Market Overview

Bitcoin is trading at a record all-time high today, currently sitting above $22,000; an exciting development given that the year for cryptocurrencies has been anything but ordinary. The number one cryptocurrency’s exciting performance so far has been met with significant attention, especially from institutions and high net worth individuals in the traditional market space. Despite a short scare in early March with Bitcoin falling by half its price, it wasn’t enough to deter bullish investment perspectives and speculative demand. Now, at roughly 5 times its worth since then, and with the occasional dip along the line, Bitcoin seemingly remains a high-performance asset and has certainly instilled optimism in market watchers and respective holders alike. But, with the price at such a record high now, how can one jump into the market without investing significant capital at one time? Fortunately, there’s a popular and effective strategy for investors to consider to allow themselves to potentially spend less on their investment cost and realise an adequate overall return in the long term. Moreover, Dollar Cost Averaging (DCA) is beginning to shape up to be an enormous opportunity to take advantage of.

Dollar Cost Averaging

Cryptocurrencies are extremely volatile investments, so timing market entry points can be quite difficult and confusing. But, in any market, the most prominent and established strategy investors might use is known as dollar cost averaging (DCA). This is an accumulation strategy in which you invest a fixed amount of capital over regular time intervals, usually on a weekly basis. This allows you to capture a range of different purchase prices, which hopefully results in a lower average cost. DCA is a long term strategy that investors will usually deploy over multiple years. On the contrary, entering with a lump sum investment at one given point may result in higher returns if timed well, but dollar cost averaging is considered a relatively safer alternative.

