bitcoin before the next Bitcoin halving takes place.

Miners: For miners, the halving means that they will receive fewer Bitcoins for their efforts. Miners might be forced to find more efficient ways of mining, which could lead to some miners switching to other cryptocurrencies or ceasing operations altogether. Some miners might sell Bitcoin to offset the decrease in rewards. However, the price of BTC plays a significant part in the value of the rewards collected by miners. At BTC’s all-time highs, miners were collecting around $430k USD per block reward of 6.25 BTC.

While the halving may cause short-term volatility in Bitcoin prices, it is generally considered as a positive event for the cryptocurrency.

Halving Offers Hope During Crypto Winter

Bitcoin halving is an event that happens roughly every four years where the mining reward for adding transactions to the blockchain is reduced by half. Given that Bitcoin has a maximum supply of 21 million coins, once they have been mined, no more will be created, and miners and validators will only earn transaction fees. Investors may use the halving as a reason to speculate on the increasing price of Bitcoin. The next Bitcoin halving will take place in April 2024.

For investors who believe in Bitcoin's long-term potential, this series of halvings presents a possible catalyst for prices to increase. With 'crypto winter' behind us, and many positive narratives around the original crypto asset including steep price rises, the upcoming halving could send the BTC price soaring even further.

Frequently Asked Questions

Q. Can I make money from the BTC halving?

A. You can make money from the BTC halving if you buy before the price increases and sell after price appreciation. Your timing will determine whether you make money.

Q. Does Ethereum (ETH) have a halving event?

A. Ethereum does not have halving events that affect validator rewards.

Q. What is the Bitcoin halving date?

A. The next Bitcoin halving date will be in mid-April 2024 after 210,000 Bitcoins have been mined since the last halving. You can estimate the next Bitcoin halving date on CoinMarketCap.

Recommended reading: Timing the market vs. time in the market

Make Your First Investment With Caleb & Brown

You don’t have to be an expert to start investing in bitcoin or other cryptocurrencies.

Caleb & Brown is the world's leading crypto and bitcoin brokerage for beginner and advanced investors alike, making your entry into the market effortless.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto.

Not to mention key features such as:

- No joining or sign up costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3ikvwifNCbD6wUgfIV54O6%2Fb7f9988999a7817d47f416513efd3915%2FBlog-Cover_19_.jpg&a=w%3D200%26h%3D113%26fm%3Djpg%26q%3D80&cd=2022-08-04T05%3A04%3A04.468Z)