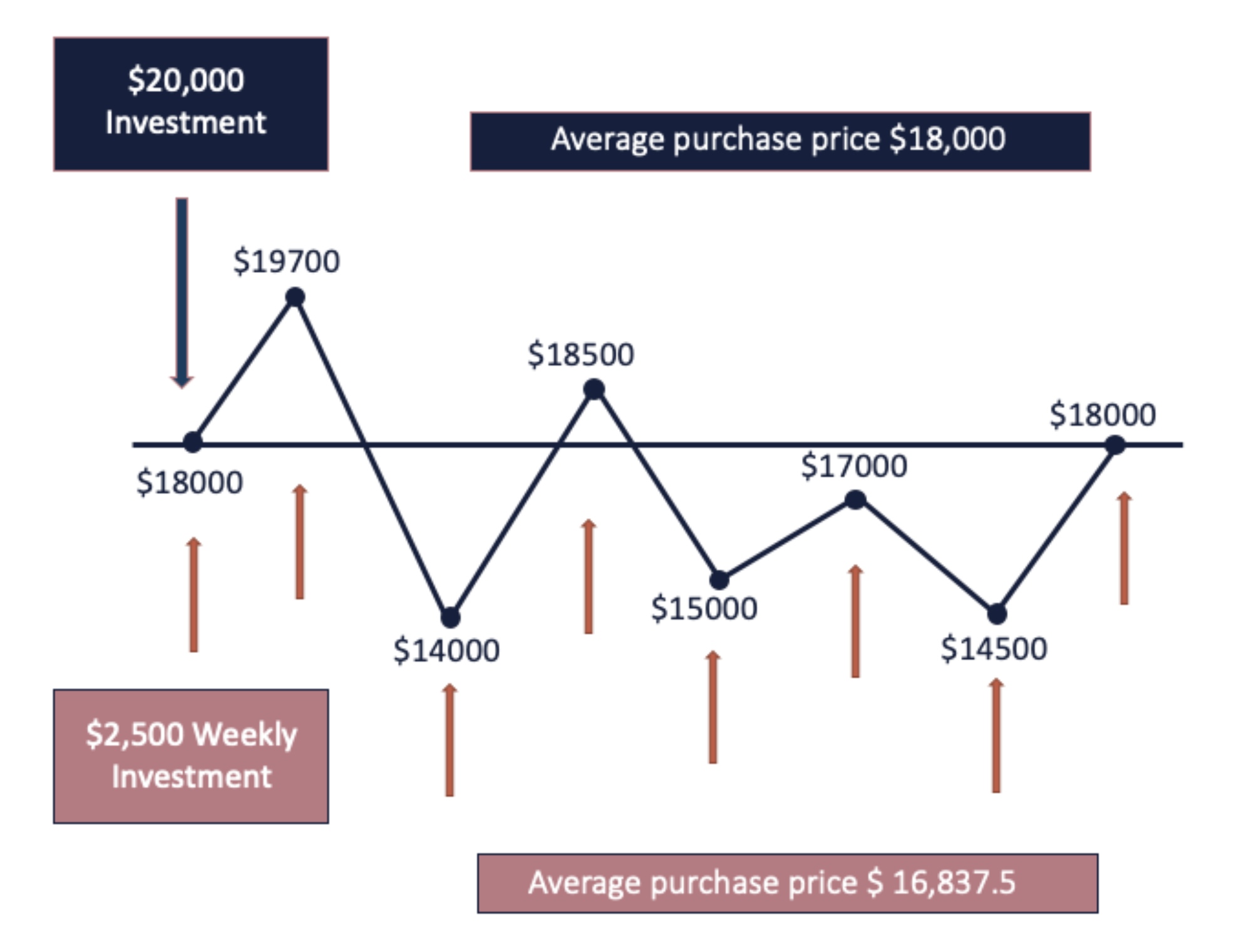

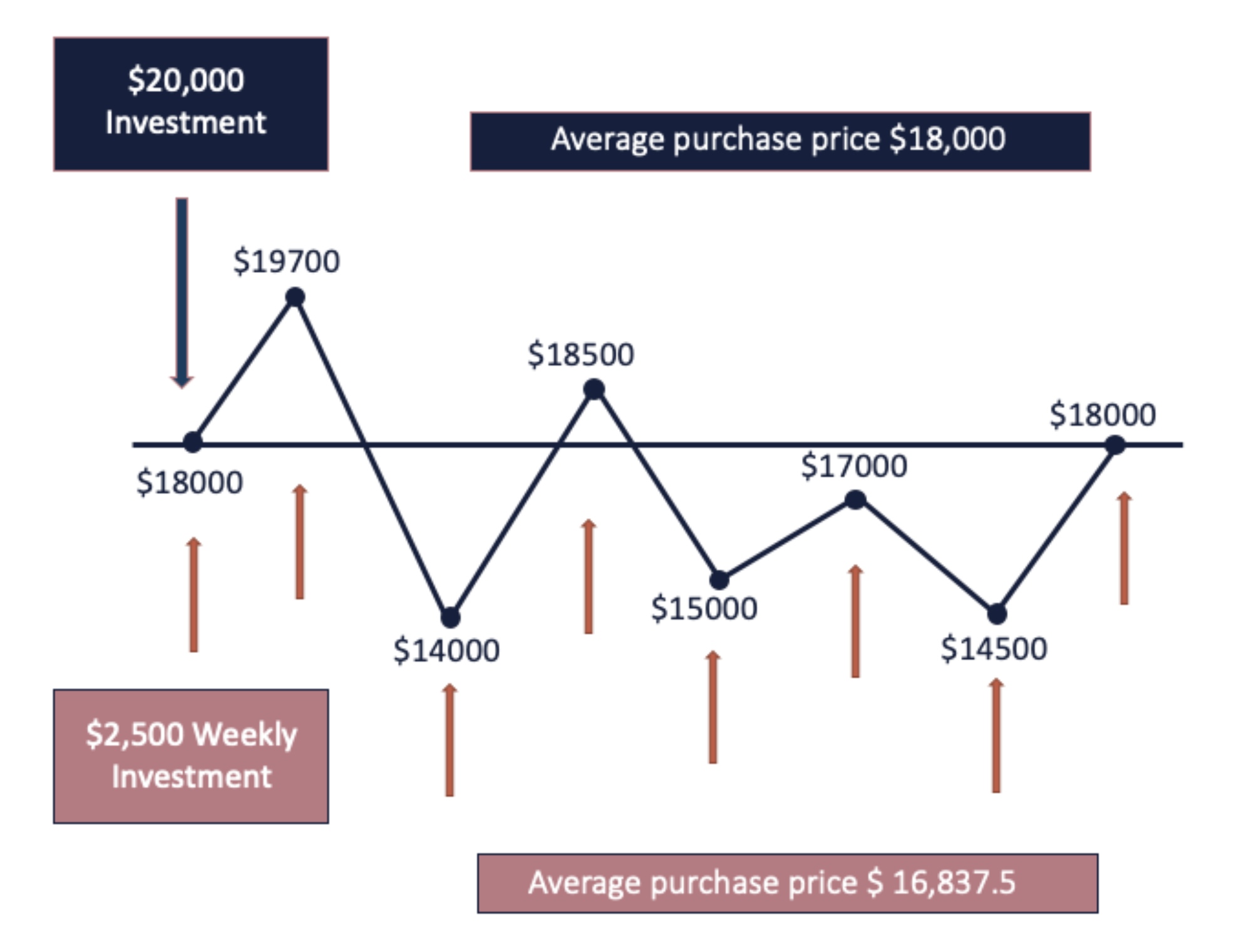

The diagram below shows an example of how using dollar cost averaging may lower the average purchase price of the asset. In this specific case, if we consider a lump sum strategy involving $20,000 spent on BTC priced at $18,000, and the market falls, a DCA strategy of a weekly investment of $2500 of BTC would yield a better return on investment overall (6.46% compared to 0% after this eight-week period), denoted by a lower average purchase price.

This strategy removes a lot of the emotion from investing, since you are continuously buying lesser increments over a longer period of time, mitigating the potential stress that comes with short term volatility. This is especially important with cryptocurrency, as its volatility can lead investors to making impulsive investment decisions that may yield poor results.

Historical DCA Performance

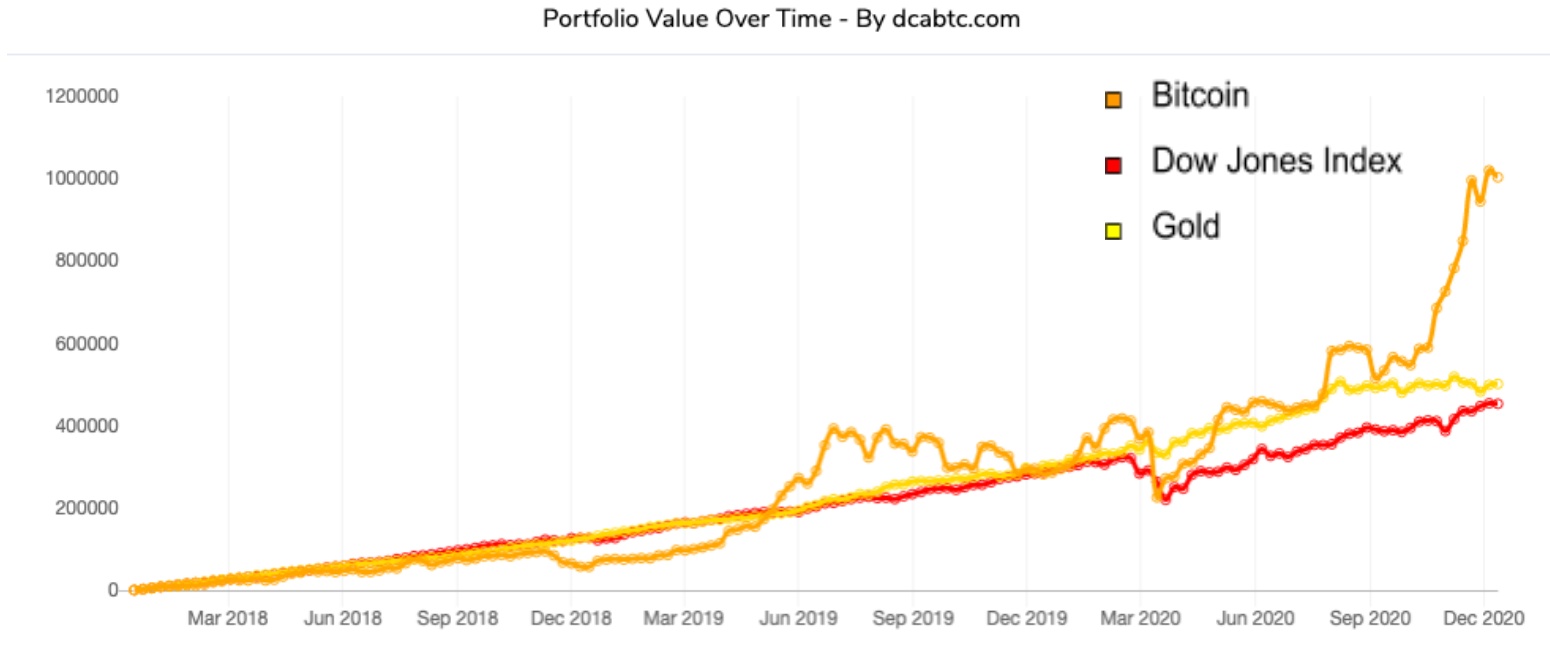

Let’s put ourselves in the past for a moment. If you were to invest $2,500 every week since the peak of Bitcoin’s bull run in 2017, you would realise a portfolio performance illustrated on the graph below over time, taken from dcabtc.com:

The total cost of this portfolio is $392,500, with an end value of $1,003,679 at the time of writing; a yield of $611,179 in profit, or a 155.71% ROI. In fact, the minimum ROI that one could have made from implementing DCA at any time over a 3 year period in Bitcoin’s history is roughly 100%, so using DCA would have yielded at least double on an initial investment.

Using gold and the Dow Jones index as benchmarks in the same case, dollar cost averaging Bitcoin would have eclipsed the two in terms of ROI. A weekly $2,500 investment would have yielded only a 28% return in gold and 15.76% if invested in a Dow Jones ETF, more than $500,000 less profit over the three-year period.

Best time to Dollar Cost Average

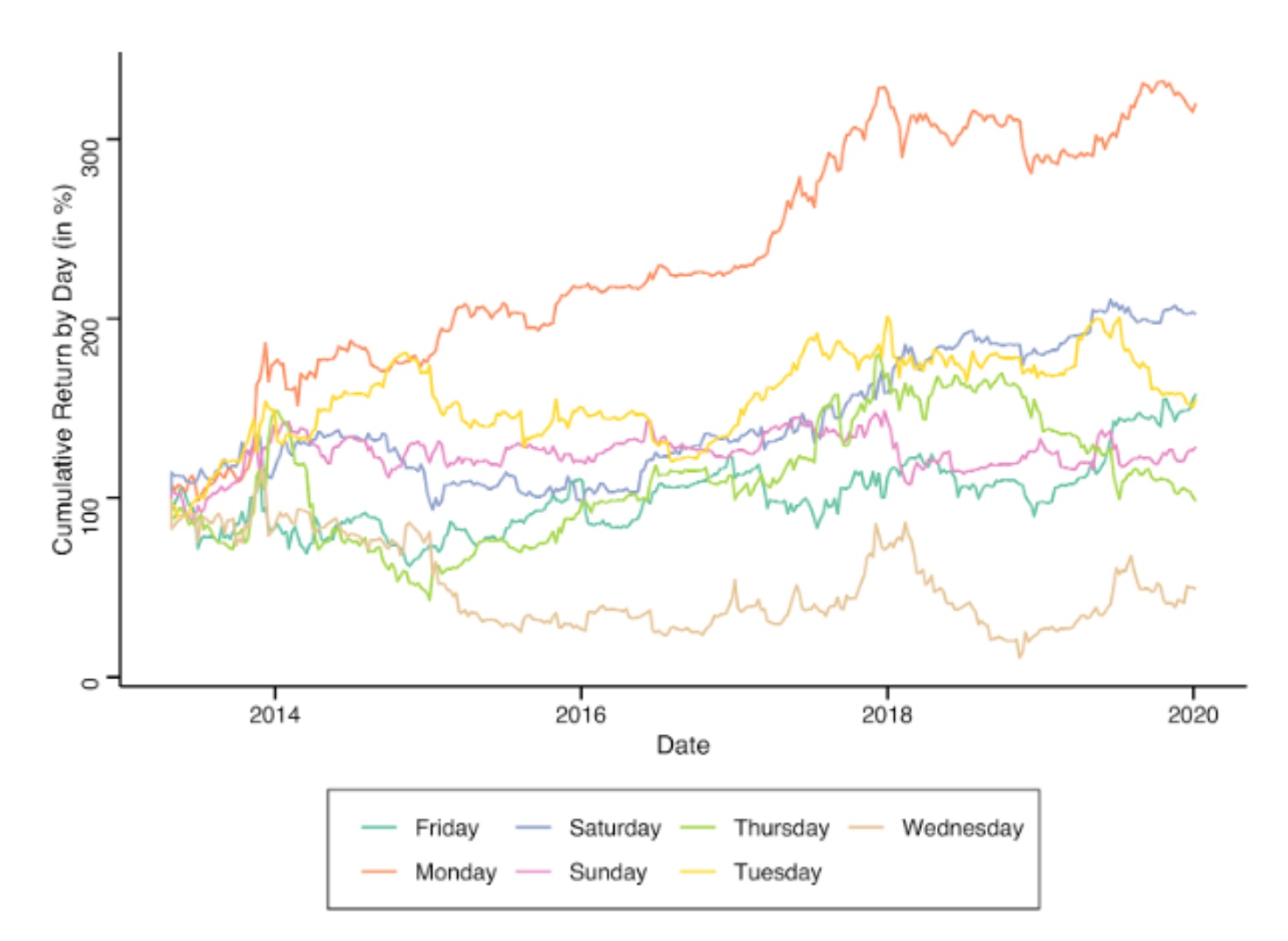

Interestingly enough, the day of the week that one performs dollar cost averaging may have some influence on overall returns. Historically, the best time of the week to dollar cost average into Bitcoin has been on Monday, after an analysis conducted by Cointelegraph highlighted that purchasing consistently on this day yields the best average % return. This is especially compelling when one compares this fact to equities, which historically yield the worst returns on a Monday, a result of what many refer to as the “weekend effect”.

The chart below shows the cumulative return by day from 2013 to 2020, highlighting a large discrepancy in the best days to invest. It seems that investing on Monday yielded a cumulative return of 100% above the returns on any other day of the week.

Closing Remarks

Indeed, dollar cost averaging may be a superb approach for investors who don’t enjoy the idea of being exposed to significant price dips and risks. But, of course, DCA isn’t perfect and won’t always work out to the best outcome. For instance, if the market sees a gradual but significant upwards trend, a lump sum investment can potentially yield a much higher return than an incremental investment over time, although this involves the uptake of higher risk. Additionally, if the market swings and undergoes a drastic change, dollar cost averaging would essentially leave your capital locked into your strategy, which means it is somewhat less flexible to rearrange away from a dollar cost average approach compared to working with a lump sum. It’s important to remember that all strategies have certain value, and considering multiple strategies for different market conditions is what makes an investor ride the market with greater confidence and expertise. Always research, consider your risk aversion and evaluate what your investment goals are in the financial world.

Nevertheless, when it comes to assets like Bitcoin, dollar cost averaging is seriously a diamond in the rough that can reap a kind of profitability that is completely unheard of in the traditional financial market. The fact that an investor can dollar cost average on Bitcoin at any given moment over three years and roughly double their investment with little to no short-term volatility risk exposure is a highly underrated opportunity. So, consider adding DCA to your investment strategy when it comes to the cryptocurrency market over a long time horizon. With Bitcoin taking a massive step beyond chartered territory, the road could be a rocky one, but if it ultimately leads up, taking a DCA approach may very well generate significant rewards at the end of the day.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)